Every customer interaction I have as CEO of ThoughtSpot is an opportunity to learn about business transformation. In one meeting, I’m learning about how data is transforming a mom-and-pop restaurant businesses, while at the very next meeting I’m learning about the supply chain seasonality challenges of a global toy business. What we’re building at ThoughtSpot is at the center of all these, which is very exciting.

—Sudheesh Nair, CEO, ThoughtSpot

According to recent data from CBI Insights, 70% of tech startups fail — usually about 20 months after they’ve first raised their first million in financing.

That isn’t surprising. Getting to product/market fit by itself — not to mention building a successful marketing and sales engine, scaling a team, and navigating the numerous challenges of go-to-market — are formidable. At Sapphire Ventures, one of our core strategies is to uncover those rare companies that have overcome these early obstacles, and then help take them to the next level. When we find these teams, we commit for the long haul.

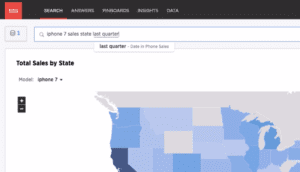

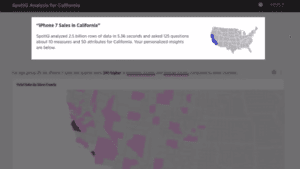

Today we’re excited to announce our follow-up investment in ThoughtSpot — a visionary search & AI-driven analytics platform transforming business intelligence by bringing data insights to everyone in the enterprise (not just analysts and data scientists). Recently named a Leader in the Gartner 2019 Magic Quadrant for Analytics and BI Platforms, ThoughtSpot empowers any business user to find insights in their company’s data through a simple search experience, which requires a deep architecture powering sub-second performance across billions of rows of data. In addition, the platform includes an AI-driven automated insights engine (SpotIQ) that lets users select simple terms, such as “product sales”, and the system automatically generates valuable insights to questions they might not have known to ask.

Two of the biggest names in the Business Intelligence and Analytics category — Looker (also a Sapphire Ventures investment) and Tableau — were recently acquired within days of each other for a combined total of $18.5 billion. Google (GCP) and Salesforce made these acquisitions because of the recognition that BI and Analytics are becoming the lifeblood of all enterprises as they transform themselves to be more agile and data driven. However as we know companies that get acquired often have a short shelf life and they become slower to innovate. The void left in the market because of acquisitions have to be filled and that is where a company like ThoughtSpot with its unique search-based analytic capabilities and a truly incredible management team to fill it.

Instead of delivering this information in technical jargon, ThoughtSpot both receives and displays queries in natural language, so that everyone — from frontline employees to C-suite executives — can quickly interact with their data and take action.

Since its Series A in 2012, the company has taken off. It now counts more than half of the Fortune 10 as customers — along with major enterprises like Walmart, Hulu, Daimler, 7-Eleven, and Rolls-Royce. Sales grew by 195% in the first half of the year, allowing the team to expand into Singapore, Tokyo, Dusseldorf, and India. Internally, ThoughtSpot has grown employee count by more than 65%, to nearly 500 employees, and has been recognized as a Technology Pioneer by the World Economic Forum, one of the 100 most important cloud companies by Forbes, and one of the 50 best private cloud companies to work for by Glassdoor and Bessemer Ventures.

Many factors have contributed to this rise; however, the most important has been leadership. Co-founder and executive chairman Ajeet Singh’s product

expertise combined with CEO Sudheesh Nair’s leadership and customer empathy has lifted ThoughtSpot to a new level.

Ajeet and Sudheesh have known each other for years. The duo worked together at Nutanix, which Ajeet co-founded and where Sudheesh built and led the sales organization from zero to over $1 billion in revenue. We originally invested in Ajeet’s business because of his impressive track record, keen understanding of the market, and extraordinary technical talent. Yet as ThoughtSpot began to take off, Ajeet realized he needed a partner once more. Today, Ajeet drives the development of the ThoughtSpot platform, while Sudheesh spearheads operations and tackles building a diverse, high-performing team.

In his new role, Sudheesh has not only proved himself to be enormously talented at hitting and exceeding goals for growth — he also has a rare empathy and understanding of organizational behavior. At a time when so many tech teams are balancing the pressures of scaling with the desire to remain creative and experimental at their core, Sudheesh has a unique ability to balance the personalities, values, and skill sets of early-stage employees — many of whom thrive in a chaotic, experimental environment — with later hires, who often bring more operating experience and appreciate order.

Yes, we think ThoughtSpot has an amazing product, but if you want to know the real drivers behind ThoughtSpot’s ascension, I would point to the culture of selfless excellence Sudheesh and Ajeet have created that includes:

- employees with missionary-like zeal, who go above and beyond their job descriptions in pursuit of excellence – not for personal glory, but for the good of the company and customers;

- a transparent and supportive work environment for all types of talent; and

- flexibility to pivot when challenges and opportunities arise.

(If you want a deep dive into Sudheesh’s leadership style, he presented his approach and the lessons he’s learned in this video from Sapphire Ventures’ recent Cloud Go-to-Market Summit.)

It’s a privilege to continue the journey with Sudheesh, Ajeet, and the entire ThoughtSpot team. This is a rare opportunity — and we’re incredibly excited for what’s to come.

Disclaimer: Nothing presented within this article is intended to constitute investment advice, and under no circumstances should any information provided herein be used or considered as an offer to sell or a solicitation of an offer to buy an interest in any investment fund managed by Sapphire Ventures. Information provided reflects Sapphire Ventures’ views as of a time, whereby such views are subject to change at any point and Sapphire Ventures shall not be obligated to provide notice of any change. Companies mentioned in this article are a representative sample of portfolio companies in which Sapphire Ventures has invested in which the author believes such companies fit the objective criteria stated in commentary, which do not reflect all investments made by Sapphire. A complete alphabetical list of Sapphire’s investments made by its direct growth investing funds is available here. No assumptions should be made that investments listed above were or will be profitable. Due to various risks and uncertainties, actual events, results or the actual experience may differ materially from those reflected or contemplated in these statements. Nothing contained in this article may be relied upon as a guarantee or assurance as to the future success of any particular company. Past performance is not indicative of future results.