Over the past several years, we’ve sharpened our investment focus on the next generation of software companies improving healthcare administration and care delivery. Our experience in backing digital health companies serving employers (Livongo, Sword Health and Unmind), providers (Collectly and Verse Medical) and life sciences (Medable) reflects our excitement about innovation in healthcare.

Our conviction in healthcare technology stems from observing several parallels to enterprise software, which is core to Sapphire’s DNA. HealthTech startups are beginning to prove clear and quantifiable ROI, demonstrate their ability to sell sticky, recurring revenue contracts and show repeatability in their sales motions. While key points of friction still remain, particularly around sales and implementation cycles, we believe tech, political and cultural paradigms have shifted favorably.

Having met with over 125 innovative healthcare companies in the past year alone, we want to highlight some of the most compelling healthcare trends, startups and questions we’re closely following as we look ahead into 2024.

1. How Does AI Impact Healthcare in 2024?

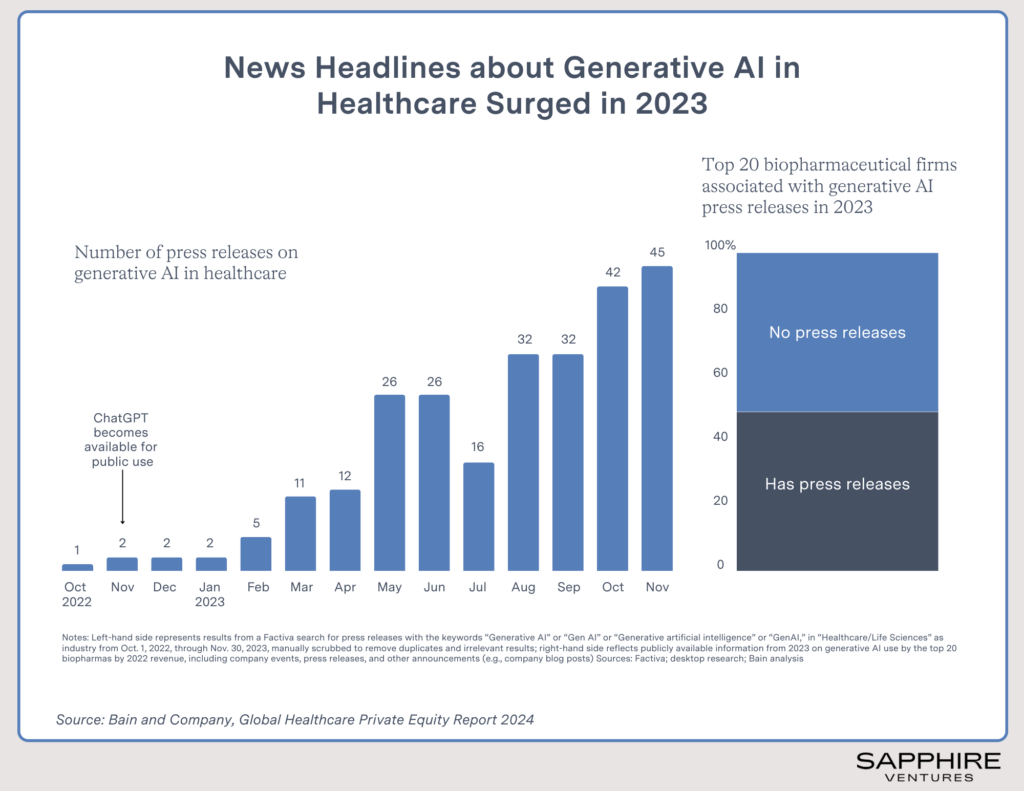

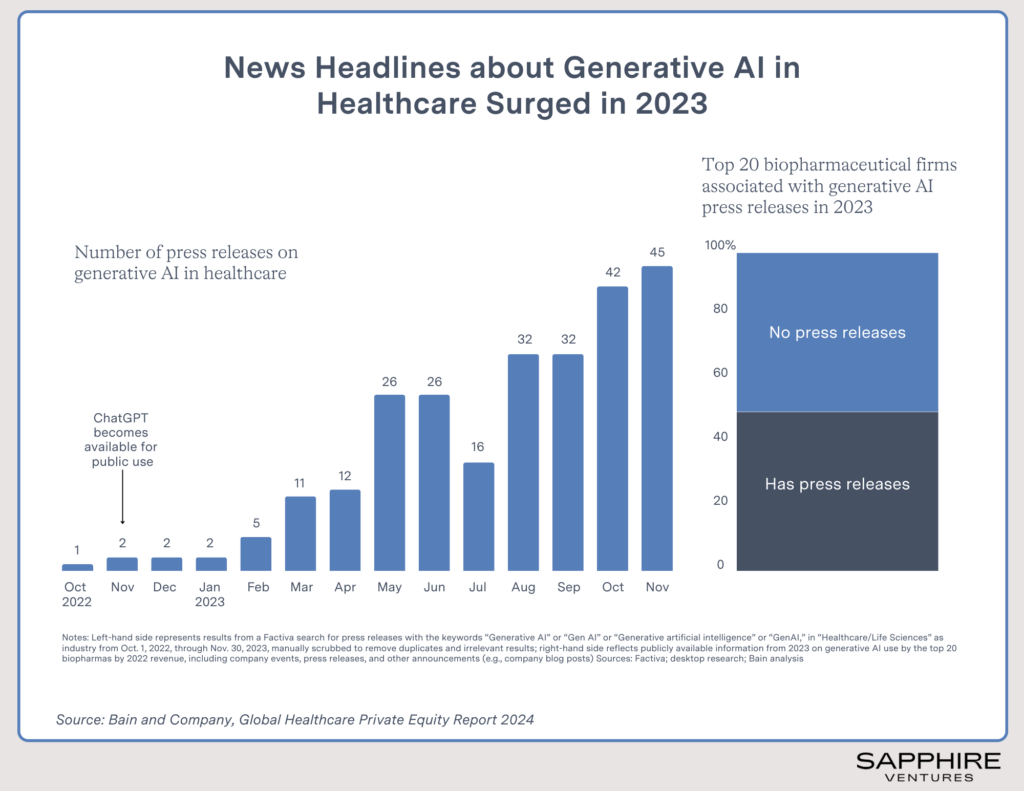

A Bain & Company report found that GenAI mentions in healthcare-related headlines surged 20x YoY in 2023, underscoring how quickly this topic became widespread. But while AI entered the mainstream conversation in healthcare in 2023, we believe repeatable AI use cases in healthcare are just now emerging, and there is a healthy dose of skepticism from the provider ecosystem.

At Sapphire, we have been tracking this trend over time and observed two opposing forces that we believe will shape the trajectory of AI utilization in healthcare. Firstly, there is a prevailing lack of trust among clinicians and healthcare buyers in AI-driven applications, as highlighted by a GE survey indicating that 58% of clinicians express skepticism towards AI tools. Conversely, the substantial potential for AI to yield a significant margin lift (estimated at 5-10%) presents a compelling opportunity. In the face of margin compression, health systems and payors may be compelled to embrace next-gen AI technology as a strategic imperative.

While we believe we are still early in the adoption curve (see below for more details on the use of co-pilots in healthcare settings), we’ve seen interesting and compelling use cases across RCM, diagnostics and patient engagement workflows that improve efficiency and accuracy.

Finally, there’s the looming question of whether a healthcare-specific foundational model is necessary. Or do existing foundational models perform well enough and simply need to be finetuned? We’ve now seen numerous examples (including a recent one here) suggesting open source and readily available models have been trained on enough healthcare data to, at the very least, serve as a starting point for a refined model. Another challenge with a healthcare-specific LLM is that healthcare data is messy — is it possible to build a dataset that is clean enough, with high-quality data, to actually build a healthcare-specific LLM?

To the counterpoint, Google has already shown incredible results with their Med-PaLM 2 model, while Hippocractic outperforms GPT-4 across a variety of tests.

Much like the traditional enterprise, all eyes are on AI. We believe 2024 will be an important year for understanding which use cases can drive real value.

2. Co-Pilot Use Cases Go Live & Deliver ROI

One of the most promising initial applications of AI in healthcare we’re seeing is in the back office. As the demand for care continues to accelerate, healthcare workers who are already stretched thin across clinical and administrative responsibilities, continue to see their workloads grow. Resignations in the industry have increased from ~400K per month in 2020 to nearly 600K per month in 2023 as a result, and general workforce sentiment has suffered — so much so that health system executives are taking notice and urgently looking for a solution.

In 2024, we expect AI co-pilots, specifically those targeting administrative workflows like clinical documentation, patient engagement and billing, will gain adoption as healthcare organizations look to reduce staff workloads and streamline the patient care journey. For example, ambient voice platforms like Abridge, Ambience and Nabla leverage AI to capture and structure clinical conversations and upload notes to the EMR, offloading the time-consuming note-taking process for physicians and powering downstream care coordination and other workflows like billing. Memora Health leverages AI to automatically nudge patients along their respective care plans, intelligently respond to common patient questions and triage/escalate patient concerns, enabling healthcare providers to improve adherence to care programs and drive better overall health outcomes. Companies like SmarterDx, Codametrix and Regard focus on the broader revenue cycle workflow, automating the highly manual and error-prone process of translating clinical notes into billable medical codes.

While clinical-facing applications already demonstrate transformative potential for care delivery, adoption is likely to be slower out of the gate as key questions around coverage and risk must be addressed, with the government still figuring out the role it will play to backstop liability.

3. Technology Drives Efficiency Across Clinical Trial Operations

While we’ve seen improvement in the use of technology in clinical trials, another key theme we expect to gain traction in 2024 is better technology to drive outcomes and improve the conversion funnel for drug development. While much has been written about AI applications in drug discovery, we are also excited by non-discovery use cases.

On the trial design side, Medable, (a Sapphire Ventures portfolio company) is beginning to use historical clinical trial data to optimize protocols, including appropriate endpoint selection, sample sizes and study durations, resulting in cheaper, more effective trials.

Additionally, we’re seeing several companies seek to improve trials by improving the patient experience. All parts of the patient funnel are broken (and this is worthy of a longer blog post): less than 15% of patients are aware of potential clinical trials and a fifth of successfully enrolled participants drop out during the duration of the trial, leading to delays, added expense and ultimately slower drug development for pharma companies. Pluto Health accelerates access to clinical trials by automatically checking eligibility based on pre-existing patient data. Mural Health is another exciting early-stage company that sits at the intersection of fintech and healthcare, making it easier for trial participants to get paid, ultimately leading to more completed trials.

The past few years have seen the rise of decentralized clinical trials — a much-needed innovation allowing pharma companies to complete more trials more efficiently that we’re eagerly watching evolve.

4. The Rise of the Modern Private Practice Tech Stack

Over the past decade, the share of physicians working in private practices has fallen by 13 percentage points while those working in hospital or health system-affiliated practices have increased by eight percentage points. Fueling at least part of this transition is the impact of rising practice costs and significant administrative burdens placed on small practices that must do more with less.

To survive, we expect smaller practices across specialties to increasingly turn to technology to offload highly manual administrative workflows like scheduling, documentation, patient engagement and payments/billing — and they will have a robust ecosystem of next-generation solutions to pick from.

Sapphire Ventures portfolio company Collectly, for example, is squarely focused on improving the patient out-of-pocket billing workflow by templatizing and automating omnichannel patient outreach campaigns to drive up payment collections. Other companies like Prompt and NexHealth provide more of an end-to-end practice management suite for clinics, enabling practices to manage everything from scheduling to patient management to billing and reporting through a single modern interface.

We’ve been tracking the rise of the next-gen digital health enablement stack for a while. We recently wrote about the emerging class of technology platforms supporting not only digital health companies but also the traditional healthcare providers looking to pull forward into the modern era of care delivery. This year, we’ll be closely following how the once nascent, but now expansive healthcare delivery tech stack begins to make a real impact, particularly for smaller practices across the country.

Despite a choppy decade+ for HealthTech from the rise of digital health in the 2010s to peak demand during COVID and the subsequent macro pullback, we are optimistic and excited for 2024 as we believe it will represent a year of maturation across the industry. While 2023 innovation budgets enabled healthcare organizations to experiment with new applications, we expect real use cases to emerge this year, and funding for technology to concentrate accordingly. We look forward to staying deeply connected with the HealthTech buyer universe and startup ecosystem, keenly tracking emerging stars and evolving investment priorities that define the sector’s commercial future.

We welcome feedback! And if you’re building in HealthTech, we’d love to chat. Email us at: [email protected], [email protected], and [email protected]

Legal disclaimer

Disclaimer: Nothing presented within this article is intended to constitute investment advice, and under no circumstances should any information provided herein be used or considered as an offer to sell or a solicitation of an offer to buy an interest in any investment fund managed by Sapphire Ventures (“Sapphire”). Information provided reflects Sapphires’ views as of a time, whereby such views are subject to change at any point and Sapphire shall not be obligated to provide notice of any change. The quotes set forth within the attached presentation are from members of current and former Sapphires’ portfolio companies and other third parties with whom Sapphire interacts under such categories and have provided a statement as such. Statements reflect endorsements related the nature and type of management services provided by Sapphire as an operating partner and do not constitute testimonials to Sapphires’ investment advisory services and no inference to the contrary should be made. Sapphire has provided no compensation related to such endorsements. Companies mentioned in this article are a representative sample of portfolio companies in which Sapphire has invested in which the author believes such companies fit the objective criteria stated in commentary, which do not reflect all investments made by Sapphire. A complete alphabetical list of Sapphire’s investments made by Its direct growth and sports investing strategies is available here. No assumptions should be made that investments described were or will be profitable. Due to various risks and uncertainties, actual events, results or the actual experience may differ materially from those reflected or contemplated in these statements. Nothing contained in this article may be relied upon as a guarantee or assurance as to the future success of any particular company. Past performance is not indicative of future results.