2021 was a pivotal year for the French tech ecosystem, which saw a record number of new unicorns minted, €11.3B raised across 600 transactions and 3 Unicorn IPOs. A particularly exciting development was the wave of second-time founders and early employees starting companies on significant growth trajectories and helping reinforce flywheel effects in the ecosystem – an effect that will only accelerate startup growth this year, and beyond. It’s therefore no wonder that international VCs have started paying more and more attention to France, opening the floodgates of capital and creating an intensely competitive environment for the best French businesses.

At Sapphire, we were thrilled to play our part in this milestone year for France, continuing our history of investing in French startups (i.e. Criteo, Gorgias, etc.) by partnering with Paris HQ’d GitGuardian, a DevSecOps company.

Setting the scene: une courte histoire

Less than a decade ago, the words “French” and “startup” were rarely found in the same sentence. The French tech environment was made inhospitable by anti-startup bureaucrats and VC investors were few and far between. It wasn’t for a lack of stellar French entrepreneurs though, look no further than Snowflake (a Sapphire investment at IPO), Datadog and Eventbrite. Instead, the country was a less attractive place to build a business with few support structures and less available venture capital.

Yet, in a relatively brief amount of time, we have seen a complete sea-change in the French tech market. Surprisingly, we can credit the French government as a driving force behind this. Macron pledged to have 25 French unicorns minted by 2025 (achieved in Jan ’22) and has recently committed to seeing 10 companies valued at €100 billion ($113 billion USD) by 2030. To facilitate this growth, the French government has focused on pro-startup policies, regulations and programmes. It’s this change in government sentiment combined with startup incubators like Station F that have kicked off the French Tech Revolution and set it up to snowball.

Where are we today: 2021 statistiques et thèmes

2020 was already a record year for French startups, and 2021 managed to smash it out of the park. Paris vaulted to the #2 spot for startup investment, only behind London, as total investment grew from €5.1B in FY20 to €11.3B in FY21, 14 new unicorns were minted and average deal size (Seed-Series E) rose by 78%.

Moreover, French VC Funds, including Partech, Eurazeo, Singular, Serena and Elaia, raised a total of €4.1B in 2021. That’s more than >2x the total amount raised by French VC funds in 2020, pointing to a record amount of domestic dry powder in the ecosystem.

Historically, France has had a strong depth of early stage investors, but lacked investors at the later stage, key both at a fundamental level for access to capital and more qualitatively to provide access to portfolio communities and synergies with later stage entrepreneurs. In 2021, we saw the tide shift as large global funds began to plug this gap.

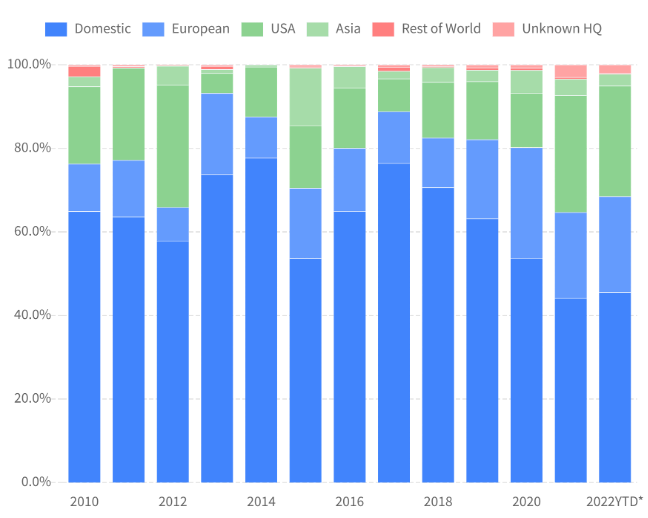

% of Funds Invested in French Startups from U.S. investors grew >2x 2020 to 2021

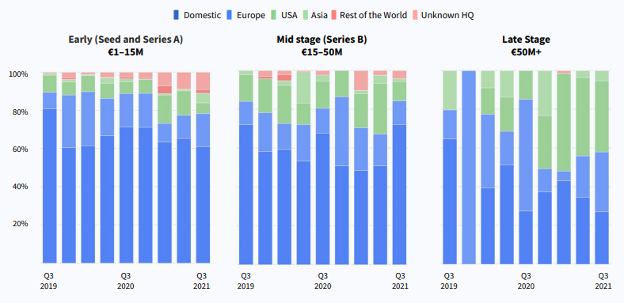

Foreign investors are typically more active in later-stage French funding rounds, while domestic investors continue to dominate at the earlier stages

As each new unicorn makes news headlines, this has fed back into the ecosystem. Inspiring new entrepreneurs to make the jump to start their own businesses and through collaboration, winners have helped to lift fledgling companies up the ladder.

For instance, founders at companies such as Qonto and Veepee are investing back into the ecosystem, be it through angel investments or scout programmes. Additionally, some of France’s biggest startups including BlaBlaCar and Doctolib have become acquirers in their own right. This flywheel effect is extremely encouraging and points to a long-term French Tech Revolution versus 2021 being a flash in the pan moment.

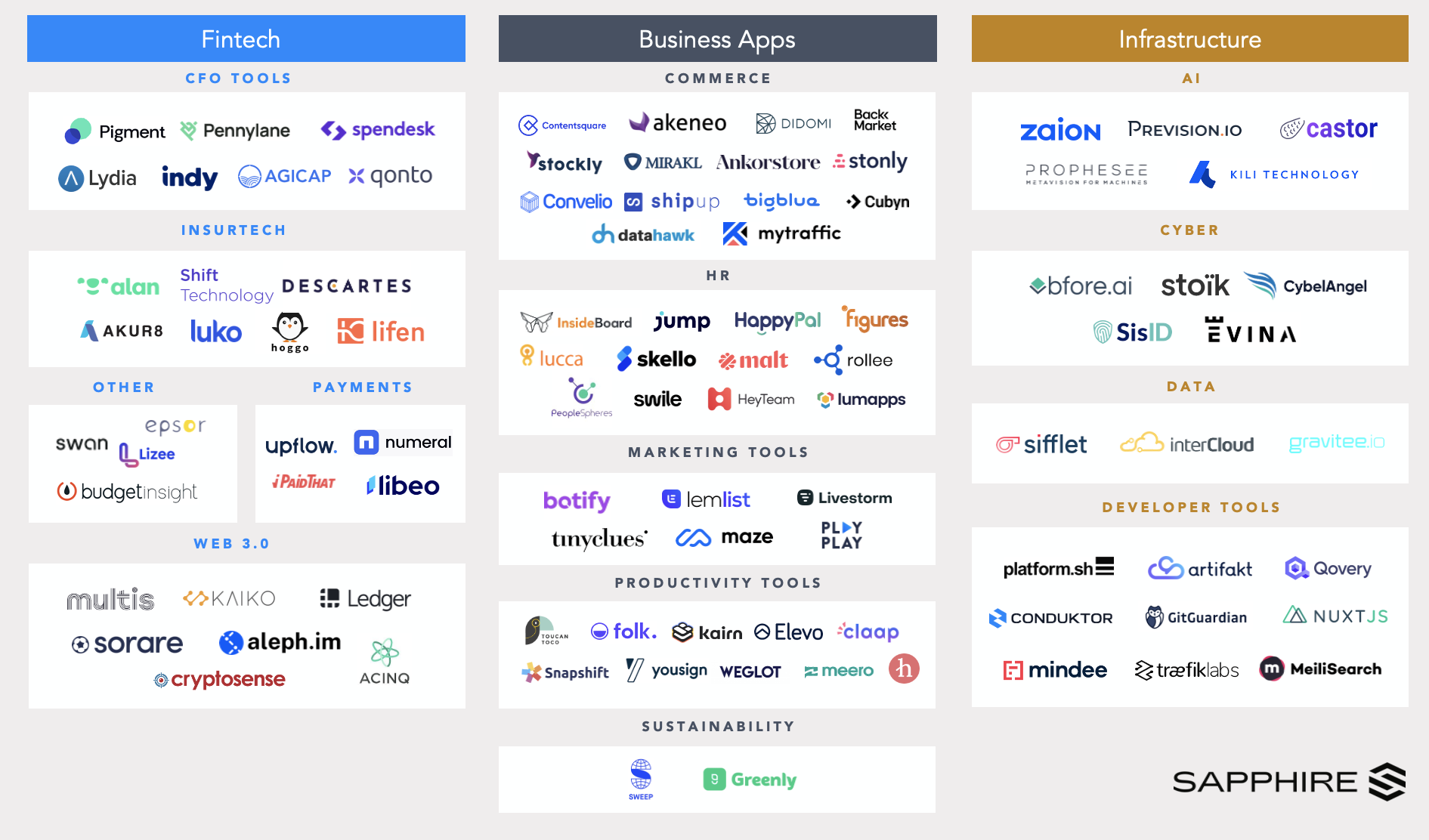

In 2021 we saw a concentration of startups raise funding across the following themes:

- Fintech: Incumbent solutions don’t adequately serve the needs of today’s SMEs when it comes to accounting, banking, cash management, insurance, etc. As such, we’re seeing a new wave of players tackling pain points and bringing digital-first, interconnected tools to market.

- Sustainability: Facing the reality of a deteriorating environment and intense pressure from both consumers demanding carbon-free products and investors demanding visibility into both transitional and acute climate risk we saw a surge in sustainability-focused fundraises in 2021.

- Web 3.0: Along with the rest of the world, France also got the crypto bug in 2021 and saw record levels of investment into Web 3.0 companies.

- Within this flood of investment, three key themes stand out: CeFi <> DeFi bridges (eg Ledger, Kaiko), the metaverse (e.g. Sorare) and smart contract tooling.

What the future holds: 2022 et au-delà

With three new unicorns minted in the first two weeks of 2022 alone – a phenomenal start! – we expect France to see more notable M&A and IPO exits, additional top-tier global talent entering the French ecosystem and continued growth in the smaller startup ecosystems outside of Paris as it unlocks even more financing, particularly for later-stage deals.

We see four key factors driving this growth and turning France into a breeding ground for companies of consequence in the next few years:

- A deep talent pool: A critical ingredient to any startup ecosystem, France ranks second in Europe when it comes to the number of graduates in science, technology, engineering and mathematics. Additionally, in 2018, it ranked 7th in a global study of AI startup formation. This deep and comparatively cheaper talent pool (versus similarly qualified talent in the U.S.) means many founders are choosing to keep R&D and tech in France – even when expanding their customer base internationally.

- An increasing number of international investors doubling down in France: 2021 saw a significant influx of investment from international investors that shows no signs of relenting in 2022. This will be of particular benefit to founders as bigger funds can connect founders to larger networks of entrepreneurs and partners to share notes, support internationalisation efforts and move them along the path to IPO.

- The attractive nature of government support: Macron is the poster child for the revolution in French government support for startups. The current government’s startup-friendly policies, such as the French Tech Visa, Station F, Government seed fund and R&D tax credits, make France one of the most attractive European countries to launch a business in today.

- The human capital flywheel effect: The BlaBlaMafia (256 companies have been founded by BlaBlaCar alumni), QontoMafia, and many more, are exploding in France. In particular, second-time founders are starting companies like Sunday and Ankorstore on outstanding growth trajectories. With each success, we subsequently see multiple more companies feeding back into the French ecosystem, which boosts the talent pool and drives a spirit of collaboration that lifts even more companies.

This combination of talent, international investment, government support and the flywheel effects is exactly why France has quickly become a hotbed for tech innovation and has the potential to create companies of consequence for years to come.

Looking ahead: exciting B2B categories flourishing in France

At Sapphire, we are particularly excited to dig into French startups emerging across the following areas:

SME CFO Tools:

Incumbent CFO tooling solutions fail to cater to the needs of today’s SMEs due to long onboarding processes, uncompetitive pricing, limited feature/product offerings and poor digital capabilities. In response, we have seen many segments in the SME CFO tooling suite see innovation.

France has been a driving force behind innovation in this space with companies typically focussing first on one pain point before expanding to offer additional capabilities and eventually evolving into a platform solution.

For example, Agicap first focussed on the pain of cash flow management and is now expanding to incorporate AR/AP functionality into its offering. Meanwhile, other startups are focusing on complimentary pain points. For example, Pigment is solving forecasting and planning, Qonto is targeting business banking and expense management and Pennylane has homed in on accounting.

Payments:

We’ve shared our excitement around the European payments landscape before, and it’s a sentiment that remains true as we look at 2022 and beyond. While the UK has traditionally been the centre of all things fintech, France is giving the UK a run for its money.

For example, companies like Sunday, which exploded onto the scene in 2021 by offering an easier way to pay in restaurants and Numeral, which allow tech companies to automate bank payments through a single API.

Web 3.0:

This will continue to be a core theme in 2022 as we see further “picks and shovels” businesses emerge to recreate the financial stack across security, custody, market data, brokerage, accounting and more. Moreover, with the imposition of Markets in Crypto-Assets EU regulation, we anticipate a rise in players tackling compliance-related use cases.

Tools for Designers:

Record-breaking rounds raised globally by the likes of Figma and Canva have cast a spotlight on the design tool category and the many pain points that remain unsolved within design.

We are thrilled to see companies such as Maze democratising access to user insights and PlayPlay expanding video and content creation within organisations.

Productivity & Collaboration Tools:

We recently wrote about how we see Europe as leading the Future of Work. In the post, we highlighted the role of digitisation, a mobile workforce and advancements in AI and ML in supporting the momentum behind a new generation of productivity and collaboration tools.

France is a notable hotbed for startups building in this category, with companies such as Folk rethinking the CRM, Claap enabling asynchronous meetings and Hera making calendars fit for remote work.

Developer Tools:

As data and analysis access becomes increasingly democratised, and data security and governance moves towards being a more centralised aspect of the data stack, France is emerging as a key player in developer tooling solutions.

Exciting startups in this space include Mindee, which is building a document parsing API, MeiliSearch, an open-source search engine and Conduktor, which has developed a desktop client with a user-friendly interface for engineers who work with Apache Kafka.

To Conclude: un pays de licornes

It’s never been a more exciting time to be a founder, tech worker or investor in the French ecosystem as France continues to close the tech-investment gap with the UK and Germany.

At Sapphire, we’re looking forward to seeing a growing number of companies of consequence come out of France, and would love to hear from you if you are equally excited about France or if there are companies not in our landscape that we should be aware of. Please reach out to [email protected].

Legal disclaimer

Disclaimer: Nothing presented within this article is intended to constitute investment advice, and under no circumstances should any information provided herein be used or considered as an offer to sell or a solicitation of an offer to buy an interest in any investment fund managed by Sapphire Ventures (“Sapphire”). Information provided reflects Sapphires’ views as of a time, whereby such views are subject to change at any point and Sapphire shall not be obligated to provide notice of any change. Companies mentioned in this article are a representative sample of portfolio companies in which Sapphire has invested in which the author believes such companies fit the objective criteria stated in commentary, which do not reflect all investments made by Sapphire. A complete alphabetical list of Sapphire’s investments made by its direct growth and sports investing strategies is available here. No assumptions should be made that investments listed above were or will be profitable. Due to various risks and uncertainties, actual events, results or the actual experience may differ materially from those reflected or contemplated in these statements. Nothing contained in this article may be relied upon as a guarantee or assurance as to the future success of any particular company. Past performance is not indicative of future results.