Not surprisingly, horizontal SaaS has long been one of the most attractive areas for software investors. Applications that solved for industry-agnostic problems promised larger TAMs and the potential to evolve into true platforms (e.g., Salesforce for CRM, Coupa for procurement, Bill.com for accounts payable). While there are incredible horizontal platforms yet to be built, we are increasingly bullish on vertical solutions. Multiple converging dynamics have informed our conviction that Vertical AI is the New Horizontal.

The rise of AI in vertical SaaS

We don’t need to tell you that AI is what most people are talking about these days. As we consider where to invest, we’re having debates internally and with founders about how companies build moats and defensibility when many are using the same underlying foundation models.

Ultimately, we think defensibility comes from having access to proprietary data sets that aren’t easily replicable. It also comes from deep context and domain-specific understanding, both at the model level (i.e., a model tuned for specific use cases) and at the company level (i.e., a leadership team with a strong understanding of the customer).

Vertical software shines across these two dimensions. The best vertical solutions are often deeply embedded in the end-user workflow, allowing vendors to collect industry data not easily found elsewhere. This data, in turn, allows vendors to fine-tune models, which improves the usefulness of the algorithms. Law and healthcare are two examples of fields in which disruptors leverage “hard-to-reach” data sources, such as information on legal settlements or medical claims to build AI-enabled products that drive tangible value for customers.

Vertical SaaS vs horizontal SaaS: Focusing on underserved industries with high-potential

Horizontal SaaS startups face an arduous path, competing against both legacy solutions and disruptors. We are now in a world in which many horizontal SaaS startups represent Gen-3 or Gen-4 solutions. Despite horizontal solutions often benefitting from the ability to target a defined budget line item or category, it can be difficult to replace Gen-2 or Gen-3 software incumbents that buyers view as “good enough.”

But in the land of vertical SaaS, the grass looks greener. Many core workflows remain manual and/or leverage on-prem infrastructure. Given historical interest in horizontal solutions, vertical software companies have seen relatively less investment. As a result, vertical players generally face less competition as they seek to displace legacy solutions.

While certain verticals may be earlier in the technology adoption curve, we are at a Goldilocks moment in terms of established playbooks and talent diffusion. Early success stories in more mature verticals have reached enough scale to spawn their own “mafias,” which start new companies that solve for adjacent problems. By our count, alums from project44 (a Sapphire portfolio company) have created at least 10 companies across the supply chain space. Other companies, such as Veeva, Shopify, nCino, Procore and ServiceTitan, offer playbooks for both employees and investors on building enduring vertical SaaS companies. One of the key lessons from these companies is that TAMs often end up being larger than people initially realize. In the life sciences, for example, we are seeing the emergence of large companies, including Apprentice, Benchling, BenchSci, Causaly, Medable (a Sapphire portfolio company), Reify Health and TetraScience.

Simply put, we believe we are in the early innings of a Cambrian explosion of vertical SaaS talent that understands their relevant space, as well as the ins and outs of building a startup. When these entrepreneurs pair up with investors who understand vertical SaaS playbooks, the entire ecosystem can grow and mature even more quickly.

Finally, and while this has been a popular topic over the years, it is important to note we think vertical software uniquely benefits from the wave of embedded fintech applications. When paired together, vertical software can solve mission-critical, vertical-specific workflows that drive customer stickiness, while embedded fintech solutions can become revenue accelerators using adjacent transaction flows.

Rewarding durable and efficient growth

The combination of durable and efficient growth is another core advantage of many vertical software business models and companies. Given the relative lack of competition and a capital environment that didn’t invest hand over fist in these spaces, vertical SaaS companies tend to experience consistent growth coupled with solid efficiency. Other factors driving these outcomes in the vertical software market include deep feature sets and unfair distribution advantages, given tighter networks and word-of-mouth referral loops.

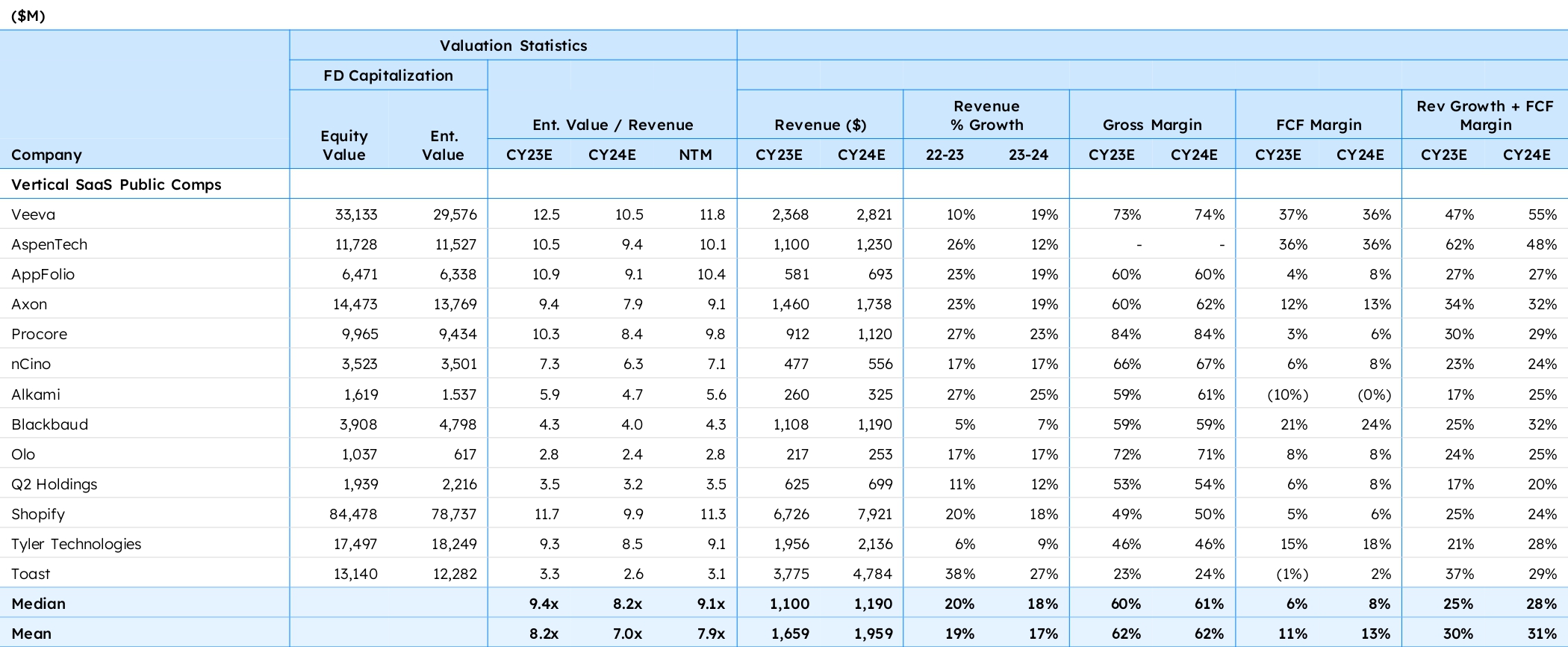

We can look to the public markets to validate this. Of the 13 public vertical SaaS companies that we track most closely at Sapphire, the median NTM multiple is ~9x (as of July 12) as described below. Compare that to our overall public SaaS applications comp set (~40 companies), where the median NTM multiple is ~5x. These 13 vertical companies are, on average, growing ~20% YoY, and 11 of them are FCF positive. On the Rule of 40, the vertical companies are at ~25%, in line with broader application software.