GmbH. SAS. Ltd. For many of us this can be alphabet soup and at the mere mention of legal structuring we yawn. The reality is that compared to U.S. peers, legal structures for European startups can be more complex and exist in a variety of types.

When establishing a new company, most European founders generally don’t spend too much time thinking about where to incorporate their startup. The decision is usually based on where they live and the legal structure of that country. At the beginning of a startup journey, this is generally the smart option. However, as the company matures, legal structuring may be re-visited. For European startups expanding to the U.S., accepting U.S. venture capital financing and/or considering exits (M&A or IPO) in the U.S., the question of flipping to a U.S. legal structure often arises.

At Sapphire, we strongly believe that companies of consequence can be built from anywhere, and we have backed companies with a variety of legal structures. Some of our European portfolio companies have pursued flipping to U.S. structures, while others have not. We have and will continue to support both choices because ultimately, there is no right answer.

Each startup journey is unique and there are often different pros and cons to consider in a U.S. flip. Because of this, it can often be confusing to founders to understand the tradeoffs and best course of action to take. I recently teamed up with Stacy Kim, London-based Partner at Wilson Sonsini, to sit down with a group of European founders contemplating flipping to the U.S. I want to share some of the common questions we addressed to help demystify the process for founders.

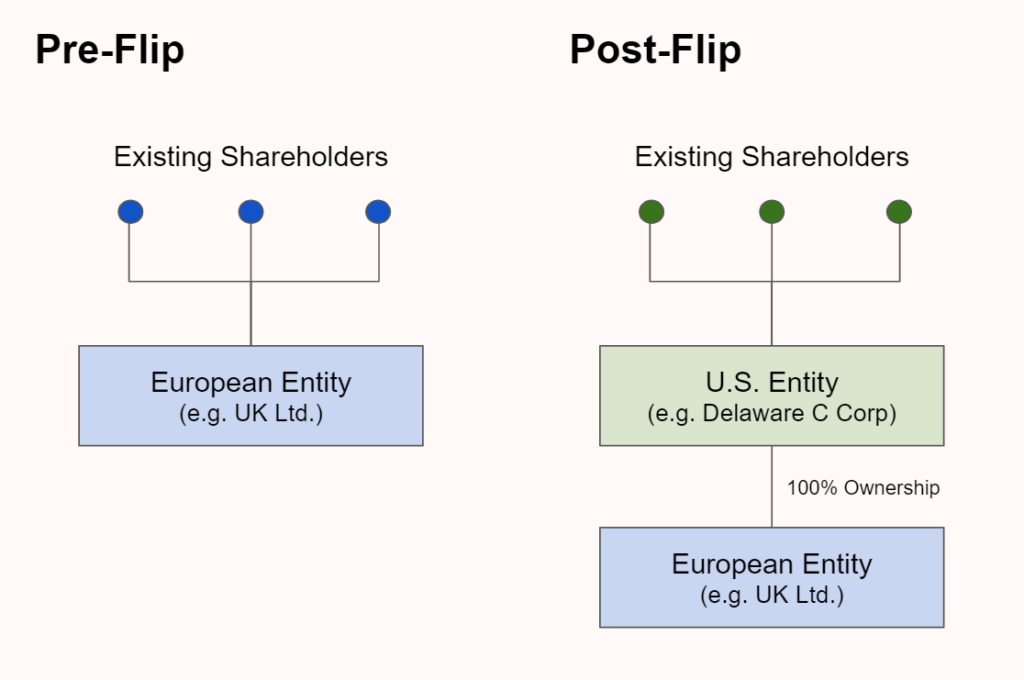

What is a U.S. flip?

A flip is a shorthand term for a legal reorganization of a startup in the U.S. In practicality, the U.S. entity is almost always a Delaware C Corporation. The flipping process creates a new U.S. entity (i.e. Delaware C Corp) that become a holding company for a foreign entity (i.e. original startup entity). In this process, the shareholders of the original startup entity do a share-for-share exchange with the new U.S. entity. Once completed, the U.S. TopCo fully owns the foreign entity.

When and why should you consider flipping?

Founders in conjunction with their board should only pursue a flip when there is a compelling reason to do so. At the early stage, this could be joining a great accelerator program or accepting funding from an early-stage U.S. investor that requires or highly encourages being a U.S. entity. For Sapphire and other sophisticated international VCs, investing in non-U.S. legal structures is not an issue and these firms are experienced in doing so. At the pre-seed to series A stages, smaller U.S. VCs may be restricted by the rules agreed upon with their limited partners or have a strong preference due to comfort to invest in Delaware entities though these behaviors are changing with more U.S. VC interest in the European ecosystem. At the same time, there are great early-stage European VC firms who are more comfortable with and have an easier time investing in their local legal structures. For early-stage startups, the decision can come down to from whom and where the best option for financing is coming from.

As a startup matures, the time, complexity and cost of executing a flip increases. At the later stages, founders may choose to pursue a flip (or not) based on the trajectory of the business. If the majority of the operations and the potential exit (eg. listing on NYSE / NASDAQ) becomes more U.S. centric, then it may be worthwhile to consider flipping.

That said, because flipping is a costly process from a financial, resources and time perspective, it is not something that European founders should pursue preemptively. At the early-stage or late-stage, it is always important for a founder (and their board) to have a clear, compelling reason to pursue a flip.

Practically, how is a flip executed?

The time and cost of completing a flip can depend on the local jurisdiction and stage of the company. No matter the local jurisdiction though, a flip can be broken down into three key steps:

- Establishing a Delaware C Corp by the current shareholders of the foreign (original) entity

- Exchange 100% of ownership of the foreign (original) entity to the U.S. entity

- Shareholders agree to new legal documentation that matches U.S. style

What about tax implications?

The short answer is, yes, there will be some. The long answer is it can get complicated. Reason being is that the differences across European countries are mostly driven by different tax rules. It is important to consider and weigh the tax implications of completing a flip. Flipping can cause an unexpected tax event for founders and investors. From this perspective, flipping from the UK can be easier than from other European countries. It is best to get expert advice from an experienced lawyer as there can be different creative solutions based on the specific situation. Although tax implications become an important consideration, with expert advice it does not need to become a blocker to flipping.

What can you do to best prepare to flip?

If a founder is strongly considering flipping the best initial steps to take are:

- Start socializing the idea with the board. This way, the board can discuss the compelling reason to flip, seek expert advice and start to discuss the pros and cons.

- Tactically, it can also be helpful to check if there is a drag along clause in the company’s legal documents. If a startup decides to flip, then this clause can help streamline the process with smaller shareholders, though it is rarely used.

- Thirdly, it is best practice to ensure company documents are well organized, executed and clean. This hygiene is important to ensure before and during a flip so that way future investors will not question if a flip was done properly.

Flipping is Not a Must to Building a Company of Consequence

Finally, as the European VC ecosystem has matured with a record breaking $20B raised in Q1, we see world-class angels, pre-seed/seed and series A funds that are great at supporting European founders at the early-stage. The belief that in order to be successful a founder has to move to Silicon Valley is long dead and has been disproved many, many times.

Flipping is not a must to build a company of consequence. In our experience, some of our portfolio companies have flipped and others have not. We continue to believe that global, world-class, visionary companies can be built either way.