Many organizations are considering pricing models based on usage or consumption of their products. While there are several factors that are driving interest in this sort of pricing strategy, two main reasons include:

- Consumption models are becoming commonplace, so customers are demanding the approach. That’s especially the case with major cloud providers like AWS, Azure and Snowflake, which are all offering consumption models

- Disruption challenges from new entrants through consumption models are driving an increase in popularity.

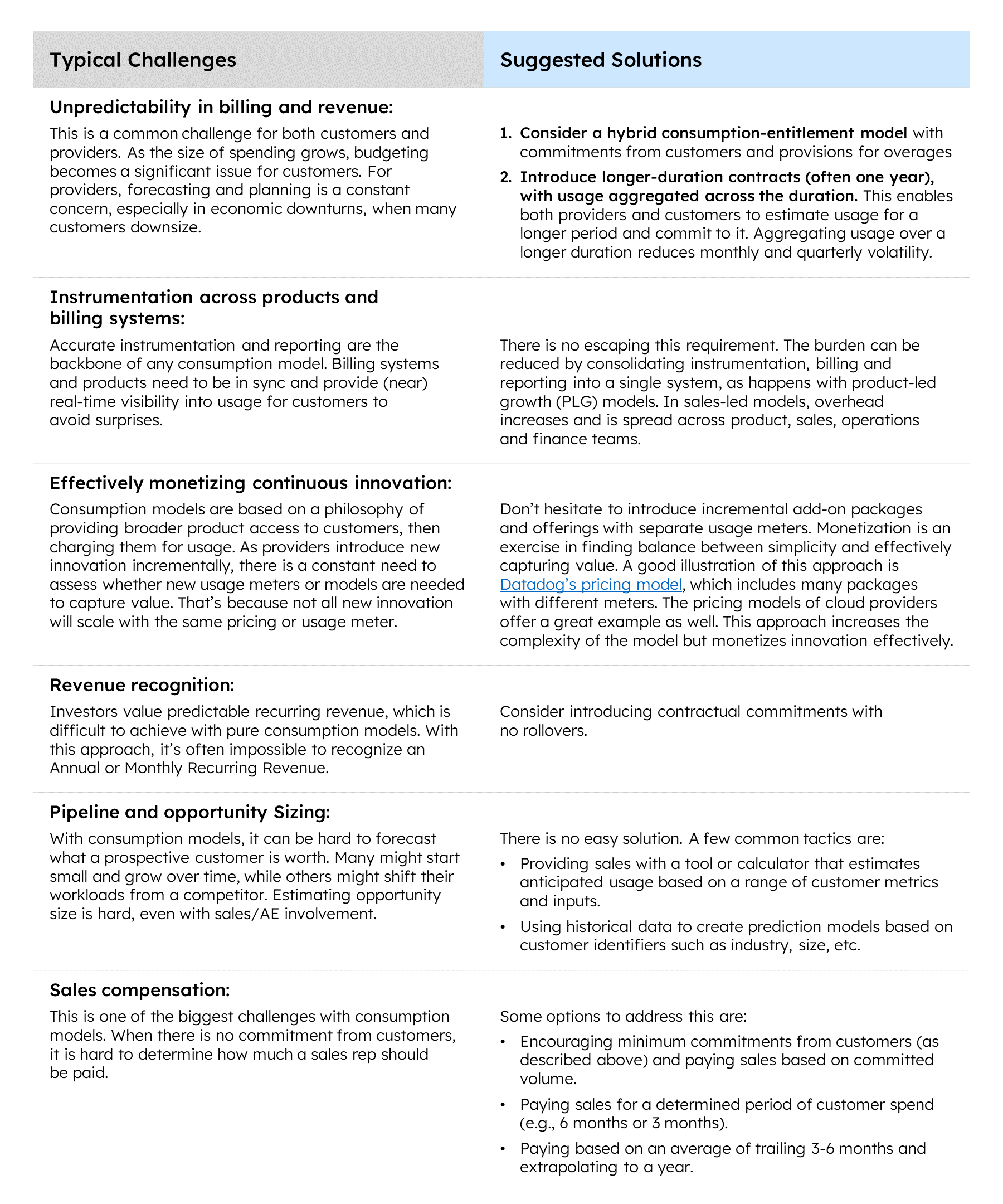

While consumption-based pricing has its benefits, companies that adopt such models run into some common challenges.

In this post, we’ll break down what consumption pricing models are and their pros and cons. Then, we’ll discuss what it takes to adopt consumption models and how to address typical hurdles that come along with them.

Defining the spectrum of pricing models

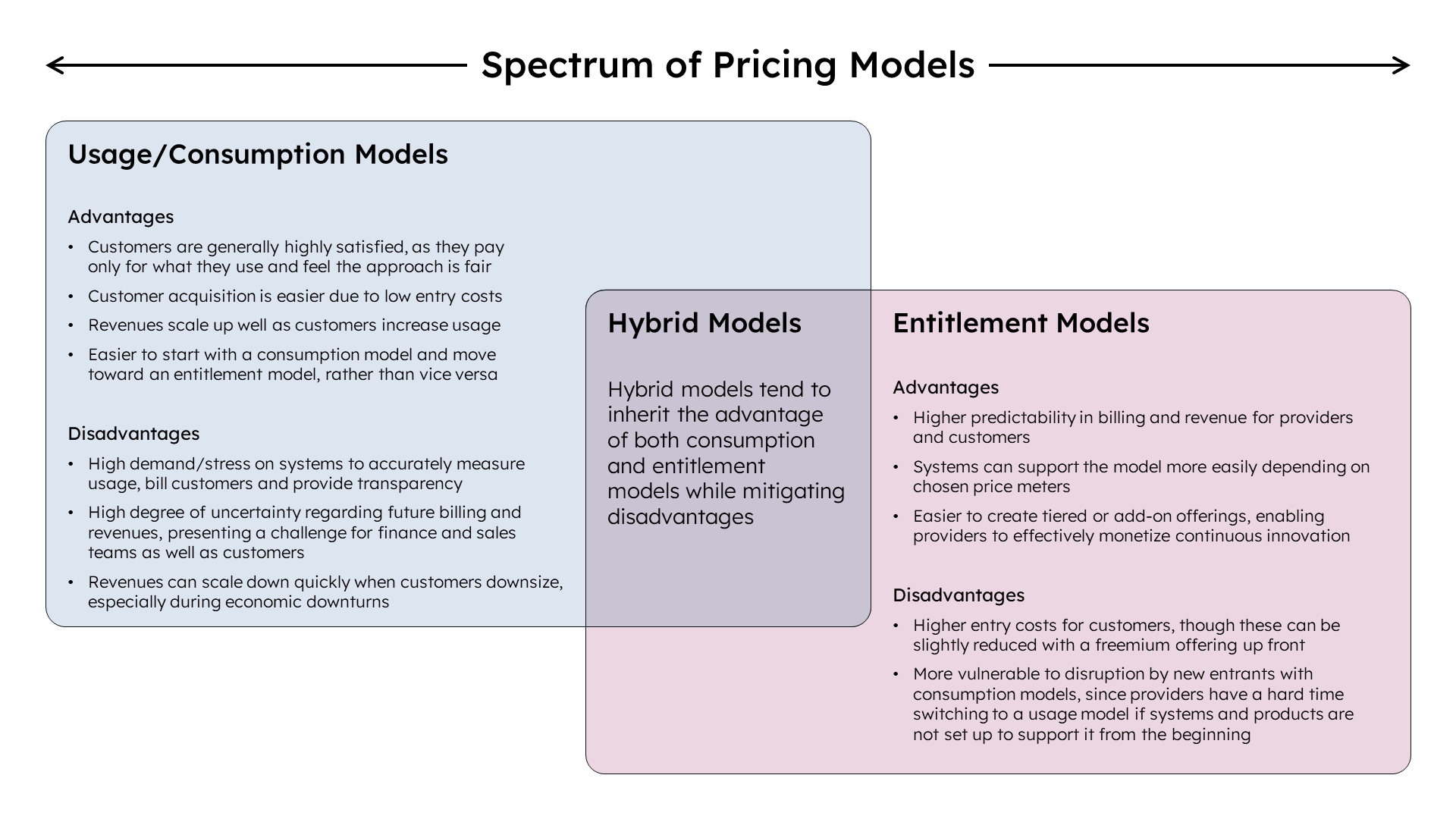

Pricing models broadly fall on a spectrum between those based on usage or consumption and those based on entitlement. The key difference is how the customer’s price is determined: retrospectively based on usage in a certain period or in advance based on predefined entitlements the customer has committed to.

The following chart provides detail on each model and where it works well:

The pros and cons of consumption & entitlement models

The table below outlines the pros and cons of consumption and entitlement models. Key points to note are that customers generally prefer consumption models, but this approach presents execution challenges for providers.

Both customers and providers dislike the unpredictability of spend that comes with consumption models. Hybrid models that build on consumption models but require commitments from customers and contracts with longer durations have emerged to address this challenge.

Addressing the challenges of consumption models

Below are some obstacles organizations typically see when adopting consumption models and suggestions for dealing with them. These are not exhaustive, but give a good sense of the range of potential hurdles.

Considerations before switching to a consumption model

Consumption models have advantages, but you should also be prepared to handle the accompanying challenges.

Below are four critical steps to take before you introduce a consumption model:

- Ensure that the pricing meters you choose align well with a) value delivered to customer and b) cost of delivery. Often, there are multiple dimensions of usage, and cost of delivery scales differently across those.

- Ensure your products and systems are equipped to do at least the following:

- Accurately measure all usage metrics that pricing is based on

- Provide transparency to customers on how metrics were computed

- Integrate between billing systems (ERP) and product to enable accurate billing and invoicing

- Assess revenue recognition impact and get buy-in from finance and accounting teams.

- Agree to a sales compensation approach in partnership with sales leadership.

To sum it up, consumption pricing models have many advantages and as such, appeal to customers. However, they also come with challenges that organizations need to be prepared to address. There will be many more questions that might come up as you embark on this journey. Feel free to contact me ([email protected]) with questions.

Legal disclaimer

Nothing presented within this article is intended to constitute investment advice, and under no circumstances should any information provided herein be used or considered as an offer to sell or a solicitation of an offer to buy an interest in any investment fund managed by Sapphire Ventures, LLC (“Sapphire”). The author of this article is not an employee of Sapphire, whereby the content and views reflect those of the author only and do necessarily reflect Sapphire’s beliefs. Information provided reflects the author’s views at a certain point in time, whereby such views are subject to change at any point While Sapphire believes the author has used reasonable efforts to obtain information from reliable sources, Sapphire makes no representations or warranties as to the accuracy, reliability, or completeness of third-party information presented herein. Due to various risks and uncertainties, actual events, results or the actual experience may differ materially from those reflected or contemplated in these statements. Nothing contained in this article may be relied upon as a guarantee or assurance as to the future success of any particular company.

Past performance is not indicative of future results.

![SapphireVentures_ConsumptionModel_Charts_08072023 [Slide 1]](https://sapphireventures.com/wp-content/uploads/2023/08/SapphireVentures_ConsumptionModel_Charts_08072023-Slide-1.png)