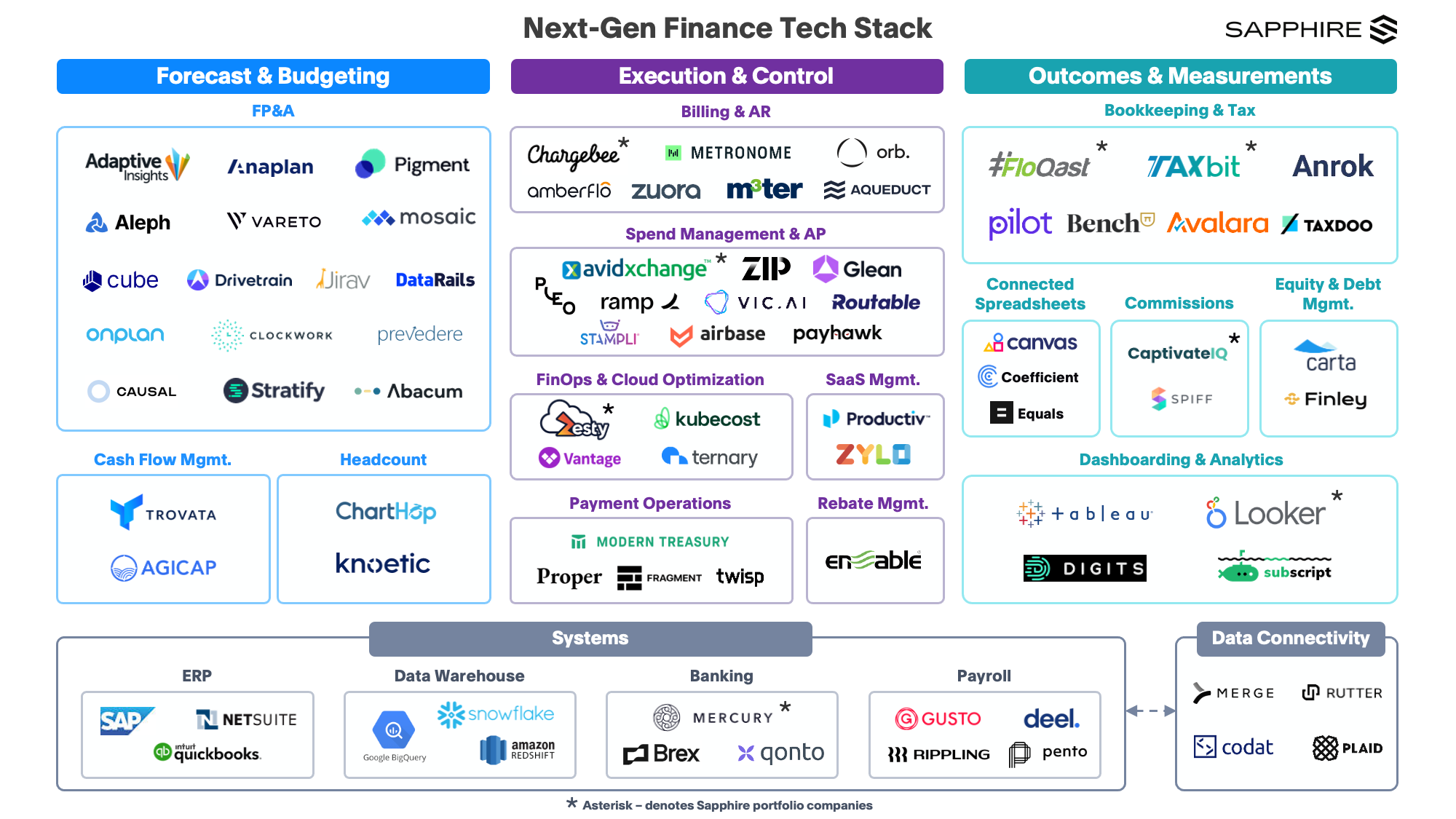

FP&A

FP&A tools enable finance organizations to run highly-flexible scenario analyses and build continuous financial forecasts to set revenue and spend guard-rails for the upcoming fiscal period(s). Companies like Anaplan and Adaptive Insights (Workday) initiated the first wave of modernization in this category, breaking the planning function out of manual, disconnected spreadsheets and moving it into their cloud-hosted systems-of-record.

Today, many of the next-generation FP&A tools seek to advance these capabilities further with improved data aggregation, collaboration features and better UI/UX. Given spreadsheets are the most commonly used tool amongst finance professionals, many modern FP&A software vendors look to leverage Excel (or a spreadsheet-like interface) as the core workspace within their platforms. Companies in this space include Mosaic, DataRails, Abacum and Pigment.

Cash Flow Management

Cash Flow Management tools integrate with a company’s bank accounts and financial tools to track cash inflows and outflows in real-time, and provide visibility into the business’s cash position. With the advent of open banking APIs, a new class of automated cash flow management platforms have emerged that aggregate bank transaction data and intelligently present key metrics around cash to treasurers, finance professionals, accountants and other key stakeholders. Companies in this space include Agicap and Trovata.

Headcount

For most companies, particularly in SaaS, headcount drives upwards of 70-80% of total operating spend–that’s more than enough to warrant close attention by finance. Headcount planning tools help organizations set realistic hiring plans that address strategic and operational needs while keeping headcount-related spend (e.g., payroll) within budget. Common features offered by these platforms include org charts, diversity reporting, compensation management and more. ChartHop and Knoetic are two companies to watch in this space.

Billing & Accounts Receivable (AR)

Anyone in SaaS finance will agree that calculating a seemingly straightforward metric like ARR is a far cry from a simple exercise. Given the complexities in SaaS contract terms, recurring billing scenarios and GAAP revenue recognition standards, next-generation billing and AR platforms have emerged to offer organizations a central command center through which to manage their customer subscriptions, issue invoices and accurately track ARR/revenue. Furthermore, the rise of usage-based pricing models has created increasing billing infrastructure complexities and challenges. Companies addressing this opportunity from a tooling perspective include Chargebee (a Sapphire portfolio company), Metronome and Orb.

Spend Management & Accounts Payable (AP)

As organizations execute against their operating plan during the fiscal year, departments must unlock spend within their approved budgets to invest in their respective initiatives. To ensure all spend remains within plan and also within compliance with corporate policies, many businesses turn to advanced spend management platforms that control spend (via corporate cards), automate expense tracking, systematize approval workflows and streamline bill pay. Companies in this space include AvidXchange (a recent Sapphire exit) and Zip (workflow automation platform for spend approvals).

FinOps & Cloud Optimization

Mass cloud adoption has been well underway. According to Gartner, more than 70% of companies have migrated “at least some workloads” to the public cloud. But as cloud utilization has increased, so too has cloud spend. And organizations are beginning to appreciate the sheer scale of their overspend in this area.

According to a survey conducted by Virtana, 82% of IT and cloud decision-makers shared that they had incurred unnecessary cloud costs. In an effort to address this issue, a movement, dubbed “FinOps,” has emerged wherein finance and engineering teams closely collaborate and leverage technology to make data-driven decisions around cloud spend. While pioneers like CloudHealth (an exited Sapphire investment) and Cloudability (acquired by Apptio) were early to market in this category, growing complexity in cloud infrastructure has given rise to a new generation of companies including Zesty (a Sapphire portfolio company), Kubecost and Vantage.

SaaS Management

The explosion in SaaS software has created a challenge on its own for organizations to keep track of all their software subscriptions and associated spend. Tools like Zylo and Productiv enable businesses to gain a single view of all their software vendor licenses, understand utilization on a per seat basis and optimize overall spend.

Payment Operations

Many companies need to manage high volumes of payment flows as a part of their core product offering (i.e., two-sided marketplaces with fund collection and disbursement flows). Historically, large back office teams were spun up to manually process the intensive operational tasks behind these high transaction volumes, from initiating/collecting payments to tracking and reconciling fund flows with the ERP. Companies like Modern Treasury, Fragment, Proper Finance and Twisp automate the core functions across the money movement workflow, such as ledgering and payment reconciliation.

Rebate Management

For businesses handling physical inventory, a significant driver for cost savings (on the supply side) and sales (on the demand side) stems from execution of rebates. Oftentimes, however, tracking rebates across suppliers and customers, calculating rebate amounts and forecasting/reporting accurate financials end up being manual and error-prone processes. Platforms like Enable tackle these challenges by providing a rebate management platform that brings together finance, sales and IT teams, as well as executive leadership, allowing companies to better monitor rebates in real-time, calculate savings and earnings, and easily prepare financial reports.

Bookkeeping & Tax

Though the dynamic nature of company building can bring great variation in workstreams on a weekly, monthly and yearly basis, there are two important competencies that finance teams can count on happening for however long their organization remains in business: accounting close and tax preparation.

These processes are intensive, as accountants and tax professionals must reconcile transactions, close the company’s books and file tax forms on a continuous basis after each fiscal period–often times under very tight timelines. Companies like FloQast (accounting close; a Sapphire portfolio company) and TaxBit (crypto taxes; a Sapphire portfolio company) seek to automate routine accounting and tax cycles, freeing up teams to focus on more strategic tasks where human skills are best suited.

Connected Spreadsheets

Finance professionals are likely to agree in unison that, though Excel has reliably served their needs over time, it could benefit from a makeover. As finance is increasingly being asked to unify data from across the enterprise in order to complete ad-hoc analyses and continuous reporting, current tools come up short in empowering non-technical financial analysts to access the information they need in a self-serve manner. This often results in BI / data analysts receiving high volumes of requests for relatively simple data pulls, diverting valuable technical resources from higher-order tasks across the business. In response, next-generation spreadsheet platforms like Canvas and Equals have emerged to provide business analysts with an Excel-like workspace connected to all the key data sources across the organization. Within these tools, users are empowered to explore their data in a familiar UI without needing to write custom scripts in SQL.

Commissions

Quota-bearing reps are one of the most important levers a company has in affecting top-line bookings productivity in any given fiscal period. Properly incentivizing reps with an enticing commissions program is critical in encouraging optimal performance against the organization’s revenue plan.

Today, most companies manage commissions planning using archaic and manual excel models that fail to facilitate seamless collaboration between GTM teams, finance and HR. Companies like CaptivateIQ (a Sapphire portfolio company) and Spiff have emerged in recent years to offer a flexible, easy-to-use commissions platform that integrates with all the systems housing key rep compensation calculation inputs (e.g., Salesforce, Snowflake, Redshift, etc.) and allows companies to accurately compensate their customer-facing teams.

Dashboarding & Analytics

Dashboarding & Analytics tools enable finance teams to build and consume rich outputs (often in the form of visual charts and graphs) explaining important trends across all key financial and operational metrics. General-purpose business intelligence (BI) tools like Tableau and Looker (an exited Sapphire portfolio company) commonly sit on top of a structured database (e.g., Snowflake, a Sapphire investment at IPO) and act as a low-code interface through which analysts are able to query data from across the organization. There are numerous software tools that seek to help businesses answer more specific questions around accounting metrics, SaaS revenue and more. Companies in this space include Digits, Subscript and Puzzle.

Equity & Debt Management

Equity and Debt Management platforms help companies manage their cap tables, debt facilities, 409a valuations, employee stock compensation and more. Companies in this space include Carta for equity management and Finley for debt management.

ERP

The ERP has widely been regarded as the system-of-record for financial data and most, if not all, organizations have an ERP platform in place. Most importantly, these systems contain the accounting general ledger, which records all transactions and enables financial reporting. ERP vendors also offer a wide-range of features covering many other categories discussed above, as well as many non-financial resource planning capabilities (e.g., supply chain, project management, inventory, etc). Smaller, newer businesses tend to opt for lighter weight tools in this space like Quickbooks (Intuit), and often graduate to more robust platforms like NetSuite (Oracle) or SAP.

Data Warehouse

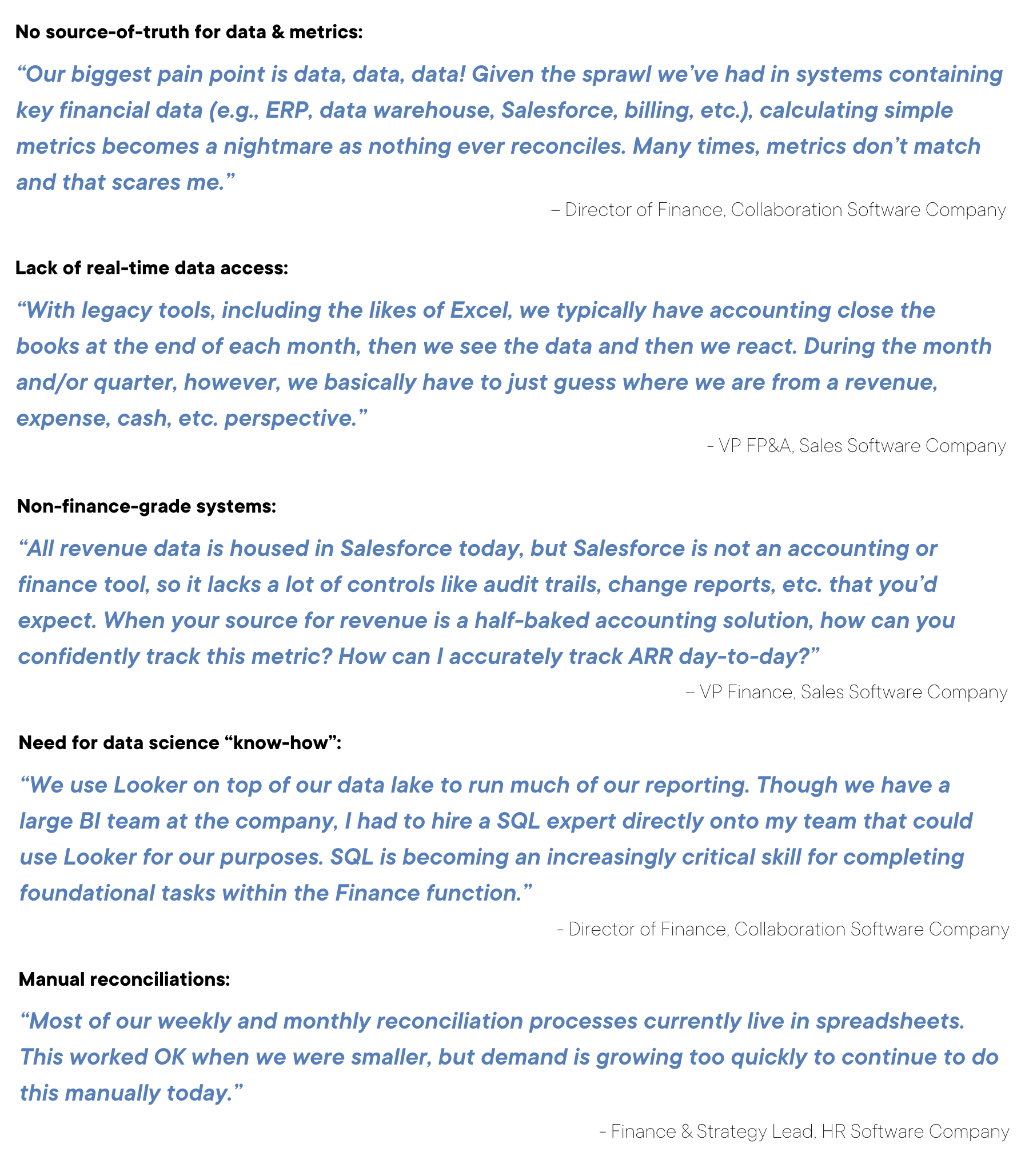

As the role of the finance organization has evolved from solely preparing financial statements to becoming a strategic function helping answer key operational questions for the business, the need for a unified, holistic view of company data has increased.

Given this, finance teams are increasingly adopting the cloud data warehouse as their single source-of-truth upon which semi-technical analysts are able to run structured queries on data coming from key systems in use across the business. Popular data warehouse platforms today include Snowflake, Amazon Redshift and Google BigQuery.

Business Banking

Business Banking platforms offer a suite of traditional banking services (e.g., checking accounts, debit cards, treasury services, etc.) through a digital interface, often relying on APIs that customers leverage to integrate core banking functions into their operational workflows. Companies in this space include Mercury (a Sapphire portfolio company), Brex and Qonto.

Payroll

Payroll platforms enable businesses to accurately pay employees and track compensation metrics. Many payroll platforms are marketed as part of broader HR software platforms, as is seen with vendors in this space like Rippling and Gusto. Pento is an automated payroll software platform solely focused on employee compensation. Additionally, as companies increasingly look to tap talent all over the world, platforms like Deel streamline international payroll, compensation accounting and several other tedious processes required for managing a global workforce.

Data Connectivity

Though this category does not always weave into the Finance organization’s workflow directly, vendors in this space enable read/write access to data sitting in core finance systems of record (e.g., NetSuite, Workday, bank, etc.). Platforms like Merge.dev provide their customers with a single point of integration with various HR and accounting systems to support use cases like corporate card management and headcount planning. Rutter provides a universal API that integrates with ecommerce, accounting and payments platforms to enable use cases such as underwriting and dropshipping.

Sapphire’s predictions for the future of finance tech

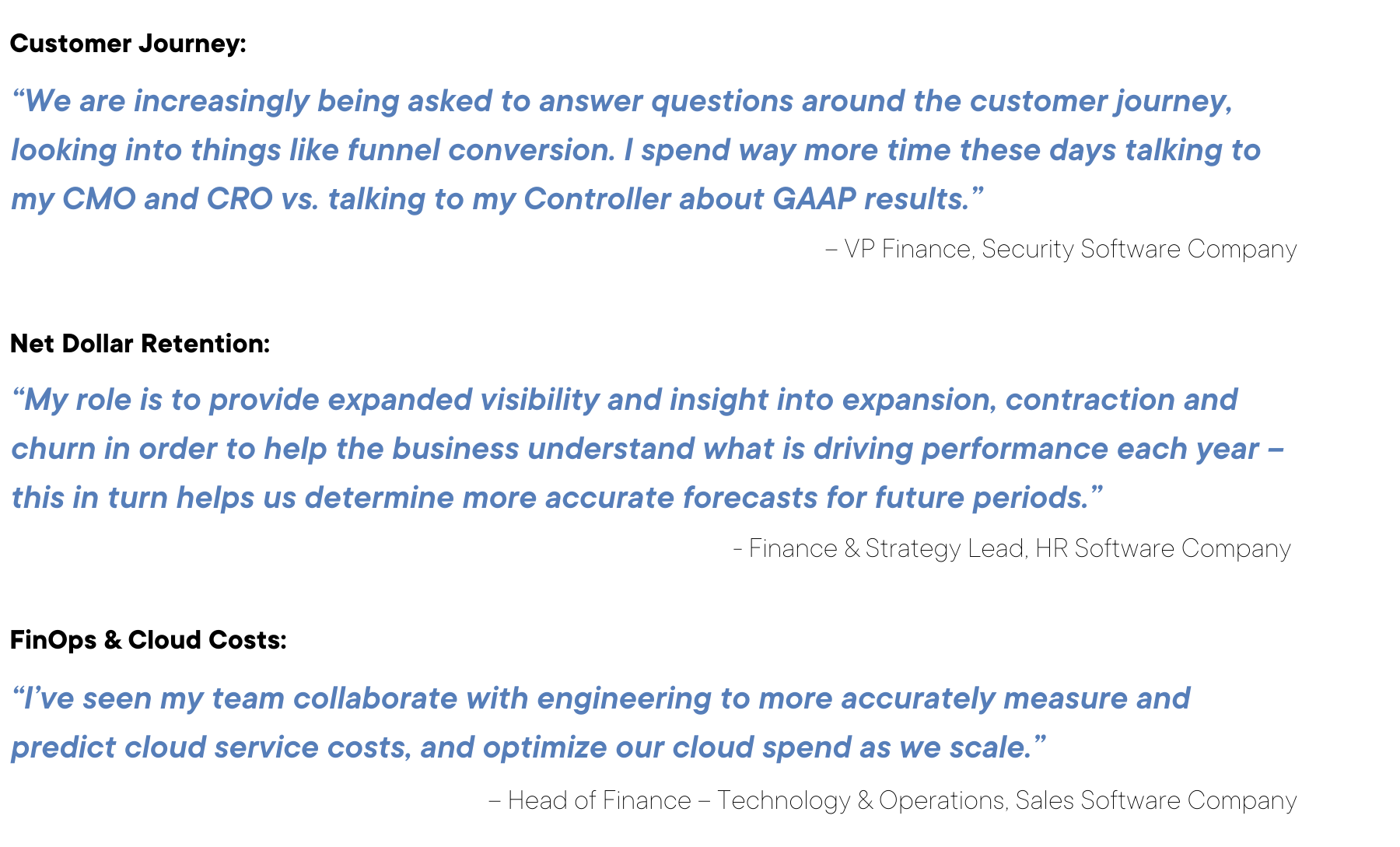

1. The next-generation of finance is being driven by the convergence with data science.

FP&A teams are desperate for a single source-of-truth for all financial data and are increasingly turning to the data warehouse as the centralized repository for this information as opposed to disparate spreadsheets across the organization.

When data lives in a single location like a data warehouse where it can easily be queried, FP&A teams–along with the help of technical and semi-technical BI teams–are finding opportunities to develop automated reporting processes, saving considerable time for finance professionals and freeing them up to focus on higher-order projects to support the business.

2. Explosion of cloud utilization is driving the need for programmatic monitoring and optimization of cloud costs.

As cloud usage continues to rise, we believe the challenge around cost management will only increase (both in technical complexity and financial/business impact), driving additional demand for intelligent tooling that helps organizations understand cloud usage, negotiate pricing with cloud platforms and forecast costs. To this end, we’ve been fortunate to partner with Zesty, a leading vendor in the space, which provides users with full visibility and control of their cloud resource costs via a plug-and-play API. Zesty’s AI-powered platform autonomously predicts cloud usage and optimizes spend, driving upwards of 50% in cost savings for customers.

3. Growing demand for SaaS platforms is driving the need for intelligent and automated billing and revenue recognition tools to manage contracts from a vendor perspective.

According to a report published by ARKInvest in 2020, global SaaS spend is estimated to grow at a 20%+ CAGR until 2030 resulting in over $750B of new spend. While pioneers like Salesforce, Netflix and Amazon, helped initiate the subscription economy, the types of businesses leveraging subscription models have broadened considerably in the past 10 years and the “as-a-service” trend is expected to continue.

SaaS companies are increasingly realizing the complexities of managing recurring revenue contracts and would rather spend internal development time on their core tech/product versus the billing engine. Next-generation billing management systems like Chargebee, a Sapphire portfolio company, provide an integrated platform for managing subscription and recurring revenue SaaS, services and e-commerce businesses. Chargebee customers, for example, can easily address the full order-to-revenue lifecycle in one platform, with access to subscription and billing management, invoicing, payments and plan and pricing management capabilities.

4. Accounting close remains a frustratingly manual process, creating the need for automated financial close solutions that reduce close time and errors, and streamline financial reporting.

While ERPs and modern accounting systems are great for tracking transactions, they are not built for reconciling account balances. This means accounting staff often rely on Excel to perform account reconciliations, which is an error-prone, manual effort. As more companies scale and prepare to enter the public markets, robust, error-free and efficient account close processes become a key requirement in order to remain compliant with regulations and manage the business effectively on a quarterly basis under the public investors’ eyes. One of the leading companies in this space is accounting workflow automation platform FloQast.

A Sapphire portfolio company, FloQast provides accounting teams with close management software that includes a centralized checklist, automated tie-outs and integrations to existing ERPs and cloud storage environments. With these capabilities, accountants are able to save time across their daily workflows, gain visibility into outstanding tasks and seamlessly collaborate with the key stakeholders involved in the financial close process.

5. The rise of the tokenized economy has created widespread confusion with regards to tax and accounting implications, resulting in the need for 3rd-party software that simplifies cryptocurrency taxes and ensures businesses remain compliant.

Given the fundamentally unique infrastructure upon which cryptocurrency transactions take place, businesses working with crypto require purpose-built software that can capture transaction activity, translate transaction activity into accounting ledger entries, populate required tax forms automatically, intelligently make crypto asset sale decisions (e.g. tax loss harvesting) and more.

TaxBit, a Sapphire portfolio company and leader in this emerging category, aims to address these needs by providing a digital asset tax platform that automates tax calculations/form preparation and handles backend compliance tasks.

6. The growing demand for real-time financial data.

Freshness of financial data is typically limited by the underlying data architecture, with leadership teams limited to backward-looking views on a monthly or quarterly basis. Innovations in data warehousing (e.g., Snowflake) have created an opportunity to aggregate data inputs in real-time and output analytics and dashboards (i.e., through tools like Looker and Tableau) that enable leadership teams to review key performance metrics continuously, rather than on a periodic basis. These metrics include recurring revenue, ACVs, retention, cash burn and other customer analytics.

The opportunity ahead for finance software

While selling into the finance department has historically been a daunting task due to large incumbents in the category, we believe the next-generation of finance software has arrived. There’s a huge opportunity ahead for vendors who identify critical components of the finance workflow that have been grossly underserved by technology.

As the broader finance function continues to take on a more diverse and strategic role within organizations, the appetite to invest in software that tangibly improves process efficiency, data-driven decision-making capabilities and overall financial performance management will only continue to grow.

If you are working to address this opportunity, please reach out to Rajeev at [email protected], Jane at [email protected] and Adi at [email protected]. We look forward to hearing from you!

Thanks to Drew Laxton, Luke Zapart, Song Mu, Larry Cheng, Brittany Rosenau, Minesh Patel, Justin Schumacher, Luna Lu, Nicholas Maffei and Hasib Omarzi for your feedback. And shout out to our intern, Matt Parthun who was instrumental in putting this article together!