2021 was a historic year for crypto, marked by surging demand from consumers (retail and “pro-sumer”), institutions (e.g. banks, asset managers) and publicly-traded companies (e.g. Meta, Google, Visa). Major brands (e.g. Nike, Adidas, Dolce & Gabbana) and celebrities embraced NFTs, while token prices saw rapid appreciation despite noted market volatility. More recently however, the crypto markets have been in flux with a number of major players (e.g. Coinbase, Bitso, Gemini) announcing layoffs/hiring slowdowns that can potentially be seen as reflective of the deceleration in retail trading volumes. That being said, there is a somewhat expected volatility to the Web3 landscape and the continued strong fundraising announcements made by companies building within Web3 evidence an exciting future for the Web3 landscape and continued positive investor sentiment.

We at Sapphire believe that Web3 represents an inflection point where whole new financial and developer ecosystems will revolutionise how financial products are accessed and how next gen applications are built. It is the ‘picks and shovels’ businesses that excite us the most in the Web3 landscape – the development of secure, compliant and scalable bridges that enable CeFi users to access DeFi and that help to onboard the next 10M developers into Web3. Our belief in the importance of better infrastructure to enable institutional and retail participation in Web3 we’ve highlighted in our recent blog posts (Marketscape: Crypto Infrastructure and Building Better Infrastructure for Digital Assets), and it’s what has led to our investments in Blockdaemon, FalconX, TaxBit, and Helsinki-based Tesseract.

With this in mind, we believe that Europe is well-positioned to serve as a global hub for crypto innovation. Europe surpassed other global regions as the largest crypto economy in June 2021, receiving $1T in digital assets and accounting for 25% of global crypto activity during the trailing 12 months. Not surprisingly, high volumes of transaction activity growth (e.g., trade, investments) has corresponded to the emergence of 16 European Unicorns and counting including; Bitfury, Bitpanda, Blockchain.com, Bullish Global, Concordium, Copper, Dfinity, Dune, Improbable, Ledger, LMAX Group, Multichain, Sorare, The Sandbox (Animoca Brands), Worldcoin and 21Shares.

Moving forward, we expect Europe to continue to serve as a bedrock for building companies of consequence in Web3, as evidenced by strong momentum in early-stage European crypto venture investing.

Key Drivers making Europe a Hotbed for Web3 Innovation

Europe exhibits a unique mixture of support from both public and private institutions. This creates an observable flywheel for Web3 innovation, as the push towards greater regulatory clarity for the new digital asset class helps to instil confidence for crypto startups to locate within the region. And as Europe has long served as a strong foundation for Web2 developer talent, it is not surprising to similarly see the growth of larger Web3 developer communities within the region.

There are several notable characteristics that have helped to establish Europe as a strong ecosystem for crypto innovation:

- Regulatory Clarity: We believe the shift towards greater regulatory clarity – relative to North America and Asia Pacific – increases willingness for Web3 companies to ‘BUIDL’ in Europe. As highlighted in our previous analysis on Open Banking, this dynamic traces back to similar innovation trends within the traditional fintech landscape. PSD2 (European legislation that mandates that financial institutions open up their data for third-parties) and Open Banking (UK legislation that standardised the format for that open data) set the stage for a culture of regulation-enabled innovation in traditional fintech in Europe.As it relates to Web3, regulatory initiatives such as Markets in Crypto Assets (MiCA) and the Digital Operational Resilience Act (DORA) have gained traction with the European Commission and will likely provide regulatory certainty and clarity that enables similar innovation in crypto. Further, the European Central Bank’s (ECB’s) experimentation with Central Bank Digital Currencies (CBDCs), via the recently launched Digital Euro project, indicates an openness to exploring the value that distributed ledger technology can bring to financial markets.

The financial system in Europe looks heavily to regulators to first set the rules and provide regulatory clarity before making any major moves…Thus, the role regulation plays is really a mix of boundary setter as well as a beacon of light to set the overall direction.

Yichen Wu

Founder & CEO, Tesseract Investment

- Receptivity to More Open Financial Systems: As the birthplace of Open Banking, Europe has created a strong precedent for having a more open financial infrastructure where consumers ‘own their data’. PSD2 fundamentally shifted ownership of consumer financial data toward consumers and away from traditional financial institutions. With consumer consent, non-bank entities can access financial data held at banks, with a standardised API interface. DeFi takes the concept of open banking one step further, with publicly available data that can be accessed and leveraged by anyone.

- Institutional Adoption of DeFi: Institutional adoption of DeFi has driven Europe to become the largest region for cryptocurrency transactions. According to the Chainalysis report on Geography of Cryptocurrency, Europe emerged as the largest cryptocurrency economy over the course of 2021, driven by strong institutional adoption. More specifically, large institutional transactions (> $10m transaction size) accounted for the bulk of Europe’s growth in transaction volume, representing only 10-15% of volume in early 2020, but growing to >50% of volume by mid-2021. By mid-2021, more than 75% of this large institutional volume was sent to DeFi applications / protocols.

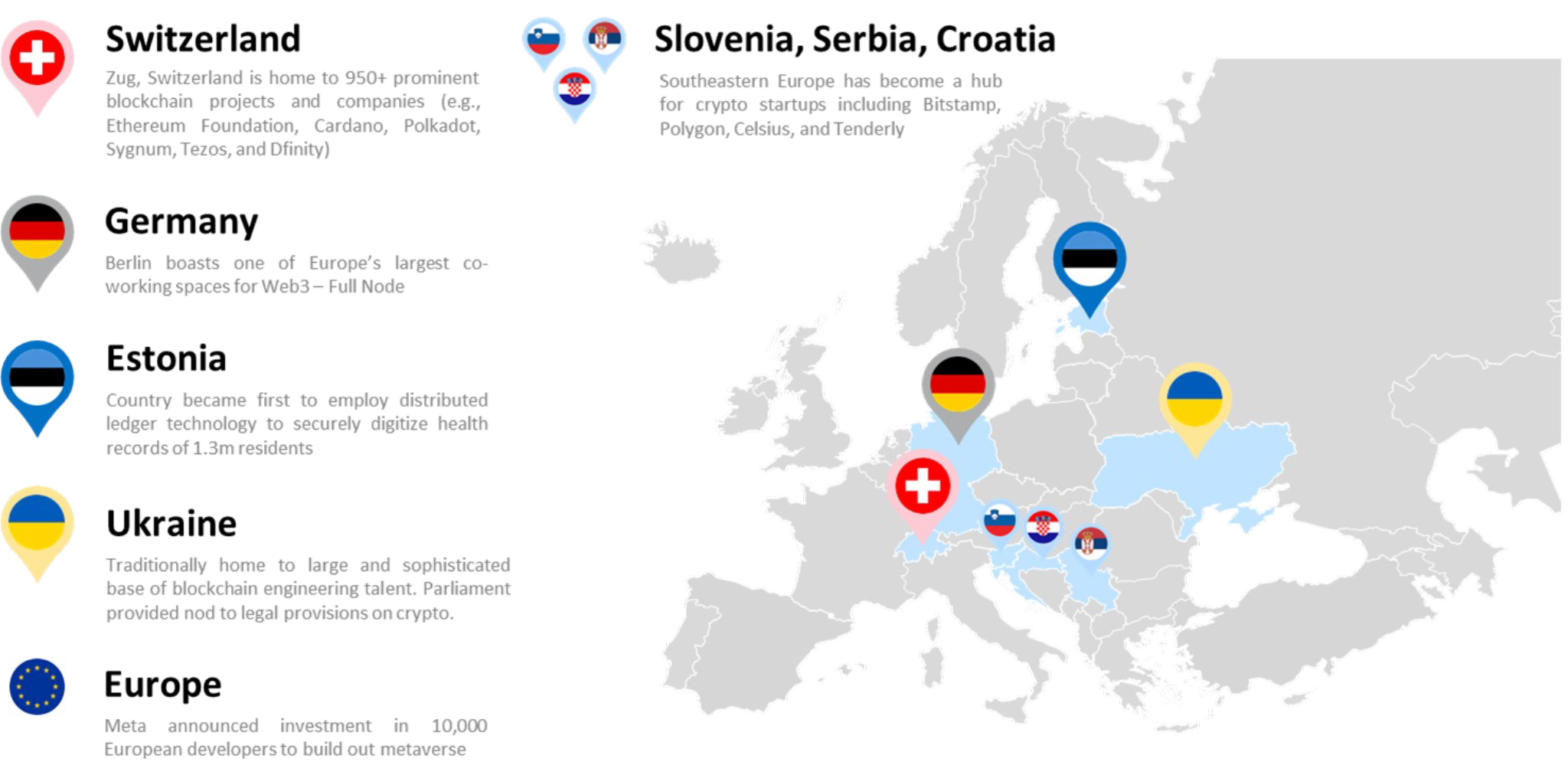

- Nexus of Web3 Dev Talent: While there may be no ‘Silicon Valley’ of crypto, given the paradigm shift from a centralised world to a decentralised one, Europe is well on its way to establishing itself as a hotbed for developer talent. The graphic below details several of the Web3 communities that are beginning to emerge in markets such as Switzerland and Germany. These dynamics are not too surprising, given that Europe has long served as a global talent hub for software developers in the Web2 space.

Unlike past technological eras and the dominance of certain geographies the world has become flatter. Developing in the decentralised design-space allows for participation regardless of where entrepreneurs and dev teams are. Europe has certainly been at the forefront of the development of Web3.

Sebastian Blum

Partner, Greenfield One

It is important to highlight that the current conflict in Ukraine may have implications for the Web3 developer community. With more than 300,000 professionals in the technology space, Ukraine accounts for one of the primary sources of developers in Europe. Within Web3 specifically, the country’s parliament has created favourable legal provisions to allow for consumers to easily access digital money, which has helped contribute to the growth of institutional as well as retail participation in the digital asset class. Sadly, the European Web3 community will likely be severely impacted by the ongoing conflict.

Europe is a hotbed for developer talent

Key Themes Underpinning Recent Investment Activity

As a result of the favourable regional dynamics for Web3 innovation, it is not surprising to note the heightened level of Web3 investments, as well as the growth of crypto-focused VCs in Europe. Interestingly, we feel there are several emerging patterns for investment activity:

- Bridges between Centralised and Decentralised Finance: A number of companies that have reached the growth stage (Series B and later) have centred on creating more secure, scalable and compliant onramps into DeFi. This includes companies such as Ramp, from London, that enable connectivity for seamless exchange between traditional currencies and cryptocurrencies. These represent one of the initial investable use cases for crypto with demonstrable ROI – which accelerated over the course of last year’s DeFi summer.

- Smart Contract Development: While the last few years have focused on building first order crypto protocols and applications, there is increasing demand for second-order tooling to simplify smart contract development and to secure protocols through agent or scenario based simulation testing. Companies such as Tenderly, out of Belgrade, are building Web3 developer tools that enable smart contract development (e.g., debugging and simulation) and allow for ongoing performance monitoring after deployment. Moralis abstracts away the complexity for building high performance dApps creating an ‘all-in-one’ platform for authenticating users, conducting real-time transaction monitoring, and aggregating cross-chain data.

- Data & Analytics: As detailed in a prior article, initial use cases for Web3 focused on enabling institutions and users to mint, buy, and sell tokens and NFTs. Now, users are looking for sophisticated tools to understand digital asset markets (e.g. token / NFT trading activity, DeFi platform usage, “whale” wallet activity) in order to fuel more dynamic use cases. Dune Analytics, out of Oslo, became a crypto unicorn with just 16 employees by providing real-time, on-chain quantitative metrics and dashboards as well as build-your-own query functionality. Additionally, Kaiko, from Paris, has built a data platform focused on cryptocurrency analytics riding the wave of increasing institutional demand.

- Big Bets on the Metaverse: While Web2 tech giants (e.g. Meta, Google, etc.) have placed big bets on the metaverse, Europe is becoming home to many Web3-native, metaverse companies that are developing highly engaging, open virtual world experiences. The Sandbox is creating an open metaverse world where consumers and brands can interact in carefully curated and designed experiences. Even celebrities are getting involved, such as Snoop Dogg hosting concerts on the Sandbox.

- Emergence of DAO Tooling: Decentralised Autonomous Organisations (DAOs) represent a radically new form of social organisation, rather than relying on a central authority or bureaucracy for decision-making, DAOs are community-led entities where members vote on governance proposals, and smart contracts execute the relevant decisions. DAOs rely on software to enable core operational functions such as treasury management, payments, user authentication, etc. Although the DAO landscape is still nascent, we see this as an exciting emerging category in Europe with companies such as Superfluid for programmable money movement (e.g., subscriptions, salary, rewards) and Multis for financial planning, analysis and accounting.

Web3 European Investment Activity

Looking Forward

At Sapphire, we are excited about the future of Web3 innovation in Europe. Being home to both open banking fintech innovators and the next generation of Web3 developers, we are looking forward to seeing a growing number of Web3 companies of consequence come out of the ecosystem.

Given that most of the core infrastructure is in place to enable retail and institutional users to lend, trade and custody digital assets, we expect that second-order areas of development will feature more prominently going forward. These areas include tooling – to increase the efficiency and ease of use of blockchain technology (e.g., DevSecOps tooling, crypto enabled fintech) – and applications built on top of the tech stack (e.g., real-world asset securitisation, metaverse gaming, etc.).

At Sapphire we believe that it is still early days for the Web3 space. Nevertheless, with our entrance into crypto and notable track-record of supporting disruptive technology companies that aim to democratise finance in Europe (e.g., Currencycloud, Wise, Yapily, Tesseract, etc.), we are looking forward to backing more incredible European entrepreneurs in the Web3 space. We’d therefore love to hear from you if you are building a Web3 company! Please reach out to [email protected] or [email protected].

Special thanks to Jason Brooke and Matthew Parthun who have been deeply analysing the Web3 space and greatly contributed to the development of this blog.

Legal disclaimer

Nothing presented within this article is intended to constitute investment advice, and under no circumstances should any information provided herein be used or considered as an offer to sell or a solicitation of an offer to buy an interest in any investment fund managed by Sapphire Ventures (“Sapphire”). Information provided reflects Sapphires’ views as of a time, whereby such views are subject to change at any point and Sapphire shall not be obligated to provide notice of any change. Companies mentioned in this article are a representative sample of portfolio companies in which Sapphire has invested in which the author believes such companies fit the objective criteria stated in commentary, which do not reflect all investments made by Sapphire. A complete alphabetical list of Sapphire’s investments made by its direct growth and sports investing strategies is available here. No assumptions should be made that investments listed above were or will be profitable. Due to various risks and uncertainties, actual events, results or the actual experience may differ materially from those reflected or contemplated in these statements. Nothing contained in this article may be relied upon as a guarantee or assurance as to the future success of any particular company. Past performance is not indicative of future results.