At Sapphire Ventures, as a matter of good investment discipline (and our personal love for geeking out over venture data), we routinely set aside time to stress test our investment assumptions. And as many of you know, in addition to our direct growth investment vehicle, we also invest through Sapphire Partners, an evergreen vehicle into Series A focused, early-stage venture funds. There has also been a lot going on in venture over there last few years — things that can, and have, impacted the financing stage loosely called “Series A” — and we wanted to take a deep look to see if things had changed sufficiently enough to shift our investment focus.

Here’s what we’ve seen:

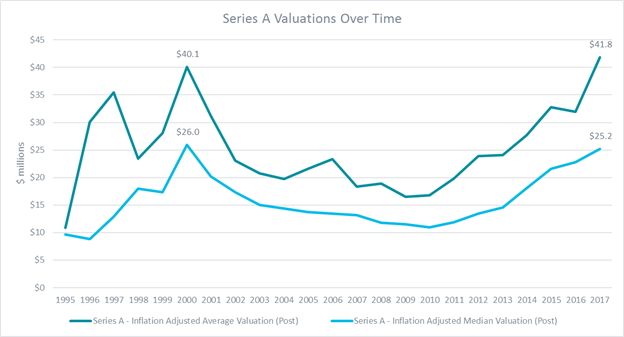

- Series A round sizes that now equal what was a Series B not so long ago with valuations back up to dotcom era highs

- A noted “angel/seed stage deal slump” or “implosion of early-stage VC funding”

- Billions raised in tokens that one could argue would have been raised in fiat in years previously

- An impressive number of new venture funds raised annually — most of which are sub $100m and therefore most likely focusing on pre-seed, seed and early Series A

- At the same time, many established funds have raised larger vehicles along with separate growth/opportunity funds

- Corporate venture capital has also been consistently, and meaningfully, investing in venture

- Venture backed companies have delayed exiting thanks to the seemingly never-ending amount of money available for them to raise at public valuations privately

- And last but not least, there is, of course, the launch of the really, really big game changing SoftBank’s Vision Fund

So, as we approach the close of 2017, it felt like a particularly important time to take a step back and see what is going on at the Series A level. After much research and internal discussion, we are happy to share the first of a three-part series on the overall market for Series A investing. In this post, I’ll share data on active investors in Series A, followed by a second post on the role of Series A in the overall funding stack and a final post on the exit market at Series A.

It’s all about Supply and Demand

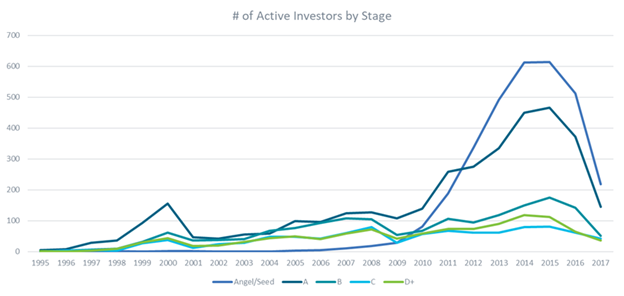

Series A is has become a crowded and competitive space. Despite a recent downward trend, there are still three times more active Series A investors (defined as doing 3-plus Series A deals a year) than there were 10 years ago.

Data from Pitchbook, as of 7/31/2017

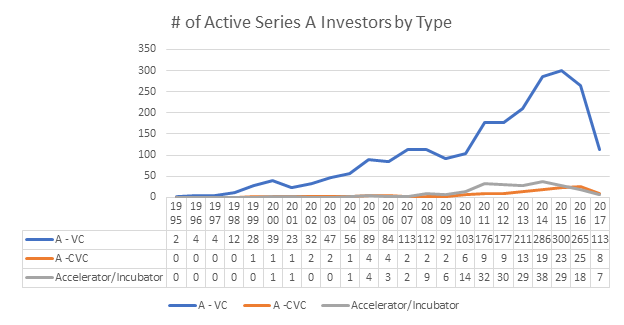

And while corporate venture and accelerators have grown in the last decade, traditional venture firms still dominate at the Series A.

Data from Pitchbook, as of 7/31/2017, “Active” defined as an investor who has done at least three Series A deals in the given year.

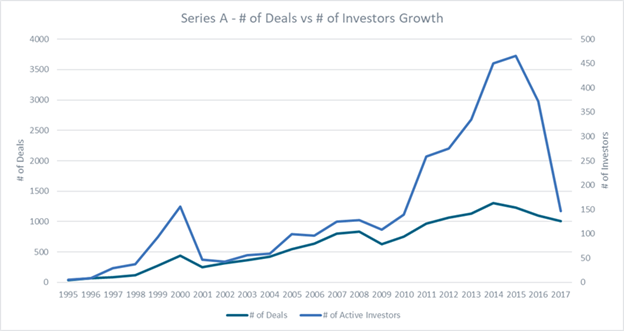

The number of investors have outpaced the number of deals done at the A-level for over a decade.

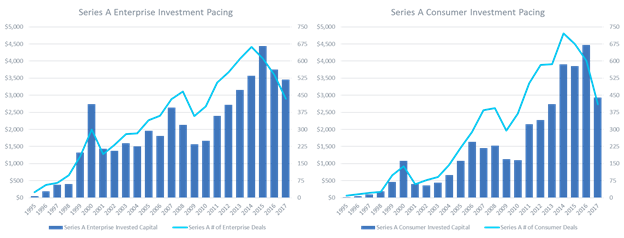

With enterprise and consumer investments currently of relatively equal interest to Series A investors.

Not surprisingly, with all this money and attention around Series A, valuations have grown over the last decade and now exceed Dotcom era levels.

The question we naturally asked ourselves next, was given the persistent increase in Series A valuations over the last seven years, is Series A still a compelling place to invest?

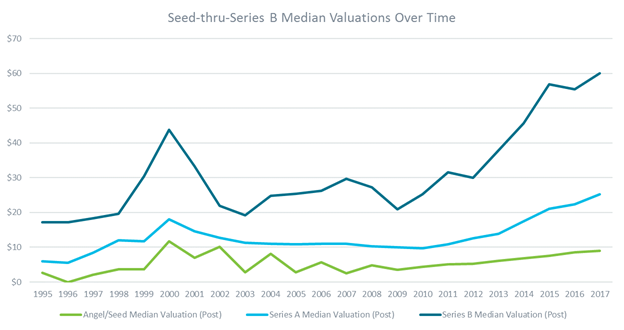

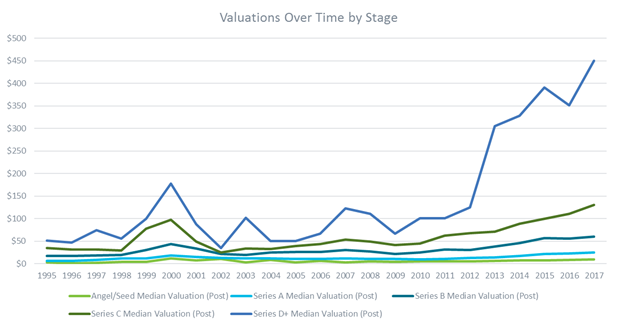

To answer this question, we looked deeper into the data and found that while Series A is a competitive and crowded space with heated valuations, the valuation jump post-A is still far greater than from seed to A. This has been true historically, hence why we made Series A an investment focus originally. And it seems that despite the run up in funds raised, all the dollars deployed into venture backed companies and companies staying private longer, it is still true. In fact, the valuation jump delta between Series A and B is still so narrow overall (see first chart below). You have to zoom in further to see what is going on (see second chart below).

In my next post, I’ll share what we saw when we looked deeper into the role of Series A in the funding stack.

Author’s note: Special thanks to Eugene Chou, Stefanie Gordish and Laura Odujinrin for their help with this post.