Jamstack (JavaScript, APIs, Markup), first coined by Mathias Biilmann (Netlify, CEO) over 6 years ago, continues to take the software development world by storm, from the first Jamstack conference in 2018, to the inception of “Full Stack JAMstack” in 2020 and corresponding adoption by global enterprises, including Unilever, Nike and PayPal. According to HTTP Archive, the number of Jamstack websites is growing c.2x annually and interestingly the percentage of Jamstack developers with less than one year of experience more than tripled 2021 vs 2020 showing that developer interest in Jamstack architecture is growing significantly.

Jamstack relates to decoupled, static-first and progressively enhanced websites. As much HTML as possible is pre-built and stored in a content delivery network (CDN) while dynamic components of the application are based on APIs and serverless microservices. As a result of this construction it delivers better application performance and a faster user experience, scalability, security (fewer attack points), maintainability, improved SEO and a superior developer experience versus a monolithic architecture.

There are a number of trends to highlight within and driving the Jamstack ecosystem. Firstly, with over a third of Jamstack developers now building websites that have audiences in the millions, this demonstrates the successful expansion of Jamstack architecture implementations to serve larger sites and more dynamic user experiences. This has likely been helped by the rise of server side rendering which allows for pages that are highly dynamic and change constantly to be rendered by the user’s server. Both Gatsby and Nuxt’s introduction of server-side rendering into their frameworks has created an increased opportunity for building powerful hybrid experiences.

Secondly, evolutions in the web framework landscape have been interesting to observe. While React continues to dominate, frameworks such as Astro, Sveltekit and Vite are seeing increasing adoption. The Astro approach deserves special mention. By default, Astro doesn’t ship JavaScript to the browser, rendering HTML on the server and stripping away any remaining, unused JavaScript.

A third interesting trend to highlight relates to browser-native web components. Although browser-native web components were introduced 11 years ago, support from major browsers was lacking until c.2018. Since then, we have seen a notable acceleration in their adoption and anticipate this will increase further in the coming years.

Finally, static side generation introduced the challenge of needing to rebuild the entire site for any change, however small. GatsbyJS 4’s introduction of deferred static generation now enables the build and cache of a page upon a user’s request. Moreover, we are also seeing serverless adoption taking off, per jamstack.org’s community survey results, serverless usage jumped from 46% to 71% in the space of the past year.

At Sapphire, we are proud to have made investments in Jamstack related companies, namely Contentful (Headless CMS) and Auth0 (User Authentication, acquired by Okta). In addition, we are excited about the rapidly thriving ecosystem and we believe there are many more companies of consequence to be built in this space.

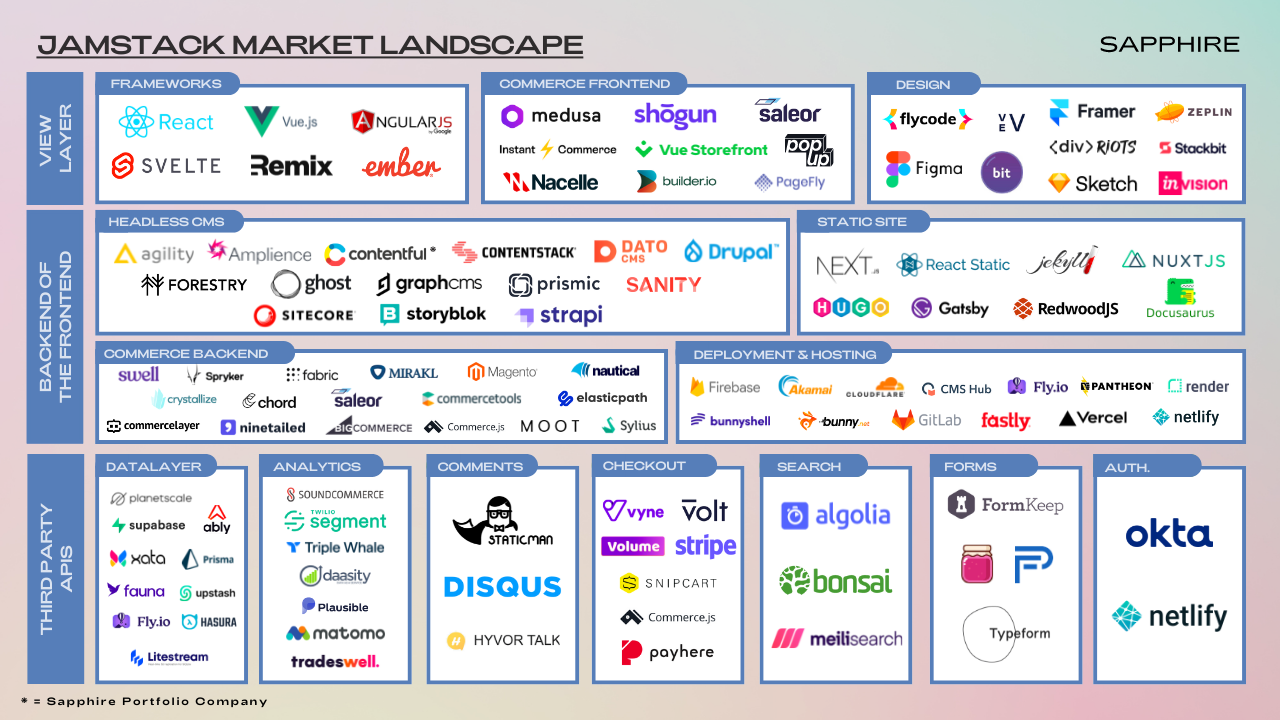

Below we’ve put together a non-exhaustive mapping of the various tools, frameworks and APIs available in the market today.

Focusing on the European and the Israeli ecosystem, there are a few companies building exciting propositions in the Jamstack ecosystem that we wish to highlight:

- Bit.Dev is building an open-source tool and cloud platform for components enabling front-end developers to collaborate and build component-driven software. Example use cases include design systems, micro frontends, monorepos and micro services. The company most recently announced a Series B in November 2021.

- Commerce Layer provides a set of APIs for merchants to build eCommerce apps with their own, customised front-ends. Examples include adding global shipping capabilities, adding a shopping cart to existing websites, building ecommerce into native mobile apps and connecting POS software to provide a seamless, omnichannel commerce experience. Commercelayer most recently raised a Series B in May 2021.

- MeiliSearch is an open-source search engine that can be deployed to any website or application in a matter of minutes. Meilisearch claims they can return search-as-you-type answers in less than 50 milliseconds and is “typo tolerant”. The product currently has over 10M downloads, 300 contributors and over 29K stars on GitHub. Meilisearch most recently announced a Seed round in January 2022.

- Xata is a serverless data platform with built-in search and analytics that developers can easily connect to through one API. As of this November, Xata launched out of beta and is seeing strong traction among developers. The company most recently raised a Series A in March 2022.

Additionally, we’ve seen the emergence of a number of exciting Series A / Seed players building in the headless frontend space:

- Instant Commerce is a low-code headless storefront builder focused on empowering every member of the e-commerce team from developers to marketers. Marketers can add new features, launch new pages, and build storefronts and developers can build custom blocks and integrations and add advanced customisation features without worrying about the technical architecture and deployment. The company most recently announced a Seed round, in September 2022.

- Medusa is an open-source e-commerce tool for JavaScript developers enabling merchants to adopt a “headless” stack and connect to third-party tools including payment providers, logistics tools and customer management systems. Medusa is active in eCommerce shops, selling in excess of $100M a year, and has amassed a community of more than 2K developers who have started over 10K projects on the platform. The company most recently announced a Seed round in July 2022.

- Vue Storefront is an API-first, front-end platform based on Vue.js, enabling users to create pre-built, customisable eCommerce front-ends on a cloud-hosted infrastructure. Vue Storefront has built an active community of over 5k members, 250+ contributors and 120 partner agencies and most recently announced a Series A, in October 2021.

Looking to the year ahead, we anticipate further rapid expansion in the ecosystem of players, particularly in areas related to content, design assets, data and commerce. At Sapphire, we are excited to continue to spend time and dig deeper in the space as it continues to evolve and offer opportunities for companies of consequence to be built. If you are building in the space and/or would like to exchange insights, we’d love to hear from you. Please reach out to [email protected] and [email protected].

Special thanks to Paolo Negri for his feedback and contribution to the development of this blog.

Legal disclaimer

Disclaimer: Nothing presented within this article is intended to constitute investment advice, and under no circumstances should any information provided herein be used or considered as an offer to sell or a solicitation of an offer to buy an interest in any investment fund managed by Sapphire Ventures (“Sapphire”). Information provided reflects Sapphires’ views as of a time, whereby such views are subject to change at any point and Sapphire shall not be obligated to provide notice of any change. Companies mentioned in this article are a representative sample of portfolio companies in which Sapphire has invested in which the author believes such companies fit the objective criteria stated in commentary, which do not reflect all investments made by Sapphire. A complete alphabetical list of Sapphire’s investments made by its direct growth and sports investing strategies is available here. No assumptions should be made that investments listed above were or will be profitable. Due to various risks and uncertainties, actual events, results or the actual experience may differ materially from those reflected or contemplated in these statements. Nothing contained in this article may be relied upon as a guarantee or assurance as to the future success of any particular company. Past performance is not indicative of future results.