2018 was a strange year. The Red Sox won the World Series again, Kanye West and Donald Trump held a policy summit at the White House, and global stock markets rallied and fell multiple times without clear catalysts. But perhaps the oddest thing that happened in the markets was something that hasn’t happened in nearly 50 years: investments in S&P 500 stocks and bonds both lost money. (i)

Stocks and bonds haven’t declined in the same calendar year since 1969 when the S&P 500 fell 8.5% and 10 Yr. Treasury fell 5.0%. (i) In 2018, the S&P 500 finished the year off 5.2% and S&P 500 bonds fell 3.3%, upending traditional diversification strategies designed to hedge losses in the market. (ii)

Conventional wisdom is that stocks and bonds are supposed to move in opposite directions. Interest rates generally rise when the economy heats up, and when rates go up, bond prices go down. Thus, rising interest rates are usually a sign that the economy is in good shape and getting better. Not so in today’s market. The Fed has been playing catch-up after years of near-zero interest rates and savvy equity investors see an earnings plateau in 2019, with a nearly decade long bull run losing steam and a trade war brewing.

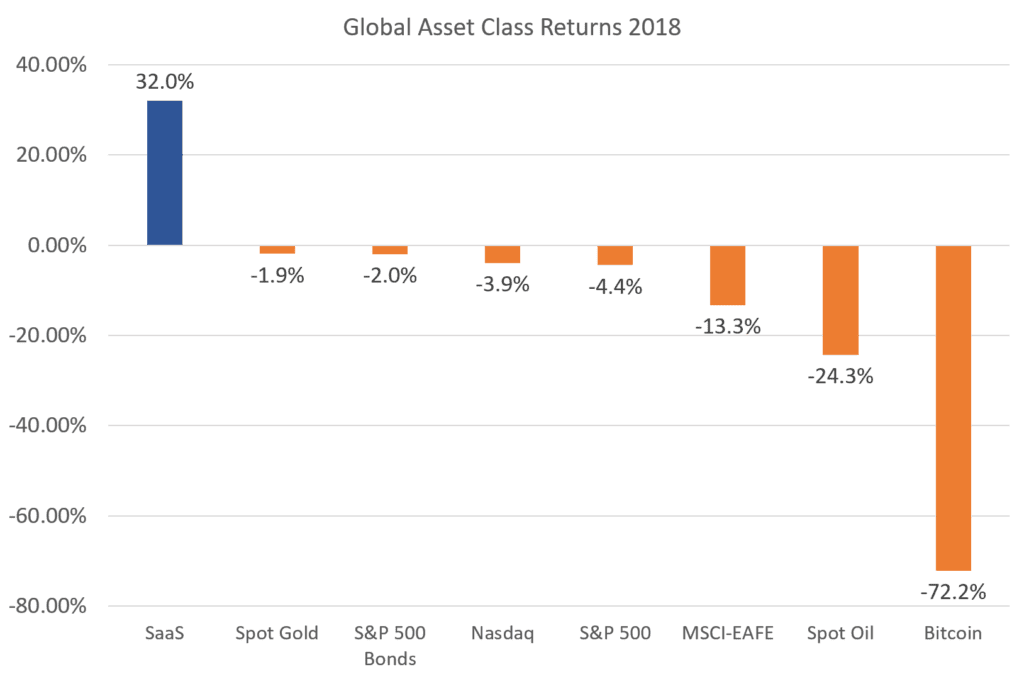

So, what’s an investor to do? Well, it’s a global economy so it makes sense to look outside the U.S., right? No, the MSCI developed country index was off 13.4% in 2018 and the emerging markets index finished the year down 14.5%. Surely commodities were a safe bet. Think again. Oil was off 24.3% and even old faithful gold was down 1.9% in 2018. It’s Silicon Valley, so why not stash your cash in crypto? Nope, Bitcoin finished the year down 72.2%. (ii)

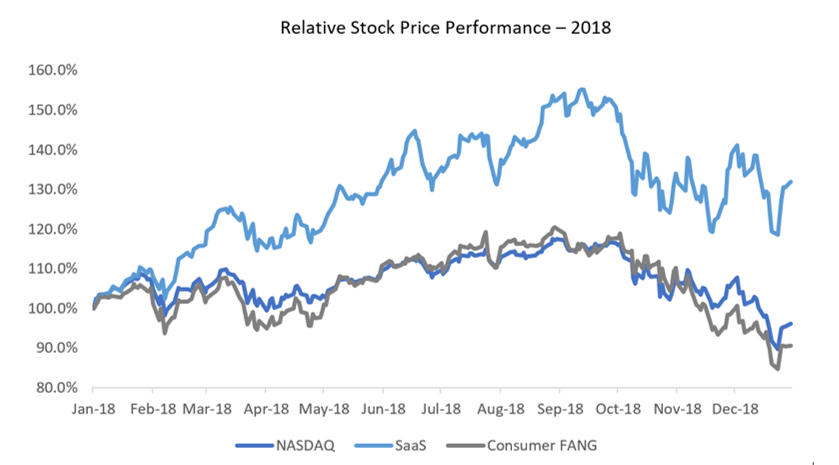

Here at Sapphire Ventures, where we’ve spent over a decade investing in what Gartner calls the Great Cloud Migration, we were not surprised to see one uncorrelated asset in 2018 turned out to be SaaS stocks, which were up 32% on the year, according to our internal estimates. (iii) Not tech stocks, but SaaS stocks. The tech-heavy Nasdaq index was down 3.8% in 2018, and the Consumer FANG group (Facebook, Apple, Netflix, Google) was down even more. A dollar invested in the Consumer FANG index left you with just 91 cents by year-end. (ii)

Source: (ii) CapIQ, WSJ.

All composite indices are indexed to 100% on the first trading day of 2018.

(1) SaaS index based on KeyBanc SaaS comps.

(2) Consumer FANG = Facebook, Apple, Netflix, Google

So why were SaaS stocks sparred the rout that overtook the markets in 2018? It is our opinion, despite the global macro uncertainty and the supposed end to the secular bull run, mainstream cloud adoption continued unabated, and in fact, even picked up momentum. Put simply, SaaS stocks just grew right through all the volatility in 2018. The potential slowdown in consumer spending which seemingly impacted the Consumer FANG stocks couldn’t slow the growth in cloud computing, as the cost benefits and potential revenue enhancements to enterprises from a move to the cloud have become too clear: more flexibility, scalability, innovation, and cost-effectiveness, all at the same time.

In fact, we believe that we have reached a tipping point, where the inevitability of a dominant cloud computing paradigm has reached the mainstream enterprise. According to Gartner, most organizations (~70%) now use cloud services in a meaningful way, and of the enterprises that use cloud services, >75% now adopt a cloud-first strategy. More than 20% of total IT budgets are now focused on the cloud, with that number expected to grow at more than 20% annually through 2022. Gartner projects the growth of the cloud services industry at nearly three times the growth of the overall IT services industry through 2022, with SaaS software growing at over 17+% annually (versus non-cloud software at just 3%). (iv)

So, after the estimated 32% appreciation in 2018, are SaaS companies still a good investment? Here at Sapphire Ventures, we think the snowball is just beginning to roll downhill. In 2019, over 30% of new enterprise software investments will shift from cloud-first to cloud-only, also according to Gartner. (iv) Over the next few years, as enterprises face spending triggers based on legacy IT asset obsolescence, we believe it’s clear that the shift to a cloud computing paradigm will continue its steady march forward.

After peaking at ~9x 2019 revenue multiples in late summer 2018, a basket of public SaaS stocks today trades at a median multiple of just ~6.5-7.0x 2019 projected revenues. Certainly not cheap by broad market standards, but SaaS stocks haven’t been cheaper since 2016 when they traded at ~5.5x forward revenues on average. Every other year since 2012 SaaS stocks have traded on par or higher, most typically in the 7x to 8.5x range. (iii)

With the group growing at a median of >20% and some of the best companies growing at >30% annually (iii), we feel SaaS stocks have a lot going for them. Salesforce (CRM) has grown to become a $100+ billion market cap company and we think plenty of other enterprise application software segments will continue to follow, including collaboration, business analytics, and office suites. We’ve been able to invest in a number of these SaaS companies who have already gone public, including Alteryx (AYX), Box (BOX), DocuSign (DOCU), and Five9 (FIVN).

And with over $100 billion invested by venture capital firms in 2018 and over $50 billion raised by VC funds last year, according to PitchBook/NVCA(v), there’s plenty of support for the Great Cloud Migration in the private markets as well. That’s why Sapphire Ventures continued to invest heavily in the cloud economy in 2018 – in horizontal SaaS companies such as Alation, DataRobot, Outreach, Pendo, and ThoughtSpot, in vertical SaaS companies such as project44 and Reonomy, and in DevOps and cloud infrastructure companies such as Auth0, Contentful, InfluxData, and Matillion. For a list of all of Sapphire Ventures venture investments, click here

So as John Neff, the legendary Vanguard Funds investor said, “Obsession with broad diversification is the sure road to mediocrity.” We agree. In 2019, we intend to invest in the next generation of SaaS leaders and cloud innovators.