Those of you who read the in-depth piece from our brilliant infrastructure investing colleagues on the Evolution of the Software Development Life Cycle (SDLC) & the Future of DevOps would know that the Sapphire team is excited about a number of emerging DevOps trends. We continue to see an explosion of new tools and capabilities in the DevOps space, so wanted to follow up on this deep dive in collaboration with David Carter, Head of our Infrastructure and DevOps Center of Excellence (part of our Portfolio Growth Platform) to shine a spotlight specifically on the emerging players and trends in Europe’s DevOps ecosystem.

From our perspective, DevOps is a cultural shift – a set of practices and landscape of tooling that connects cross-disciplinary teams and encourages increased collaboration with the goal of quickly delivering high-quality and robust products.

At Sapphire, we’ve been fortunate to partner with numerous enterprise technology startups that have become part of the DevOps toolchain including Apigee, Catchpoint, CircleCI, Cypress, GitGuardian, JFrog, Kong, Mulesoft, OpsRamp, PubNub, StackHawk, Sumo Logic, Tetrate, Zesty, etc. Our growing team on the ground in London is well-positioned to discover the top trends impacting the DevOps ecosystem and observe the influx of amazing entrepreneurs building the next generation of consequential DevOps companies across Europe and Israel.

Overall, we believe the emerging DevOps ecosystem trends we highlighted in our original piece are equally applicable to Europe as to other geographies. These trends include:

- Increased Machine Learning in the SDLC

- Software Supply Chain Security

- Continuous Experimentation and Shifting Right

- Measuring and Improving Engineering Productivity

- Next-gen Development Environments

Sitting here in London, it’s exciting to see more and more companies adopting DevOps principles as well as ambitious entrepreneurs contributing to open source projects and building new tools to support this implementation. We believe that Europe, in part due to its large and diverse developer talent pool, is uniquely positioned to serve as a strong ecosystem for DevOps innovation. In fact, as of the beginning of 2022 Europe had 8.8 million developers (vs. 6.5 million in the United States), with 30% of the world’s open source developers. Additionally, Europe continues to add to this talent pool through increasing numbers of computer science graduates each year and successfully attracting talent from other continents. With Covid as a catalyst, European countries continue to attract more developers to live and work remotely, which only adds to the richness of the talent base and ambition of the continent.

Spotlight on Emerging European & Israeli Players in the DevOps Ecosystem

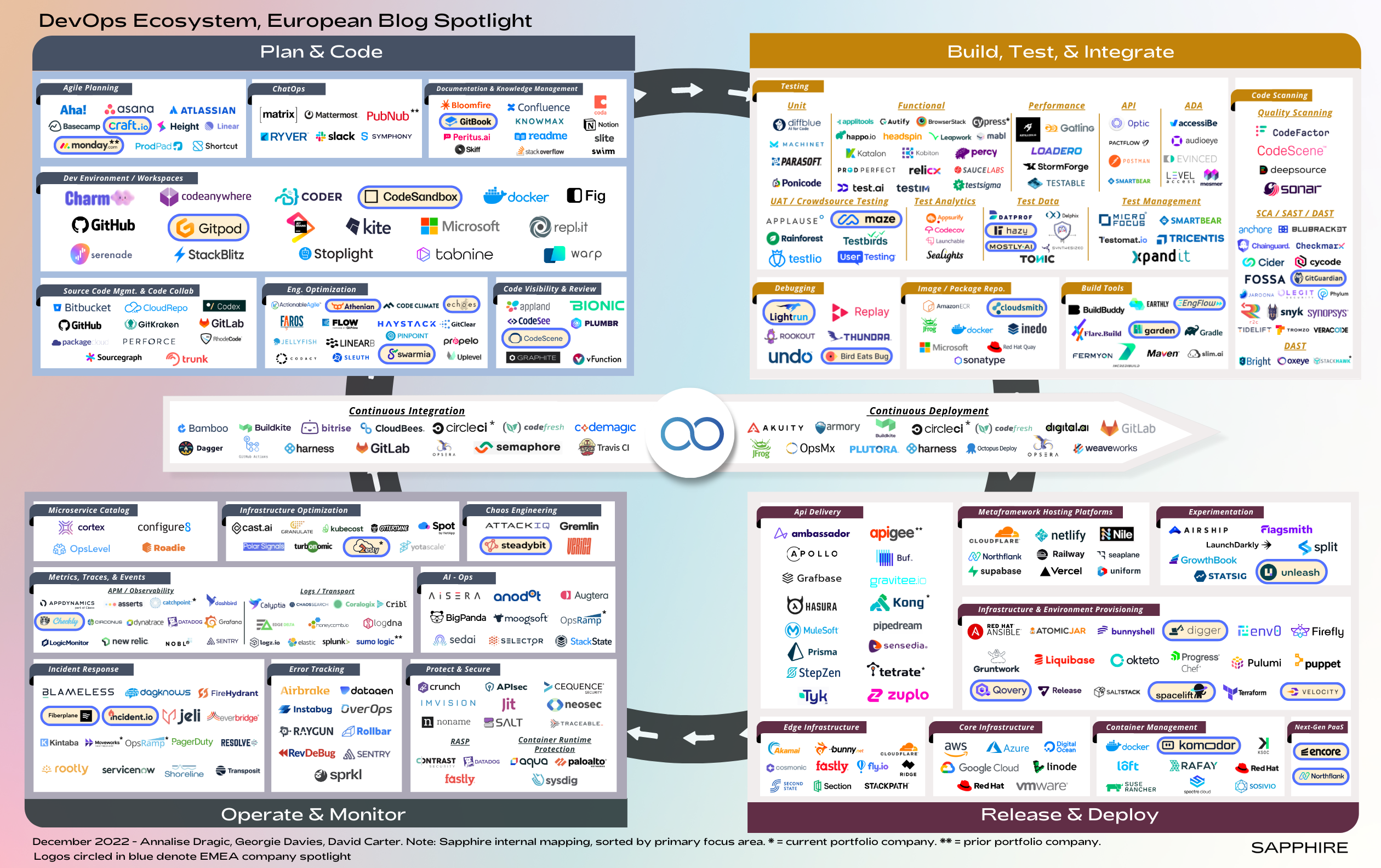

As part of this European deep-dive, we want to highlight some of the emerging European and Israeli next-gen startups across the full scope of the DevOps ecosystem, which we break down into four broad categories: 1) Plan and Code; 2) Build, Test, and Integrate; 3) Release and Deploy; and 4) Operate and Monitor – as well as tools that enable continuous integration and delivery.

Take a look below at the incredible wide-ranging innovation coming out of Europe and Israel across the DevOps ecosystem.

1. Startups Focusing on Planning and Coding

Before any code is written, software architects and engineers need to thoughtfully evaluate technical design requirements and collaborate effectively across teams to plan for efficient development. To support the agile planning of development, Sapphire portfolio company monday.com aids the project management of increasingly complex cross-team workflows and Tel Aviv-based Craft helps align teams on product decisions. On top of this, there are a plethora of companies improving documentation and knowledge management, such as Lyon-based GitBook.These types of companies are becoming more important when coordinating across remote and distributed development teams, which are prevalent in Europe.

Furthermore, we are also excited about the European companies that are enabling developers to improve their productivity and efficiency, and enabling them to do more of what they love to do – code. As mentioned earlier, we see next-gen development environments as a key emerging trend in DevOps as more coding transitions from being written via an integrated development environment (IDE) on a local machine to cloud-based development environments. There are a number of exciting startups building next-gen solutions for development environments and workspaces coming out of Europe, including Netherlands-based CodeSandbox, which is providing an online code editing platform, and Germany-originated Gitpod, which is changing the workflow of writing code through its new Cloud Development Environments (CDEs).

Relatedly, another key trend we see propelling DevOps ecosystem forward is tools measuring and improving engineering productivity. More software development teams nowadays are working distributed and are continuing to feel resource constrained despite the growing European talent pool. As a result, more companies are adopting tools that help engineering leaders gain valuable insights into the state of development in their organisations, optimise resource allocation, and drive operational excellence. For example, Malmö-based CodeScene is shining a light on technical debt within organisations, knowledge distribution, and efficient delivery. And companies such as Echoes HQ, Swarmia and Athenian help deliver actionable insights to drive high productivity and efficiency improvements across engineering teams. With the current macroeconomic challenges, we expect that tools like these will continue to be in high demand by corporate buyers.

2. Startups Focusing on Building, Testing, and Integration

Looking at the next phase in the software development lifecycle – building, testing, and integration – there are several impressive startups emerging out of Europe and Israel. Paris-based GitGuardian, with which we had the fortune to partner with last year, helps organisations detect and remediate leaked secrets.

We are looking forward to continuing to invest in European companies in this phase of the DevOps cycle. In particular, we are keeping a close eye on companies that are enabling faster builds, such as EngFlow. Berlin-based Garden is also innovating quickly in the space combining fast development, testing, and DevOps automation in one tool, and Belfast-based Cloudsmith provides functionality to quickly set up a cloud-native artifact repository enabling developers to work faster across projects and teams.

Additionally, there are several emerging companies that are helping improve different aspects of testing and debugging, including Berlin-based Bird Eats Bug – focused on improving bug reporting, Tel Aviv-based Lightrun –providing a developer observability platform, and Paris-based Maze –enabling application testing and user research. Finally, we are seeing more companies innovating around synthetic test data generation, including Vienna-based Mostly AI and London-based Hazy.

Across all of the different sub-categories encompassing the building, testing, and integration phase of the software development lifecycle, we are particularly excited about the increased adoption of machine learning (ML) enabled tools. We believe that much of the future innovation will be ML led to further drive efficiency and automation.

3. Startups Focusing on Releasing and Deployment

Once the code is ready for a new feature or update, it is time for the next phase – releasing these new changes and deploying into production or a new environment. On one hand, we see the large cloud infrastructure providers releasing new features and capabilities on top of their core platforms to continue to enable better infrastructure management; but on the other, we see several startups quickly scaling out of Europe and providing innovative solutions.

In particular, we are seeing increased activity in Europe and Israel with new solutions for infrastructure and environment provisioning like London-based Digger, Paris-based Qovery, Warsaw-based Spacelift, and Tel Aviv-based Velocity –all founded in the last three years. Additionally, companies like London-based Northflank and Stockholm-based Encore are innovating in the next-gen Platform-as-a-Service space enabling developers to simplify development and deploy code more reliably and cost-effectively. Plus, we also see new solutions popping up around container management, such as Tel Aviv-based Komodor, which automates troubleshooting across an organisation’s Kubernetes stack. In the experimentation space, Oslo-based Unleash is providing a next-generation feature management platform that allows developers to easily try out new features. It’s great to see the breadth of innovation happening across these sub-categories, which while addressing various pain points, are all focusing on the overarching goal of accelerating and improving the development process.

4. Startups Focusing on Operations and Monitoring

Post deployment, we believe it is critical for organisations to operate and maintain their applications efficiently as well as continue to monitor for issues. In this phase of the SDLC, we are seeing a rise of companies utilising ML to better optimise infrastructure configurations as well as detect anomalies, correlate events, and automate responses to incidents. As an example, Sapphire is fortunate to partner with Tel Aviv-based Zesty, which uses ML to help companies dynamically configure their cloud infrastructure while maintaining performance.

Additionally, we are thrilled by the emerging European startups that are building developer-focused products to improve monitoring at scale, such as Berlin-based Checkly, which helps companies actively check reliability, validate, and report on API endpoints and transactions to detect and resolve problems faster. We are also seeing more companies utilise chaos engineering, such as Cologne-based Steadybit to improve the resiliency of applications and reduce downtime.

Lastly, responding quickly and effectively to issues, outages, and errors is critical for all organisations. We are encouraged by the emergence of companies that are enabling more collaboration across teams when resolving incidents, such as Netherlands and remote-based Fiberplane –through its collaborative notebook, as well as London-based Incident.io –via its slack-integrated tooling. We believe that especially in Europe when more SREs and developers are distributed across countries and time zones enabling productive collaboration will be key to resolving incidents quickly and effectively.

The Future Opportunities for DevOps in Europe and Israel

Looking to the future, it is inspiring to see more and more companies adopting DevOps principles as well as ambitious entrepreneurs contributing to this cultural shift within development. What we have highlighted here are just a few of the European companies rising to meet the challenge of the huge demand for DevOps tooling, and we are encouraged to see innovation in the DevOps space happening across the continent. We believe that we will continue to see an explosion of new tools in this space and more European companies of consequence emerge.

If you are a European DevOps company and/or contributing to the evolution of the SDLC in any way, please reach out to [email protected] or [email protected] or [email protected].

Legal disclaimer

Disclaimer: Nothing presented within this article is intended to constitute investment advice, and under no circumstances should any information provided herein be used or considered as an offer to sell or a solicitation of an offer to buy an interest in any investment fund managed by Sapphire Ventures (“Sapphire”). Information provided reflects Sapphires’ views as of a time, whereby such views are subject to change at any point and Sapphire shall not be obligated to provide notice of any change. Companies mentioned in this article are a representative sample of portfolio companies in which Sapphire has invested in which the author believes such companies fit the objective criteria stated in commentary, which do not reflect all investments made by Sapphire. A complete alphabetical list of Sapphire’s investments made by its direct growth and sports investing strategies is available here. No assumptions should be made that investments listed above were or will be profitable. Due to various risks and uncertainties, actual events, results or the actual experience may differ materially from those reflected or contemplated in these statements. Nothing contained in this article may be relied upon as a guarantee or assurance as to the future success of any particular company. Past performance is not indicative of future results.