The way we work has fundamentally changed. A company’s success used to rest on its full-time, in-house workforce — yet today, the most productive organizations are figuring out ways to balance salaried employees with an extended group of freelancers, consultants, and part-time workers. If done right, this approach provides greater access to talent, reduces costs, and creates a more supportive organization. If botched, it can bring chaos, new expenses, and leave non-traditional employees feeling siloed and ignored.

According to recent data from Upwork and the Freelancers Union, freelance, gig, and contract workers now make up more than one-third of the global workforce. Nearly 40 percent of workers below the age of 35 take on contract work in addition to full-time employment. Because of this, companies are scrambling to re-imagine their employees as fluid and adaptable — and struggling to create more flexible systems to hire, onboard, retain, and develop them.

Brightfield, the latest addition to the Sapphire Ventures portfolio, approaches this opportunity faster (and better) than nearly anyone. They saw massive inefficiencies with how many organizations were trying to manage their contingent workforce — including misaligned vendor relationships, a lack of visibility into procurement spend, misclassified SOWs, and broken integrations.

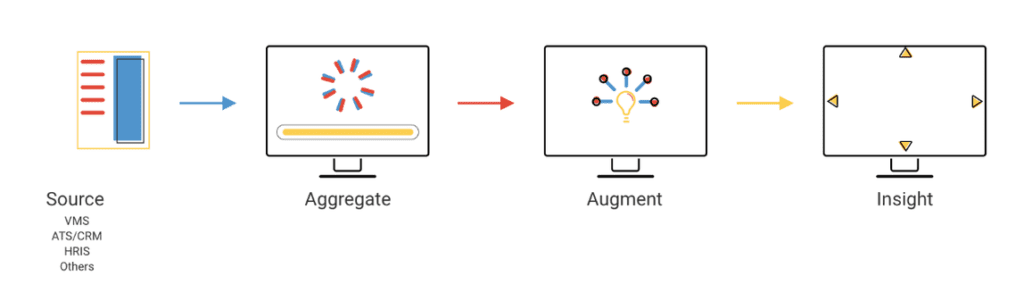

To fix this, the team developed a powerful analytics platform that sits on top of and optimizes a company’s existing HR and vendor management systems. Brightfield harnesses practical applications of AI and Natural Language Processing (NLP) to parse information — including job applications, service agreements, CRM data, and program KPIs — and unearth new insights to help their customers reduce risks, cut costs, and boost productivity across the board.

What’s more, Brightfield offers customers access to their Talent Data Exchange (TDX)—a platform with actual vendor management transaction data from more than 300 organizations, 15 verticals, 16 job functions, and 115 countries. This hub delivers unparalleled visibility into how other teams are designing their teams — and immediately gives new customers ways to benchmark their progress.

As Brightfield grows, so too does TDX, becoming a valuable differentiator that will make it difficult for competitors to catch up.

I first learned about Brightfield through their CEO, Jesse Levin. Jesse is an industry veteran, who most recently served as General Manager and Head of Strategy & Corporate Development at CEB. During his 18-year tenure, the public company grew to ~$1B in subscription revenue and $3.5B in market cap.

During this time, Jesse wore a second hat as Head of CEB Ventures. In this role, he oversaw more than 30 acquisitions and investments (totaling nearly $1 billion in value). His broad and deep market experience — and comfort with both public and private companies — makes him an obvious fit for taking Brightfield to the next level. Some people even say companies that Jesse works for in the space have an “unfair advantage,” given his unique skill set.

What I most appreciate about Jesse, however, is that he is incredibly team-oriented. In 2011, Jesse and I co-invested in PayScale, one of Sapphire’s early investments in people-oriented technologies. I was struck by his dedication to the company, a leading database for salary data. It was clear from the start that he was passionate about bringing more transparency to the space and helping employers and employees reach fair compensation value. In 2014, PayScale was acquired by Warburg Pincus and today has more than 50 million individual salary profiles uploaded.

As an operator, Jesse naturally seeks out and partners with top talent. Brightfield’s co-founder Jason Ezratty is a leading data scientist with an excellent track record in the industry. Together, the two bring a powerful combination of intellect, industry experience, personal networks, and grit.

Jesse’s and Jason’s vision and expertise weren’t the only reasons Sapphire decided to invest. The company more than tripled their software business last year and expects to more than double it again this year. With freelance workers anticipated to comprise nearly half of the U.S. workforce by 2027 — and growth in freelancing currently outpacing employment growth in many parts of Europe, including the United Kingdom, France, and the Netherlands (according to recent data from MarketWatch) — this rare combination of such a booming company and market is a VC’s dream.

I’m thrilled to continue Sapphire’s history of investing in HR and people-oriented technologies with Brightfield. In addition to PayScale, our team has backed HR companies like LinkedIn, Jibe, AllyO, and Culture Amp. We’ve been curious about and committed to the industry for nearly a decade — and are excited to partner with Jesse, Jason, and the entire Brightfield team as they continue to shine.