Resource Center

-

Blog PostThought Leadership / April 11, 2024Charting the Course in Climate Tech: Decarbonization Opportunities in 2024

-

Blog PostThought Leadership / April 3, 2024“La French Tech” – A Tour de Force of Innovation and Growth

-

Blog PostInvestment / March 7, 2024A Modern Approach to National Security Software: Why We’re Excited to Back Defense Unicorns

-

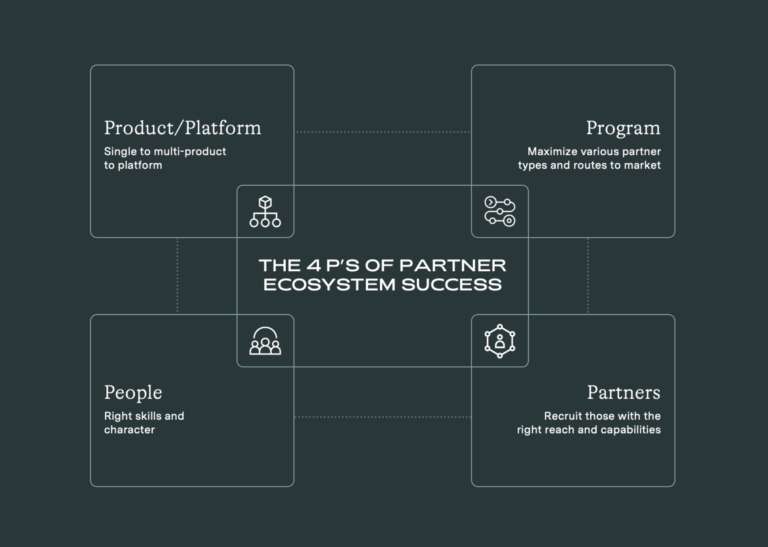

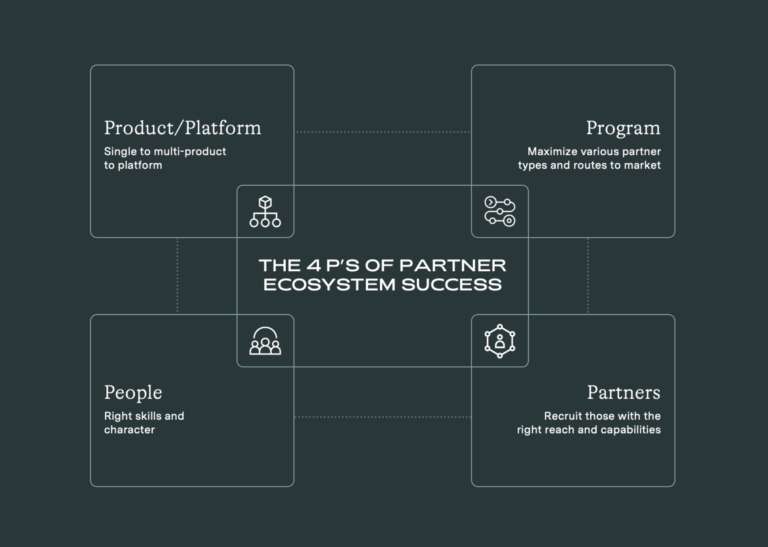

ReportInvestment / February 29, 2024A Guide to Building an Effective Partner Strategy Framework

-

Blog PostThought Leadership / February 29, 2024Introducing A Guide to Building an Effective Partner Strategy Framework

-

Blog PostThought Leadership / February 28, 2024Observability in 2024: Understanding the State of Play and Future Trends

Thought Leadership

/

February 15, 2024

The GTM Perspective: Navigating Product-Led Growth vs. Sales-Led Growth Models

Thought Leadership

/

February 8, 2024

Silicon Valley Meets The Department of Defense: Top Observations & Opportunities in Defense Tech

-

Blog PostThought Leadership / January 31, 2024Navigating the Future of Healthcare: 4 Major Trends & Pivotal Questions to Explore in 2024

-

ReportThought Leadership / January 30, 2024The State of the SaaS Capital Markets: A Look Back at 2023 and Look Forward to 2024

-

Blog PostReport / January 30, 2024The State of the SaaS Capital Markets: A Look Back at 2023 and Look Forward to 2024

-

Blog PostFirm NewsSapphire Ventures:

2023 Year in Review -

Blog PostThought Leadership / December 21, 2023The Year GenAI Comes to Fruition: 10 Enterprise Tech Trends Set to Define 2024

-

ReportThought Leadership / December 19, 20232023 KeyBanc Capital Markets & Sapphire Ventures SaaS Survey

Thought Leadership

Events

/

December 7, 2023

Navigating a New Normal: GTM Learnings From Our Inaugural Sapphire Ascend Summit

-

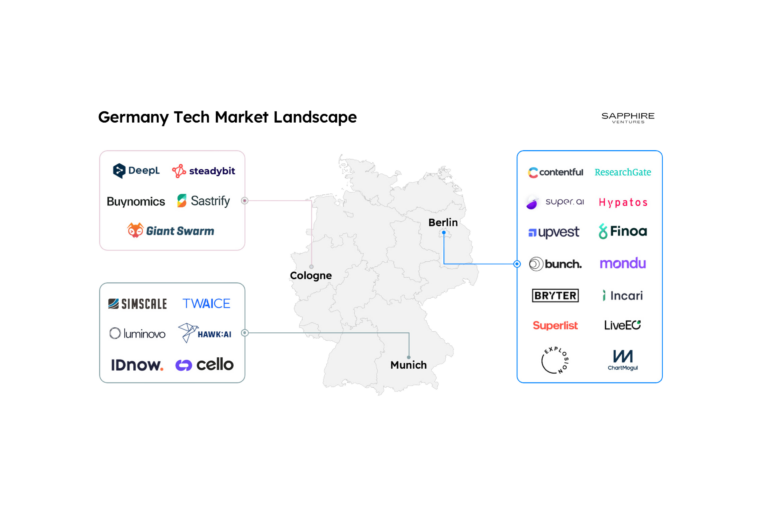

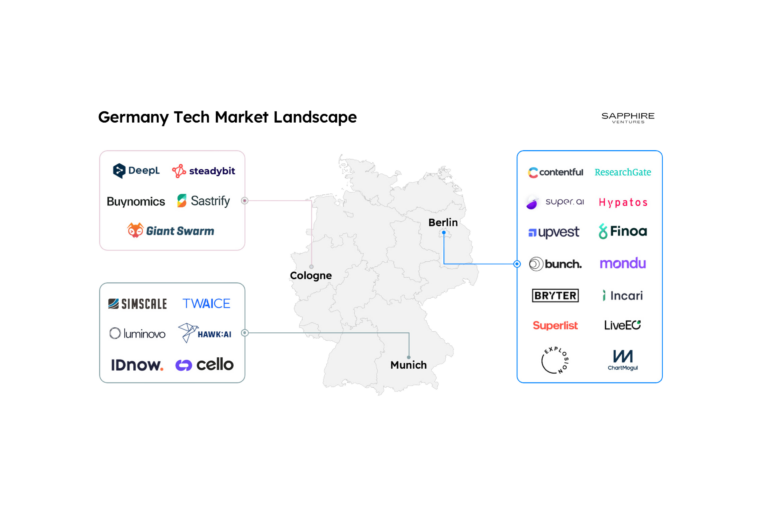

Blog PostThought Leadership / September 14, 2023Germany’s Booming Startup Scene, in Berlin and Beyond…

-

Blog PostFirm News / September 13, 2023Celebrating What’s New and Next

-

Press Release

-

Blog PostThought Leadership / September 7, 2023Streaming Wars: Video Security & Video Intelligence Edition

-

ReportThought Leadership / September 6, 20232022 Sapphire ESG Framework and Report

-

Blog PostFirm News / September 6, 2023Introducing Sapphire’s ESG Framework & Inaugural Report

-

Press Release

-

Blog PostThought Leadership / August 22, 2023How to Adopt Consumption-Based Pricing — and Avoid Common Pitfalls

-

Blog PostThought Leadership Events / August 16, 2023How to Balance AI Innovation and Efficiency: Lessons from our 2nd Annual Hypergrowth Engineering Summit

-

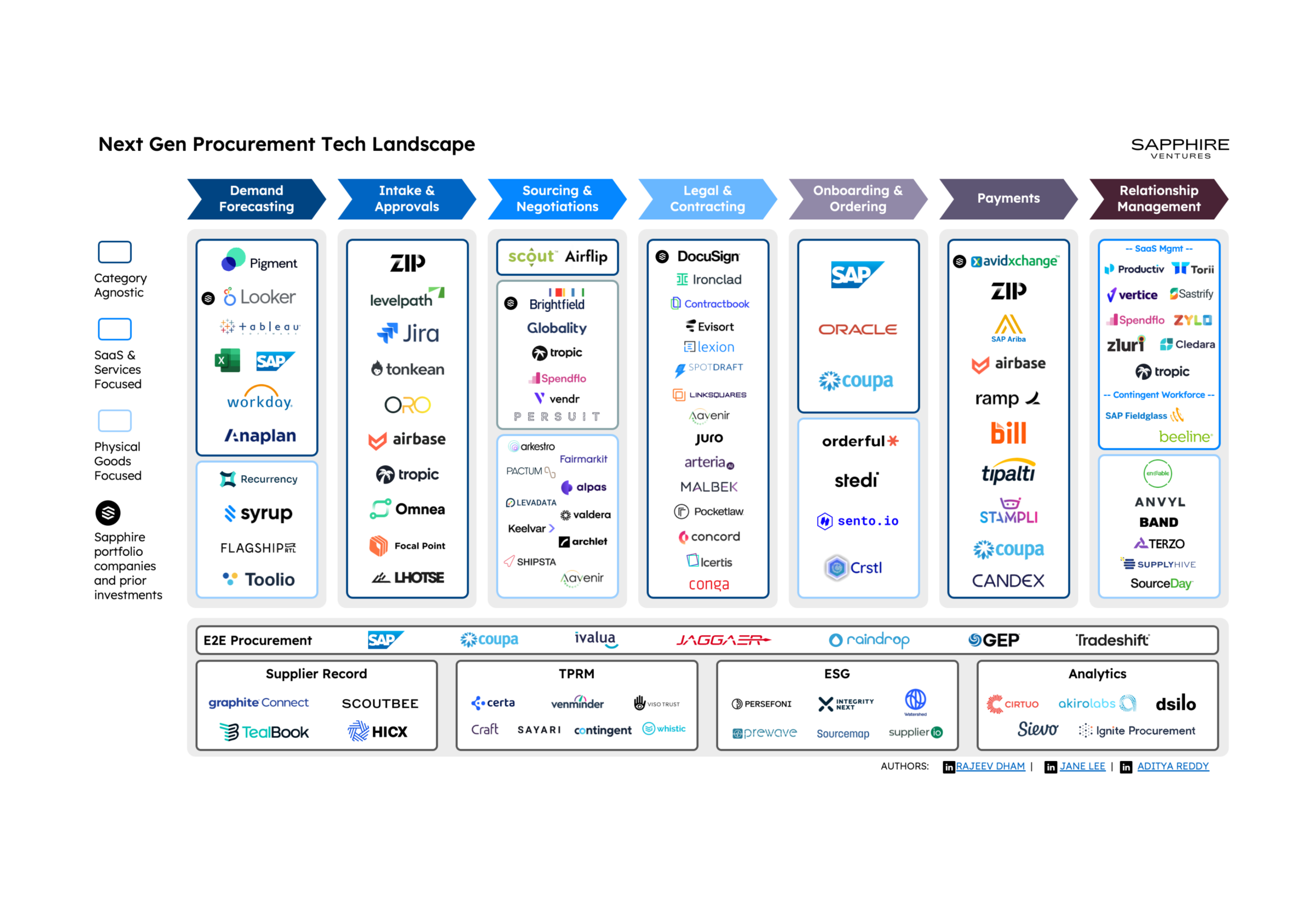

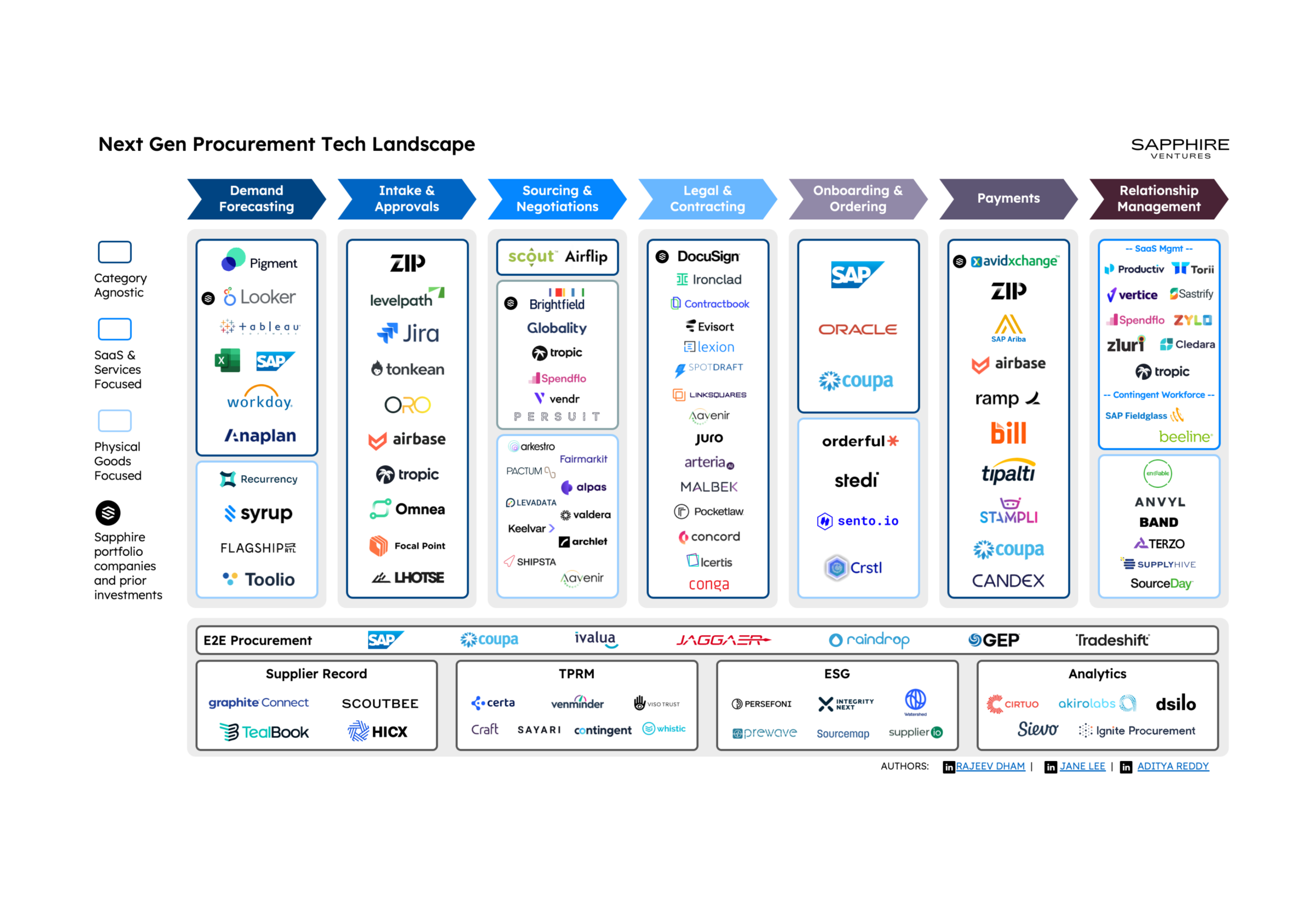

Blog PostThought Leadership / August 15, 2023From Purchase Orders to Boardrooms: Procurement’s Tech Renaissance and Evolution

-

Blog Post

-

ReportJuly 26, 20232023 Creating a Data-Driven Culture Playbook

-

Blog PostInvestment / July 20, 2023Taking the Pain out of Patient Payments: Why We’re Excited to Lead Collectly’s Series A

-

Blog PostThought Leadership / July 19, 2023Vertical(ai) is the New Horizontal

-

Blog PostThought Leadership / July 11, 2023The 5 Eras of AI: The Vast Possibilities of GenAI Will Be Here Before We Know It

-

Press Release

-

ReportJune 14, 20232023 SaaS Buyers Outlook

-

Blog Post

-

Blog Post

-

Blog PostInvestment / May 16, 2023Managing Security for the 99%: Why We’re Excited to Lead Huntress’ Series C

-

ReportInvestment / May 10, 2023The European Expansion Playbook Volume 2: A Startup’s Guide to Expanding within the Region

-

Blog PostInvestment / May 2, 2023Transforming Employee Experience with the Power of AI: Why We’re Excited to Lead Simpplr’s Series D

-

Blog PostThought Leadership / April 27, 2023The Nordic Flywheel Effect: Building the Next Startup Trailblazers

-

Blog PostThought Leadership / April 26, 2023Keep It Clean: Advice for Raising Growth Capital in 2023

-

Blog PostThought Leadership / April 20, 2023Securing the Future: Cybersecurity’s Evolution & What’s On the Horizon

-

Blog PostFirm News / April 19, 2023Introducing Sapphire Communities – A Robust Knowledge Network for Startup CEOs and Industry Leaders

-

Blog PostThought Leadership / March 22, 2023Doing More With Less: Is Making the Move Upmarket Right For You?

-

Blog PostThought Leadership / February 27, 2023What SaaS Profitability Looks Like in 2023

-

Blog PostThought Leadership / February 21, 2023The 2023 European CIO Outlook: 4 Pressing Challenges Impacting Enterprises

-

Year-In-ReviewThought LeadershipReflecting Back on an Unparalleled Year of Change

-

Blog PostThought Leadership / February 9, 2023AI: Paving the Future of Digital Healthcare

-

Blog PostThought Leadership Events / February 7, 2023Sapphire Roundtable Recap: How Startups Plan to Tackle Revenue Growth in 2023

-

Blog PostThought Leadership / January 19, 2023SaaS Stocks: In It to Win It, Why We Remain Long-Term Bullish on Next-Gen SaaS

-

Blog PostThought Leadership / January 17, 2023Will Current Market Conditions Cause Unicorn Status to Lose its Lustre?

-

Blog PostThought Leadership / December 12, 2022The Future of DevOps: A Spotlight on European Players in the DevOps Ecosystem

-

Blog PostThought Leadership / December 5, 2022Jamming Out Some Thoughts on Jamstack: The Trends and Companies Advancing the Growing Ecosystem

-

Blog PostThought Leadership / November 16, 2022Back in Stock! Emerging Supply Chain & Logistics Trends and Technology Landscape

-

Blog PostThought Leadership / October 18, 2022What’s Up With WebAssembly: Compute’s Next Paradigm Shift

-

Blog Post

-

Blog Post

-

Blog PostSeptember 29, 2022The #OpenLP Podcast Miniseries: Beezer Clarkson, Sapphire Partners

-

Blog PostThought Leadership / September 26, 2022Explosion of the European Web3 Landscape: Enabling the Next Frontier of Crypto

-

Blog PostThought Leadership / September 20, 2022Rise of the Digital Health Enablement Tech Stack: How Technology is Accelerating Innovation for Modern Care Delivery

-

S2: PodcastSeptember 16, 2022How Brands and the Metaverse Blend in Today’s Internet Age

-

Blog PostThought Leadership / September 15, 2022Revenue Planning for High Growth Startups

-

Blog PostThought Leadership / September 7, 2022Building Web3 Block by Block: A Look at the Growing Developer Tool Landscape

-

Blog PostInvestment / August 29, 2022Transforming Data Infrastructure with Real-Time Analytics: Why We’re Excited to Back StarTree

-

Blog PostFirm News / August 25, 2022Welcoming Mahau Ma to Sapphire as an Operating Partner!

-

Blog PostThought Leadership / August 8, 2022If It Don’t Make Dollars, It Don’t Make Sense: Demystifying Interest Rates vs. Valuation for High-Growth SaaS

-

Blog PostThought Leadership Events / July 29, 2022Recapping the Hypergrowth Engineering Summit: A window into the engineering playbooks of tomorrow

-

S2: Podcast

-

Blog PostThought Leadership / July 20, 2022The Modern B2B Go-To-Market Tech Stack: A Spotlight on European Players

-

Blog PostThought Leadership / July 18, 2022Rise of The Connected Spreadsheet – The “Killer” App For The Modern Data Stack

-

Blog PostThought Leadership / July 12, 2022Metrics that Matter: Crucial KPIs for High Functioning Revenue Teams

-

Blog PostFirm News / July 11, 2022Welcome Dave Wilner to Sapphire!

-

Blog PostThought Leadership / June 30, 2022Metrics that Matter: Enabling a Data Driven Revenue Organization

-

Press Release

-

Blog PostLP Insights / June 9, 2022The #OpenLP Podcast Miniseries: Jaclyn Hester of Foundry Group

-

Blog PostThought Leadership / June 2, 2022Evolution of the Software Development Life Cycle (SDLC) & the Future of DevOps

-

S2: Podcast

-

Blog PostEvents / May 23, 2022It Takes Technology AND People: Perspectives from The Future of Supply Chain Conference

-

Blog PostFirm News / May 18, 2022Welcome Karan – Sapphire’s Revenue Excellence Leader!

-

Blog PostThought Leadership / May 11, 2022Demystifying the Modern B2B Go-To-Market Tech Stack

-

Blog PostLP Insights / May 4, 2022Dirty Secret: Venture Reserves are Not Always a Good Thing

-

Blog PostThought Leadership / April 28, 2022Sapphire à Paris. Diving Into the French Tech Revolution

-

Blog PostInvestment / April 26, 2022Transforming Websites into Sales & Marketing Machines: Why We’re Excited to Lead Qualified’s Series C

-

Blog PostThought Leadership / April 19, 2022Rise of the Next-Gen CFO: The Evolution of Finance’s Role and Tech Stack

-

S2: Podcast

-

Blog PostThought Leadership / March 29, 2022From an Explosion of Decacorns to a Boom in Female Founders, Sapphire Predicts 5 European Tech Trends Still to Come in 2022

-

Blog PostThought Leadership / March 10, 2022The Future of AI Infrastructure is Becoming Modular: Why Best-of-Breed MLOps Solutions are Taking Off & Top Players to Watch

-

S2: Podcast

-

Blog PostThought Leadership / March 1, 2022An Employee-Driven Future: How Europe is Leading the Future of Work

-

Blog PostInvestment / February 15, 2022Unlocking Student Potential with On-Demand Academic Support: Why We’re Proud to Partner with Paper

-

Blog PostThought Leadership / February 10, 2022Product-Led Growth (PLG) CRMs Emerge: Mapping the Market and Our 2022 Predictions

-

Press Release

-

Blog PostInvestment / January 27, 2022Doubling Down on the Future of Digital Asset Infrastructure: Why We’re Excited to Lead Blockdaemon’s Series C

-

Blog PostInvestment / January 26, 2022Captivating Revenue Teams with Transparent Sales Commissions: Why We’re Excited to Partner with CaptivateIQ

-

Year-In-ReviewInvestmentCelebrating a Year of Impact

-

Blog PostThought Leadership / January 20, 2022Top 6 European Enterprise Technology Trends to Watch in 2022

-

EventJanuary 19, 2022How to Accelerate Growth By Acing Net Dollar Retention

-

Blog PostInvestment / January 18, 2022Social Infrastructure for Web3: Sapphire Sport’s Investment in POAP

-

Press ReleaseTeam Promotions / January 6, 2022Sapphire Announces 2021 Partner Promotions in the U.S. and Europe After Landmark Year of Growth

-

Blog PostThought Leadership / January 6, 2022The Sapphire Future Six: 2022 Predictions for the Future of Work

-

Blog PostInvestment / December 27, 2021Transforming the Candidate Experience with the Power of Conversational AI: Why We’re Excited to Partner with Paradox

-

Blog PostThought Leadership / December 16, 2021Digital Accessibility Series, Part 3: Vendor Landscape

-

Press ReleaseCapital Raise / December 14, 2021Sapphire Ventures to Expand European Reach Following Unveiling of Nearly $2bn in New Capital Commitments

-

Blog PostThought Leadership / December 8, 2021Digital Accessibility Series, Part 2: How to Get Started with Digital Accessibility

-

Blog PostInvestment / December 7, 2021Transforming DevSecOps Starting with Real-Time Secrets Detection: Why We Are Excited to Back GitGuardian

-

Blog Post

-

Press ReleaseCapital Raise / November 30, 2021Sapphire Announces Nearly $2 Billion in New Capital Commitments Across Growth-Focused Technology Funds

-

ReportCapital Raise / November 29, 20212021 CIO Innovation Index: Reimagining the Enterprise

-

ReportCapital Raise / November 26, 2021CRO Edition: 2020 CIO Innovation Index

-

ReportCapital Raise / November 26, 2021Special Report: The Impact of COVID-19 on Enterprise Innovation

-

ReportCapital Raise / November 26, 20212020 CIO Innovation Index: Startup Engagement Trends for the Crisis CIO

-

Blog PostThought Leadership Events / November 24, 2021Sapphire Vision Summit 2021: 5 Trends Shaping the Enterprise

-

Blog PostInvestment Portfolio News / November 24, 2021Putting an End to Musculoskeletal Pain: Why We’re Proud to Back SWORD Health

-

Blog PostThought Leadership / November 24, 2021Digital Accessibility Series, Part 1: What is Digital Accessibility and Why is it Important?

-

Blog PostInvestment / November 15, 2021Automating Cloud Management for DevOps: Why We’re Excited to Back Zesty

-

Blog PostLP Insights / November 3, 2021The #OpenLP Podcast Miniseries: Saul Klein of LocalGlobe and Latitude – Champion of the European Tech Ecosystem

-

Blog PostInvestment / October 28, 2021DataRobot: Enabling Knowledge Workers to use Boring AI

-

Blog PostThought Leadership Investment / October 28, 2021The Database of the Future: Why We’re Excited to Lead Yugabyte’s Series C

-

Blog PostThought Leadership / October 27, 2021Bridging the Board Gap: Insights from European Female Board Executives on the Path to Parity

-

Event

-

Press Release

-

Blog PostThought Leadership / October 7, 2021Decarbonizing the Future: Why Sapphire is Excited about B2B Software Powering the Transition

-

Press ReleaseOctober 5, 2021Sapphire Expands Leadership Team with CMO Ellie Javadi

-

Blog PostLP Insights / September 30, 2021The #OpenLP Podcast Miniseries: Kim Lew, CEO of Columbia University’s Endowment

-

Blog PostInvestment / September 28, 2021The Ultimate Platform for Modern Recruiting: Why We’re Excited to Back Gem

-

Blog PostThought Leadership / September 22, 2021The Emergence of the Modern Data Stack: An Explosion of European & Israeli Data Tooling Companies

-

Blog PostThought Leadership Investment / September 21, 2021Building Better Infrastructure for Digital Assets: Why We’re Excited about FalconX, Blockdaemon, TaxBit & Tesseract

-

Blog PostGrowth Insights / September 14, 2021Long Live the Tech IPO

-

Blog PostInvestment / September 13, 2021Securing the 99.9%: Why We’re Excited to Lead JumpCloud’s Series F

-

Blog PostGrowth Insights / August 27, 2021Cazoo Becomes European Company of Consequence in Rapid Time

-

Blog PostThought Leadership / August 26, 2021The Ransomware Problem: Security Leaders (Like the FBI) Share How to Tackle the Unavoidable Threat

-

Blog PostThought Leadership / August 26, 2021NFTs – a Gateway to the Metaverse

-

Blog PostInvestment / August 25, 2021#gettingInvolved with Customer Success: Here’s Why We’re Thrilled to Lead involve.ai’s Series A

-

EventAugust 25, 2021Sapphire Vision Summit: Reimagining the Enterprise

-

Blog PostLP Insights / August 24, 2021Turning the Tables on Notation: Introducing the #OpenLP Origins Podcast Miniseries

-

Blog PostLP Insights / August 12, 2021Sapphire Partners Announces Next Generation of #OpenLP Initiative

-

Blog PostGrowth Insights / August 10, 2021Coming Into the Spotlight: How Customer Success Can Turbo Charge Subscription Growth

-

Blog PostInvestment / August 4, 2021The Rise of Customer Experience (CX) Automation: Why We’re Excited to Co-Lead yellow.ai’s Series C

-

Blog PostThought Leadership Investment Portfolio News / July 28, 2021Banking on Disruption: Why We’re Over the Moon to Invest in Mercury

-

S1: Podcast

-

Blog PostInvestment / July 21, 2021From Visualizing to Realizing the Future of Video: A Big Congrats to Kaltura on the IPO

-

Blog PostInvestment / July 21, 2021Supercharging Open Banking to Create Better Financial Services: Why We’re Excited to Lead Yapily’s Series B

-

Blog PostGrowth Insights / July 14, 2021The Power of Payments: Why the European Payments Market is Hotter than Ever

-

S1: PodcastJuly 14, 2021Anchor Partnerships Around The World With Seann Gardiner

-

Blog PostThought Leadership Investment / July 13, 2021All Hail Happiness: The Gen Z Buying Habit Coming to a Wellness Investment Near You

-

Blog PostGrowth Insights / July 7, 2021Redefining Conventional Wisdom. Congratulations to Wise on its Public Debut!

-

S1: Podcast

-

Blog PostGrowth Insights / July 6, 2021Israel’s Booming Tech Scene: Top Trends & Players in the Startup Nation

-

Blog PostGrowth Insights / June 30, 2021Congratulations to IAS on the IPO Milestone! On a Mission to Measure & Verify Digital Ad Integrity

-

Blog PostThought Leadership Firm News / June 29, 2021Why I joined Sapphire Sport

-

S1: Podcast

-

Blog PostThought Leadership / June 22, 2021Harnessing our Network’s Collective Intelligence: Sapphire Unveils Centers of Excellence to Help Portfolio Companies Scale

-

Blog PostThought Leadership / June 17, 2021The Future of Work in Post-Pandemic Europe from CXOs at Roche, Bentley, Deutsche Telekom and Others

-

S1: Podcast

-

Blog PostThought Leadership Growth Insights / June 15, 2021The Startup’s Guide to Nailing Customer Success

-

Blog PostGrowth Insights / June 10, 2021Monday on a Thursday. Congratulations to Monday.com!

-

S1: Podcast

-

Blog PostInvestment / June 8, 2021Simplifying Transcription and Captioning with AI: Why Sapphire is Thrilled to Once Again Back Verbit

-

S1: Podcast

-

S1: Podcast

-

Blog Post

-

Event

-

Blog PostGrowth Insights / May 20, 2021Flipping & Financings: What European Founders Need to Know about Flipping to a U.S. Company Structure

-

S1: Podcast

-

Blog PostGrowth Insights / May 13, 2021Sapphire & Pendo: Partners in Delighting Users with Better Digital Product Experiences

-

Blog PostInvestment / May 12, 2021Time to Prioritize Preventative Mental Health & Wellness: Why We’re Excited to Back Unmind

-

S1: Podcast

-

S1: Podcast

-

Blog PostInvestment / May 4, 2021A Smarter Way to Fight Cybercrime: Why We’re Proud to Lead JupiterOne’s Series B

-

Blog PostGrowth Insights / May 3, 2021On a Mission to Address Every Identity Use Case: Congratulations to Auth0 on Joining Forces with Okta

-

Blog PostLP Insights / April 28, 2021Fund Recycling Moves the Needle for Both LPs and GPs. Here’s How.

-

Blog PostGrowth Insights / April 22, 2021What is the Open Data Ecosystem and Why it’s Here To Stay

-

EventApril 14, 2021The Startup’s Guide to Opening European Operations

-

Blog PostThought Leadership / April 14, 2021A Startup’s Guide for Opening European Operations

-

Blog PostInvestment / April 13, 2021Reimagining the Workforce Upskilling Experience: Why We’re Excited to Co-Lead Degreed’s Series D

-

Blog PostInvestment / April 1, 2021The Rise of AB”X” and the RevTech Revolution: Why We’re Backing 6sense

-

Blog PostInvestment Portfolio News / March 31, 2021Transforming Lives Through Fitness, Health and Wellness: Why Sapphire is Thrilled to Once Again Back Tonal

-

Blog PostGrowth Insights / March 24, 2021Best Practices for Planning an Exit Strategy from the CFOs of JFrog and Segment

-

Blog PostInvestment / March 16, 2021‘Data Driven’ Starts with Data: Why We’re Excited to Back SafeGraph, a Leading DaaS Company for Places

-

Blog Post

-

Blog PostInvestment / March 9, 2021Bringing Governance and Security to Democratized Data: Why We’re Partnering with Privacera

-

Press Release

-

Blog PostInvestment / February 25, 2021Mobile Coaching and the Employee Renaissance: Why We’re Excited to Back BetterUp

-

Blog PostGrowth Insights / February 23, 2021A SPACtacular Future: The Rapid Rise of SPACs & What Comes Next

-

Press ReleaseFebruary 17, 2021Sapphire Sport Welcomes Chloe Steinberg as its Newest Partner

-

Blog PostGrowth Insights / February 9, 2021A New Way to Achieve Board Diversity: Announcing Our Founding Partnership with All Raise’s Board Xcelerate Program

-

EventFebruary 4, 2021The Road to IPO or M&A: Best Practices for Planning an Exit Strategy

-

Press Release

-

Blog PostLP Insights / February 2, 2021The Black Swan Year: How 2020 Impacted Venture Investing and Performance

-

Blog PostInvestment / February 1, 2021Bringing Mission-Critical Data Protection to the Cloud: Why We’re Thrilled to Partner with OwnBackUp

-

Blog PostGrowth Insights / January 29, 2021How Automation & Low Code/No Code Platforms Help Power our Lives: 4 Trends Driving Adoption

-

Blog Post

-

Blog PostThought Leadership / January 28, 2021Sapphire Ventures: 2020 Year-in-Review

-

Blog Post

-

Press Release

-

Blog PostGrowth Insights / January 21, 2021Ecommerce is Having a Moment: Why We’re Excited & What’s Next

-

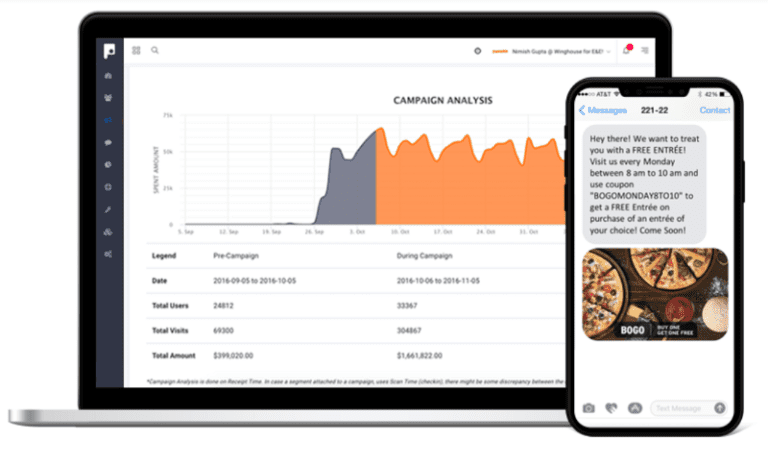

Blog PostGrowth Insights / January 19, 2021Punchh & Sapphire Ventures: Partners in Improving Customer Loyalty and Engagement for Brick-and-Mortar Retailers

-

Blog PostGrowth Insights / January 13, 20217 Tips for European Female Founders Fundraising Right Now

-

Blog PostThought Leadership / January 13, 2021Category Creation: A Marketing Strategy for Long-Term Differentiation

-

Blog PostThought Leadership / January 12, 20214 Key Strategies to Implementing a Usage-Based Pricing Model

-

Blog Post

-

Blog PostThought Leadership / December 16, 20205 Insights Startup CMOs Should Know About Analyst Relations

-

Blog PostGrowth Insights / December 15, 2020No Going Back Now: 10 Enterprise Tech Trends Taking Shape in 2021

-

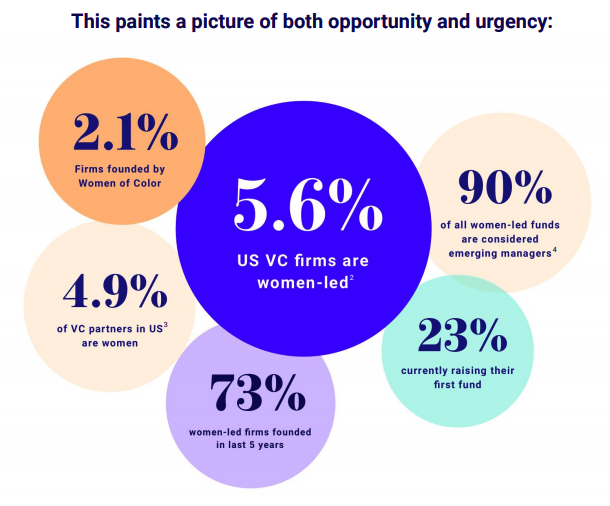

Blog PostLP Insights / December 11, 2020Diversity in VC: Learnings From an LP Audit and How we Can Make This Better Together

-

Blog PostInvestment / December 10, 2020Revolutionizing Customer Service for e-Commerce: Our Investment in Gorgias

-

Blog PostGrowth Insights / December 8, 2020Since we Last Spoke: StackHawk’s CEO Joni Klippert on Helping Developers Secure Code as They Write It

-

Blog PostGrowth Insights / December 3, 2020Since we last Spoke: Uptycs’ CEO on Providing Security Analytics for Everyone & Partnering with a VC that Knows Enterprise Tech

-

Blog PostGrowth Insights / December 2, 2020The (Tele)doctor Will See You Now: How COVID-19 Has Accelerated HealthTech Adoption

-

Blog PostInvestment / November 24, 2020Ushering in a New Era of Online Banking: Why Sapphire Ventures is Excited to Partner with Current

-

Blog PostInvestment / November 23, 2020Near-Perfect Transcription with a “Human-in-the-Loop” Approach: Our Investment in Verbit

-

Blog PostInvestment / November 19, 2020Leading the Way in Decentralized Clinical Trials: Why Sapphire Ventures is Excited to Partner with Medable

-

Blog PostThought Leadership / November 18, 2020While the Work is Never Done, Here’s How Leaders at Culture Amp, Outreach & Pendo are Working to Get D&I Right

-

Blog PostInvestment / November 17, 2020Pioneering a Better Way to Work: Why Sapphire Ventures is Excited to Partner with ActivTrak

-

Blog PostThought Leadership Growth Insights / November 3, 2020Livongo and Sapphire Ventures: Partners in Revolutionizing Chronic Condition Management

-

Blog PostThought Leadership / October 30, 2020Building the Next Normal: 5 Key Insights for CMOs Delivering Virtual Events from Someone Who Knows

-

Blog PostThought Leadership / October 29, 2020Introducing the CRO Edition of the 2020 CIO Innovation Index: Startup Engagement Trends for Today’s Revenue Leaders

-

Blog PostInvestment / October 27, 2020Securing Apps From the Very Beginning: Why Sapphire Ventures is Excited to Partner with StackHawk

-

Blog PostThought Leadership / October 15, 2020How to Achieve Diversity, Inclusion & Equality in the Workplace from the People Leaders at Livongo

-

Blog PostGrowth Insights / October 13, 2020Since We Last Spoke: Highspot’s CEO on the Importance of Business Agility During COVID-19 and Beyond

-

Blog PostInvestment / October 7, 2020The Rise of Digital B2B Payments and Why We’re Excited about AvidXchange

-

Blog PostThought Leadership / October 6, 2020The Startup’s Guide to Cloud Marketplaces eBook: How to Get Started and Drive Revenue with this Growing Sales Channel

-

Blog PostInvestment / October 5, 2020Baby, You Can Drive My Car ♫: Our Investment in Cazoo’s £240M Series D

-

Blog PostThought Leadership Growth Insights / September 30, 2020Sapphire & ThoughtSpot: Partners in Democratizing Data for Everyone

-

Blog Post

-

Blog PostInvestment / September 17, 2020Congratulations to Sumo Logic on the IPO! And for Revolutionizing DevSecOps with Continuous Intelligence

-

Blog PostInvestment / September 16, 2020Congratulations to JFrog! An Iconic IPO that Highlights the Coming-of-Age of DevOps

-

Event

-

Press Release

-

Blog PostLP Insights / September 4, 2020Virtual Annual Meetings are Here to Stay: Best Practices for Re-Imagining the AGM for our Remote World

-

Blog PostThought Leadership / August 28, 2020Zoom’s Head of Global Business Development and Channel On How To Integrate Alliance Strategy With Revenue Strategy

-

Blog PostInvestment / August 27, 2020Investing in the Future of Live Video: Why Sapphire is Excited to Partner with Restream

-

Blog PostGrowth Insights / August 18, 20203 Strategies Software Companies Can Borrow from the Open Source Cloud Playbook

-

Blog PostThought Leadership Growth Insights / August 13, 2020Since we Last Spoke: CircleCI’s CEO on Automating the Complexity of Writing and Delivering Software, and Partnering with Sapphire

-

Blog PostLP Insights / August 5, 2020The 4 P’s of Fundraising for Emerging Managers

-

Blog PostThought Leadership / August 5, 2020Sapphire Sport: Investing in the Future of Consumer Experiences

-

Blog PostThought Leadership / August 4, 2020Introducing the Sapphire Ventures CIO Innovation Index Special Report: The Impact of COVID-19 on Enterprise Innovation

-

Blog PostThought Leadership / July 30, 2020Leaders from Auth0 and Segment Share How Globally Distributed Teams Drive Innovation

-

Blog PostGrowth Insights / July 27, 2020Open Banking & Beyond: What’s Next for European FinTech Infrastructure?

-

Blog PostGrowth Insights / July 22, 2020Since we Last Spoke: UJET’s CEO on Reimagining How Consumers Interact with Businesses and Finding the Right VC Partner

-

Blog PostLP Insights / July 17, 2020What You Need to Know About Fundraising This Year

-

Blog Post

-

Blog PostThought Leadership / July 6, 20205 Strategies That Will Define the Crisis-Era CIO Post COVID-19

-

Blog PostThought Leadership Growth Insights / June 30, 2020The Ultimate Stress Test: How COVID-19 Is Accelerating the Evolution of Customer Support

-

Blog Post

-

Blog PostInvestment / June 17, 2020Welcome to Agile Content Management: Why Sapphire Ventures is Excited to Continue to Partner with Contentful

-

Blog Post

-

Blog PostThought Leadership Growth Insights / June 11, 2020Is PropTech the Solution to Real Estate’s COVID-19 Slump?

-

Blog PostThought Leadership / May 19, 20204 Ways RevOps Can Help Build Certainty During Uncertain Times

-

Blog PostThought Leadership Growth Insights / April 30, 2020How to Build a Prospect Risk Assessment Model

-

Blog PostThought Leadership Investment / April 23, 2020Modernizing the Way Business Happens Locally: Why We’re Excited About Podium

-

Blog PostThought Leadership Investment / April 20, 2020Solving Marketing’s Top Challenge: Why Adverity and Sapphire Ventures Chose to Partner

-

Blog PostThought Leadership Growth Insights / April 20, 20203 Start-Up CEOs Share How to Get Through This Economic Downturn

-

Blog PostThought Leadership / April 15, 2020How CIOs are Navigating a Mandated Remote Workforce

-

Blog PostThought Leadership Growth Insights / April 14, 20205 Ways CROs Are Building Revenue Resiliency

-

Blog PostThought Leadership / April 9, 2020From CXO to Board Director: A Discussion with Julie Cullivan

-

Blog PostThought Leadership Growth Insights / April 8, 2020Considerations For When Letting People Go

-

Blog PostInvestment / April 7, 2020Deliver Apps at the Speed of Business: Why Sapphire Ventures Chose to Invest in CircleCI

-

Blog PostThought Leadership Growth Insights / March 31, 2020COVID-19: Our Guidance to Portfolio Companies During These Difficult Times

-

Blog PostThought Leadership / March 12, 2020Why More Than 50% of CIOs Advise Startups

-

Blog PostThought Leadership / February 26, 2020Over 50% of Proof of Concepts Fail — Here’s How to Fix Yours

-

Press Release

-

Blog PostThought Leadership / January 30, 2020Nutanix CIO Wendy M. Pfeiffer’s Path to the Qualys Board

-

Blog PostJanuary 24, 2020Sapphire Ventures: Looking Back on 2019

-

Blog PostEvents / December 20, 2019Four Things Employees Expect in the Workplace in 2020

-

Press Release

-

Blog PostThought Leadership / December 17, 2019Sapphire Ventures Raises More than $1.4B to Support Entrepreneurs in Building Category Leaders

-

Blog PostEvents / November 22, 2019PropTech Summit 2019: Uncovering the Latest in Real Estate Tech

-

Blog PostThought Leadership / November 15, 2019Corporate Boards Need More Technologists — Here’s How CIOs Can Bridge the Divide

-

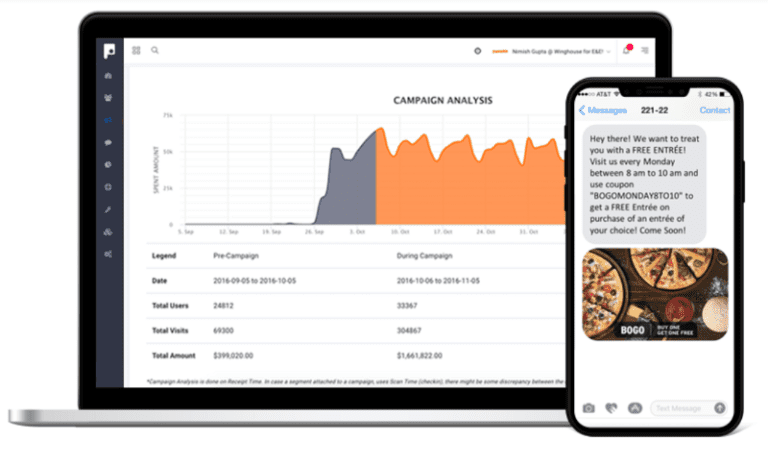

Blog PostInvestment / November 14, 2019Punchh: Helping Retailers Understand Online and In-store Customers with their AI/ML Platform

-

Blog PostInvestment / November 14, 2019“Real” AI in Enterprise IT — Why Sapphire Ventures and Moveworks are Excited to Partner

-

Blog PostLP Insights / November 7, 2019Which Investments Generate the Greatest Value in Venture: Consumer or Enterprise?

-

Blog PostInvestment / November 7, 2019Our Investment in Side: Empowering Agent Teams

-

Blog PostThought Leadership / November 3, 2019A New Playbook for Sports Media

-

Blog PostThought Leadership Events / October 18, 2019Three Ways CIOs Are Leveling Up Their Companies in 2019

-

Blog PostInvestment / October 9, 2019Clari: Transforming the Revenue Operations Process

-

Blog PostThought Leadership / October 8, 2019Sudheesh Nair on 3 Ways to Build a Team That Repeatedly Delivers Innovative, Valuable Products at Scale

-

Blog PostThought Leadership / October 3, 2019Announcing Sapphire Venture’s CIO Innovation Index: Benchmarking Disruption Within IT

-

Press Release

-

Blog PostInvestment / October 1, 2019Brightfield: Lighting Up the Extended Workforce

-

Blog PostInvestment / August 27, 2019Thinking Twice About ThoughtSpot — a Visionary Product and Team at the Forefront of Business Intelligence

-

Blog PostLP Insights / August 20, 2019Fundraising Tips – How to Build a Better Data Room

-

Blog PostThought Leadership Events / August 7, 2019From CXO to Board Director: 3 Lessons to Help You Forge Your Path

-

Blog PostInvestment / July 30, 2019Monday is our New Favorite Day: Why monday.com and Sapphire Chose to Partner

-

Blog PostInvestment / July 25, 2019Congratulations Livongo, a True Company of Consequence

-

Press Release

-

Blog PostThought Leadership Investment / June 6, 2019Congratulations, Looker, on Your Acquisition

-

Blog PostInvestment / June 5, 2019Riding High with Highspot: Why Sapphire and Highspot Are Excited to Partner

-

Blog PostInvestment / June 5, 2019AllyO: Helping you win the Talent War with Boring AI (Artificial Intelligence)

-

Blog PostGrowth Insights / May 21, 2019The Do’s and Don’ts of Sustainable Consumer Startup Growth

-

Blog PostThought Leadership / May 14, 2019Inbound to Outbound: Implementing the Blended Go-to-Market Model

-

Blog PostThought Leadership / May 13, 2019Closing the Gap: 5 Tips for Women Seeking Board of Director Positions

-

Blog PostThought Leadership LP Insights / May 8, 2019What Makes a Good Annual Meeting? An LP’s Point of View

-

Blog PostThought Leadership Investment / May 7, 2019Exabeam: Shedding Light on Security Data

-

Blog PostThought Leadership / April 16, 2019Transform!2019: How VC-led Innovation Fuels Digital Transformation

-

Blog PostLP Insights / April 5, 2019How Does Data Influence LP and GP Decisions?

-

Blog PostInvestment / April 2, 2019Why Sapphire Ventures and Segment Are Excited to Partner

-

Blog PostThought Leadership / March 28, 20193 Cardinal Mistakes Startups Make During CIO Pitches

-

Blog PostLP Insights / March 27, 2019The Internationalization of Venture Capital: Will this Affect LP Allocations?

-

Blog PostThought Leadership / March 25, 2019These are the Good Old Days for SaaS

-

Blog PostInvestment / March 20, 2019Portworx: Providing Data Management for Container-based Applications

-

Blog PostThought Leadership Scaling / March 14, 2019SV Explorer: Connecting CIOs to the Collective Wisdom of the VC Community

-

Blog PostThought Leadership / March 5, 2019They Talk the Talk, But Can They Walk the Walk? 7 Ways To Assess the Value-Add of VC Firms

-

Blog PostGrowth Insights LP Insights / March 4, 20192018 Year In Review

-

Blog PostThought Leadership / February 14, 2019Why Sport?

-

Blog PostLP Insights / February 13, 2019When Money Isn’t Enough: How to Distinguish Yourself as a VC in a Crowded Market

-

Blog PostLP Insights / February 8, 20193 Things that Make a Great Limited Partner For A Venture Fund

-

Blog PostThought Leadership Investment / January 29, 2019Introducing Sapphire Sport: A new early-stage venture platform

-

Blog PostThought Leadership / January 24, 2019Embrace the Cloud

-

Blog PostScaling / January 18, 2019Tools Every Startup CFO Needs to Succeed

-

Blog PostInvestment / January 17, 2019Alation: Finding Truth in Data

-

Press ReleaseJanuary 15, 2019Sapphire Ventures Announces Promotion of Jai Das to President

-

Blog PostThought Leadership Events / December 19, 2018The New Science and Art of Customer Engagement

-

Blog PostGrowth Insights / December 12, 2018The Big Opportunity in Small Business

-

Blog PostInvestment Portfolio News / December 5, 2018Head Over Heels for Headless

-

Blog PostEvents / November 15, 2018How AI Is (and Is Not) Transforming the Workplace

-

Blog PostScaling / November 2, 2018Introducing Sapphire Fellows: Proven leaders to help founders scale

-

Blog PostEvents / October 24, 20183 Ways CIOs Stay on the Front Lines of Innovation: Takeaways From the 2018 CIO Summit

-

Blog PostInvestment / October 23, 2018project44: Democratizing the Amazonification of Shipping

-

Blog PostGrowth Insights Scaling / October 23, 2018The Right COO Will Take Your Company to the Next Level — Here’s How to Find Your Match

-

Blog PostGrowth Insights / October 19, 2018New York on Our Mind

-

Press ReleaseSeptember 21, 2018Michael Spirito Joining Sapphire Ventures as Partner

-

Blog PostInvestment / September 12, 2018Pendo-monium! — Why Sapphire and Pendo are Excited to Partner

-

Blog PostThought Leadership Scaling / July 17, 2018Top Challenges Today’s Product Managers Face

-

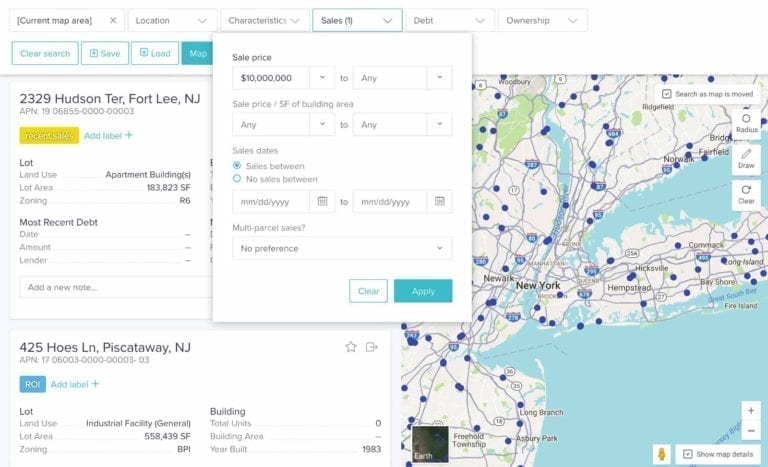

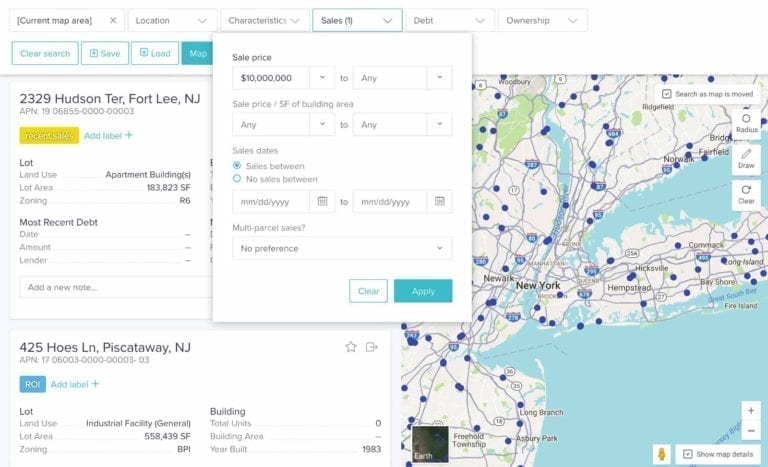

Blog PostInvestment / June 14, 2018Reonomy: Lifting The Veil On Commercial Real Estate

-

Blog PostLP Insights / June 13, 2018LPs Push Into the Crypto Fray

-

Blog PostLP Insights / June 3, 2018Raising A Fund? 9 Questions That Help Get You To GP/LP Fit

-

Blog PostInvestment / May 22, 2018Out-Reaching for Consequence — Why Outreach and Sapphire Ventures Are Excited to Partner

-

Blog PostLP Insights / May 21, 2018What LP’s are Saying About Emerging Venture Manager Funds

-

Blog PostThought Leadership / May 17, 2018I’m Joining Sapphire Ventures!

-

Press Release

-

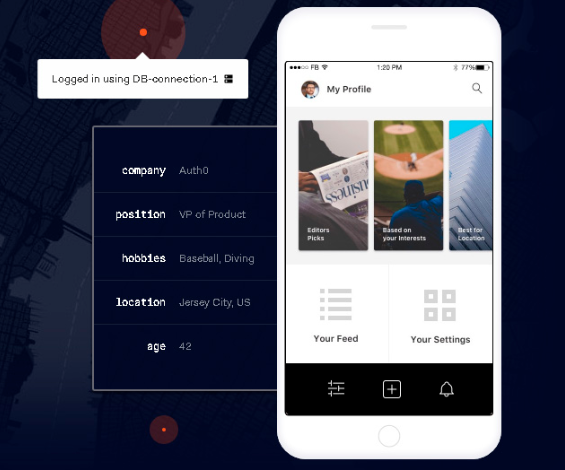

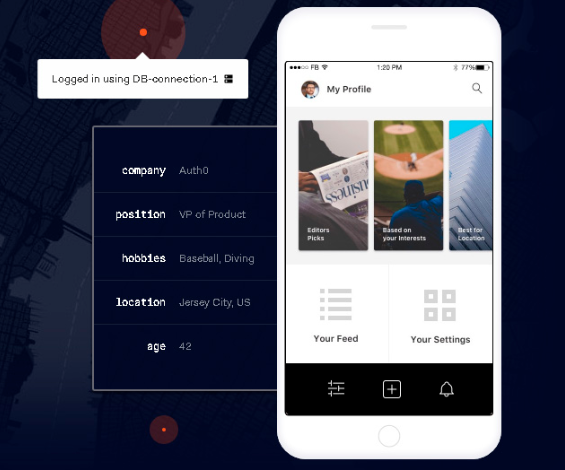

Blog PostInvestment / May 15, 2018Auth0: Bringing Identity as a Service

-

Blog PostGrowth Insights / May 9, 2018Why CIOs Must “follow the money” — When It Comes To Startups

-

Blog PostInvestment / May 8, 2018ThoughtSpot — Empowering The Enterprise To Be Analytical And Data-driven!

-

Blog PostThought Leadership Events / May 4, 2018Legos, Lazy Developers And Robots On Facebook: Reflections From Sapphire’s Tech Stack Forum

-

Blog PostInvestment / April 12, 2018Punchh-ing For Retailers

-

Blog PostThought Leadership / April 4, 2018How Startups Power PepsiCo’s Innovation Strategy

-

Blog PostInvestment / March 22, 2018Matillion: Changing The Data Integration Game

-

Blog PostLP Insights / March 3, 2018Why The Health Should We Care

-

Blog PostLP Insights / February 26, 2018#OpenLP: Turning the Tables on Notation Capital

-

Blog PostLP Insights / January 25, 2018The A to Z on Series A: Part Three | The Exit

-

Blog PostLP Insights / December 20, 2017The A to Z on Series A: Part Two

-

Blog PostLP Insights / December 6, 2017The A To Z On Series A: Part One

-

Blog PostLP Insights / November 21, 2017Chatting With Margo Doyle On All Things LP

-

Blog PostLP Insights / June 10, 2017Why You Probably Won’t Invest in the Next Unicorn

-

Blog PostLP Insights / May 31, 2017Beezer’s Breakdown Take II with Harry Stebbings

-

Blog PostLP Insights / May 25, 2017Parsing The Maddening Venture Capital Market

-

Blog PostLP Insights / March 27, 2017Chatting With TechCrunch On The M&A And IPO Market In 2017

-

Blog PostLP Insights / March 21, 2017VC Interest Piqued in Healthcare

-

Blog PostLP Insights / January 17, 2017Venture Capital In 2017 Is When The Rubber Hits The Road For Returns

-

Blog PostThought Leadership LP Insights / December 15, 2016One Year Later: Our European Report Card

-

Blog PostLP Insights / December 13, 2016Speaking At Slush And TechCrunch Disrupt

-

Blog PostThought Leadership LP Insights / November 21, 2016Why Enterprise Funds May Return More Capital Than Consumer Funds

-

Blog PostThought Leadership LP Insights / October 15, 2016Beezer Clarkson: My Chat With The Twenty Minute VC On LPs And The World Of VC

-

Blog PostThought Leadership LP Insights / September 24, 2016All In: Re-imagining Our Role As An LP In Venture

-

Press Release

-

Blog PostThought Leadership LP Insights / August 29, 2016#OpenLP: Why Founders Should Care Where Their VCs Get Their Money

-

Blog PostLP Insights / June 7, 2016New York Venture State Of Mind

-

Blog PostLP Insights / April 22, 2016The Money Behind The Money: A Conversation With LPs And GPs

-

Blog PostLP Insights / April 20, 2016Why Your Limited Partner Might Pass On Your Next Fund

-

Blog PostLP Insights / January 19, 2016Reading The Venture Tea Leaves For 2016

-

Blog PostLP Insights / January 18, 2016How To Raise An Institutional Seed Fund In Europe: An Interview With Point Nine Capital

-

Blog PostLP Insights / January 18, 2016In Support Of A Better Calculator: Various Factors That Affect Portfolio Returns In A Bull Market

-

Blog PostLP Insights / January 18, 2016To SPV Or Not To SPV: Decoding The Pros And Cons Of Special Purpose Vehicles

-

Blog PostLP Insights / January 18, 2016Building a Firm, Not Just Raising a Fund

-

Blog PostLP Insights / January 18, 2016Building A Venture Firm Is A Marathon, Not A Sprint

-

Blog PostLP Insights / January 5, 2016Top 10 Tips For Pitching An LP

-

Press ReleaseOctober 16, 2014SAP Ventures Becomes Sapphire Ventures

all

-

Blog Post

Thought Leadership / April 11, 2024Charting the Course in Climate Tech: Decarbonization Opportunities in 2024

Thought Leadership / April 11, 2024Charting the Course in Climate Tech: Decarbonization Opportunities in 2024 -

Blog Post

Thought Leadership / April 3, 2024“La French Tech” – A Tour de Force of Innovation and Growth

Thought Leadership / April 3, 2024“La French Tech” – A Tour de Force of Innovation and Growth -

Blog Post

Investment / March 7, 2024A Modern Approach to National Security Software: Why We’re Excited to Back Defense Unicorns

Investment / March 7, 2024A Modern Approach to National Security Software: Why We’re Excited to Back Defense Unicorns -

Blog Post

Thought Leadership / February 29, 2024Introducing A Guide to Building an Effective Partner Strategy Framework

Thought Leadership / February 29, 2024Introducing A Guide to Building an Effective Partner Strategy Framework -

Blog Post

Thought Leadership / February 28, 2024Observability in 2024: Understanding the State of Play and Future Trends

Thought Leadership / February 28, 2024Observability in 2024: Understanding the State of Play and Future Trends -

Blog Post

Thought Leadership / February 15, 2024The GTM Perspective: Navigating Product-Led Growth vs. Sales-Led Growth Models

Thought Leadership / February 15, 2024The GTM Perspective: Navigating Product-Led Growth vs. Sales-Led Growth Models -

Blog Post

Thought Leadership / February 8, 2024Silicon Valley Meets The Department of Defense: Top Observations & Opportunities in Defense Tech

Thought Leadership / February 8, 2024Silicon Valley Meets The Department of Defense: Top Observations & Opportunities in Defense Tech -

Blog Post

Thought Leadership / January 31, 2024Navigating the Future of Healthcare: 4 Major Trends & Pivotal Questions to Explore in 2024

Thought Leadership / January 31, 2024Navigating the Future of Healthcare: 4 Major Trends & Pivotal Questions to Explore in 2024 -

Blog Post

Report / January 30, 2024The State of the SaaS Capital Markets: A Look Back at 2023 and Look Forward to 2024

Report / January 30, 2024The State of the SaaS Capital Markets: A Look Back at 2023 and Look Forward to 2024 -

Blog Post

Firm NewsSapphire Ventures:

Firm NewsSapphire Ventures:

2023 Year in Review -

Blog Post

Thought Leadership / December 21, 2023The Year GenAI Comes to Fruition: 10 Enterprise Tech Trends Set to Define 2024

Thought Leadership / December 21, 2023The Year GenAI Comes to Fruition: 10 Enterprise Tech Trends Set to Define 2024 -

Blog Post

Thought Leadership Events / December 7, 2023Navigating a New Normal: GTM Learnings From Our Inaugural Sapphire Ascend Summit

Thought Leadership Events / December 7, 2023Navigating a New Normal: GTM Learnings From Our Inaugural Sapphire Ascend Summit -

Blog Post

Thought Leadership / September 14, 2023Germany’s Booming Startup Scene, in Berlin and Beyond…

Thought Leadership / September 14, 2023Germany’s Booming Startup Scene, in Berlin and Beyond… -

Blog Post

Firm News / September 13, 2023Celebrating What’s New and Next

Firm News / September 13, 2023Celebrating What’s New and Next -

Blog Post

Thought Leadership / September 7, 2023Streaming Wars: Video Security & Video Intelligence Edition

Thought Leadership / September 7, 2023Streaming Wars: Video Security & Video Intelligence Edition -

Blog Post

Firm News / September 6, 2023Introducing Sapphire’s ESG Framework & Inaugural Report

Firm News / September 6, 2023Introducing Sapphire’s ESG Framework & Inaugural Report -

Blog Post

Thought Leadership / August 22, 2023How to Adopt Consumption-Based Pricing — and Avoid Common Pitfalls

Thought Leadership / August 22, 2023How to Adopt Consumption-Based Pricing — and Avoid Common Pitfalls -

Blog Post

Thought Leadership Events / August 16, 2023How to Balance AI Innovation and Efficiency: Lessons from our 2nd Annual Hypergrowth Engineering Summit

Thought Leadership Events / August 16, 2023How to Balance AI Innovation and Efficiency: Lessons from our 2nd Annual Hypergrowth Engineering Summit -

Blog Post

Thought Leadership / August 15, 2023From Purchase Orders to Boardrooms: Procurement’s Tech Renaissance and Evolution

Thought Leadership / August 15, 2023From Purchase Orders to Boardrooms: Procurement’s Tech Renaissance and Evolution -

Blog Post

-

Blog Post

Investment / July 20, 2023Taking the Pain out of Patient Payments: Why We’re Excited to Lead Collectly’s Series A

Investment / July 20, 2023Taking the Pain out of Patient Payments: Why We’re Excited to Lead Collectly’s Series A -

Blog Post

Thought Leadership / July 19, 2023Vertical(ai) is the New Horizontal

Thought Leadership / July 19, 2023Vertical(ai) is the New Horizontal -

Blog Post

Thought Leadership / July 11, 2023The 5 Eras of AI: The Vast Possibilities of GenAI Will Be Here Before We Know It

Thought Leadership / July 11, 2023The 5 Eras of AI: The Vast Possibilities of GenAI Will Be Here Before We Know It -

Blog Post

-

Blog Post

-

Blog Post

Investment / May 16, 2023Managing Security for the 99%: Why We’re Excited to Lead Huntress’ Series C

Investment / May 16, 2023Managing Security for the 99%: Why We’re Excited to Lead Huntress’ Series C -

Blog Post

Investment / May 2, 2023Transforming Employee Experience with the Power of AI: Why We’re Excited to Lead Simpplr’s Series D

Investment / May 2, 2023Transforming Employee Experience with the Power of AI: Why We’re Excited to Lead Simpplr’s Series D -

Blog Post

Thought Leadership / April 27, 2023The Nordic Flywheel Effect: Building the Next Startup Trailblazers

Thought Leadership / April 27, 2023The Nordic Flywheel Effect: Building the Next Startup Trailblazers -

Blog Post

Thought Leadership / April 26, 2023Keep It Clean: Advice for Raising Growth Capital in 2023

Thought Leadership / April 26, 2023Keep It Clean: Advice for Raising Growth Capital in 2023 -

Blog Post

Thought Leadership / April 20, 2023Securing the Future: Cybersecurity’s Evolution & What’s On the Horizon

Thought Leadership / April 20, 2023Securing the Future: Cybersecurity’s Evolution & What’s On the Horizon -

Blog Post

Firm News / April 19, 2023Introducing Sapphire Communities – A Robust Knowledge Network for Startup CEOs and Industry Leaders

Firm News / April 19, 2023Introducing Sapphire Communities – A Robust Knowledge Network for Startup CEOs and Industry Leaders -

Blog Post

Thought Leadership / March 22, 2023Doing More With Less: Is Making the Move Upmarket Right For You?

Thought Leadership / March 22, 2023Doing More With Less: Is Making the Move Upmarket Right For You? -

Blog Post

Thought Leadership / February 27, 2023What SaaS Profitability Looks Like in 2023

Thought Leadership / February 27, 2023What SaaS Profitability Looks Like in 2023 -

Blog Post

Thought Leadership / February 21, 2023The 2023 European CIO Outlook: 4 Pressing Challenges Impacting Enterprises

Thought Leadership / February 21, 2023The 2023 European CIO Outlook: 4 Pressing Challenges Impacting Enterprises -

Blog Post

Thought Leadership / February 9, 2023AI: Paving the Future of Digital Healthcare

Thought Leadership / February 9, 2023AI: Paving the Future of Digital Healthcare -

Blog Post

Thought Leadership Events / February 7, 2023Sapphire Roundtable Recap: How Startups Plan to Tackle Revenue Growth in 2023

Thought Leadership Events / February 7, 2023Sapphire Roundtable Recap: How Startups Plan to Tackle Revenue Growth in 2023 -

Blog Post

Thought Leadership / January 19, 2023SaaS Stocks: In It to Win It, Why We Remain Long-Term Bullish on Next-Gen SaaS

Thought Leadership / January 19, 2023SaaS Stocks: In It to Win It, Why We Remain Long-Term Bullish on Next-Gen SaaS -

Blog Post

Thought Leadership / January 17, 2023Will Current Market Conditions Cause Unicorn Status to Lose its Lustre?

Thought Leadership / January 17, 2023Will Current Market Conditions Cause Unicorn Status to Lose its Lustre? -

Blog Post

Thought Leadership / December 12, 2022The Future of DevOps: A Spotlight on European Players in the DevOps Ecosystem

Thought Leadership / December 12, 2022The Future of DevOps: A Spotlight on European Players in the DevOps Ecosystem -

Blog Post

Thought Leadership / December 5, 2022Jamming Out Some Thoughts on Jamstack: The Trends and Companies Advancing the Growing Ecosystem

Thought Leadership / December 5, 2022Jamming Out Some Thoughts on Jamstack: The Trends and Companies Advancing the Growing Ecosystem -

Blog Post

Thought Leadership / November 16, 2022Back in Stock! Emerging Supply Chain & Logistics Trends and Technology Landscape

Thought Leadership / November 16, 2022Back in Stock! Emerging Supply Chain & Logistics Trends and Technology Landscape -

Blog Post

Thought Leadership / October 18, 2022What’s Up With WebAssembly: Compute’s Next Paradigm Shift

Thought Leadership / October 18, 2022What’s Up With WebAssembly: Compute’s Next Paradigm Shift -

Blog Post

-

Blog Post

September 29, 2022The #OpenLP Podcast Miniseries: Beezer Clarkson, Sapphire Partners

September 29, 2022The #OpenLP Podcast Miniseries: Beezer Clarkson, Sapphire Partners -

Blog Post

Thought Leadership / September 26, 2022Explosion of the European Web3 Landscape: Enabling the Next Frontier of Crypto

Thought Leadership / September 26, 2022Explosion of the European Web3 Landscape: Enabling the Next Frontier of Crypto -

Blog Post

Thought Leadership / September 20, 2022Rise of the Digital Health Enablement Tech Stack: How Technology is Accelerating Innovation for Modern Care Delivery

Thought Leadership / September 20, 2022Rise of the Digital Health Enablement Tech Stack: How Technology is Accelerating Innovation for Modern Care Delivery -

Blog Post

Thought Leadership / September 15, 2022Revenue Planning for High Growth Startups

Thought Leadership / September 15, 2022Revenue Planning for High Growth Startups -

Blog Post

Thought Leadership / September 7, 2022Building Web3 Block by Block: A Look at the Growing Developer Tool Landscape

Thought Leadership / September 7, 2022Building Web3 Block by Block: A Look at the Growing Developer Tool Landscape -

Blog Post

Investment / August 29, 2022Transforming Data Infrastructure with Real-Time Analytics: Why We’re Excited to Back StarTree

Investment / August 29, 2022Transforming Data Infrastructure with Real-Time Analytics: Why We’re Excited to Back StarTree -

Blog Post

Firm News / August 25, 2022Welcoming Mahau Ma to Sapphire as an Operating Partner!

Firm News / August 25, 2022Welcoming Mahau Ma to Sapphire as an Operating Partner! -

Blog Post

Thought Leadership / August 8, 2022If It Don’t Make Dollars, It Don’t Make Sense: Demystifying Interest Rates vs. Valuation for High-Growth SaaS

Thought Leadership / August 8, 2022If It Don’t Make Dollars, It Don’t Make Sense: Demystifying Interest Rates vs. Valuation for High-Growth SaaS -

Blog Post

Thought Leadership Events / July 29, 2022Recapping the Hypergrowth Engineering Summit: A window into the engineering playbooks of tomorrow

Thought Leadership Events / July 29, 2022Recapping the Hypergrowth Engineering Summit: A window into the engineering playbooks of tomorrow -

Blog Post

Thought Leadership / July 20, 2022The Modern B2B Go-To-Market Tech Stack: A Spotlight on European Players

Thought Leadership / July 20, 2022The Modern B2B Go-To-Market Tech Stack: A Spotlight on European Players -

Blog Post

Thought Leadership / July 18, 2022Rise of The Connected Spreadsheet – The “Killer” App For The Modern Data Stack

Thought Leadership / July 18, 2022Rise of The Connected Spreadsheet – The “Killer” App For The Modern Data Stack -

Blog Post

Thought Leadership / July 12, 2022Metrics that Matter: Crucial KPIs for High Functioning Revenue Teams

Thought Leadership / July 12, 2022Metrics that Matter: Crucial KPIs for High Functioning Revenue Teams -

Blog Post

Firm News / July 11, 2022Welcome Dave Wilner to Sapphire!

Firm News / July 11, 2022Welcome Dave Wilner to Sapphire! -

Blog Post

Thought Leadership / June 30, 2022Metrics that Matter: Enabling a Data Driven Revenue Organization

Thought Leadership / June 30, 2022Metrics that Matter: Enabling a Data Driven Revenue Organization -

Blog Post

LP Insights / June 9, 2022The #OpenLP Podcast Miniseries: Jaclyn Hester of Foundry Group

LP Insights / June 9, 2022The #OpenLP Podcast Miniseries: Jaclyn Hester of Foundry Group -

Blog Post

Thought Leadership / June 2, 2022Evolution of the Software Development Life Cycle (SDLC) & the Future of DevOps

Thought Leadership / June 2, 2022Evolution of the Software Development Life Cycle (SDLC) & the Future of DevOps -

Blog Post

Events / May 23, 2022It Takes Technology AND People: Perspectives from The Future of Supply Chain Conference

Events / May 23, 2022It Takes Technology AND People: Perspectives from The Future of Supply Chain Conference -

Blog Post

Firm News / May 18, 2022Welcome Karan – Sapphire’s Revenue Excellence Leader!

Firm News / May 18, 2022Welcome Karan – Sapphire’s Revenue Excellence Leader! -

Blog Post

Thought Leadership / May 11, 2022Demystifying the Modern B2B Go-To-Market Tech Stack

Thought Leadership / May 11, 2022Demystifying the Modern B2B Go-To-Market Tech Stack -

Blog Post

LP Insights / May 4, 2022Dirty Secret: Venture Reserves are Not Always a Good Thing

LP Insights / May 4, 2022Dirty Secret: Venture Reserves are Not Always a Good Thing -

Blog Post

Thought Leadership / April 28, 2022Sapphire à Paris. Diving Into the French Tech Revolution

Thought Leadership / April 28, 2022Sapphire à Paris. Diving Into the French Tech Revolution -

Blog Post

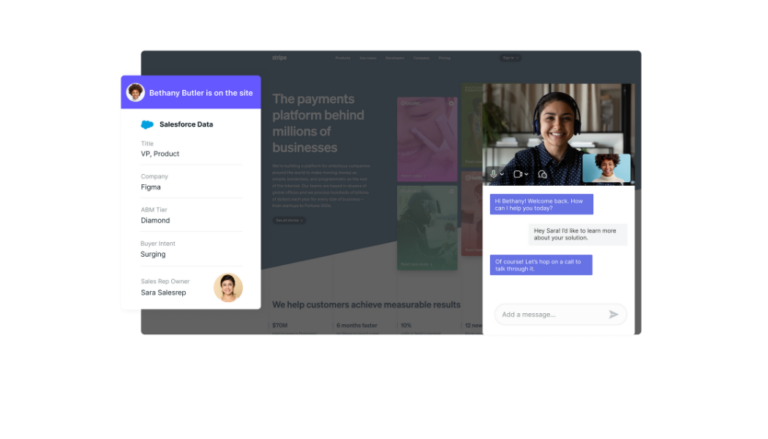

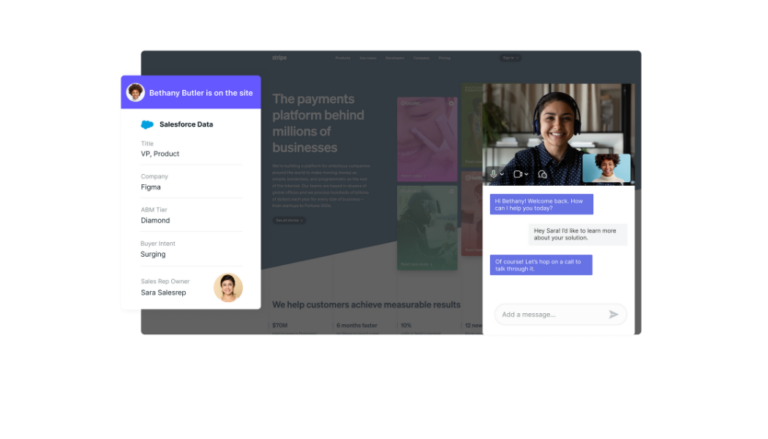

Investment / April 26, 2022Transforming Websites into Sales & Marketing Machines: Why We’re Excited to Lead Qualified’s Series C

Investment / April 26, 2022Transforming Websites into Sales & Marketing Machines: Why We’re Excited to Lead Qualified’s Series C -

Blog Post

Thought Leadership / April 19, 2022Rise of the Next-Gen CFO: The Evolution of Finance’s Role and Tech Stack

Thought Leadership / April 19, 2022Rise of the Next-Gen CFO: The Evolution of Finance’s Role and Tech Stack -

Blog Post

Thought Leadership / March 29, 2022From an Explosion of Decacorns to a Boom in Female Founders, Sapphire Predicts 5 European Tech Trends Still to Come in 2022

Thought Leadership / March 29, 2022From an Explosion of Decacorns to a Boom in Female Founders, Sapphire Predicts 5 European Tech Trends Still to Come in 2022 -

Blog Post

Thought Leadership / March 10, 2022The Future of AI Infrastructure is Becoming Modular: Why Best-of-Breed MLOps Solutions are Taking Off & Top Players to Watch

Thought Leadership / March 10, 2022The Future of AI Infrastructure is Becoming Modular: Why Best-of-Breed MLOps Solutions are Taking Off & Top Players to Watch -

Blog Post

Thought Leadership / March 1, 2022An Employee-Driven Future: How Europe is Leading the Future of Work

Thought Leadership / March 1, 2022An Employee-Driven Future: How Europe is Leading the Future of Work -

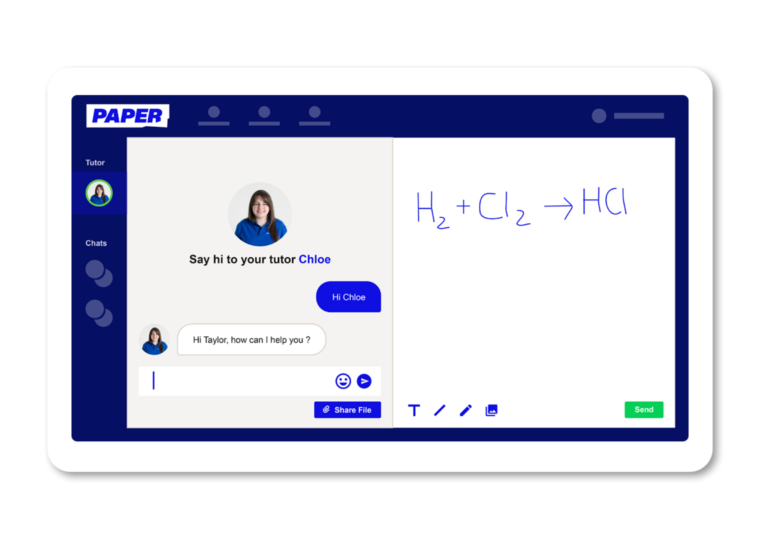

Blog Post

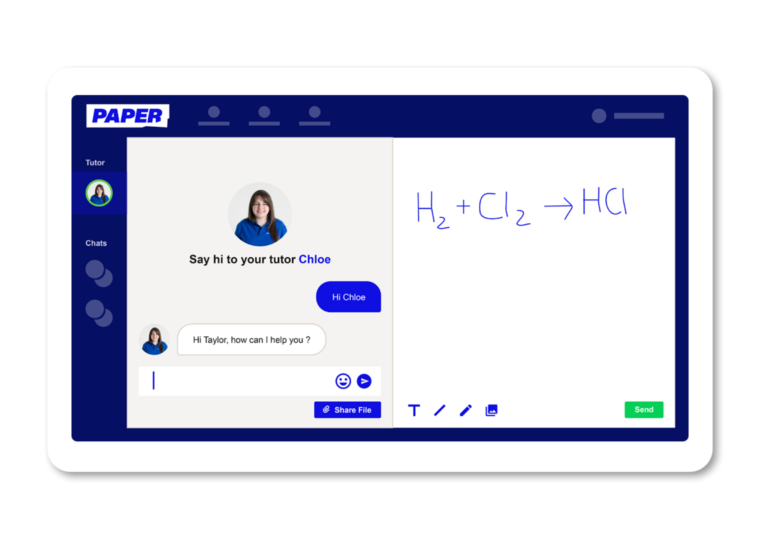

Investment / February 15, 2022Unlocking Student Potential with On-Demand Academic Support: Why We’re Proud to Partner with Paper

Investment / February 15, 2022Unlocking Student Potential with On-Demand Academic Support: Why We’re Proud to Partner with Paper -

Blog Post

Thought Leadership / February 10, 2022Product-Led Growth (PLG) CRMs Emerge: Mapping the Market and Our 2022 Predictions

Thought Leadership / February 10, 2022Product-Led Growth (PLG) CRMs Emerge: Mapping the Market and Our 2022 Predictions -

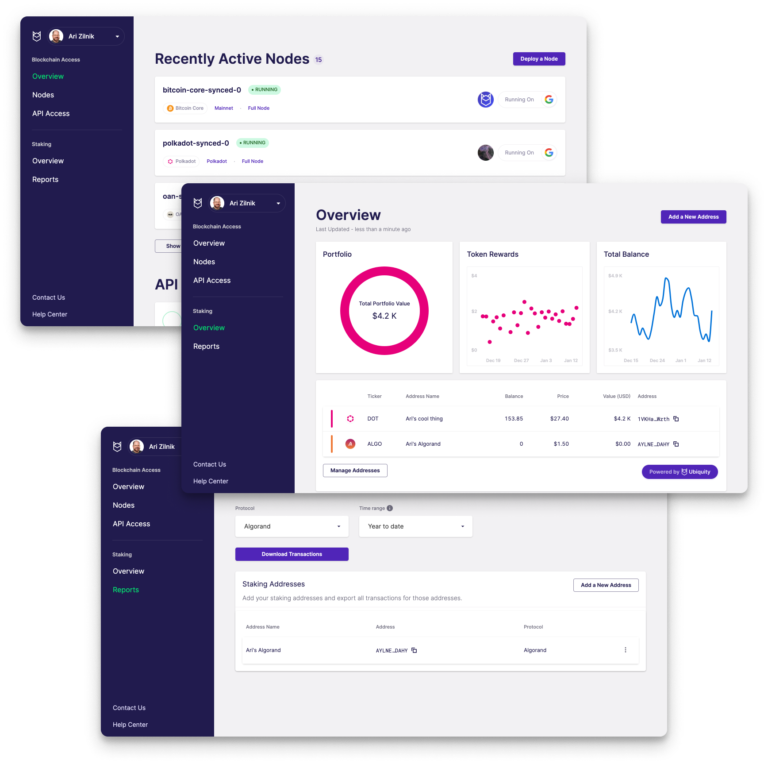

Blog Post

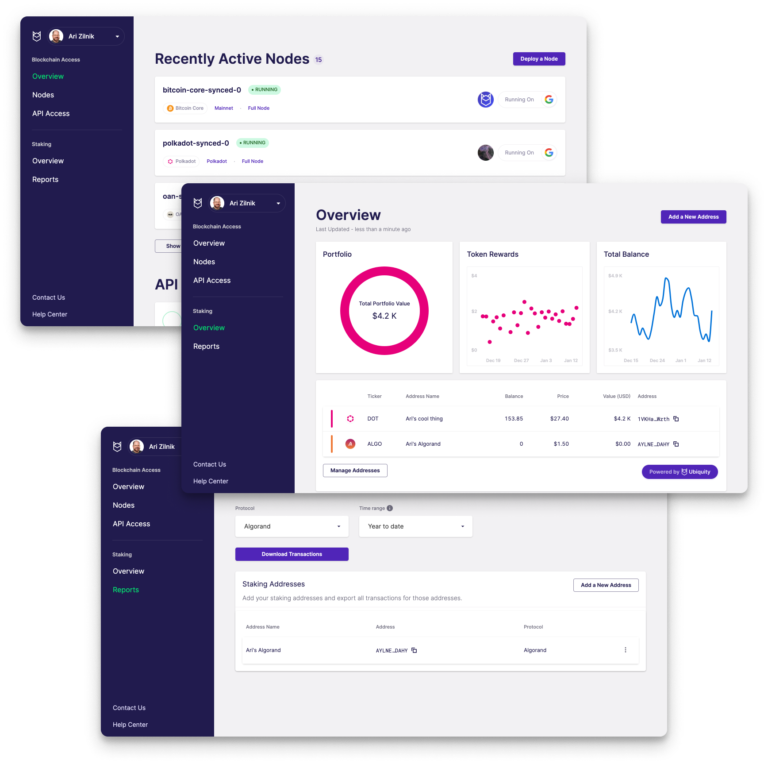

Investment / January 27, 2022Doubling Down on the Future of Digital Asset Infrastructure: Why We’re Excited to Lead Blockdaemon’s Series C

Investment / January 27, 2022Doubling Down on the Future of Digital Asset Infrastructure: Why We’re Excited to Lead Blockdaemon’s Series C -

Blog Post

Investment / January 26, 2022Captivating Revenue Teams with Transparent Sales Commissions: Why We’re Excited to Partner with CaptivateIQ

Investment / January 26, 2022Captivating Revenue Teams with Transparent Sales Commissions: Why We’re Excited to Partner with CaptivateIQ -

Blog Post

Thought Leadership / January 20, 2022Top 6 European Enterprise Technology Trends to Watch in 2022

Thought Leadership / January 20, 2022Top 6 European Enterprise Technology Trends to Watch in 2022 -

Blog Post

Investment / January 18, 2022Social Infrastructure for Web3: Sapphire Sport’s Investment in POAP

Investment / January 18, 2022Social Infrastructure for Web3: Sapphire Sport’s Investment in POAP -

Blog Post

Thought Leadership / January 6, 2022The Sapphire Future Six: 2022 Predictions for the Future of Work

Thought Leadership / January 6, 2022The Sapphire Future Six: 2022 Predictions for the Future of Work -

Blog Post

Investment / December 27, 2021Transforming the Candidate Experience with the Power of Conversational AI: Why We’re Excited to Partner with Paradox

Investment / December 27, 2021Transforming the Candidate Experience with the Power of Conversational AI: Why We’re Excited to Partner with Paradox -

Blog Post

Thought Leadership / December 16, 2021Digital Accessibility Series, Part 3: Vendor Landscape

Thought Leadership / December 16, 2021Digital Accessibility Series, Part 3: Vendor Landscape -

Blog Post

Thought Leadership / December 8, 2021Digital Accessibility Series, Part 2: How to Get Started with Digital Accessibility

Thought Leadership / December 8, 2021Digital Accessibility Series, Part 2: How to Get Started with Digital Accessibility -

Blog Post

Investment / December 7, 2021Transforming DevSecOps Starting with Real-Time Secrets Detection: Why We Are Excited to Back GitGuardian

Investment / December 7, 2021Transforming DevSecOps Starting with Real-Time Secrets Detection: Why We Are Excited to Back GitGuardian -

Blog Post

-

Blog Post

Thought Leadership Events / November 24, 2021Sapphire Vision Summit 2021: 5 Trends Shaping the Enterprise

Thought Leadership Events / November 24, 2021Sapphire Vision Summit 2021: 5 Trends Shaping the Enterprise -

Blog Post

Investment Portfolio News / November 24, 2021Putting an End to Musculoskeletal Pain: Why We’re Proud to Back SWORD Health

Investment Portfolio News / November 24, 2021Putting an End to Musculoskeletal Pain: Why We’re Proud to Back SWORD Health -

Blog Post

Thought Leadership / November 24, 2021Digital Accessibility Series, Part 1: What is Digital Accessibility and Why is it Important?

Thought Leadership / November 24, 2021Digital Accessibility Series, Part 1: What is Digital Accessibility and Why is it Important? -

Blog Post

Investment / November 15, 2021Automating Cloud Management for DevOps: Why We’re Excited to Back Zesty

Investment / November 15, 2021Automating Cloud Management for DevOps: Why We’re Excited to Back Zesty -

Blog Post

LP Insights / November 3, 2021The #OpenLP Podcast Miniseries: Saul Klein of LocalGlobe and Latitude – Champion of the European Tech Ecosystem

LP Insights / November 3, 2021The #OpenLP Podcast Miniseries: Saul Klein of LocalGlobe and Latitude – Champion of the European Tech Ecosystem -

Blog Post

Investment / October 28, 2021DataRobot: Enabling Knowledge Workers to use Boring AI

Investment / October 28, 2021DataRobot: Enabling Knowledge Workers to use Boring AI -

Blog Post

Thought Leadership Investment / October 28, 2021The Database of the Future: Why We’re Excited to Lead Yugabyte’s Series C

Thought Leadership Investment / October 28, 2021The Database of the Future: Why We’re Excited to Lead Yugabyte’s Series C -

Blog Post

Thought Leadership / October 27, 2021Bridging the Board Gap: Insights from European Female Board Executives on the Path to Parity

Thought Leadership / October 27, 2021Bridging the Board Gap: Insights from European Female Board Executives on the Path to Parity -

Blog Post

Thought Leadership / October 7, 2021Decarbonizing the Future: Why Sapphire is Excited about B2B Software Powering the Transition

Thought Leadership / October 7, 2021Decarbonizing the Future: Why Sapphire is Excited about B2B Software Powering the Transition -

Blog Post

LP Insights / September 30, 2021The #OpenLP Podcast Miniseries: Kim Lew, CEO of Columbia University’s Endowment

LP Insights / September 30, 2021The #OpenLP Podcast Miniseries: Kim Lew, CEO of Columbia University’s Endowment -

Blog Post

Investment / September 28, 2021The Ultimate Platform for Modern Recruiting: Why We’re Excited to Back Gem

Investment / September 28, 2021The Ultimate Platform for Modern Recruiting: Why We’re Excited to Back Gem -

Blog Post

Thought Leadership / September 22, 2021The Emergence of the Modern Data Stack: An Explosion of European & Israeli Data Tooling Companies

Thought Leadership / September 22, 2021The Emergence of the Modern Data Stack: An Explosion of European & Israeli Data Tooling Companies -

Blog Post

Thought Leadership Investment / September 21, 2021Building Better Infrastructure for Digital Assets: Why We’re Excited about FalconX, Blockdaemon, TaxBit & Tesseract

Thought Leadership Investment / September 21, 2021Building Better Infrastructure for Digital Assets: Why We’re Excited about FalconX, Blockdaemon, TaxBit & Tesseract -

Blog Post

Growth Insights / September 14, 2021Long Live the Tech IPO

Growth Insights / September 14, 2021Long Live the Tech IPO -

Blog Post

Investment / September 13, 2021Securing the 99.9%: Why We’re Excited to Lead JumpCloud’s Series F

Investment / September 13, 2021Securing the 99.9%: Why We’re Excited to Lead JumpCloud’s Series F -

Blog Post

Growth Insights / August 27, 2021Cazoo Becomes European Company of Consequence in Rapid Time

Growth Insights / August 27, 2021Cazoo Becomes European Company of Consequence in Rapid Time -

Blog Post

Thought Leadership / August 26, 2021The Ransomware Problem: Security Leaders (Like the FBI) Share How to Tackle the Unavoidable Threat

Thought Leadership / August 26, 2021The Ransomware Problem: Security Leaders (Like the FBI) Share How to Tackle the Unavoidable Threat -

Blog Post

Thought Leadership / August 26, 2021NFTs – a Gateway to the Metaverse

Thought Leadership / August 26, 2021NFTs – a Gateway to the Metaverse -

Blog Post

Investment / August 25, 2021#gettingInvolved with Customer Success: Here’s Why We’re Thrilled to Lead involve.ai’s Series A

Investment / August 25, 2021#gettingInvolved with Customer Success: Here’s Why We’re Thrilled to Lead involve.ai’s Series A -

Blog Post

LP Insights / August 24, 2021Turning the Tables on Notation: Introducing the #OpenLP Origins Podcast Miniseries

LP Insights / August 24, 2021Turning the Tables on Notation: Introducing the #OpenLP Origins Podcast Miniseries -

Blog Post

LP Insights / August 12, 2021Sapphire Partners Announces Next Generation of #OpenLP Initiative

LP Insights / August 12, 2021Sapphire Partners Announces Next Generation of #OpenLP Initiative -

Blog Post

Growth Insights / August 10, 2021Coming Into the Spotlight: How Customer Success Can Turbo Charge Subscription Growth

Growth Insights / August 10, 2021Coming Into the Spotlight: How Customer Success Can Turbo Charge Subscription Growth -

Blog Post

Investment / August 4, 2021The Rise of Customer Experience (CX) Automation: Why We’re Excited to Co-Lead yellow.ai’s Series C

Investment / August 4, 2021The Rise of Customer Experience (CX) Automation: Why We’re Excited to Co-Lead yellow.ai’s Series C -

Blog Post

Thought Leadership Investment Portfolio News / July 28, 2021Banking on Disruption: Why We’re Over the Moon to Invest in Mercury

Thought Leadership Investment Portfolio News / July 28, 2021Banking on Disruption: Why We’re Over the Moon to Invest in Mercury -

Blog Post

Investment / July 21, 2021From Visualizing to Realizing the Future of Video: A Big Congrats to Kaltura on the IPO

Investment / July 21, 2021From Visualizing to Realizing the Future of Video: A Big Congrats to Kaltura on the IPO -

Blog Post

Investment / July 21, 2021Supercharging Open Banking to Create Better Financial Services: Why We’re Excited to Lead Yapily’s Series B

Investment / July 21, 2021Supercharging Open Banking to Create Better Financial Services: Why We’re Excited to Lead Yapily’s Series B -

Blog Post

Growth Insights / July 14, 2021The Power of Payments: Why the European Payments Market is Hotter than Ever

Growth Insights / July 14, 2021The Power of Payments: Why the European Payments Market is Hotter than Ever -

Blog Post

Thought Leadership Investment / July 13, 2021All Hail Happiness: The Gen Z Buying Habit Coming to a Wellness Investment Near You

Thought Leadership Investment / July 13, 2021All Hail Happiness: The Gen Z Buying Habit Coming to a Wellness Investment Near You -

Blog Post

Growth Insights / July 7, 2021Redefining Conventional Wisdom. Congratulations to Wise on its Public Debut!

Growth Insights / July 7, 2021Redefining Conventional Wisdom. Congratulations to Wise on its Public Debut! -

Blog Post

Growth Insights / July 6, 2021Israel’s Booming Tech Scene: Top Trends & Players in the Startup Nation

Growth Insights / July 6, 2021Israel’s Booming Tech Scene: Top Trends & Players in the Startup Nation -

Blog Post

Growth Insights / June 30, 2021Congratulations to IAS on the IPO Milestone! On a Mission to Measure & Verify Digital Ad Integrity

Growth Insights / June 30, 2021Congratulations to IAS on the IPO Milestone! On a Mission to Measure & Verify Digital Ad Integrity -

Blog Post

Thought Leadership Firm News / June 29, 2021Why I joined Sapphire Sport

Thought Leadership Firm News / June 29, 2021Why I joined Sapphire Sport -

Blog Post

Thought Leadership / June 22, 2021Harnessing our Network’s Collective Intelligence: Sapphire Unveils Centers of Excellence to Help Portfolio Companies Scale

Thought Leadership / June 22, 2021Harnessing our Network’s Collective Intelligence: Sapphire Unveils Centers of Excellence to Help Portfolio Companies Scale -

Blog Post

Thought Leadership / June 17, 2021The Future of Work in Post-Pandemic Europe from CXOs at Roche, Bentley, Deutsche Telekom and Others

Thought Leadership / June 17, 2021The Future of Work in Post-Pandemic Europe from CXOs at Roche, Bentley, Deutsche Telekom and Others -

Blog Post

Thought Leadership Growth Insights / June 15, 2021The Startup’s Guide to Nailing Customer Success

Thought Leadership Growth Insights / June 15, 2021The Startup’s Guide to Nailing Customer Success -

Blog Post

Growth Insights / June 10, 2021Monday on a Thursday. Congratulations to Monday.com!

Growth Insights / June 10, 2021Monday on a Thursday. Congratulations to Monday.com! -

Blog Post

Investment / June 8, 2021Simplifying Transcription and Captioning with AI: Why Sapphire is Thrilled to Once Again Back Verbit

Investment / June 8, 2021Simplifying Transcription and Captioning with AI: Why Sapphire is Thrilled to Once Again Back Verbit -

Blog Post

-

Blog Post

Growth Insights / May 20, 2021Flipping & Financings: What European Founders Need to Know about Flipping to a U.S. Company Structure

Growth Insights / May 20, 2021Flipping & Financings: What European Founders Need to Know about Flipping to a U.S. Company Structure -

Blog Post

Growth Insights / May 13, 2021Sapphire & Pendo: Partners in Delighting Users with Better Digital Product Experiences

Growth Insights / May 13, 2021Sapphire & Pendo: Partners in Delighting Users with Better Digital Product Experiences -

Blog Post

Investment / May 12, 2021Time to Prioritize Preventative Mental Health & Wellness: Why We’re Excited to Back Unmind

Investment / May 12, 2021Time to Prioritize Preventative Mental Health & Wellness: Why We’re Excited to Back Unmind -

Blog Post

Investment / May 4, 2021A Smarter Way to Fight Cybercrime: Why We’re Proud to Lead JupiterOne’s Series B

Investment / May 4, 2021A Smarter Way to Fight Cybercrime: Why We’re Proud to Lead JupiterOne’s Series B -

Blog Post

Growth Insights / May 3, 2021On a Mission to Address Every Identity Use Case: Congratulations to Auth0 on Joining Forces with Okta

Growth Insights / May 3, 2021On a Mission to Address Every Identity Use Case: Congratulations to Auth0 on Joining Forces with Okta -

Blog Post

LP Insights / April 28, 2021Fund Recycling Moves the Needle for Both LPs and GPs. Here’s How.

LP Insights / April 28, 2021Fund Recycling Moves the Needle for Both LPs and GPs. Here’s How. -

Blog Post

Growth Insights / April 22, 2021What is the Open Data Ecosystem and Why it’s Here To Stay

Growth Insights / April 22, 2021What is the Open Data Ecosystem and Why it’s Here To Stay -

Blog Post

Thought Leadership / April 14, 2021A Startup’s Guide for Opening European Operations

Thought Leadership / April 14, 2021A Startup’s Guide for Opening European Operations -

Blog Post

Investment / April 13, 2021Reimagining the Workforce Upskilling Experience: Why We’re Excited to Co-Lead Degreed’s Series D

Investment / April 13, 2021Reimagining the Workforce Upskilling Experience: Why We’re Excited to Co-Lead Degreed’s Series D -

Blog Post

Investment / April 1, 2021The Rise of AB”X” and the RevTech Revolution: Why We’re Backing 6sense

Investment / April 1, 2021The Rise of AB”X” and the RevTech Revolution: Why We’re Backing 6sense -

Blog Post

Investment Portfolio News / March 31, 2021Transforming Lives Through Fitness, Health and Wellness: Why Sapphire is Thrilled to Once Again Back Tonal

Investment Portfolio News / March 31, 2021Transforming Lives Through Fitness, Health and Wellness: Why Sapphire is Thrilled to Once Again Back Tonal -

Blog Post

Growth Insights / March 24, 2021Best Practices for Planning an Exit Strategy from the CFOs of JFrog and Segment

Growth Insights / March 24, 2021Best Practices for Planning an Exit Strategy from the CFOs of JFrog and Segment -

Blog Post

Investment / March 16, 2021‘Data Driven’ Starts with Data: Why We’re Excited to Back SafeGraph, a Leading DaaS Company for Places

Investment / March 16, 2021‘Data Driven’ Starts with Data: Why We’re Excited to Back SafeGraph, a Leading DaaS Company for Places -

Blog Post

-

Blog Post

Investment / March 9, 2021Bringing Governance and Security to Democratized Data: Why We’re Partnering with Privacera

Investment / March 9, 2021Bringing Governance and Security to Democratized Data: Why We’re Partnering with Privacera -

Blog Post

Investment / February 25, 2021Mobile Coaching and the Employee Renaissance: Why We’re Excited to Back BetterUp

Investment / February 25, 2021Mobile Coaching and the Employee Renaissance: Why We’re Excited to Back BetterUp -

Blog Post

Growth Insights / February 23, 2021A SPACtacular Future: The Rapid Rise of SPACs & What Comes Next

Growth Insights / February 23, 2021A SPACtacular Future: The Rapid Rise of SPACs & What Comes Next -

Blog Post

Growth Insights / February 9, 2021A New Way to Achieve Board Diversity: Announcing Our Founding Partnership with All Raise’s Board Xcelerate Program

Growth Insights / February 9, 2021A New Way to Achieve Board Diversity: Announcing Our Founding Partnership with All Raise’s Board Xcelerate Program -

Blog Post

LP Insights / February 2, 2021The Black Swan Year: How 2020 Impacted Venture Investing and Performance

LP Insights / February 2, 2021The Black Swan Year: How 2020 Impacted Venture Investing and Performance -

Blog Post

Investment / February 1, 2021Bringing Mission-Critical Data Protection to the Cloud: Why We’re Thrilled to Partner with OwnBackUp

Investment / February 1, 2021Bringing Mission-Critical Data Protection to the Cloud: Why We’re Thrilled to Partner with OwnBackUp -

Blog Post

Growth Insights / January 29, 2021How Automation & Low Code/No Code Platforms Help Power our Lives: 4 Trends Driving Adoption

Growth Insights / January 29, 2021How Automation & Low Code/No Code Platforms Help Power our Lives: 4 Trends Driving Adoption -

Blog Post

-

Blog Post

Thought Leadership / January 28, 2021Sapphire Ventures: 2020 Year-in-Review

Thought Leadership / January 28, 2021Sapphire Ventures: 2020 Year-in-Review -

Blog Post

-

Blog Post

Growth Insights / January 21, 2021Ecommerce is Having a Moment: Why We’re Excited & What’s Next

Growth Insights / January 21, 2021Ecommerce is Having a Moment: Why We’re Excited & What’s Next -

Blog Post

Growth Insights / January 19, 2021Punchh & Sapphire Ventures: Partners in Improving Customer Loyalty and Engagement for Brick-and-Mortar Retailers

Growth Insights / January 19, 2021Punchh & Sapphire Ventures: Partners in Improving Customer Loyalty and Engagement for Brick-and-Mortar Retailers -

Blog Post

Growth Insights / January 13, 20217 Tips for European Female Founders Fundraising Right Now

Growth Insights / January 13, 20217 Tips for European Female Founders Fundraising Right Now -

Blog Post

Thought Leadership / January 13, 2021Category Creation: A Marketing Strategy for Long-Term Differentiation

Thought Leadership / January 13, 2021Category Creation: A Marketing Strategy for Long-Term Differentiation -

Blog Post

Thought Leadership / January 12, 20214 Key Strategies to Implementing a Usage-Based Pricing Model

Thought Leadership / January 12, 20214 Key Strategies to Implementing a Usage-Based Pricing Model -

Blog Post

-

Blog Post

Thought Leadership / December 16, 20205 Insights Startup CMOs Should Know About Analyst Relations

Thought Leadership / December 16, 20205 Insights Startup CMOs Should Know About Analyst Relations -

Blog Post

Growth Insights / December 15, 2020No Going Back Now: 10 Enterprise Tech Trends Taking Shape in 2021

Growth Insights / December 15, 2020No Going Back Now: 10 Enterprise Tech Trends Taking Shape in 2021 -

Blog Post

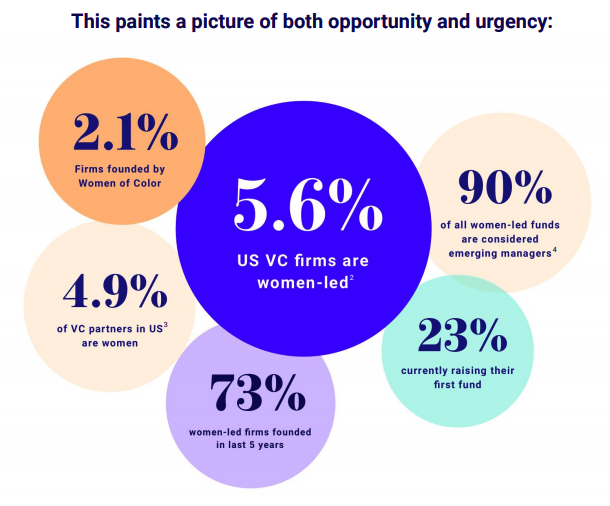

LP Insights / December 11, 2020Diversity in VC: Learnings From an LP Audit and How we Can Make This Better Together

LP Insights / December 11, 2020Diversity in VC: Learnings From an LP Audit and How we Can Make This Better Together -

Blog Post

Investment / December 10, 2020Revolutionizing Customer Service for e-Commerce: Our Investment in Gorgias

Investment / December 10, 2020Revolutionizing Customer Service for e-Commerce: Our Investment in Gorgias -

Blog Post

Growth Insights / December 8, 2020Since we Last Spoke: StackHawk’s CEO Joni Klippert on Helping Developers Secure Code as They Write It

Growth Insights / December 8, 2020Since we Last Spoke: StackHawk’s CEO Joni Klippert on Helping Developers Secure Code as They Write It -

Blog Post

Growth Insights / December 3, 2020Since we last Spoke: Uptycs’ CEO on Providing Security Analytics for Everyone & Partnering with a VC that Knows Enterprise Tech

Growth Insights / December 3, 2020Since we last Spoke: Uptycs’ CEO on Providing Security Analytics for Everyone & Partnering with a VC that Knows Enterprise Tech -

Blog Post

Growth Insights / December 2, 2020The (Tele)doctor Will See You Now: How COVID-19 Has Accelerated HealthTech Adoption

Growth Insights / December 2, 2020The (Tele)doctor Will See You Now: How COVID-19 Has Accelerated HealthTech Adoption -

Blog Post

Investment / November 24, 2020Ushering in a New Era of Online Banking: Why Sapphire Ventures is Excited to Partner with Current

Investment / November 24, 2020Ushering in a New Era of Online Banking: Why Sapphire Ventures is Excited to Partner with Current -

Blog Post

Investment / November 23, 2020Near-Perfect Transcription with a “Human-in-the-Loop” Approach: Our Investment in Verbit

Investment / November 23, 2020Near-Perfect Transcription with a “Human-in-the-Loop” Approach: Our Investment in Verbit -

Blog Post

Investment / November 19, 2020Leading the Way in Decentralized Clinical Trials: Why Sapphire Ventures is Excited to Partner with Medable

Investment / November 19, 2020Leading the Way in Decentralized Clinical Trials: Why Sapphire Ventures is Excited to Partner with Medable -

Blog Post

Thought Leadership / November 18, 2020While the Work is Never Done, Here’s How Leaders at Culture Amp, Outreach & Pendo are Working to Get D&I Right

Thought Leadership / November 18, 2020While the Work is Never Done, Here’s How Leaders at Culture Amp, Outreach & Pendo are Working to Get D&I Right -

Blog Post