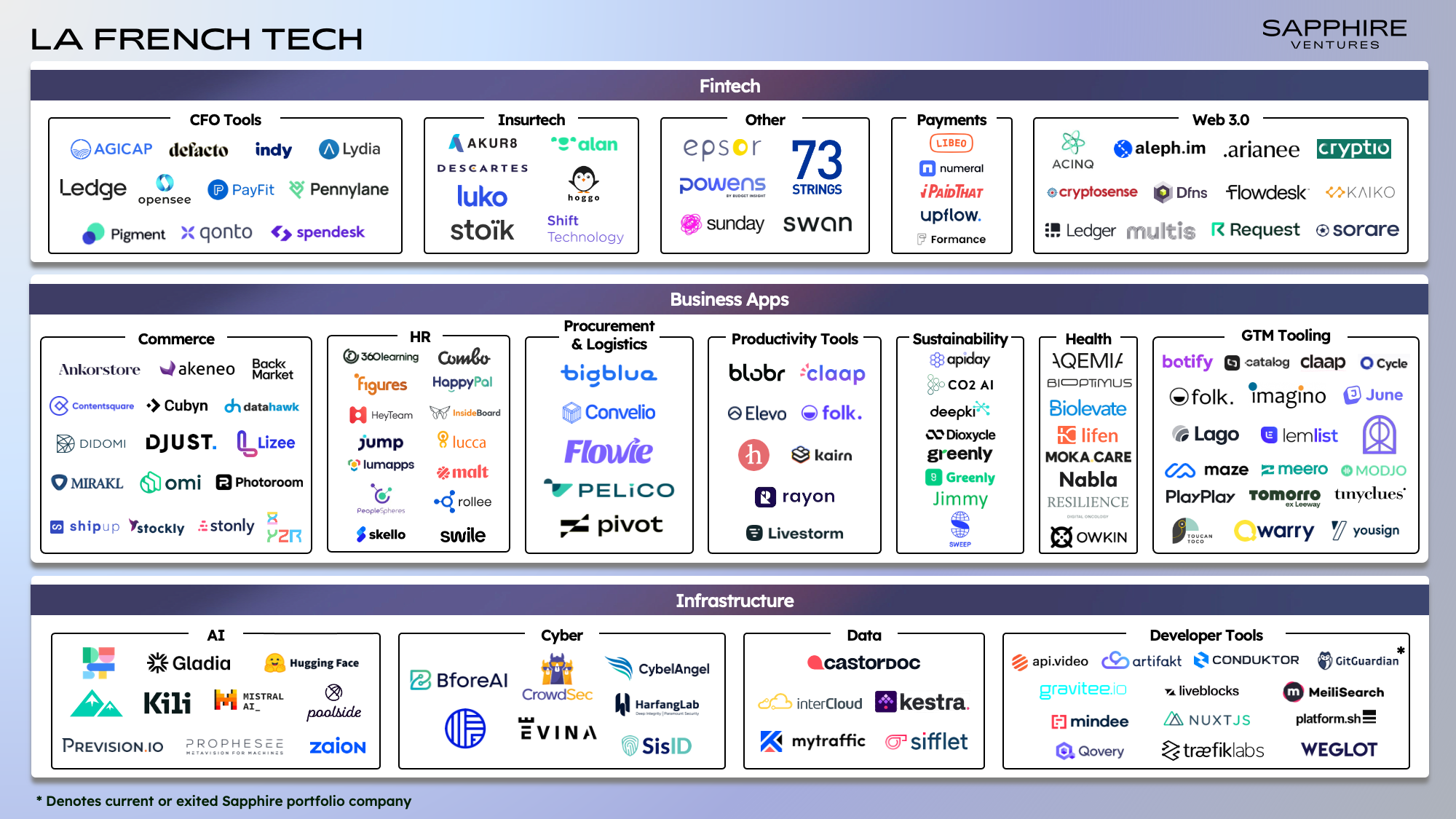

Fresh from Kubecon Europe in Paris, where we recently spent time with leading innovators and local ecosystem investors, it is evident that the French tech ecosystem showed remarkable resilience during its first modern downturn in 2023. In fact, the tech scene has caught a fresh wind, rallying to raise €8.3B across 715 companies in 2023.

Numerous innovators from French unicorns like Owkin, Payfit, Ledger and Datadog, to name a few, are branching out to build their own companies, generating an exciting buzz at the early stage. Additionally, stealth startups are experiencing significant pre-seed and seed financing rounds. Therefore, we can confidently say that “La French Tech” will stay firmly in the spotlight for 2024, led by entrepreneurs building in AI, DevOps and climate tech.

Most notably, since our last update on the ecosystem in 2022, there has been a clear shift in the landscape from a focus on fintech to the strengthening of other sectors such as DevOps, healthcare and CFO tooling. So, what is driving growth in these sectors? Below, we provide an overview of the five categories we think will be most influential in 2024 and the French tech companies we believe are leading the way.

Artificial Intelligence (AI)

Paris is home to some of the world’s top engineering schools, such as École Normale Supérieure, Polytechnique and Centrale and has long been a breeding ground for world-class mathematicians. Many of these professionals are staying in France or returning from the United States to launch startups focused on developing their own Large Language Models (LLMs) or creating cutting-edge Gen AI applications. Some of France’s stars in the current AI boom include:

- Mistral AI is a Paris-based OpenAI rival building cutting-edge LLMs for developers to deploy AI-powered services, including chatbots and search engines. The company captured headlines in December 2023 when it raised a €385M Series A, six months after its €105M Seed round. Co-founded by engineers who cut their teeth at Google Deepmind and Meta’s Fundamental AI Research in Paris, Mistral’s quick growth is a testament to France’s technical expertise and talent.

- Poolside, launched in 2023, is a ChatGPT-like tool that can write software code. It raised a $126M Seed round in May 2023, quickly followed by a $100M extension in August. At the same time, the company relocated from the United States to Paris, significantly bolstering France’s ambition to emerge as a leading force in AI.

- Hugging Face is a Franco-American startup that helps companies build, develop, train, and share machine learning code and datasets (think of it as an AI-focused GitHub). Headquartered in New York, this company also had a banner year. Founder Clément Delangue said it was on track to multiply its revenues by five in 2023 as it raised $200M at a $4B valuation. Three French engineers founded the company, and the majority of its employees are based in Paris.

- Dust is building AI-powered assistants on top of LLMs developed by OpenAI, Cohere, AI21 and more. The company is specifically focused on improving team productivity by breaking down internal silos and surfacing crucial knowledge. Dust was co-founded by Gabriel Hubert and Stanislas Polu, who sold their first startup to Stripe and subsequently worked at Alan and OpenAI, respectively. Sequoia led the $5.5M seed round in June 2023.

- Photoroom is an AI-powered photo-editing app. The company raised a $43M Series B at a $500M valuation in February 2024, led by Balderton and Aglaé Ventures. Photoroom has focused on training its own models and claims that its custom architecture can speed up image generation for users by up to 40% compared to other visual AI platforms. The business counts Warner Bros, Bvlgari, Wolt and Hennessy as customers.

We at Balderton are excited by the fantastic level of AI entrepreneurship in France. Few realized that so many French Al engineers were leading some of the most innovative research projects at places like Meta or Google. They are now emerging as the new wave of entrepreneurs. This is driving an unprecedented momentum in pre-seed and seed activity and gives great hopes for the rise of global category leaders originating in France.

Bernard Liautaud

General Partner at Balderton

In the domain of pure scientific research, a new AI lab called Kyutai was launched in Paris in November 2023. It’s designed to work with Ph.D. students and researchers to publish scholarly papers and create foundational models—all open-source. The non-profit lab was established thanks to a €300M financing led by Rodolphe Saade, the CEO and owner of shipping giant CMA-CGM, alongside Eric Schmidt, the former software engineer who served as the CEO of Google, and Xavier Niel, the telecom billionaire entrepreneur behind Station F and Kima Ventures.

Sign up for our newsletter

The Office of the CFO

Although mega-rounds of funding have become rarer for French fintechs since the financing boom from 2020 to 2022, they have not completely disappeared. Notably, France’s fintech stars continue to develop new products, gain market share and increase revenues.

- Agicap, the Lyon-based cash flow forecasting software, last raised a $100M Series B in May 2021. Since then, Agicap has expanded from a single product to a multi-product offering, launching CashCollect, its accounts receivables automation, and Payment, its accounts payables automation, two years ago. Most recently, Agicap launched Spend Management for companies to better manage expenses in 2023. With these new product offerings, Agicap caters to the SMBs it targeted at inception, and now to mid-market companies with revenues in the hundreds of millions.

- Pigment, a business planning software designed to replace the need for countless spreadsheets to analyze KPIs and craft business plans, experienced an exceptional 2023. The company secured an $88M Series C, revealed it had doubled its client base, tripled its annual recurring revenue (ARR) and quadrupled its revenue in North America, making the continent its largest market.

- Pennylane, an all-in-one accounting software startup, became France’s latest unicorn in February after raising an additional €40M from existing investors DST Global and Sequoia. The company calls its software “Financial OS,” targeting both companies and accounting firms. Since 2022, Pennylane’s user base of SMEs has increased by 40x, and according to TechCrunch, “You don’t see that kind of growth rate that often — even for a startup.”

- Swile, an employee benefits startup, kicked off 2023 with a bang by acquiring its competitor Bimpli, owned by Groupe BPCE. Following the deal, Groupe BPCE became Swile’s largest shareholder with 22% equity. In the third quarter of last year, Swile announced that it was about to become profitable. The company has expanded to business travel since its acquisition of Paris-based Okarito in 2022.

DevOps and Data

While DevOps giant Datadog was founded by two Frenchmen – Olivier Pomel and Alexis Le-Quoc, the company was built from its New York headquarters. Much has changed in the 13 years since Datadog’s foundation, with much credit to the French government and startup incubators like Station F. As a result, France has become a hotbed for innovation in the DevOps space, with several companies making waves that we are particularly excited about:

- DevSecOps startup GitGuardian (a Sapphire Ventures portfolio company) helps developers prevent sensitive data leakage across both private and public repositories like GitHub by scanning source code to detect API keys, passwords, certificates, encryption keys and more.

- Founded in 2021, Sifflet has built a data observability platform that monitors data across clients’ tech stacks, promptly notifying them of any anomalies it detects. Sifflet also computes data lineage, or how data flows from one part of the data stack to another, facilitating quicker resolution of underlying issues.

- Meilisearch, another champion of open-source code, has built a search engine for companies of all sizes to integrate into their apps and websites. The code for this has been downloaded millions of times. The company now offers Meilisearch Cloud, a product tailored to the enterprise and used by prestigious names like Louis Vuitton and Hugging Face, to name a few.

French startups are gaining prominence thanks to the impressive engineering talent pool and innovative technologies. In industries such as AI, where technology plays a pivotal role, French engineers have proven to be among the world's best. This technical excellence is crucial for startups, particularly in fields like AI, Cybersecurity and DevOps. The primary challenge for French startups is not in the creation of high-quality tech products but in their distribution. By targeting the U.S. market early in their journey and with strong financial backing, French startups have the potential to transform products into industry giants.

Eric Fourrier

CEO at GitGuardian

Healthcare

France, long recognized as home to pharmaceutical giants like Sanofi and Pierre Fabre, has unsurprisingly become a hub for some of Europe’s most innovative healthcare startups. Capitalizing on the nation’s expertise in AI, these enterprises are pioneering novel treatments and enhancing patient care delivery. Below are some of the companies we find most intriguing in this sector:

- Owkin is a French medtech startup that harnesses AI to accelerate drug discovery and develop diagnostic tools. Its algorithms, built on data from the United States and North American hospitals, use a decentralized approach to machine learning known as federated learning. This method involves training algorithms locally rather than aggregating data in a central repository, thereby increasing privacy when manipulating sensitive data.

- Nabla is the developer of Nabla Copilot, an AI assistant for doctors that automatically generates clinical notes. The copilot creates a transcript of medical appointments using speech-to-text technology, which is then refined by Nabla’s large language model trained on medical data to highlight important information. Finally, it generates a medical report that includes prescriptions and additional appointment letters.

- Resilience aims to enhance the care pathway for cancer patients with a mobile app to manage treatment daily. The company offers oncologists a SaaS platform to improve patient monitoring. The company was founded by serial entrepreneurs Céline Lazorthes, former Founder and CEO of the Leetchi Group, and Jonathan Benhamou, former Co-Founder and CEO of PeopleDoc – some of France’s most respected founders.

- Lifen started as a solution enabling medical facilities and practitioners to send and receive medical documents efficiently. It now leverages machine learning to extract key information and convert it into structured data, facilitating improved diagnosis and decision-making by medical practitioners.

Climate Tech

Last but not least, France is emerging as a center of innovation in green technologies, spanning both software and “hardware.” Noteworthy non-software climate tech companies innovating to fight climate change include:

- Jimmy, founded in 2020, designs and operates small nuclear reactors to produce decarbonized heat for industrial processes. Jimmy is on a mission to commission its industrial demonstrator by 2026 to realize its vision of a decarbonized and competitive industry in France.

- Dioxycle, which transforms CO2 emissions into high-value, sustainable chemicals, is decarbonizing everyday products. The company was built on the idea that with breakthrough advances and a DIY attitude, we can develop electricity-driven pathways that convert waste carbon emissions into critical feedstocks cheaper than ever before.

- Verkor is a Renault-backed battery builder for EVs and energy-storage sites. It is working to meet the growing demand for electric vehicles—and electric mobility as a whole—as well as stationary storage in Europe.

French entrepreneurs are also contributing to the battle against climate change within Sapphire’s investment area of focus – B2B software. Here are some of the French tech startups and scale-ups we believe are the most promising in this field:

- Descartes Underwriting, founded by the former leaders of Axa’s parametric insurance business, has quickly become a global leader in parametric insurance, providing large corporations with automated insurance policies to protect against wildfires, hurricanes and other natural disasters.

- Deepki is a Paris-based provider of software for real estate firms to track and improve ESG criteria across their portfolio, starting with carbon emissions. Founded in 2014, the company now has over 400 customers in 60 countries and is used to oversee over 400 million square meters of real estate.

- CO2AI spun out last year after originally being developed as an in-house carbon emissions management platform for Boston Consulting Group’s clients. In October 2023, the company announced it had raised $12M from Partech, Unusual Ventures and BCG. Despite the competitive market, CO2AI benefits from an early advantage as a number of BCG’s corporate clients are already using its services.

Looking Ahead: The Next Chapter in French Tech Innovation

Despite facing the same global headwinds as the tech sector in 2022 and 2023, the French startup ecosystem showed remarkable growth and resilience, raising €8.3B in 2023 and cementing its status as a European innovation hub. After establishing itself as one of Europe’s premier Fintech hubs from 2020 to 2022, Paris became a leader in GenAI in 2023, as did the French ecosystem in sectors such as DevOps, healthcare and CFO tooling.

As we look ahead to the next chapter in French tech innovation, sustainability will be determined by the ecosystem’s ability to deliver sizable IPO and M&A outcomes consistently. A key indicator will be how effectively the French startup ecosystem can sell into the U.S. market. We’ve seen many French startups tackle this challenge successfully and increasingly earlier in their journey. At Sapphire, we are thrilled to have front-row seats to watch this trend play out and are eager to see what 2024 holds.

The main roadblock for Cybersecurity, DevOps, Data Stack or AI startups, especially in the Enterprise Software segment, is still that most of their potential clients are in the US where the market is overall more mature in terms of tech adoption and software budgets. In those industries, the best distribution often beats the best technology, and so the key challenge that we’ve seen more and more French startups tackle successfully is to bring those high-quality tech products to the US market earlier in their journey and with more financial capacity.

Thomas Turelier

Investment Director at Eurazeo

We’d love to hear from you if you are equally excited about France and/or if there are any companies missing on our market map that we should know about. Please reach out to [email protected].

Special thanks to Bernard Liautaud, Eric Fourrier and Thomas Turelier for sharing their insights and expertise with us.

References:

Legal disclaimer

Disclaimer: Nothing presented within this article is intended to constitute investment advice, and under no circumstances should any information provided herein be used or considered as an offer to sell or a solicitation of an offer to buy an interest in any investment fund managed by Sapphire Ventures (“Sapphire”). Information provided reflects Sapphires’ views as of a time, whereby such views are subject to change at any point and Sapphire shall not be obligated to provide notice of any change. Companies mentioned in this article are a representative sample of portfolio companies in which Sapphire has invested in which the author believes such companies fit the objective criteria stated in commentary, which do not reflect all investments made by Sapphire. A complete alphabetical list of Sapphire’s investments made by Its direct growth and sports investing strategies is available here. No assumptions should be made that investments described were or will be profitable. Due to various risks and uncertainties, actual events, results or the actual experience may differ materially from those reflected or contemplated in these statements. Nothing contained in this article may be relied upon as a guarantee or assurance as to the future success of any particular company. Past performance is not indicative of future results.