It’s undeniable that one of the hottest topics right now is AI. While recently much of the buzz has centered around generative AI use-cases, we think that long-term, one of the areas where AI will have the greatest impact is healthcare.

While the adoption of AI solutions for healthcare has historically been slow due to long sales cycles, siloed data and regulatory considerations, we are seeing signs that this is beginning to change and are excited about what the future holds.

The Future of AI in Healthcare

When it comes to AI and healthcare, early applications have been for drug discovery and diagnostics. Biotech companies received $34B in venture funding in 2021 (more than double 2020). Not only has investment boomed in biotech, but we’ve seen some notable public outcomes such as Recursion, Exscientia and 23andMe (a Sapphire portfolio company) pushing the envelope on how drugs are discovered, developed and tested. There has also been a lot of excitement on the diagnostic side. Radiology, in particular, has been one of the earliest adopters of AI technology. Companies like Aidoc and Viz.ai have enabled radiologists to work more efficiently and effectively by detecting dangerous conditions and allowing radiologists to read scans more quickly.

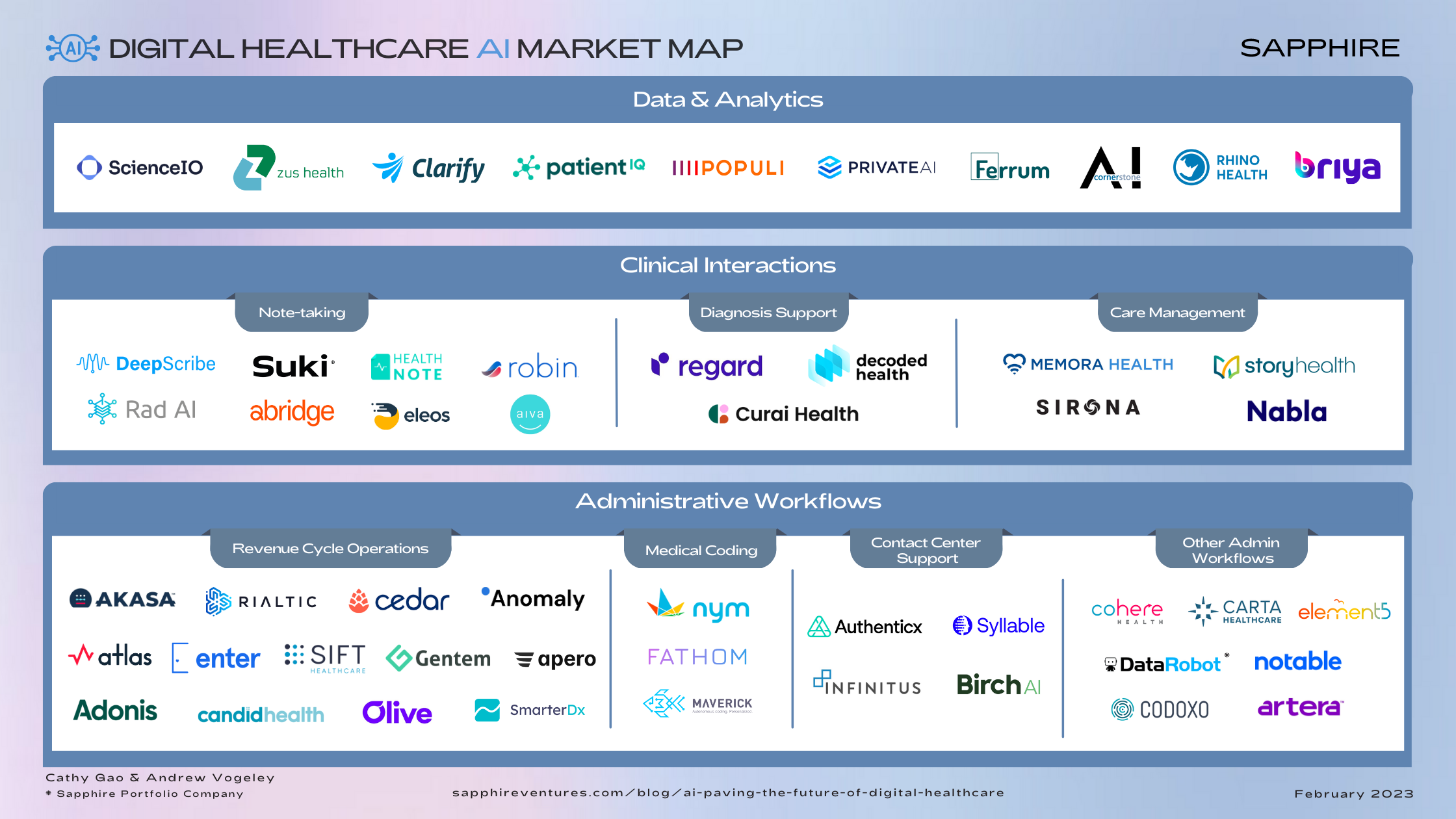

Drug development and radiology are just the tip of the iceberg for AI/ML in healthcare. We believe we’re on the precipice of a wave of innovation driven by AI/ML for providers across three key workflows: data and analytics, clinical interactions, and administrative workflows. Our conviction comes from broader work we are doing to understand the key technologies and trends pushing healthcare forward, which we explored in greater detail in an earlier blog post.

Below we outline the series of events that have unfolded, which has created the perfect time for the increasing adoption of AI/ML technologies. From there, we’ll dive into a few categories and use cases where we are seeing companies build useful products.

Strike While the Iron is Hot: 5 Trends That Enable AI/ML in Healthcare

In meeting with many AI/ML and healthcare startups, as well as enterprises in our network to better understand where opportunities for innovation exist and where the healthcare industry can benefit, five key trends have emerged as to why AI/ML may start to play a more meaningful role in healthcare going forward.

COVID challenges opened new doors for innovation

COVID proved that healthcare can be delivered virtually, and be equally as effective as in person care in many instances. Medicare visits conducted by telehealth were 63x higher in 2020 than they were in 2019, resulting in 64% of providers being more comfortable using telehealth. Furthermore, 21 states changed their laws entirely to make telehealth access and payment reimbursement more equitable.

The increased adoption of digital healthcare technologies during the pandemic has changed how medical professionals perceive technology within their field. Forced to adapt, doctors quickly changed their processes on the fly, while still delivering better patient care. As we’ve written about before, the pandemic has accelerated the adoption of digital technologies within healthcare in a way that is equivalent to years of traditional GTM sales and market education.

This new found popularity in telehealth is a big win for the future of AI/ML in the space. Case in point: 2021 was a peak year of health tech funding. Even though investment activity declined in 2022, we believe more investors are now spending time in the space, which means there will likely be more dollars available for innovative AI/ML companies.

Doing more with less: how tech addresses the labor shortage

Despite the layoffs in tech, the broader US economy continues to face a labor shortage. One area where this shortage is particularly acute is healthcare. Driven to burnout by the extraordinary pressures faced during the pandemic, nurses have quit their jobs in droves (one account suggests that ~20% of nurses quit their job during the pandemic). This leaves many hospitals understaffed, with some estimates of the nursing vacancy rate as high as 30%.

Much of this trend is driven by the amount of time spent on non-patient interactions. Nurses spend up to 25% of their time on documentation. Doctors, too, are constantly seeking ways to do more with less. A study found that 30% of doctors spend more than 20 hours a week on administrative tasks.

And in an environment where the supply and demand imbalance is only expected to increase as the population ages, healthcare workers will have to become more efficient than ever. AI promises to drive automation and increase efficiency through better care management and reductions in administrative burdens.

Efficiencies from Digital Healthcare Helping Curb Operational Costs

Another major challenge facing the healthcare industry is increasing costs–across both providers and patients. Data continues to show that Americans struggle to afford healthcare, while providers are operating with negative margins.

Medical costs have far outpaced overall inflation–the CPI for medical care is up, on average, 3.5% per year over the last 20 years, while the overall CPI has grown, on average, 2.1% per year. Despite this, providers are still struggling to operate profitably, as it is becoming increasingly expensive to treat patients over longer stays, in part due to sicker patients and increased prices for medical supplies.

While technology is not a cure-all for lowering expenses (particularly since some portion of cost increases are due to increased adoption of high-priced technologies), we do believe that improved outcomes and operational efficiencies driven by new technologies in digital healthcare will play a role in slowing the rise of healthcare costs.

Practitioners are increasingly comfortable with AI-powered tools

As we’ve spoken with doctors and other clinicians over the past few months, we’ve heard a recurring sentiment, “Our peers in other industries are leveraging AI-based technologies successfully–how can we use these tools, as well?”

Data supports this anecdote. Optum recently found that 74% of healthcare leaders now trust AI to support non-clinical workflows. While patient trust in AI-driven diagnoses remains mixed, the upside of non-clinical use cases is that the decision ultimately lies with the practitioner and doesn’t directly impact clinical diagnoses.

Given that the stakes are in most cases higher in healthcare than say, enterprise SaaS, it’s understandable that doctors are cautious when it comes to the adoption of new technology. But as AI/ML use cases continue to take hold in the everyday lives of healthcare practitioners, we anticipate more willingness to adopt AI-based solutions, particularly for non-clinical use cases.

The introduction of LLMs and continued investment in basic research

OpenAI released the next iteration of its powerful Generative Pre-trained Transformer model (GPT-3), with rumors of the next version (GPT-4) being released later this year. Trained on hundreds of billions of words across a variety of data sources, GPT-3 represents one of the most advanced large language models (LLM) built to-date.

In the same vein, researchers at Google/DeepMind recently fine-tuned Flan-PaLM to a medical-specific context. The resulting model, Med-PaLM performed close to physician-level on answering long-form medical questions.

Much of this explosion in LLMs has been driven by basic research. The number of AI patents filed in 2021 was 30x higher than the number filed in 2015. This research, funded by universities, governments and private companies, will continue to drive innovation and provide the basic building blocks with which startups can create the next generation of companies.

Three Areas of AI/ML Opportunity for Providers

There are a number of different functions within healthcare where there’s massive opportunity for AI/ML to help improve processes and efficiencies. In spending countless hours exploring the healthcare startup ecosystem and learning about the way in which healthcare does business, we have identified 3 core categories where AI/ML can benefit.

Note that in our assessment, we focus here on tooling for providers, as we think the AI/ML applications for providers will help drive the future of care. The above map is not meant to be exhaustive. We know that there are other provider-centric use-cases, as well as myriad non-provider use cases across payers, life sciences, drug discovery, etc. The below workflows are simply a few areas in which we’ve seen interesting applications. Let’s explore each.

Data & Analytics

Perhaps unsurprisingly, key healthcare data (clinical and operational) is spread across many disparate systems. The promise of leveraging data to drive healthcare outcomes relies on connecting and standardizing this data.

Companies like Clarify Health have built datasets that combine individual-level datasets (e.g., insurance claims, social determinants, etc.) with provider-level data, and have done the hard work of cleaning and standardizing this data. From there, Clarify Health has an intelligence layer leveraging AI/ML to offer predictions and analytics across a variety of use cases, including referral optimization and network analytics.

In another example, ScienceIO has trained a healthcare-specific algorithm, leveraging a wide variety of medical documents and sources, to offer API access that allows healthcare companies to make sense of their large swaths of unstructured data.

Clinical Interactions

While the use cases for clinical workflows are vast, we’ve seen strong activity in three different use-cases:

Note-taking

Doctors spend an average of 16 minutes in the EHR per patient visit, with much of that time spent on documentation. With the rise of LLMs and summarization algorithms, AI represents an opportunity to minimize the note taking responsibilities of clinicians. Companies like DeepScribe and Suki provide AI-based transcription, along with integrations into EHR systems that reduce documentation workload per patient.

Diagnosis Support

Startups like Regard empower doctors with potential diagnoses, based on existing patient data from EMRs. Others, like Curai, are building diagnosis models across a variety of use-cases, to assist their clinicians. For many, AI-first diagnostics remains the holy grail of AI + Healthcare. In the near-term, we think approaches that aim to empower or assist healthcare professionals are more realistic and helpful in the medium-term.

Care Management

Healthcare extends beyond just the patient / clinician visit. Accordingly, there are a number of players trying to provide more holistic care management tools, to ensure patients stay on the right path outside of their clinical visits. Companies like Memora Health integrate with systems of record (e.g., EHR and CRMs) and unlock that data to automate standard clinical workflows like post-visit follow-up and symptom triage, reducing the amount of tasks providers must manually complete in these systems.

Administrative Workflows

Our final category is also our broadest. Beyond every provider is a mountain of administrative work that must be done to ensure proper payment, patients are prepared for care, and that patients have a good experience.

Revenue Cycle Operations

Much like AI/ML has improved the speed and accuracy of payments within FinTech, we think there is potential for the same impact in healthcare. Cedar has leveraged ML to issue contextual reminders across different channels in an effort to collect patient payment, leading to improvements in payment rates.

Anomaly sits on the other side of the equation, providing an intelligence layer for insurance claims. Instead of waiting for a claim to be rejected, the startup has built algorithms that can predict which claims will be rejected and why, saving time and money for both providers and payers–and unlocking some interesting potential future use cases.

Medical Coding

An important part of the administrative process is medical coding. Several startups like Fathom and Nym Health aim to automate the medical coding process, freeing up valuable hours for the admin team.

Other Administrative Workflows

While revenue cycle management is one of the most important administrative workflows for providers, there are other important workflows where AI/ML can make an impact. Companies like Cohere Health work to streamline the prior authorization process, while Notable makes it easier for providers to refer patients, and then schedule those patients once a referral has been made.

Contact Center Support

A number of startups are building tools that directly improve the healthcare contact center experience. Syllable and Infinitus are tackling the phone and call-center space, making it easier for healthcare call-center workers to provide better experiences. Birch.ai works to make the lives of contact center workers easier, through better summarization tools.

Some challenges ahead

While we’re undoubtedly excited about the application of AI/ML within healthcare, we’re still in the early stages of adoption, and there are a number of issues that must be addressed before we see widespread adoption:

- Healthcare-specific infrastructure: For the promise of AI/ML to come to fruition, healthcare-specific infrastructure needs to be built. This includes healthcare-specific training data sets (including those that help reduce and remove biases), better compliance with healthcare standards and regulations, and continued adoption of standard data structures.

- Contextual GTM motions that accept longer sales cycles: Selling in and around healthcare remains difficult because of healthcare-specific regulations, legacy tech stacks (which are driven in-part by healthcare-specific regulations) and the fact that multiple stakeholders are involved. These reasons present a particular challenge for digital health companies trying to scale. Administrative officers are often required to approve any software purchase and oversee the implementation when the end user is likely the clinician. The mismatch causes confusion for how digital health companies should approach a large enterprise deal. And especially for AI-first companies, sales teams may have to sell across Chief Innovation Officers, Chief Medical Officers and Chief Business Officers, while generating buy-in from the underlying end users (e.g., doctors or nurses).

- Limited implementation needs: It’s our belief that more healthcare providers will need to hire developers instead of solely relying on traditional IT departments. As new tools enable more functionality, building a development-first culture will enable providers to both maintain the existing infrastructure and expand applications with the advantage of developers with context and alignment.

Looking ahead, we believe the companies that will win will focus just as much on distribution and implementation as they do on differentiated product solutions. The quicker digital health companies can prove value, the more likely healthcare buyers will be willing to give a new solution a try.

In spite of these challenges, we are optimistic that the tides are turning–for technological and cultural reasons–and that AI/ML is primed to play a larger role in the healthcare ecosystem in the very near future.

At Sapphire, we’re actively looking for startups that are leveraging AI/ML to drive real outcomes and are building Companies of Consequence. If that’s you, drop us a note–we’d like to chat. As mentioned, we are aware that these are still early days for AI/ML in healthcare and there are likely other areas where this new and innovative technology will be able to play an impactful role. If you’ve read this piece and believe there’s more to add, please reach out to us at: [email protected] and [email protected].