The B2B revenue process has changed dramatically in recent years. Buyers are more informed, armed with information gathered from many sources before engaging vendors. New subscription and consumption-based business models require different management and measurement approaches, and ever-increasing competitive pressure and accelerating pace of change requires B2B teams to be much more agile than in the past.

The rise of revenue operations

All of these dynamics highlight the need for a different approach to managing the modern revenue process. To respond to these changes, innovative companies are combining their marketing, sales, and customer success teams into a single business function called revenue operations (or RevOps). The purpose of this new alignment is to create more transparency and accountability between team members as they work towards their shared goals of customer acquisition, retention, and account expansion- i.e. the levers that accelerate a company’s top-line growth.

Pendo, and Contentful. As business leaders eliminate inefficiencies and try to find new ways to create more relevant and satisfying experiences for their customers, they are focusing on how to make revenue operations teams work more cohesively and efficiently. Recent data shows that companies with formal revenue operations teams grew sales 3X faster in 2019 than those who didn’t — and public companies with revenue operations teams had 71% higher stock performance.

Although revenue operations has become one of the fastest growing roles in enterprise sales, the technology to support it has lagged behind. It’s relatively easy to find tools that empower marketers, sales reps, and customer success teams to do their jobs faster and with greater attention to detail. But to bridge these teams and bring their different tech silos together, organizations typically have had to cobble together hand-coded spreadsheets, custom reporting and manual processes.

A new way to revenue

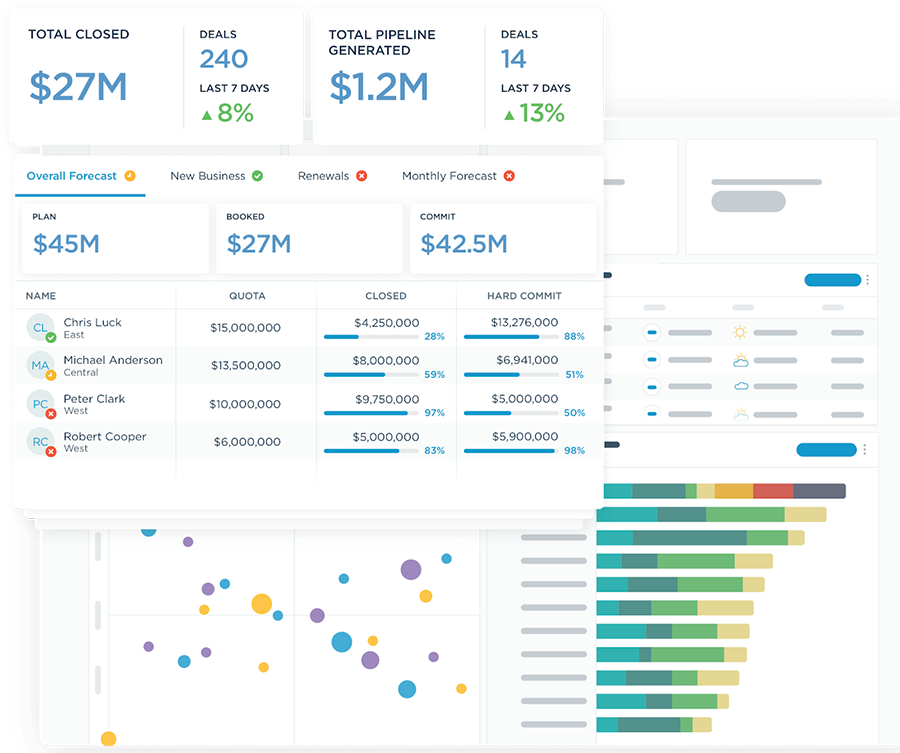

Clari, the latest addition to the Sapphire Ventures portfolio, anticipated this problem and has been working to solve it since its inception. The company’s powerful platform offers complete visibility into which leads in the pipeline will turn into customers and which customers at risk for churn or are primed for upsells. It even provides finance and operations teams insights to improve forecasting accuracy, and measure sales and marketing team productivity. In essence, Clari provides a single view and shared set of workflows for a company’s go-to-market operations — yet its ability to harness AI and machine learning to improve them truly sets the system apart.

Clari works alongside its customers’ existing marketing automation system, CRM, emails, calendars, and other repositories of revenue information and uses its AI/ML to automatically associate and bi-directionally sync each data point with its correct account and opportunity. From there, it generates valuable insights on active and potential deals and highlights how sales reps and marketing campaigns are engaging with these leads and prospects. Clari can help sales leaders coach reps on how to allocate their time and improve their communications to close more deals in less time. It also ensures that the team has a full picture of every contact, aggregating information from every customer touchpoint into a single, comprehensive, and easily accessible view.

Since its inception, Clari has raised $75M from investors — including its last round of $35M (less than a year ago). It’s grown both customer count and employee count by 100% YOY — and shows no signs of slowing down.

We’ve been following Clari and its CEO Andy Byrne for the past four years as they’ve doubled down on product and launched an enormously successful GTM strategy while the revenue operations movement heated up. As a leader, Andy brings more than two decades of experience in sales, marketing, and management to Clari — and this is far from his first rodeo. Prior to Clari he was part of the founding team at Clearwell Systems, where he helped grow the company from pre-product & pre-revenue to $100 million run rate until its acquisition by Symantec (SYMC).

The success of a startup never hinges on any one person, however, and Andy has gathered a highly experienced, high-performing team around him. Clari’s CTO Venkat Rangan has more than 36 years of experience (22 years of executive experience) designing and architecting enterprise software products. VP of Product Kurt Leafstrand also has more than two decades of experience, previously serving as Senior Director of Product Management at Clearwell and Director of Product Management at IBM. Clari’s CRO Kevin Knieriem formerly led sales teams at Oracle and SAP (where he spent a decade and ran many of SAP’s US retail lines).

Simply put, we’re inspired by the brainpower and maturity of this team, who we believe are more than well equipped to bring Clari to the next level.

Revenue operations may be new, but Sapphire has been investing in this space for years. Through our investments in LeanData, Highspot, and Outreach, we support and collaborate with founders working at the front lines of automating and improving the revenue operations business process every day. We’ve been privileged to see this sector develop and come into focus for other VCs and high-growth teams — and are thrilled to bring our expertise and network to support Clari as it continues to lead the pack in the years to come.