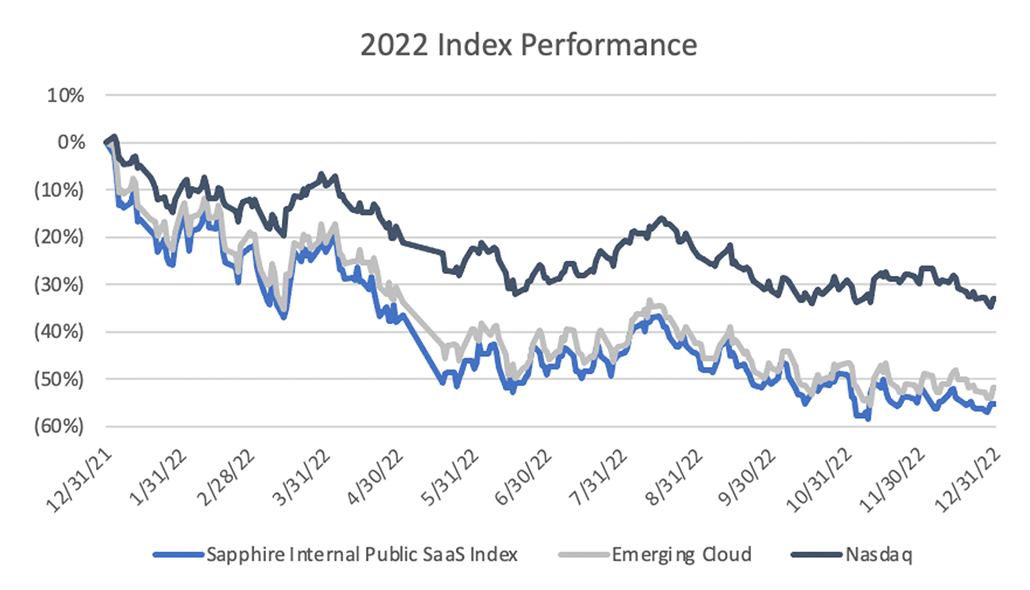

Let’s cut right to the chase – 2022 was a challenging year for SaaS stocks. On November 9, 2021, the Nasdaq Emerging Cloud Index (which tracks a cohort of 76 cloud companies) hit an all-time high. On that same date, Sapphire’s internal index of public SaaS companies also hit a high-water mark.

But since then, it’s been all downhill. The Emerging Cloud Index finished 2022 down ~52%, while the Sapphire broad SaaS index was down ~55%. The tech-heavy Nasdaq finished the year deep into bear market territory, down ~33%1.

While SaaS markets may have been overheated in 2021 (likely due in large part to the impact from stimulative COVID monetary policy) and market conditions have become uncertain, we at Sapphire are not beginning 2023 on a Debbie Downer note: we are still long-term bullish on SaaS, just like we were in this blog from 2019.

The team at Sapphire believes that now is as good a time as ever to invest in attractive SaaS companies, whether that’s in the public markets or in the next generation of private horizontal and vertical software companies. Our entire thesis at Sapphire is to invest in all flavors of private expansion-stage enterprise SaaS companies that we think can become enduring market leaders – Companies of Consequence.

3 Key Reasons to Keep Faith in SaaS Stocks

And why do we believe so deeply in today’s public SaaS market leaders and the next generation of breakout private SaaS companies? Three key reasons:

- The fundamental drivers of SaaS growth have not changed, as the shift to the cloud continues, even faster than predicted;

- Even with the recent downturn, SaaS has outperformed over the long run (see below); and

- We think today’s market uncertainty will actually be a long-term positive for high-growth SaaS companies, as it will force many companies poised for category leadership to become more operationally efficient sooner, building even stronger foundations.

SaaS Growth Rates: Underlying Numbers Remain Strong

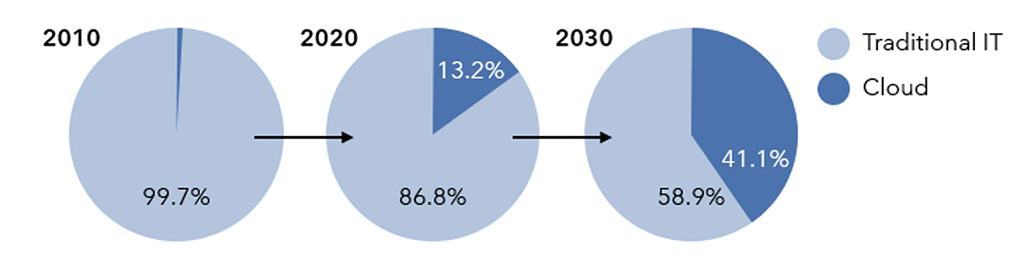

We believe the downward move in SaaS valuations has been driven primarily by multiple compression due to macroeconomic changes (the end of near-zero interest rates – the era of so-called “easy money”). The median forward multiple for high growth SaaS names has compressed ~75% since the peak in November 2021, from ~33x to ~7x CY23 revenues2. But we believe the underlying fundamentals of SaaS businesses remain largely unchanged. As an example, the cloud’s share of IT spend has accelerated from less than 1% in 2010 to closer to 20% today. And while that’s rapid growth, even 20% “market share” (compared to traditional IT) means we are still in the early innings of cloud penetration. Gartner projects cloud’s share of spend will reach 40%+ by 2030.3

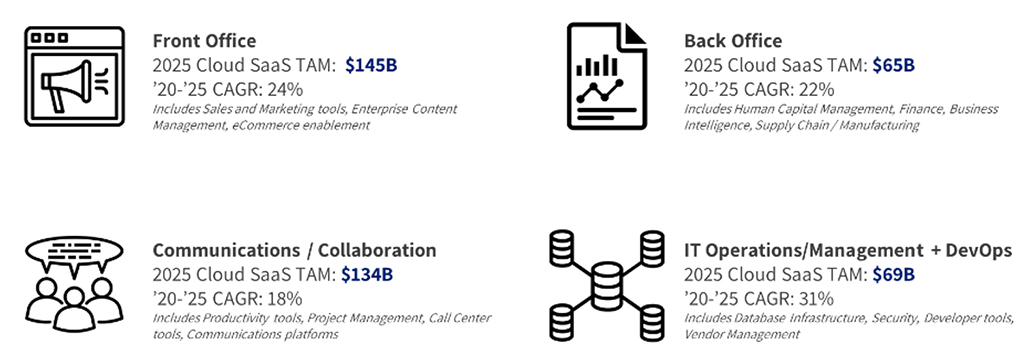

Zooming in, when we look at specific horizontal market segments that Sapphire invests in, we’re seeing rapid growth prospects as well. Front Office tooling, which includes things like Sales and Marketing software, is projected to be a $145B market by 2025.4 This means demand for solutions from companies such as Gong, Jasper, Outreach and Attentive (the latter two of which are Sapphire portfolio companies) may continue to accelerate.

One of the fastest growing segments is IT Operations/Management + DevOps, which Gartner projects will see annual growth of 31% through 2025.5 We believe that this bodes well for companies in these markets such as Docker, Synk, OwnBackup and Netskope (the latter two of which are also Sapphire portfolio companies).

Moreover, we don’t believe that fundamental SaaS economics have changed in the past year. Many SaaS companies are still high gross margin, low capital intensity businesses, with demonstrated strong recurring revenue growth, fueled by powerful secular trends. Gartner estimates that global software spend will exceed $1T in 2025.6

Finally, public SaaS companies themselves are exhibiting strong underlying metrics. Median consensus NTM growth rate for our internal set of 58 core comparable SaaS companies is 21%, coupled with free cash flow generation (median FCF margin is 2%) and strong net dollar retention (median of 121%).7

The Relative Outperformance of SaaS Companies’ Stocks

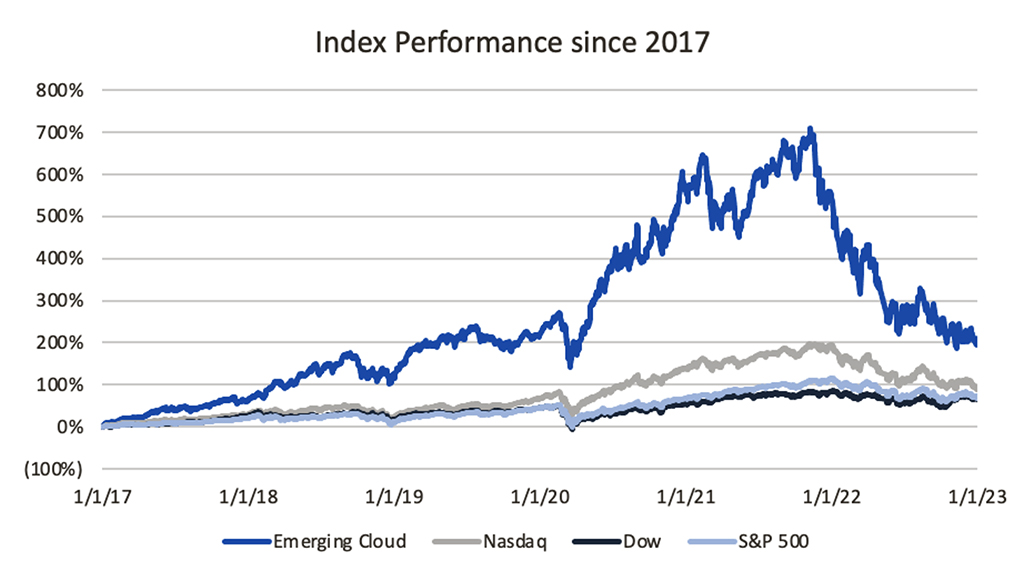

Despite the recent compression in public SaaS valuations, we believe the category has performed incredibly well over a longer-time horizon, which justifies our focus on investing in private next gen SaaS companies. Over the last six years (since 1/1/17), cloud stocks are up over 200%, while the Nasdaq is up only 95%.8

While the current environment might not be the “Good Old Days” for SaaS (as we discussed in another 2019 blog), we believe performance remains strong over the long-run and may remain strong in the future for both operational and market valuation reasons.

A Time for Operational Efficiency

In our opinion, over the last 10+ years, the market has rewarded growth at all costs. But as investors become sensitive to interest rate increases, and discount future cash flows even further, we’ve observed a rotation to investment in public companies that are profitable such as VMware, Adobe, DocuSign and Box (the latter two of which are former Sapphire portfolio companies).

Companies are responding to investor demands for efficient growth. For example, we’ve seen layoffs from many SaaS companies, commitments to reduce marketing spend, and a broader push to do more with less. For many of these businesses, for which efficiency has never been the core focus, we believe leaner periods in the public markets will force operational efficiency and help these companies deliver on one of SaaS’s key long-term value props: consistent cash generation.

Should the general economy see a further slowdown in 2023, we think SaaS will actually outperform the broader market. This is because we believe SaaS companies are particularly well suited to respond, as variable sales and marketing spend can often be quickly adjusted downward to meet market conditions. Furthermore, because many SaaS companies go-to-market with annual contracts, cash is often pulled forward, something that investors may be particularly keen on in a recessionary period.

Finally, software can be naturally deflationary, as it can help companies operate more efficiently. Given that, our belief is that many non-tech companies will accelerate (or least maintain) software usage in a downturn, as a means of driving more leverage in their business.

Bank on Multiple Expansion

As venture capitalists, it’s not our expertise to make market timing calls on a quarter-to-quarter basis as macro hedge fund investors might do. But it is our business to forecast longer-term tech trends that will impact our investment thesis over a 5-10 year horizon. To that end, with SaaS companies trading at just 4.8x NTM revenues versus historical medians of 8.9x and 5.9x since 2017 and 2005, respectively, we believe it’s reasonable to conclude that over the next 3-5 years not only will SaaS companies grow materially but they may also be the beneficiaries of multiple expansion as the Fed stops raising (and even potentially lowers) interest rates and monetary policy eases9.

Don’t Sleep on SaaS!

One key takeaway: we remain as bullish as ever here at Sapphire on the next generation of SaaS companies. We believe the ongoing correction in the public markets is healthy and will help ensure that strong businesses are invested in going forward.

If you’re a founder of a growth-stage company, we’d love to help you reach the public markets. With our Capital Markets Center of Excellence, we maintain strong relationships with leading public investors, sell-side analysts, and other capital providers, as well as playbooks on the steps necessary to prepare your company for a public exit.

Please reach out to Steve Abbott ([email protected]) or Andrew Vogeley ([email protected]) to discuss these topics further.

Legal disclaimer

1. CapIQ, Internal Sapphire analysis

2. Source: Sapphire broad SaaS index

3. Source: Gartner, Piper Sandler

4. Source: Goldman Sachs, Gartner

5. Source: Goldman Sachs, Gartner

6. Source: Gartner

7. Source: Internal Sapphire analysis

8. Source: CapIQ, Nasdaq Emerging Cloud Index

9. Source: KeyBanc

Disclaimer: Nothing presented within this article is intended to constitute investment advice, and under no circumstances should any information provided herein be used or considered as an offer to sell or a solicitation of an offer to buy an interest in any investment fund managed by Sapphire Ventures (“Sapphire”). Information provided reflects Sapphires’ views as of a time, whereby such views are subject to change at any point and Sapphire shall not be obligated to provide notice of any change. Sapphire does not make any representation as to the accuracy or completeness of information provided herein.

”Sapphire Internal Public SaaS Index” (“The index”) is an internal paper composite maintained by Sapphire is for informational purposes only and is in no way intended to constitute investment advice. The index consists of individual SaaS related public equities, whereby aggregate index performance results described reflects the equally weighted performance of such equities over a stated time period. The index is not investable and does in no way represent any investment offering to be made in any fund managed by Sapphire. While Sapphire has used reasonable efforts to present observations from analysis of the index, Sapphire makes no representations or warranties as to the accuracy, reliability, or completeness of observations presented within any analysis described or the index itself. All metrics and observations described in relation to the index must be considered academic and hypothetical in nature and are in no way guaranteed in actual practice. While Sapphire has used reasonable efforts to obtain information from reliable sources, we make no representations or warranties as to the accuracy, reliability, or completeness of third-party information presented within the index or this article. No assurance can be given that all material assumptions have been considered in connection with the analysis of the index, therefore actual results may vary from those estimated therein.

No assumptions should be made that any investments described above were or will be profitable. A complete alphabetical list of Sapphire’s investments made by its direct growth investing funds is available here. Due to various risks and uncertainties, actual events, results or the actual experience may differ materially from those reflected or contemplated in these statements. Nothing contained in this article may be relied upon as a guarantee or assurance as to the future success of any particular company.

Past performance is not indicative of future results.