Allocating for follow-on dollars, also known as reserves, is an important tool in the arsenal of every fund manager. Nearly every early-stage manager I encounter has a reserve strategy incorporated into their fund model. In our portfolio of fund managers at Sapphire Partners, we see a variety of follow on strategies, though the majority cluster around a 1:1 initial/reserves ratio.

I have been both looking at our portfolio and running some hypothetical numbers on how reserves are deployed. To be bold and transparent – when we see outperformance, it almost always comes down to making investments in great companies and generating outlier multiples on each subsequent financing into these winners. Reserves, therefore, impact funds based on the returns they generate. And while reserves can occasionally boost returns, they can, and more frequently do, bring down fund multiples. They also (dare I say) sometimes create potential conflicts of interest with LPs. This is why LPs want to understand how a GP thinks about using reserves.

Why have reserves at all?

The rationale for reserving is clear: de-risked dollar deployment. GPs make an initial investment into a company. Because they are now partnered, they have a close relationship with the team and strong insights into company development. When it comes time for a subsequent round, GPs can use this proprietary information to make a better-informed investment decision. Follow-ons should therefore be de-risked and more likely to succeed than an initial check. This can bolster financial returns.

Easier said than done

While the premise is simple, there are a couple considerations that complicate things:

– Reserves mean you need to return more capital. By having a reserve strategy, GPs are essentially increasing the size of their fund to accommodate the extra dollars. If a GP is committed to investing $50M into initial checks but also wants a 1:1 reserve ratio, they now need to do two things 1) raise and/or recycle to reach $100M and 2) return $100M several times over. This means exit events need to be larger. If a GP of a $50M fund has 7.5% ownership at company exit, they need a $666M exit to return the fund. If they use reserve dollars in subsequent funding rounds to protect their ownership (increasing it to 10% at exit), the required exit value still climbs to $1Bn in order to return the (now) $100M fund.

– Reserve dollars have to be concentrated into winners to improve fund performance and there usually aren’t many of them. Early-stage venture remains a power-law business, and many portfolios come down to one or two winners. We have been fortunate enough to partner with numerous GPs who have 5x+ funds (though, of course, there are many funds who haven’t, including underperforming funds). Of these 5x+ funds, the top company in each fund’s portfolio (some realized, some not) is held at an average of ~90x MOC (!), with the second best company at a ~25x. The average mark for the remaining investments in these portfolios is 1x.¹ This means that a successful reserve strategy will require a GP to successfully identify the top companies in the portfolio AND put substantial reserves into them to maintain a high multiple on the overall fund. If reserve dollars are mistakenly funneled into companies that become a 1-2x outcome or are written off, it can significantly lower overall fund returns.

– A hot market makes things more challenging. While the current market is changing in real-time, over the past few years financing rounds (many preempted) have been happening so rapidly that there may not be time for a company to develop operationally between rounds. Conceptually, a company should become a “safer bet” as it matures and grows from seed>Series A>Series B, etc… But the rapidfire fundraising we’ve seen means companies may not be actually de-risked (aside from having a longer cash runway). Another complication is timing. With the acceleration of rounds, GPs may have to make follow-on decisions about some companies before they fully understand the opportunity set in their portfolios.

– Adverse selection is a thing. There may be adverse selection concerns for the very best deals. Top companies may have very limited room in follow-on rounds (despite pro-rata rights for existing GPs), or they may have a valuation so high it makes following-on challenging. In the Q4 Pitchbook NVCA report, the median early-stage pre-money valuation is $46.0M but the 75th percentile is $100.5M. That’s a big difference.

Reserve Scenarios

Top-Down

Reserve math is particularly hard to model as there are so many different scenarios and strategies, each specific to a GP and market. Still, a vastly over-simplified model is helpful to think through potential impact and considerations.

Expand

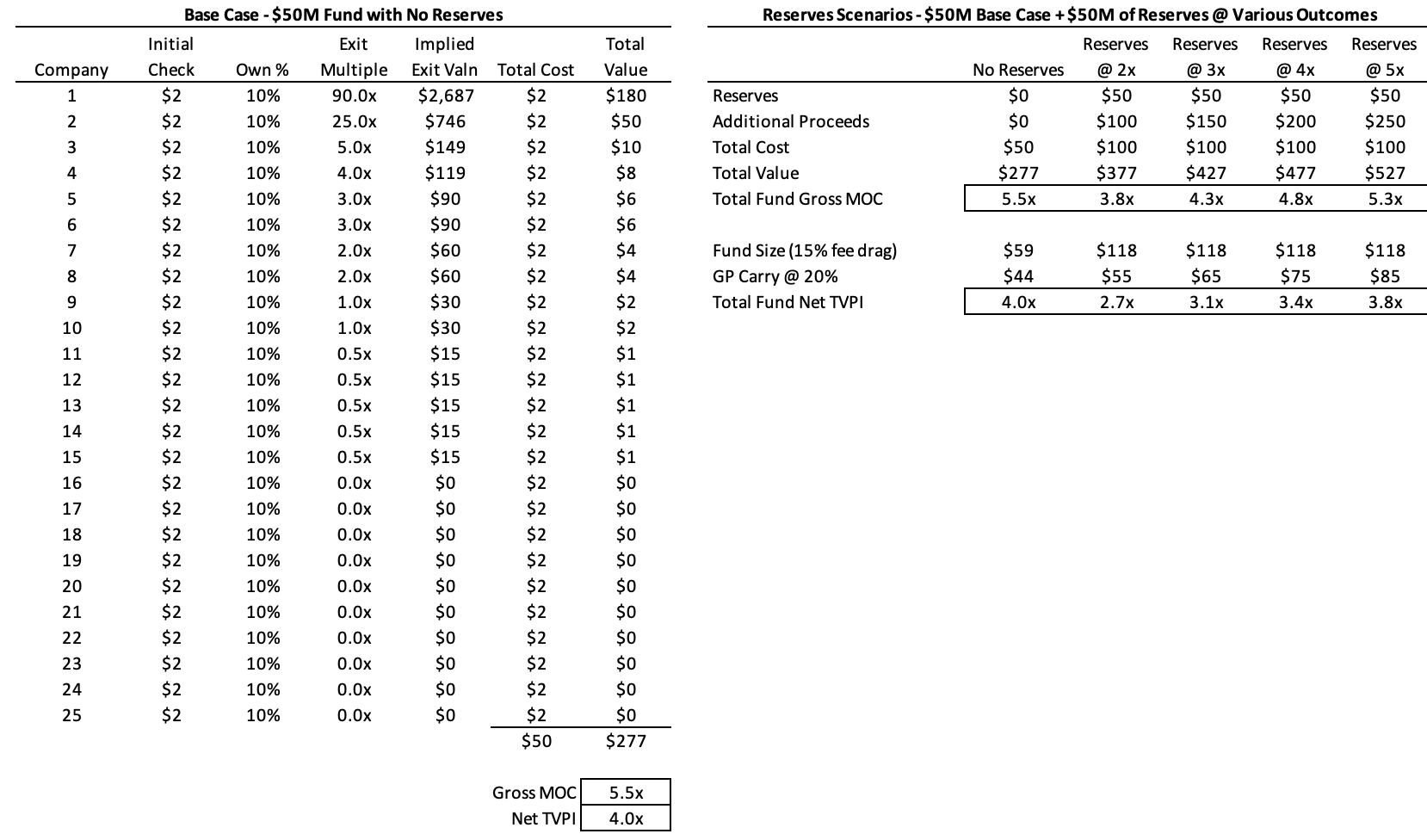

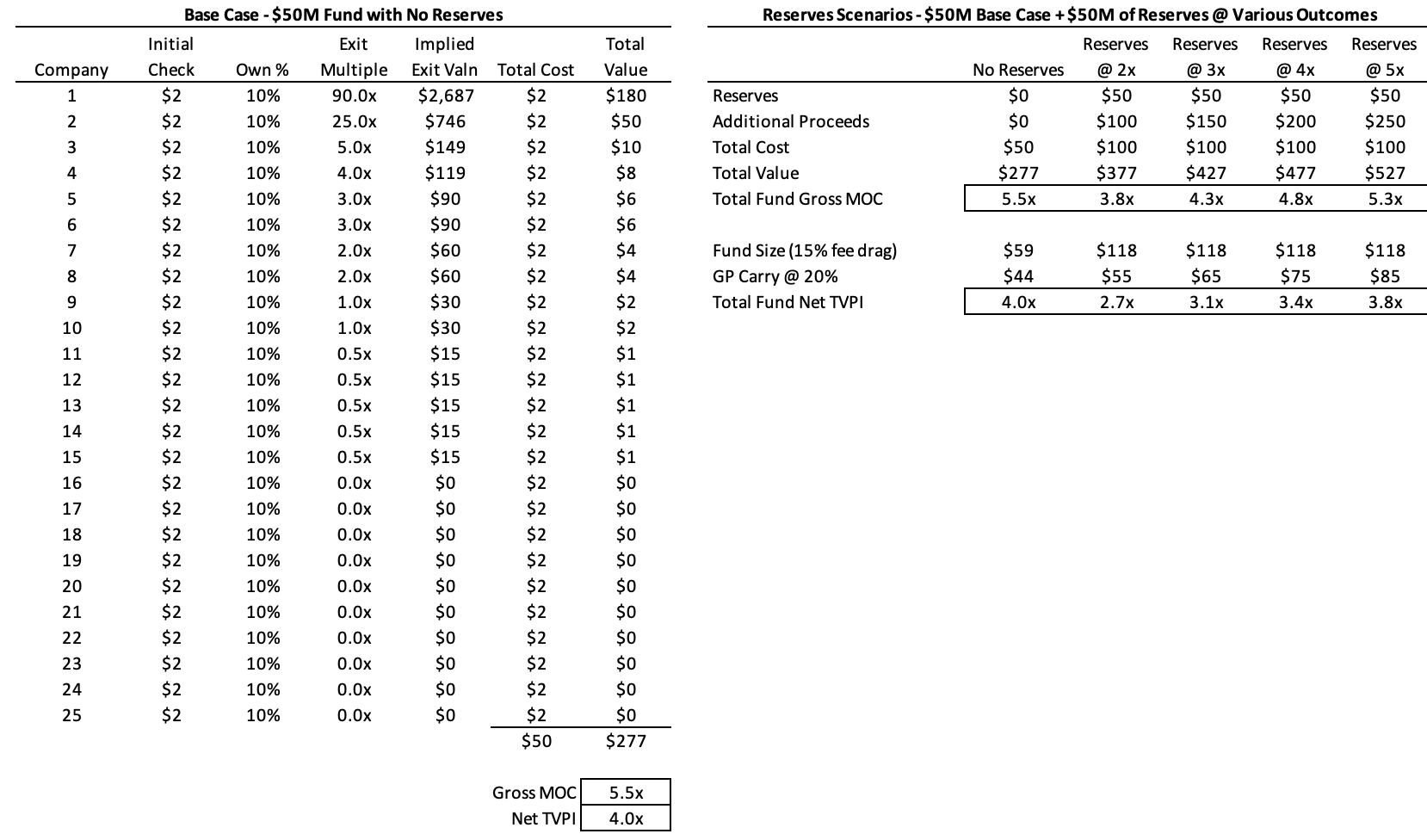

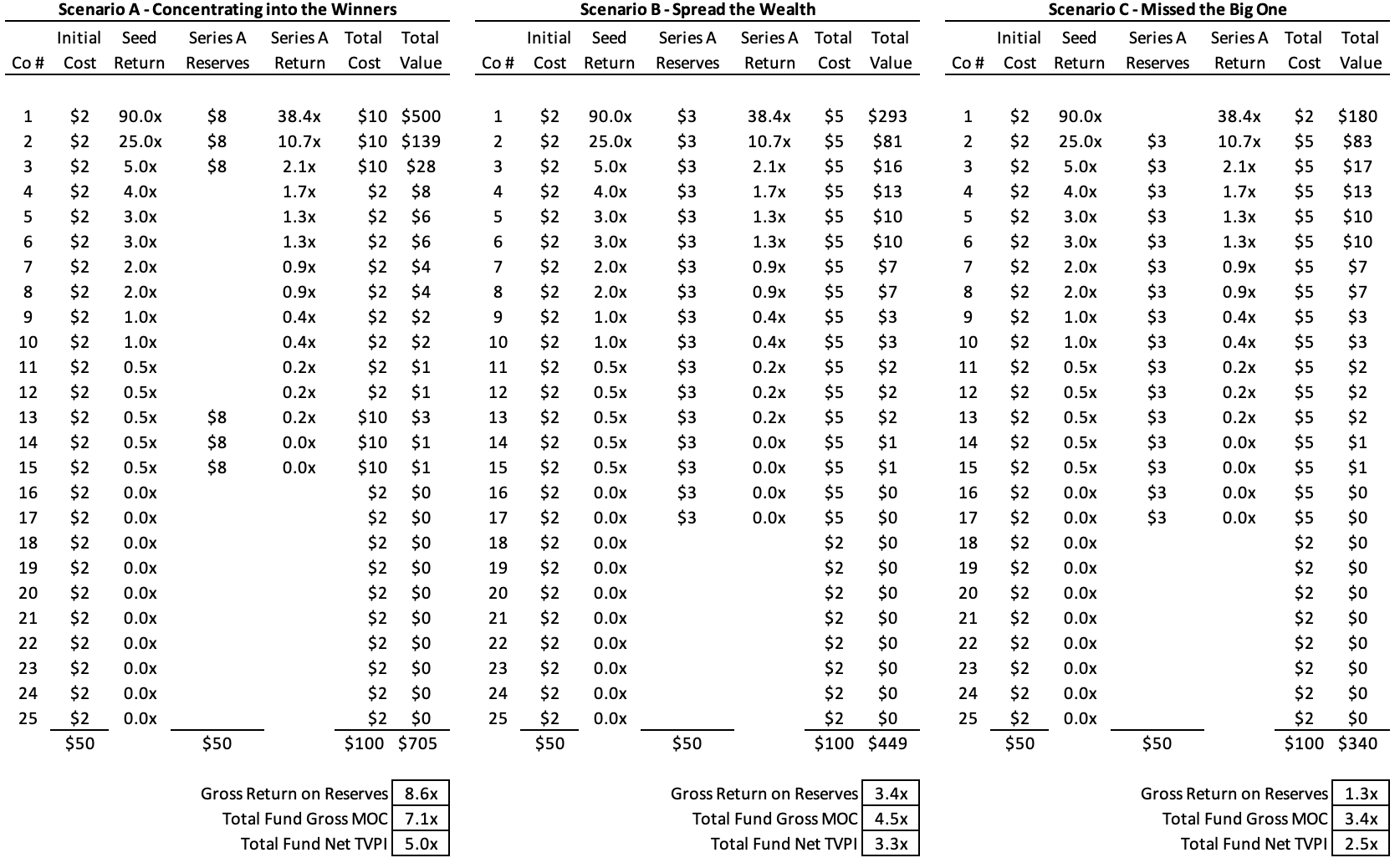

$ in millions. Scenario assumes $2M checks go into 25 companies, buying 10% of each company. Implied exit valuation calculated using the exit multiple and assuming 33% dilution to the original ownership. Net TVPI incorporates 15% fee drag and 20% carry. Table represents hypothetical results only. Please see important disclaimer at the end of this article.

Let’s take a theoretical GP as a base case (left hand chart). Our GP is leading seed rounds and putting $50M into initial investments, which implies a slightly larger fund size due to fee drag. This GP invests $2M out of a $3M round for each of their initial 25 investments and doesn’t follow-on at all. They are diluted by 33% by the time of exit. They have a true home-run portfolio – a 90x returner, a 25x returner, and the remaining investments returning 0x-5x (but averaging out to 1x). Overall, this yields a 5.5x gross and 4.0x TVPI at the fund level. This is a strong performing fund.

Now let’s walk through some reserve scenarios (right hand chart). The GP now decides to deploy $50M of follow-on capital, raising the total invested from $50M to $100M. Unsurprisingly, the returns generated by the reserve dollars impact both carry amounts and fund multiples greatly (but sometimes in opposite ways).

If the GP generates an aggregate 5x on the follow-on capital, carry increases from $44M to $85M but TVPI is slightly reduced from 4.0x to 3.8x. On the other hand, if reserve dollars generate only a 2x in aggregate, carry still increases from $44M to $55M, but net TVPI falls dramatically from 4.0x to 2.7x. This demonstrates the importance of successfully funneling reserves into companies that generate the highest multiples from the time that subsequent investment is made.

Bottom-Up

It’s clear that the return that reserves generate as a whole can greatly impact fund performance, but let’s dig deeper into how reserves can be deployed into specific companies. The chart below builds off the base case detailed above. It shows three scenarios for how the $50M of reserve dollars could be spent by our GP in subsequent rounds. Remember that our GP made initial investments into seed rounds, so follow-on dollars go into Series A here.

Expand

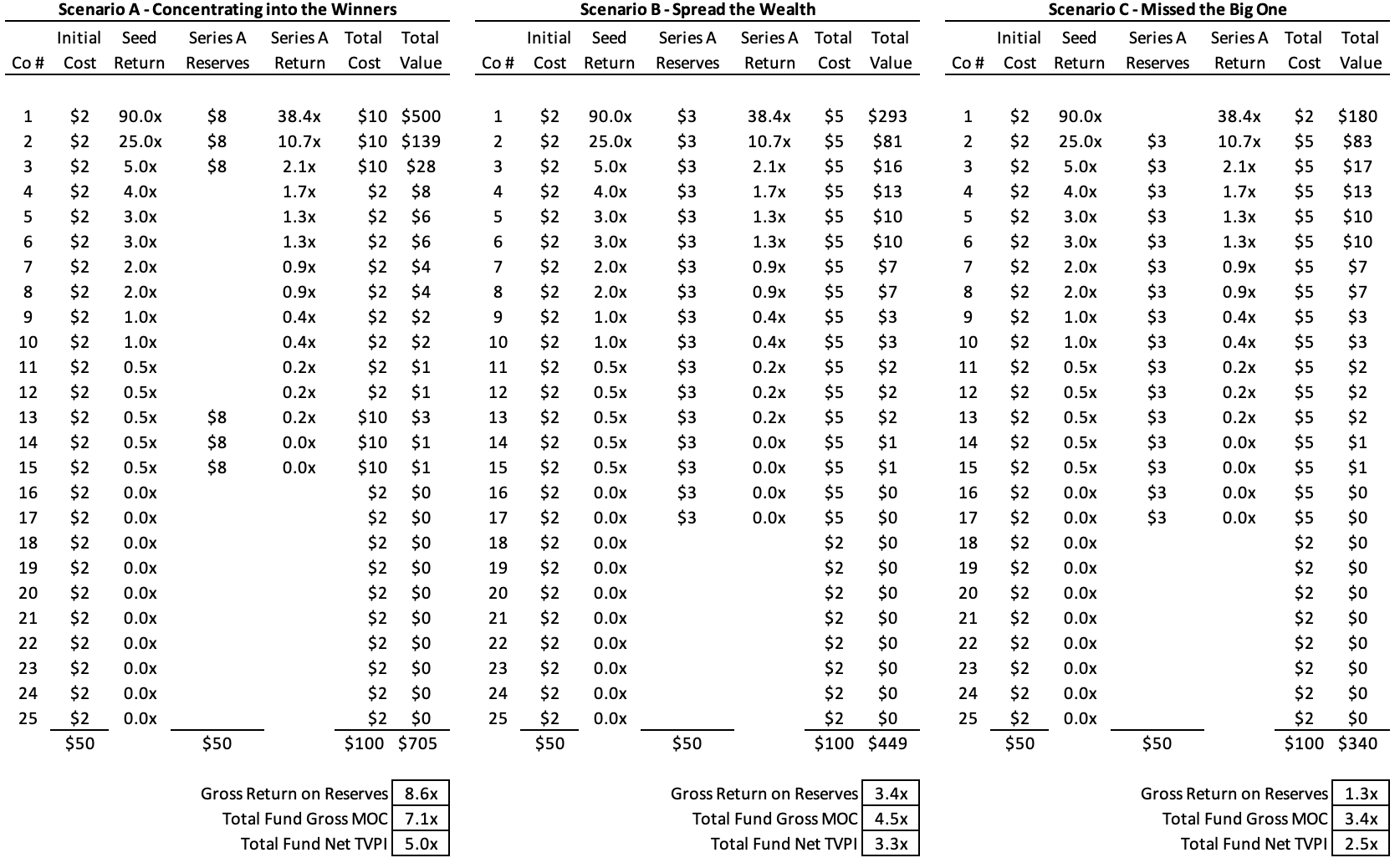

$ in millions. Series A return calculated using Series A reserves amount multiplied by Series A return. Series A return calculated by assuming a $70M Series A valuation and using the implied return multiple from the exit valuation.Table represents hypothetical results only. Please see important disclaimer at the end of this article.

– Scenario A: Concentrating into the winners. This is a very strong scenario for reserve deployment. The GP identified outliers early and deployed half the reserve dollars into the three strongest performing companies. The other 50% of the dollars went into companies that didn’t pan out. The follow-ons generate an aggregate 8.6x, which boosts the overall fund returns on a gross basis from a 5.5x to a 7.1x, and the net TVPI increases from 4.0x to 5.0x.

– Scenario B: Spread the wealth. Here the GP puts the same dollar amount into every company that raises a Series A (17 out of 25 seed investments). This has them gaining more exposure in the winners but also putting substantial dollars into companies that don’t go on to produce large outcomes, especially at the Series A, and it yields a blended 3.4x on reserves. The fund-level multiples take large hits, with gross return decreasing from 5.5x to 4.5x and net from 4.0x to 3.3x.

– Scenario C: Missed the big one. A nightmare reserve scenario. Here the GP takes the same strategy as in Scenario B (ie. follows-on in all companies raising a Series A) but happens to miss the company that went on to become the big outlier. The results are much more dramatic, with the gross return plummeting from 5.5x to 3.4x, and net decreasing from 4.0x to 2.5x. Note that while we didn’t include carry numbers in these scenarios, even with the net multiple significantly decreasing, the total carry proceeds for the GP would still increase from $44M to $48M.

What these scenarios highlight:

– Fund management is irrelevant unless there are winners in the portfolio. For GPs looking for top fund-level returns, at the end of the day, they need outlier companies in the portfolio and it’s HARD. While this base case portfolio has two companies generating 90x and 25x on the initial checks and an overall 4.0x TVPI, it STILL wouldn’t make top quartile for 2010-2014 vintages.² In Scenario C (where the GP missed the home-run), the net multiple decreased to 2.5x, which would put it in the third quartile for 2010-2014 vintages.

– Reserves need to be very concentrated in the highest multiple opportunities to be accretive to overall fund returns. A top performing fund depends on having winners, and a fund structure and strategy where a GP can put enough dollars into these outliers early enough to drive returns for the entire fund. For reserves, it is especially important to concentrate dollars into the winners because these investments are typically being made at higher valuations; if the upside isn’t there, there is risk that a fund’s net multiple decreases.

A lot of things needed to go right for the GP in Scenario A, and it still only boosted the net multiple from 4.0x to 5.0x. The GP was able to identify a small subset of potential companies that contained the two that would go on to become very large winners. Then, this GP wrote very large follow-on checks and put a full one-third of follow-on capital into those top two companies. They invested the follow-on capital early at the Series A, so the investments still generated home-run multiples of 38x and 11x. If the GP wanted to truly increase the overall fund net multiple, they would have to have an even higher concentration in the winners, as a more diversified reserve strategy would substantially lower returns. In Scenario B where the GP followed-on in all the Series A rounds (which is an understandable strategy given how early and sometimes unclear companies are at the seed stage), the net fund multiple dipped from 4.0x to 3.3x.

– Incentives are complex. Reserves impact GPs, LPs and entrepreneurs differently. As we saw above, in many reasonable-seeming scenarios where a GP funnels reserves into strong potential companies, reserves end up reducing the overall net multiple for LPs. However, a GP can reduce the multiple on the overall fund while generating substantially higher carry dollars (and fees) because of a larger fund size. If the GP generates a 2x return on reserve dollars, their total carry rises from $44M to $55M. But, for an LP with a set $10M commitment, they have now gone from making 4.0x on those dollars to 2.7x (bummer). Still, there are other angles to consider. These comments on incentives and alignment haven’t touched on the most important part of the ecosystem – founders. Follow-on rounds can be a very important way for investors to support founders, which then, of course, benefits GPs and then LPs (who partner with GPs fund over fund). A consideration here might be how GPs market their strategy to founders and communicate expectations upfront.

– Recycling can help with net multiple and reserves. While incentive tradeoffs between LPs and GPs for reserves are complex, they are more aligned with fund recycling. There is a large gap between gross and net. In the base case above, a 5.5x gross results in a 4.0x net (assuming 15% fee drag and 20% carry). 4.0x net is still good… but is a lot less good than 5.5x. Here is where recycling comes in. Recycling can increase net returns and total proceeds for both GPs and LPs, while also freeing up additional capital for follow-ons.

– Some portfolios will look like this, but most will not. There is no one-size-fits-all, and we have seen GPs with incredible returns whose portfolios don’t look anything like these scenarios. They may have a high number of strong outcomes without a single 50x+ company. They may have smaller checks to start and then buy up ownership in subsequent rounds. There are infinite combinations. Hopefully these various scenarios and observations will still be helpful for those with different fund models, strategies, or philosophies.

Advice for GPs

Each situation is different, but here is some general guidance for GPs regarding reserves:

– Don’t put 1:1 reserves in place simply because it’s the norm. Instead, consider where you like to invest and where you can successfully invest. Remember, the only guaranteed ownership is at the time of the initial investment.

– Be proactive at managing the opportunity set for reserve dollars. Have a process and constantly revisit it.

– View each follow-on option in the context of the opportunity cost of making another new investment or following-on in a different company. Think of it as new underwriting and ensure the upside is very attractive. Net multiples for funds dictate how easy future fundraising will be. If there is a little capacity left in a fund but you don’t see high multiple potential, you can always decide not to call the capital.

– While SPVs can be administratively challenging, they remain a good option if you have pro-rata in a superstar company but your fund is maxed out. Many LPs appreciate these opportunities. You can even use them to strengthen relationships with potential LPs if there is excess room after you have already offered existing LPs the opportunity.

– The most important thing is to implement the strategy where you think you can drive the highest returns. Know your strengths. Then find LPs who believe in you and your strategy.

Bold question for another day: What about a no reserves strategy? Repeating smaller funds with absolute outlier multiples on rinse-and-repeat is pretty badass 😊.

—

¹ Inclusive of all Sapphire Partners funds and underlying portfolio companies. Data as of 9/30/21.

² According to Cambridge Associates US Venture Capital Benchmarks as of 9/30/21.