Since launching the Sapphire Ventures Portfolio Growth team 5 years ago, we’ve developed a network of CIOs, CTOs and digital executives at Global 2000 companies that are motivated to engage with VC-backed startups and emerging technologies. In our interactions, we have consistently observed two challenges enterprises face in navigating startups. First, CIOs face challenges in identifying promising and viable startups amid a noisy market that funds thousands of new enterprise startups every year. This prompted us to launch the SV Explorer innovation portal, which over 300 corporate innovators now use to discover startups vetted by Sapphire and our VC network.

The second recurring challenge is that even though CIOs are working around the clock to instill innovation into their organizations (while keeping the lights on!) – they have no way to assess their innovation management practices and outcomes relative to other companies. We’ve addressed questions on this anecdotally in the past, but lacked comprehensive data. Today, we’re proud to address this industry blindspot with the release of Sapphire Ventures’ CIO Innovation Index, a quantitative study that establishes the first-ever set of measures capturing the state of Global 2000 organizations’ interactions with the startup and innovation ecosystems.

CIO Innovation Index: What We Found

The Index study revealed some compelling indicators of just how intertwined CIOs, IT and startups are, as well as the common processes and challenges that characterize this ecosystem. In analyzing data provided by 70+ IT executives from Global 2000 organizations spread across 12 industries, we studied three interdependent areas that influence an organization’s overall approach to emerging technology and startups:

- Organizational processes related to startup engagement and emerging technologies

- CIOs’ individual participation in the innovation and startup ecosystem

- Current adoption level of startup and emerging technologies

Given how intertwined these areas are — and recognizing every company’s unique situation — we’re presenting the CIO Innovation Index results as a “conversation starter”, rather than a set of definitive conclusions. We hope that CIOs can use the Index to begin evaluating and benchmarking their current approach to startup engagement relative to some of the world’s largest corporations, and better understand the drivers for effective outcomes. For the startups, we believe the Innovation Index presents a series of observations that should influence how they think about influencing IT leaders, the role POCs play in their sales pipelines, and their relative advantages and weaknesses compared to established players.

Since our goal for the CIO Innovation Index is to increase the transparency between large enterprises and startups, our initial report explores questions such as:

- What percent of IT budgets do startups currently account for, and how is that share of budget expected to trend?

- Which emerging technologies do CIOs prefer to engage startups for, over more established vendors (and vice versa)?

- What are the commonly reported benefits of working with startups, and the challenges?

- What role do startup Proofs of Concepts (POCs) play in the evaluation process CIOs and their teams?

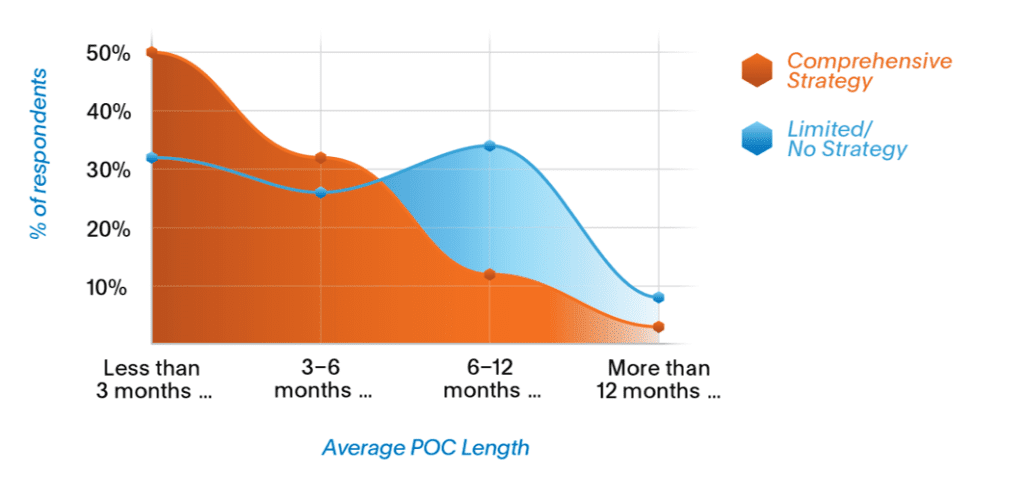

One of the most interesting findings in our initial report is that companies that say they have a comprehensive strategy for adopting emerging technology tend to have significantly shorter durations for their Proof of Concepts (POCs) with startups — often less than 3 months — and tend to have a higher “graduation rate” for those POCs into production implementations relative to companies who say they have limited or no strategy for these new technologies. This suggests how important having a clear, overarching strategy is in helping companies identify the right technology to trial, and defining what “success” should look like for any startup POC. It also implies that startups should assess whether their prospects have defined strategies for the emerging technology domains they represent, as this will impact their chances of being adopted.

Read more about the role of POcs in adopting emerging technology — and all of the results of the CIO Innovation Index — by downloading the report here.

What’s next for the CIO Innovation Index?

What’s next for the CIO Innovation Index?

This release of this report is the first step for the CIO Innovation Index, with participation from more than 70 organizations across 30 data points. Looking ahead, we want to drive CIO participation in the Index so we can keep growing the quality and breadth of the data set. And as we evolve the framework, we want to gather metrics in other areas, such as:

- Correlation between business KPIs and Innovation Index metrics. For example, we know CIOs are eager to see data on whether there is a correlation between the adoption level of emerging technologies and company profitability.

- Startup-driven metrics. With startups forming a key part of this equation, we want to invite startups to contribute data on their experiences engaging with CIOs and large enterprises, such as standard timelines and commercial models for POCs with enterprise customers.

Download the free CIO Innovation Index study

Our plan is to update the CIO Innovation Index annually, so we can monitor the trendline of how interactions with Global 2000 organizations and startups are faring. Ultimately, we believe that CIOs are better off measuring their innovation playbooks against an aggregate index of peer activity, and we aimed to capture these playbooks with a broad canvas. If you are a CIO or an IT executive from a large organization, and you would like to participate in the Innovation Index research study by contributing your company’s data, please reach out to us at ([email protected]). We welcome your thoughts and feedback on this effort and the original findings in the Index report.