Summer 2021 has been eye opening for many of us. The U.S. West Coast continues to be on fire (an annual trend nowadays), while parts of the East Coast recently saw their wettest summer. Another category 4 hurricane struck New Orleans on the anniversary of Katrina, the remnants of which walloped a wholly unprepared New York City metro area. On a global scale, historic flooding in China, Germany and Belgium destroyed towns in what was considered to be a once in a millennium flood. Amidst a UN designated code red for human driven global heating, climate change is a now problem affecting the way we live and do business today.

But there is hope on the horizon: rapidly improving battery technologies, renewable energy prices decades ahead of plan and even carbon negative chemicals. Entrepreneurs are building next gen decarbonization technologies, and key stakeholders are turning up the heat, pressuring the world’s largest companies to begin to decarbonize. At the same time, consumers have shifted towards sustainable products, driving 50% of aggregate CPG growth between 2013 and 2018. Most importantly, corporate executives are waking up to the situation at hand.

Facing the reality of a deteriorating environment and intense pressure from both consumers demanding carbon free products and investors demanding visibility into both transitional and acute climate risk, 21% of the global 2000, representing $14T in annual revenue have committed to net-zero emissions targets. In addition, driven by a surge in responsible investing, public market investors are getting in the fray and demanding carbon transitions of the largest companies.

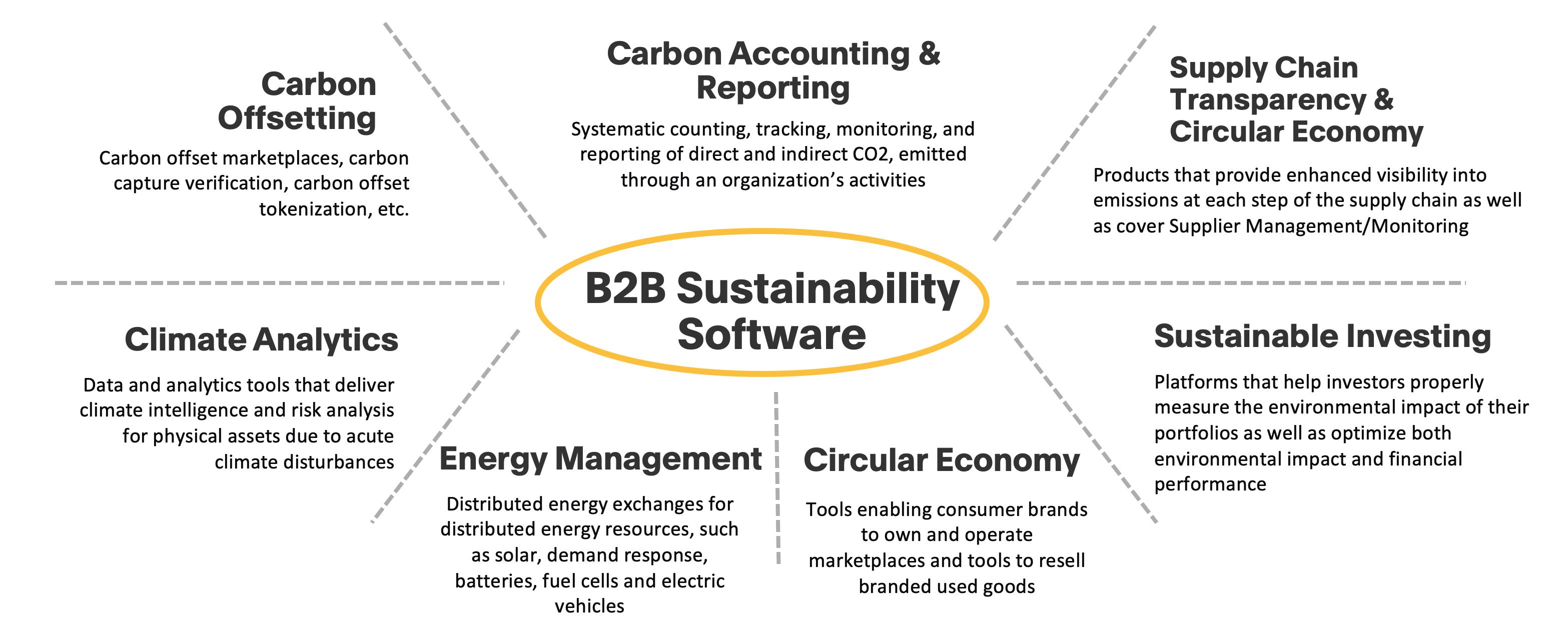

We know the future is decarbonized, but navigating the transition won’t be simple for the vast majority of companies. Software will be a necessary ingredient to a climate transition. Here at Sapphire, we like to back companies behind the strongest megatrends, and there is no tailwind stronger than climate change. Along with hard-tech, we believe that a whole suite of software tools will help power the decarbonized economy. We call these platforms: B2B Sustainability Software.

What is B2B sustainability software?

Carbon touches nearly every industry. From jet fuel in planes to the carbon “emitted” by cows, carbon is everywhere, yet nowhere in that it can’t be easily measured. Whole industries will need to decarbonize over the next several decades, but there is a fundamental data visibility problem that needs to be addressed first. Carbon cannot be scanned via an RFID tag. It can’t be stored and monitored as easily as data in a warehouse. The good news is that new software platforms are providing the necessary visibility into the carbon footprint of the world’s largest companies that desperately need it. Visibility is step 1. Decarbonization is step 2.

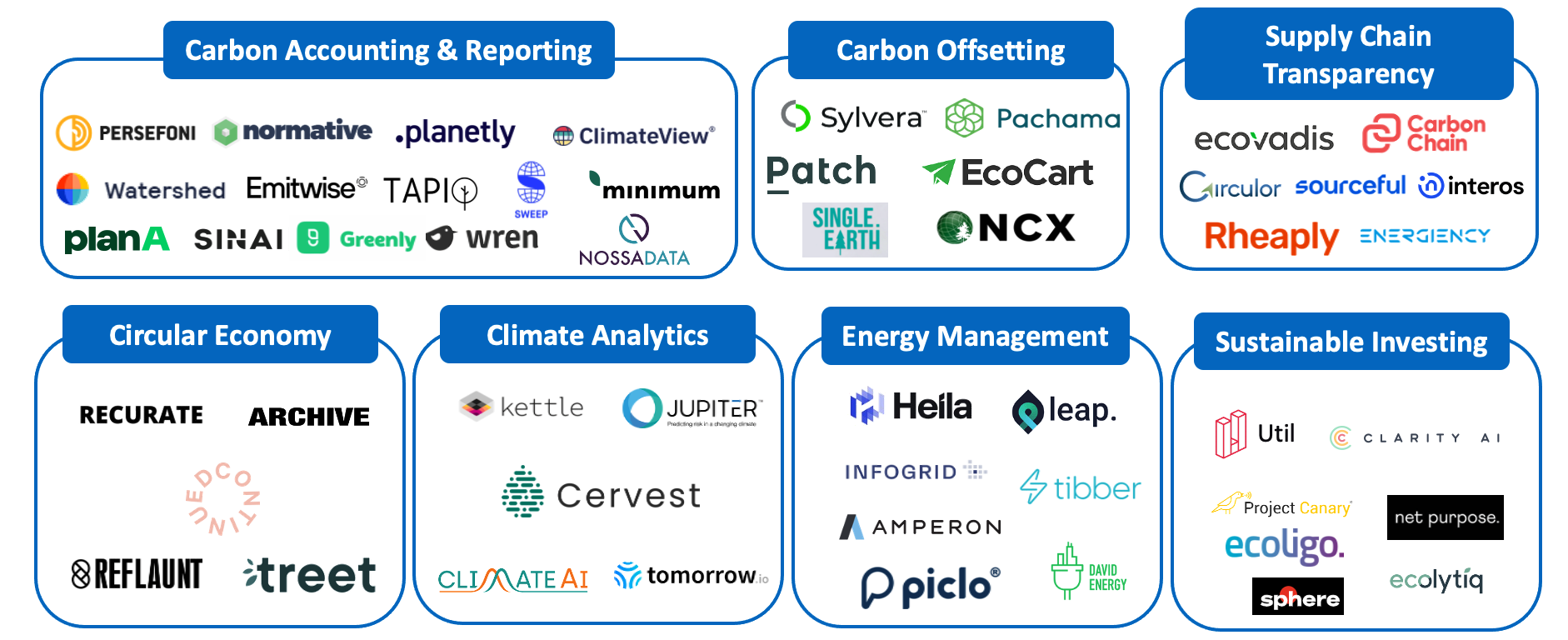

We define B2B Sustainability Software as software products that help corporations across verticals drive their sustainability agenda through a wide range of potential use cases. We are seeing excitement across the entire industry, but have witnessed the most activity within three sub-verticals: carbon accounting & reporting, carbon offsetting and supply chain transparency. Let’s dive in.

Carbon accounting & reporting

Faced with public market investor and downstream customer demands for carbon neutrality, the world’s largest companies have scrambled over the past 18 months to not only announce a carbon neutrality target, but get a handle on their own carbon footprint. Therein lies the problem–determining an organization’s carbon footprint is a complex endeavor.

In comparison to financial accounting, with a few data sources, one easily converted currency and a handful of key calculations, carbon accounting runs amok with data sources from all over a company’s operations, currency in all sorts of different units (kwH vs. kgs of cement vs. BTUs, etc.) and several hundred calculations confusing the end result. It is no wonder that previously, the global 2,000 have either a) not tracked their carbon footprint or b) used human-centric, manual processes, to track it. Consulting firms like Bain, BCG and McKinsey have historically dominated the space, but new tech platforms have an opportunity to digitize these workflows to accurately calculate, monitor and predict carbon footprint, as well as provide insights through AI/ML.

The market is highly competitive as a number of startups are attempting to build the right solution for F500 companies, but we believe that there is room for a number of players in what is shaping up to be a massive market with regional regulatory idiosyncrasies. Different regulatory environments will give ample opportunity to companies both in the U.S. and Europe.

We also believe that the carbon footprint management layer will be the linchpin that enables a whole ecosystem of applications that could never have been dreamt up without this core piece of information. The way we see it, carbon footprint management companies will serve as a crucial piece along an entire value chain that enables decarbonization.

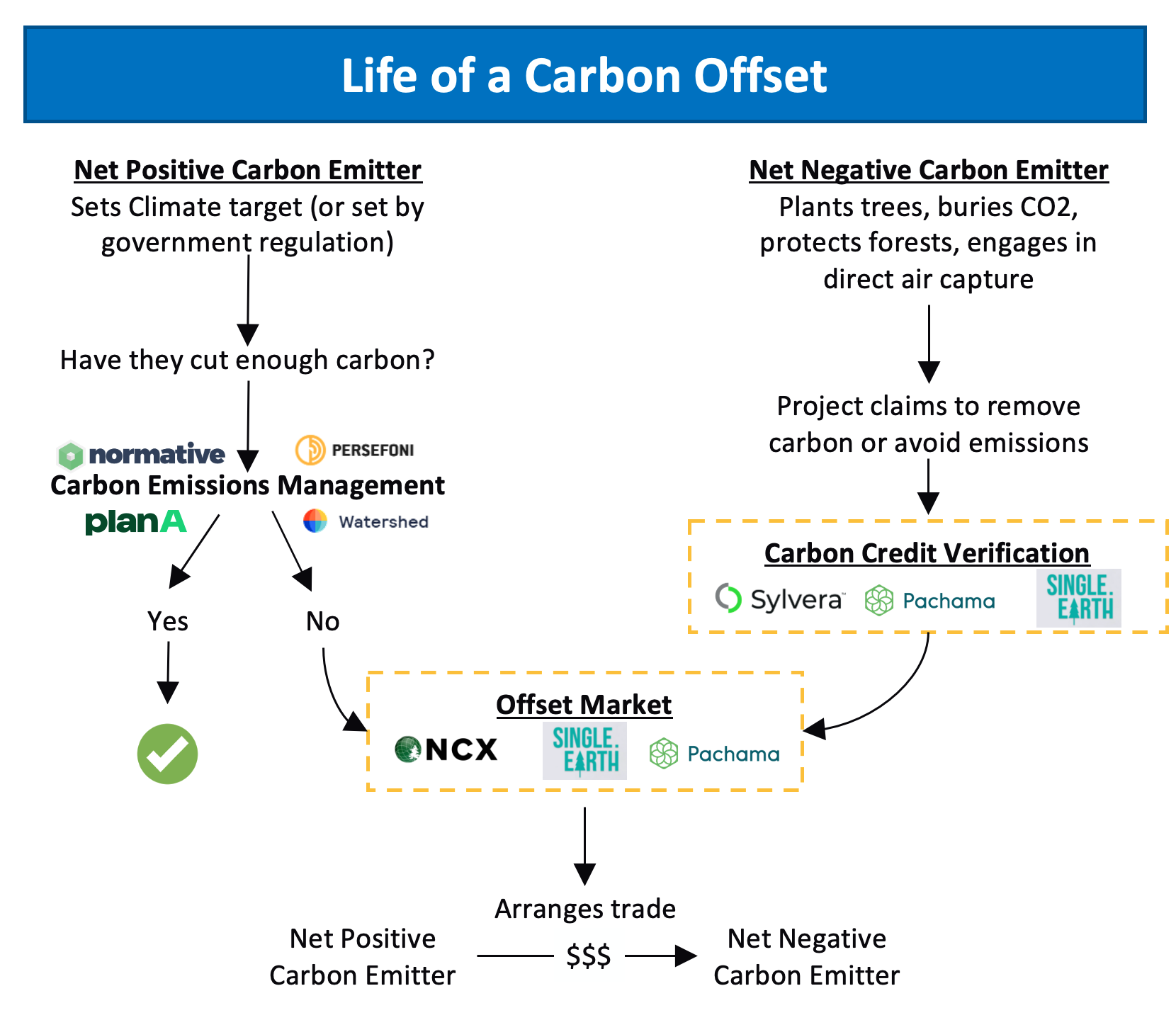

Carbon offsetting – Digital marketplaces and verification

As much as we love to work from our pajamas, business and personal travel will remain for the foreseeable future, and electric planes are still very much a pipe dream. Despite the promise of startups attempting to decarbonize the world’s largest industries, many essential processes today, like cement, aerospace and steel production, are likely decades away from economical alternatives. That said, companies that deal in these industries, notably several U.S.-based airlines, still aspire to achieve carbon neutrality long before it will be technologically feasible to be fully decarbonized. Thankfully, carbon offsets can help.

Most people know what a carbon offset is, but as a refresher, a carbon offset is a financial transaction where the purchaser (a net positive carbon emitter) pays a net negative carbon emitter to sequester carbon for them. Several startups are developing next gen technologies to store carbon, but the most economically viable option today relies on a fundamental biological process: photosynthesis. As trees photosynthesize energy from the sun, they pull carbon out of the air, store it in their trunks and emit the oxygen we breathe in exchange.

Carbon offset projects have existed for years, and McKinsey estimates that the market for carbon offsets could be worth $50Bn by 2030 and 5-10x larger by 2050. However, today’s carbon market lacks the liquidity and visibility necessary for efficient trading, because carbon credits are highly heterogeneous and there is systematic over-crediting of forest offsets–California’s $2B offset program has been shown to be overvalued by hundreds of millions of dollars.

Forests come in all different shapes and sizes, some capturing far more carbon than others. In Northern California, the beloved Redwood forests along the coast capture as much as 250x more carbon than their more inland peers, but there is no clear demarcation line between these carbon dense temperate rainforests and their less carbon dense, dryer inland cousins. These wide differences can lead to little visibility into the success of the offset. This, coupled with the analogue functioning of these old-school marketplaces, it’s no wonder that they are fundamentally broken and incapable of achieving their one singular aim: sequestering carbon.

We think that rapidly improving satellite imagery combined with the power of AI/ML can achieve a verified tech enabled carbon marketplace that not only simplifies the process for purchase of carbon offsets, but also provides significant financial incentive for new carbon offset projects to get off the ground. A huge opportunity exists for companies to unlock these carbon markets and the natural power of the earth to heal itself.

Supply chain transparency

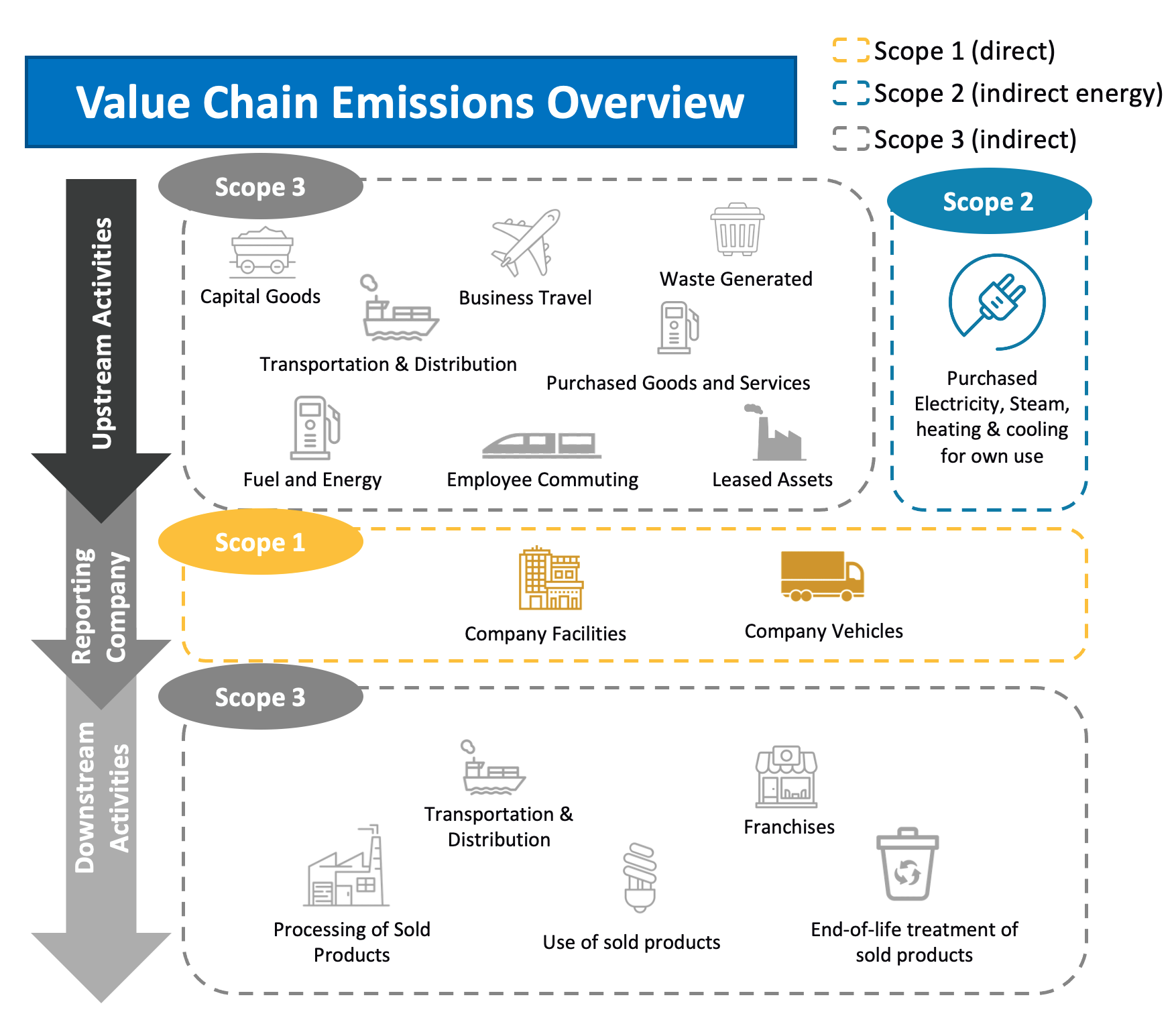

A company’s carbon footprint does not stop with its direct carbon and energy use. It extends further upstream to the carbon footprint of its inputs and raw materials, as well as downstream to the use, distribution and end of life treatment of its products. A company’s carbon footprint is broadly bucketed within three scopes.

- Scope 1 refers to direct emissions from the reporting company

- Scope 2 includes all purchased electricity

- Scope 3 includes all other emissions associated with the production, distribution and use of a company’s product.

Scope 3 emissions represent the vast majority of a company’s carbon footprint that are often hidden behind archaic and analogue supply chains. Digitization of supply chain processes enables every organization to have better control over the impact of their actions and respond to any sustainability-related issues. While a good solution, only 50% of organizations have digitized their supply chain. As individual companies are beginning to understand their carbon footprint by digitizing their supply chain, they are forcing their suppliers and customers to look beyond their direct carbon emission (Scope 1) and indirect energy consumption (Scope 2) as the majority of company carbon emissions result from upstream vendor and downstream customer activities (Scope 3). In looking at existing data, of the 239 companies that signed up for the Science Based Targets Initiative in 2020, 94% included commitments to reduce these Scope 3 emissions which account for ~80% of their overall climate impact. And according to Gartner, by 2025, 50% of the world’s largest tech and services companies will use a demonstrated commitment to net zero emissions as a supplier selection criterion up from 3% today.

While useful, product-level emissions data is not available for everything companies procure today, and many suppliers don’t understand their own Scope 1 and 2 emissions. Addressing this data gap will require collaboration between multiple players in the value chain. So what does this mean for the startup ecosystem? There is a huge market opportunity for a startup to build digital supply chain management tools that provide customers better insight to their own supply chain, sustainable procurement and overall corporate sustainability.

More areas to be excited about

As the climate warms up, seas turn angrier and wildfires turn unrulier, companies like Kettle, Cervest and Climate AI are building the next generation of climate risk intelligence to protect companies’ vital assets from climate related catastrophes. Companies like Leap, Heila and Piclo are rethinking the software necessary to power the decentralized electricity grid of tomorrow. Clarity AI is empowering the growing generation of impact minded investors hoping to achieve carbon free and sustainable investment portfolios. Lastly, a new cohort of e-commerce enablement companies, including Recurate, Archive and Treet, are focusing not on better clickthrough and conversion rates, but on empowering the world’s most forward thinking brands to recycle and resell their worn goods through branded and proprietary digital resale marketplaces. These companies play in sub sectors of sustainability on their own, and much can be written about each. We are excited about all of these areas, in addition to the use cases that no one has come up with yet.

Entrepreneurs tackling the world’s biggest Problems

We believe that the sense of urgency to create solutions solving climate change has only just begun. The peak of climate enthusiasm is years away, but the vibrancy of the early stage climate tech ecosystem, powered by a list of rapidly growing world class investors including, G2VP, Lowercarbon, The Westly Group, Pale Blue Dot, Obvious, Salesforce Impact and Breakthrough Energy (to name but a few), validates the momentum behind the space.

We view the companies and sustainability sectors outlined in this post as Sustainability 1.0, attacking the most pressing and obvious use cases for software in the drive towards decarbonization. We know that there are many sustainability related problems that remain to be solved, and we can’t wait to see this future generation of sustainability companies flourish into companies of consequence. But we are also excited to witness what the next generation of climate enthusiastic entrepreneurs build in their quest to heal the planet.

If you are building software for the decarbonized economy, we would love to hear from you. You can reach us at [email protected] and [email protected].