Another January, another opportunity to make (and break) your New Year’s resolutions, and a new opportunity for us in the venture industry to reflect on the state of the enterprise SaaS markets. We made a good call on the resiliency of the SaaS sector at the beginning of 2023, and remain long-term bullish on SaaS as we have been for years.

This year, we decided to raise the stakes with our outlook, unearthing new data to inform what we anticipate in 2024. We are excited to debut The State of the SaaS Capital Markets annual report. This report highlights the key enterprise software trends we observed in 2023 across both private and public markets, as well as the connection between the two: the exit environment. With this comprehensive set of data views, we share our 2024 predictions regarding the investment environment for enterprise software.

We like to read, so it’s not lost on us that the last month has produced a ton of quality prediction pieces already, including those from Sapphire President, Partner and Co-Founder Jai Das on what to expect in enterprise technology trends in 2024, as well as year-end reports from investment banks and VC data providers. With the first iteration of this report, we aim to distinguish ourselves in a few significant ways:

- Our analysis covers both private and public enterprise SaaS markets in detail, including several proprietary views on sub-categories.

- Our predictions focus solely on the state of the enterprise SaaS capital markets (vs. the broad technology landscape), including valuations, capital allocation and exits.

- Our prognostication is data-driven, based on a thorough look back at what happened in 2023, how that compared to the past decade and recent quarterly trendlines.

To dig into the data, check out the full report here, and read on for our top 10 predictions for 2024, along with two honorable mentions, with select data views from the report that informed our thinking.

Top 10 Enterprise SaaS Predictions for 2024

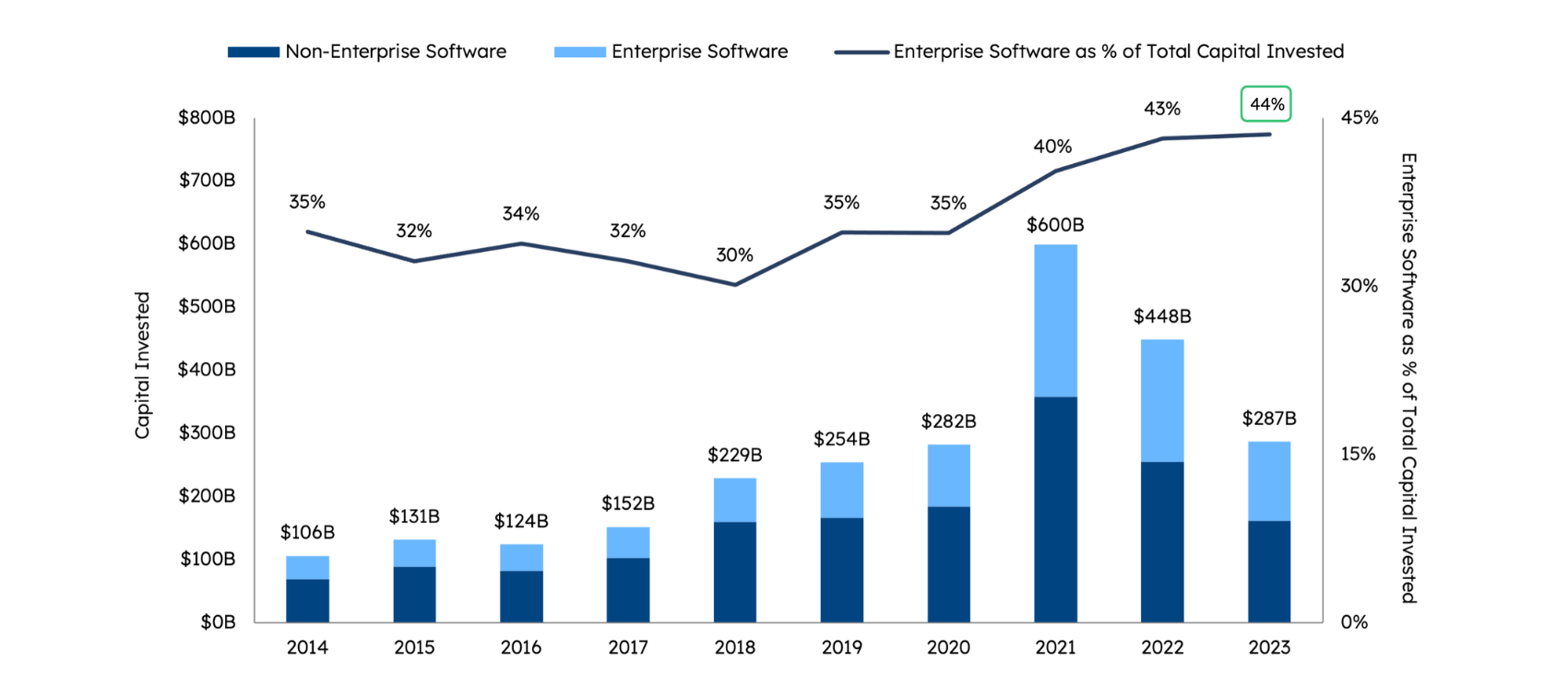

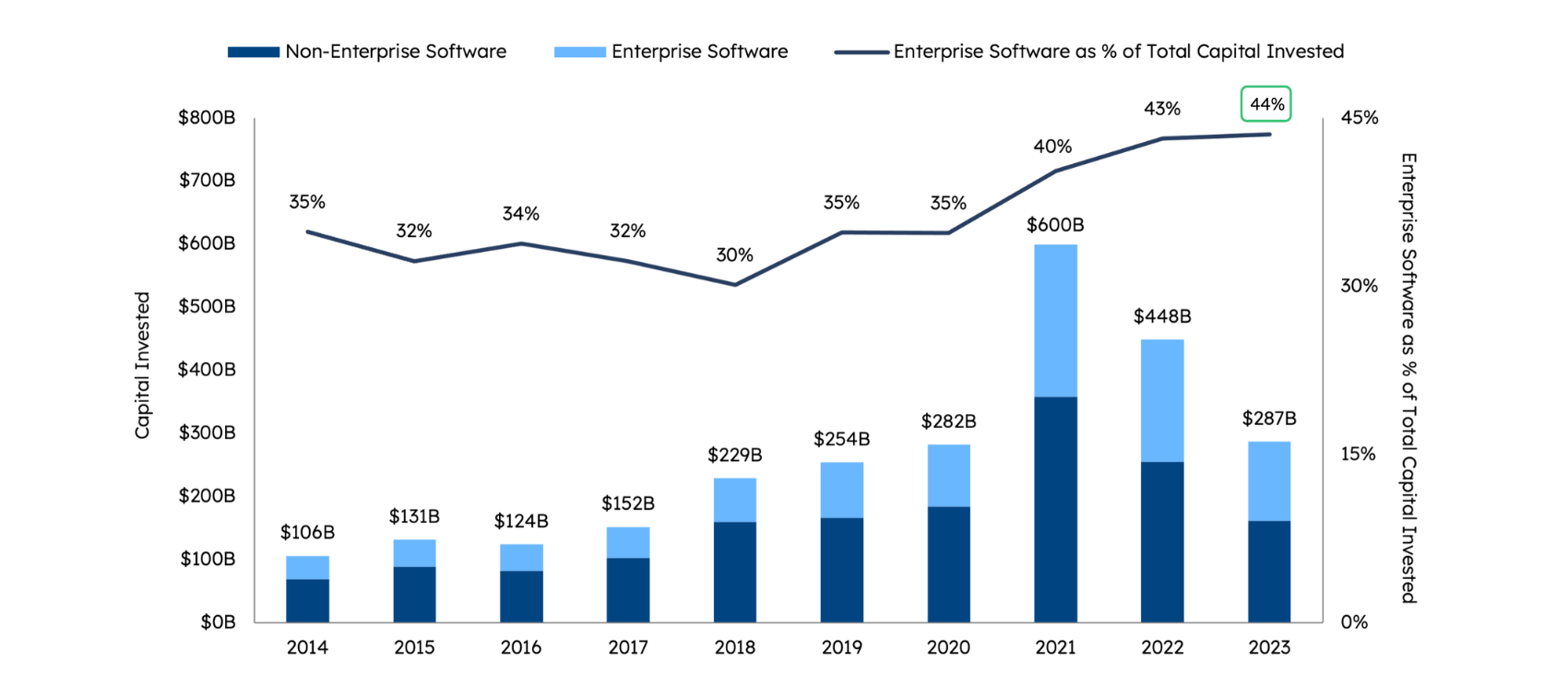

1. VC Funding will Grow Incrementally in 2024

2023 marked a second consecutive yearly decline in VC funding (-36% YoY), and at $287B (ex-China), it was roughly flat with 2020. We don’t believe this is due to a lack of innovation, but rather that cupboards were fully stocked in 2021. Investors and entrepreneurs are just now starting to see eye-to-eye on valuations. We expect total funding to grow back into the pre-pandemic trendline (+5-10% overall growth) as investors with ample dry powder incrementally increase deal pacing. We believe enterprise software (including, of course, Gen AI-fueled business models) will continue to be a big driver of total VC investment in 2024.

Expand

Sources: Pitchbook data pulled as of Dec. 31, 2023; Sapphire Internal Analysis (Jan. 2024)

2. The Software Markets will Return to a Growth Mindset

After two years of declining growth rates across the SaaS universe, we believe that growth will inflect upward in 2024 as (1) economic conditions prove resilient and (2) AI begins to reach the initial deployment stage. While the painful cuts many companies made in 2023 were necessary for the long-term (and are still not done), company leaders and investors alike will recognize that growth can solve many of a company’s remaining challenges and will embrace them playing more offense as we move through the year.

3. Growth Returns, but the “Growth at All Costs” Mentality Does Not

As we saw in our 2023 KeyBanc Capital Markets & Sapphire Ventures SaaS Survey: A shift towards efficient execution and profitability, unit economics will continue to be in sharper focus in 2024. This means more headcount reductions and AI-driven automation to pursue truly efficient growth. Software CEOs will embrace the data-driven reality that a point of growth is worth ~2x more than a point of margin – and they and their VC boards will agree to spend to grow in pursuit of large TAMs and to create exit opportunities.

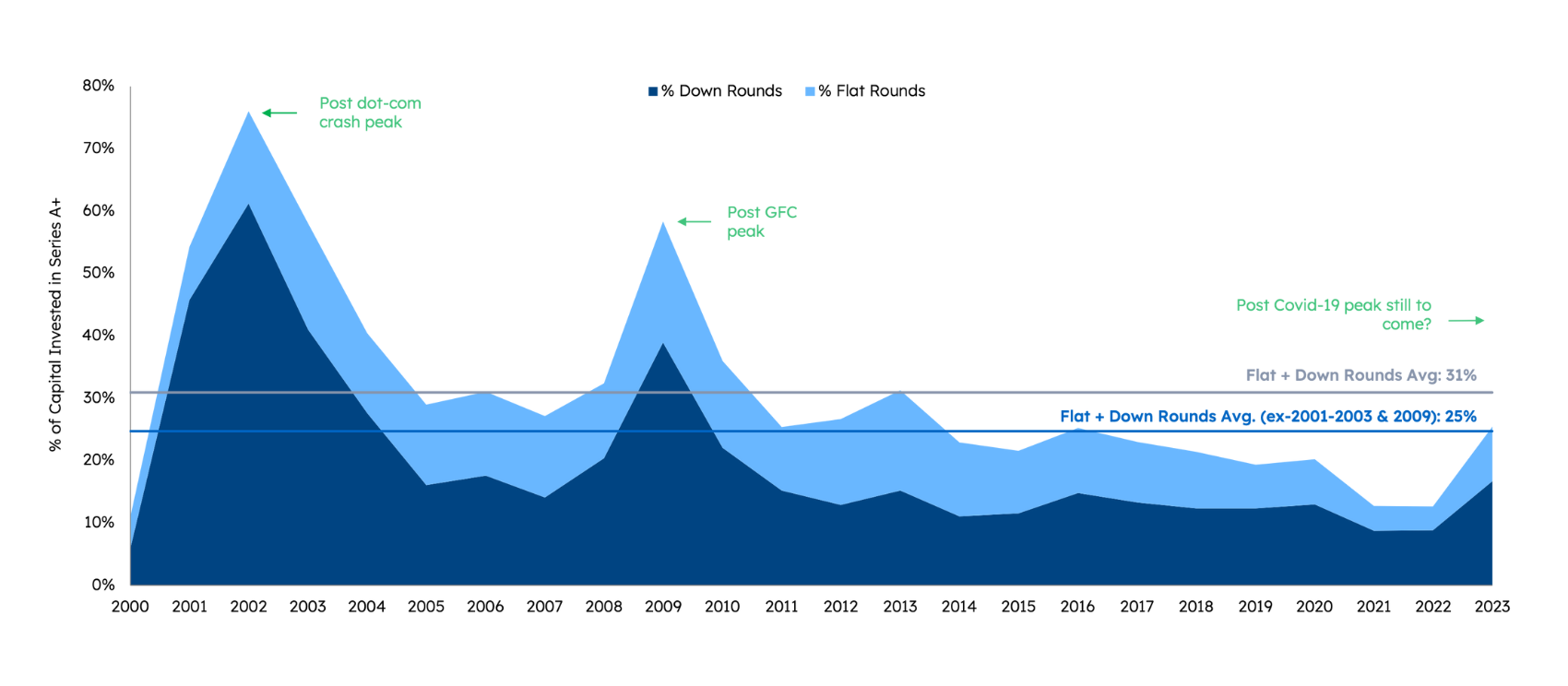

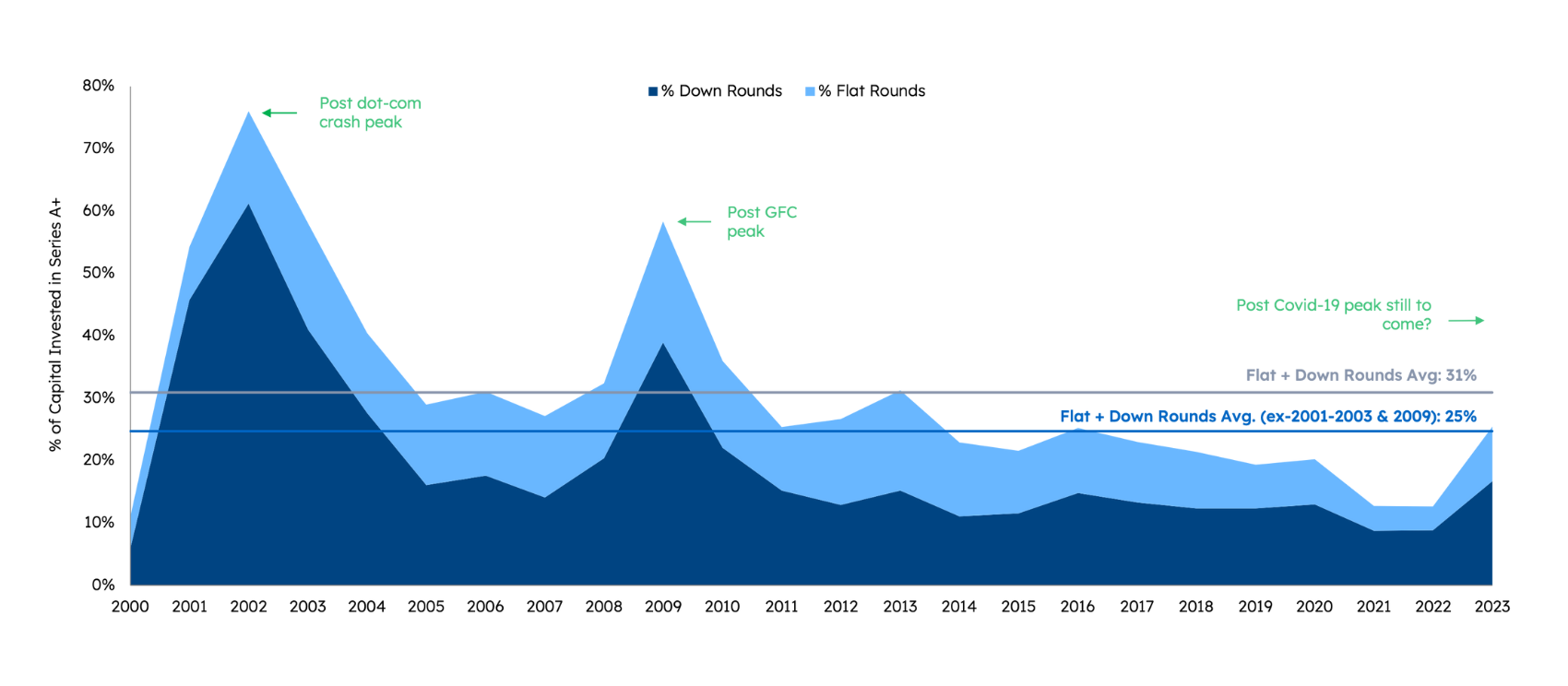

4. Flat and Down Rounds will Continue to Rise

In 2023, flat and down rounds spiked to ~25% of deals, bringing them in line with the 20-year average excluding the post-dot-com (63% average from 2001-2003) and post-GFC (58%) peaks. While we don’t anticipate reaching those crisis-era levels in 2024, we expect the up-trend to continue as the industry collectively continues to work through pandemic-era valuation excesses. More flat and down rounds are not a bad thing at all – but rather a sign of a normalizing market, companies returning to growth, and long-term optimism to invest fresh capital in the innovation economy!

Expand

Sources: Pitchbook data pulled as of Dec. 31, 2023; Sapphire Internal Analysis (Jan. 2024)

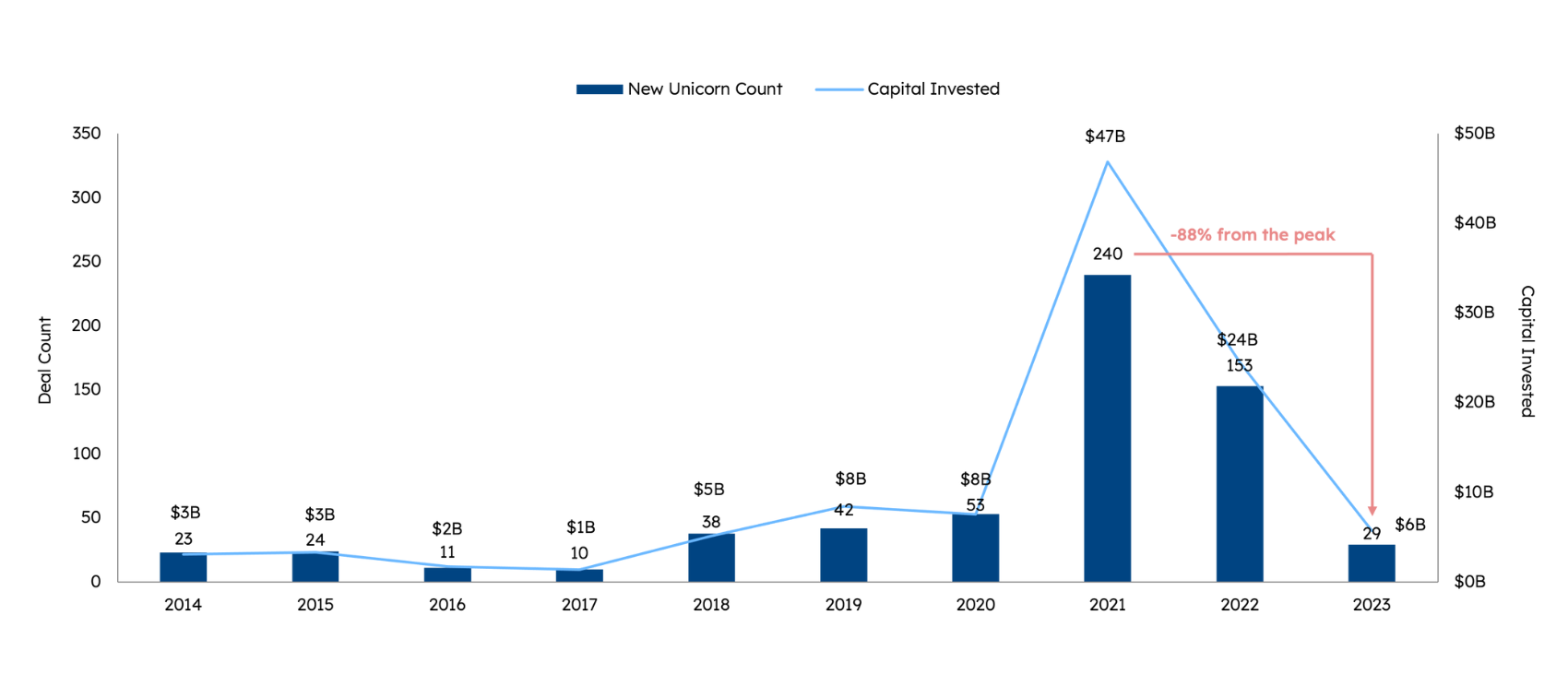

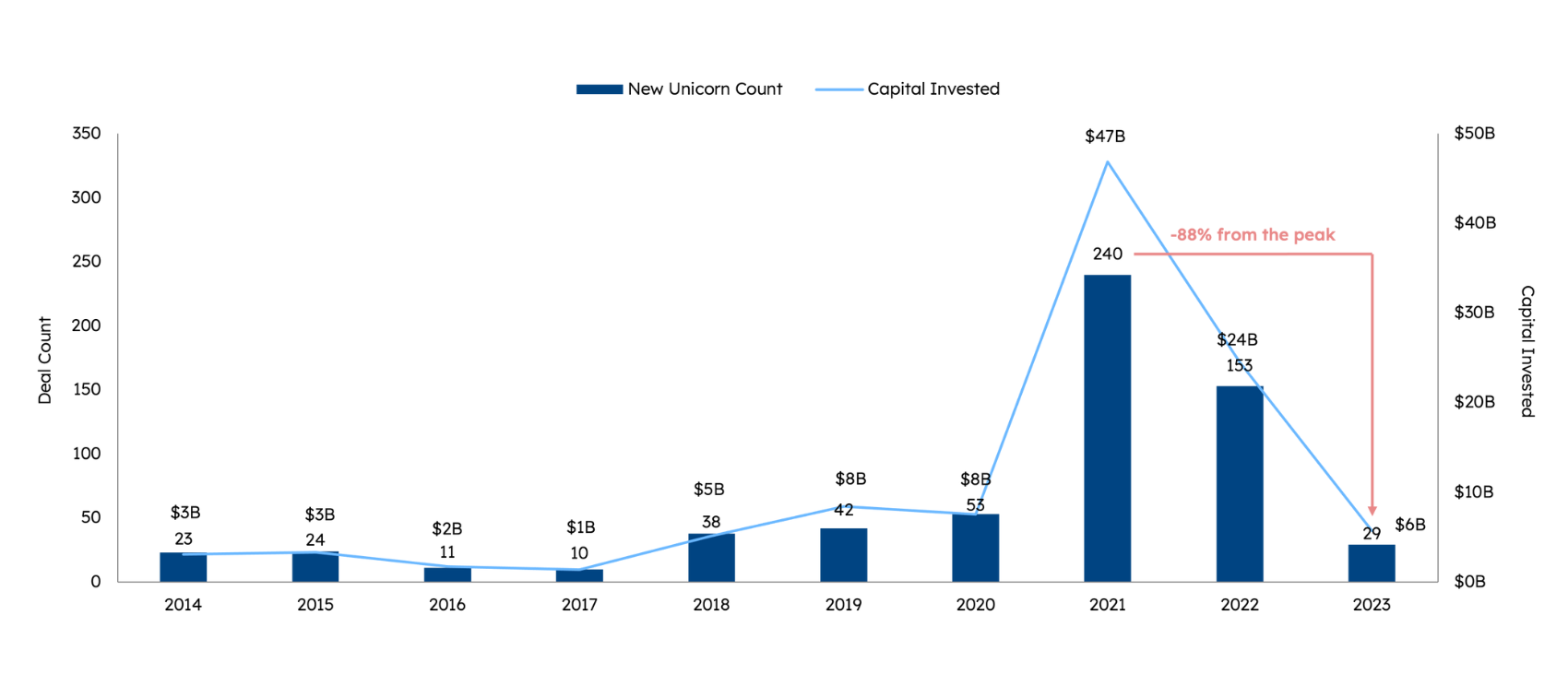

5. We are Finally (and Thankfully) Past “Peak Unicorn”

Aileen Lee’s “unicorn” moniker turned 10 years old in 2023 and brought with it the slowest rate of new unicorn creation since pre-2018. The 29 newly minted software unicorns of 2023 represent an 88% decline from 2021’s peak and, we believe, evidence of a transition past “peak unicorn.” While exact numbers are difficult to track, we have also recently seen several notable failures of existing unicorns, a trend we believe is just starting. In 2024 and 2025, we expect that (1) many existing unicorns will face challenges maintaining their current valuations and (2) investors will continue practicing more valuation discipline. As a result, the number of fallen and acquired unicorns will well outpace new unicorn creation across the software industry.

Expand

Sources: Pitchbook data pulled as of Dec. 31, 2023; Sapphire Internal Analysis (Jan. 2024)

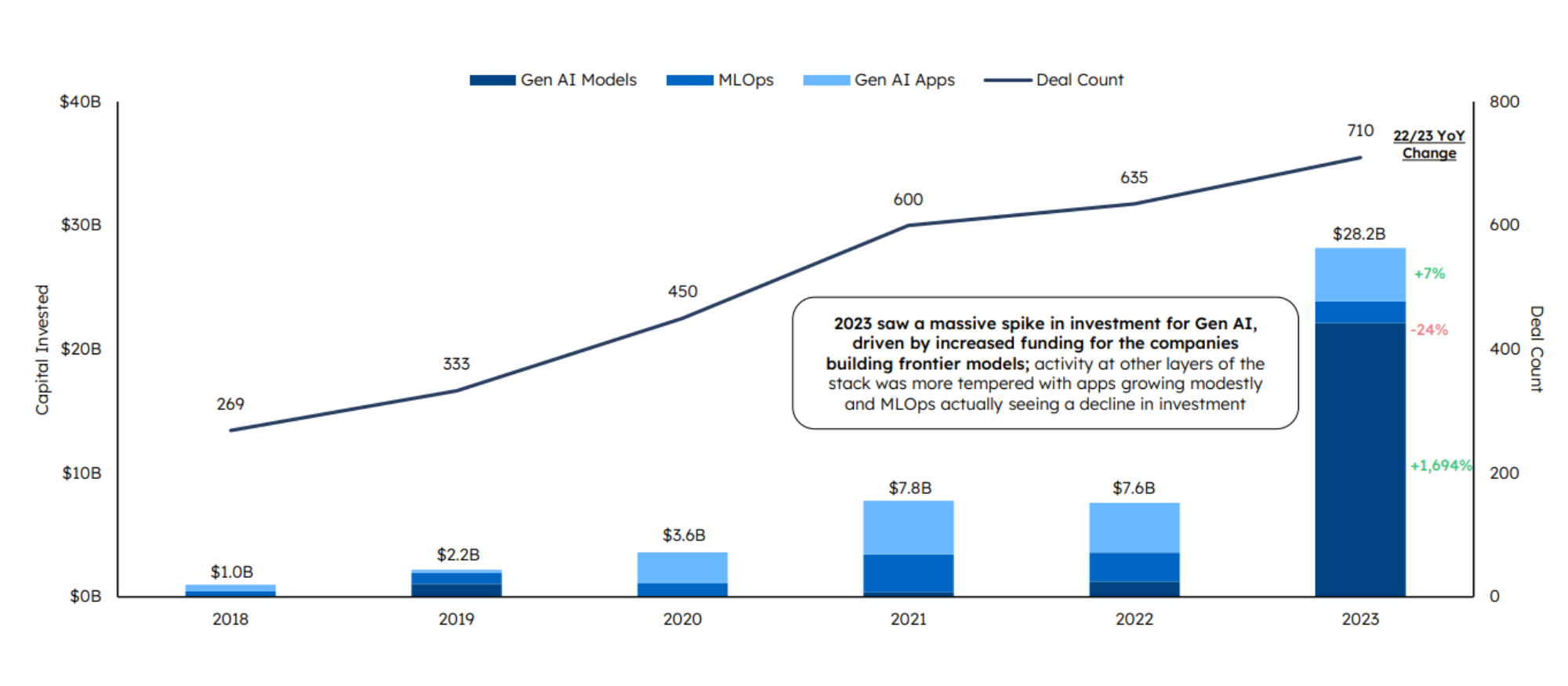

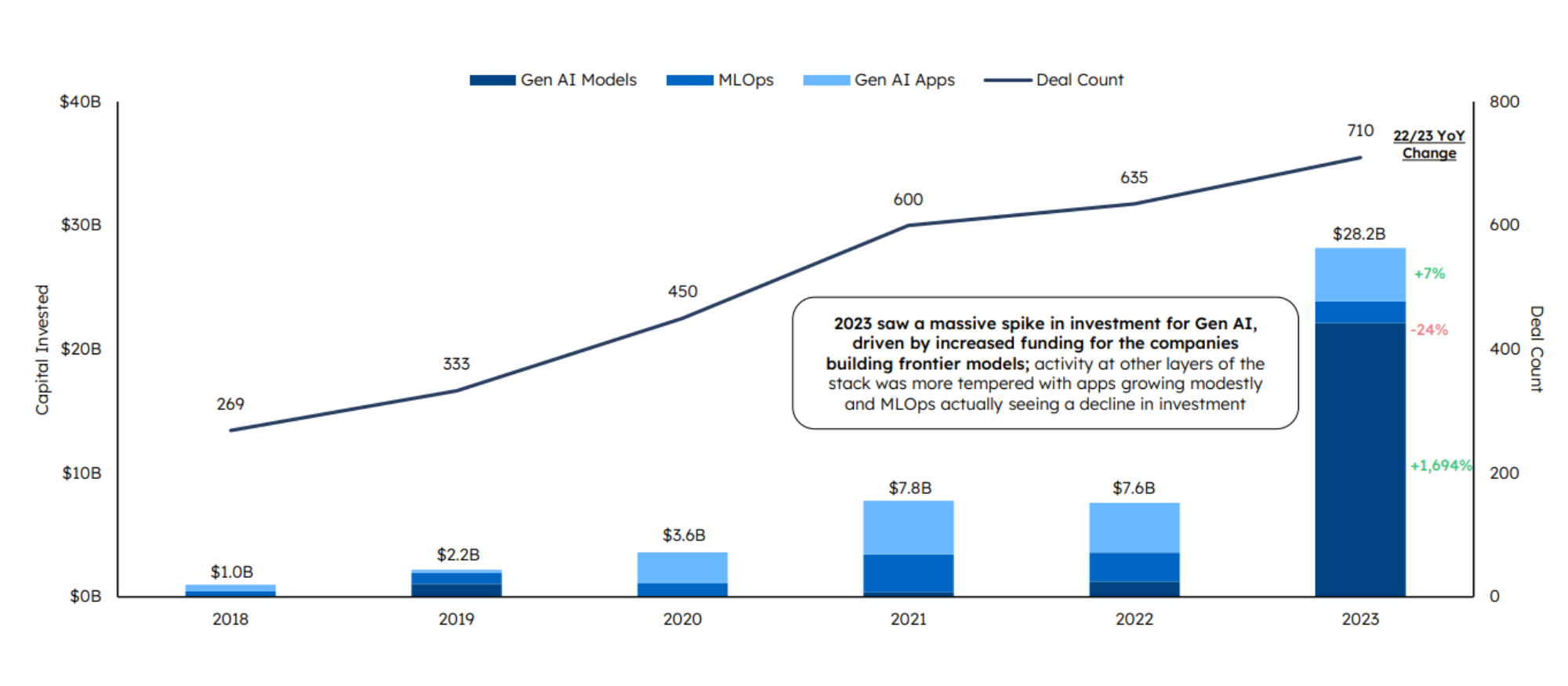

6. Gen AI Funding will Continue at a Strong Pace, but Investors will be More Discerning

Gen AI was the dominant investment theme during 2023 and was one of the very few areas to see an increase in funding during the year (+271% by our calculation). While it may be cliché to say it is “still so early,” we believe the reality is that we are indeed in the early stages. We expect investor appetite for companies both building and integrating Gen AI to remain strong in 2024. We also anticipate more growth at the MLOps and Apps layers. And of course, leading foundational model players will want to extend their leads and raise ahead of training next-generation models. Finally, we can forsee at-scale deployment of enterprise use cases picking up in 2H 2024. That said, we believe we are likely to see more separation emerge between companies achieving true product-market fit and those that lack differentiation in a space that was marked by super-premium valuations in 2023.

Expand

Sources: Pitchbook data pulled as of Dec. 31, 2023; Sapphire Internal Analysis (Jan. 2024)

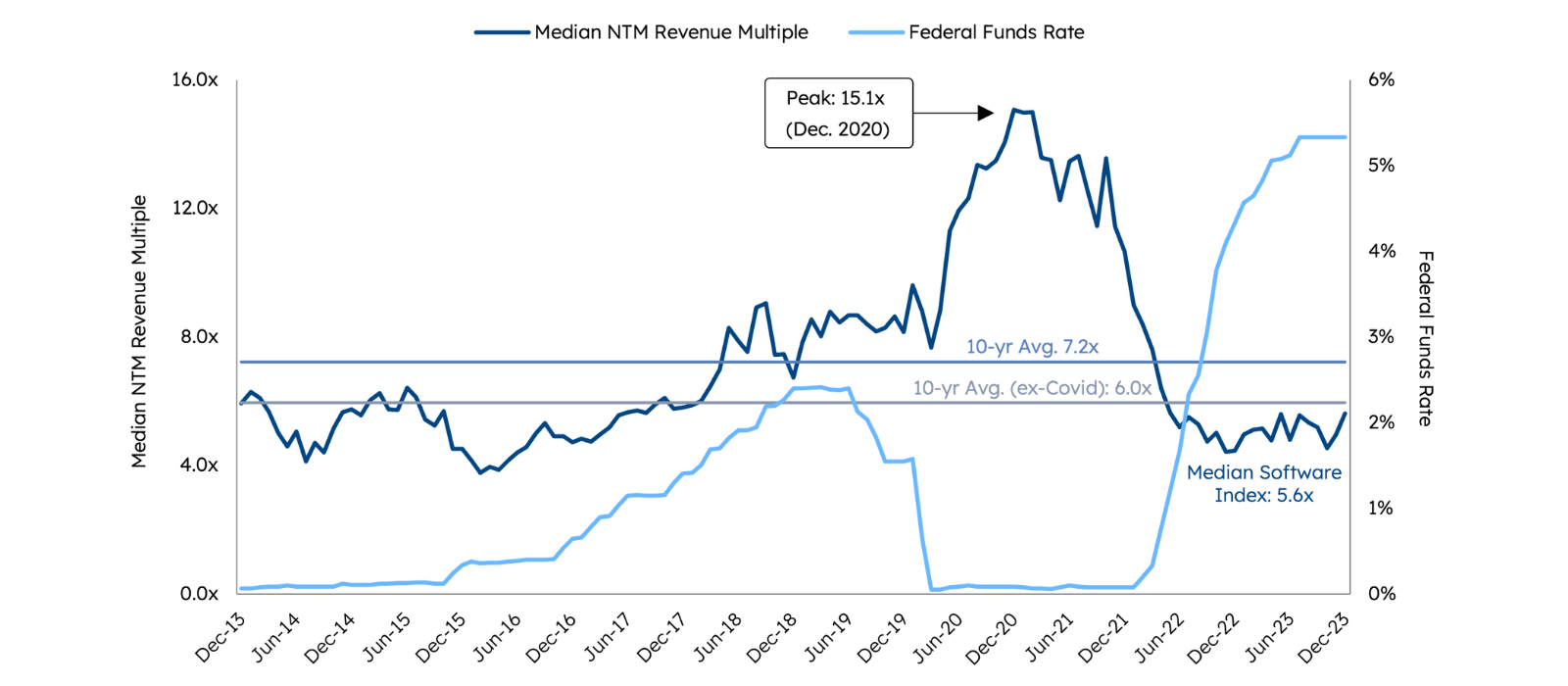

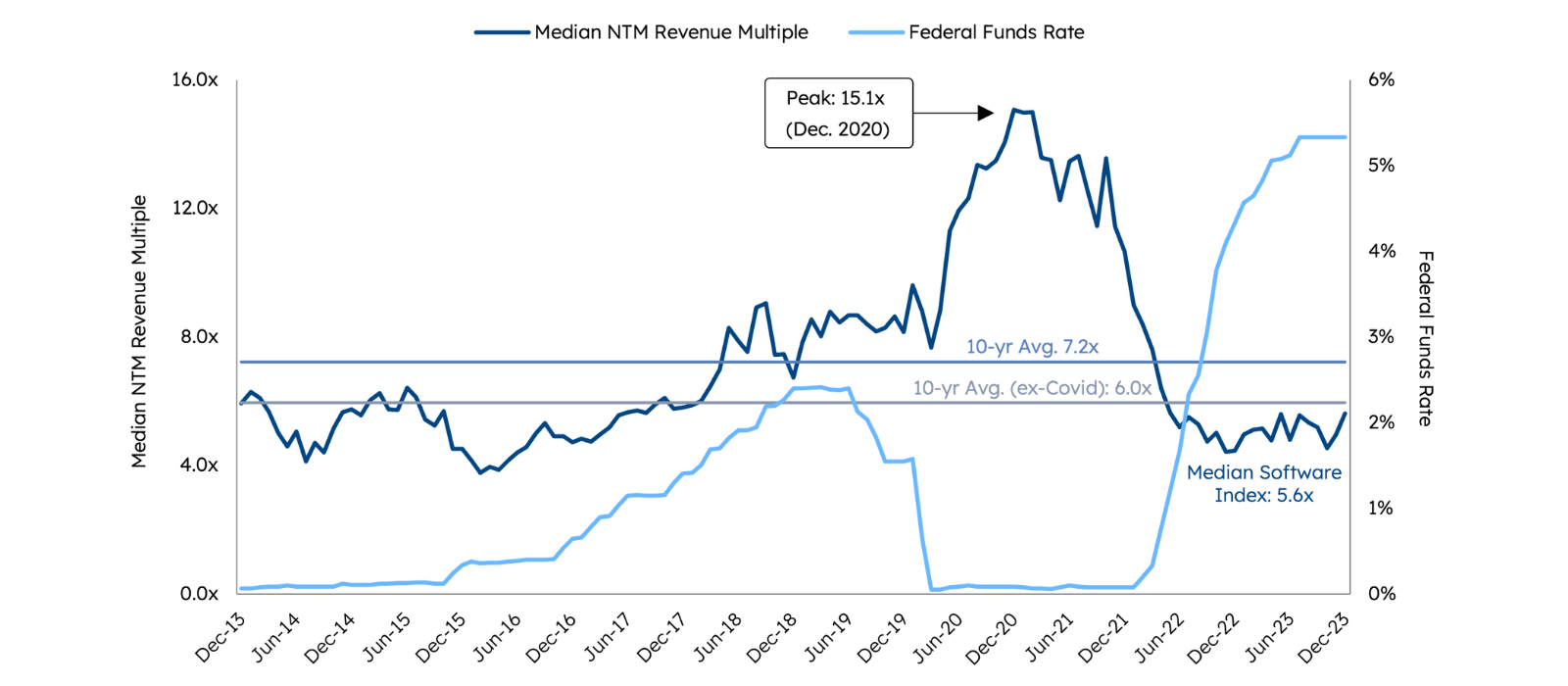

7. Public Software Multiples will Expand Incrementally in 2024

Despite rebounding strongly in 2023 (+26% YoY), software valuation multiples remain slightly below their 10-year historical average. While we don’t see another 25%+ expansion per se, we believe multiples will expand incrementally, likely breaking to the upside of the long-term average, as:

- Growth rates inflect higher throughout the year

- Companies strengthen their profitability

- The Fed begins to lower interest rates

- Any U.S. Presidential election year volatility subsides in Q4.

Lower interest is particularly important as this will cause money to flow back into risk assets (e.g., the technology equity markets) from the higher interest rate money market accounts of 2023.

Expand

Sources: S&P Capital IQ data pulled as of Dec. 31, 2023; Sapphire Internal Analysis (Jan. 2024)

8. M&A Volume will Increase, with Small-to-Medium-Sized Deals in the Spotlight

Enterprise software M&A fell for a second consecutive year in 2023, closing the year at ~$260B in deal value across 511 completed transactions. Despite the decline, 2023 was still the 4th highest total of the past decade, from a value perspective – far from a depressed deal-making market. In Q4, we observed what we believe will be a strong trend heading into 2024, which is a much higher velocity of small-to-midsize deal-making activity as strategics and PE firms tap their strong cash reserves and increasingly take advantage of an environment where VC is more selective. The year started off with a bang with the announcement of a $35B merger in the highly specialized technical software sector between Synopsys and Ansys, but in general, we believe regulatory scrutiny and election overhang limit the potential for blockbuster deal-making in 2024. We expect a very active market in sub-$3B transactions.

9. Private-to-Private M&A will Finally have its Day in the Sun

Once considered unnecessary, given the abundance of available capital and high rates of organic growth, and/or too difficult from an integration perspective, private-to-private M&A deal activity will increase significantly in 2024 as strong private companies look to consolidate their positions, add scale (to gain efficiency and reach a higher IPO bar), and improve NDR with new land and up-sell opportunities. VCs and other stakeholders who would have resisted being acquired by another private company in the past will welcome the opportunity to roll their stakes into larger, more successful private companies that can ultimately go public or command an M&A premium at exit. Private equity-funded companies will add appeal and growth by acquiring efficiently growing VC-backed tuck-ins for more reasonable valuation multiples.

10. Software IPOs will Become a Thing Again – but the Real Action will Happen in 2025

After an almost two-year drought, many software companies have finally reached the new higher bar for IPO exit scale ($300-400M+ projected revenue levels vs. $200-250M in ZIRP days) and have a sightline to near-term profitability. While we expect some larger deals to seed the market in 1H 24 and gauge investor appetite, momentum will accelerate in the second half of the year, with the real deluge of software IPOs hitting in 2025, including underwriters finally testing the viability of smaller cap software IPOs again. If successful, this will be a great development for the software sector and the innovation economy.

Honorable Mentions

“Flat will be the New Up” for VC Fund Sizes. After a decade of near-free money that led to ever-increasing VC fund sizes, we believe this trend will reverse as round sizes stabilize and VCs focus again on fundamental principles of portfolio construction. Constrained by a tougher fundraising environment, VCs will raise only enough capital as is actually needed to build a portfolio of 30-35 great companies.

The Distinction between “Growth-Stage Venture” Investing and “Growth Equity” Investing will Blur. Higher cost of capital and the newly embraced efficient growth playbook will result in more “Rule of 40” companies. Whether these durable growers are backed by traditional VC firms, minority growth equity investors, or even founder bootstrapped, will become less relevant. Savvy investors will gravitate toward becoming “scaled specialists” in one or more sectors. For example, we saw the number of VC firms investing in at least 5 private enterprise software companies go down from 11% of all firms who made at least one software investment in 2021 to just 2% in 2023. In our view, what will matter in 2024 is the subject matter and stage expertise of the investor, and the investor’s ability to provide value-add in pursuit of efficient growth, not the VC versus PE label.

Let us know what you think about the report and our predictions – we’d love to hear from you about what you think we got right, where you might disagree and what we may have missed.

Reach out to Steve Abbott ([email protected]) or Kevin Burke ([email protected]) with any thoughts or questions.

Here’s to a great 2024 in enterprise software!

Legal disclaimer

Nothing presented herein is intended to constitute investment advice, and under no circumstances should any information provided herein be used or considered as an offer to sell or a solicitation of an offer to buy an interest in any investment fund managed by Sapphire Ventures, LLC (“Sapphire”). does not solicit or make its services available to the public. Prospective investors may rely only on a fund’s confidential private placement memorandum or an official supplement thereto. An investment in a Sapphire fund is speculative and involves a high degree of risk.

Information provided reflects Sapphires’ views at a point in time. Such views are subject to change without notice; as of January 30, 2024 unless otherwise noted.

Certain information contained in this presentation including any prediction or projection may constitute “forward-looking statements,” which can be identified by the use of forward-looking terminology such as “may,” “will,” “should,” “expect,” “anticipate,” “target,” “project,” “estimate,” “intend,” “continue” or “believe,” or the negatives thereof, or comparable terminology. Due to various risks and uncertainties, actual events or results, or the actual results may differ materially from those reflected or contemplated in such forward-looking statements, and no assumptions should be made that any such strategy or investments were or will be profitable. Sapphire provides no assurance or no guarantee that any such prediction will ultimately occur.

This Presentation has been prepared from original sources, or other cited data, and is believed to be reliable. However, no representations are made as to the accuracy or completeness thereof. The information in this Presentation is not presented with a view to providing investment advice with respect to any security, or making any claim as to the past, current or future performance thereof, and Sapphire expressly disclaims the use of this Presentation for such purposes. The inclusion of any third-party firm and/or company names, brands and/or logos does not imply any affiliation with these firms or companies. None of these firms or companies have endorsed Sapphire or its affiliates. References to specific companies in this Presentation are for illustrative purposes only and should not be considered a recommendation to carry out securities transactions. It should not be assumed that recommendations made in the future will be profitable or will equal the performance discussed herein.

“Internal Sapphire Analysis” described within respective graphs above refers to observations of the ”Sapphire Internal Public SaaS Index” which is an internal paper composite maintained by Sapphire is for informational purposes only and is in no way intended to constitute investment advice. The index consists of individual SaaS related public equities chosen at Sapphire’s discretion. The index is not investable and does in no way represent any investment offering to be made in any fund managed by Sapphire. While Sapphire has used reasonable efforts to present observations from analysis of the index, Sapphire makes no representations or warranties as to the accuracy, reliability, or completeness of observations presented within any analysis described or the index itself. All metrics and observations described in relation to the index must be considered academic and hypothetical in nature and are in no way guaranteed in actual practice. While Sapphire has used reasonable efforts to obtain information from reliable sources, we make no representations or warranties as to the accuracy, reliability, or completeness of third-party information presented within the index or this article. No assurance can be given that all material assumptions have been considered in connection with the analysis of the index, therefore actual results may vary from those estimated therein and are subject to change. No assumptions should be made that any investments described above were or will be profitable.

The content in this Presentation has not been reviewed or approved by the Securities and Exchange Commission.

Past performance is not indicative of future results.