Over the last few years, we’ve witnessed a pervasive trend of growth at all costs. Companies across industries raced to expand their customer base, penetrate new markets and generate rapid revenue growth. While this approach may have yielded short-term gains, it also led to the emergence of unproductive and bloated sales and marketing organizations. The following is a short guide to help organizations transition to a healthier revenue model.

We’ve seen this overexpansion occur in particular around supporting GTM resources. A few examples:

- Sales Development: In an effort to accelerate pipeline generation and take responsibility away from closing roles, we’ve seen the ratio of sales to SDRs draw closer to 1:1.

- Sales Engineering: We have seen an increase in sales engineers (SEs) given the need for more technical overlay roles to support more complex product offerings. In practice, we believe this has led sellers to become overly reliant on SEs early in the sales cycle. As a result, we are seeing sellers spending less time on discovery and learning pain and more time on showcasing features and functionality through demos.

- Customer Success: CS leaders have refined down the “book of business” size for their CSMs to offer more “white glove” support for end customers. While this may be relevant up-market, we are seeing this shift across all segments.

Individually, each of these shifts may not have a significant impact on the efficiency of an organization’s GTM strategy. But in aggregate, we think they lead to highly inefficient revenue organizations.

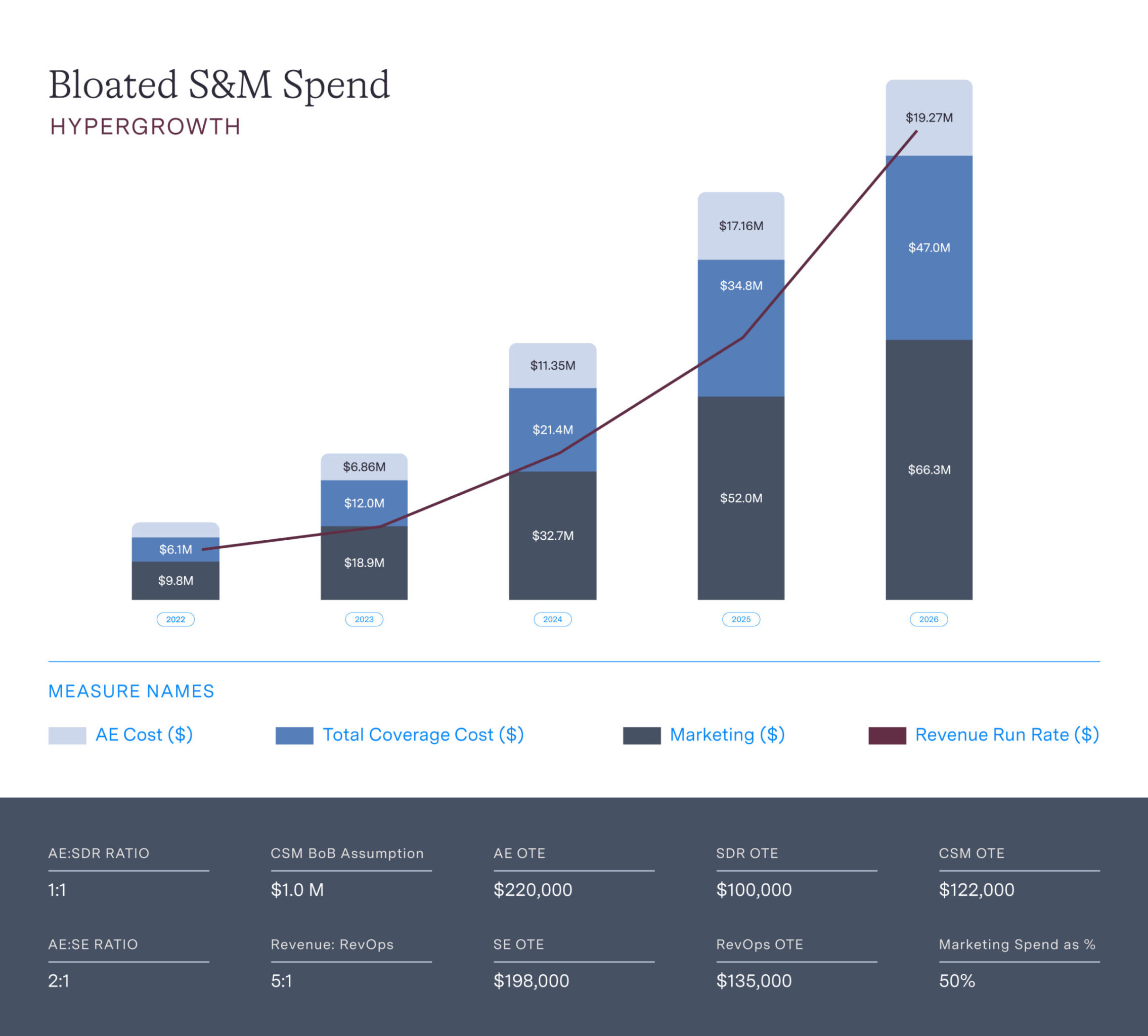

Let’s walk through an illustration of how this type of GTM strategy can impact a company’s margin for success. Below is a hypothetical “hypergrowth” startup in the first five years of its journey. We applied what we have observed as bloated sales and marketing spend:

Notice that the hypothetical company very quickly needs a significant growth rate to justify sales and marketing expenses, even without considering other expenses.

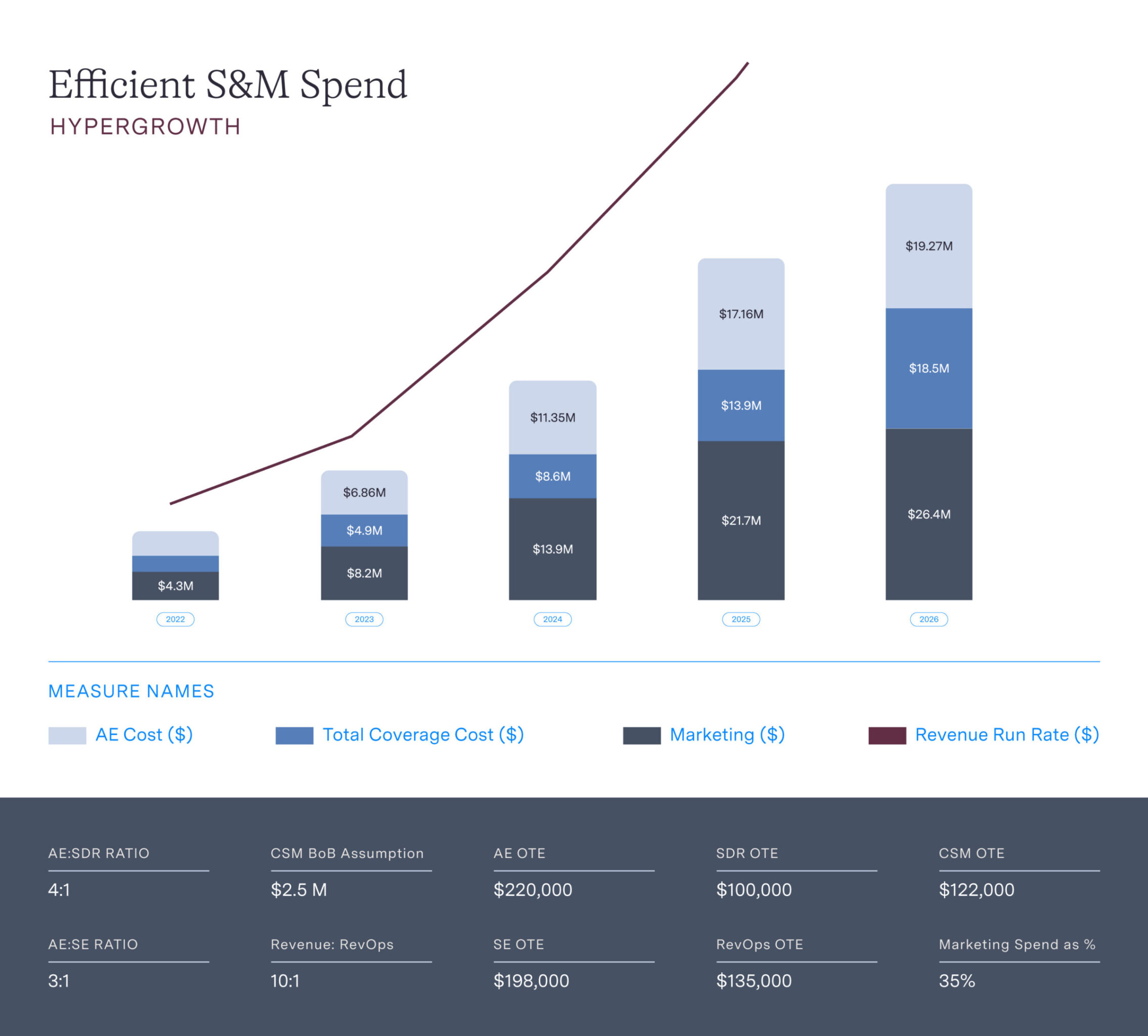

Alternatively, if we revert back to coverage ratios that we saw as being standard prior to the last few years, we see a more tenable outcome for the company in question:

As we navigate a new macro environment in which durable growth is critical, it’s essential to reflect on the past and redefine how we resource our GTM organizations.

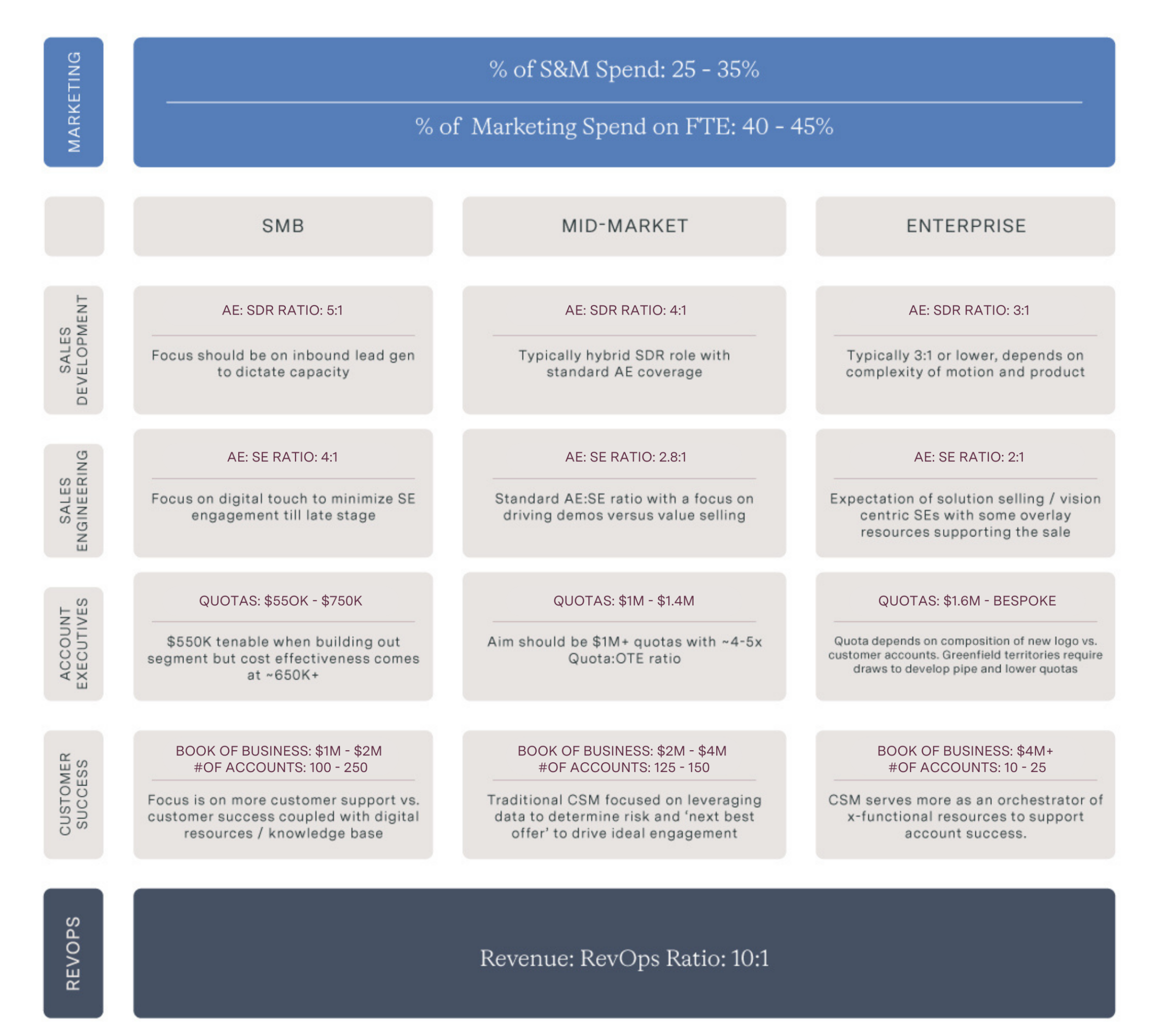

We spoke with a handful of highly experienced operators in our network to understand how they think about resourcing sales and marketing teams with revenue efficiency as a guiding principle.

We’ve compiled what we’ve learned and applied this thinking to SMB, mid-market and enterprise organizations in a single view below.

Looking ahead, we see an opportunity for great companies to reevaluate how they execute their GTM resourcing strategy. When executed properly, we firmly believe that optimizing your GTM organization can result in clearer roles and responsibilities, enhanced customer engagement, and overall improved productivity among your revenue team. Making the transition, however, can be a difficult journey, especially if your organization has not considered efficiency as a guiding principle in the past.

If you are looking to make the transition to a healthier coverage resourcing model, consider conducting this transformation with a people-first mindset. Allow for natural attrition where possible, focus on training and developing your team members, so they can transition to other roles within the organization where appropriate. Finally, ensure that you maintain strong guardrails in the future around the resources you add. This approach can help ensure your resources are being utilized as efficiently as possible, making a meaningful impact on the long term outcomes of your company.

Legal disclaimer

Disclaimer: Nothing presented within this article is intended to constitute investment advice, and under no circumstances should any information provided herein be used or considered as an offer to sell or a solicitation of an offer to buy an interest in any investment fund managed by Sapphire Ventures (“Sapphire”). Information provided reflects Sapphires’ views as of a time, whereby such views are subject to change at any point and Sapphire shall not be obligated to provide notice of any change. Sapphire does not make any representation as to the accuracy or completeness of information provided herein.

The illustrations and summaries provided by Sapphire are for informational purposes only and are in no way intended to constitute investment or business advice. Although Sapphire has provided and described various assumptions within this article, many other factors may impact any practical outcome that is estimated therein. While Sapphire has used reasonable efforts to present observations from analysis and research, Sapphire makes no representations or warranties as to the accuracy, reliability, or completeness of observations presented within this article, analysis, or the illustrations themselves. All metrics and observations presented within this article must be considered academic and hypothetical in nature and are in no way guaranteed in actual practice. Such observations are based on numerous assumptions, are subject to change at any point and do not in any way represent official statements by Sapphire. No assurance can be given that all material assumptions have been considered in connection with the analysis in this article and the illustrations, therefore actual results will vary from those estimated therein. Due to various risks and uncertainties, actual events, results or the actual experience may differ materially from those reflected or contemplated in these statements. Nothing contained in this article may be relied upon as a guarantee or assurance as to the future success of any particular company. Past performance is not indicative of future results.