This is the third part in a series of articles on venture capital investments in enterprise and consumer companies. You can read part one here and part two here.

In my previous two posts, I took a look at venture-backed value creation across enterprise and consumer investments since 1995, highlighting that enterprise has traditionally been more attractive as a venture capital investment based on the distribution of outcomes. Also, I noted that there has been significant value created by consumer investments in recent history relative to other points along the venture capital timeline, mainly driven by a few, large outcomes. In this article, I investigate the relationship between invested capital and exit value per year.

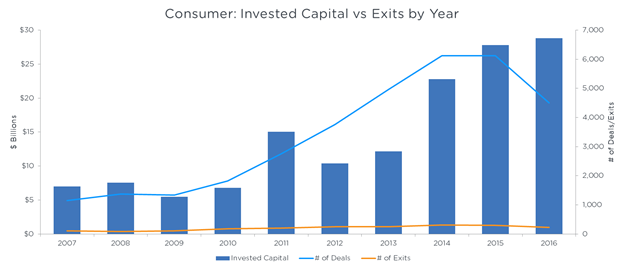

Financing and exits per year

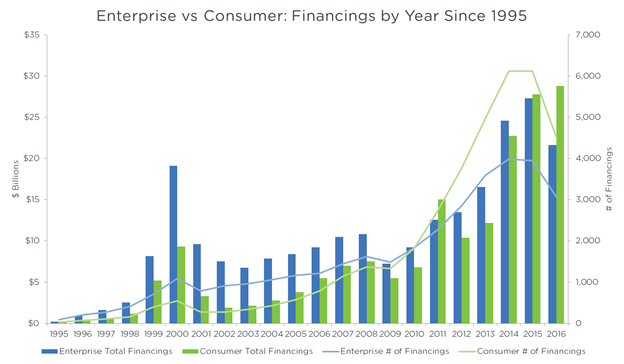

Investment financings have increased in recent years. In particular, consumer financings have become more frequent than enterprise financings, a trend which is especially evident since 2010.

- $224 billion of venture capital has been invested into enterprise tech companies since 1995; of which $121 billion, or 54 percent, has been invested since 2010.

- $160 billion of venture capital has been invested into consumer tech companies since 1995; of which $109 billion, or 68 percent, has been invested since 2010.

Source: Pitchbook, Sapphire Ventures

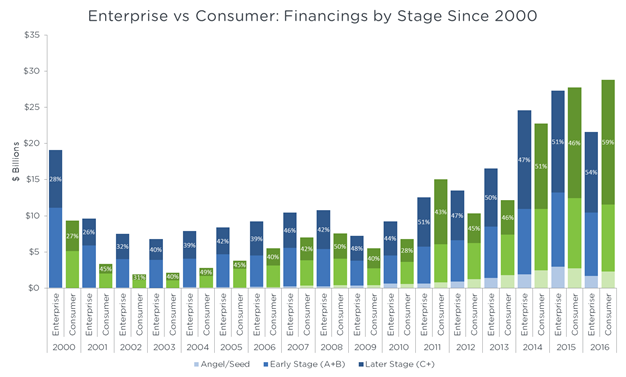

Since 2000, later stage investments have become much more prevalent in the past decade across both enterprise and consumer.

- $109 billion out of $220 billion invested in enterprise tech companies since 2000 has been at later stages. The proportion of late stage capital in enterprise has increased from 2010 to date, accounting for $64 billion of the $121 billion invested.

- $79 billion out of $153 billion invested in consumer tech companies since 2000 has been at later stages. The proportion of late stage capital in consumer has also slightly increased from 2010 to date, accounting for $59 billion of the $109 billion invested.

Source: Pitchbook, Sapphire Ventures

Source: Pitchbook, Sapphire Ventures

Source: Pitchbook, Sapphire Ventures

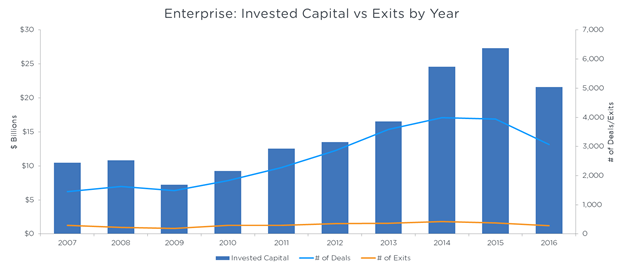

Looking at the prior graphs, it’s clear that venture capital investing has become busier in recent years, and that investors are investing more capital into VC-backed companies, though exit markets have not responded commensurately yet. According to our research, the median exit value has not been above $100 million since 2000 (for both enterprise and consumer), which has and should continue to inform how some funds think about portfolio construction (including price/multiple paid and ownership) and fund size to drive top tier returns. That said, neither LPs nor VCs are shooting for the median.

Also, given that in 2016 the top five largest companies by market capitalization are software/technology companies, and the combined market capitalization of these companies is larger by hundreds of billions of dollars than it was just five years ago, perhaps there is capacity for larger exits by some of these increasingly valuable software/technology companies.

Nonetheless, as an limited partner, the world of venture capital investing has become more complex, with more companies being financed, an array of new micro-VC entrants, many funds growing in size to respond to market pricing, opportunity funds coming into vogue, GPs looking to invest to capture value creation across multiple stages and geographies as companies scale, and more. Those GPs responding to these market dynamics with a strategy that is compelling in terms of its likelihood to capture value will be one that is attractive for an LP portfolio.

Thank you @EugeniusSays for your help with this project!