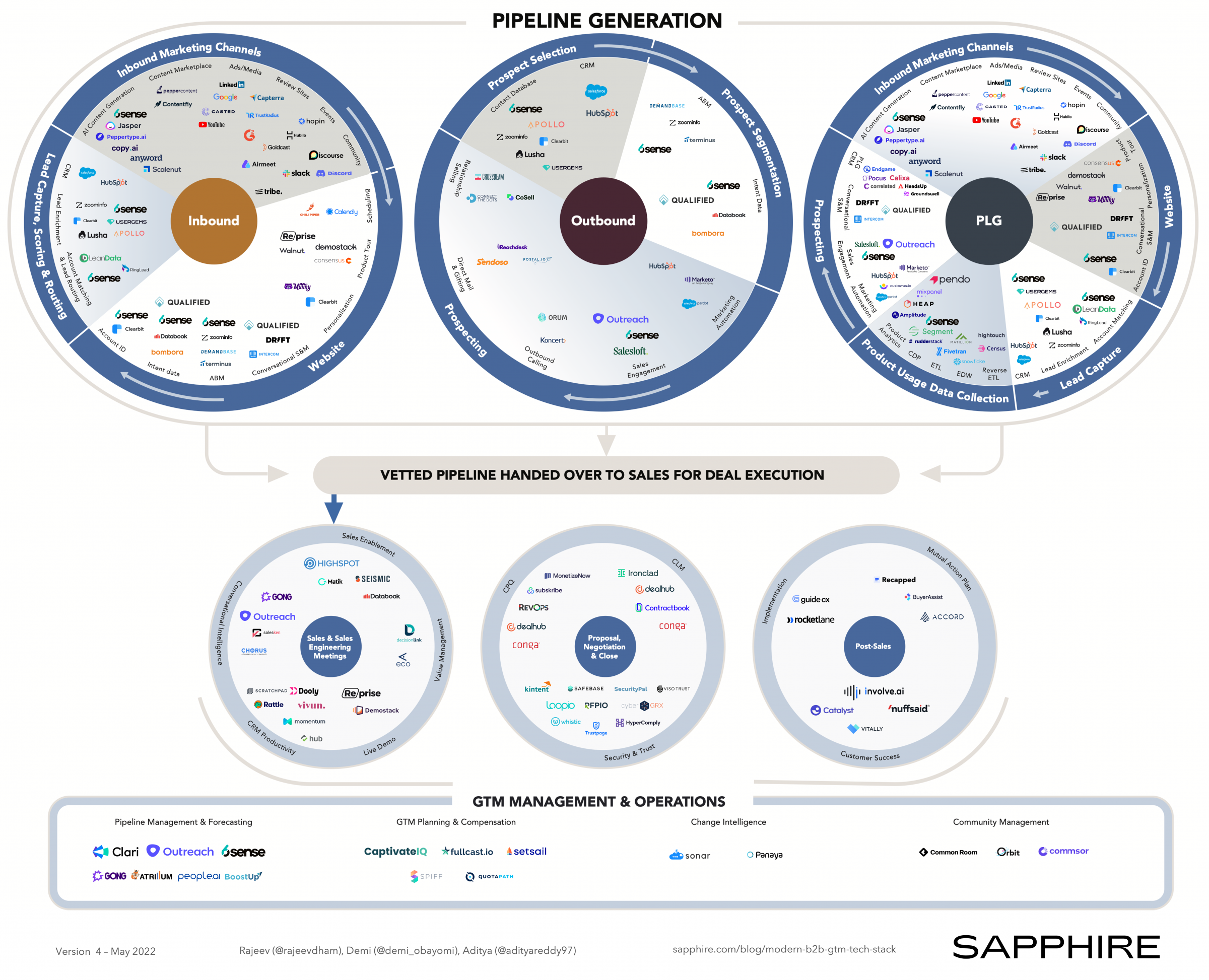

Pipeline Generation

Inbound

We define an inbound lead as a cold lead that engages with a vendor through Inbound Marketing Channels, which include content such as blogs, podcasts and videos, as well as advertising, review sites, events, communities and more.

The goal of inbound pipeline generation is to direct a lead to the Website. On the website, there are various technologies that can be implemented to identify each lead, determine the lead’s level of intent to purchase as well as engage with the lead.

Products in the Account Identification and ABM categories have developed several techniques to identify anonymous website visitors. Data and lead scores from Intent Data vendors as well as ABM vendors can then be used to determine the extent to which a lead is ready to purchase. Using Conversational S&M tools, companies can engage with prospects while they are right on the website either through automated chatbots or by having a sales rep engage directly with the prospect through live chat.

Other website technologies include Personalization tools that dynamically generate a web page customized for each site visitor. In addition, Product Tour vendors have developed technology to create and embed click-through demos on websites so that website visitors can simulate what it’s like to use the product. Companies can also leverage Scheduling tools on their website to enable leads to schedule meetings directly with sales reps.

The final aspect of the Inbound tech stack we highlight is Lead Capture, Scoring and Routing, which occurs in the background as the lead is identified on your website or provides their information in the process of filling out a form, scheduling a call with a sales rep and so on. This category includes CRMs, which serve as the system of record for all sales activities, as well as ABM platforms, which often come with lead scoring functionality of their own.

Lead Enrichment tools provide additional information on each identified lead including firmographic data, technographic data, job title, contact information, job change alerts, etc. Once the lead has been captured, scored and enriched, Account Matching and Lead Routing tools can match the contact to an existing account in the CRM and route the lead to the right sales rep on your team.

Outbound

We use outbound to refer to the process of a company determining its ideal customer profile (ICP), building a prospect list, and segmenting the list to inform the best tactics to use in engaging these prospects.

Prospect Selection typically starts with a Contact Database that can be filtered down to the subset of accounts that fit the ICP. These accounts, along with any enrichment data in the contact database, can then be pushed into the CRM. The next step is Prospect Segmentation where Intent Data providers and ABM platforms help segment the prospect list using the proprietary intent scores that their algorithms generate.

Based on the segments created in the prior step, companies can then decide exactly how to engage these prospects. For example, a prospect that perfectly matches the ICP and demonstrates a high intent to purchase may warrant an Outbound Call, whereas a prospect that is still in the early stages of researching the market may be best served by a nurture campaign managed through a Marketing Automation Platform or an outbound email sequence using a Sales Engagement tool. Other ways to prospect include using Direct Mail and Gifting, as well as Relationship Selling tools that can help find a connection who has a strong relationship with a particular prospect.

Product-Led Growth (PLG)

We define PLG as a GTM strategy where the product is the primary vehicle for driving customer acquisition, activation, retention and expansion. For a deep dive into what PLG is and why it is important, check out our recent post on the topic here.

Though PLG has elements of inbound and outbound embedded within it, it is distinguished by the fact that leads actually get to use the product while they are still in the early stages of the sales process. In addition, the data generated by these leads as they use the product is at the very heart of the PLG motion.

Similar to inbound, a PLG motion can take advantage of Inbound Marketing Channels to funnel leads to the website for conversion into product signups. Once leads sign up, Product Usage Data can be collected using Product Analytics tools, Customer Data Platforms (CDPs) and Enterprise Data Warehouses (EDW).

The data from any of these sources can then be pushed into a PLG CRM through integrations. Alternatively, Reverse ETL tools can be used as “pipes” for pulling data from the EDW into the PLG CRM (as well as other SaaS applications). Once the data is in the PLG CRM, each account or user can be scored based on previously configured criteria (e.g. number of logins, number of collaborators invited, number of channels created etc.). At this point, a PLG motion starts to look similar to an outbound motion. After a lead has been scored in the PLG CRM, the GTM team can then use customer segmentation to determine the next best action to drive the lead deeper into the sales funnel. This could include engaging with the lead through chat, email, nurture campaigns, etc. depending on the quality of the lead and the results of the segmentation exercise.

Deal Execution

Sales & Sales Engineering Meetings

Every new opportunity is vetted by the sales team and opportunities that are accepted move on to meetings between sales, sales engineering and the prospective customer. Sales Enablement vendors provide platforms for marketing and sales to develop presentations, one-pagers etc. that can be used as context for meetings and shared with prospective customers. With the majority of sales conversations happening over the phone, video conferencing and email, Conversational Intelligence tools have emerged to keep a record of every sales touchpoint and provide insight into the health of each deal and the performance of each sales rep.

Sales reps are typically working multiple deals at a time which means that they often fall behind on keeping the CRM up-to-date, causing problems for sales operations and sales leadership who need the latest data to manage the business. Multiple CRM Productivity tools have emerged to solve this by making it easy for sales reps, as well as sales engineers, to keep their pipeline updated – typically by providing an intuitive UI that is connected to the CRM or by leveraging existing tools (e.g. Slack) to collect and sync updates into the CRM.

Additionally, new vendors have emerged to enable sales engineers deliver Live Demos without having to manage and maintain a traditional demo environment which can cost significant time and money. Finally, Value Management products have risen in popularity to enable sales reps build and present an ROI case as well as iterate on the ROI equation in collaboration with prospects.

Proposal, Negotiation & Close

Once an opportunity progresses to the later stages of the sales process, it’s time to generate a proposal, negotiate and close the deal. This starts with the Configure, Price & Quote (CPQ) process. Various standalone vendors are available in this category in addition to the solutions provided by CRM vendors. Contract Lifecycle Management (CLM) tools can be used to manage the legal documents and workflows associated with negotiation and collecting signatures. Finally, with Security & Trust reviews now commonplace in the sales process, several vendors have emerged with products that make it easier for sellers to communicate their organization’s security policies, as well as for buyers to evaluate and track their vendors on an ongoing basis.

Post-Sales

After a deal is signed, implementation comes to the fore. Leveraging dedicated Implementation and Mutual Action Plan tools is an important way to continue to deliver a best-in-class experience for new customers. These platforms provide visibility into the implementation process, as well as manage key vendor and customer deliverables to ensure that the kickoff or launch is as successful as possible.

From there, the Customer Success team becomes actively involved in managing the customer relationship and ensuring customers realize the ROI case constructed during the sales process. Customer success teams now have a variety of tools they can use to plan and track their activities, as well as programmatically monitor customer health and orchestrate next best actions to enable customers in their journey to adopt and deepen their use of the product.

GTM Managment & Operations

While customer-facing teams are squarely focused on driving pipeline generation and deal execution, there is a constant effort running in the background to monitor the entire sales process and tech stack in order to ensure that it’s operating effectively. This responsibility falls on the GTM Operations teams which could include RevOps, Sales Ops, Marketing Ops etc. depending on the organization.

One of the key roles of operations teams is Pipeline Management and Forecasting, which involves tracking the activity of sales reps in order to develop as accurate a sales forecast as possible.

In GTM Planning & Compensation, multiple vendors have emerged to automate sales commissions management. In addition, there are early-stage companies focused on handling the need for real-time GTM planning given the dynamic nature of GTM orgs.

The complexity and interconnectedness of the modern GTM tech stack has given rise to the Change Intelligence category that gives operations team members who focus on managing GTM systems the ability to visualize how different tools in their stack are connected. This becomes extremely handy when seeking to make changes to integrations, reports, etc. without inadvertently taking down the entire tech stack.

Finally, given that developing an engaged community of users and other stakeholders is becoming a required competency for every business, the new category of Community Management tools is cropping up to provide the capabilities that companies need to manage their communities across disparate channels including chat, social media, forums, events etc.

No Better Time to Build B2B GTM Software

As SaaS investors passionate about B2B GTM, we’re excited about the non-stop innovation in the category due to the step-function improvements new technology can deliver for GTM teams. We don’t expect the pace to slow down because of the opportunities that still exist to improve Pipeline Generation, streamline Deal Execution and empower GTM Management & Operations teams.

The goal of this post is to provide B2B GTM leaders with a clear view of what we believe to be the best-in-class technologies, and how they can be combined to build a highly-productive, modern GTM motion. Though, we suspect that given just how rapidly this space evolves, our findings may very well be soon out of date!

It goes without saying that we continue to be extremely active investors in GTM technology and we look forward to meeting founders seeking to disrupt today’s modern B2B GTM tech stack, yet again.

Please reach out to Rajeev ([email protected]), Demi ([email protected]) and Adi ([email protected]) if you are building a company in this category. We can’t wait to hear from you!

Thanks to Kraig Swensrud, Sean Whiteley, and Brad Smith for their invaluable input on this blog post.