Those of you who read the brilliant piece from our colleagues on the Modern B2B GTM tech stack last month will know that GTM tech is thriving and that there’s a rich array of emerging innovation to watch. We wanted to follow-up on the aforementioned deep dive and shine a spotlight specifically on Europe’s B2B GTM startup ecosystem. There’s a huge amount of activity happening within Europe and many brilliant entrepreneurs building companies of consequence in the B2B GTM tech stack. This blog explores some of those trends and some of the most exciting next-gen companies in this space.

Definitionally, we use the term B2B GTM to refer to every function in a B2B enterprise that engages a customer or potential customer, including sales, marketing and post-sales functions like implementation and customer success.

At Sapphire, we’ve been lucky to partner with numerous technology companies that have now become core to the B2B GTM motion (6Sense, CaptivateIQ, Clari, ExactTarget, Highspot, Involve.ai, LeanData, Outreach, Qualified, and Segment). From this vantage point, our rapidly expanding team on the ground in Europe has been well positioned to observe the top trends impacting the industry on this side of the Atlantic, as well as the products at the cutting edge of the B2B GTM tech stack.

From this position, we believe the most exciting trends emanating from Europe have global ambition and application. B2B companies are utilising more data and AI generated content to personalise engagement for website visitors as well as through more sophisticated account-based marketing. Alongside this, teams are adding more automation to their workflows and CRMs. Additionally, post-sales and GTM operations teams are getting new tech to replace spreadsheets and improve collaboration, and of course, more and more companies are pursuing product-led growth strategies requiring a different approach and tech stack as highlighted in our PLG CRM overview. The innovation is as wide-ranging as it is exciting.

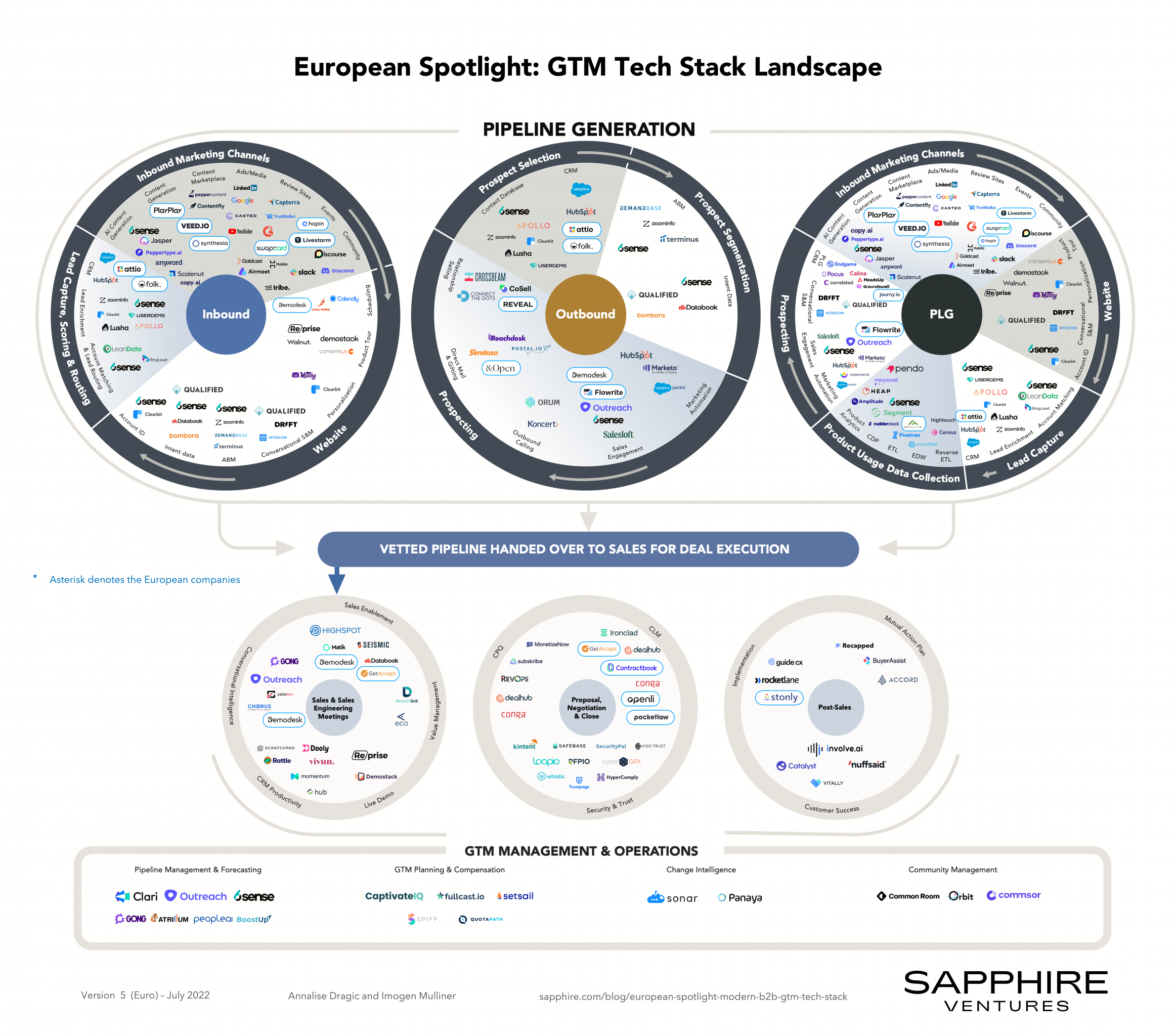

Spotlight on Emerging European Players in the Modern B2B Go-To-Market Tech Stack

As part of this European deep-dive, we wanted to highlight the emerging European next-gen startups across the full GTM stack of pipeline generation, deal execution, post sales, and GTM operations.

View the full list of companies included in the graphic below here.

Startups focusing on Pipeline Generation

First looking to the top of the funnel, here we are seeing the emergence of next-gen solutions driving pipeline generation through inbound, outbound, or increasingly popular PLG sales motions.

Behind a successful inbound lead motion, engaging content is the key driver; however, traditionally content has been time consuming to create and often requires specific skill sets. While content marketing continues to be dominated by white papers, blog posts, case studies, webinars, etc., more companies are also turning to video to grab the attention of prospects. Companies such as PlayPlay, Veed.io and Synthesia are helping automate video content creation and enabling teams to quickly put together engaging short videos.

On the outbound sales side, prospect selection and segmentation are fundamental starting points. Specifically on B2B partnerships, Reveal is helping B2B companies better collaborate with their partners and acquire new, qualified leads. Once prospects have been identified, software like Flowrite helps the sales team supercharge prospecting emails by turning short instructions into ready-to-send emails at the click of a button. Additionally, Sapphire has already partnered with some of the leading companies in this space (6Sense, Outreach, and Qualified), who are now active or actively seeking to expand to the European market.

Furthermore, although Salesforce and Hubspot continue to dominate, we are seeing exciting next-gen CRMs focused on improving the user experience and automating the traditionally clunky workflows that plague legacy solutions, such as Folk and Attio. For PLG focused companies, Journy has built a customer intelligence platform that includes features such as a 360 degree customer view that can be segmented by metric type and signals which trigger certain action, for example, a drop in weekly usage triggers customer support outreach.

Startups focusing on Deal Execution

With a full pipeline in place, B2B companies are deploying new solutions to drive sales productivity and ultimately win more deals. As part of this, sales enablement vendors, such as Sapphire portfolio company Highspot, which already has two offices in Europe in London and Munich, have emerged to support this part of the sales process.

Additionally, with the majority of sales conversations happening over the phone and through video conferencing tools, customer intelligence and productivity tools are being built to help supercharge sales reps. For example, Demodesk assists reps live during calls, provides insights into what’s working, and automates all scheduling processes. Moreover, GetAccept provides sales reps with a deal management platform covering sales document libraries, trackable experiences and proposals, intelligent reminder workflows, contract management, and e-signature.

An important part of the deal execution process is contracting and new solutions are emerging to better automate workflows and facilitate collaboration, such as Contractbook and PocketLaw. Additionally, with the implementation of regulations such as GDPR, security and trust reviews have become even more important to sales processes. Openli aids companies with these processes by providing a complete overview of their existing and prospective vendors and GDPR compliance efforts in one place.

Startups focusing on Post Sales

Once the contract is signed, it is time to get the new customer activated and post-sales activities of implementation and onboarding come into play. Companies like Stonly provide tools to build interactive guides to onboard users and provide continuous adaptive guidance. Customer success teams also get involved to drive customer satisfaction, stickiness, and upsell opportunities.

Startups focusing on GTM Operations

In addition to customer facing teams, GTM operations teams (RevOps, Sales Ops, Marketing Ops, Finance Ops, etc.) are also leveraging new software solutions to replace spreadsheets and ensure that marketing and sales activities run smoothly especially when interconnected with other parts of the organisation.

When it comes to pricing, B2B SaaS companies are leveraging new billing engines such as Chargebee, a Sapphire portfolio company, but are also looking for better solutions to enable usage-based pricing such as M3ter, which helps companies intelligently deploy and manage usage-based pricing using an API-first approach.

We are also excited to see more companies emerge to improve pipeline management & forecasting, GTM planning & compensation, and community management tools.

The Time is Now

These companies represent just a few of the many exciting European based startups building solutions within the B2B GTM tech stack. As SaaS investors, we are really excited by the depth and breadth of innovation in this space and see massive opportunity areas still ripe for disruption. If you are building a company of consequence in this space or wish to exchange insights and thoughts, we’d love to hear from you. Please reach out to [email protected] and [email protected].