#OpenLP is doing a mini-takeover of Notation’s Origins podcast. Listen to episode one featuring Notation, and episode two featuring Kim Lew of the Columbia University endowment.

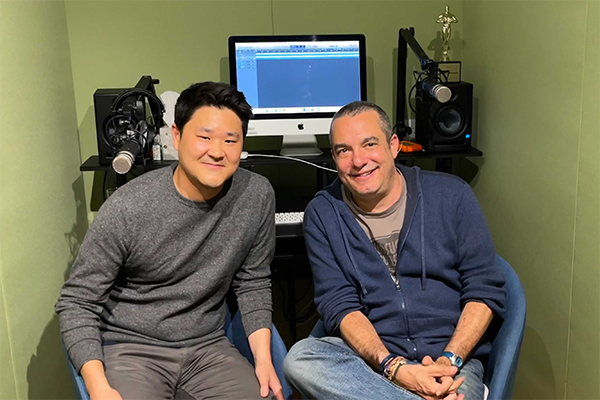

In this episode of the #OpenLP podcast miniseries, Sapphire Partners’ Thomas Moon chats with Saul Klein, Partner and Co-founder of LocalGlobe and Latitude. LocalGlobe is the preeminent seed fund based in London, and Latitude is LocalGlobe’s sister fund that invests in breakout companies at the series B. Saul also co-founded SeedCamp, and was formerly a general partner at Index for eight years. He has had significant operational experience, having been part of the original executive team at Skype, and co-founded LoveFilm, which ultimately sold to Amazon.

Saul has been, and continues to be, an early champion of the European tech ecosystem.

During the conversation, Thomas and Saul touch on the following topics:

- What Saul had to “unlearn” as he transitioned from operator to investor

- European venture then vs now. If you think it was always like today – think again!

- The people side of venture – How Saul thinks about developing and training VCs

- The philosophy behind how LocalGlobe structures carry and donates profits

- The potential for European venture moving forward