Backing Companies of Consequence

We are intimately familiar with the growth journey of B2B software companies. For more than 20 years, we’ve worked with startups to help them scale from expansion stage to IPO by providing the necessary capital, resources and expertise.

-

30+IPOs

-

80+Exits

-

$11.3B+Firmwide Assets Under Management

-

82CEO NPS SCORE

-

360+Annual Executive Talent Intros

-

360+Annual Customer & Partner Intros

Legal disclaimer

- “IPOs” represents all Sapphire direct growth strategy investments that have had an IPO or public listing from the firm’s inception in 2011 to June 2025;

- “Exits” represents all Sapphire direct growth strategy investments that have had an IPO, M&A, or public listing from the firm’s inception in 2011 to June 2025;

- “Assets Under Management” represents Sapphire’s Growth Strategy Regulatory Assets Under Management as of 12/31/2024 per ADV filed March 2025, as well as all new commitments made or adjusted to managed funds during calendar year 2025;

- “CEO NPS Score” represents the overall Net Promotor Score (82) Sapphire achieved, according to portfolio company feedback received by Sapphire as it relates to Sapphire’s role as an operating partner in companies in which Sapphire Growth strategy has invested and chose to participate in a survey that was conducted by Sapphire; as of April 2024. Companies in which Sapphire Growth strategy has both invested and has spent significant time as an operating partner were invited to participate in the survey, whereby not all portfolio companies Sapphire has invested in were invited to participate. Sapphire does not believe the invitation was biased for favorable results. The CEO NPS Score indicates the level of satisfaction portfolio company executives have had working with Sapphire as an operating partner on a scale of 0-100%. The CEO NPS Score does not in any way refer to the investment advisory services Sapphire provides to managed Funds;

- “Annual Talent Intros” represents relationship introductions made by Sapphire and third parties relating to talent business objectives during calendar year 2024;

- “Annual Customer Intros” represents relationship introductions made by Sapphire and third parties relating to customer business objectives during calendar year 2024;

Companies of Consequence

Legal disclaimer

*“Companies of Consequence” graphic above represents all companies in which Sapphire growth strategy made a direct initial investment from January 2020 through June 2025.

Perspectives VIEW ALL

-

Blog February 10, 2026The AI Workforce for Financial Crime Operations: Why We’re Excited to Lead Bretton AI’s Series B

The AI Workforce for Financial Crime Operations: Why We’re Excited to Lead Bretton AI’s Series B

The AI Workforce for Financial Crime Operations: Why We’re Excited to Lead Bretton AI’s Series B -

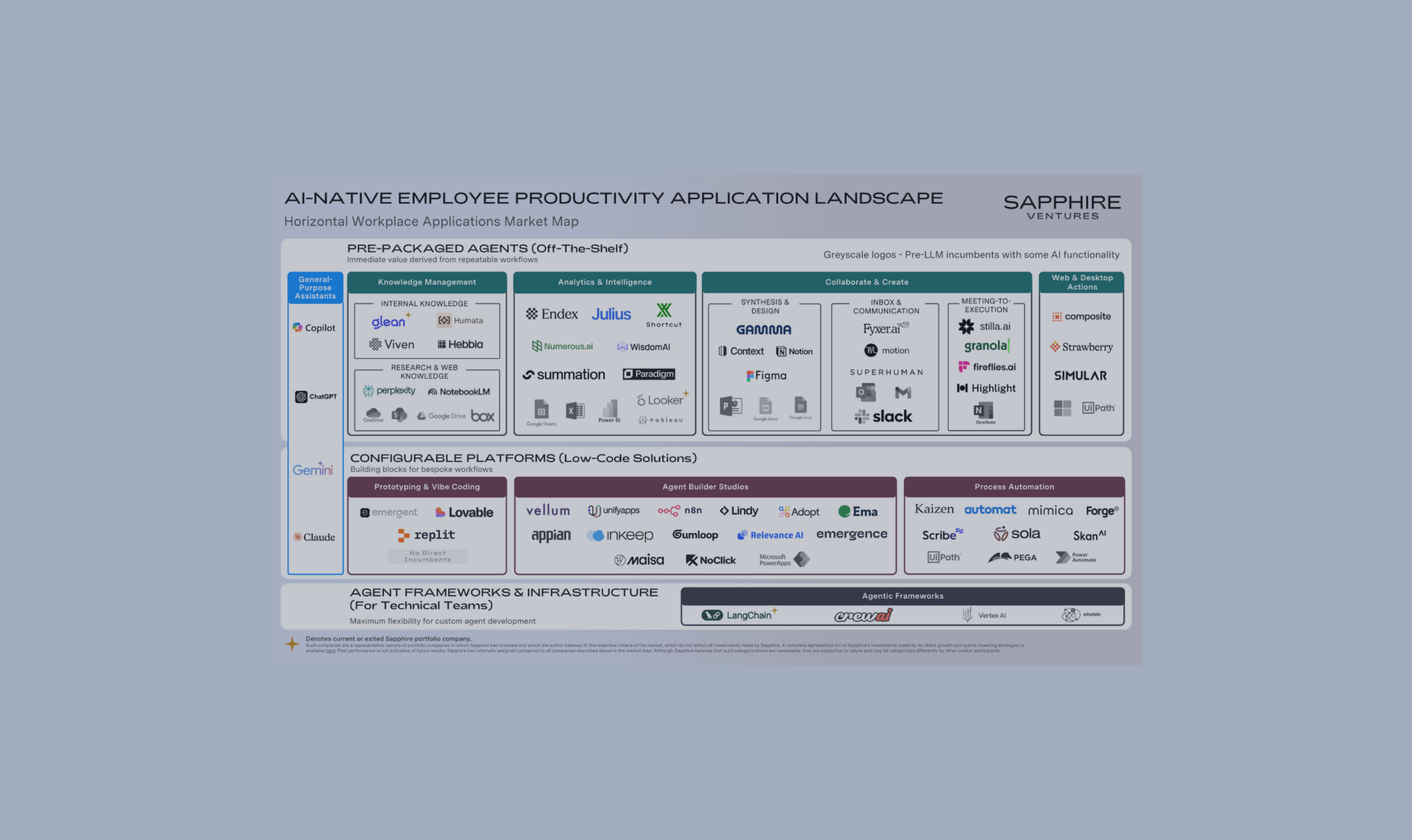

Blog February 3, 2026AI and the End of the Productivity Bundle

AI and the End of the Productivity Bundle

AI and the End of the Productivity Bundle -

Blog January 13, 2026The Ultimate Command Operating System for Global Defense: Why We’re Excited to Co-Lead Onebrief’s $200M Series D

The Ultimate Command Operating System for Global Defense: Why We’re Excited to Co-Lead Onebrief’s $200M Series D

The Ultimate Command Operating System for Global Defense: Why We’re Excited to Co-Lead Onebrief’s $200M Series D -

Blog December 11, 2025Our 2026 Outlook: 10 AI Predictions Shaping Enterprise, Infrastructure & the Next Wave of Innovation

Our 2026 Outlook: 10 AI Predictions Shaping Enterprise, Infrastructure & the Next Wave of Innovation

Our 2026 Outlook: 10 AI Predictions Shaping Enterprise, Infrastructure & the Next Wave of Innovation -

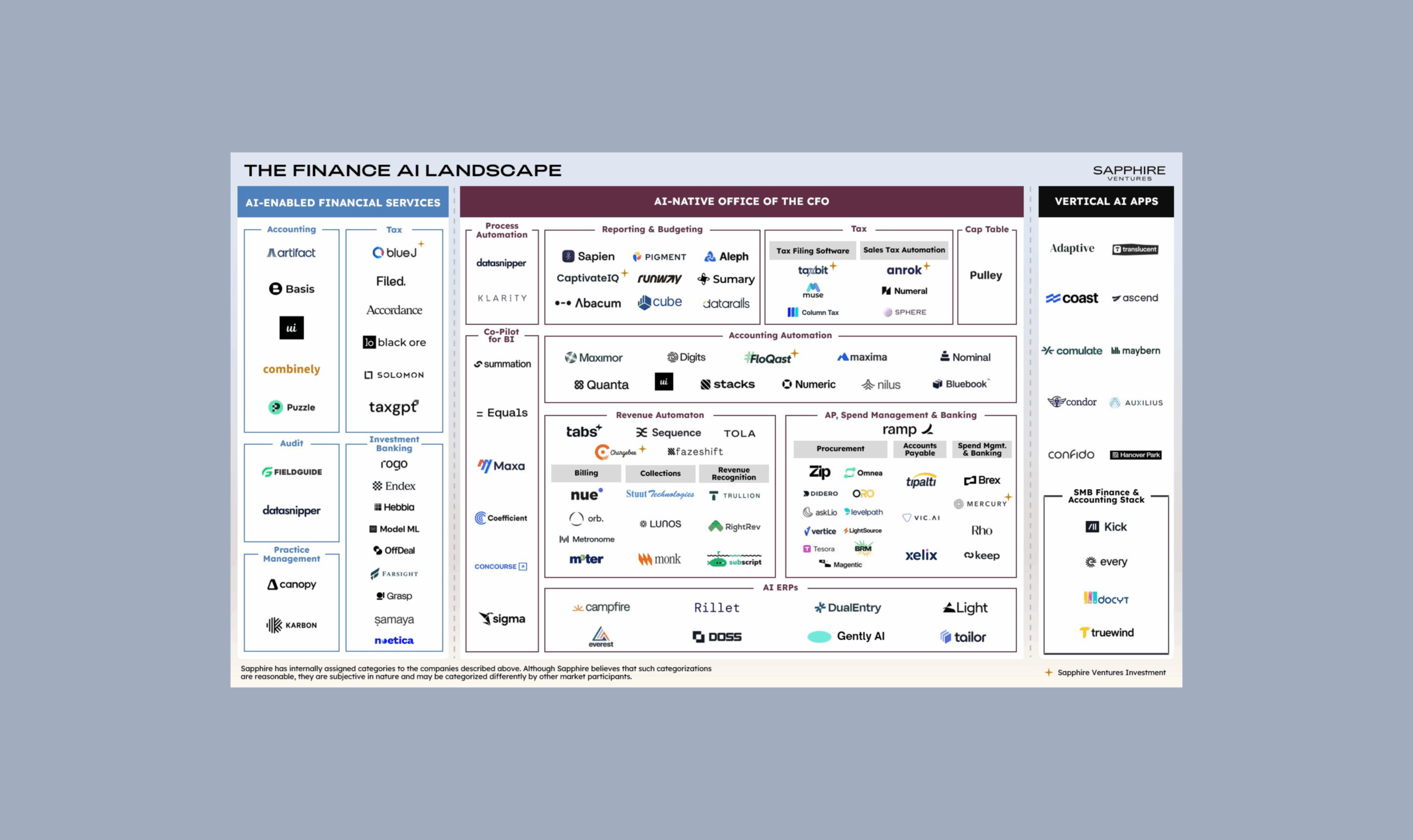

Blog November 20, 2025From Spreadsheet Analysts to AI Agents: Reinventing the Modern Finance Stack

From Spreadsheet Analysts to AI Agents: Reinventing the Modern Finance Stack

From Spreadsheet Analysts to AI Agents: Reinventing the Modern Finance Stack -

Report November 13, 20252025 KeyBanc Capital Markets & Sapphire Ventures SaaS Survey

2025 KeyBanc Capital Markets & Sapphire Ventures SaaS Survey

2025 KeyBanc Capital Markets & Sapphire Ventures SaaS Survey