By all measures, 2021 was a record year for digital health fundraising. Aggregate investments in US-based digital health companies nearly doubled from a previous all-time-high of ~$15B in 2020 to ~$29B and despite the cooling macroeconomic environment in 2022, digital health funding through H1 2022 tracked to well above normalized 2020 levels with ~$10B poured into the sector in the first half of the year.

While the traditional brick-and-mortar facility-based model of healthcare has served our communities well since the dawn of institutional health systems, the shift of care beyond the “four walls of the hospital” has accelerated in recent years, resulting in increased adoption of digitally-enabled care delivery services. Hospitals, which are regionally constrained by design, have long been required to invest in physician capacity and technology to treat conditions for both chronic and acute patients. As patient population growth has not been a meaningful lever for overall growth for hospitals, maintaining comprehensive coverage of nearly all health conditions has been critical. However, with the emergence of digital health companies over the past decade that has pushed care into the home and virtual settings, we’ve seen this model of healthcare get disrupted time and again. Individual, technology-first (or at least technology-enabled) platforms instead specialize in a certain domain of care (i.e., Livongo* targeting diabetes, SWORD Health* targeting MSK, Hello Heart targeting heart health, Lyra Health targeting mental health, etc.) while chasing a much larger target population nationally.

We believe the digital health model of care delivery is here to stay and is poised to accelerate over the coming decade. As the ecosystem matures, we believe the need for specialized infrastructure technology focused on enabling the next generation of digital health platforms will continue to grow. In fact, we’ve already seen an explosion in digital health-specific infrastructure software platforms addressing every step of the patient journey and completely transforming the internal and backend processes for healthcare organizations.

So, what has given rise to the digital health movement?

Before we dive into the market of digital health infrastructure technology, it is worth exploring why we believe digital health platforms have gained traction in the US over recent years.

Regulation stimulates technology adoption and enables open and secure data access.

Healthcare technology regulation has evolved meaningfully over the past 30 years, starting with the passage of the Health Insurance Portability and Accountability (HIPAA) Act in 1996. Among several landmark provisions, HIPAA established a set of standards for the privacy and security of electronic health information including the Security and Privacy Rules which outlined requirements for confidential data sharing and patient data ownership. With the groundwork laid for compliant patient data interoperability, new digital health platforms are empowered to capture, process, and share healthcare data as part of their care delivery services.

In 2009, the US government acted again in a sweeping manner to digitize the healthcare industry by signing the Health Information Technology for Economic and Clinical Health (HITECH) Act into law. The HITECH Act established financial incentives for the “meaningful use” of certified qualified electronic health records (EHR). From 2009 to 2015, the percent of hospitals utilizing a basic EHR grew 7x. With more patient data living in digital systems, digital health platforms gained the potential to pull in a more comprehensive record of patient health data to personalize and target care effectively.

Another pivotal piece of legislation, the 21st Century Cures Act, was passed in 2016 and addressed key issues around information blocking and interoperability in a clinical setting. As part of this bill, the ONC adopted a “secure, standards-based API certification criterion” to ensure that healthcare data was made accessible to permissioned parties using a common technical framework known as FHIR (Fast Healthcare Interoperability Resources). With healthcare industry stakeholders increasingly complying with FHIR, software developers building digital health platforms gained the ability to access data using an API-based approach they were familiar with. These are just a few examples of how US regulation has evolved over the years and created an environment in which digital health companies could build highly-efficacious, technology-driven care delivery platforms.

The consumerization of healthcare: the empowered patient takes more ownership of holistic personal health.

Though the global pandemic shed light on the overleveraged US healthcare system, one of the key silver linings from the past two and a half years has been the acceleration in consumers’ desire to take proactive ownership of their personal health. In the past, where large health plans directed care decisions by determining which services would be paid for, patients are now actively engaged in making spending decisions about their healthcare by looking at where they get the most value for their money and deciding what is meaningful and important to them from a care perspective. This brand of patient, referred to as “ePatients” – a term originally coined by Tom Ferguson, MD in a 2007 white paper and meant to refer to the empowered patient who engages with their physicians as equals during the patient journey – takes initiative to understand their specific healthcare needs, identify the optimal care path, determine the best model of care delivery (e.g., physical in-person vs. digital remote), and track outcomes on a continuous basis. This type of patient is often the core target audience for digital health platforms that are leveraging innovative technologies and methodologies to treat highly-specific conditions comprehensively.

Shift to value-based care aligns incentives around digital health platforms prioritizing preventative and continuous care.

As providers and payers in the US increasingly move towards risk-bearing coverage models with capitation, it becomes critical to administer the highest quality of care at the lowest possible cost. Utilizing physical hospital space and synchronous appointments with physicians for 100% of the patient journey is simply inefficient and ineffective. With new and innovative digital health companies emphasizing continuous care both in a preventative context as well as post-op, providers operating in value-based models are incentivized to direct patients to these platforms in order to better manage holistic patient health while minimizing unnecessary and expensive in-person, 1:1 physician capacity.

Technology evolution enables highly-efficacious, comprehensive and continuous care.

The pace of technology innovation in healthcare has accelerated in recent years, ushering in new clinical capabilities and improving existing processes altogether. With the rise of home-based care, for example, we’ve seen compact and cost-efficient sensors and diagnostics systems (i.e., blood pressure monitors, glucometers, etc.) be deployed, allowing healthcare organizations (both traditional and digital) to closely track patient health on a continuous basis and trigger programmatic remediation workflows at just the right time. As a result, the overall efficacy of digital health platforms continues to increase, making it a viable alternative to (or at least augmentation of) the traditional, in-person healthcare paradigm.

The modern digital health enablement technology stack

With digital health continuing to gain adoption as one of the primary care delivery models for modern healthcare, the market opportunity for vertically-focused technology infrastructure vendors serving this category has exploded. As we’ve seen in other industries, such as FinTech, the set of foundational tech capabilities that companies need in order to offer their core product or service increasingly becomes standardized and, in many cases, better suited to be offloaded to specialized third-party tech vendors. In the context of digital health, internal backend functions like patient record keeping, data management, and security, or patient-facing modules like communications, clinician staffing, and diagnostics, are examples of workloads that specialized infrastructure vendors are productizing today.

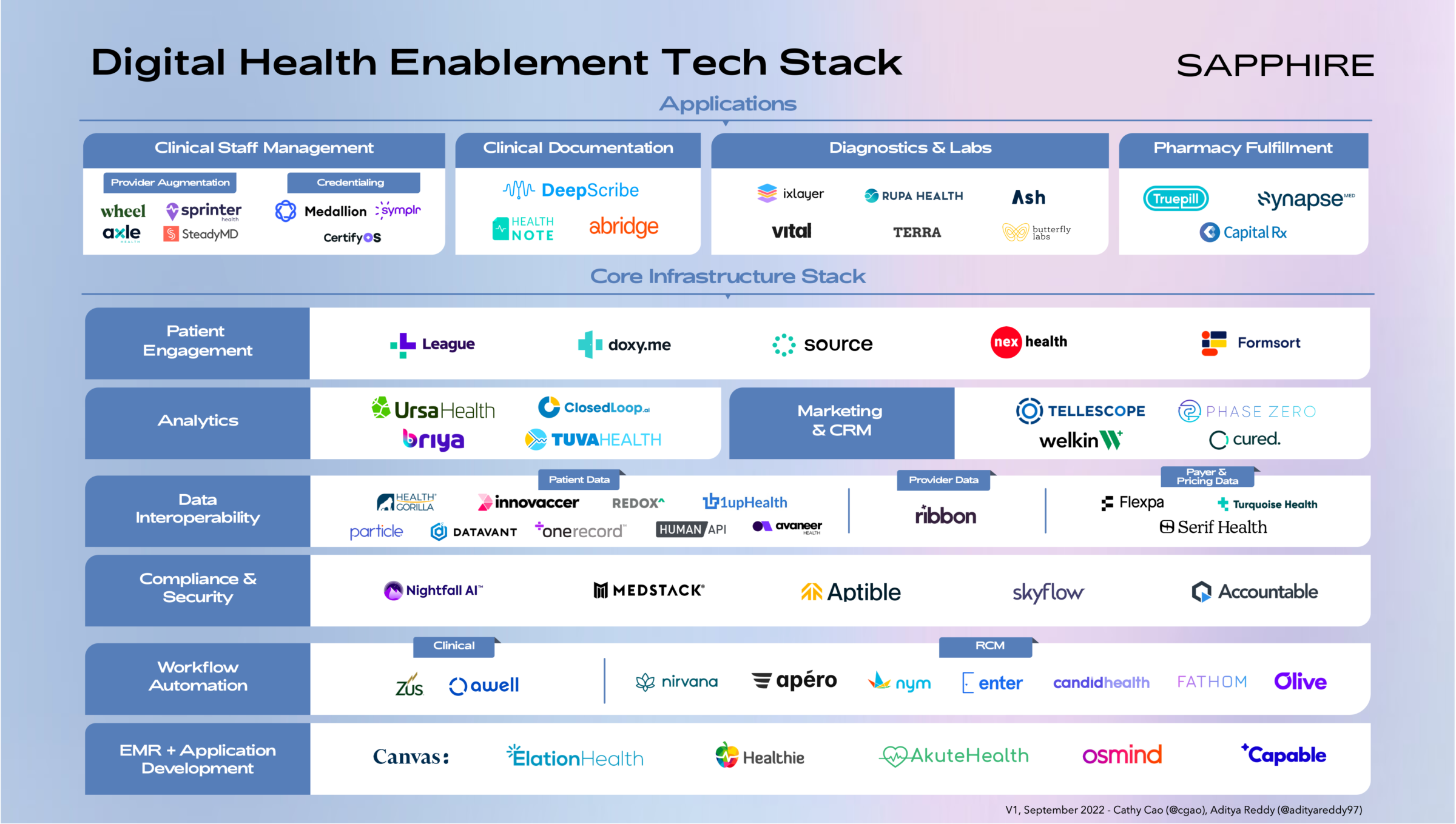

In putting pen to paper on outlining the digital health technology infrastructure ecosystem, we acknowledge the diversity in business models (e.g., leveraging human clinical staff vs. fully automated or all-digital) that are present across digital health organizations. The market landscape below is structured to highlight what we believe is a core infrastructure technology stack that nearly every digital health business, regardless of model, could benefit from implementing.

Above this stack, we lay out a series of application layer tools that businesses can leverage depending on their model – if a part of the platform involves deploying clinical staff, then staffing and credentialing tools would be relevant, for example.

Core infrastructure stack

EMR + Application Development.

The Electronic Medical Record (EMR) system has been the backbone of the modern healthcare organization since the 2009 HITECH Act digitized the backend for virtually all hospitals and medical facilities. The next generation of digital health platforms requires much of the same functionality around medical record tracking, appointment scheduling, billing, etc. that traditional EMRs – such as those built by the Epics and Cerners of the world – offer traditional healthcare organizations. Platforms like Canvas Medical and Elation Health provide digital health developers with APIs and SDKs to build highly-flexible EMR systems hypertuned for each individual business’s care delivery model.

For digital health businesses looking to quickly spin up patient-facing applications, API-first development platforms like Capable Health provide core capabilities like authentication, bi-directional messaging, and surveys all out-of-the-box and in a HIPAA-compliant manner.

Workflow Automation.

As healthcare IT systems continue to proliferate, it is critical for healthcare organizations (both traditional and digital-first) to ensure the patient-facing clinical and administrative workflows running on top are doing so efficiently. Platforms such as Awell Health enable clinical teams to tie disjointed IT systems together and automate workflows around patient onboarding, care pathways, and more by integrating with EMRs, scheduling tools, and billing systems.

Revenue cycle management (RCM) – which refers to the workflows that healthcare organizations undertake to manage revenue, process claims, and facilitate payments – has been a notoriously painstaking process for providers and patients alike due to the highly bespoke reimbursement models set by payers, complex coding requirements, and manual collections methods. Platforms such as Nirvana (focused on mental health), Apero, and Enter Health help automate core steps in the billing workflow including payer enrollment, claims building, eligibility checks, payments, and more. Tools like Nym Health help automate the highly manual process of medical coding using the power of AI trained on unstructured physician language.

Compliance & Security.

As digital health companies increasingly capture and process through PHI data, it is critical for them to maintain compliance with all HIPAA requirements for data storage and sharing. Given the risk posed by poor handling of patient information, it may be prudent for healthcare organizations to turn to healthcare-focused compliance and security platforms like Skyflow, Aptible, and Medstack that offer varying degrees of software and services around infrastructure provisioning, policy management and governance, and data management.

Data Interoperability.

Healthcare data has historically been difficult to access in a secure manner due to the sprawling and disjointed nature of systems-of-record in healthcare, information blocking practices conducted by various industry stakeholders, and misaligned incentives around transparency (in the context of pricing, for example). With recent developments in regulations requiring owners of healthcare data to open their “walled gardens” (e.g., the CURES Act API requirement), there has been an explosion in vendors looking to aggregate, refine, and route patient, provider, and payer and pricing data to approved parties across traditional and digital health.

Patient Data: Obtaining a longitudinal record of patient health data unlocks a world of possibilities for digital health companies to offer innovative and more efficacious care delivery models. As regulatory developments set standards and compel healthcare industry participants to open up access to their data to approved parties, new platforms have emerged to help facilitate permissioned data sharing. For example, the current rollout of Qualified Health Information Networks, or “QHINs”, under the Trusted Exchange Framework and Common Agreement, or “TEFCA”, is establishing a network of government-regulated organizations (both private and public) that will work together to enable healthcare data sharing across permissioned parties in the industry. Health Gorilla is charting a path to become one of the first QHINs in the U.S. whereby they will effectively help moderate access to patient data sitting across healthcare IT systems in the country. Another vendor in the space, Avaneer Health, has taken a different approach by partnering with some of the largest payers and providers and enabling them to share data directly over a closed network.

Provider Data: Finding the right provider to treat a specific health condition in a cost-effective manner is no trivial task. As digital health platforms consider maintaining any form of doctor directory or offer any provider navigation capabilities in their service, it is critical to tap into a comprehensive set of up-to-date provider quality and cost data. Ribbon Health, an emerging vendor in this space, has aggregated thousands of data sources on providers, insurance plan coverage, and medical costs to help keep provider directories up to date, ensure clinical referrals are done appropriately, and navigate patients to the best doctor for their needs.

Payer & Pricing Data: With healthcare costs continuing to skyrocket, increased spotlight has been placed on the lack of price transparency in the industry and complexity of billing workflows. Government regulations are also beginning to directly address this issue, with recent developments such as the CMS’s Hospital Price Transparency Rule (in effect as of January 1, 2021) requiring hospitals to post “their standard charges prominently on a publicly available website” and Transparency in Coverage Final Rule (in effect as of July 1, 2022), which requires insurers to disclose their negotiated rates with providers for covered services. With this data becoming increasingly available and published in machine-readable formats, technology platforms like Turquoise Health and Serif Health are helping industry stakeholders negotiate contracts using accurate benchmarks and enabling patients to select the most cost-effective alternatives for care.

On the payer data front, Flexpa offers a series of Patient Access APIs which allow digital health applications to connect to their users’ health plan information (much like a Plaid does for access to financial institutions) and ensure seamless execution of the full care delivery to payment process.

Analytics.

Once all the required and relevant data sets are made accessible, the next step is to properly normalize, prep and transform the data, apply data science models, and interpret the resulting insights. Ursa Health provides healthcare organizations with a no-code analytics development environment where both nontechnical and technical team members can collaborate to push data into their relational datastores, transforming that data for consumption across the business using SQL-based frameworks. ClosedLoop focuses on the downstream workflow around advanced analytics, offering a suite of MLOps tools to help organizations manage the end-to-end lifecycle of a healthcare-centric AI/ML model.

Marketing & CRM.

While the EMR has long served as the patient system-of-record, or the de facto CRM for healthcare, these systems have not been designed to treat patients as customers that provider organizations must acquire, nurture and retain. As a result, there have been a series of vendors, like Tellescope, Welkin and Cured, that have built healthcare-specific CRM platforms to help centralize patient engagement activities, coordinate patient-facing team member roles and responsibilities and track overall effectiveness of the patient acquisition and retention motion.

Patient Engagement.

Sitting at the top of the core digital health infrastructure stack is the connective layer of tissue that bridges the provider / digital health platform and the patients themselves. The tooling available here spans across multiple mediums, like video software for virtual visits (i.e., Doxy), HIPAA compliant web-based forms for patient intake (i.e., Formsort), mobile and web scheduling and bi-directional messaging (i.e., NexHealth), mobile and web UI development platforms (i.e., League) and more.

Applications

Clinical Staff Management.

For digital health companies offering patients access to physicians, whether in synchronous 1:1 settings or asynchronously, a significant share of administrative work stems from staffing physicians and ensuring they are licensed / credentialed and enrolled across states and payers. Platforms like Wheel and SteadyMD help companies access clinical staff capacity in a flexible and on-demand basis across the country. As home-based care gains popularity, platforms like Sprinter Health and Axle Health augment the clinical staff of digital health companies by sending clinicians directly to patients’ homes.

One of the major advantages of the digital health model is the ability for these platforms to expand across geographies. However, given the unique healthcare rules and processes in place across states in the US, it is necessary for clinicians to be licensed and credentialed specifically for each region. Tools like Medallion, CertifyOS, and Symplr help organizations ensure that their clinical staff remain up to date on all licenses and credentials, and are enrolled into payer networks so that they can provide medical services seamlessly.

Clinical Documentation.

Capturing detailed accounts of all provider-patient interactions and any billable events is critical to ensuring the proper clinical actions are taken and providers are compensated accurately for their work. Tools like DeepScribe and Abridge Health capture audio conversations and transcribe complex clinical conversations into structured data that can power downstream clinical and billing workflows through their integrations with core systems like the EMR. Another vendor in the space, Health Note, focuses on capturing patient information during digital intake and pushing it into the EMR to help reduce administrative / repetitive tasks typically plaguing doctor’s appointments.

Diagnostics & Labs.

For digital health companies that trigger lab tests and look to capture patient diagnostics in order to improve medical decision-making, many procedural and policy challenges stand in the way – namely, the process of syncing to a lab testing site bi-directionally and receiving prior authorization from the insurance carrier. Platforms like Rupa Health and ixlayer have emerged to tackle this problem by moving lab testing to the home and providing an end-to-end system for lab ordering, execution, and results viewing. Platforms like Vital take this a step further by leveraging wearable technology allowing digital health companies to monitor patient vitals on a continuous basis.

Pharmacy Fulfilment.

If a corrective course of action results in the need for medication to be prescribed, digital health companies require a seamless channel through which they can connect with pharmacies. To this end, platforms like Truepill offer programmatic APIs that allow providers to submit pharmacy orders and have medications delivered directly to their patients.

Sapphire’s perspectives on digital health infrastructure

While we do acknowledge the important “build vs. buy” decision that digital health companies will have to make when it comes to leveraging third-party software as part of their core product offering, we believe there will be an increasing aversion toward reinventing the wheel for many important components of the digital health tech stack. As the modern digital health ecosystem matures, we see a huge opportunity for next-generation vendors to build core infrastructure and applications that enable critical steps across the end-to-end patient journey. We believe that, as the target market for digital health infrastructure grows, new and existing infrastructure vendors will emerge to productize the countless manual workflows that plague the healthcare industry today and generate costly inefficiencies that impact providers, payers and patients alike.

Since our inception, Sapphire has been fortunate to partner with numerous companies of consequence in the broader Digital Health category including Livongo, Medable, Sword Health, 23andMe, Fitbit, Unmind and more. We’ve seen first hand how changing regulations, evolving consumer preferences and technology innovation have created meaningful tailwinds for companies in this market. Now, we are excited to meet the new class of startups productizing the technology infrastructure upon which the next generation of digital health platforms will be built.

If you are working to address this opportunity, please reach out to Cathy at [email protected] and Adi at [email protected]. We can’t wait to hear from you!

Thanks to Jacob Effron, Kesar Varma, Emily Zhen, Saharsh Patel, Kohsheen Sharma, Derek Xiao, Lydia Liu, Aditya Shah, Nick Briguglio and Chrissy Farr for your invaluable feedback and insights!