Germany’s startup ecosystem has grown remarkably over the last two decades, helped by a supportive regulatory environment, access to capital and an academic structure and culture that encourage entrepreneurialism. The country has produced 30+ unicorns and, according to Sifted and the German Startup Monitor 2022, is home to over 20,000 startups employing more than 620,000 people across fintech, cybersecurity, cleantech, climate tech, enterprise software and many other sectors. We have been taking a look at the trends to understand the drivers behind Germany’s next wave of innovators.

Funding the Future

Building on a rich history of industrial innovation, Germany’s startup landscape has attracted entrepreneurs, investors and talent from around the world. It looks like entrepreneurship is likely to continue thriving, with the German Startup Association recording a 16% increase in the number of startups in the first half of 2023. German startups have benefited from a strong funding environment to support the ambitions of founders, with ~$72B in total funding over the last decade and the importance of startups to the wider economy is well-recognised in Germany. For example, the German government established the High-Tech Gründerfonds (HTGF) to provide early-stage financing and support to innovative startups. Its portfolio includes SimScale, a 3D engineering simulation platform, and Natif AI, an intelligent document processing and automation platform. Dozens of other local and national organisations, supported by private and public investors, have played a crucial role in providing capital, mentorship and networking opportunities to fuel the success of German startups.

Time to Hit the Autobahn

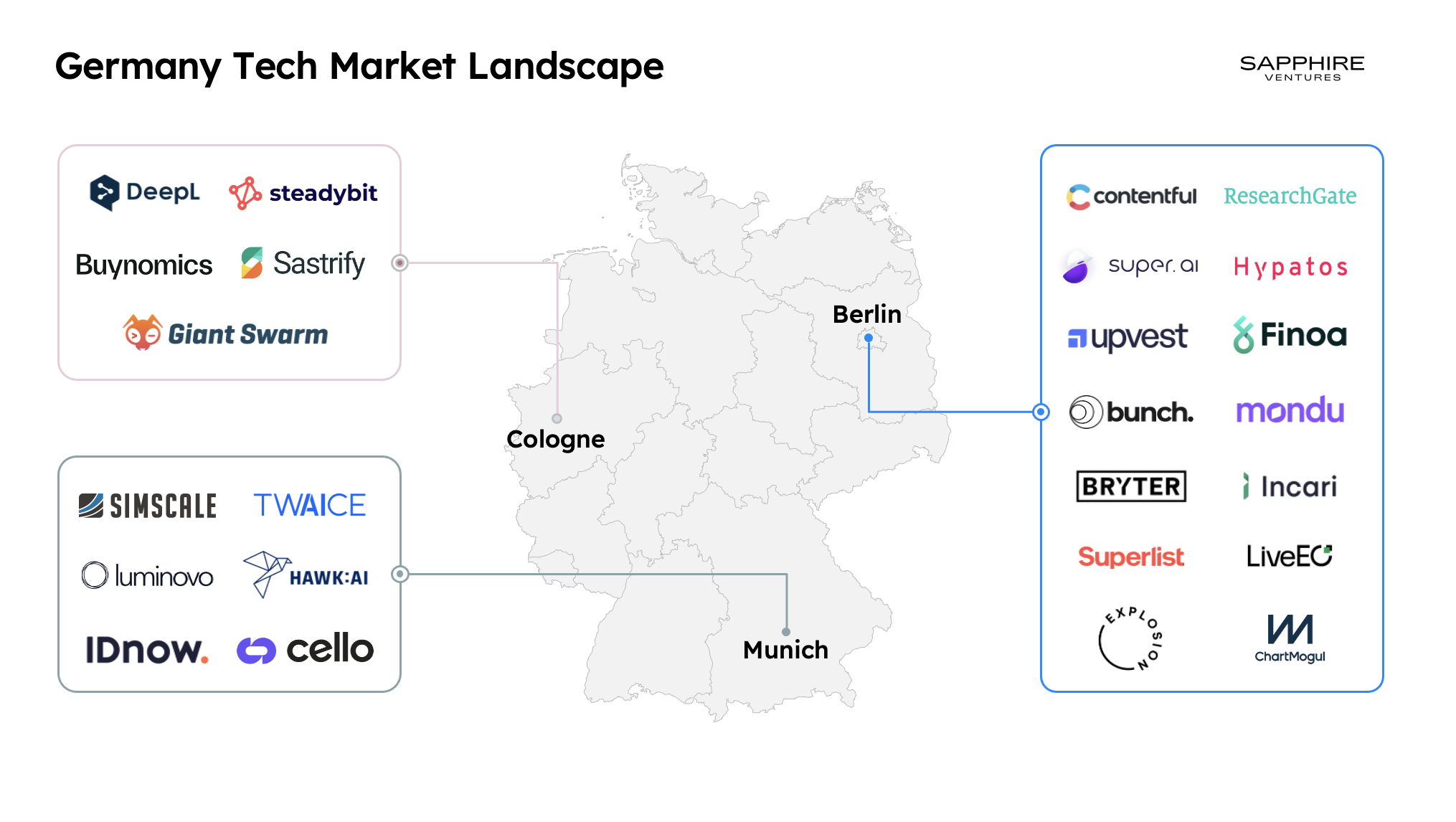

We believe it is clear that the German startup landscape is becoming ever more federated, with hubs of research and innovation flourishing across the country. In Sifted’s 2023 Rising 100 list of B2B SaaS startups in Europe and Israel, 19 of the companies were based in six cities across Germany. As further evidence, StartupBlink’s Global Startup Ecosystem Index included 40 German cities in the 2023 ranking. In this piece, we will take a closer look at 3 of the biggest tech hotspots: Berlin, Munich and Cologne.

Berlin

Berlin, the epicenter of Germany’s startup scene, is home to around 16% of the nation’s startups. The city’s vibrant atmosphere and entrepreneurial spirit have attracted numerous successful startups and investors over the past decade. The ecosystem has benefited from renowned accelerators and incubators, such as Rocket Internet and Factory Berlin, which provide resources and a strong mentorship network to budding entrepreneurs. It is also the home base of Sapphire portfolio company Contentful, which offers an API-first composable content platform that enables customers to create, manage and distribute content across digital channels.

Given Berlin’s track record, it’s no surprise that the capital is charging ahead with a new wave of startups built on AI technology that are revolutionising the way we work. Explosion are building tools that will drive progress in AI and natural language processing (NLP); they’ve already launched Prodigy, an annotation tool for machine teaching, and spaCy, an open source library for NLP. SuperAI, which now operates in the U.S. and Europe, was born in Berlin. The startup is building an AI-powered platform to automate unstructured data processing through a “GenAI for documents” product and a “Data Processing Crowd” offering for data labelling, post-processing, and exception handling. Another Berlin-based firm, Hypatos, is developing AI-powered software for document processing and extraction to “hyperautomate” complex tasks and drive efficiencies in back-office processes.

Berlin is also a hub of fintech innovation, with startups innovating across payments, crypto, insurance and banking. There are big shoes to fill in this space: several minted unicorns, including N26, TradeRepublic, Mambu and WeFox, were born in Berlin. Founders taking on the challenge include Martin Kassing at Upvest. Founded in 2017, the company is creating an investment API to enable banks, fintechs and corporations to build investment experiences for end customers. At Finoa, co-founding team Christopher May and Henrik Gebbing are building a regulated custodian for digital assets with a platform offering secure services, such as trading and staking services, to institutional investors and corporations. Cherry Ventures portfolio company bunch is shaking up private market investing with a platform that makes it easy and cost-efficient to invest and works across legal structures, asset classes and jurisdictions. In the B2B payment space, the team at Mondu are building payment software designed to offer BNPL arrangements to SMEs, enabling them to offer flexible payment terms to customers and drive growth as they scale.

There are dozens of other companies in Berlin that we’re excited to watch in the coming years, including:

- Bryter offers a no-code platform for building digital applications by automating expert knowledge. It enables non-technical profiles to automate manual processes and develop applications based on their subject expertise in legal, compliance and procurement workflows.

- Incari is pushing forward human-machine interface technologies with a 3D-first and no-code approach, enabling designers and engineers across industries to create HMIs in a streamlined and cost-effective manner.

- The team around Ijad Madisch at ResearchGate, founded in 2008, is disrupting traditional academia and publishing by providing a platform for experts to network, collaborate, discover and publish their latest research and data.

- LiveEO combines earth observation data and machine learning to provide infrastructure monitoring, including work with the UN to further develop monitoring services for the forestry sector and industry stakeholders.

- ChartMogul is building powerful subscription analytics software that enables businesses to centralise and analyse core SaaS metrics. Users can segment and present their subscriber base in key dashboard views, making insights accessible across the business.

- Some of the Wunderlist team are back with Superlist, a next-gen task and project management tool for modern teams. They’re currently in private beta mode, and we’re excited to see what’s coming.

Munich

Bavaria, with its strong manufacturing history, boasts a thriving startup ecosystem, and Munich has become a startup hotspot to rival Berlin. Renowned academic institutions, such as the Technical University of Munich (TUM) and the Fraunhofer-Gesellschaft, have contributed significant brainpower to building Germany’s latest cohort of leading engineers and entrepreneurs.The collaboration between academia and industry, and the support behind R&D, have resulted in Munich having the highest number of startups per capita.

Some of our favourite Munich startups have roots in traditional manufacturing industries from the region. For example, TWAICE is developing predictive analytics software for optimising the performance and lifespan of lithium-ion battery systems. We’re also excited about what TUM alum Sebastian Schaal is building at Luminovo; founded in 2017, the team is developing data-driven and collaborative operating software to streamline processes for OEMs, EMS and distributors.

A range of other sectors, from cybersecurity to e-commerce software, are also thriving. Some of the companies we’re excited about include:

- Hawk.AI is building an ML-driven crime detection platform to detect financial corruption cyber threats in banks, payment companies and fintechs. Co-founders Tobias Schweiger and Wolfgang Berner recently raised their Series B led by Sands Capital.

- IDnow provides a Verification-as-a-Service platform using AI-enabled capabilities for identity verification and digital onboarding solutions across a range of industries. The team is involved in collaborative research projects exploring AI bias, personal data management and deep fake detection.

- The team at Cello, which recently raised a seed round led by HV Capital, is building a user-led growth platform that enables B2B SaaS businesses to integrate user referrals as a key part of their customer acquisition strategy.

Cologne

In recent years, Cologne boasts a diverse and robust economy characterised by a blend of traditional and modern industries. Historically renowned for its media, arts and cultural sectors, media giants like RTL Group have a significant presence in the city.

Cologne has expanded its economic base to include a thriving tech scene, with several Companies of Consequence emerging in recent years, including:

- Recently minted unicorn DeepL has built an ML-driven translation platform to rival that of GoogleTranslate and is building out core enterprise and team workflow capabilities to enable seamless bilingual operations. With a strong focus on data privacy, DeepL has its own servers based in Iceland. It currently supports 31 languages and is continuously adding capabilities.

- Chaos-engineering platform Steadybit is designed to proactively reduce downtime and provide visibility into systems to detect issues, helping customers to improve system resilience and security.

- Buynomics is working with consumer goods companies around the world to forecast and test the impact of product and pricing strategies across their portfolios. The platform uses large-scale simulation technologies to digitise strategies and predict purchasing behaviour, enabling more sophisticated and informed revenue optimisation.

- SaStrify, which recently raised a Series B led by Endeit Capital, is developing procurement software to design, centralise and manage companies’ SaaS stacks. The team claims that 20% of SaaS subscriptions typically go unused, and optimising spend here is a key way to driving efficiencies within businesses.

- The team at GiantSwarm offers a kubernetes-based, fully managed Cloud Native Developer platform. It’s designed to improve developer productivity by providing all maintenance behind the best-in-class platform, and enabling better resilience and scalability of applications. The company is part of the STARTPLATZ incubator in Cologne.

Bis Bald!

As this quick snapshot shows, innovation is thriving in the German start-up ecosystem. Whilst Berlin has been at the forefront of tech in recent years, there are blossoming communities in cities across the country that are addressing big problems in B2B software and building the next generation of exciting companies. If you’re an entrepreneur or VC based in Germany, we’d love to connect! Please reach out to [email protected] and [email protected].