It’s time to retire the phrase “The robots are coming”—the robots are already here. Almost three centuries after the first Industrial Revolution liberated human workers from tedious physical labor, the automation revolution has now arrived for knowledge workers.

At the forefront of this transformation is a new class of innovators popularly known as “low-code/no-code” (LCNC) platforms. By allowing users to customize software to their needs with little to no programming ability, these platforms, which were previously restricted to a handful of highly skilled developers, are now accessible to any employee across the organization.

Popularized in recent years, low-code adoption is picking up steam. Gartner predicts low-code app development will account for more than 65% of all app development functions by 2024. Meanwhile, two-thirds of enterprise companies will deploy at least four low-code platforms.

But “low code/no code”, while a catchy name, doesn’t do full justice to the scope of innovation that’s propelling the space to be worth more than $20 billion by 2022. A series of developments have set the stage for the current golden age of workplace automation, and it’s our belief that there are four types of products that are driving the category forward. Let’s take a closer look:

Consumerization & Innovation Gave Rise to Low Code, and a Better Way to Develop Software

Automation has long been a goal of enterprise operations, thanks to its promise to unlock efficiencies and increase productivity. But it’s only over the last few years that enterprise automation technology has started to come into its own, due to a combination of technological improvements, mounting competitive pressure and evolutions in B2B user behavior.

BPM: The Automation Revolution That Wasn’t

The first rudimentary enterprise automation solutions appeared in the1990s under the name business process management (BPM). The promise was compelling: a systematic approach to automating business processes and enhancing productivity, visibility, process enforcement and flexibility. But as a result of both business complexity and technical limitations, reality largely failed to live up to the promise.

Enterprise processes at the time were highly complicated, spanning multiple functions and departments within the same organization and BPM use cases were primarily focused on synchronizing data between proprietary systems like SAP, Oracle, NetSuite, IBM, and others. Implementing and maintaining these solutions was time-intensive and expensive, requiring heavy involvement from consultants and extensive internal training.

Even today, a look at the financials of BPM providers Pegasystems and Appian show that anywhere from 25% to 50% of total revenue comes from professional services, due to the level of time, resources and technology involved with implementation and training internal teams to use these systems.

In short, while the first generation of automation solutions promised greater innovation through digitization, BPM systems actually slowed innovation within the enterprise, due to the sheer complexity and rigidity of the solutions.

The Consumerization of Enterprise and the Popularity of Distributed Work

Today’s automation innovators are entering a very different landscape than the one that BPM companies faced 30 years ago. In many ways, the shifts have resulted in a landscape far more conducive to automation innovation.

One of the most important shifts has been in the way enterprise software is bought and distributed. The model prevalent in the 1990s—pricey software packages that centralized IT departments purchased and maintained—has been replaced by a decentralized model that more closely resembles B2C software. Self-serve and freemium business models have shifted purchasing power out of IT departments and into the hands of individual team members while also encouraging network virality in how enterprise software is adopted.

But the “consumerization of enterprise“ isn’t limited to how software is purchased—it applies to user experience, as well. The average employee today uses eight different SaaS applications on the job and, increasingly, they expect these work tools to be as intuitive and easy to use as the apps they use in their personal lives. The popularization of bring your own device (BYOD) policies has further increased the demand for turn-key, interoperable solutions that would integrate with employees’ existing tech stacks.

At the same time that organizations’ app ecosystems are growing increasingly decentralized, the workforce that’s using those apps is growing more decentralized. Even before COVID-19, remote work was increasing in popularity, but the onset of the pandemic has dramatically accelerated the trend. Three months after stay-at-home orders first went into place across the United States in March 2020, 42% of the U.S. workers were working from home full-time. Looking ahead, a PwC survey found that 55% of business leaders expect most of their employees to continue to work remotely after the pandemic has passed.

The shift toward a remote-first workforce will accelerate the demand for automation solutions. With workforces spread across cities and even continents, businesses will need ways to simplify and streamline operations in order to increase efficiency and improve visibility.

Innovation at the Speed of Low Code

The shift to remote work is not the only thing the pandemic has accelerated. Competitive pressures are also intensifying, as the performance gap between top-performing companies and everyone else continues to widen. This places increased pressure on companies and their employees to continue to innovate—particularly in the digital sphere.

Helping to facilitate this accelerated rate of innovation is the proliferation of APIs and open software platforms that have given rise to the ability to truly create workflows that transcend multiple systems. Like the foundation of a house, this digital infrastructure has provided a solid foundation for innovators to build on, and the new class of low-code innovators is showing they know exactly what to do with it.

It’s at the intersection of these three trends—the consumerization of enterprise software, the rise of distributed work and the accelerating pace of both competition and innovation—where low-code/no-code and automation platforms are coming into their own.

By making automation accessible to workers without extensive coding backgrounds, low-code platforms democratize access to IT innovation. This, in turn, frees up IT resources and developer time, helping to mitigate developer shortages within organizations. Low-code platforms also enable organizations to tackle complex business integrations, tying together numerous third-party applications and databases across the organization and keeping the whole organization in sync.

Most importantly, low-code and automation platforms deliver what every business technology innovation in history has delivered: a finer-grained distinction in the division of labor between people and machines. By managing complex processes and automating routine, repetitive tasks, low-code platforms free individuals to focus on the higher-order tasks that only humans can do—and that unlock still greater levels of innovation for the company.

The High Growth Potential of Low-Code/No-Code Innovation

We’ve laid out the market conditions that have set the stage for low code/no code and grown it into a $10 billion industry. The next question is, how much bigger is the sector likely to grow as these market forces continue to exert their pressure on enterprise operations?

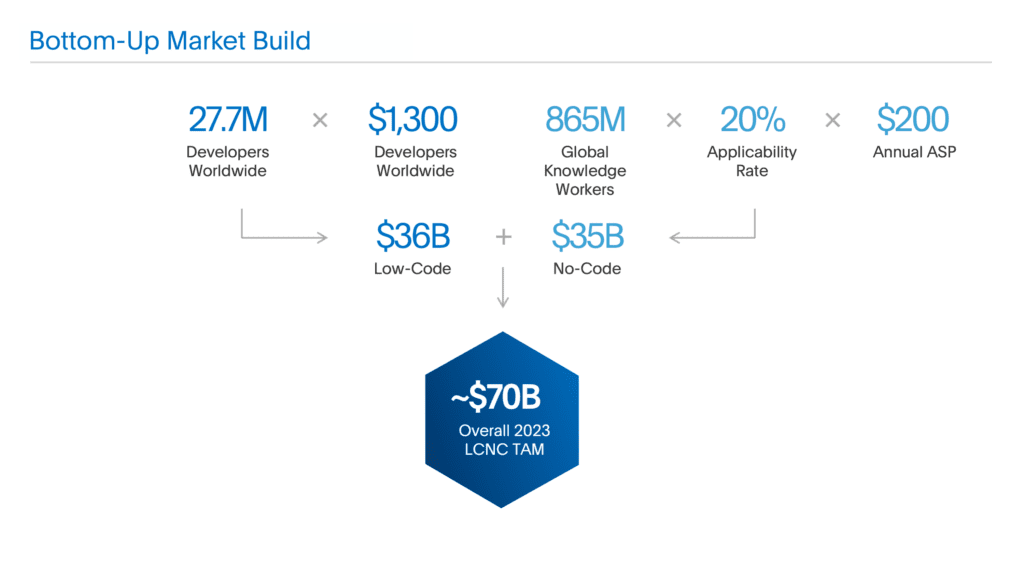

While exact answers to this question vary, what’s clear is that there is a large and expanding total addressable market with significant runway for growth. Top-down models predict the market for low-code platforms will grow to $21 billion by 2022, more than five times its $4 billion total in 2017. But viewed from the bottom up, the opportunity space could be larger still.

Assuming that roughly 28 million developers worldwide use low-code tools totaling $1,300 ASP, that equates to a $36 billion market. But it’s important to keep in mind that one of the core selling points of low-code platforms is that they extend the market for these solutions beyond the traditional developer audience. Assuming even 20% of the 865 million global information workers adopts low-code solutions at a $200 ASP, that gives us an additional $35 billion, and a $70 billion total addressable market by 2023—more than three times the amount the top-down model predicts in 2022.

Further underscoring low-code’s promise is the increased focus it’s receiving from hyper-scale providers such as Microsoft, Google, Salesforce and IBM. With its Power Platform, Microsoft is positioned to drive digital transformation within its existing customer base. As of December 2019, 86% of F500 enterprises were using Microsoft Power Apps and the number of monthly users had grown 250% year over year. To expand its low-code RPA capabilities, Microsoft acquired Softomotive in 2020.

In addition, in 2018, IBM announced its partnership with low-code development platform Mendix. Shortly after, in 2019, Salesforce announced that it acquired Tableau for $15.7 billion in a bid to expand its low-code/no-code data visualization capabilities and ServiceNow released its own low code development platform called the Now Platform. More recently in January 2020, Google announced that it would replace its own internal low-code platform App Maker with Seattle-based app-building platform AppSheet.

It’s notable that many hyper-scalers are opting to acquire or partner with low-code and automation startups rather than develop these solutions in-house. Not only does it validate low code as a major center of enterprise innovation going forward, but it underscores the fact that, for startups that get this right, a successful exit may not be far away.

4 Areas of Opportunity Within Low Code/No Code

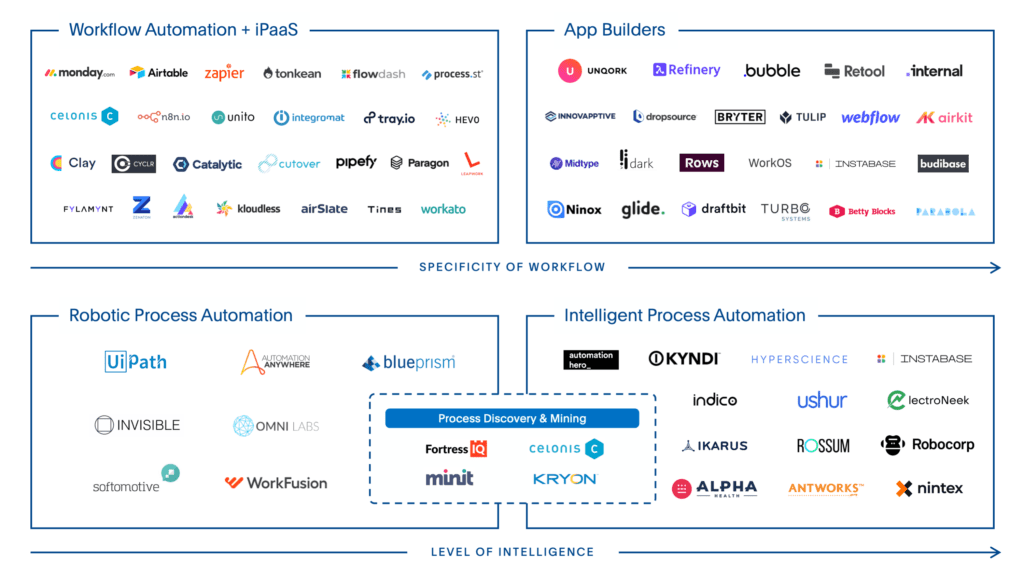

Now that we’ve established the scope of opportunity waiting to be unlocked, let’s look at four areas of technology driving that opportunity forward: Workflow Automation & iPaaS, App Builders, RPA and IPA.

1. Workflow Technology + iPaas (Integration Platform as a Service)

One consequence of the consumerization of enterprise software outlined above has been an explosion in the sheer quantity of applications in use within companies. At the end of 2018, the average enterprise organization (2,000+ employees) used an average of 129 apps—a 68% increase over four years—while smaller organizations average 73 apps.

Our first category of automation innovators—workflow technology and integration platform as a service (iPaaS)—has its sights set on bringing order to that chaos and helping companies streamline and automate business processes across their numerous applications.

Airtable and Sapphire investment Monday.com are among the early leaders in this category due to their familiar spreadsheet-like interfaces and the breadth of use cases they could address. There’s now a new wave of companies building on top of these ideas, which explore intuitive approaches.

General workflow automation platform Tray.io, for example, is applying graphical interfaces to the workflow automation problem. What started with just a few email-based automations now includes integrations with over 400 apps. The company counts IBM as a partner and has raised total funding of more than $100M.

Tonkean and Flowdash take a promising approach by going one step further and orchestrating workflows around the “human in the middle” versus solely between applications. Most workflow automation and iPaaS solutions lack capabilities that intelligently route and delegate many human tasks that cannot be abstracted and focus on automation only. Tonkean and Flowdash provide both and act as an adaptive middleware that becomes smarter and more personalized over time.

Process Street, another entrant in the workflow automation category, has its roots in the “work from anywhere” movement, starting as an internal solution for founder Vinay Pantankar’s distributed marketing company before going on to raise $12 million in Series A funding. They’ve also landed customers including Accenture, Spotify, Salesforce and Atlassian (the last two of which are also investors in the company).

Workflow technology and iPaaS solutions are gaining popularity due to the strength of their ability to orchestrate and automate end-to-end business processes, as well as their potential to abstract all interfaces to a UI of choice. Solving more advanced problems based on intelligent data cleansing and data quality management will be the next important milestone for many companies in this category.

2. App Builders

While workflow automation and iPaaS solutions focus on improving the interoperability of existing apps, a second category of low-code/no-code innovators is focused on helping workers build custom applications of their own.

One of the chief value propositions of app builders is their promise to increase the speed with which applications can be operationalized. Drag-and-drop code builders like Retool, for instance, allow developers to build internal apps up to 40 times faster than if they were writing the code from scratch. Apps built with app builders are also easy to maintain, adjust and update—a selling point unto itself, given that developers spend more time on maintaining code than they do on writing new code.

While the app-builder category is still in the early stages, there have been a number of high-profile early successes in the space. In October 2020, Retool raised $50 million at a buzzed-about $925 million valuation. The company counts Amazon, Progressive and Peloton among its customers. In September 2020, low-code web builder Webflow was named to the Forbes Cloud 100, a list of the top 100 privately held cloud companies, and recently raised a $140 million Series B at a $2.1 billion valuation. And Bubble has built an extremely powerful, fully customizable platform that allows customers to create interactive, multi-user apps for desktop and mobile web browsers, while also managing deployment and hosting.

Despite all the excitement, there are still challenges and unresolved questions in the app builder sector. For one, most of today’s solutions focus on allowing customers to build internal applications versus customer facing applications that have much more complex requirements in terms of security, design, reliability, regulations like GDPR, HIPAA, etc. Airkit is a solution that addresses these issues and allows its users to build personalized customer engagement workflows in a low-code fashion.

Ultimately, it’s important to understand that these tools still require humans with the time and ability to master them, including any app sprawl and the resulting application lifecycle management. As a post on Webflow’s blog emphasizes, even no-code tools “require technical users—people who can debug, people who can think in abstractions, and, above all, people who know how to glue just the right tools together in the right way to produce business value.”

3. RPA (Robotic Process Automation)

While young companies are able to implement automation built on low-code/no-code platforms, the shift toward greater automation is not without its risks for older enterprise companies. These organizations have extensive existing infrastructure and established business processes–disruption to any of which could spell disaster for the organization.

This is where robotic process automation (RPA) systems have their chance to shine. These solutions offer a “best of both worlds” scenario of being able to automate some mundane task, boost productivity and free employees to focus on higher-order tasks—without disturbing underlying business processes. As a recent post by UiPath puts it, RPA “lets companies tie existing processes together without needing to rip and replace what they already have.”

Clearly, the value proposition resonates with enterprise audiences. RPA was the fastest-growing category in enterprise software in 2019, according to Gartner. That’s why it’s no wonder that UiPath announced a $225M Series on a $10B valuation in August 2020. According to CFO Ashim Gupta, recurring revenue has quadrupled from $100M to $400M in the last two years. And Automation Anywhere recently raised a $290M round.

But there are limitations to RPA technology that call into question the technology’s durability as a stand-alone low-code/no-code player. For one thing, RPA systems only work with structured data, which limits their usefulness outside of a few business functions, such as finance and accounting. RPA systems also tend to be fragile, require significant resources for maintenance and lack intelligence capabilities that allow the systems to adapt and learn over time. It seems probable that in the long-term, RPA will become a feature of broader platforms, as opposed to a stand-alone tool (e.g. see Microsoft’s acquisition of Softomotive).

4. IPA (Intelligent Process Automation)

First-gen RPA solutions may face a test of their staying power sooner than they realize, and in the form of challenges from our final category of automation, Intelligent Process Automation (IPA). These platforms take the core premise of robotic process automation and add an artificial intelligence layer.

IPA systems directly address many of the limitations of RPA platforms. IPA systems are able to work with both semi-structured and structured data—a meaningful improvement, given the fact that less than 20% of all data is structured. IPA tools also have the ability to mimic human interaction and make advanced decisions, as well as continually learn and improve from user feedback.

The first crop of promising players in the IPA field is just now starting to emerge. For example, ElectroNeek, which streamlines automation for IT professionals and other workers without a background in robots, graduated in the 2020 class of YCombinator companies. Another IPA entrant, Robocorp, raised a $5.6 million seed series in November 2019 for its solution that combines RPA with open source technology. While many IPA providers take a horizontal approach, others are much more focused on a specific vertical or use case. Examples include AlphaHealth for healthcare revenue cycle management, Indico for document intake and understanding, or Ikarus for accounts payable.

There are still challenges to be navigated in IPA. These systems still require initial training and guidance from human operators, and players will need to continue to innovate around automating workflows and processes end-to-end.

High Hopes for Low-Code/No-Code Innovation

Throughout history, popular narratives around automation have centered on horror stories of mass unemployment, but the truth is far more optimistic.

What we’re seeing isn’t a mass displacement of human ingenuity–it’s a shift in where that ingenuity is focused. A 2018 McKinsey report predicts that there will be a 15% decrease in hours spent using basic cognitive skills from 2016 to 2022, while the time spent on social and emotional skills and technological skills will increase by 24% and 55%, respectively.

In other words, the robots aren’t replacing humans, they’re freeing us to focus on the kinds of skills—creativity, innovation, empathy, etc.—that humans are uniquely suited to perform. Here at Sapphire, we’re excited to see the new levels of uniquely human innovation that low-code and automation platforms will unlock—and we look forward to partnering with the innovators who help make it possible.