An Employee-Driven Future: How Europe is Leading the Future of Work

These are just a few phrases that have become part of our daily, if not hourly vocabulary as the working world rapidly tried to keep pace with everything COVID threw at it.

As employees and companies alike continue to adapt to new ways of working, it’s no surprise that the Future of Work has entered the spotlight – often rooted in the increased adoption and acceptance of distributed work and the rise of an “extended workforce”.

At Sapphire, we were thinking about the Future of Work long before the pandemic, and are proud to have a history backing Future of Work companies including BetterUp, Box, CultureAmp, Degreed, Docusign, Gem, LinkedIn, monday.com, Paradox, Splashtop and Unmind.

Looking into 2022 and beyond, the Future of Work, in many ways, has turned into the Now of Work, with COVID catalysing and accelerating the transition to new digital tools and platforms, as well as bringing more empathy into the working world. These themes are here to stay and ones we’ll continue to be passionate about, especially as we see more and more ambitious founders building new Future of Work companies across both Europe and Israel.

What do we mean by the Future of Work?

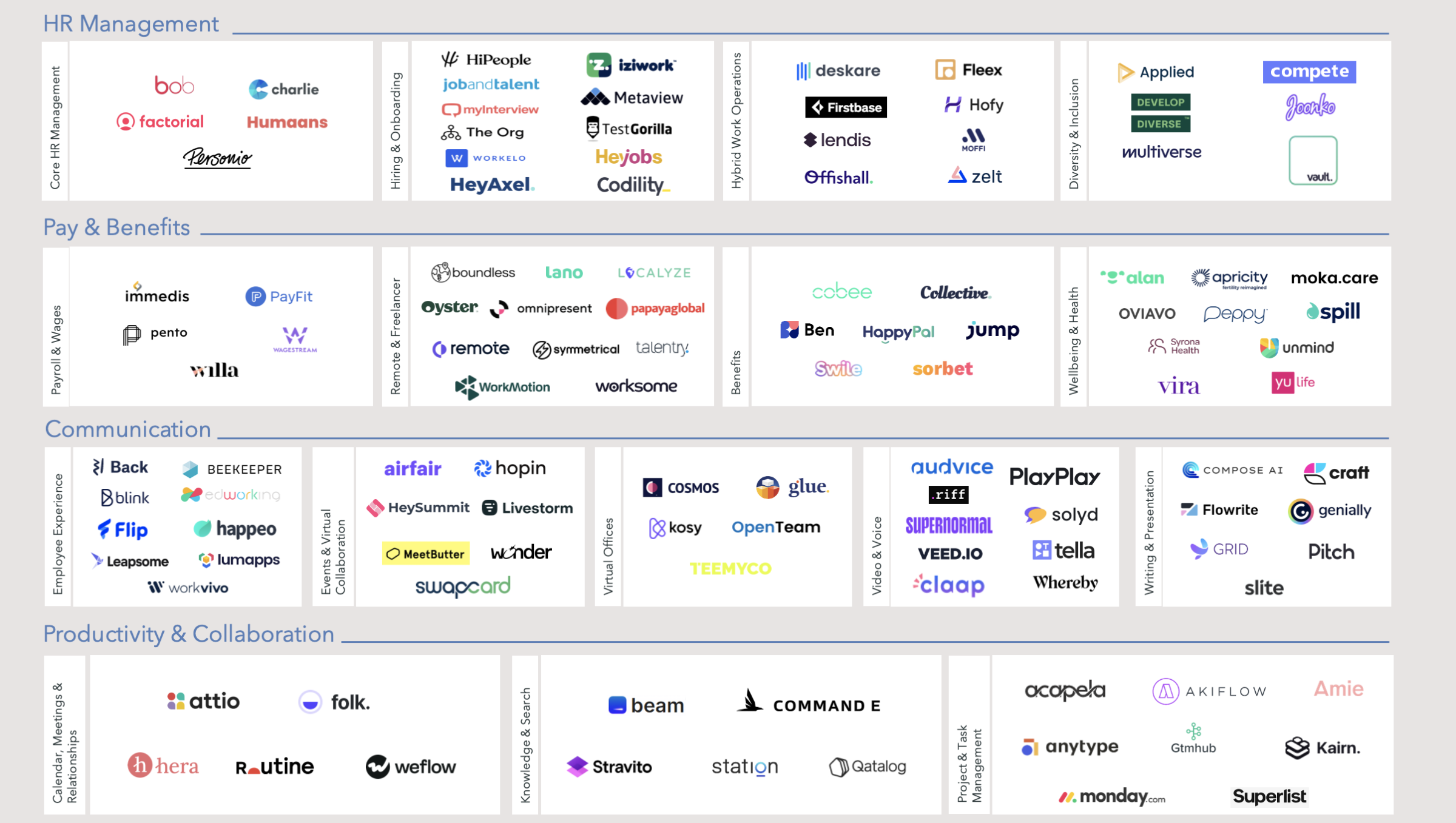

We define the Future of Work as the tools and services that enable a more productive and enjoyable working world for both organisations and individuals. Within this category, we see four main sub-sectors:

- HR Management

- Pay & Benefits

- Communication & Experience

- Productivity & Collaboration

One area we have our eye on, but won’t touch on in detail here is DAOs (Decentralised Autonomous Organisations), a blockchain-based, decentralised alternative to traditional free-market corporations whereby workers are also owners of the entity, and have, in most cases, governance say in it. We are attentively watching this trend and are excited about the further decentralisation DAOs can bring to organisations and the Future of Work.

2022 Global Predictions for Future of Work

A few weeks ago, we published our 2022 predictions for the Future of Work, in which we highlighted six predictions for the year ahead.

- Automation in talent acquisition

- Offering expanded benefits to employees

- Embrace the freelance workforce for added agility

- Enabling remote and hybrid workplaces for the long term

- Digital learning & development will take-off

- Closing the gap on diversity, equity and inclusion

We believe these six predictions will hold true for the global ecosystem for 2022, but we also believe that some additional key trends are driving the Future of Work in the European market.

Key Trends Underpinning the Future of Work in Europe

Our investment thesis around the Future of Work in Europe is underpinned by three broad themes: the consumerisation of the enterprise, distributed and hybrid work, and the great resignation and redefining priorities. Employee preferences are a consistent driver across these themes, especially as demographics change and we experience increasingly diverse ways of where and how we work. Due to the unique attributes of the European ecosystem and the prior experience of European founders in building companies across distributed, as well as culturally and linguistically diverse teams, we see European founders as particularly well positioned to build global category-defining Future of Work businesses.

1. Consumerisation of the Enterprise

A typical consumer interfaces with technology from the moment they wake up to the moment they go to sleep. Consequently, consumer expectations around the technology they use at home have bled into their expectations around the technology they use at work. We’ve heard about this trend now for a while – it was initially dubbed as the consumerisation of IT, but has now moved far beyond just IT and into every enterprise experience.

Consumers expect clean, easy-to-use UIs and an engaging UX as standard and products that provide clear value-add to them as an individual – inside the workplace and out. As a result, today’s B2B software providers have had to adapt from selling to C-level decision makers and software design reflecting their needs, to selling to the end-user employee and software design that is engaging, useful and provides a consumer-like experience in order to ensure user and ultimately customer retention.

This brings us to the secondary impact of digitisation, product-led-growth (PLG) strategies. As employees are increasingly becoming the most important decision makers when it comes to purchasing decisions, B2B software providers are targeting bottom-up distribution approaches with the view to drive land-and-expand sales motion.

2. Distributed and Hybrid Work are Here to Stay

As many European founders have experience building across distributed hubs and hiring inclusive teams across languages and cultures, when COVID hit, we saw our European portfolio companies exhibit strong agility to adjusting to new working styles. While we’ve seen the shift away from a single office over the last couple of years, there is no denying that COVID helped to significantly accelerate the trend to hybrid work by forcing companies to adopt remote and hybrid work almost overnight.

Despite individuals returning to offices, hybrid work is here to stay. A recent study of 9,000 knowledge workers by Slack showed that 72% of workers surveyed would prefer a hybrid approach and only 12% full-time office work. So rather than focusing on the question of “when will workers fully return to the office?” companies have switched to focusing on “what should the office of the future look like?”.

In Europe, we believe that work will continue to be distributed across countries, time zones and cultures with a greater importance placed on creating a resilient culture in a distributed and hybrid work environment.

3. The Great Resignation & Redefining Priorities

While digitisation has raised the bar on what workers expect from their software providers, hybrid work has done the same for employee expectations. In the last several months, we have seen record numbers of individuals leave their jobs. This “Great Resignation” first exploded in the U.S. last Summer with 4 million Americans quitting their jobs in July 2021 alone. However this is no longer just a U.S. problem, with roughly one million workers switching jobs in the UK between July and September of 2021. In addition, a UK poll found that almost a quarter of workers say they are actively planning on finding a new role.

The Great Resignation has further put the power in the hands of employees, placing extra emphasis on equality, wellness and inclusivity within organisations. If a company wants to attract and retain the best talent today, it must listen to its employees and craft a working environment and benefits policy reflective of those employees’ needs and desires. The cliché that a company’s most important asset is its people is now truer than ever before.

The European Future of Work B2B Landscape

At Sapphire, we are a B2B focused, growth investor and as such, in the categories highlighted below we have chosen to focus on Future of Work companies selling predominantly through a B2B motion rather than those solutions focused on selling directly to the consumer, freelancer or gig worker.

1. HR Management Software

At the core of next-gen solutions in the Future of Work space we see the rise of companies better able to capture crucial employee data and provide fundamental functionality for companies versus incumbent HRIS solutions, in both a more intuitive and easy to use way. We’ve seen an explosion in demand for these types of solutions, such as Factorial, Humaans and Personio.

On top of this, there has been an exponential growth in the adoption of distributed and remote work over the past two years – and despite workers returning to their offices, the trend is here to stay. Driven and made possible by digitisation, globalisation and government regulation, employees are now able to work effectively, compliantly and efficiently from home with the pandemic helping remove some of the traditional arguments levied against remote work, such as employee inefficiency.

We’ve seen a corresponding explosion in startups selling to organisations and catering to distributed teams across talent engines (Distributed and Comet), hiring & onboarding (HiPeople, Metaview, TestGorilla, The Org and Codility), as well as operationally enabling hybrid work, with significant funding rounds in response. There has been similar growth on the freelancer side, with companies such as Jump and SafetyWing providing more security for those choosing freelance and/or a digital nomad lifestyle.

Separately, plenty has been written and said regarding diversity, equity, and inclusion (DE&I) within the 21st-century workplace, yet the majority of workplaces still have a way to go to ensure diverse representation and inclusion. Urgent tasks for organisations include implementing diversity and inclusion policies, increased cross-company collaboration and for workers to continue to speak out against employers who fail on the DE&I front. To help employers achieve such tasks and put in the hard work required to transform their workplaces we have seen an increase in the number of startups emerging to tackle these issues head on. For example, Applied, Vault, Multiverse and Compete are companies driving change in the space. While there is still significant progress to be made regarding DE&I, we are excited by the startups in this space, and look forward to seeing them mature and make a quantifiable impact on the lives of individuals.

2. Pay & Benefits

At Sapphire, we’ve worked closely helping our portfolio companies tackle the war on talent and navigate The Great Resignation, and thus have seen the increasing importance pay & benefits have within the hiring flow firsthand. Pay & benefits alone represent a significant TAM. In Europe, the payroll outsourcing market was worth $5.3B and the employee benefits market was worth $9.0B in 2020.

It’s no wonder that a number of strong, exciting players, such as Pento and Payfit, have emerged and raised significant fundraising rounds tackling the tricky issue of payroll automation. While companies such as Papaya, Remote and Oyster are reducing the payroll complexities around hiring remote workers, within employee benefits specifically, companies such as Ben and Cobee are building platform solutions, helping employers offer curated benefit programmes without significant admin complexity. Focused on the PTO space, Sorbet is building a solution to allow employees to cash out on unused PTO. While YuLife has built a new kind of life insurance offering which uses a gamified interface to incentivise and reward users who focus on physical and mental health.

When it comes to pay & benefits, two key themes in particular are seeing increased attention: mental wellbeing and female health. Even prior to COVID, an estimated 1 in 5 U.S. adults were living with a mental illness, and 1 in 6 employees in the UK experienced a mental health issue on a yearly basis, costing U.S. employers $80-100 billion and U.K. employers $45-60 billion per year. While over the past decade the stigma around mental health has been fading as we’ve seen society embrace meditation and mindfulness tools, the pandemic and its impact has put mental health front and centre for organisations. Here at Sapphire, we believe that mental wellbeing needs to be openly addressed in the workplace with better tools and preventative care at the core. That’s why we are proud backers of Unmind, a workplace mental health platform.

In addition, we are seeing more and more companies starting to offer benefits relating to female health. Underpinning this, we’ve seen major growth in the number of female health startups selling B2B2C solutions, including the likes of Apryl, Peppy, Vira Health and Syrona Health. Areas covered include menopause, fertility, pregnancy and post- and pre-natal care. The majority of companies in this B2B2C space are just starting to scale-up, and so here at Sapphire we are keeping a close eye on them and the part they play in the development of this ecosystem.

3. Communication & Experience

The growth of remote and distributed work has further reinforced the importance of communication and collaboration across organisations with regards to employee experience and business continuity. Companies such as Zoom and Hopin, the darlings of the COVID era, were able to capitalise on this and we’ve since seen an explosion of startups in this field, including the likes of Workvivo, Back, Claap, Slite and Butter. Taking employee engagement one step further, we have since seen the emergence of companies building virtual offices such as Teemyco and Cosmos.

Another core aspect to employee engagement revolves around employee learning and development, a space at Sapphire we’ve looked at in depth. Organisations are under pressure from their employees, and in particular, from Gen-Z workers who demand greater opportunity and personalisation in how they navigate their careers. For this reason, we backed Degreed last year, a U.S.-based company that provides a single-view platform for personalised learning experiences.

Finally, it’s all well and good to adopt tools to help drive better employee engagement, but ultimately how does a business measure efficacy? Like many other sectors, within HR tech, we have seen an increasing focus on the importance of data to help tackle this information gap. This importance has recently been highlighted by Peakon’s exit to Workday in early 2021. Employee analytics, efficiency and satisfaction are areas we’ve been following for many years, having first invested back in Culture Amp, an employee analytics and feedback platform, in 2017 and ActivTrak, a workforce productivity and analytics software in 2020.

4. Productivity & Collaboration Tools

Advancements in AI and ML, combined with the digitisation and growth of a mobile workforce have supported the momentum behind a new generation of productivity tools displacing, at the most basic level, pen and paper ways of conducting business through to products such as Microsoft Excel and Powerpoint. The scope of use cases startups are tackling is vast, ranging from presentations and video (Pitch, Veed and PlayPlay), calendars and relationships (Folk, Attio and Hera), knowledge and search (CommandE, Qatalog and Station) through to project and task management (GtmHub and Amie). However, a consistent theme across all of them is that they cater to the increasing demand for consumer-grade UI and more agile and flexible solutions. Moreover, most typically favour a product-led growth strategy, seeking user adoption prior to selling enterprise contracts. In this space, Sapphire is fortunate to have partnered with customisable work operating system monday.com; content management platform and Sapphire IPO Box; and e-signature tool Docusign. And are looking forward to supporting other teams building next-gen productivity tools.

The Future of Work Will Be Employee Driven

Organisations must listen to their employees’ needs and desires in order to ensure engagement and retention. At the same time, B2B software companies must build solutions for the end user and no longer the C-level decision maker.

At Sapphire we are thrilled by the array of opportunities to build a Future of Work defining company of consequence in Europe. We would love to hear from you if you are building a company in this space or if there are other companies not in our landscape we should be aware of. Please reach out to [email protected] or [email protected].

Disclaimer: Nothing presented within this article is intended to constitute investment advice, and under no circumstances should any information provided herein be used or considered as an offer to sell or a solicitation of an offer to buy an interest in any investment fund managed by Sapphire Ventures, LLC (“Sapphire”). Information provided reflects Sapphires’ views as of a time, whereby such views are subject to change at any point and Sapphire shall not be obligated to provide notice of any change. While Sapphire has used reasonable efforts to obtain information from reliable sources, we make no representations or warranties as to the accuracy, reliability, or completeness of third-party information presented herein, which is subject to change. Companies mentioned in this article are a representative sample of portfolio companies in which Sapphire has invested in which the author believes such companies fit the objective criteria stated in commentary, which do not reflect all investments made by Sapphire. A complete alphabetical list of Sapphire’s investments made by its direct growth and sports investing strategies is available here. No assumptions should be made that investments listed above were or will be profitable. Due to various risks and uncertainties, actual events, results or the actual experience may differ materially from those reflected or contemplated in these statements. Nothing contained in this article may be relied upon as a guarantee or assurance as to the future success of any particular company. Past performance is not indicative of future results.