There are few human connections as strong as the one that sports fans have with their teams. Entire identities are formed around local team loyalties. Sports fandom unites cities and brings families and friends together. The memories we form watching sports when we are young are the stories we’re still talking about decades later.

And it all plays out on the television screen. That is, it has — until now.

Digital technologies have transformed the way we do everything, from how we buy groceries to how we stay in touch with friends and family. How we connect with our favorite teams is no exception. The advent of digital media and the disruption of traditional media distribution channels are changing the rules about how sports fans engage with the leagues, teams and athletes they follow.

These shifts have big implications for stakeholders across the sports world. With a projected $21 billion in yearly media rights revenue on the line this year in North America alone, teams, leagues, networks, and investors are all asking the same question: What does a successful sports media operation look like in a post-television, digitally connected world?

This is where the Sapphire Sport platform comes into play. When we introduced Sapphire Sport in January, we explained that sports, media and entertainment has all the characteristics we look for as venture capitalists: large, fast-growing markets; technological disruption; and new experiences, business models, and platforms being created as a result of that disruption. We identified four core markets where we see that potential:

- Next Gen Media

- Digital Health and Fitness

- Gaming and eSports

- Data Analytics and Sports Betting

In this post, we’ll focus on the Next Gen Media piece of the puzzle and how the shifting sports media landscape translates into exciting opportunities to help shape how people watch and experience their favorite sports teams.

How Digital Technology Is Disrupting Sports Media

For a while, there were those who held the line that sports would be the exception to the digital disruption rule. Supposedly, there was something endemic to the sports viewing experience that demanded a sit back, traditional television experience. In fact, pundits posited, sports would be the thing that kept the traditional MVPD package afloat.

But time — and the data — has not been kind to this thesis. When you look at the numbers, it’s clear: digital disruption is not only coming for sports media — it’s already here.

But disruption is, by its nature, creative as well as destructive. For every traditional avenue that digital disruption has closed, there are new avenues opening up on all sides, all leading to exciting new ways for sports fans to engage with media.

Before we dive into those, let’s take a moment to talk about what, exactly, has happened in sports media — and what it means to the brands that are feeling the tectonic shift.

Rise of the cord-cutter: How consumer viewing habits have changed

The story in sports media is much the same as the stories playing out in its sister verticals, serialized television and film. Legacy formats — traditional cable and local broadcast channels — have seen growth challenged as next-generation platforms — direct-to-consumer (DTC) streaming services and other over-the-top (OTT) platforms — continue to proliferate.

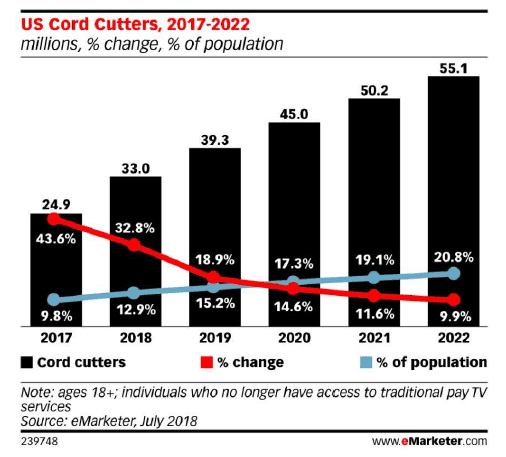

33 million households have quit their multichannel video programming distributor (MVPD) as of 2018, according to data from eMarketer. 50% of Americans aged 22-45 watched zero hours of traditional television last year. Meanwhile, more than 50% of American households now subscribe to a streaming service. By 2023, the number of subscription OTT users will nearly triple the number of traditional pay-TV subscribers.

The fundamentality of streaming services is particularly pronounced among younger viewers, many of whom have never subscribed to traditional cable in the first place. These are ‘cord-nevers.’ 56% of millennial sports fans use streaming websites and apps, compared with 29% of Gen X. And as millennials and the subsequent generation, Gen Z, start to account for a greater percentage of viewership (and, just as importantly, buying power), it has never been more imperative to meet these viewers where they are — in a mobile and digital environment.

How sports fans watch isn’t the only thing that has shifted: how much they are watching has shifted as well. The number of hours people have to allocate to entertainment is finite, and, in today’s media landscape, viewers have more options than ever before. Video games, eSports, and the seemingly infinite binge-able offerings of Netflix, Hulu, Amazon and others are all vying for sports fans’ limited viewing time — and sports doesn’t always come out on top. Viewership of regular-season NFL games was down 8% in 2016 and a further 10% in 2017 before rebounding 5% in 2018.

Taken together, what these facts show us is a media landscape in flux. The way that people engaged with sports media five, ten, twenty years ago isn’t necessarily the same as the way they’re engaging with it now or will engage with it in the future. Now, let’s talk about why that matters — and who it matters to.

Death of a business model? Why Sports Media stakeholders are feeling the pinch.

These tectonic shifts in viewing habits mean it’s an interesting time to be a sports media rights holder — especially if your business relies on traditional delivery business models tethered to monthly subscriptions or advertising dollars. New bidders in the marketplace such as the FANGs and DAZN are helping to prop up more traditionally valued rights, while fewer eyeballs watching ads and continued pay-TV atrophy work against the rights holder. And given that the sports media piece of the pie is $40 billion annually and that media rights account for anywhere between 25% and 40% of the economics of any league or team’s income statement, then long-term asset valuation is at risk.

Meanwhile, there’s a second challenge confronting media brands that runs parallel: the “data disruption” problem. Media analysts love to talk about how data is “the new oil,” but in reality, data is increasingly no longer an advantage — it’s the price of admission.

Digital-first brands like Facebook, Amazon, Netflix and Google have this valuable data on their viewers, and they’re able to put that data to work to inform business decisions, drive engagement and growth, build new viewer experiences, and generally fortify their connections with their customers. But teams and leagues don’t have access to that kind of information — and without it, they are essentially flying blind and at a disadvantage to more data-enabled brands. We as consumers give our data to almost any entity that asks, from airlines to social media sites to digital commerce to credit agencies. Yet the teams and leagues that we love and have more affinity for that virtually every brand on the planet in most cases have no conduit through which to connect to their fans in a data-centric manner.

Marquee legacy brands are making their move

With any major disruption event, it’s worth paying attention to what the legacy power players in the space are doing in response. In the case of sports media, what they’re doing is investing in next-generation media solutions that can bring them closer to where their target audience is: digitally.

Major media players including Disney (owner of ESPN) and Fox have made significant investments in sports-specific streaming solutions over the past several years. In 2017, Disney acquired a controlling share in BAMTech, a direct-to-consumer streaming and marketing platform, valuing it at $3 billion. A year later, Fox invested $100 million in gaming broadcast platform Caffeine.

There are other signs as well. Leagues are beginning to launch their own DTC offerings. Tech giants from Google to Facebook to Amazon have increasingly been bidding on sports media rights.

There are three key lessons we can draw from this:

- There is value in next-gen sports media. Disney and Fox’s investment in the streaming solutions space validates demand for next-generation media solutions catering specifically to sports. And if two of the largest and most well-resourced corporations on earth are turning to outside technologies instead of building out a solution internally, smaller entities will need to do the same.

- Brand and viewer alignment matter. It’s worth noting that neither BAMTech nor Caffeine are truly tech companies, in that neither company developed any original or proprietary technology. What they have done is build a platform solution and viewer experience that aligns with the way younger demographics prefer to consume media — the same demographics that Fox and Disney are eager to win back.

- The market is underserved. As these companies get acquired and are brought in-house, their solutions become proprietary, meaning they are no longer serving the breadth of clients that they did as independent brands. This creates an opportunity for new up-and-coming technology enabled companies to step in and fill that gap in the market.

When we look at all of these factors together — the shift in viewer behavior, the resulting challenges posed to traditional business models and the moves that mature brands are making to secure their position against these shifts — we see ideal conditions for venture investment opportunities.

The Sapphire Sport Playbook

Sports media is a sprawling, complex ecosystem. When you talk about “media,” it covers everything from how content is created to how it’s distributed to the supporting technologies that service this, including sponsorship and data collection, and ultimately the consumer experience and how that translates to who’s watching and how much they’re watching. There exists opportunity across the full breadth of this landscape, and the stage from which to ask: Is there a better way to do it?

- Is there a better way to deliver content to viewers so that they will actually see it and engage with it?

- Is there a better way to unlock profitability in sports media so that brands can continue to grow?

- Is there a better way to incorporate data analytics to enable brands to guide their media decisions with even more precision?

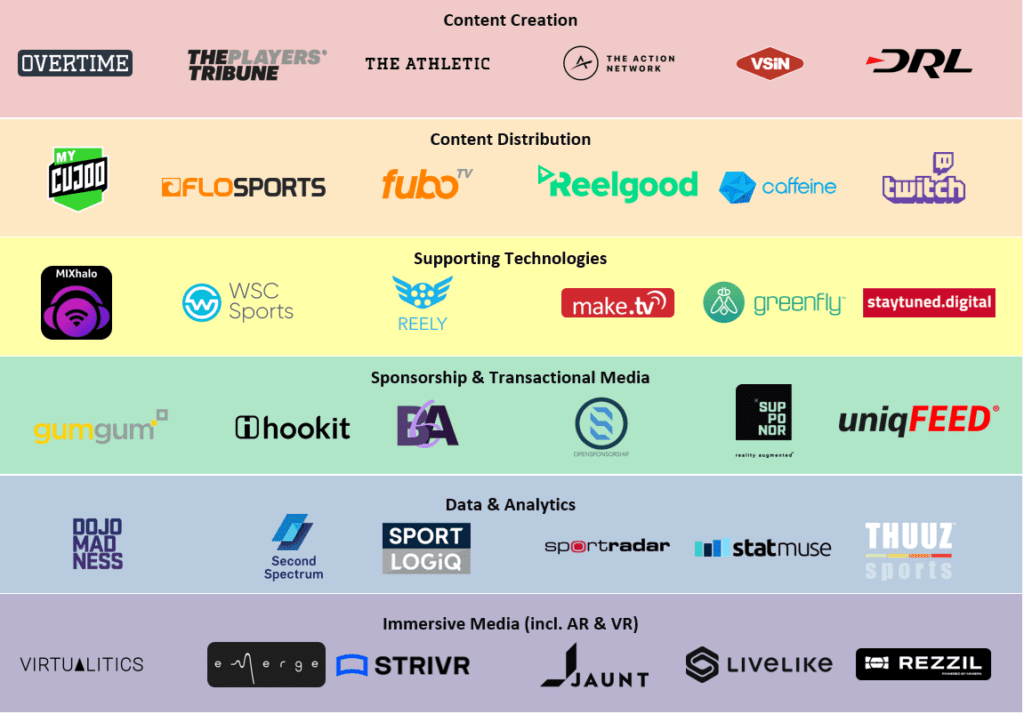

With that in mind, we’ve organized our potential areas of investment in the sports media space into six key categories, all built around the idea of helping sports brands have more control over how they deliver their media and how they connect with their fans in a digital-first media landscape.

The Next Generation Media Landscape (1)

- Content Creation: The genesis of digitally native written, audio and video content, if people are consuming content differently it stands to reason that content should be created differently. For example, Overtime and The Athletic are leaders in innovating in video and print content across the sports media landscape.

- Content Distribution: Companies that are developing paths through distribution that both deepen and expand the ways fans connect with their favorite sports brands. Take, for example, the streaming experience of Twitch, which enables deeper levels of engagement through live chat.

- Supporting Technologies. Here we cover a wide array of supporting platforms and technologies that go into the production and distribution of media including filming and editing, packaging and measuring, streaming operations, ad tech — basically any solution that adds value along the media continuum is interesting to us.

- Sponsorship & Transactional Media. Here we look at solutions that can help brands get in front of and resonate with the demographics they’re trying to reach. Global sports sponsorship is a $35 billion marketplace annually, and brands messages are increasingly getting lost in a digital world.

- Data Analytics. If data is the currency of success in the media landscape, sports brands need to participate. How can sports brands’ data ownership be commensurate with the affinity their fans have for them is the question we are trying to answer through investment.

- Immersive Media. Slower to develop, but bursting with potential for the sporting world. VR and AR technologies have become less futuristic science fiction and more a reality of how people interact with content.

The Playbook in Action: Overtime + Mixhalo

As an investor, it’s one thing to form a hypothesis and an entirely different thing to start putting those theories into action by singling out the businesses that you feel confident will be the ones to carry the ball forward. At Sapphire Sport, we’ve started to do exactly that with our investment in two exciting young sports media companies: Overtime and Mixhalo.

Overtime. Overtime is a company whose core brand values begin in content creation. We are believers in the ‘athlete as a brand’ (and as investor) at Sapphire, and Overtime puts the athlete at the center of its brand. We believe that ‘The Next Gen Athlete’s’ sports network is Overtime, not a traditional media company. They are telling the stories younger demographics want to hear, and share, and doing so in a way that is getting the attention of major brand sponsors like adidas, Puma, Nike and Converse. In essence we go right to the source with Overtime who is solving the problem of how the right kind of sports content can be created and distributed for the benefit of both consumers and sponsors in today’s day and age.

Mixhalo. Now when people talk about media, the default is video and digital print and sponsorship. But media is more than that – audio is a major component to how we consume entertainment, Mixhalo is democratizing (while digitizing and modernizing) the audio experience in venue. First in the live music space and now moving into the sport space where providing team and venue owners with new revenue opportunities. Mixhalo is delivering next-generation audio solutions that send high-quality, real-time audio from the playing field, announcer’s booth, or any other source to attendees’ devices and ear buds. The result is a more immersive, multimedia experience and exactly the kind of innovation that we designed the Sapphire Sport thesis to support.

The Season’s Just Beginning in Next Gen Sports Media

It’s never been a more exciting time to be a sports fan, and it’s never been a more exciting time to be investing in technologies that are disrupting sports media. I started this post by talking about the power that sports has to bring people together. The memories we form from watching sports together are memories we carry with us throughout our whole lives. Over the next 10 years, we have the chance to help shape how the next generation makes those memories. Game on.

(1) Sapphire Ventures is not invested in all companies shown in table above. Companies shown are those which Sapphire feels best represent various sections as outlined