In my first post on Series A investing, we looked at active investors at the A-level and found that while there’s a recent downward trend in the number of Series A deals done, there are three times more active Series A investors than there were a decade ago. More competition for Series A deals has inevitably meant higher valuations, but on a relative basis, still not as high as the valuation jump post the A round.

In this post, I wanted to dive deeper into the role of Series A in the overall funding stack and the dynamics at play that could be driving the decrease in Series A deals — because we know it’s certainly not for a lack of capital!

The role of series A in the overall funding stack

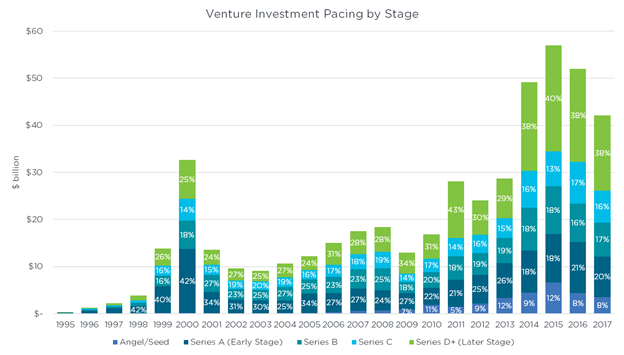

Not surprisingly, later stage is where the most money is invested and where we have seen the largest increase in valuation. This has been true since 2005. Prior to 2005, Series A dominated as a percentage of dollars invested in any given year. Now, it plays a consistently meaningful percentage, but far from dominant. The chart below shows how much money has gone into each stage and illustrates the clear rise of seed investing, virtually non-existent prior to 2007.

Further, where dollars invested goes hand in hand with the size of funds raised or put better, in the immortal words of Mike Maples, founding managing director of Floodgate, “Your fund size is your strategy.”

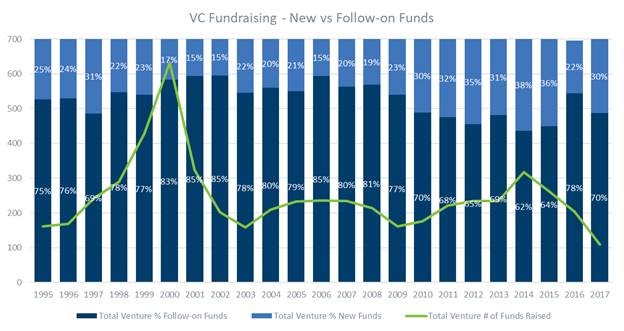

Since 2010 (with the exception of 2016), when large, established funds raised en masse, new funds have been +30% of all U.S. venture funds raised in any given year. The majority of new funds raised are typically sub $100m, implying a natural focus into seed and early A deals.

Data from Pitchbook, as of 9/30/2017

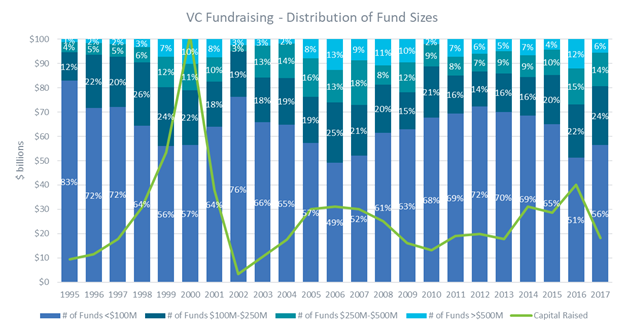

While the trend line has been going down on the total number of funds raised in a given year (see above) as well as the total annual capital raised by U.S. venture funds (see below), there is no lack of capital in the venture ecosystem overall. Specifically, there has been more than $120bn raised by U.S. venture funds since 2014, along with a notable concentration of capital into larger funds.

Data from Pitchbook, as of 9/30/2017

So why are there fewer Series A deals the last couple of years as well as a decline in the total number of active Series A investors (defined as doing 3+ deals a year)? With all the capital in funds over $100m and the attractive role Series A investments play in the valuation stack, one would think there would be more.

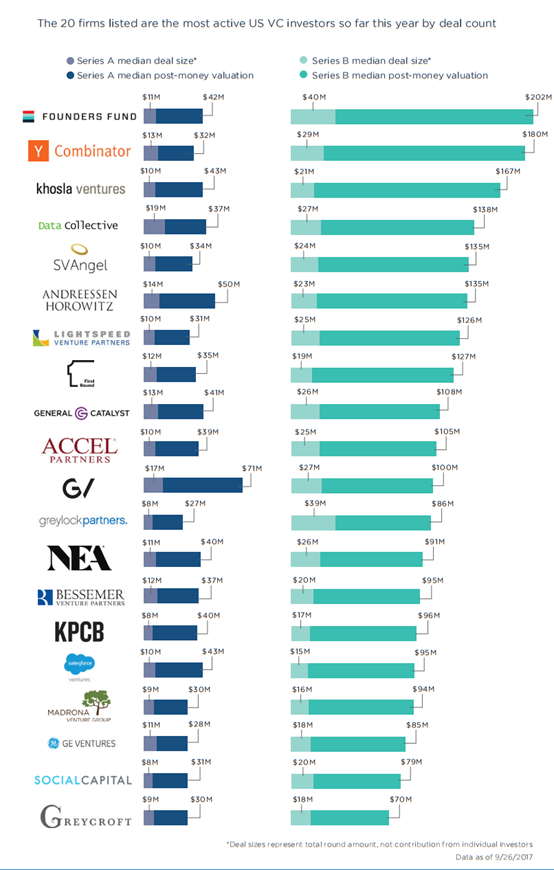

Just look at the chart (below) highlighting “how 20 big-name U.S. VC firms invest at Series A and B.” These 20 firms were, according to Pitchbook, the most active U.S. VC investors by deal count at the end of Q3’17. Interestingly, you see a range of funds playing at the A and B rounds — from seed funds like SV Angel that raise sub $100m funds to the far larger NEA that raised more than $3bn in 2015. The point being, that Series A is a stage accessible to many funds at various fund sizes. Some, like seed funds, might be participating at the Series A due to pro-rata from a prior seed deal. Others might be investing for the first time.

Data and graphic from Pitchbook, as of 9/26/2017

Bigger deals, more reserves and metrics

Our hypothesis is that as fund sizes become larger, venture investors accordingly, have to put that money to work and it is more time efficient (and possibly better portfolio construction) to do that in larger deals. This can mean larger A rounds, which have been increasing in size, but it can also mean funds doing more Series B and beyond deals.

We’re also seeing funds holding more money for reserves. Many private companies have delayed exiting, instead raising more, and often, larger rounds. We have heard from multiple venture fund managers that they are raising larger funds, not to do more deals, but to have more reserves.

We also believe based on the data and speaking with scores of seed and Series A investors, that Series A investors are doing fewer deals as they wait for more metrics to be shown by seed-backed companies. One could interpret this as “seed becoming the new Series A”, and in some respects this rings true.

With the rise of microfunds, seed, pre-seed, and other types of early-stage investing, Series A investors don’t necessarily have to take the same early-stage risks they took before. Companies have funding, can produce betas, can engage with initial customers and start generating revenue all before they go out to raise their A. It is rational, therefore, for Series A investors to pause and see how these seed-backed companies fare before investing. The good news for early-stage companies is that there is plenty of capital out there. The challenge will be producing sufficient metrics or other reasons to attract a Series A investor.

In my next and final post on Series A investing, I’ll look at the exit market and the multiples Series A investors are getting.

Author’s note: Special thanks to Eugene Chou, Stefanie Gordish and Laura Odujinrin for their help with this post.