At Sapphire, we’ve long been believers in the benefits of employing a Product-Led Growth (PLG) motion as a customer acquisition and expansion strategy, and over the last 5+ years, we’ve worked with companies such as monday.com, Auth0, Segment, JFrog and Sumo Logic as they scaled into multibillion-dollar businesses using PLG.

We define PLG as a go-to-market (GTM) strategy where the product is the primary vehicle for driving customer acquisition, activation, retention and expansion. PLG has gained significant popularity in recent years in response to the shift in buying power to end users. In fact, over 65% of the 2021 Forbes Cloud 100 employ a PLG motion today–up from less than 35% just five years ago. Over the same time period, publicly-traded PLG companies have seen their aggregate market capitalization grow significantly from $20B to well over $600B, which has further raised the profile of PLG as a viable GTM strategy.

For companies in the process of adopting a PLG model, or for those just starting out and thinking about which GTM strategy to implement, here’s a quick list of major PLG benefits:

- PLG provides global reach. PLG companies have the ability to reach a global audience early on in their development since users can sign up online and start using the product instantaneously, often for free. By removing the friction to get started, PLG companies can acquire users around the world without having to stand up a large sales team.

- PLG companies can identify and capture high quality leads right from the start. With PLG, product interest is demonstrated upfront, enabling sales teams to assess lead quality with greater ease and confidence than in traditional sales-led or marketing-led models.

- PLG drives faster account conversion. When done correctly, PLG companies demonstrate value to users early on. Initial users that get value from the product often become internal champions that help spread the word and, ultimately, help drive conversion, retention and expansion within their teams and companies.

- PLG improves sales efficiency. With PLG, there is almost no effort required from sales to get a new customer to sign up and pay for the product. In addition, customers can often make basic upgrades without sales involvement. When sales effort is required, reps can use product usage data to identify the best accounts to focus on, increasing rep productivity and improving sales efficiency.

As overall adoption of PLG has increased, a key question has emerged: How should a business execute on its PLG strategy as it scales and begins to sell multiple products to customers with complex buying processes?

Our point of view is that this requires a hybrid approach where the product drives top-of-funnel lead generation and captures product usage data that customer-facing teams can then use to prioritize which accounts to engage with. The problem is there is no industry-standard approach to surfacing product usage data to GTM teams in an actionable manner.

As such, we believe there is a large and important market opportunity for a dedicated solution that makes product usage data easily accessible to customer-facing teams right in their daily workflows. We are excited to highlight the emerging PLG CRM category that is addressing this exact opportunity.

The Evolution of PLG from a Product-Only Approach to a Hybrid Model

Though the core tenet of PLG is product-driven customer acquisition, many PLG companies eventually reach a stage where it becomes critical to introduce a human touch into the equation. For example, as they grow their businesses, PLG companies will typically expand their product capabilities over time leading to a more complex product suite. Additionally, as PLG companies move upmarket, they run into buyers who make purchases through rigorous procurement processes that are best navigated by skilled GTM professionals. As a result of these two factors, the need for a human touch to augment the product-led growth motion becomes crucial.

There are numerous examples of exceptional companies that started out with a product-only model and then went on to build sales or account management teams. Take Slack, which experienced explosive growth on the back of its highly viral messaging application. Within its first few years, Slack built a team of Account Managers who primarily worked with inbound prospects from large companies that needed to complete an internal vendor review process before they could purchase the product. As it grew, Slack realized that it needed a traditional sales team to grow its business, hiring its first VP Sales in 2016. In another example, Atlassian, a well-known PLG company, eventually built a team of “Enterprise Advocates” who squarely focus on helping large enterprise customers adopt Atlassian’s suite of products and services.

This hybrid model is commonly referred to as a “Product-Led” approach with a “Rep-Assist.” Though the product can still drive initial customer discovery and adoption, PLG businesses eventually need to augment this effort with GTM professionals that leverage customer data and product analytics to identify the top accounts to focus on, as well as how best to assist those accounts in finding success with the product.

Getting the Right Data to the Right Person at Just the Right Time

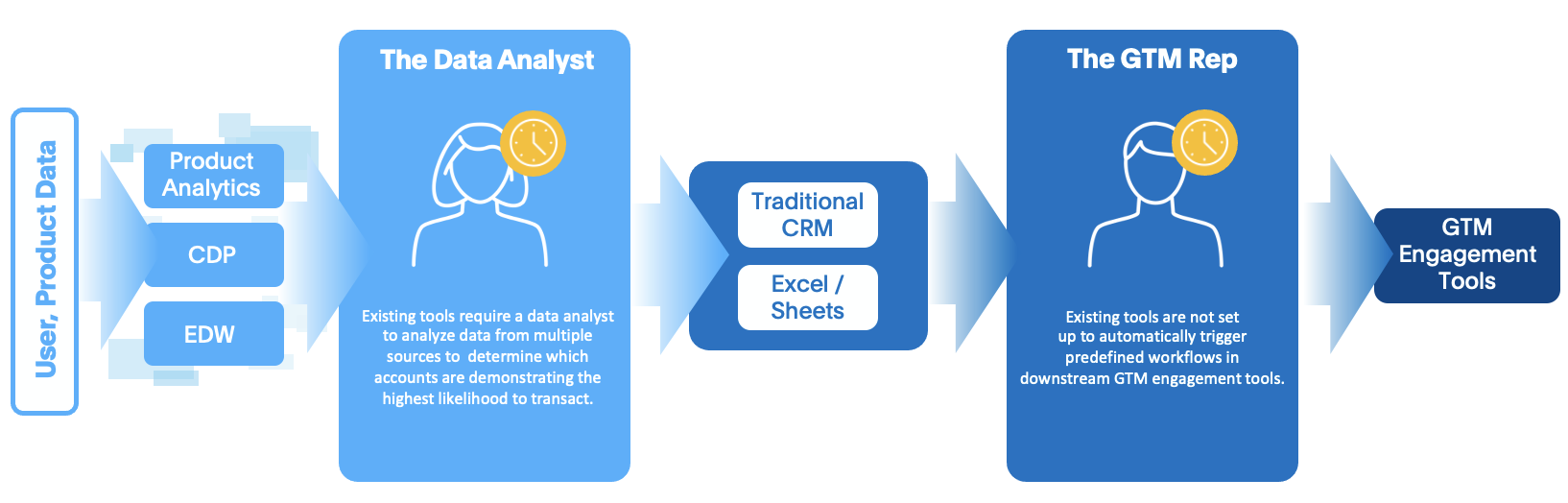

To date, in a hybrid PLG model, there has been a disconnect between the “Product-Led” and “Rep-Assist” sides of the equation. The product usage data required to bridge the gap has long been available, but a dedicated tool to serve this data to GTM teams has been lacking. Though software to capture and analyze product usage and customer data exists (e.g. CDPs, product analytics, BI tools, etc.), these products weren’t built with GTM teams in mind, resulting in two major capability gaps:

- Existing tools require a data analyst to analyze data from multiple sources to determine which accounts are demonstrating the highest likelihood to transact.

- Existing tools are not set up to automatically trigger predefined workflows in downstream GTM engagement tools.

Given the rise in popularity of PLG, we believe there is a tremendous opportunity to develop new products that can connect the entire GTM organization with a complete 360-degree profile of a company’s current and prospective customers. This is where PLG CRMs step in.

PLG CRM Overview & Market Landscape

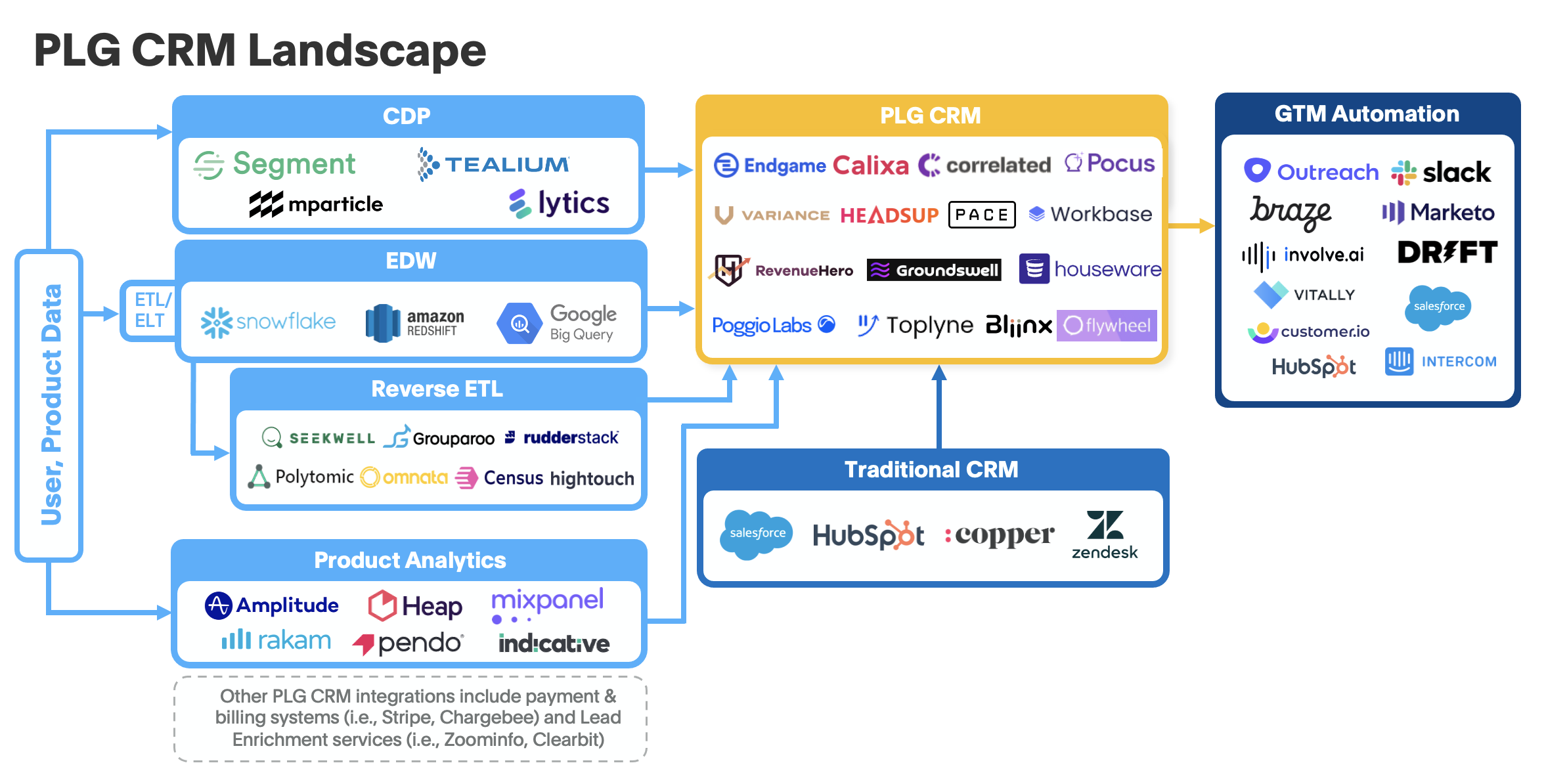

The primary purpose of a PLG CRM is to consolidate customer and product usage data, which is then used to alert reps to accounts that demonstrate a high potential to transact. PLG CRMs provide four main capabilities:

- Aggregate all relevant customer data including firmographic and demographic data from lead enrichment tools, product usage data from a variety of sources including CDPs, data warehouses and product analytics tools, account data from CRMs, ticket data from helpdesks, billing data and so on.

- Set up the criteria that characterize high purchasing intent using data collected in the previous step. Accounts that meet the criteria are typically referred to as Product-Qualified Leads (PQLs).

- Alert GTM reps when an account meets the criteria for a PQL through a proprietary UI or through notifications in collaboration tools like Slack or household CRMs like Salesforce.

- Trigger downstream GTM workflows such as initiating a sequence in Outreach (a Sapphire portfolio company) or a drip campaign through Marketo.

The PLG CRM market is in its early stages, but is rapidly evolving. Below is a graphic illustrating the vendors in the category, along with data sources they are compatible with and downstream GTM tools they could potentially integrate with.