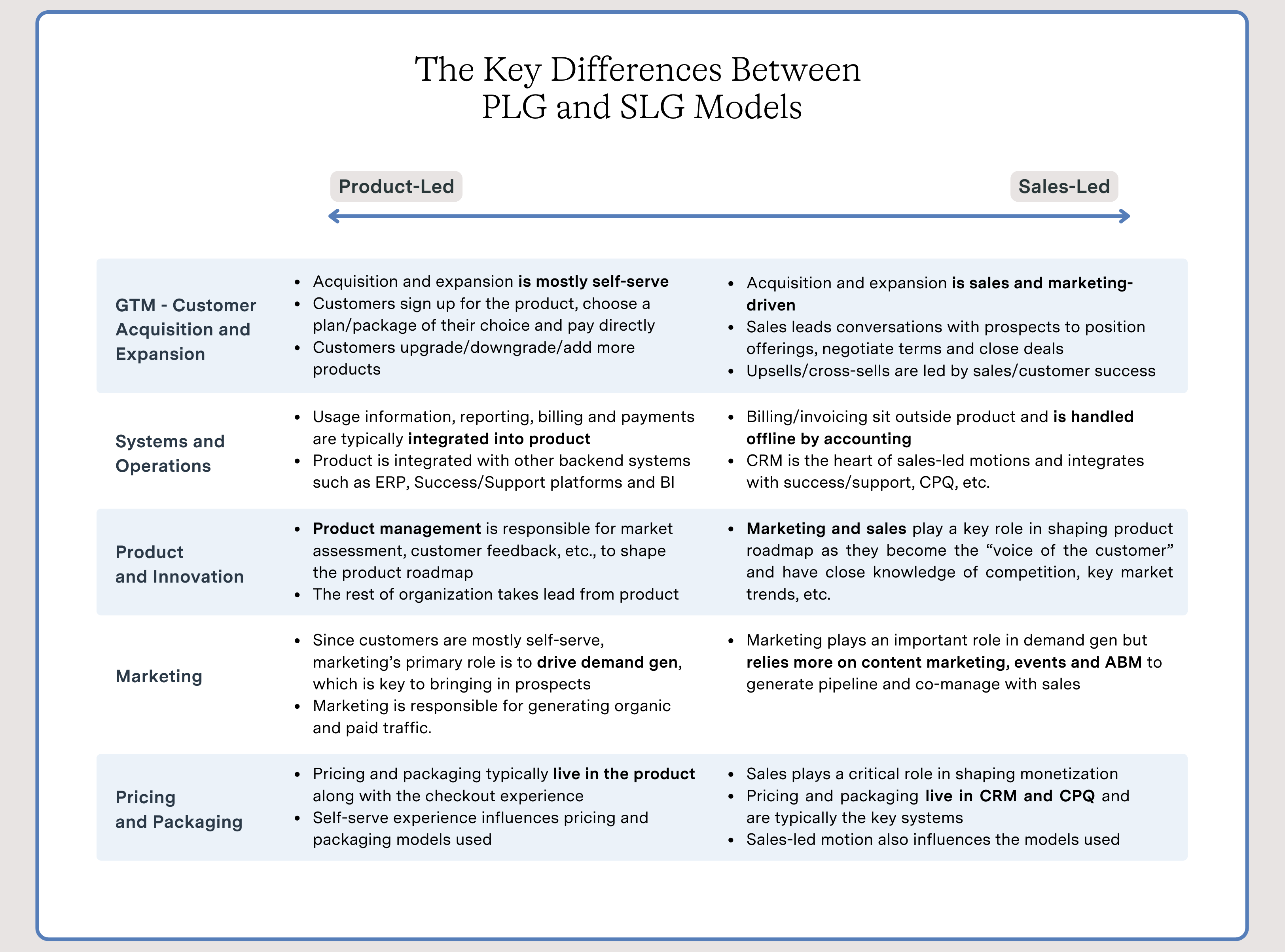

Product- and sales-led growth models create vastly different requirements across a SaaS company, specifically the GTM team. Each area—product, sales and marketing—plays a distinct role that must align with the chosen model. Additionally, pricing and packaging structures need to be tailored accordingly.

PLG model companies aspire to go ‘upmarket,’ or target larger and more sophisticated customers, while SLG companies target smaller customers and introduce a self-serve motion. As a result, transitioning from one model to another, or even considering the introduction of a new model, requires careful deliberation and thorough groundwork.

In this blog, we will navigate the nuanced distinctions between PLG and SLG models, shedding light on their varied impact across an organization, influencing pricing and packaging decisions, monetization and innovation plans, and crucial considerations such as discounts, upsells, cross-sells, as well as funnel and pipeline management for GTM teams.

Pricing and Packaging for PLG and SLG Companies

Many aspects of pricing and packaging decisions are influenced by the growth model in place – product-led or sales-led. We discuss four of these aspects below.

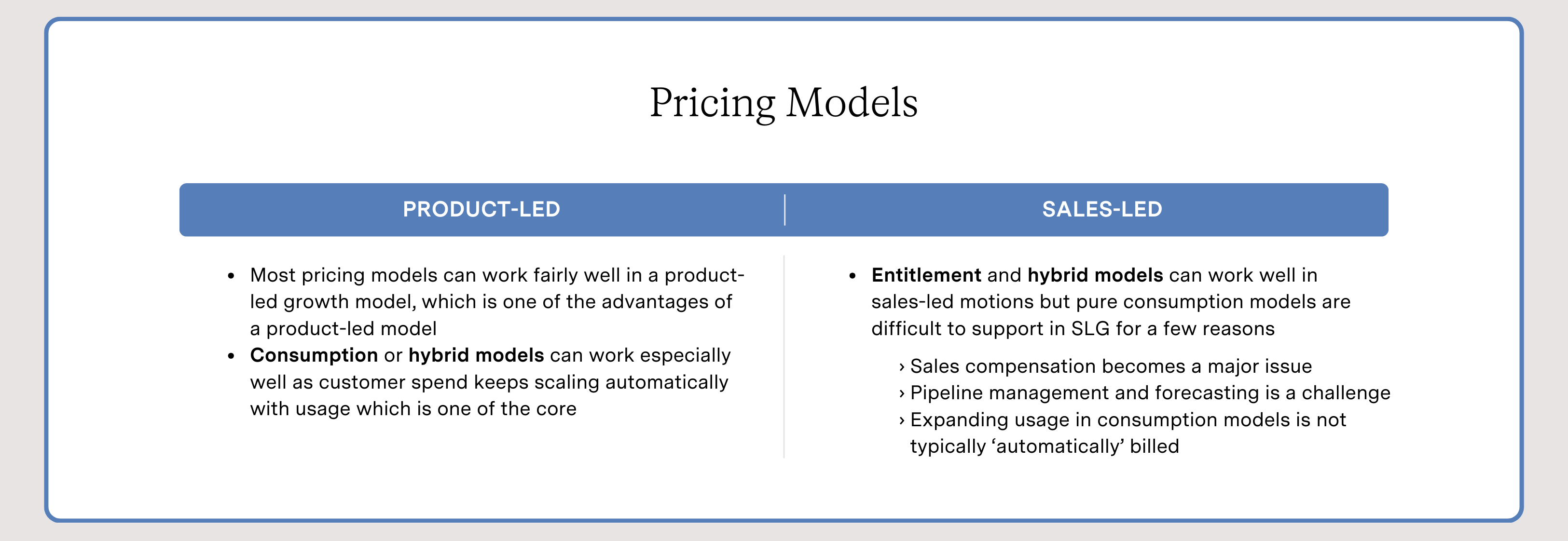

1. Pricing Models

SaaS pricing models vary across the spectrum, and PLG and SLG strategies impose certain limitations on the available options. Let’s take a look at three commonly used models: usage/consumption-based models, hybrid models and entitlement-based models to determine which pricing models are most effective for PLG and SLG strategies.

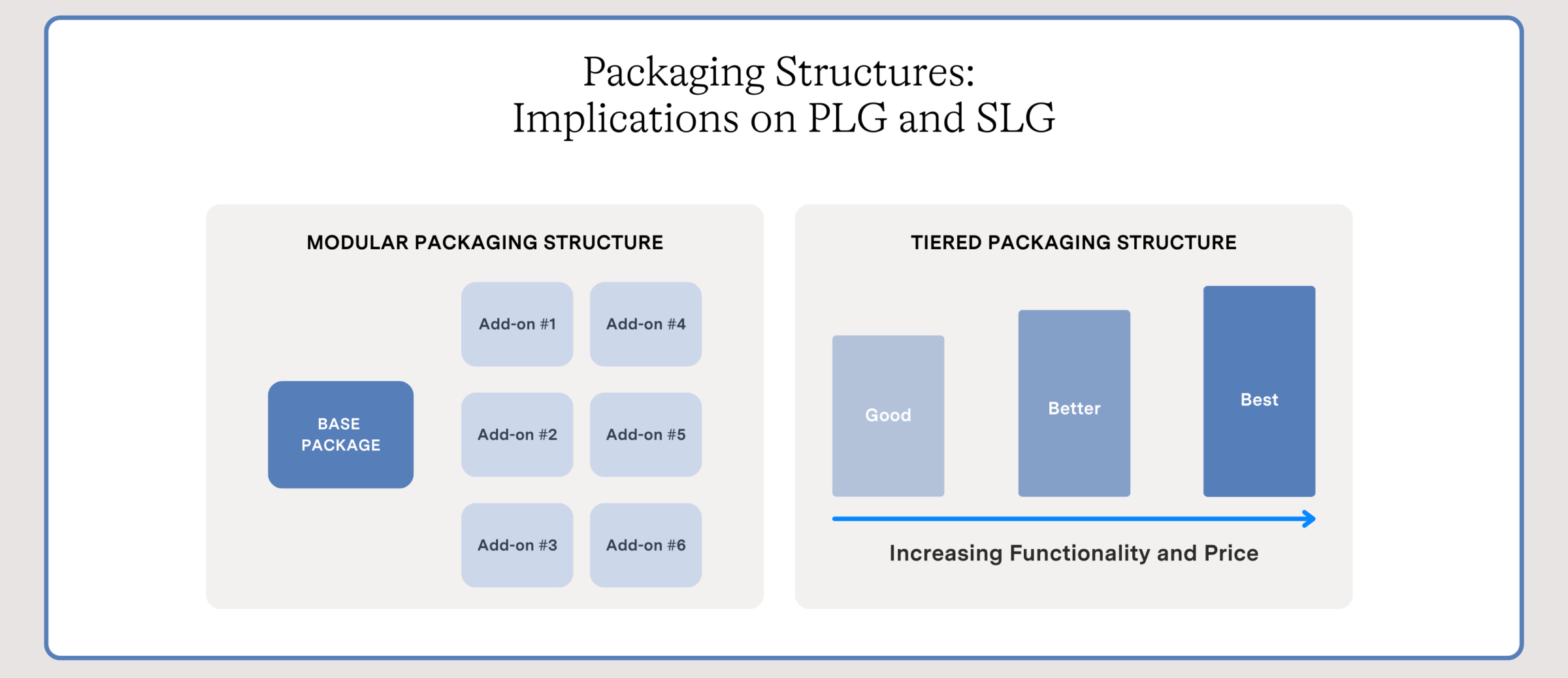

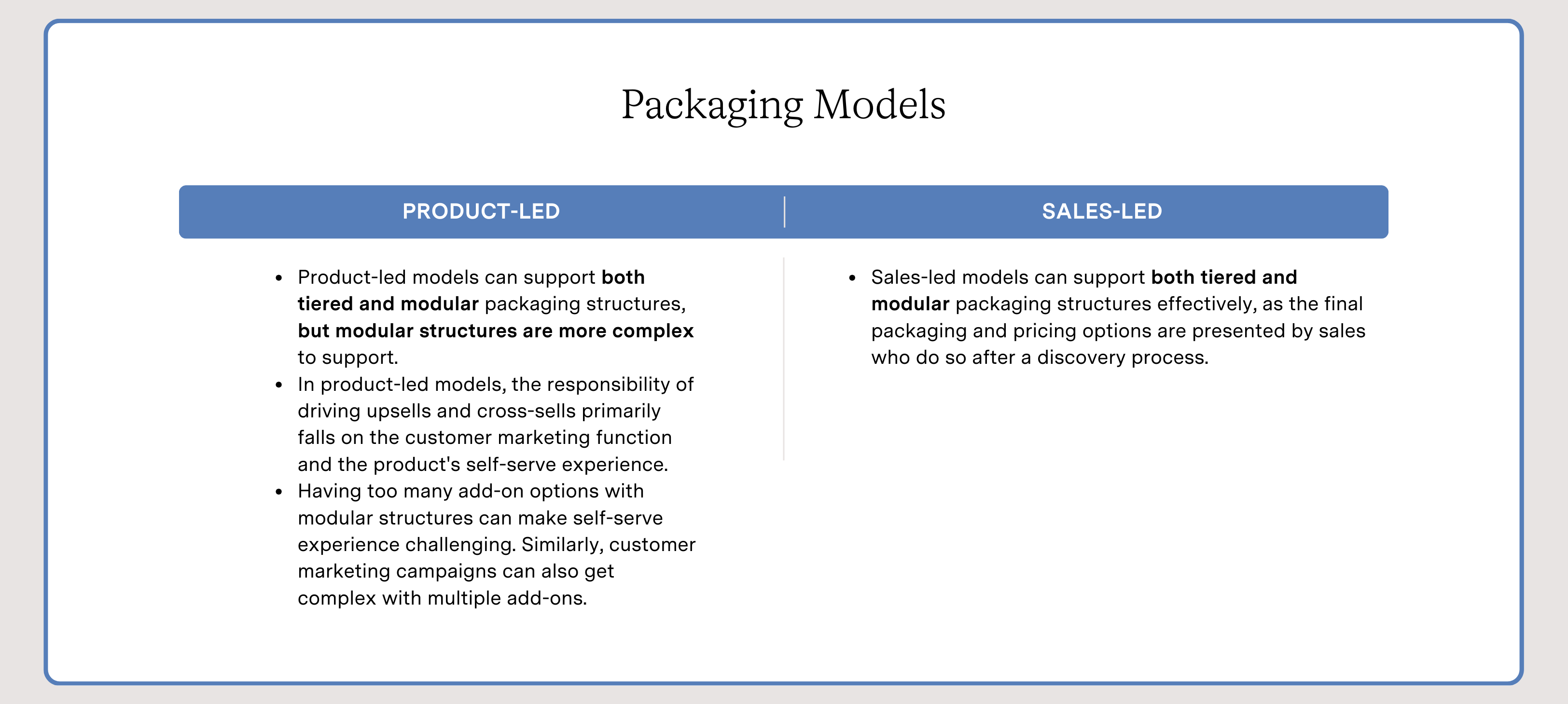

2. Packaging Models

Packaging models can be categorized on a spectrum from modular to tiered structures. In modular structures, there is typically a base package that all customers must subscribe to and then a set of optional add-ons. On the other hand, tiered structures follow the familiar “Good-better-best” approach, where price and functionality increase from a good package to the best package. Additionally, there are hybrid models that combine elements of both, featuring multiple base packages with optional add-ons.

Growth models have a bearing on what packaging structure is most feasible. A general rule of thumb for self-service is that simpler packaging structures with fewer permutations are easier to implement.

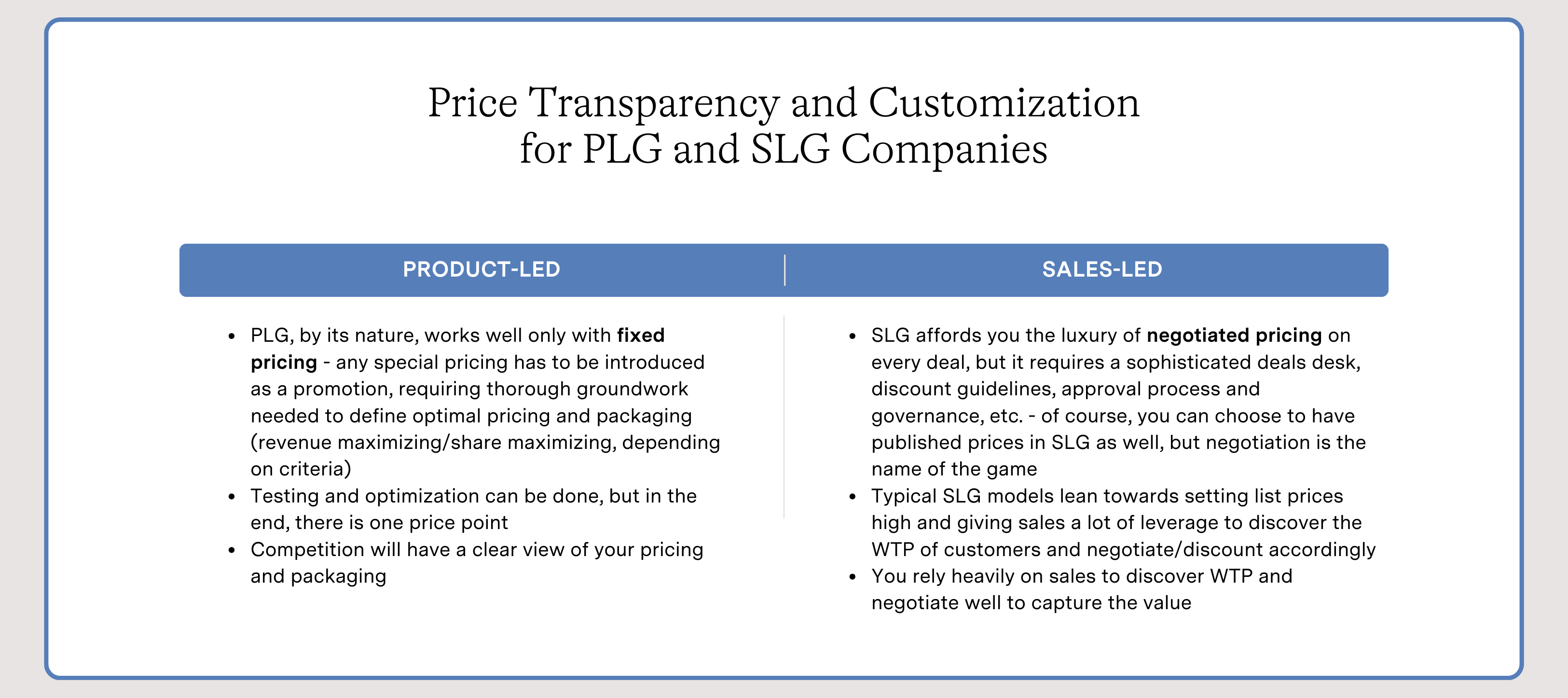

3. Price Transparency and Customization for PLG and SLG Companies

When it comes to pricing a product or service, whether in the tech or non-tech industry, there are generally two approaches:

- Prices are published for everyone to see, allowing customers to make decisions based on their willingness to pay (WTP) for a product or service.

- Prices are not published and are only shared with customers when they inquire about a product or service, allowing pricing to be adjusted based on customer needs.

See how the chosen pricing approach is influenced by the growth model in place below.

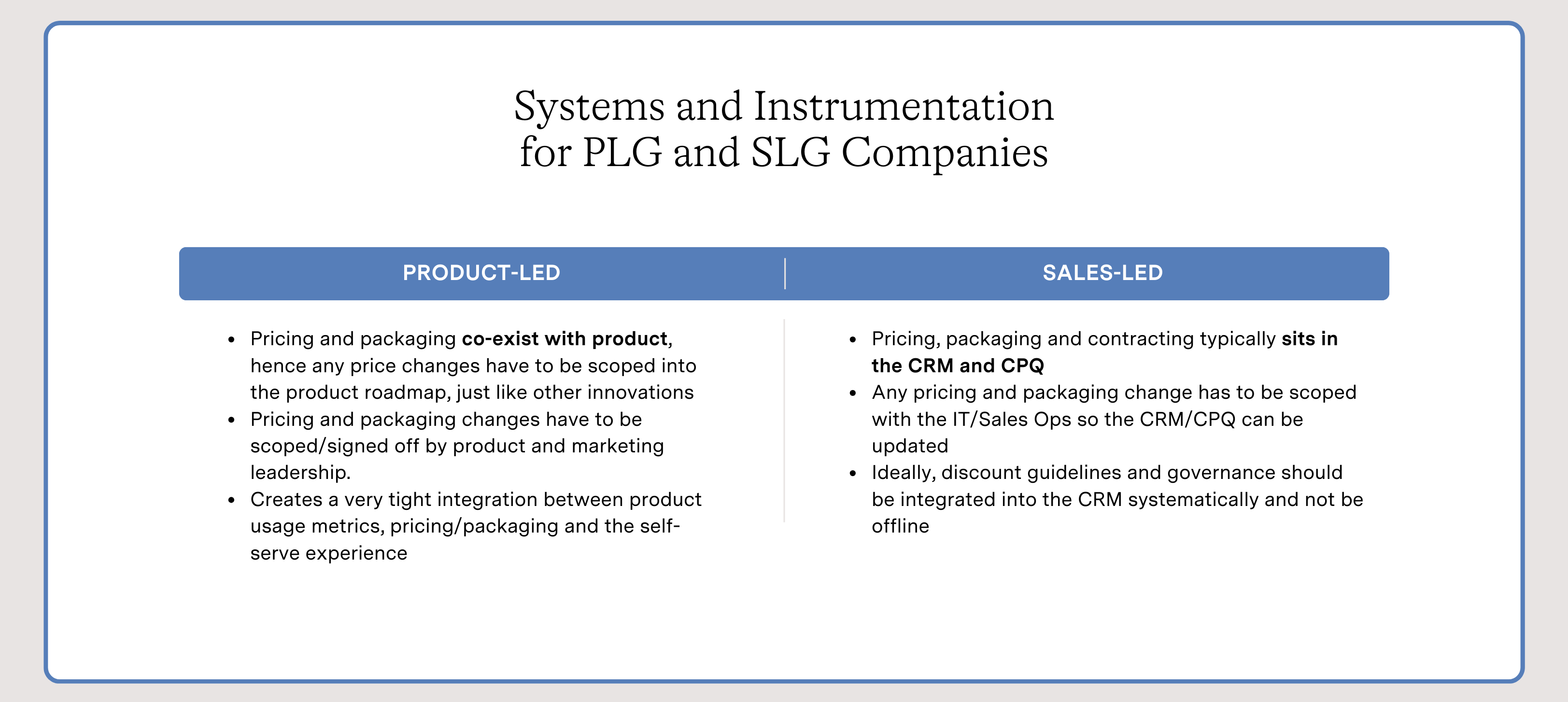

4. Systems and Instrumentation for PLG and SLG Companies

Price and order management are distributed across various systems, including product, ERP, CPQ and CRM systems. These systems are interconnected with various linkages to other systems. The chosen growth model determines the relative importance of each system.

Product-led growth strategies necessitate significant resources, including larger teams and advanced tools, to ensure a seamless purchasing experience that’s integrated with the product itself and other systems such as analytics and reporting, billing, and customer success and support. In contrast, a sales-led approach adds complexity to a sales team’s operations, involving detailed processes such as deal desk review, finance approvals for pricing outside the standard range,, product configuration setup and onboarding, and lastly, the intricacies of using CPQ (Configure, Price, Quote) and CRM (Customer Relationship Management) systems etc.).

As discussed above, the three most critical decisions in a pricing and packaging strategy are the packaging structure, pricing model and price levels, all of which are heavily shaped by the growth model in use.

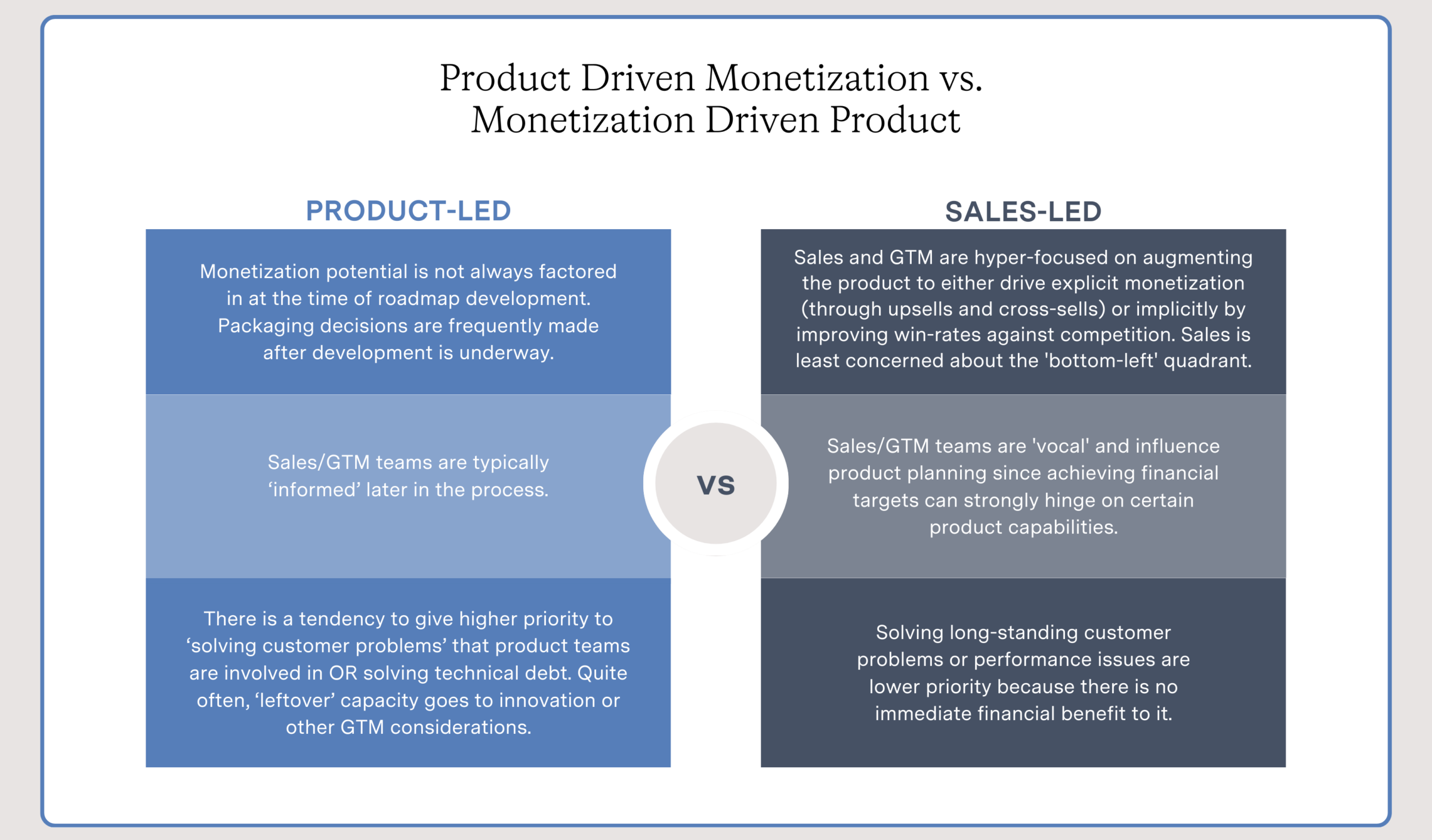

Product and Monetization for PLG and SLG Companies: Double Helix

With continuous innovation, it’s necessary to frequently update packaging and pricing. The ideal path for innovation, or innovation roadmap, should be shaped proactively with a focus on monetization potential and competitive differentiation. However, in both PLG and SLG models, product innovation and monetization plans are at times competing levers. Product-first organizations typically prioritize PLG, focusing on product innovation first and considering monetization afterwards. Sales-led motions differ in that GTM teams are often the drivers of new monetization efforts that affect product changes. While there’s no one-size-fits-all approach, aligning innovation and monetization efforts with the specific growth model is crucial as detailed below.

In summary, there are three key factors that influence how new innovations are packaged and brought to market:

- Packaging structure (Modular vs. Tiered)

- Monetization potential

- Packaging ‘theme’ (Good packaging should be thematic based on factors such as customer segments, maturity, industry etc.)

In PLG models, product and marketing teams usually drive the motion, and monetization considerations often come later. In contrast, SLG models identify gaps where they can monetize.

GTM Considerations

A company’s go-to-market strategy is significantly influenced by the chosen growth model. We will explore two key aspects of this relationship in the sections that follow.

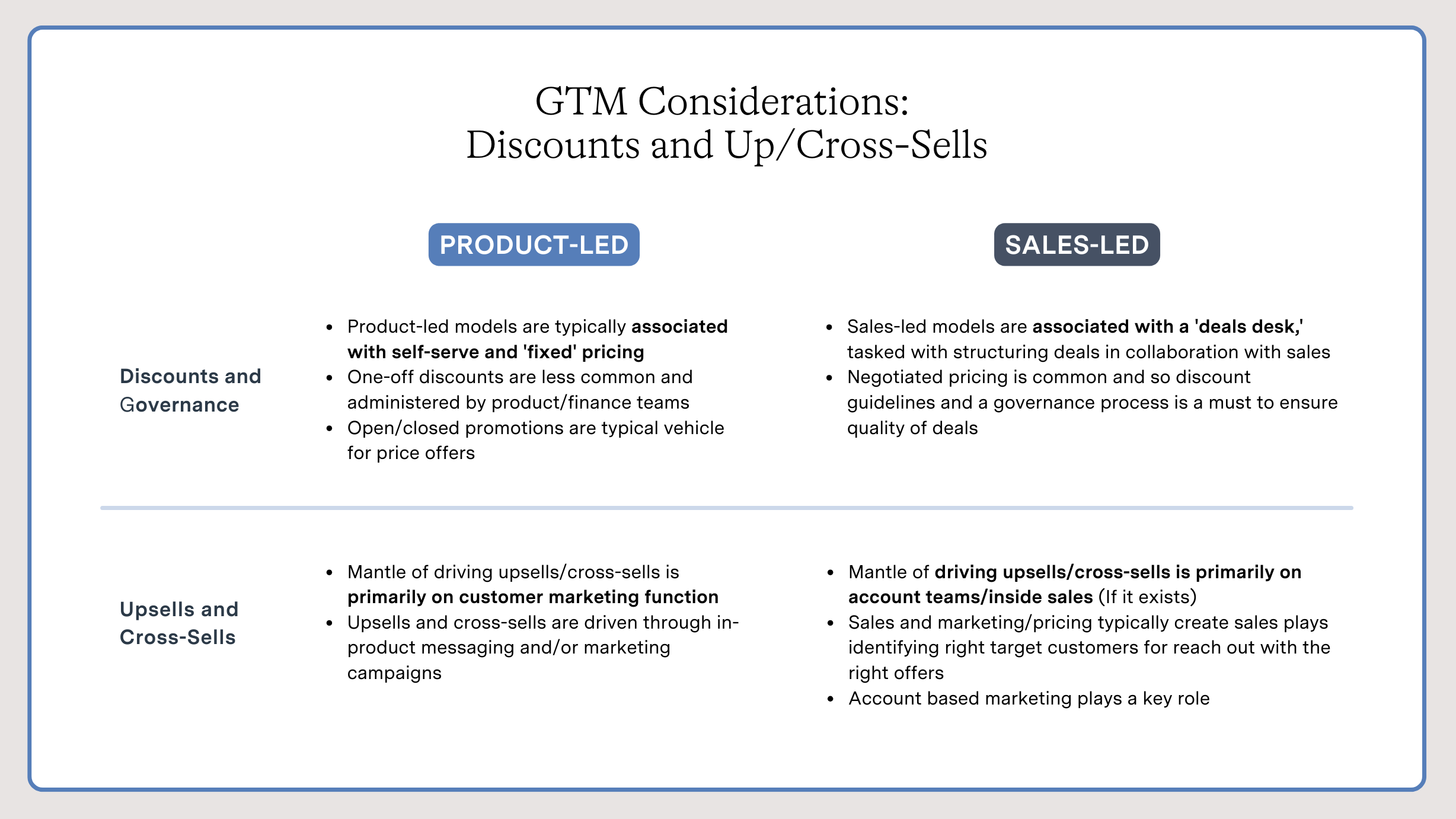

Discounts and Upsells and Cross-sells

Discounting is closely linked to the approach taken towards pricing, be it published or negotiated,as previously mentioned. As such, discount management plays a significant role in the sales-led growth model, which then has downstream effects on how sales and marketing teams operate, particularly in their approach to expanding customer value through upsells and cross-sells.

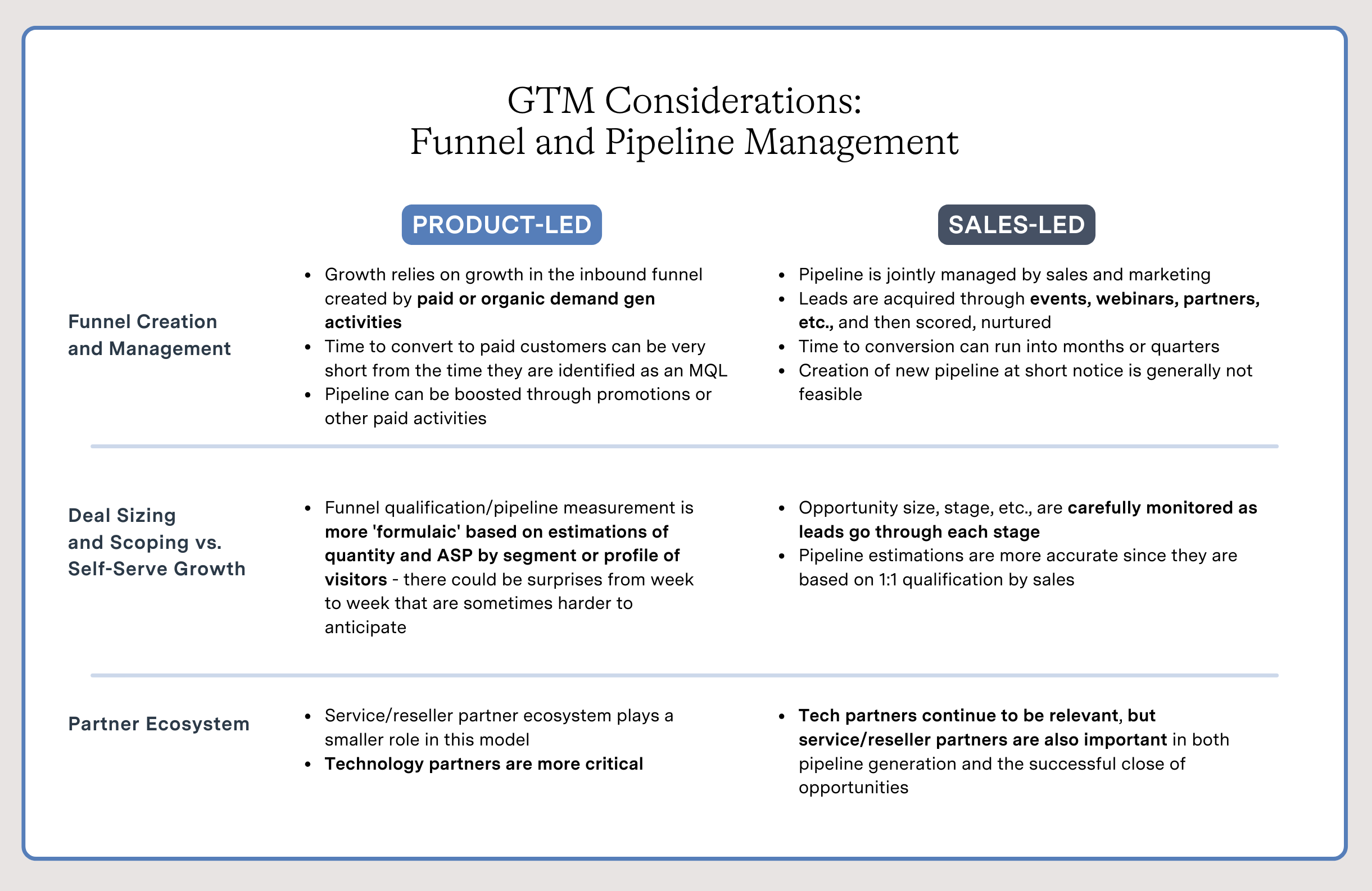

Funnel and Pipeline Management

In a product-led model, the marketing team plays a pivotal role in funnel and pipeline management, ensuring a seamless flow from awareness to conversion. Conversely, within a sales-led model, it is the sales function that assumes this role.

Conclusion

To sum it up, many factors influence whether PLG or SLG, or a combination of both, is the efficient model for an organization. It is important to note that this comparison isn’t about pitching PLG against SLG as rivals to see which one comes out on top. The right fit varies based on things like target customer segments, size of deals/customer spend, optimal routes-to-market, product complexity, product time to value and market maturity. It’s not unusual for companies to blend PLG and SLG approaches to match the needs of different customer segments or products. So, there’s no one-size-fits-all answer here.

Introducing a different model or transitioning from one model to another necessitates careful consideration and thorough preparation. For companies eyeing to go ‘upmarket’ with a PLG approach, building up go-to-market capabilities is key—think stronger sales, marketing, and partnerships. Similarly, SLG-focused companies aiming to attract smaller customers with a self-serve motion face their own set of challenges, like enormous product development efforts. As a result, many companies end up abandoning the idea altogether.

As you embark on this journey, you may inevitably encounter more questions along the way. Feel free to contact Mohan ([email protected]) and Charles Guo ([email protected]) with any questions.

Legal disclaimer

Disclaimer: Nothing presented within this article is intended to constitute investment advice, and under no circumstances should any information provided herein be used or considered as an offer to sell or a solicitation of an offer to buy an interest in any investment fund managed by Sapphire Ventures (“Sapphire”). Information provided reflects Sapphire’s guest views as of a certain point in time, whereby such views are subject to change at any point and Sapphire shall not be obligated to provide notice of any change. Views presented reflect the authors’ opinion and/or interpretation and Sapphire provides no assurance to the accuracy of such views; nor does the authors views necessarily reflect the views of Sapphire. No assumptions should be made that investments or strategies described were or will be profitable. Due to various risks and uncertainties, actual events, results or the actual experience may differ materially from those reflected or contemplated in these statements. Nothing contained in this article may be relied upon as a guarantee or assurance as to the future success of any particular company or strategy. Past performance is not indicative of future results.