Every year, we witness a rising number of severe weather disasters impacting countries, communities and habitats across the globe. Back in 2021, when we initially shared our insights on decarbonization technology, natural and weather-related events included historic flooding in China, Germany and Belgium; a catastrophic Category 4 Hurricane Ida in New Orleans, Louisiana; and an unprecedented wildfire season in the American West that resulted in $70 to $90 billion in economic damage.

Charting the Course in Climate Tech: Decarbonization Opportunities in 2024

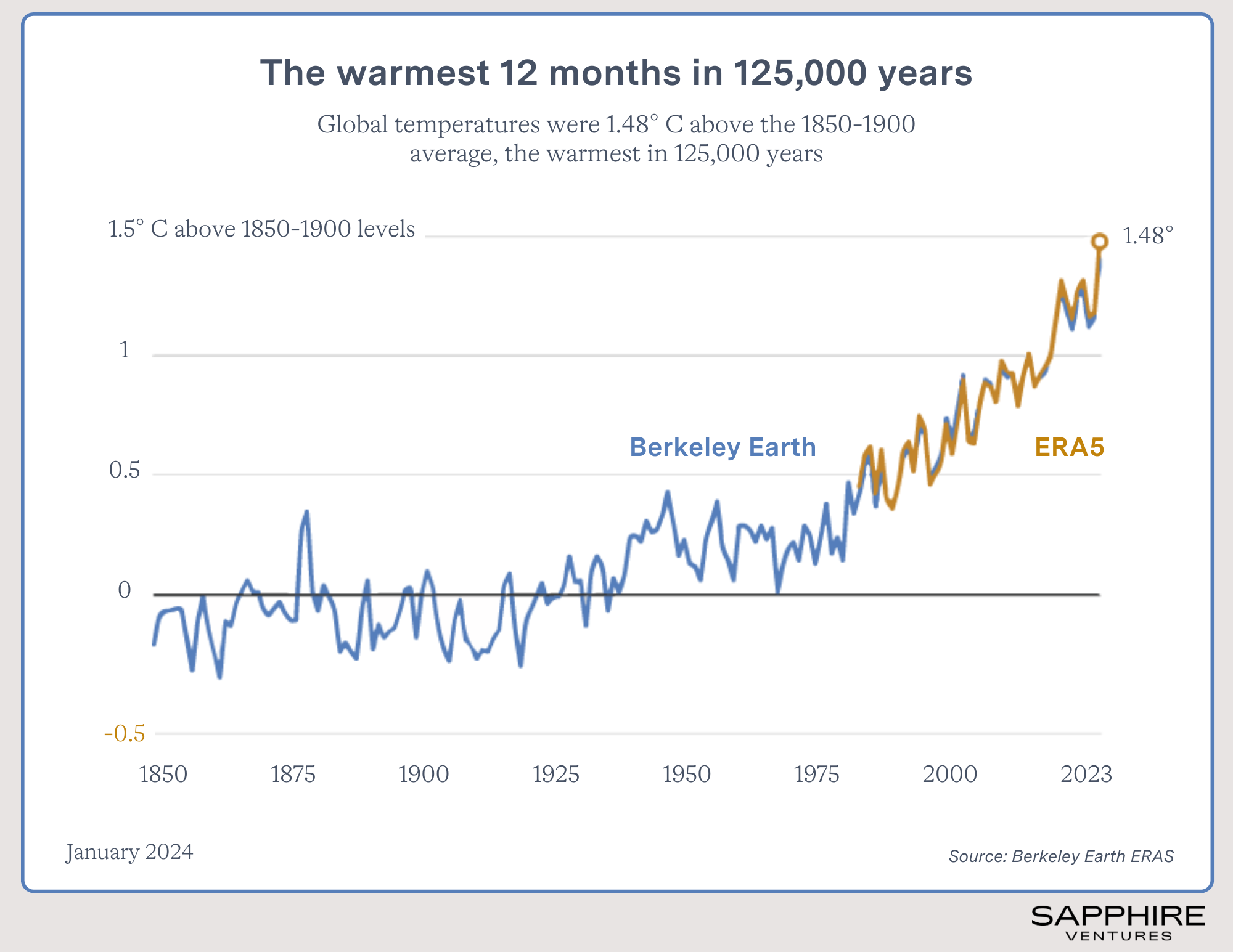

Weather disasters seem to be occurring with increasing regularity, and while devastating in their own right, they’re also resulting in significant financial losses. In 2023, damages from 28 confirmed extreme weather disaster events exceeded $1 billion each in the United States alone, up from 18 events in 2022 when adjusted for inflation. Given this escalation, the imperative to decarbonize our economy has never been more critical, with just 26 years left to reach net zero by 2050, as outlined in the Paris Agreement. Perhaps the most striking phenomenon in 2023 was the average global temperature crossing 1.5°C, a temperature above pre-industrial levels—the first significant threshold identified in the 2015 Paris Agreement, beyond which scientists predict increasingly severe climate impacts.

Since we last opined on climate tech, the space has continued to accelerate and develop. Solar panel prices fell 50% in 2023, and lithium-ion battery prices fell 14%. Meanwhile, wind and solar generated more than 10% of global electricity in 2022, and battery storage deployment is projected to increase tenfold by 2030. Governments have passed major legislation supporting clean energy, and energy transition investment has now reached parity with fossil fuel funding.

These noteworthy developments have led to a 1.9% decline in U.S. emissions in 2023, which, combined with GDP growth of 2.5% (adjusted for inflation), signals a decoupling between emissions and economic activity. In just the last three years, we’ve witnessed more investors, entrepreneurs and startups stepping up with innovative solutions and cutting-edge technologies to accelerate the transition toward sustainable energy sources. This pivotal shift compels us to offer an update on where we see the key opportunities in 2024 and a refreshed market map to highlight the climate tech startups we believe are leading the way.

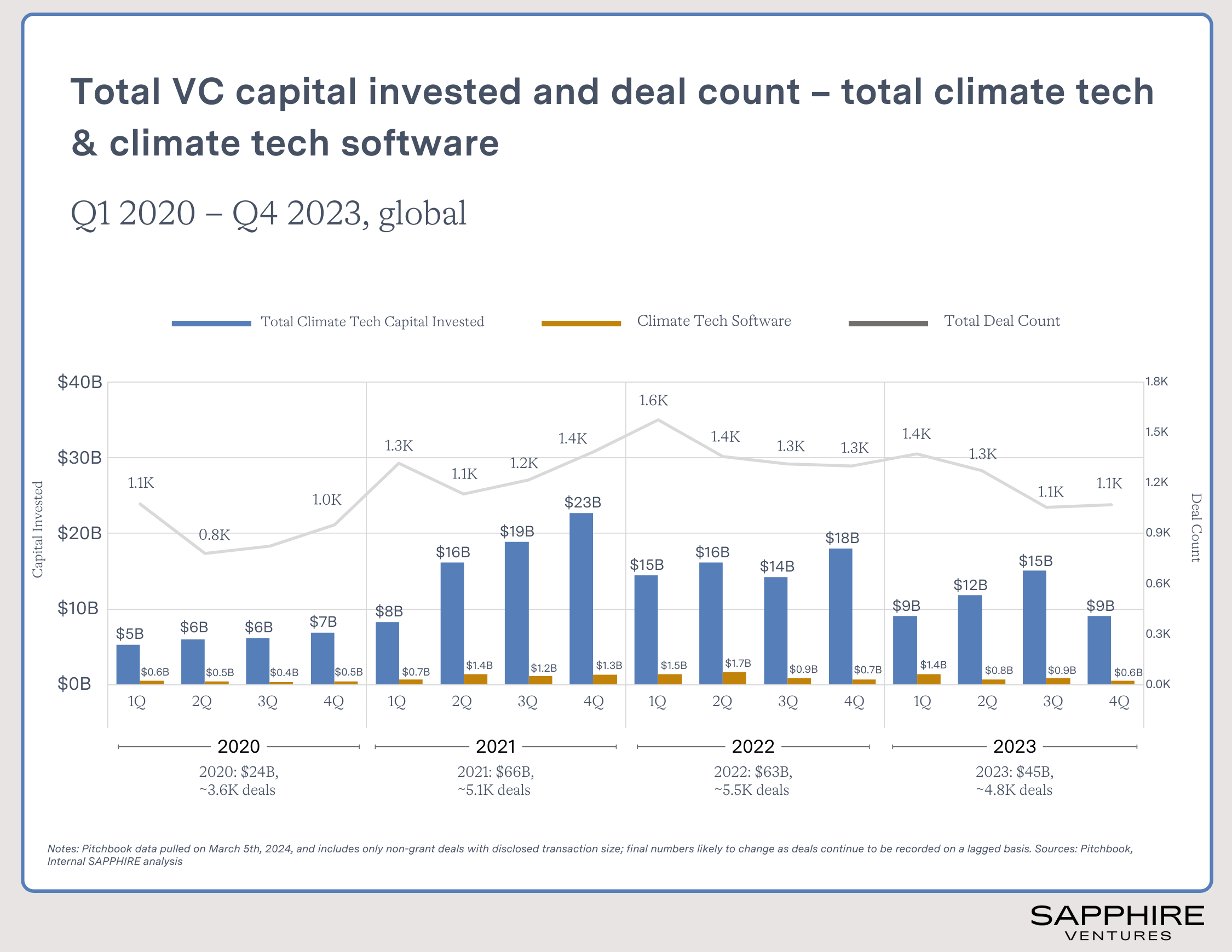

Climate Tech Investment and Market Update

2023 was a challenging year for venture capital investments, but climate tech investment demonstrated resilience. While overall funding in climate tech did drop to $45 billion from $63 billion in 2022, this 29% decrease was less severe than the broader venture capital market, which fell by 36%.

The downturn was even less pronounced for climate tech software companies, which saw a 25% reduction in funding in 2023, driven by large investments in asset-light companies such as Xpansiv, PVCase and Measurabl. In 2023, Europe continued to lead in climate tech enthusiasm, with investments in the space outpacing software and fintech to become the leading sector for capital raised. However, this performance was achieved against a backdrop of challenges for public clean energy stocks, which declined despite a positive S&P 500 and NASDAQ 100 performance.

Several market trends drove much of the enthusiasm around climate tech in 2023 and into 2024. These included the Inflation Reduction Act, climate disclosure mandates in California and the EU (and now under the SEC) and the accelerating cost declines in renewable energy technologies.

1. The Inflation Reduction Act (IRA)

Although passed in late 2022, the Inflation Reduction Act (IRA) began energizing the climate tech and clean energy landscapes in the U.S. in earnest in 2023, serving as a catalyst for the sector’s expansion. The IRA allocates an estimated $369 billion, potentially exceeding $1 trillion according to some estimates, in tax credits for clean energy initiatives, covering technologies like electric vehicles, solar, wind, heat pumps, hydrogen and carbon capture. Just one year since the legislation passed, over 210 projects have been announced, adding as much as $156 billion to U.S. GDP and 400,000 new jobs. The Inflation Reduction Act also has strong “Made in America” provisions that require many of the products to be manufactured in the U.S. This underscores the U.S. government’s long-term commitment to the sector and its deliberate push to reshore clean energy manufacturing. These provisions have created international waves, leading the EU to adopt its Net-Zero Industry Act to ensure a significant portion of its clean tech is homegrown by 2030.

2. Climate Disclosure Mandates in California and the EU

In addition to passing incentives for clean energy investment, governments are now making carbon disclosure a regular business practice of the world’s largest companies. In early 2023 and early 2024, three critical pieces of legislation required companies to disclose carbon emissions:

- The EU Corporate Sustainability Reporting Directive requires most companies in the EU (estimated at 50k companies) to disclose Scope 1 – 3 emissions by 2025.

- The Climate Corporate Data Accountability Act requires U.S. companies with annual revenues over $1 billion and doing business in California to disclose their Scope 1 – 3 emissions by 2027.

- The SEC’s long-awaited climate disclosure rules, released in March 2024, will require US-listed companies to disclose Scope 1 and 2 emissions in 2026.

New rules from Europe and California now mandate that companies report emissions from their entire supply chain, referred to as Scope 3 emissions. This requirement is sending shockwaves through supply chains and accelerating the adoption of carbon reporting. As a direct result, many more companies have submitted validated Net Zero targets. The number of companies under the Science Based Targets initiative doubled in 2023 to over 4,000.

Additionally, these rules have had an impact on climate tech VC funding, as carbon accounting providers raised large rounds in 2023 and early 2024, driven by Persefoni ($50M Series C1), Watershed ($100M Series C), Plan A ($27M Series A), CO2 AI ($12M Series Seed) and others. However, carbon markets, plagued by media and investor criticism, haven’t been as fortunate. The volume of credits from REDD+ and RE projects declined again in 2023, while purchases of more valuable carbon removals grew as much as 3x in 2023.

3. Accelerating Cost Declines in Renewable Energy

In 2023, the climate tech industry saw remarkable advancements, most notably the steep price decline for solar panels and lithium-ion batteries, a trend we initially spotlighted in 2021. Solar panel costs drastically dropped from $126 per watt in 1975 to $0.13 in 2023, with a 50% drop since 2022 alone as production scales up. This cost reduction, driven by increased deployment, follows a learning rate similar to Moore’s law in computing, with solar prices falling 44% for every doubling of capacity.

Consequently, there has been a boom in solar energy deployment, reaching 413 GW in 2023, up from 252 GW the previous year. Solar and wind represented 12% of all electricity generation and 80% of all new electricity generation growth in 2022. Likewise, lithium-ion batteries have become significantly more affordable and widely used, mainly due to the expansion of electric vehicles and stationary storage markets. Prices dropped by 14% in 2023 and 82% since 2013, with deployment soaring by 53% to 950 gigawatt-hours.

We believe we are currently experiencing a surge in renewable and zero marginal cost energy that will reshape our energy economy. This trend has implications that extend beyond climate to impact AI use and the proliferation of data centers. At Sapphire, we’re excited about this and will continue to watch it closely as it creates new market opportunities.

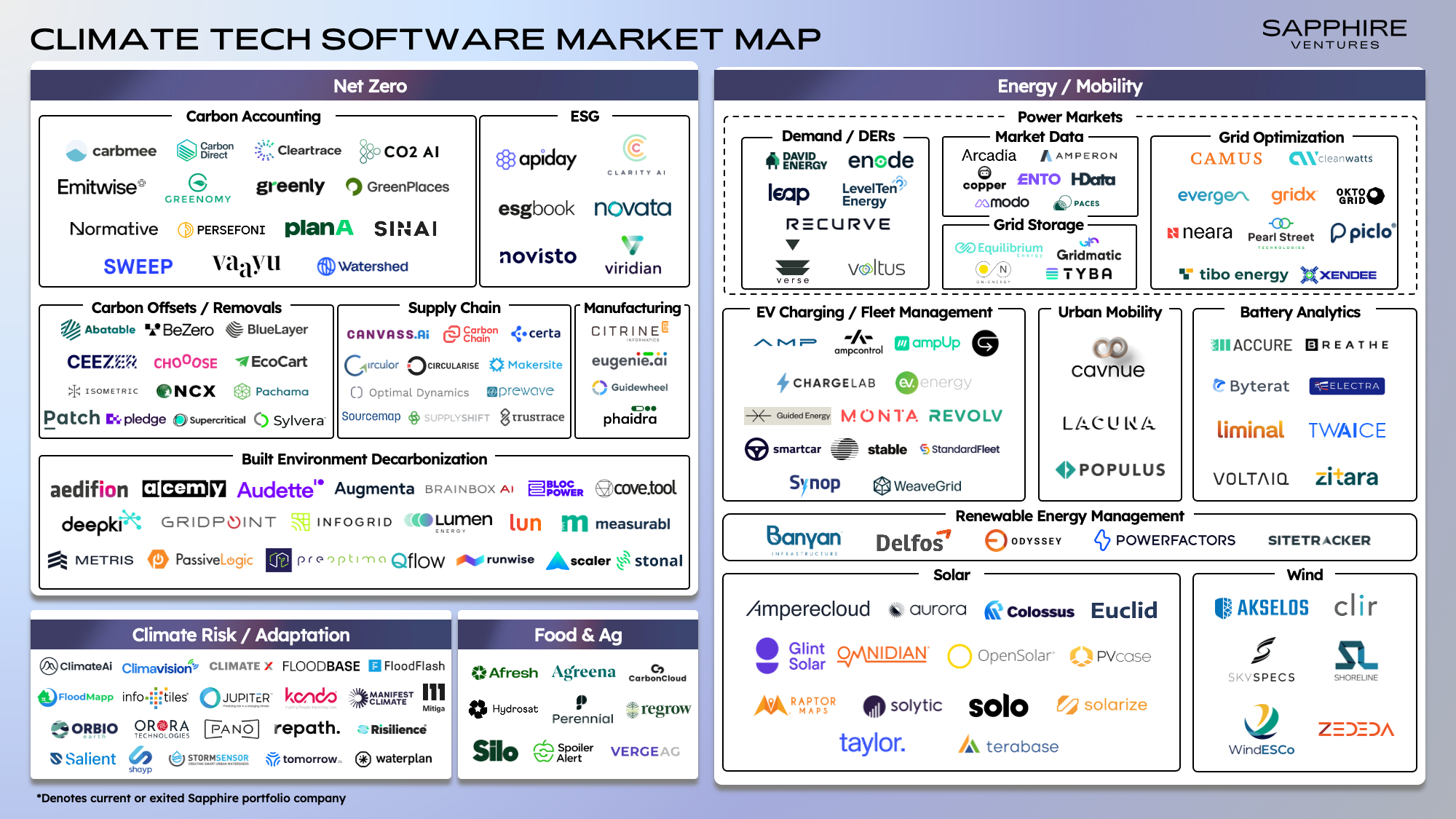

Climate Tech B2B Software Market Map

Our 2021 article covered only seven categories. As we predicted, new categories have exploded since then, including power markets, grid optimization, DERs, grid storage, EV charging, built environment, battery analytics and more.

The Key Opportunities We See in Climate Tech for 2024

While we are excited by the climate tech startups building across all of these categories, we wanted to highlight four specific themes where we see the scope of opportunity as particularly sizeable:

1. Battery-Adjacent Software

Since renewable energy is intermittent, storing power produced by renewables during periods without sun and wind is key to building a renewable energy future. As previously mentioned, battery prices have significantly declined in recent years — and are expected to continue doing so — making batteries a vital tool for decarbonization on two fronts. First, electric vehicles are proliferating worldwide. They represented 1 in 5 new car sales globally and 9% in the US, up from 2% just three years ago. Second, utility-scale stationary storage has become a realistic economic resource for smoothing out peaks from solar and wind, as the EIA projects U.S. battery storage capacity to double in 2024 to 30 GW.

This rapidly expanding market is creating many opportunities for different software companies to play a role, from EV charging management companies like Monta, Ampcontrol, Weavegrid, EV Energy and Stable – to businesses that specialize in managing utility-scale battery installations through software, such as Equilibrium Energy, Tyba, Gridmatic and others. Additionally, we are excited by companies like Byterat, Twaice, Accure and VoltaIQ, which are building battery analytics and monitoring solutions.

These innovations aim to enhance battery lifetime forecasting, optimize capacity, improve safety and correct inaccuracies post-installation that stem from the initial design and validation process. By improving battery efficiency and further reducing associated costs, these software solutions will compound the advantages of deploying battery technology and stimulate market growth.

2. Smart Grid Technology and Distributed Energy Resources

Renewable energy sources are increasingly significant in our energy mix, with “Electrify Everything” as the central mantra for decarbonization. Grid modernization is crucial for effectively integrating these intermittent sources, especially since they are more distributed than a centralized fossil-powered grid. Technologies such as smart meters, grid-enhancing technologies and intelligent grid management systems are key drivers of this transition.

These innovations may unlock the ability to monitor energy consumption, detect faults, manage demand and optimize grid operations. For example, Oktogrid has built a digital data interface that provides access to transformer and grid performance data in real-time, making it possible to monitor, forecast and react to congestions, as well as reduce the cost of asset management.

Amperon provides advanced demand and supply analytics to help power companies manage volatility. Meanwhile, Camus’ grid orchestration platform provides system-wide visibility and advanced control for distribution utilities managing a rapidly changing grid. Neara helps utilities better understand their physical network, its physical limitations and how they can optimize and enhance it for a renewable energy future. On the distributed energy resources side, Enode is an API that energy companies use to connect to small energy devices such as EV chargers, home batteries and thermostats. David Energy, a modern electricity retailer, makes the best use of customers’ internet-enabled energy devices.

The advent of smart grid technologies is particularly exciting as it enables businesses and consumers to more actively participate in the energy system. For example, these technologies unlock the ability for energy companies to sell smart energy tariffs, such as Octopus Energy’s Flux tariff, an import and export tariff that allows homeowners to schedule their home batteries to get the best rates for consuming and selling energy during peak periods.

Finally, an emerging trend in electricity grids is explosive demand growth, which the sector hasn’t seen in over a decade. This surge is primarily driven by the rapid development of data centers due to AI. Startups such as Verse and Phaidra have a big opportunity to help data center operators better manage their electricity usage, which can make up a significant portion of data center operating costs.

3. Adaptation Tech

Adaptation technology refers to solutions designed to prepare for and withstand the impacts of climate change, as well as assist companies in managing acute climate risks. Examples of adaptation strategies include advanced weather modeling, wildfire detection and response, vegetation management and enhanced agriculture. Over the past few years, weather forecasting has improved substantially, driven mostly by increases in computing power and more specialized weather models. Many companies leverage this technology to help their customers adapt to climate change.

For example, Climate AI and Hydrosat help their agriculture customers plan for a changing climate. Tomorrow.io helps customers in many verticals better plan for the weather. Other companies like Mitiga and ClimateX help customers understand their climate exposure risk. Lastly, Pano leverages remote sensors and AI to streamline wildfire detection and response for utilities, fire departments and land managers.

One area where adaptation solutions will be increasingly crucial relates to water. For every 1°C increase in the global average temperature, experts project a 20% reduction in renewable water sources such as lakes and rivers. By the end of the decade, there is an expected 40% gap between water supply and demand. Companies like Waterplan are working to address this by enabling businesses to measure, monitor and respond to the water-related risks that their direct operations and supply chain face. Meanwhile, FloodMapp has built a live street-level flood intelligence feed, and companies like FloodFlash and FloodBase sell parametric flood insurance.

4. Innovations in Supply Chain

Supply chains account for 60% of global carbon emissions; therefore, they are a critical area for reaching net zero goals, particularly as both Europe and California’s new climate disclosure rules include Scope 3 emissions. Tailwinds stemming from conflict, geopolitical tensions and the lasting impacts of the pandemic are all factors that have made supply chain issues a primary concern for CEOs. Additionally, there is growing demand from consumers and governments for visibility into product life cycles, including labor practices, environmental impact, quality, safety and more. At Sapphire, we see increasing momentum in adopting supply chain traceability, visibility and risk intelligence software. We believe this area holds significant potential for further innovation powered by AI. We see companies like Prewave, CarbonChain and Makersite as frontrunners in this space.

Another significant supply chain challenge is that logistics are frequently fraught with waste. As highlighted in our 2022 blog on the supply chain tech landscape, 35% of all heavy-duty truck miles are still being driven empty, resulting in billions of wasted miles annually and avoidable carbon emissions. As a result, there is a sizable optimization opportunity within logistics focused on reducing unused capacity, improving routing efficiency and reducing emissions.

For example, Leaf Logistics coordinates across shippers, carriers, brokers and partners to tackle inefficiency and empty miles system-wide. Optimal Dynamics is another notable company that helps individual shippers and carriers make load-by-load decisions that maximize the probability of being profitable and on time, even if the unexpected happens.

Conclusion

Since we first published our insights on the technologies fueling decarbonization, the climate tech ecosystem has seen significant growth. We believe this growth has been propelled by the rapid decrease in renewable energy costs and reinforced by substantial green subsidies and climate disclosure requirements in California, the U.S. and the EU. We have observed larger deployments of clean energy technologies and more companies than ever committing to sustainability.

We believe this space will produce generationally defining Companies of Consequence. Knowing that many sustainability-related problems remain to be solved, we can’t wait to see what ambitious founders will build in the years ahead. We would love to hear from you if you are building software for the decarbonized economy.

You can reach us at [email protected] and [email protected].

Disclaimer: Nothing presented within this article is intended to constitute investment advice, and under no circumstances should any information provided herein be used or considered as an offer to sell or a solicitation of an offer to buy an interest in any investment fund managed by Sapphire Ventures (“Sapphire”). Information provided reflects Sapphires’ views as of a time, whereby such views are subject to change at any point and Sapphire shall not be obligated to provide notice of any change. Companies mentioned in this article are a representative sample of portfolio companies in which Sapphire has invested in which the author believes such companies fit the objective criteria stated in commentary, which do not reflect all investments made by Sapphire. A complete alphabetical list of Sapphire’s investments made by Its direct growth and sports investing strategies is available here. No assumptions should be made that investments described were or will be profitable. Due to various risks and uncertainties, actual events, results or the actual experience may differ materially from those reflected or contemplated in these statements. Nothing contained in this article may be relied upon as a guarantee or assurance as to the future success of any particular company. Past performance is not indicative of future results.