$14B in VC funding, 19 IPOs and more than $15B in exits. It’s no denying that last year was an exciting one for the Israeli tech ecosystem. And so far, 2021 seems to be exceeding that velocity. Just recently, we led Verbit’s Series D financing and celebrated Monday.com’s IPO.

Even with all of these exciting recent developments, successful tech companies coming out of Israel is nothing new. It has had a great track record of producing innovative companies such as Mobileye (acquired by Intel in 2017), Waze (acquired by Google in 2013) and Annapurna Labs (acquired by Amazon in 2015), just to name a few.

At Sapphire, we have a history of identifying and backing high-growth Israeli companies including JFrog, Monday.com, Kaltura, Verbit and OwnBackup. We feel JFrog’s IPO last September, coupled with monday.com’s IPO a few weeks ago, are a testament to the strength of the Israeli ecosystem, which is why we remain excited about Israel’s continued growth as a world-class startup hub, and the country’s ability to build Companies of Consequence.

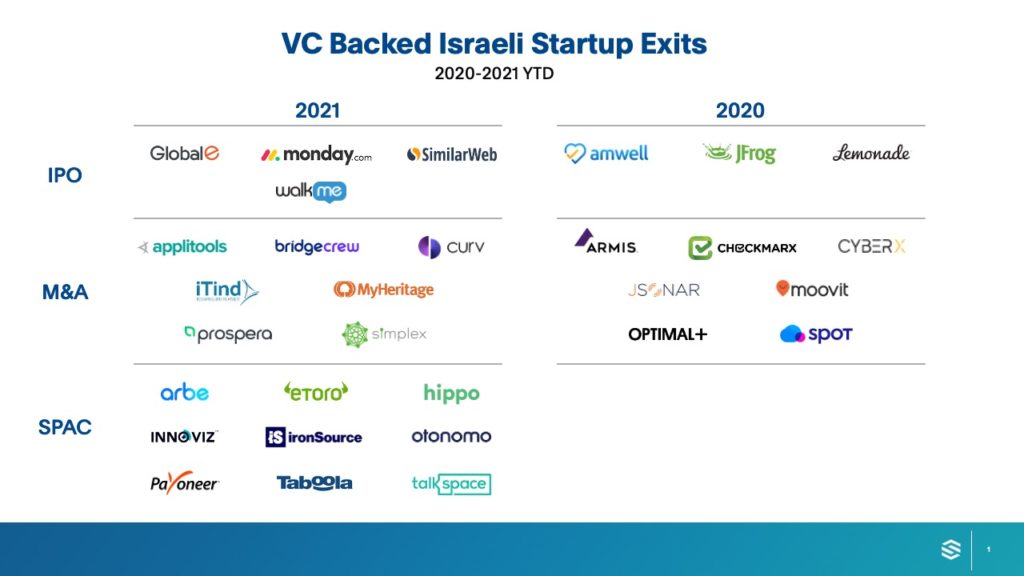

VC Backed Israeli Startup Exits 2020-2021 YTD

What’s driving Israel’s robust tech ecosystem

So what are the key factors that have created such a robust startup ecosystem in Israel? There are many reasons worth highlighting including the mature early-stage ecosystem, Israel’s military being an incubator for top tech talent and the startups’ early ambition for global expansion from day one.

1. Early-stage funds support the development of the Israeli tech scene

How did the Israeli tech ecosystem first take-off? It started in the 1980s when the defense and aerospace industries invested heavily in Israel, which led to new technologies. For example, in 1981, Israel devoted over 20% of its GDP to military expenditure. At about this same time, venture capital first emerged in Israel. The first VC fund was founded in Israel in 1985 when the former Chief of Staff of the Israel Air Force Major-General Dan Tolkowsky founded Athena Venture Partners.

This success was further expanded with Yozma, an Israeli government initiative launched in 1993 offering attractive tax incentives and using government funds to double any investment. As a result, R&D investment across all of Israel is twice the average of other countries according to the OECD. This funding and support will continue to propel the Israeli tech ecosystem forward.

Additionally, given the strength of Israeli founders coupled with global ambitions, it’s no surprise there is a mature investing ecosystem ready to support these founders. Many early stage funds such as 83North, Aleph, TLV, Angular Ventures, Entrée Capita and others invest capital into the earliest opportunities in Israel to bolster development. The presence and success of these funds at the earliest stage in Israel has led to further development of opportunities in this space.

2. The military serves as an incubator and accelerator of Israel’s startups

Israel has a strong recurring pipeline of founders and builders ready to tackle tough technical problems. Israel’s Military Intelligence Agency, Unit 8200, provides graduates with access to leading-edge technology. Many startups grow out of this community due to the technical knowledge and experience these founders gain by working on big problems in a high pressure environment and gaining valuable leadership skills early on.

To date, over 1,000 startups have been founded by former members of Unit 8200. We continue to be impressed by Israeli’s strong technical founders and look forward to meeting many of the new entrepreneurs that come from Israeli’s military.

3. Startups have early ambitions of expansion

Israel has more startups per capita than anywhere else in the world, which is largely driven by Israeli founders’ focus on going global from their initial launch. Due to it’s relatively smaller market size compared with Europe, the U.S., etc., entrepreneurs in Israel know from the start that they will need to think global to build a large company.

Further propelling the growth of Israel’s startups is the compact market size of the market, which is an advantage as entrepreneurs can recognize if they have product-market-fit quickly while keeping overhead low. Similar to Silicon Valley, there is a tight knit tech community in Israel creating network effects across the ecosystem.

Additionally, Israeli founders don’t have to go it alone to test their global ambitions. There are 270 multinational corporations including Google, Apple, Facebook, Microsoft, and many others that have established more than 320 R&D facilities across Israel to further test these hypotheses.

This unique market environment in Israel has led to a number of successes. Many of these startups are starting to gain traction globally, with over 1,000 Israeli startups working and employing people across Europe. Israel also has the third largest number of companies listed on the Nasdaq (after the U.S. and China). Sapphire is excited to continue to support these and future success stories as they build a strong foundation in Israel and look to expand globally.

5 Israeli startup trends we’re excited about

Israel’s strength as a startup hub continues to make it a priority for our team. Our goal is to invest in companies that are not only innovating in their respective verticals, but either already are or will soon become the category leader. While we evaluate and invest in startups across a range of tech sectors, there are a few areas that we’re particularly enthusiastic about:

- Cybersecurity – Well known strength attributed to military service, specifically Unit 8200

- Fintech – Recent successes show that fintech is emerging as a flourishing sector for Israel

- AI & Automation – Enterprises are looking for more efficient workflows and “boring AI” solutions

- Healthtech – Digitization of healthcare continues to accelerate in part due to Covid

- Data Infrastructure & Tooling – More and more new data tools are emerging as part of the modern data stack

A global leader in cybersecurity

Israel has long been known for its strength in cybersecurity attributed to the entrepreneurs that came from Unit 8200, and for good reason has been labeled a global leader in cybersecurity. Israel has over 400 cybersecurity companies in operation today that export over $6.5B in cybersecurity products per year. Some of the world’s largest cybersecurity companies started in Israel including Check Point, CyberArk and Forescout.

As new cybersecurity trends emerge, we’re keeping a close eye on Israeli startups leading the charge in the following areas:

- Cloud-focused solutions to safeguard identities and data have recently received significant and well-deserved attention, including Ermetic, Orca Security and Wiz.

- Threat detection is another key area of interest, whether to safeguard company data like Aqua Security and Hunters or protect the entire API library like Salt Security.

- Solutions like Perimeter81 and Axonius have gained significant traction as companies recognize the importance of cybersecurity for their assets and networks.

Fintech is fast emerging as a flourishing sector

When you think of fintech, startup hubs including London and New York may come to mind at first. However, don’t overlook Israel! Israel punches above its weight when considering its fintech success to date. Israel boasts over 500 fintech startups and has 12 fintech unicorns. Some of Israel’s flourishing fintech companies include Lemonade, eToro and Melio.

Large financial institutions recognize the potential coming out of Israel’s fintech ecosystem and are investing heavily. Citi, Barclays and Santander all built fintech innovation labs in Tel Aviv, while RBS used an Israeli fintech to build the underlying technology for its recent spinout, Esme. Fintech has emerged as a strong sector because it has tapped into synergies between security and finance, specifically around fraud and data analytics.

One of the sub-sectors in fintech we are especially excited about is the payments space. In B2B payments, Melio is disrupting how small businesses pay vendors and contractors, and Rapyd provides an API-based, fintech-as-a-service platform covering payments, banking services, and fraud prevention.

It’s not just payments that are seeing breakout success stories. Pagaya’s platform to deliver credit evaluations via machine learning and Stampli’s platform to optimize corporate invoice management represent other exciting areas within fintech.

The AI and automation sectors continue to produce success stories

Over the years, we’ve observed the rise of low code and no code platforms globally as we wrote about in our blogpost on How Automation & Low Code/No Code Platforms Help Power our Lives: 4 Trends Driving Adoption. We expect these trends to continue as Gartner predicts low-code app development will account for more than 65% of app development functions by 2024. And monday.com’s recent IPO is an example of Israel’s strength in this sector.

In addition to low-code/no-code, we are seeing exciting companies emerge out of Israel focusing on what we like to call “boring AI,” meaning AI/ML solutions focused on making the work lives of knowledge workers less boring by automating the mundane and mindless everyday tasks. In many ways, Israel is leading the way in AI development, ranking third in the world in number of AI businesses started and the AI ecosystem is growing rapidly, exceeding over 1,100 startups in 2018 (a 120% increase in the span of 4 years).

Since Automation and AI solutions can benefit every industry, there are many different use cases. For example, for manufacturers and warehouse owners, Seebo and Fabric are two companies that provide automated and predictive solutions to better streamline and monitor their operations. Salto is a solution that recently emerged from stealth mode and is targeted at improving business application configuration. Applitools tests the visual aspects of web and mobile applications to ensure they appear correctly. Granulate optimizes infrastructure and workload performance in real-time and has saved three billion hours of core usage. AI and Automation startups aren’t just impacting the typical industries you’d expect, but many others as well. And Optibus, a govtech startup, is focused on providing better routing, optimization and planning for public transit. These are only a handful of companies that come to mind, which is why this space is so attractive to us.

Healthtech has become a priority due to COVID

As Israel battled the pandemic and worked to vaccinate its citizens, startups focused on digital health and telemedicine adapted their existing platforms to fight the spread of COVID. Even before the pandemic though, changes had already begun across the healthtech landscape, with big data and AI helping the industry leap forward as explained in our blog post on How COVID-19 has Accelerated HealthTech Adoption.

One example of an exciting startup capitalizing on trends coming out of COVID is Aidoc, which uses computer vision and AI to detect and pinpoint critical anomalies for radiologists by analyzing medical images. Additionally, Datos Health is improving patient care and Nym Health is already working with 40 medical providers to provide a better billing system and prevent coding related denials of payment.

But who exactly is helping fuel the growth of these healthtech startups in the country? VC funds are driving lots of this development in the healthtech space. In fact, Pitango Capital Partners found that 250 healthtech companies have raised ~$6.5B. While VC funds and societal trends are accelerating the use of digital health solutions, the Israeli government is also backing the latest developments in healthtech. In 2018, the Israeli government earmarked $300M for digital health initiatives. The support by VCs and the Israeli government is great to see, and adds to our excitement about the next-gen healthtech startups that are emerging in Israel.

Data infrastructure and tooling startups emerge across the data stack

Data tooling and data infrastructure startups continue to be a core area of interest for Sapphire. We are seeing more and more visionary startups in this sector as the companies adopt a more modern approach to their data stack and emergence of an open data ecosystem as we’ve written about here.

As a result, we are seeing opportunities across the data stack develop out of Israel. In the cloud data warehouse space, Firebolt has built a solution to better assess, analyze and use data. Another example is Upsolver, a no-code data lake engineering platform for agile cloud analytics. Additionally, Israeli startups are looking to address data quality and observability issues, such as Monte Carlo and Databand. In the data privacy space, BigID and Mine have built powerful platforms helping both enterprises and consumers. And finally, ActiveFence’s platform is helping enterprises to better moderate their platforms and remove malicious activity. We believe that there will only be more data infrastructure and tooling startups launched out of the ecosystem, which we’re looking forward to analyzing and potentially backing.

What’s next for the Israeli ecosystem?

Israel is filled with plenty of startup technology success stories. But in many ways, this is only the beginning. We strongly believe that success will feed future success, and the Israeli ecosystem will only continue to develop promising companies across cybersecurity, fintech, AI/automation, healthtech, data infrastructure, as well as a variety of other sectors.

At Sapphire Ventures, we’ve backed numerous Companies of Consequence in the Israeli tech ecosystem and believe that innovative opportunities will continue to emerge. If you are a globally minded Israeli entrepreneur, please reach out to us here: https://sapphireventures.com/contact.

Special thanks to Tyler Crown for his help in researching and publishing this piece.