The Department of Defense (DoD), often labeled as risk-averse when it comes to adopting the latest, most innovative technologies, is one of the last remaining sectors where modern software has yet to take hold. For this reason, coupled with the long, arduous sales cycles, red tape, complex procurement processes, regulatory nuances, stringent compliance requirements and technical challenges associated with doing business with the DoD, many VCs have shied away from backing defense tech startups.

The reluctance is often worsened by the disconnect between startups’ expectations of typical enterprise procurement processes and the stubborn and painful traditions of government buying. We know that the term “Valley of Death” is associated with startups selling into the DoD as the majority have a difficult time bridging the gap between product development and true deployment.

However, as the U.S. increasingly faces new, technologically sophisticated threats, it needs to stay ahead. Software startups and the DoD are increasingly coming together with the common goal of enhancing national security, protecting the country’s interests and maintaining military readiness amidst an uncertain geopolitical climate. As the DoD prioritizes new innovation and a modern approach to defense, it’s no surprise that there’s been a sizable uptick in defense tech investment volume over the past few years.

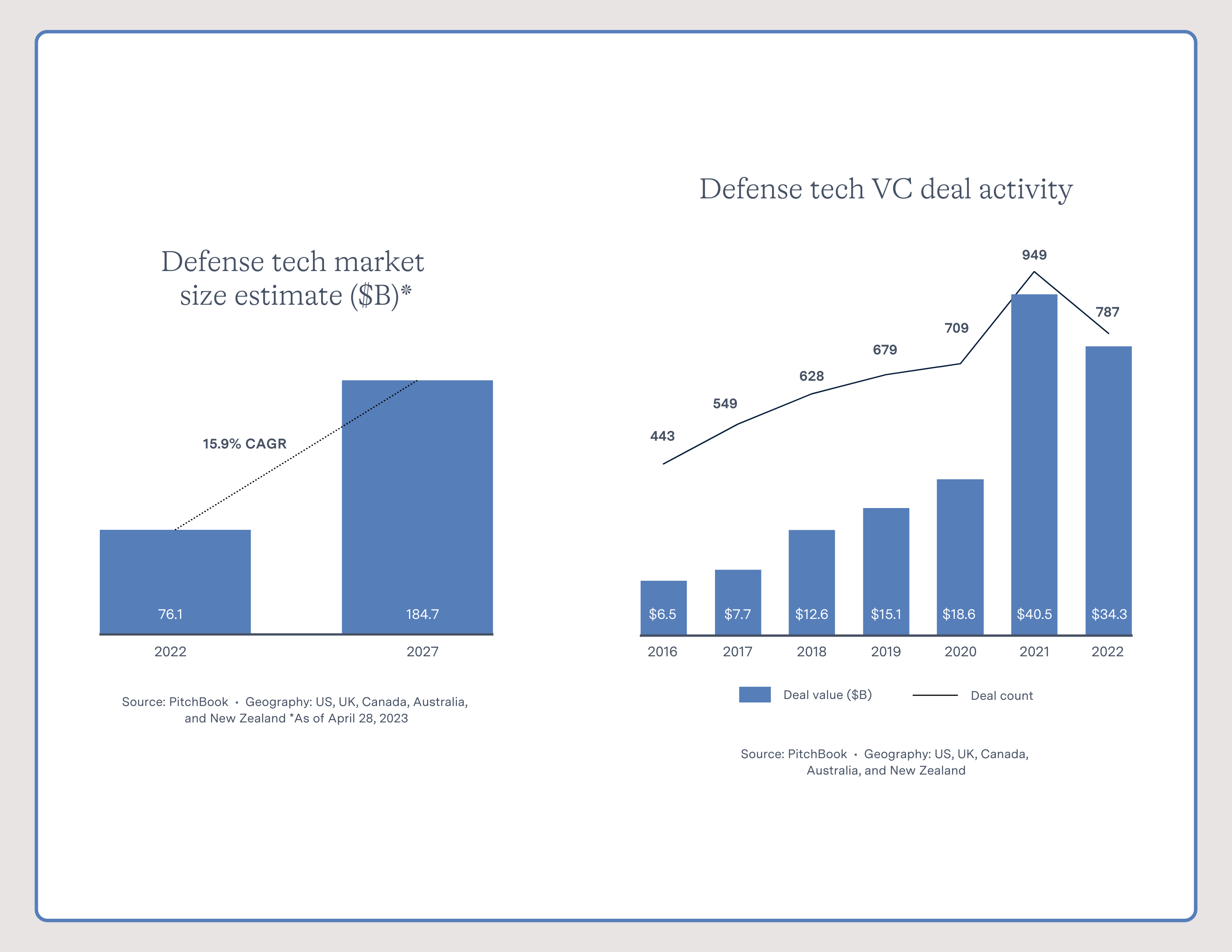

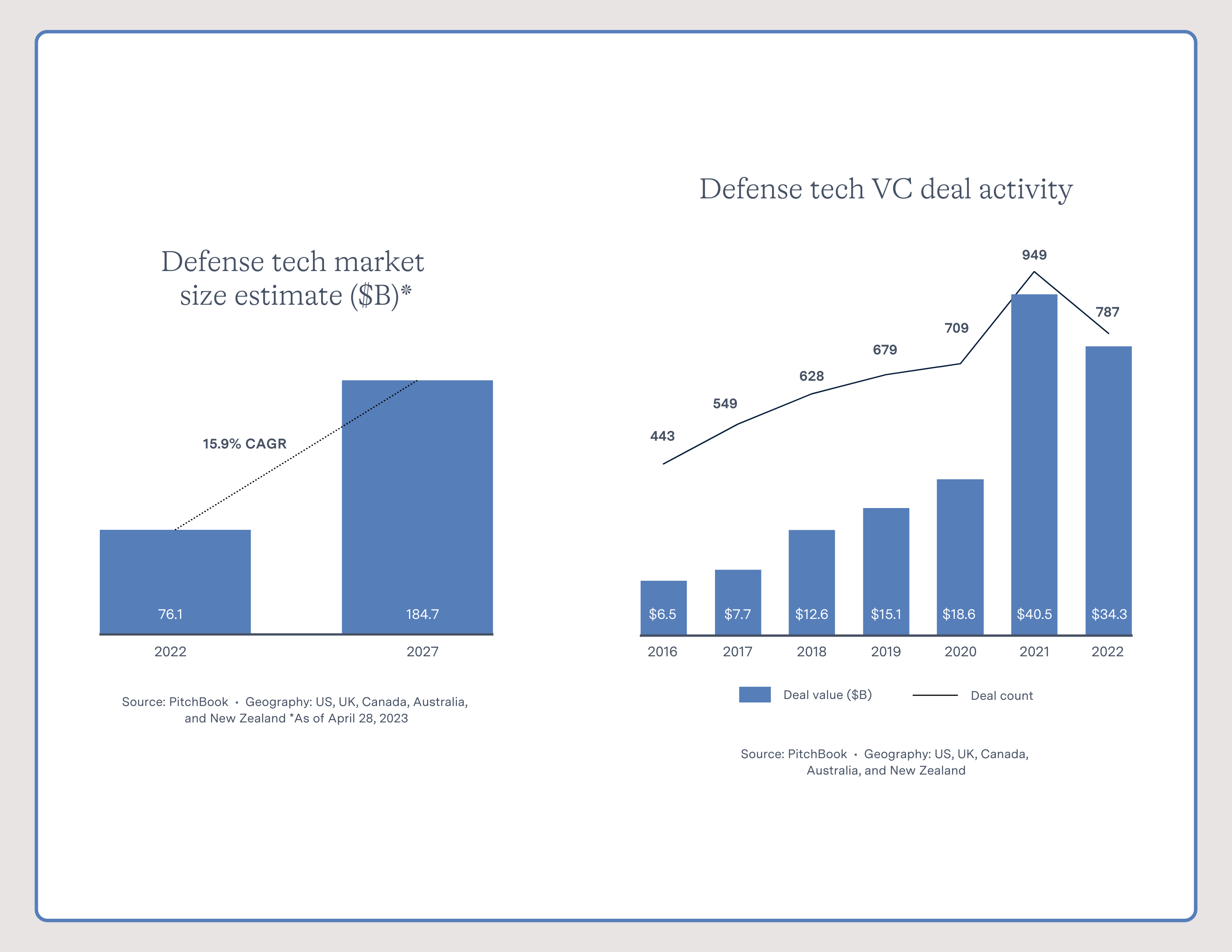

Pitchbook recently estimated that $34.3B in funding went towards defense tech startups in 2022 versus $18.6B in 2020, with a TAM that is expected to grow at a 15.9% CAGR through 2027(1). While there is still a long way to go before building, selling and investing in defense tech becomes widely popular, founders, builders and VCs are quickly waking up to the opportunity.

Expand

Pitchbook’s Defense Tech Market Size Estimate ($B) & Defense Tech VC Activity in May 2023 (1)

4 Reasons Defense Tech Is Set to Become a Thriving Industry

We believe there are several reasons behind the defense tech surge and why we are particularly interested in the category. We hinted at this in our 2024 enterprise tech predictions and want to take a moment to elaborate on the following defense industry trends:

1. Rising Global Conflict Calls for Modern Tech Defense

Defense and national security have become top priorities for the U.S. government and the general public in the face of increased adversarial threats. Terrorist groups, criminal syndicates and competing nation-states are increasingly relying on technology to gather intelligence, anticipate countermeasures, exploit vulnerabilities and launch cyber attacks on digital infrastructure. As a result, the U.S. is being forced to take advantage of the most advanced technologies available. We feel this has led to a softening sentiment around defense tech innovation and investment by the government and the Department of Defense in particular, which is increasingly thought of as a necessity for protection against credible and targeted threats.

2. The DoD Admits its Technological Shortcomings

There exists a long-standing paradox between the size of the U.S. government’s IT spending (~$59B/year(3)) and the lack of technological innovation and tangible impact resulting from these investments. Legacy systems often remain the status quo in the federal government and mission-critical systems range from eight to 51 years old–many systems even pre-date the internet(5). In recent years, the DoD has acknowledged its technological shortcomings as critical vulnerabilities, which can no longer be brushed off as unfortunate quirks of the system. In March 2023, the DoD issued the DoD Software Modernization Implementation Plan, noting the importance of evolving faster and being more adaptable than our adversaries, stating that the department’s adaptability increasingly relies on software and the ability to securely and rapidly deliver resilient software capability is a competitive advantage that will define future conflicts(6). We believe this dynamic presents a major opportunity for defense tech startups, which are commanding more and more attention from government buyers, as well as the investors who back them.

3. Government and Public Support Drives U.S. Defense Budget Up

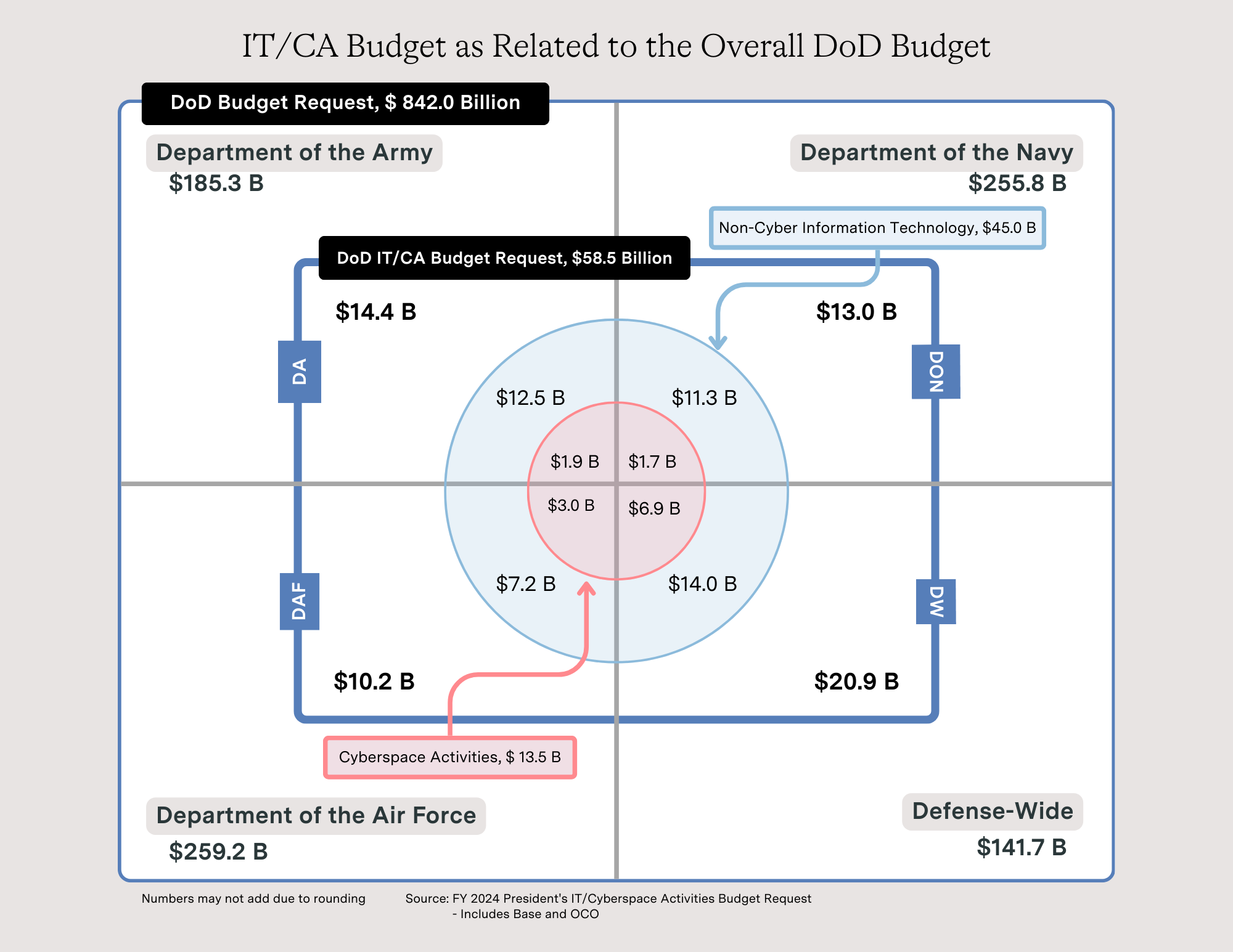

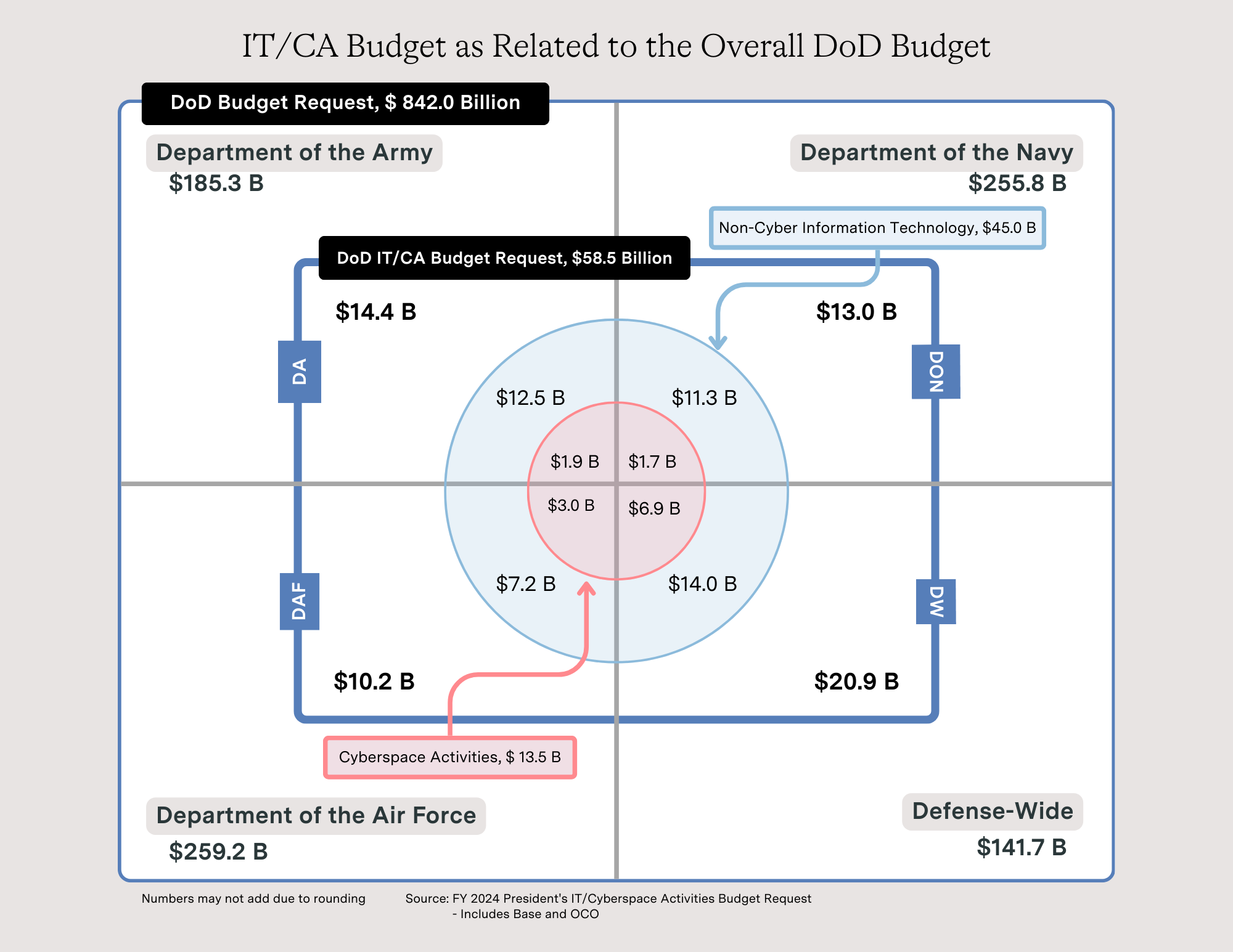

Due to an increase in more sophisticated global threats and the DoD’s new focus on improving its technology, software and systems, both the Congress and public have increasingly become supportive of growing spending in the area. In response, the U.S. defense budget has jumped to $842B in FY24 ($16B more than FY23 and $100B more than in FY22(2)), 7% of which amounts to $59B spent on IT and cybersecurity in FY24. This includes software infrastructure, business management systems, battlespace awareness and command/control, cloud, AI/ML, etc. (3). Should the DoD successfully adapt to increasing demands for more agile software procurement, adoption and delivery – initiatives they have publicly committed to – then government funding for defense technology startups may continue to tick up, further accelerating the growth of this market sector.

Expand

IT / CA Budget as Related to Overall DoD Budget from DoD Information Technology and Cyberspace Activities Budget Overview Request in May 2023. (3)

4. Top Defense Talent is Now Flocking to the Private Sector

Many federal jobs lack incentives to attract leading tech talent, which is often drawn to the private sector, enticed by materially higher salaries (federal jobs on average lagged by 27.5% in wages(7)), better benefits and a more appealing work environment. The private tech sector is regularly known for celebrating innovation and pushing boundaries as drivers of progress, while the government takes a more cautious approach. Given what’s at stake, DoD decision-makers understandably tend to stick to the status quo and can view technology as a black-box liability that could potentially put the mission at risk. We believe this dynamic has led to a talent migration from the DoD to defense startups. Startups can now hire best-in-class builders who are excited to create software that solves the pain points they experienced firsthand when working for the government and specifically, the DoD.

But a Major Challenge (and Opportunity) Lay Ahead

While we are compelled by the tailwinds fueling defense tech, we aren’t oblivious to the challenges associated with the difficult sales process and notoriously hard to obtain government contracts. The DoD’s procurement process is highly regulated and complex, involving multiple levels of approval, strict compliance demands and a diverse set of personas with varying motivations. Furthermore, to even begin selling, IT vendors must list on the GSA schedule and seek to gain FedRAMP status and/or gain accreditation (depending on the requirement), which requires substantial resources to obtain. Even when certified and/or accredited, government contracts are competitive and may be rewarded unpredictably, resulting in lumpy sales and extended sales cycles.

This means that it will take creativity, influential relationships and persistence for startups to even enter the conversation, let alone to successfully navigate DoD selling and contracting. That said, we feel confident it the opportunity that lay ahead despite the challenges. We are eager to dive in, so, the question we are now asking ourselves is where should we start first?

3 Areas Predicted to See a Flurry of Defense Tech Innovation

As 2024 unfolds, we’re keeping tabs on several trends shaping the defense and national security startup ecosystem that we believe will continue to grow in the coming decade.

Systems that Facilitate the Adoption and Delivery of Advanced Software

As the DoD drives towards adopting enterprise IT capabilities, it must first stand up major foundational infrastructure. This infrastructure is needed to tackle challenges like supporting continuous ATO, air-gapped software delivery, ensuring code-level visibility, reducing dependencies, supporting edge capabilities and interoperability – among many other initiatives. All of these complexities have traditionally made it difficult for the DoD to move quickly and adopt modern technologies necessary to support its current and future needs amid an evolving threat landscape. At the same time, the obstacles ahead also represent exciting opportunities for startups moving quickly to deliver novel solutions that help solve roadblocks head-on–many of which will enable the DoD to accelerate software delivery and achieve greater efficiency, agility and security. From our perspective, companies like Defense Unicorns, Second Front Systems and Ditto are leading the charge here.

AI & Machine Learning for Advanced Defense Capabilities and Operational Effectiveness

The DoD has declared AI/ML a top priority in recent years, launching a series of targeted initiatives including the establishment of a Generative AI Task Force in August 2023 and the release of the 2023 DOD Data, Analytics & AI Adoption Strategy in November 2023. The size and momentum associated with this market opportunity is enormous. The U.S. military has requested $1.8B for AI in their fiscal 2024 budget to deliver and adopt responsible AI/ML-enabled capabilities on secure and reliable platforms. The strategy focuses on developing systems that facilitate the rapid and scalable deployment of emerging AI/ML technologies, ultimately providing a long-term advantage from improved decision-making, planning and operational efficiency across all areas. Furthermore, ML can be leveraged for a myriad of use cases such as strategic decisioning, scenario analysis, training, threat monitoring, improvement of autonomous systems, logistics and simulations, among so many others–not to mention all the infrastructure and tooling required to continuously uphold, maintain, secure and improve these models and all of their descendants. We are keeping a close eye on the next generation of defense software companies like Vannevar Labs, TurbineOne, Scale, Snorkel, Robust Intelligence, Yurts, Calypso AI, Modern Intelligence, Strider and Howso offering these capabilities while meeting the strict and nuanced requirements set forth by the DoD.

Fortifying Cyber Resilience to Improve Readiness and Response Capabilities

Over the past decade, cyber incidents targeted at the DoD have continued to climb in number and sophistication, making it imperative for defense agencies to bolster their security posture to better prepare, prevent and respond to attacks. When it comes to protecting classified networks and highly sensitive, mission-critical data, there is little room for error. As such, threat visibility and intelligence, incident response, comprehensive access control and user authentication, vulnerability management, countermeasures and the reduction of human error (e.g. social engineering and phishing) are paramount. As a solution to growing cyber threats, the DoD has laid out a plan to achieve comprehensive adoption and enforcement of a zero-trust architecture and strategy by 2027. This is a massive undertaking that will require the widespread adoption and development of software, processes and policy enforcement tailored for the DoD across several cybersecurity capabilities. Multi-factor authentication, credentialing, behavioral biometrics, identity management and verification, in addition to many of the threat-related capabilities mentioned above, as well as DevSecOps, IoT and supply chain security solutions, are just some of the key focus areas that we are tracking in 2024 and beyond. We have already begun to see activity in these areas both from traditional enterprise security players, as well as new entrants such as Shift5, SOFTwarfare, Forward Networks, Xage Security, Dragos, Authentic8, HarfangLab and Greynoise.

These categories are far-reaching as they not only overlap with each other, but also span use cases across many different agencies, missions and functions. Hence, there are numerous opportunity spaces in defense tech that we are monitoring across the infrastructure layer, the application level or a combination of the two. We believe that activity will only continue to grow across modalities and trends. Further, this innovation will impact a number of other areas, including planning and decisioning (e.g., Onebrief and Episci), workforce development and training, data management and intelligence, communication and automation.

Get in Touch if You’re Building in Defense Tech

As we head into 2024 and beyond, defense tech innovators will continue to push boundaries, bridging the longstanding divide between software innovation and the DoD. Amidst the backdrop of geopolitical uncertainty and despite structural challenges, high-tech startups and the defense sector are coming together to advance our collective mission. Here at Sapphire Ventures, we’re aware of how impactful technological innovation can be across sectors, including defense and see incredible potential for technology to revolutionize how we do defense.

If you are working on a defense-focused start-up, please reach out to Jai Das at [email protected], Alex Lehman at [email protected] and Adam Liu at [email protected]. We look forward to hearing from you!