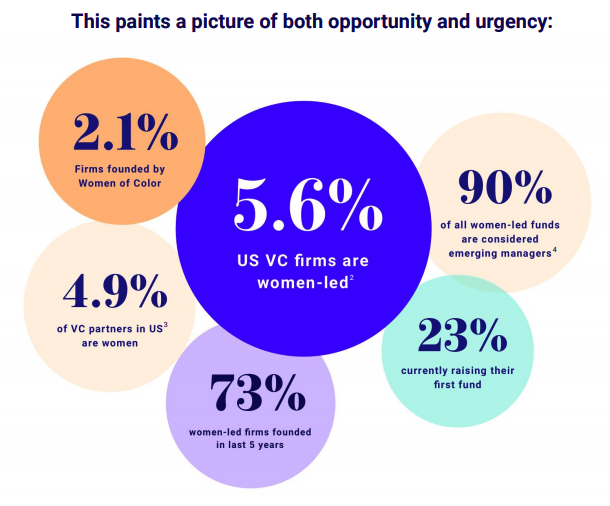

This winter, Women in VC, the world’s largest community of female venture investors, released a report on “The Untapped Potential of Women-led Funds.” The research was stark, if not surprising. According to the group’s proprietary data, 5.6% of U.S.-based VC firms are led by women (with less than half of those being founding partners), and Black and Latinx women each make up just 0.2% of VC partners. These dismal stats have a huge downstream effect as the report points out: a lack of diversity among fund managers directly contributes to the funding gap for women- and minority-led startups.

At Sapphire Partners, we’ve always believed that diverse teams drive strong results. Since our founding in 2012, we’ve invested in early-stage venture funds (predominantly those focused at Series A) across the U.S., Europe and Israel through an evergreen-like structure that allows us to partner with our GPs for the long term. As a diverse team ourselves, we’ve never had a separate bucket for “diversity” dollars, instead directing our core investments to the most promising funds.

The report ends with a call to action. We took it to heart and wanted to share our response to the report’s recommendations, as well as our general approach to inclusive investing. Increasing diversity in the tech ecosystem is a collective action — No one type of investor or person can do it alone. Here are the steps we took:

1. Do a diversity audit

As a first step, the Women in VC report suggests gauging the diversity of the managers in your existing portfolio. This makes sense — You have to know where you stand before you can take a step forward.

In addition to the numbers in the Women in VC report we also looked at those shared by AllRaise and Axios. By AllRaises’s math only 12% of decision-makers (e.g., check writers) at U.S. venture funds greater than $25m are women. This summer, Axios released a study that said nearly 12.4% of decision-makers at U.S. venture capital firms that had raised at least one fund of $100 million over the past 5 years are women, up from 9.65% in a similar study in February 2019. Axios also noted that 61% of the funds they surveyed did not have any female decision makers.

When we looked at our numbers, we were heartened to see that our portfolio was more diverse than industry averages – noting that the industry averages are depressingly low and there is room for improvement in our numbers as well. In our current active U.S. funds out of all the partners (those with check-writing authority), almost 20% are female partners. More encouragingly, over 50% of our current active U.S. funds have at least one female partner. And the average U.S. fund size we invest in is larger than the $100 million floor Axios set for their study.

We also noted that our investments have become more diverse over time. We think this is a function of both the industry diversifying and with whom we have chosen to invest. For example, if we look at the U.S. funds we invested in during our first three years of LP existence, only 11% had at least one female partner at the time (compared to our current active portfolio that has over 50%). And in our last three years of new U.S. commitments, currently 60% of these funds have at least one female check-writing partner, and 90% have either a female or non-white male partner.

We look to avoid bias when evaluating investments by using a structured standardized process we put all funds through that concentrates on performance and GP/product market fund fit. Our ability to serve as a permanent source of capital enables us to focus on the funds we believe will generate the highest returns. Lastly, we work hard to keep expanding our networks, amongst GPs, LPs and entrepreneurs.

We’re proud of the progress we have made with our portfolio, but there’s still plenty of room for improvement. In our current active international portfolio for example, only thirty 3% of our funds have at least one female check writer. Thanks to our audit, we can continue tracking improvements over time, and we hope other LPs will join us in moving toward transparency (we’d be happy to share our methodology).

On a last ‘audit’ note, the Women in VC report stated that female funders are more likely to invest in female entrepreneurs. What if the same is true at the GP/LP level, are female LPs more likely to invest in female GPs? This then begs the question — how diverse (or not) is the LP world? We couldn’t find any research to answer this question for us so we reflected on our own experience. Anecdotally, most annual meetings we attend have at most 20-30% female representation amongst the LPs present and sometimes I (or my other female colleagues) are the only women. When it comes to the U.S. LPACs (Limited Partner Advisory Committee) we serve on, in about 50% of the time, I (or my female colleagues) are the only female LPs. This does not of course tell the full make up of a LP team or who the ultimate decision makers are that have decided to invest (or not) into a fund but does suggest to us while the LP world feels more diverse than the GPs in venture, it is still not fifty fifty and potentially the diversity at the LP decision making level is also holding back diversity in tech.

2. Invest out of a core fund

At Sapphire Partners, we invest in all GPs through our main fund rather than carving out a separate “diversity” initiative. As the Women in VC report observes, a set-aside fund for diverse managers can sound like a good thing, but it can also run the risk of limiting the ability of women and underrepresented minority (URM) fund managers to access the larger checks typically reserved for core investments.

From our point of view, making an unbiased approach the heart of your investing strategy is the key to both greater diversity and a stronger portfolio. Too often, investing in diverse managers is discussed as something LPs “should do.” We think a homogenous lineup runs the risk of potentially overlooking deals outside of one’s network and thereby capping one’s returns. It doesn’t make sense to us that any one demographic would have a monopoly on great ideas, and a wealth of research shows that diverse teams are often more innovative and make better decisions. We believe LPs (and GPs) that are missing out on diversity might also be missing out on financial gain.

3. Make connections

Even when we can’t write a check ourselves, we try to build bridges between women and URM fund managers, LPs and entrepreneurs when possible. Every year, our firm holds multiple formal and informal events to build networks, ranging from casual dinners that introduce female GPs to female entrepreneurs as well as ones focused on introducing women and URM GPs to LPs to more formal events hosted by the Sapphire Ventures Talent team.

As the report suggests, we also make introductions to other potential providers of capital behind the scenes. We look to make introductions across all levels — from associates up to partners. We believe that in addition to supporting and making introductions to today’s leaders, another way the industry will see significant change is if we help establish relationships and support the future pipeline of female and URM GPs, LPs, and entrepreneurs as well. Lastly, when speaking on panels or podcasts, we routinely suggest diverse speakers to join us.

There are plenty of opportunities beyond check-writing for LPs to promote funds led by women and other URM GPs. But here too, avoiding a diversity silo is critical. The Women in VC report stresses the importance of making connections to “gender-neutral capital opportunities,” rather than just introducing women to other women or those in established diversity initiatives.

4. Be part of the conversation

We started OpenLP, an online community, five years ago to boost transparency among LPs, GPs and entrepreneurs. The LP world historically has been quite opaque and we welcome the opportunity to help foster greater understanding. We have also been honored to participate in conferences that focus on addressing disparities in the industry. Recently, I moderated a LP panel at the Black Venture Institute and another on how to raise your own fund for Carta’s Table Stakes event, while my colleague Laura Thompson led a panel about GP-LP interactions at the annual All Raise Summit.

Sometimes, there are also more subtle, informal opportunities. I recently reviewed the deck of a fund manager who emphasized their focus on investing in diversity. Yet all the portfolio photos they chose to highlight in the deck were of white men. They hadn’t noticed the discrepancy until I pointed it out.

There are hopeful signs that the venture industry is starting to diversify. According to an analysis from All Raise, a nonprofit promoting female founders and investors, a record number of women became partners in U.S. venture capital firms with over $25 million AUM in 2019 (52 compared to 38 the previous year). Over 90% of women-led funds are emerging managers, according to Women in VC, which means we now have an opportunity to turn the tide. There’s a long way to go, but LP dollars and engagement can be a meaningful bridge between where we are today and a more inclusive future.

LPs have an important part to play in improving diversity in the venture ecosystem. As the ones holding the proverbial purse strings, LPs can make investments, create connections and spark conversations that drive change. Tackling structural challenges can feel daunting, but the Women in VC report spells out tangible steps that any LP can take today to move the needle.

I look forward to hearing what other LPs are doing. I certainly don’t think we have all the answers, and we have a lot more work to do but we are excited to do this work and to continue to be part of the conversation.