At Sapphire Partners, we have long believed in the importance of emerging managers in the venture capital ecosystem and more specifically as an integral part of an LP’s portfolio. When we launched our LP investing work a decade ago, we intentionally built a strategy that included investing in emerging managers as a component of our early stage venture fund portfolio. To date 80%(1) of all the US emerging managers venture funds we have invested in (defined as Vintages I – III) have since gone on to raise subsequent funds such that they are now considered established managers (which we define as any vintage IV+).

Today I am delighted to announce Sapphire Partners is launching a new emerging managers investment program with a sole LP, CalSTRS, the world’s largest educator-only pension fund with 1 million(+) members and beneficiaries. For decades CalSTRS has held a similar conviction in the power and promise of emerging early stage venture managers, making them a natural partner for us.

As a part of this program, Sapphire Partners will take over the management of five existing CalSTRS “New and Next Generation Manager Funds”, representing $1.4 billion AUM(2). Together, we will have collectively partnered with more than 300 emerging manager-led funds. And going forward, we plan to deploy approximately $100M/year into emerging venture managers. This new program complements our existing LP work of investing in early stage VCs in the US, Europe and Israel. (You can read more about the announcement here.)

Emerging managers are a critical part of the VC ecosystem

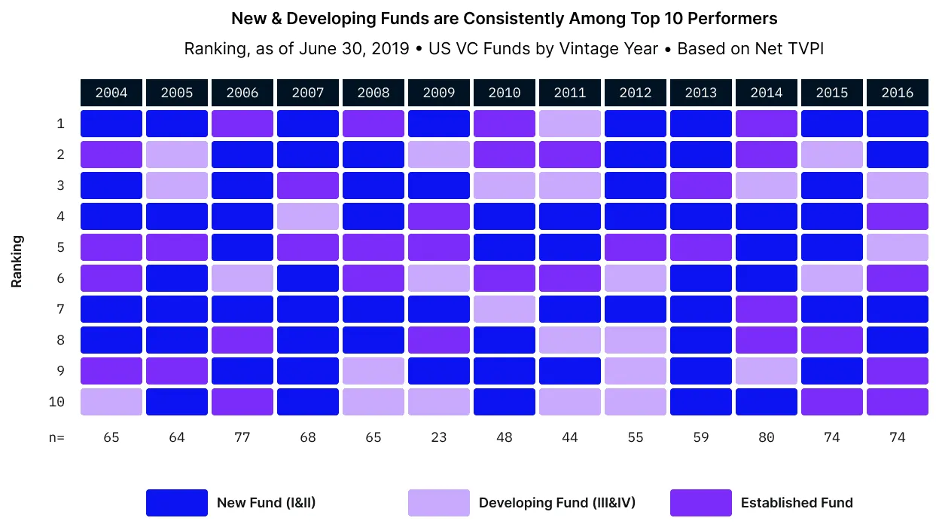

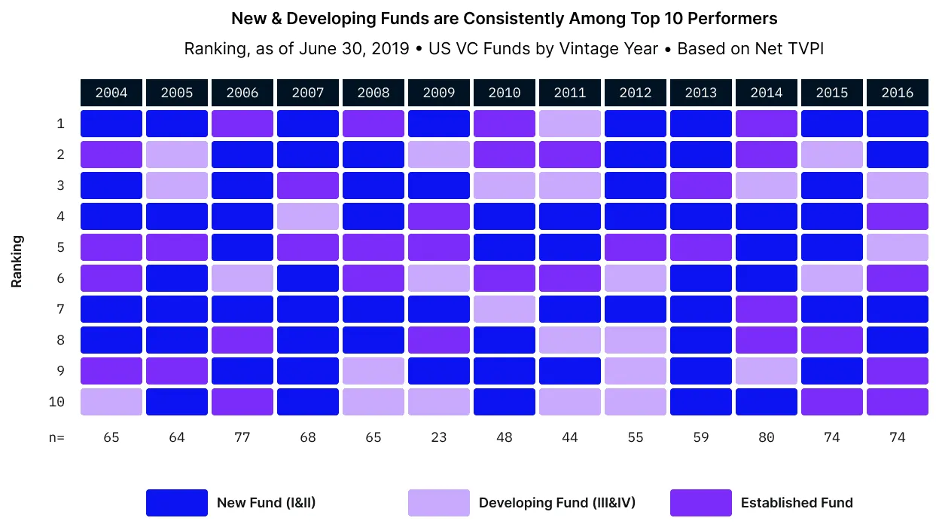

As much as today is about celebrating our new partnership with CalSTRS, our dual focus is on the emerging manager. It is important to remember that venture funds, even the legendary ones like Accel, Benchmark, Sequoia, Union Square, etc., all were first time funds once upon a time. Like all the emerging managers that have come since, they brought new ways of thinking, investing, grit and the hustle to attract the next great entrepreneur. And while being an emerging manager in no way guarantees your financial success, funds led by emerging managers made up 72% of the top returning VC firms between 2004 and 2016, according to Cambridge Associates(3).

Expand

Source: Cambridge Associates, January 2020. https://www.cambridgeassociates.com/insight/venture-capital-positively-disrupts-intergenerational-investing/

In addition to greater diversity of thought we’ve also seen greater diversity of gender, race and ethnicity in the venture ecosystem as a byproduct of emerging managers. In fact, the Sapphire Partners portfolio features nearly 70% managers from diverse backgrounds (on a by count basis).

The Road Ahead.

We know it’s not easy to go from being an emerging manager to established. We also know 2023 is a particularly tough year with US venture capital fundraising on pace to set a six-year low, according to Pitchbook’s recent NVCA Venture Monitor, through June 2023.

But it’s not all doom and gloom – while the fundraising environment in 2023 and most likely into 2024 is materially different than the previous few years, for both emerging and established managers alike, we believe there are many positives to tap today: the vast depth and breadth of the tech and venture ecosystems, an expanded LP base as many new entities, including venture funds themselves, have developed LP programs, along with more options for how managers can get started including rolling funds, AngelList, and other software platforms.

We also know legendary firms were founded in bull and bear markets and believe that will continue to be the case in the future as well.

- Benchmark started in 1995 (bull)

- Union Square Ventures in 2003 (bear)

- Andreessen Horowitz in 2009 (bear)

- Ribbit in 2012 (bull)

We’re very proud of the venture managers we have backed and their 80% graduation rate from emerging to established venture managers. They have defied many odds as the industry average graduation rate during the same period is quite a bit lower at 24% (using Pitchbook stats for US venture funds from 1995 – 2014). They defied the odds thanks to their insights, investing acumen, hustle and perseverance.

We believe a fund’s LP base can help make a difference as well in its own small way. We believe having institutional LPs on your cap table that understand and care about the venture asset class and want to build with their GPs – sharing what it takes to build a best-in-class venture firm from the early days – can be a powerful advantage. We also believe avoiding investments before Fund IV can put an LP’s portfolio at a disadvantage, lowering return potential and increasing future competition for limited LP spots once a venture firm ‘breaks out’. While many LPs are currently not, or have never invested in emerging venture managers, we believe now is a great time to be doing so.

Today we have much to celebrate:

…partnering with CalSTRS, a mission driven institution that has also long believed in what Sapphire Partners has been doing since our earliest days

…being in a position to lean into investing in emerging US early stage venture managers

And, above all, we celebrate the emerging manager, who is unafraid to take on vast challenges, to take big swings.