Follow me @samirkaji for my random, sometimes relevant thoughts on the world of early stage venture and start-ups.

This post serves a part one of a two part series that Beezer Clarkson at Sapphire Ventures and I are co-authoring to help VC’s (specifically emerging managers) navigate through fundraising cycles and engender better and more relevant relationships with LP’s.

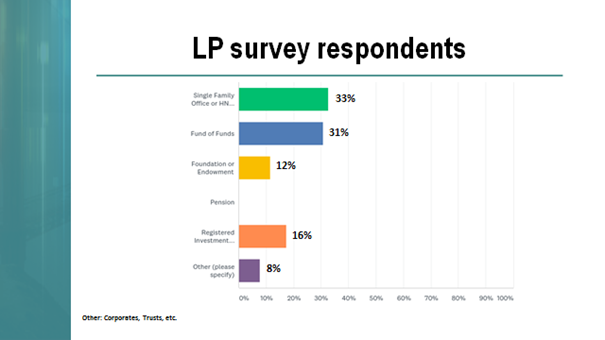

During the 3rd annual emerging manager focused RAISE conference, I presented the results of an LP survey that was conducted with RAISE LP conference attendees prior to the event. The primary goal of the survey was to better understand the current temperament of LP’s as it related to venture allocations in emerging managers. The sample size of the survey was approximately 60, and represented a good cross section of LP profiles with fund of funds, foundations, endowments, family offices, and wealth managers all participating.

Without question, there are many components to a successful fund raise. An important factor in mitigating fundraising friction is a keen sense of the profiles of LP’s, their typical preferences, and sensitivities, and then using this knowledge to build a fundraising strategy centered on LP/GP fit.

We’ll discuss how to assess LP/GP fit in part two of this series, but in this post, we’ll review the findings of the LP survey in detail.

I’m linking the entire presentation here for reference.

Survey Findings

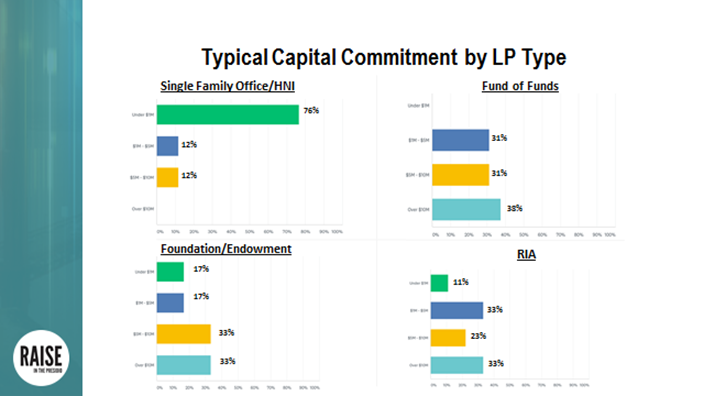

- For new venture managers (many Fund I/II profiles), family offices and high net worth individuals are unequivocally going to comprise the majority of the limited partner base and time should be accordingly spent to this finding. For all of nearly 150 venture funds on Fund I and II that we’ve tracked since the beginning of 2017, nearly 50% represent funds that currently have <$20MM closed. As the chart below shows that >60% of institutional allocations are $5MM+ and recognizing that LP’s rarely want to constitute more than 20% of the fund, institutional LP’s often represent poor fits for those that are raising funds of $25MM and lower. This further highlights the importance of thinking realistically when setting fund targets as to avoid too many unnecessary conversations with those LP’s that aren’t immediate fits.

Apologies for the fuzzy output; see link above for actual slide

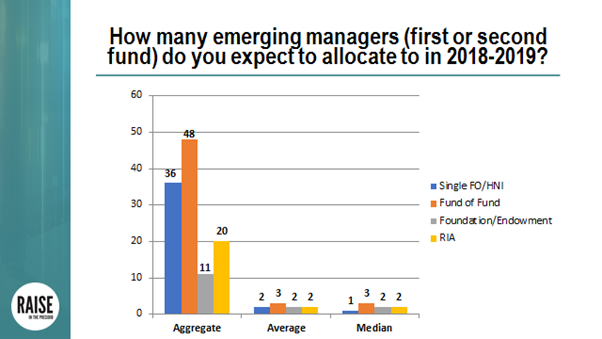

- Although no LP type indicated that they expected to allocate extremely actively to emerging managers (Fund I/II) during the next 18 months, Fund of Funds appear to be the most active allocators on average. It’s important to note that there are any more single family offices than fund of funds and we expect that if examined universally, that the majority of emerging fund allocations by volume will likely come from family offices. In an informal survey we conducted with emerging GP’s earlier in the year, fewer than 35% of GP’s indicated they had raised a Fund I in which the LP base was even 50% institutional by dollar amounts.

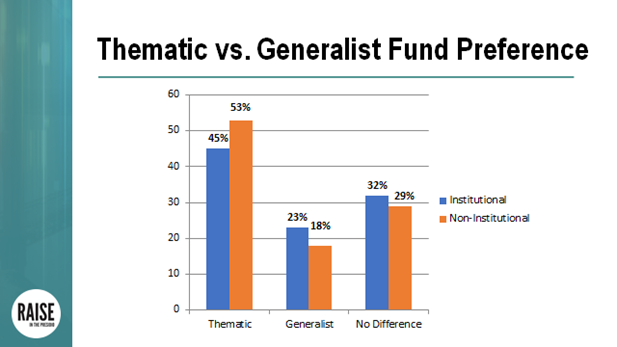

- Thematic fund profiles are very clearly preferred as nearly 2x as many institutional LP’s and nearly 3x of non-institutional LP’s indicated they’d prefer investing in a thematic fund (defined as fund that has a (very) specific, and sometimes narrow investing thesis/model). While it is not surprising given the strong push for managers to have some level of tangible differentiation, we have seen LP’s expressed concerns around thematic funds that seem too narrow in scope or manufactured for marketing purposes only.

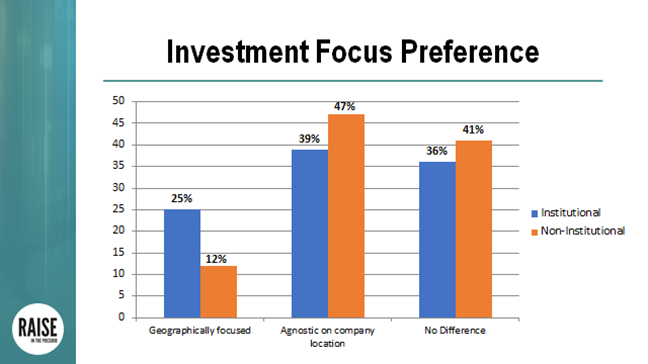

- The LP’s we surveyed were generally apathetic about geographical focus of the fund. We were a bit surprised to see that such a small minority of LP’s preferred a fund with a specific geographical mandate. Given the valuation bloat that naturally occurs in the Bay Area along with rise of technological hubs across the US, we expected that more LP’s would be actively seeking out managers that had geographically centric themes. Although these results may be a bit distressing for managers that have a specific geographic thesis, the results may be construed simply as geographic focus alone isn’t a compelling enough reason to allocate. We have seen many LP’s who want exposure internationally and in non-silicon valley US cities, but hold GP’s to the same standard as non-geographically focused funds.

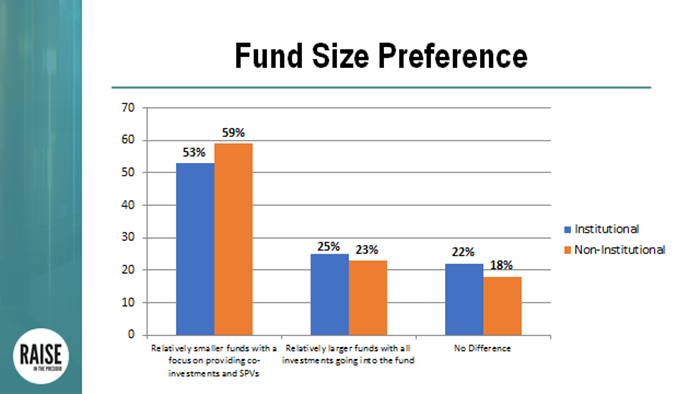

- Small funds (<$50MM) where follow-ons are done via SPV’s or co-invest were slightly preferred over larger funds where follow-ons were largely done through fund reserves. One could rationally attribute this to the difficulty of generating successful venture returns (2.5X+ net) for larger funds. For us, we were somewhat surprised initially by the institutional LP data as most generally speaking institutional LP’s do not actively participate in SPV’s or co-invests. We think our particular findings could have been due to the fact that Fund of Funds were the prevalent institutional LP type represented in the survey, many of which have adopted active co-investment practices. Additionally, given the need for endowments, pensions, and other large institutional investors to require large allocations, we believe the numbers below would be deviate greatly if the survey respondents weren’t simply the inclusive of those attending an emerging manager conference, but rather included a broader universe of institutional LP types. That said, it’s instructive to recognize the appeal of smaller funds for emerging manager focused LP’s This is particularly true for those LP’s who are smaller in size than the larger established institutional LP’s who typically carry more risk adversity and are often subject to the realities of large capital pool management.

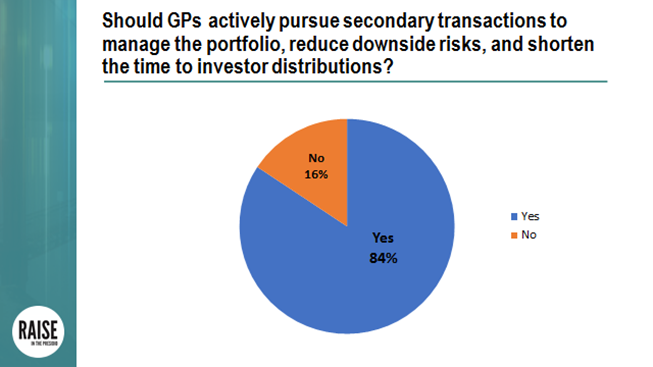

- Liquidity remains a serious concern for LP’s. Although venture (unrealized) performance as an asset category has been strong over the last decade, illiquidity continues to be omnipresent as M&A and IPO activity remain stagnant, and the time for significant venture exits to occur continues to protract. As such, the vast majority of LP’s conveyed that they prefer that fund GP’s develop a portfolio management strategy that considers secondary transactions to accelerate returns and mitigate risk, even if this strategy results in some forfeiture of medium to long term upside.

While we realize it’s acknowledged that survey results contain inherent deficiencies, we believe that many of the survey findings should be instructive for those raising funds. In our next post, we’ll cover how best to identify and create GP/LP fit.

While we realize it’s acknowledged that survey results contain inherent deficiencies, we believe that many of the survey findings should be instructive for those raising funds. In our next post, we’ll cover how best to identify and create GP/LP fit.