At Sapphire Ventures, although our portfolio has traditionally skewed towards the Bay Area, we constantly track a number of other vibrant tech ecosystems, including New York. Yesterday in a blog post, Fred Wilson referred to New York as “vital and growing rapidly.”

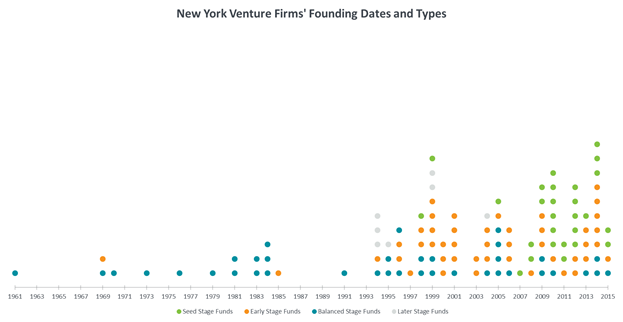

From what we have observed, we agree that there has been a significant growth of active venture capital firms in New York in the past two decades. Some of the most known players in New York, such as First Round, Greycroft, Insight, RRE, Tiger Global and USV were started prior to the recession in the late 2000’s. There has also been a plethora of rising new players in the last decade such as Bowery, Brooklyn Bridge, Collaborative, FirstMark, Metamorphic, NextView, Notation and Thrive. Moreover, many other firms that were started outside of New York are now setting up permanent offices in New York, such as Bain, Spark and Venrock. And some have even transitioned a significant portion of their human capital (and sometimes headquarters) to New York.

It’s clearly an exciting time in New York, so we dug into market level data to better understand this ecosystem. Some of our take-aways are below.

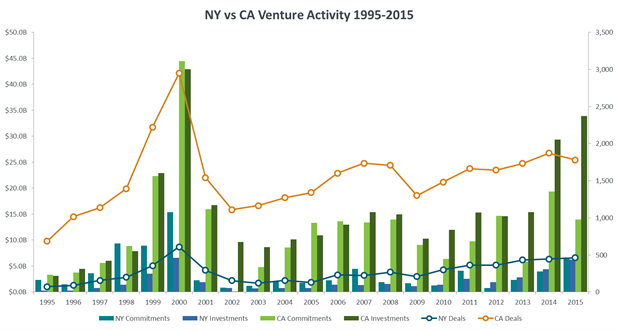

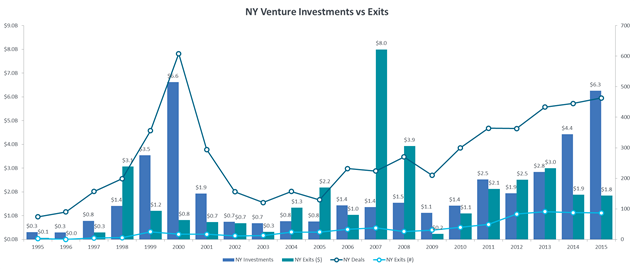

- While California is still larger, New York has a higher growth rate both in terms of number of deals (10% CAGR in NY vs 5% in CA) and dollars invested (16% CAGR in NY vs 13% in CA).

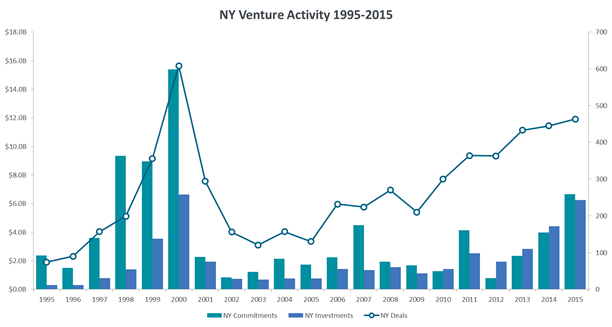

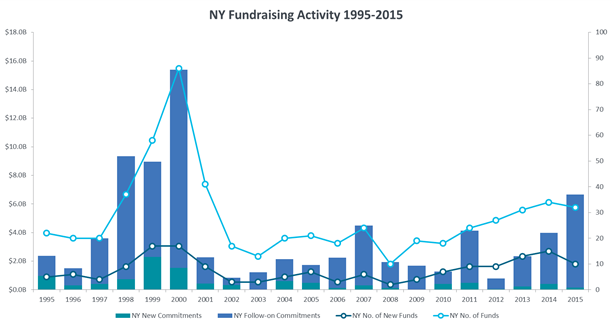

- Looking at the chart below, 2000 is clearly an outlier with over $15 billion committed to what Thomson Reuters defines as New York venture capital firms. In 2015, almost $7 billion was committed to NY-based VCs, and two larger firms comprise approximately $4.1 billion of this amount.

- Most of the NY-based VC firms in existence today were started after the mid-1990’s. There is a clear proliferation of seed funds in recent years.

- With the rise in active firms, the number of deals and amount of capital invested in 2015 is increasing to levels not seen since the dot-com era.

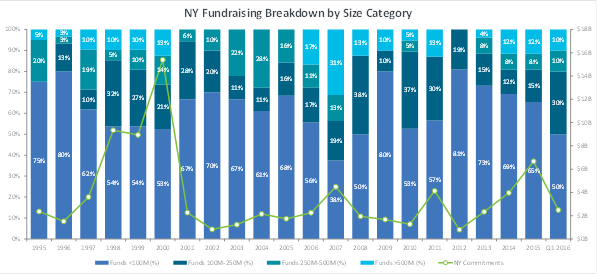

- Despite the recent rise of more new firms, the vast majority of funding from LPs to NY VCs still goes to follow-on funds (vs first-time funds).

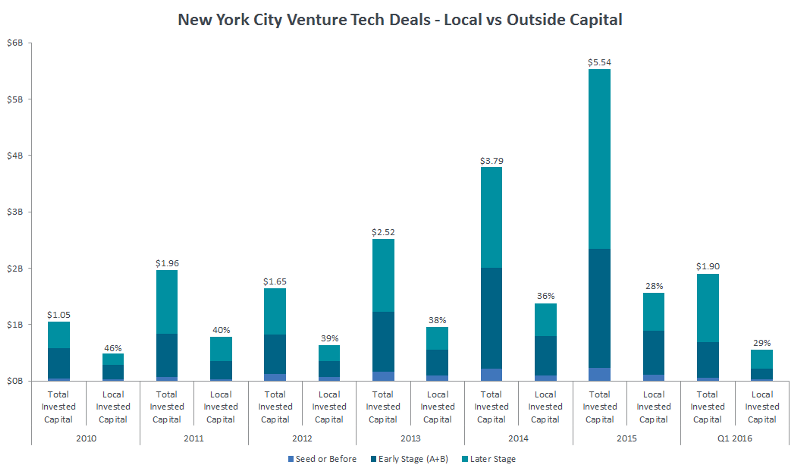

- Pitchbook data shows that in the last few years, more capital is being funneled into NY by outside venture capitalists than by local VCs, and later stage investments have been on the rise.

- Since 2009, the number of exits by NY-based companies has steadily increased per year. In particular, New York is becoming known for billion dollar plus exits, including Etsy, OnDeck and Tumblr, among many other companies that have sold for significant value.

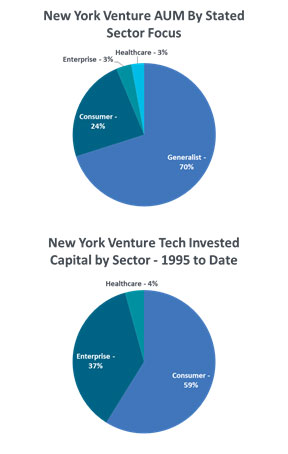

- Enterprise-only funds are still few and far between at the early stage in New York, despite a significant percentage of investments going to enterprise companies since 1995. According to our research, many funds targeting New York for enterprise investments have generalist investment strategies.

Many thanks to Eugene Chou for his help and feedback!