In January, we published The State of the SaaS Capital Markets: A Look Back at 2023 and Look Forward to 2024, sharing our perspective on the key trends and investment activity shaping the SaaS industry. We also made 10 bold predictions for the SaaS markets in 2024. Now, with the first half of the year behind us, we are checking in to see how we are tracking.

As a reminder, we aim to distinguish ourselves in a few significant ways with this report:

- Our analysis includes proprietary definitions and perspectives on both private and public SaaS markets.

- Our predictions focus solely on the state of enterprise SaaS capital markets (vs. the broad technology landscape), including valuations, capital allocation and exits.

- Our prognostication is data-driven, based on a thorough look back at what happened in the first half of 2024 and how that compared to 2023 and the past decade.

Sign up for our newsletter

Scoring Our Top 10 Enterprise SaaS Predictions for 2024

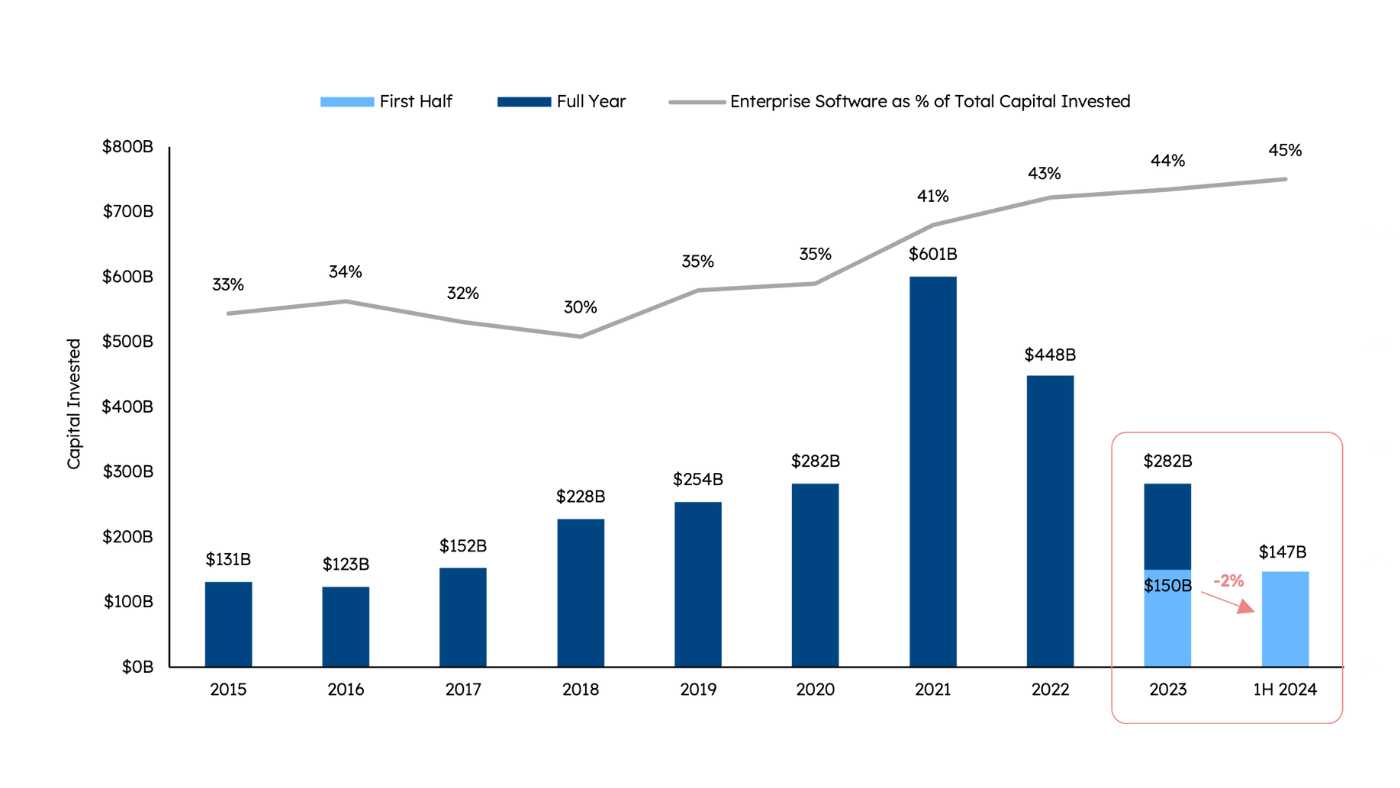

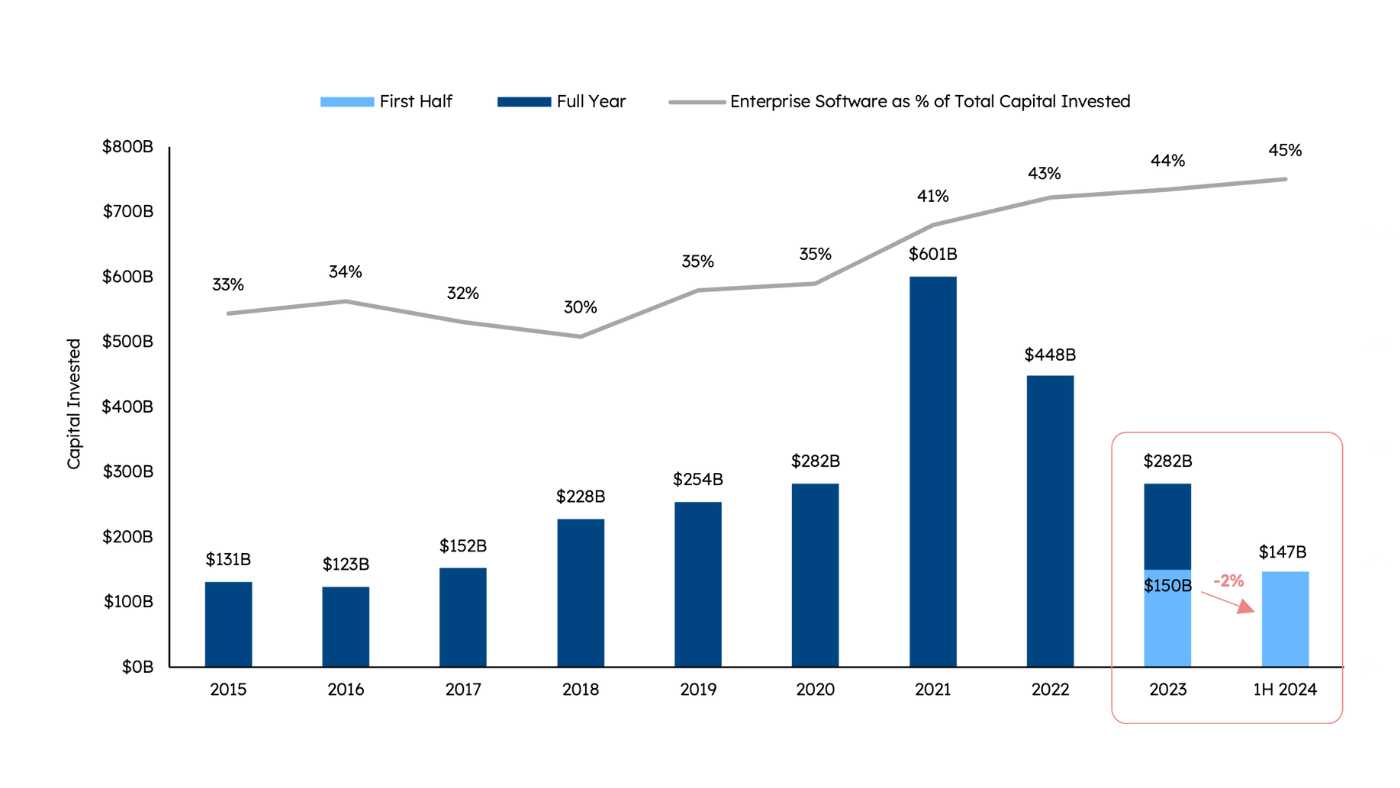

Prediction #1: VC Funding Will Grow Incrementally

Still a bit too early to tell, but we’ll give ourselves half a point on this prediction. The first half of 2024 saw $147 billion in venture capital funding invested. While this puts us on pace for 5% YoY growth, it is actually 2% lower than 1H 2023. On the plus side, while 2H 2023 experienced a meaningful slowdown, Q2 2024 showed sequential improvement for the first time since Q4 2021. To see if this prediction ultimately tips in our favor, we will continue monitoring deal activity, as well as trends in mega-round financings, which have been rising as a percentage of all activity.

Still a bit too early to tell, but we’ll give ourselves half a point on this prediction. The first half of 2024 saw $147 billion in venture capital funding invested. While this puts us on pace for 5% YoY growth, it is actually 2% lower than 1H 2023. On the plus side, while 2H 2023 experienced a meaningful slowdown, Q2 2024 showed sequential improvement for the first time since Q4 2021. To see if this prediction ultimately tips in our favor, we will continue monitoring deal activity, as well as trends in mega-round financings, which have been rising as a percentage of all activity.

Expand

Sources: Pitchbook data pulled as of Jun. 30, 2024; Sapphire Internal Analysis (Jul. 2024) Notes: Pitchbook data is updated on an on-going basis and is therefore subject to change; includes all VC activity ex-China/HK for deals w/disclosed transaction size

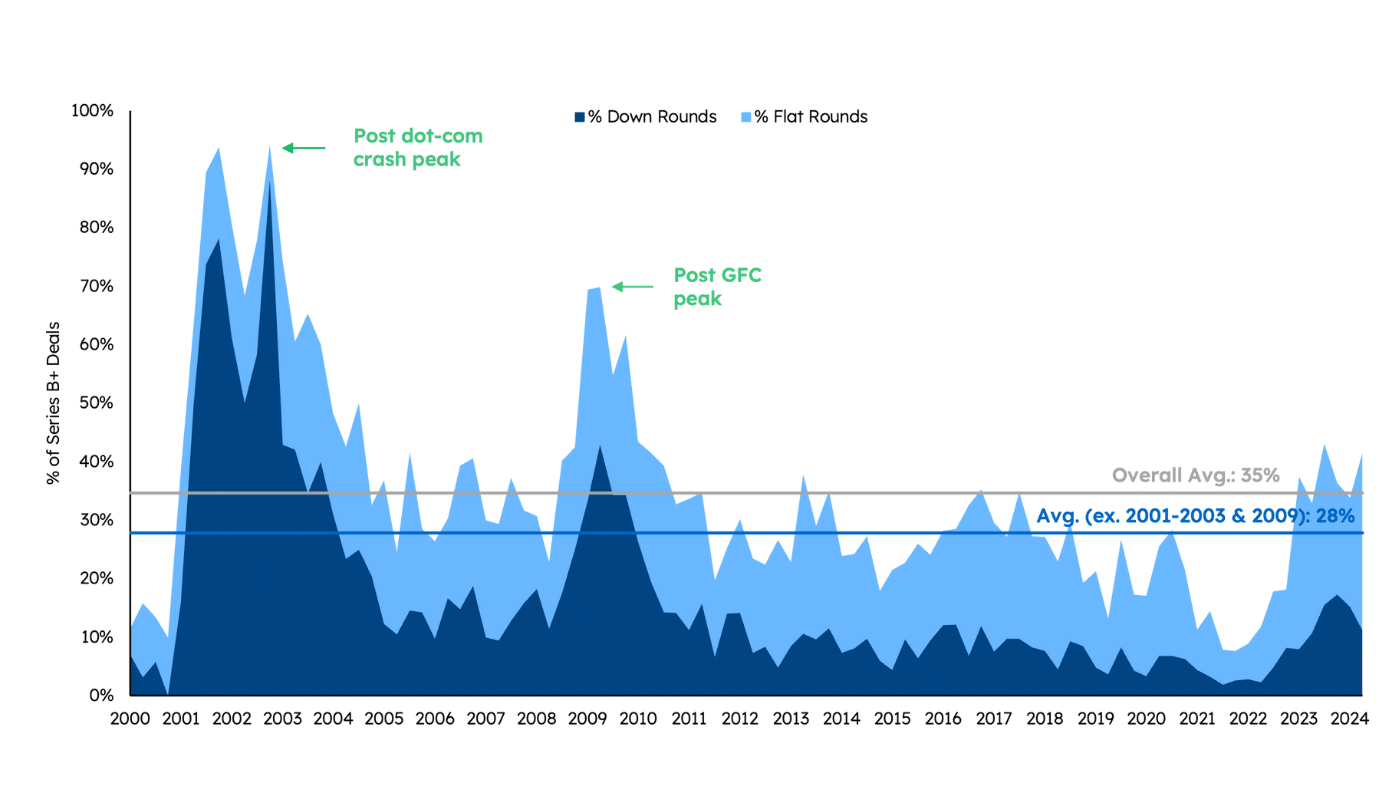

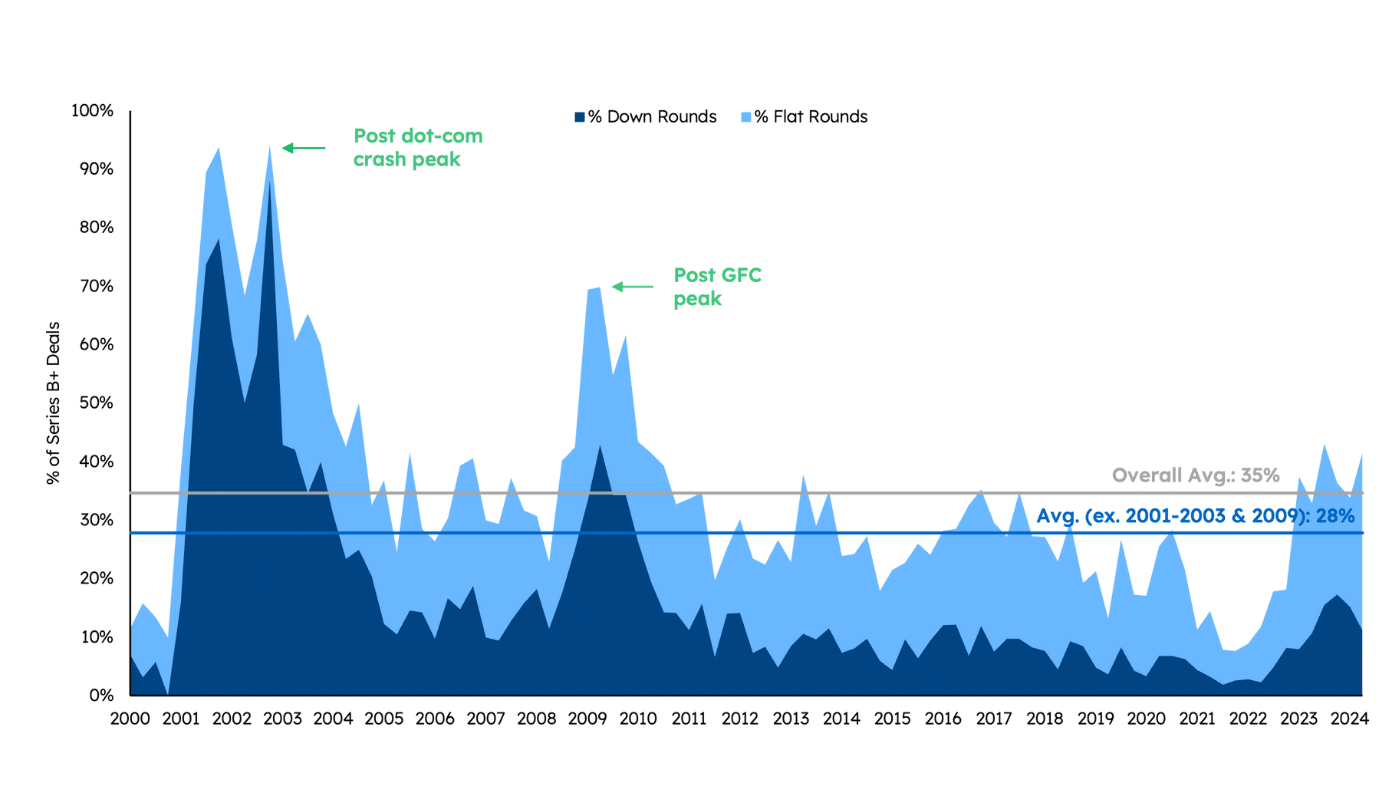

Prediction #2: Flat and Down Rounds Will Continue to Rise

Full credit for this one. Flat and down rounds increased to 41% in Q2 from 34% of all Series B+ enterprise software financings in Q1, marking the second highest level since 2010. With many secondary market transactions still trading well below their last private round valuation, we suspect that the level of flat and down rounds has room to run higher.

Full credit for this one. Flat and down rounds increased to 41% in Q2 from 34% of all Series B+ enterprise software financings in Q1, marking the second highest level since 2010. With many secondary market transactions still trading well below their last private round valuation, we suspect that the level of flat and down rounds has room to run higher.

Expand

Sources: Pitchbook data pulled as of Jun. 30, 2024; Sapphire Internal Analysis (Jul. 2024) Notes: Pitchbook data is updated on an on-going basis and is therefore subject to change; includes all enterprise software VC activity ex-China/HK for Series B+ deals w/disclosed transaction size and categorized as “down round,” “flat round,” or “up round”; definitions compare pre-$ valuation to previous round post-$ valuation; “down round” defined as 10%+ lower, “flat round” defined as +/- 10% and “up round” defined as 10%+ higher

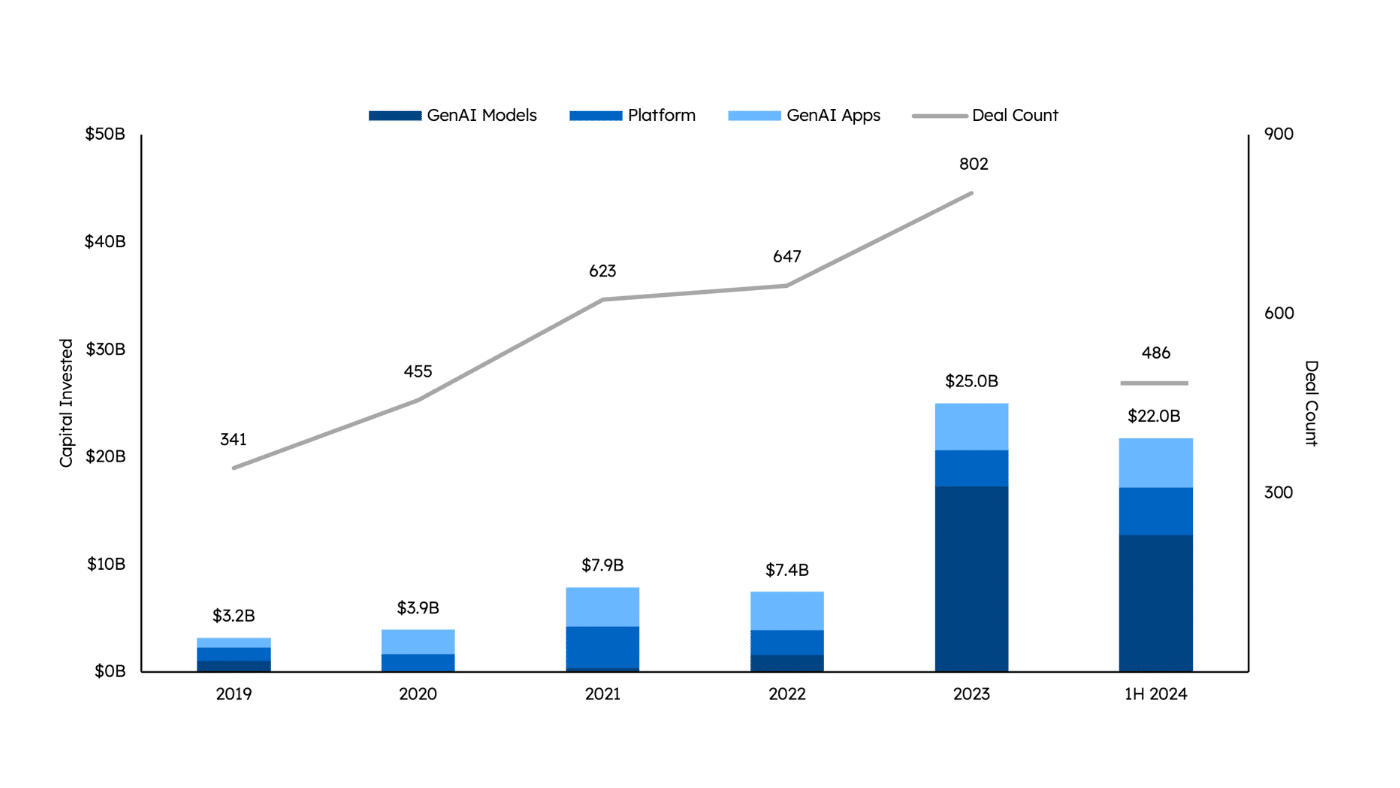

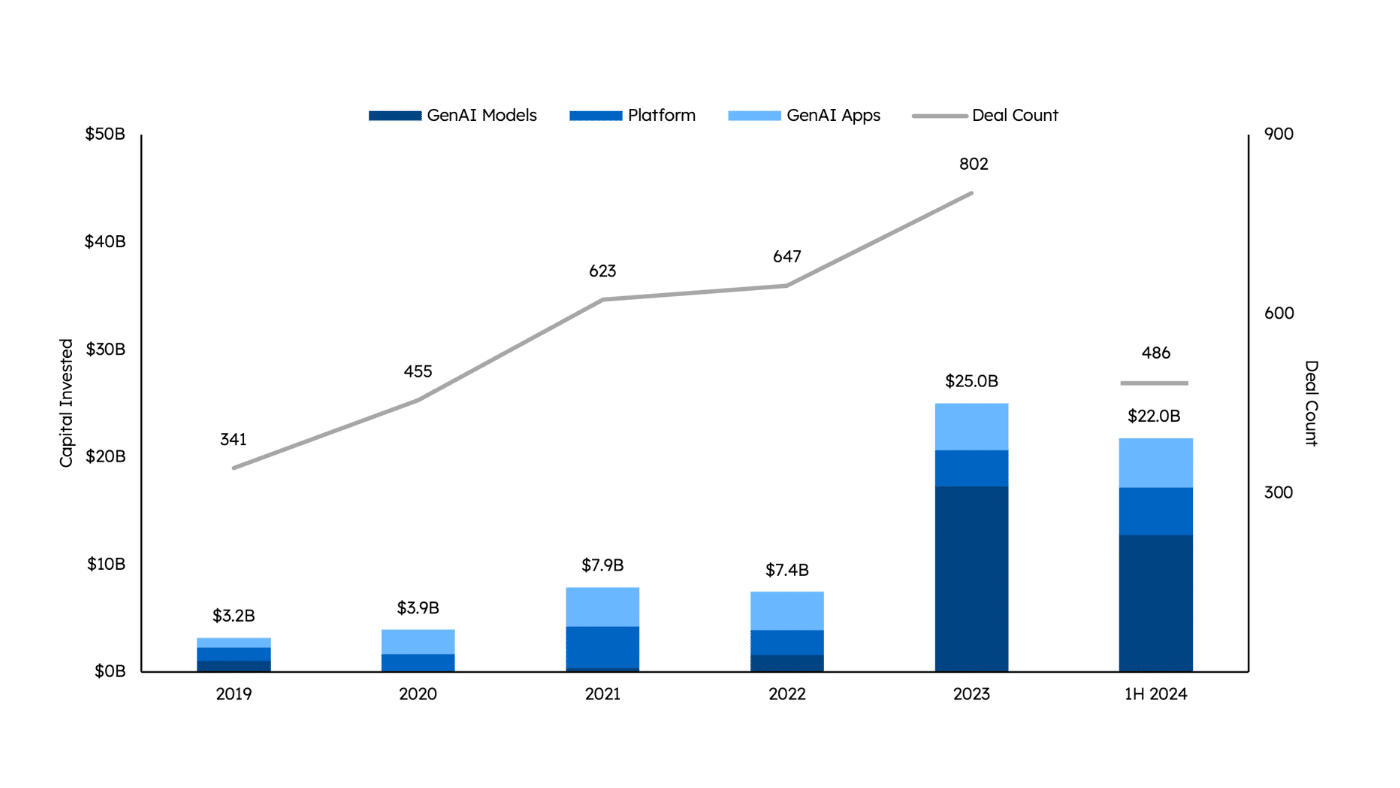

Prediction #3: Funding for GenAI Will Continue at a Strong Pace, but Investors Will be More Discerning

VC investment dollars in GenAI grew by 31% compared to 1H 23. While investors continued to pour money (and compute credits) into foundational model players, we encouragingly saw growth in both the application (+70% YoY) and platform (+256% YoY) layers. We also saw high-profile shake-ups at once red-hot companies like Inflection, Adept and Stability. These changes might signal that some company leaders and investors were unwilling to plow more time and capital into increasingly competitive categories. Additionally, there has been public debate about whether the excitement surrounding the technology and the associated infrastructure build-out is outpacing tangible business impacts. This could have a cooling effect on activity in the back half of the year. One area where we haven’t yet seen discernment is in valuations, as median early-stage valuations for GenAI companies grew from $77 million in 2023 to $119 million in 1H 24.

VC investment dollars in GenAI grew by 31% compared to 1H 23. While investors continued to pour money (and compute credits) into foundational model players, we encouragingly saw growth in both the application (+70% YoY) and platform (+256% YoY) layers. We also saw high-profile shake-ups at once red-hot companies like Inflection, Adept and Stability. These changes might signal that some company leaders and investors were unwilling to plow more time and capital into increasingly competitive categories. Additionally, there has been public debate about whether the excitement surrounding the technology and the associated infrastructure build-out is outpacing tangible business impacts. This could have a cooling effect on activity in the back half of the year. One area where we haven’t yet seen discernment is in valuations, as median early-stage valuations for GenAI companies grew from $77 million in 2023 to $119 million in 1H 24.

Expand

Sources: Pitchbook data pulled as of Jun. 30, 2024; Sapphire Internal Analysis (Jul. 2024) Notes: Pitchbook data is updated on an on-going basis and is therefore subject to change; includes all enterprise software VC activity ex-China/HK for deals w/disclosed transaction size; large discrepancy between 2023 figures and those reported in “The State of the SaaS Capital Markets Report” mainly attributable to $2.75B from Amazon’s investment in Anthropic now being recorded in 2024; Generative AI categorization and sub-categories defined by Sapphire whereby other market participants may categorize underlying companies differently

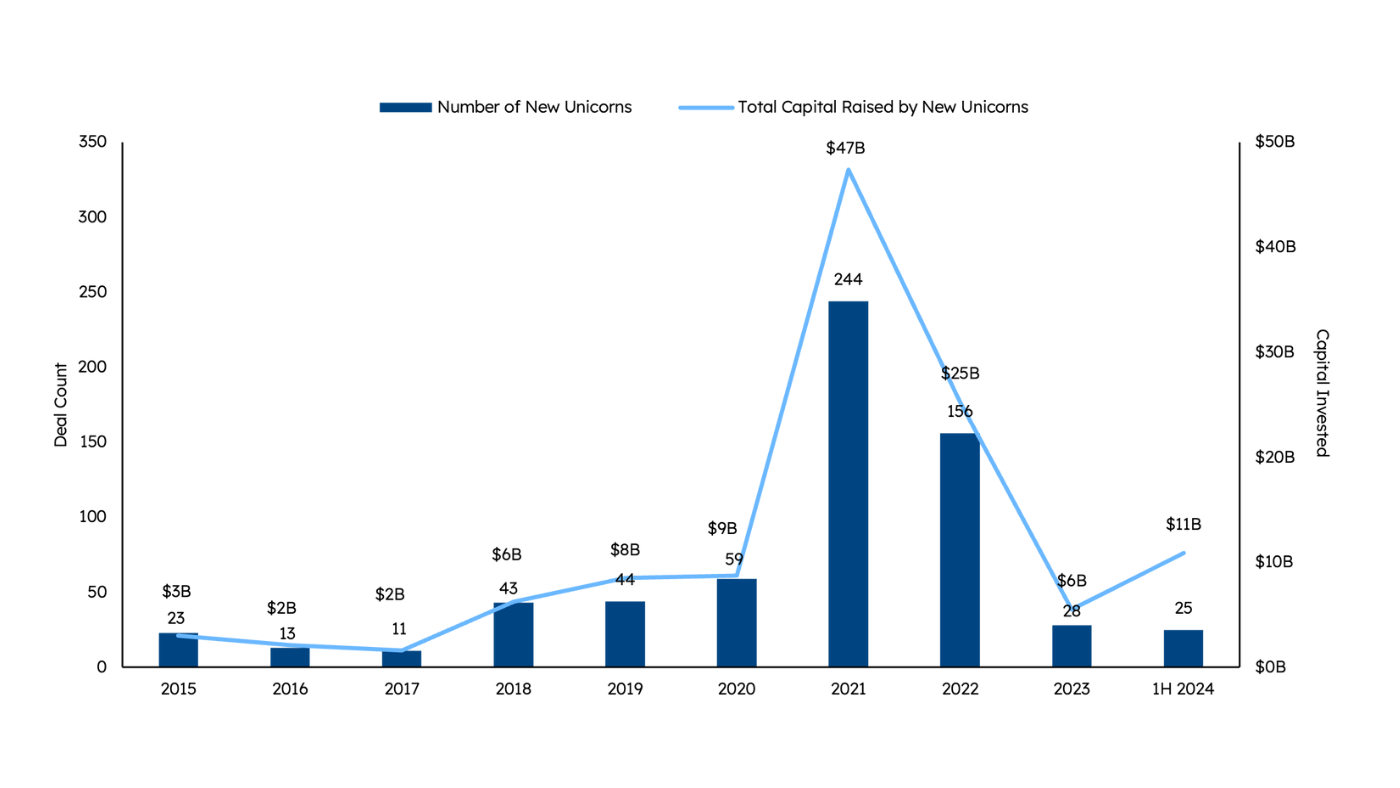

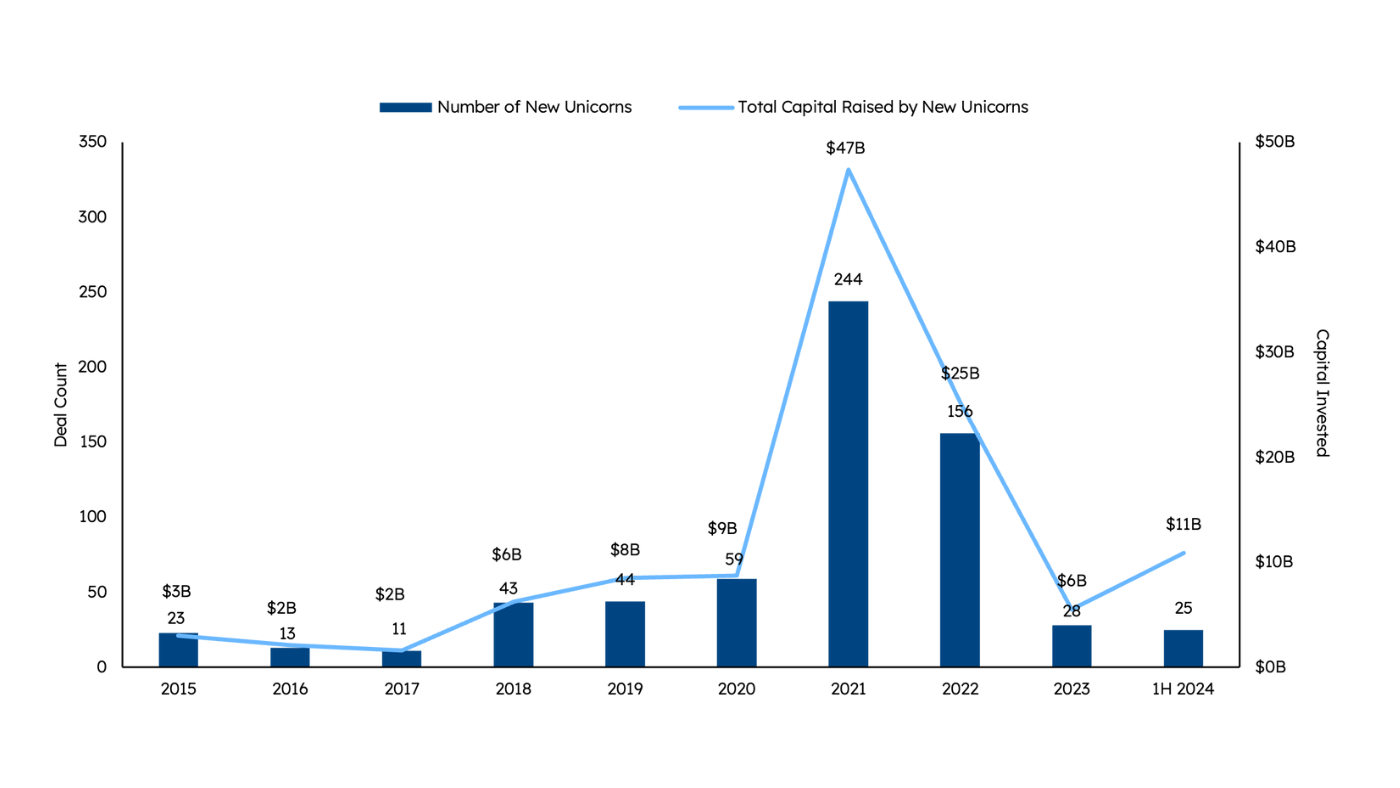

Prediction #4: We are Finally Past “Peak Unicorn”

While we saw almost as many new enterprise software unicorns created in 1H 24 (25) as we did in all of 2023 (28) – including Sapphire Ventures portfolio companies Huntress and Creatio – we are still nowhere close to the levels we saw in 2021 and 2022. We also continue to see more “fallen unicorns,” which pulls down the net creation total, including sub-$1 billion acquisitions of former unicorns Lacework ($150M), Noname Security ($450M) and Tegus ($930M).

While we saw almost as many new enterprise software unicorns created in 1H 24 (25) as we did in all of 2023 (28) – including Sapphire Ventures portfolio companies Huntress and Creatio – we are still nowhere close to the levels we saw in 2021 and 2022. We also continue to see more “fallen unicorns,” which pulls down the net creation total, including sub-$1 billion acquisitions of former unicorns Lacework ($150M), Noname Security ($450M) and Tegus ($930M).

Expand

Sources: Pitchbook data pulled as of Jun. 30, 2024; Sapphire Internal Analysis (Jul. 2024) Notes: Pitchbook data is updated on an on-going basis and is therefore subject to change; includes all enterprise software VC activity ex-China/HK for deals w/disclosed transaction size

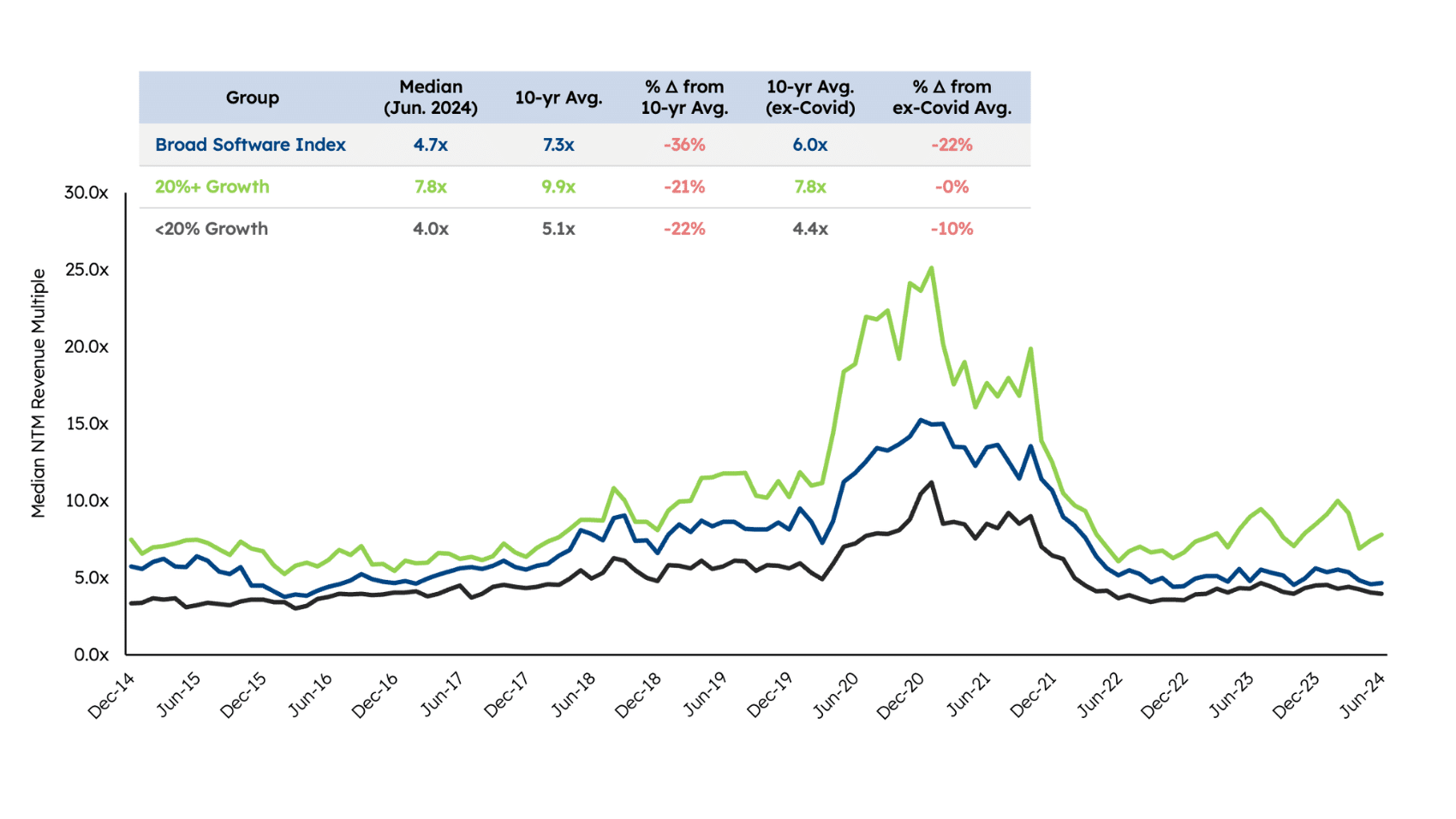

Prediction #5: Public Software Revenue Multiples Will Continue to Expand Incrementally

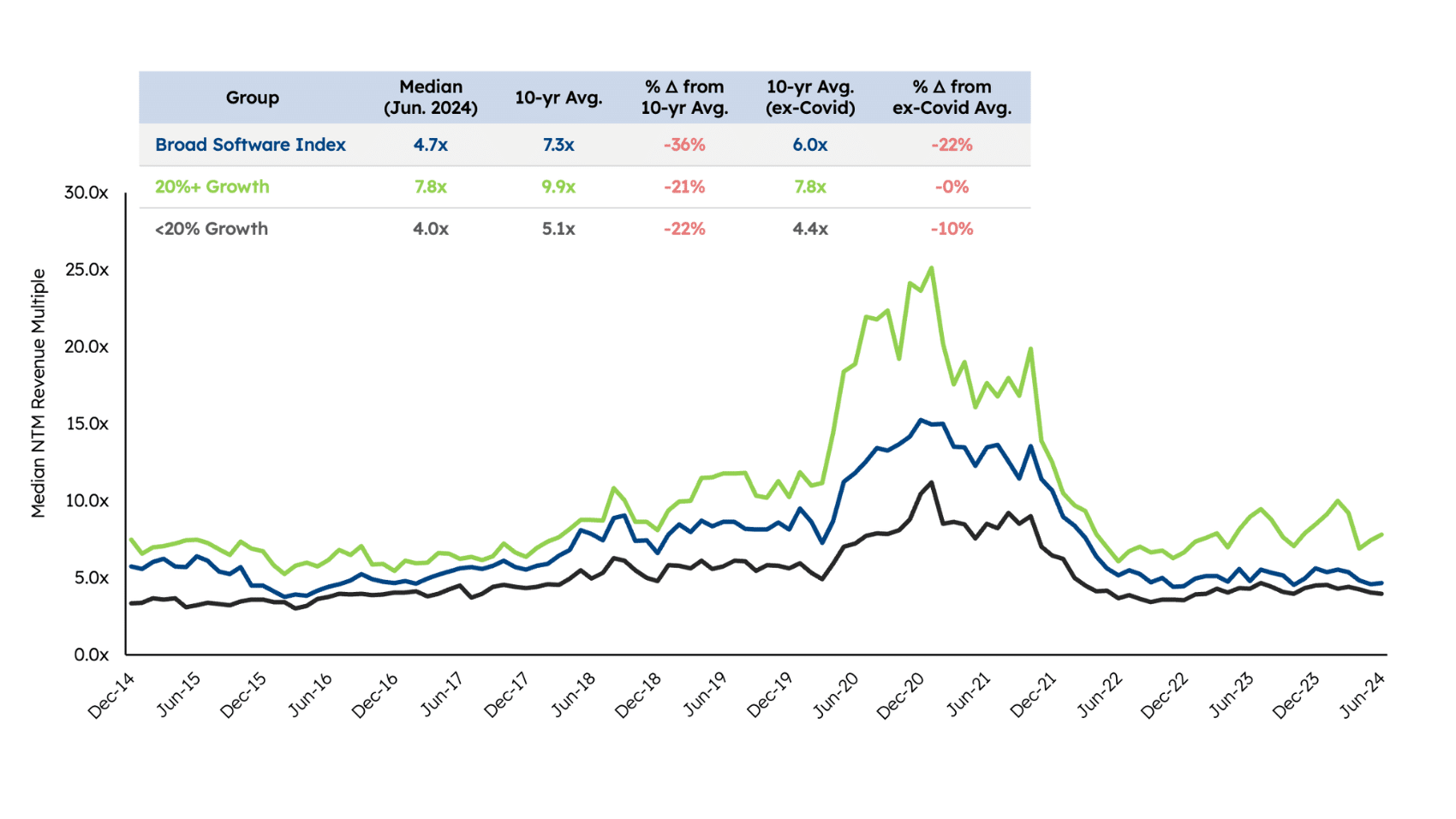

We got this one wrong. The overall median NTM revenue multiple for companies in our Sapphire Broad Software Index (133 companies) declined by nearly a full turn in 1H 24, down from 5.6x in December 2023 to 4.7x in June 2024. The impact was similar for the 31 high-growth companies (>20%), which saw median multiples fall from 8.5x to 7.8x, as well as low-growth companies (<20%), which dropped from 4.5x to 4.0x. This multiple contraction is one of the reasons that our index, which gained just 4% in 1H 24, massively underperformed the S&P 500 (+14%), the Nasdaq Composite (+18%) and the Magnificent 7 (+32%).

We got this one wrong. The overall median NTM revenue multiple for companies in our Sapphire Broad Software Index (133 companies) declined by nearly a full turn in 1H 24, down from 5.6x in December 2023 to 4.7x in June 2024. The impact was similar for the 31 high-growth companies (>20%), which saw median multiples fall from 8.5x to 7.8x, as well as low-growth companies (<20%), which dropped from 4.5x to 4.0x. This multiple contraction is one of the reasons that our index, which gained just 4% in 1H 24, massively underperformed the S&P 500 (+14%), the Nasdaq Composite (+18%) and the Magnificent 7 (+32%).

Expand

Correction: An earlier version of the report defined the low-growth category as <10% growth, the group is actually defined as <20% growth and has since been updated Sources: S&P Capital IQ data pulled as of Jun. 30, 2024; Sapphire Internal Analysis (Jul. 2024) Notes: Sapphire Broad Software Index includes 133 Sapphire-selected enterprise software companies; Covid years defined as March 2020 – March 2022; data based on mean consensus NTM revenue estimates

Prediction #6: We Will Return to a “Growth Mindset” in Software…

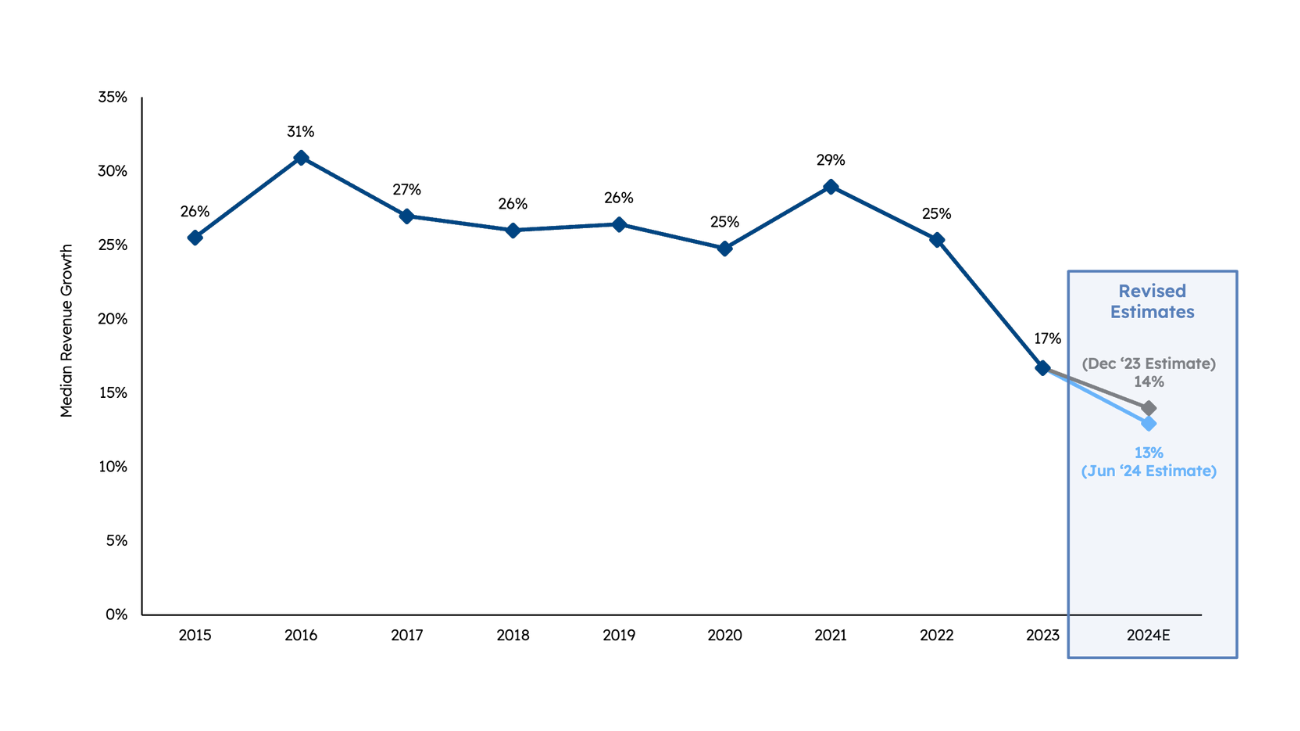

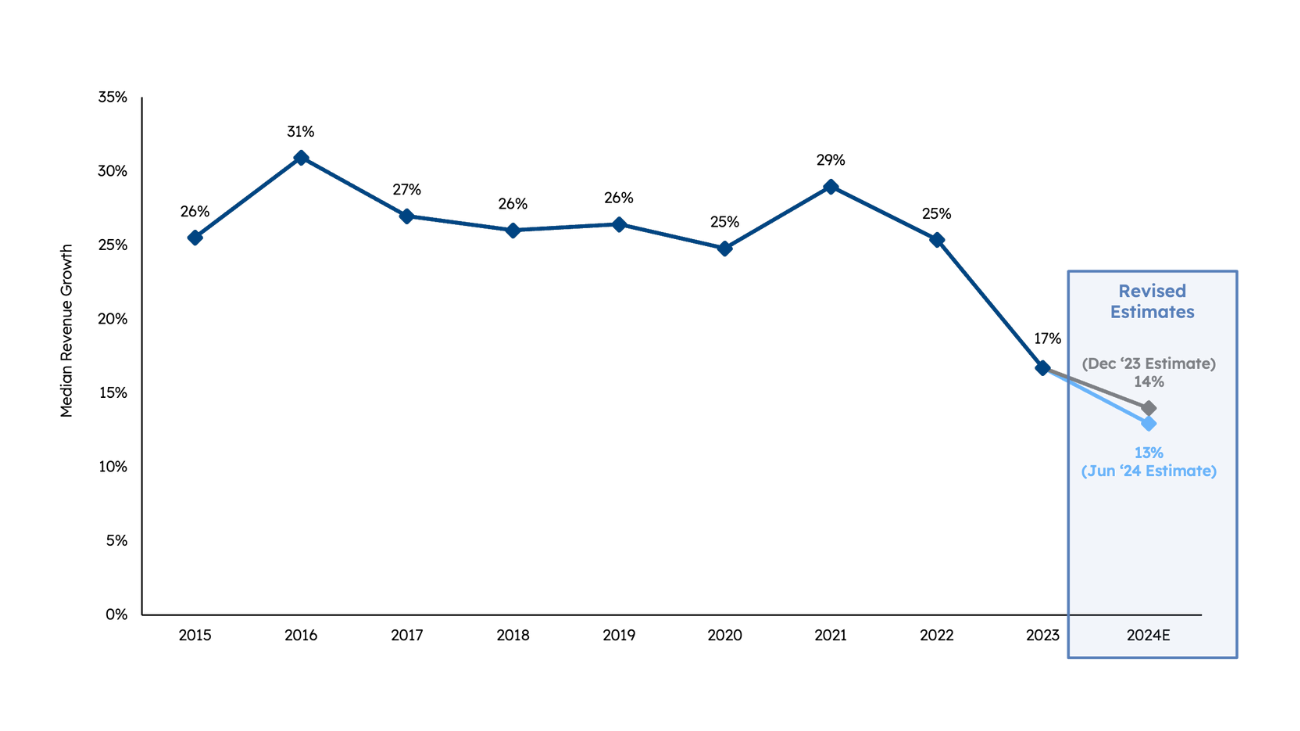

Wrong again. While we initially considered the 14% estimated growth rate for 2024 to be our “bear case,” given companies’ regular beat and raise cadence, Wall Street analysts are now projecting median 2024 software growth to be just 13%. As we discussed in our June 2024 Market Memo, software continues to be under pressure given tighter budgets, vendor consolidation, longer sales cycles and, in some cases, AI overhang as buyers are pausing to assess vendor capabilities before reasserting, or making new, long-term commitments. CIO surveys indicate mixed intentions for spending in the second half of the year. While we remain optimistic about long-term software growth, expecting a significant increase in the numbers this calendar year may be unrealistic.

Wrong again. While we initially considered the 14% estimated growth rate for 2024 to be our “bear case,” given companies’ regular beat and raise cadence, Wall Street analysts are now projecting median 2024 software growth to be just 13%. As we discussed in our June 2024 Market Memo, software continues to be under pressure given tighter budgets, vendor consolidation, longer sales cycles and, in some cases, AI overhang as buyers are pausing to assess vendor capabilities before reasserting, or making new, long-term commitments. CIO surveys indicate mixed intentions for spending in the second half of the year. While we remain optimistic about long-term software growth, expecting a significant increase in the numbers this calendar year may be unrealistic.

Expand

Sources: S&P Capital IQ data pulled as of Jun. 30, 2024; Sapphire Internal Analysis (Jul. 2024) Notes: Sapphire Broad Software Index includes 133 Sapphire-selected enterprise software companies; data based on mean consensus revenue estimates; companies are included beginning in the first full calendar year that they are publicly listed

Prediction #7: …but not “Growth at all Costs” as We Enter a Second “Year of Efficiency.”

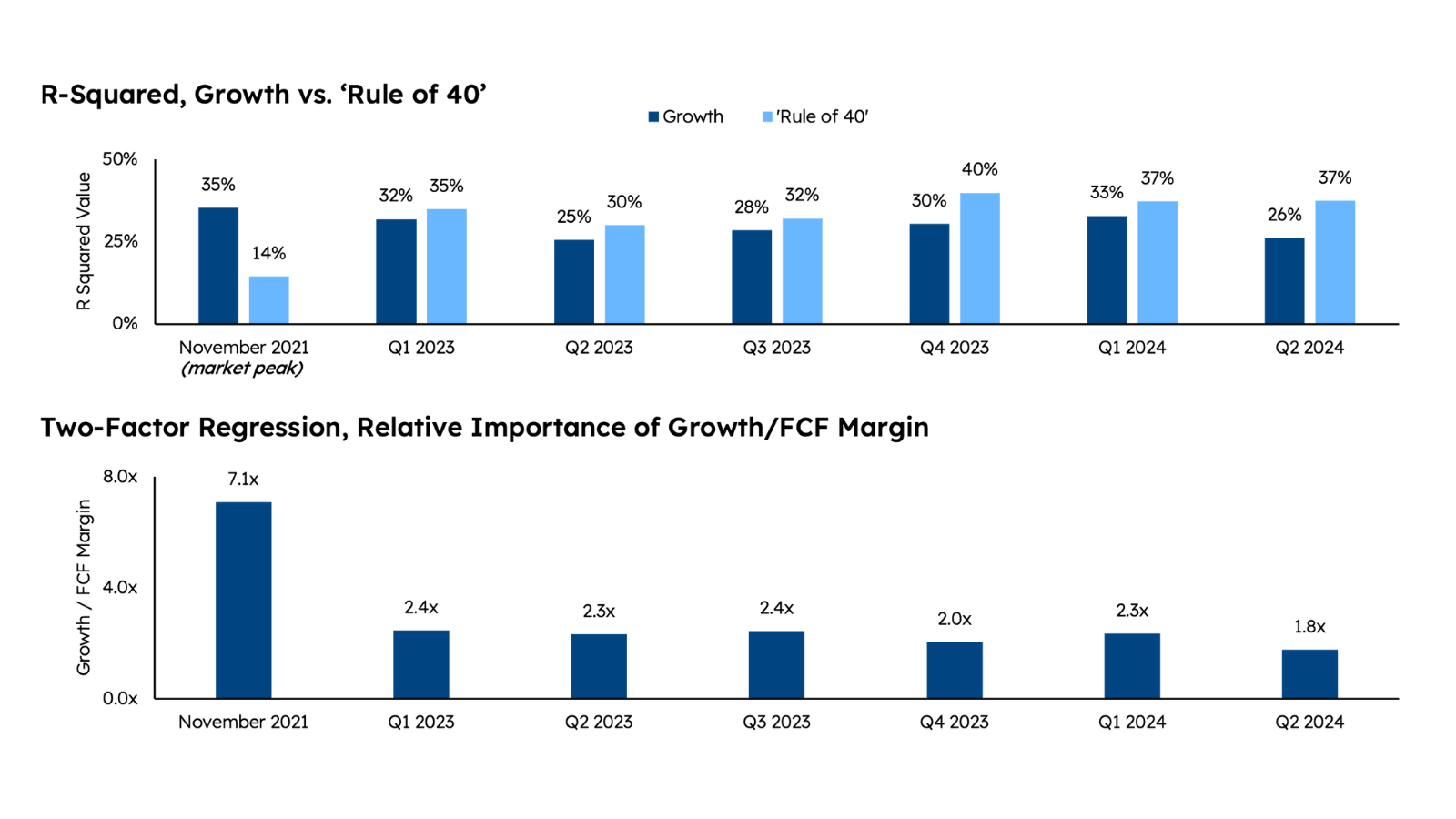

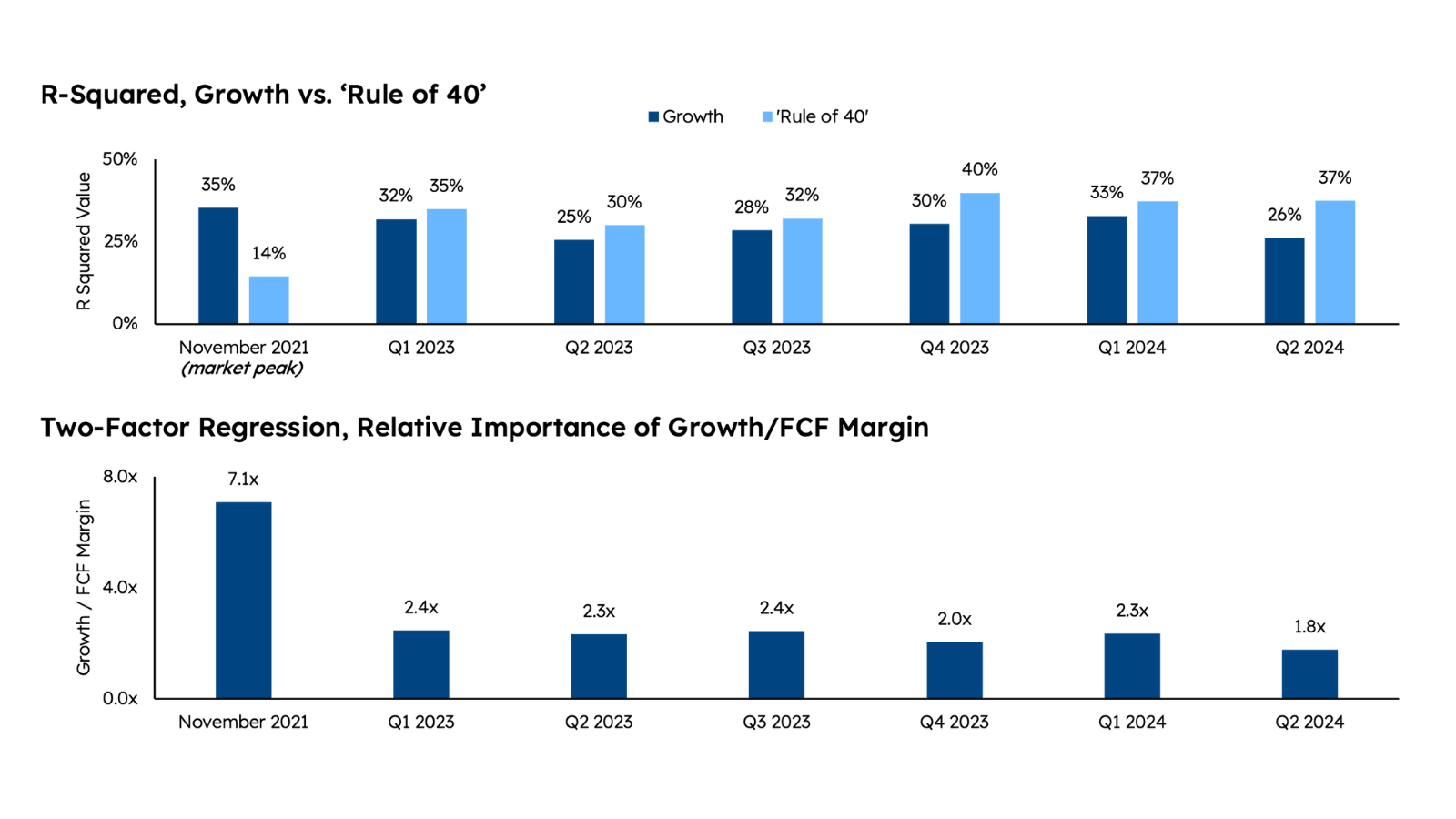

Q2 24 saw investor preference shift further toward ‘Rule of 40’ vs. pure growth, as measured by a standard R-squared analysis. Our two-factor regression showed similar results, with growth now just ~1.8x more important than FCF margin in terms of its impact on revenue multiples, compared to 2.0x – 2.5x throughout much of 2023. We expect this trend to continue until we see growth inflect higher across the sector in 2H 24 or 1H 25.

Q2 24 saw investor preference shift further toward ‘Rule of 40’ vs. pure growth, as measured by a standard R-squared analysis. Our two-factor regression showed similar results, with growth now just ~1.8x more important than FCF margin in terms of its impact on revenue multiples, compared to 2.0x – 2.5x throughout much of 2023. We expect this trend to continue until we see growth inflect higher across the sector in 2H 24 or 1H 25.

Expand

Sources: S&P Capital IQ data pulled as of Jun. 30, 2024; Sapphire Internal Analysis (Jul. 2024) Notes: Sapphire Broad Software Index includes 133 Sapphire-selected enterprise software companies; data based on mean consensus NTM estimates; regression and r-squared analyses exclude outliers

Prediction #8: In M&A, Deal Volume Will Pick Up with Small-to-Medium Sized Deals in the Starring Role…

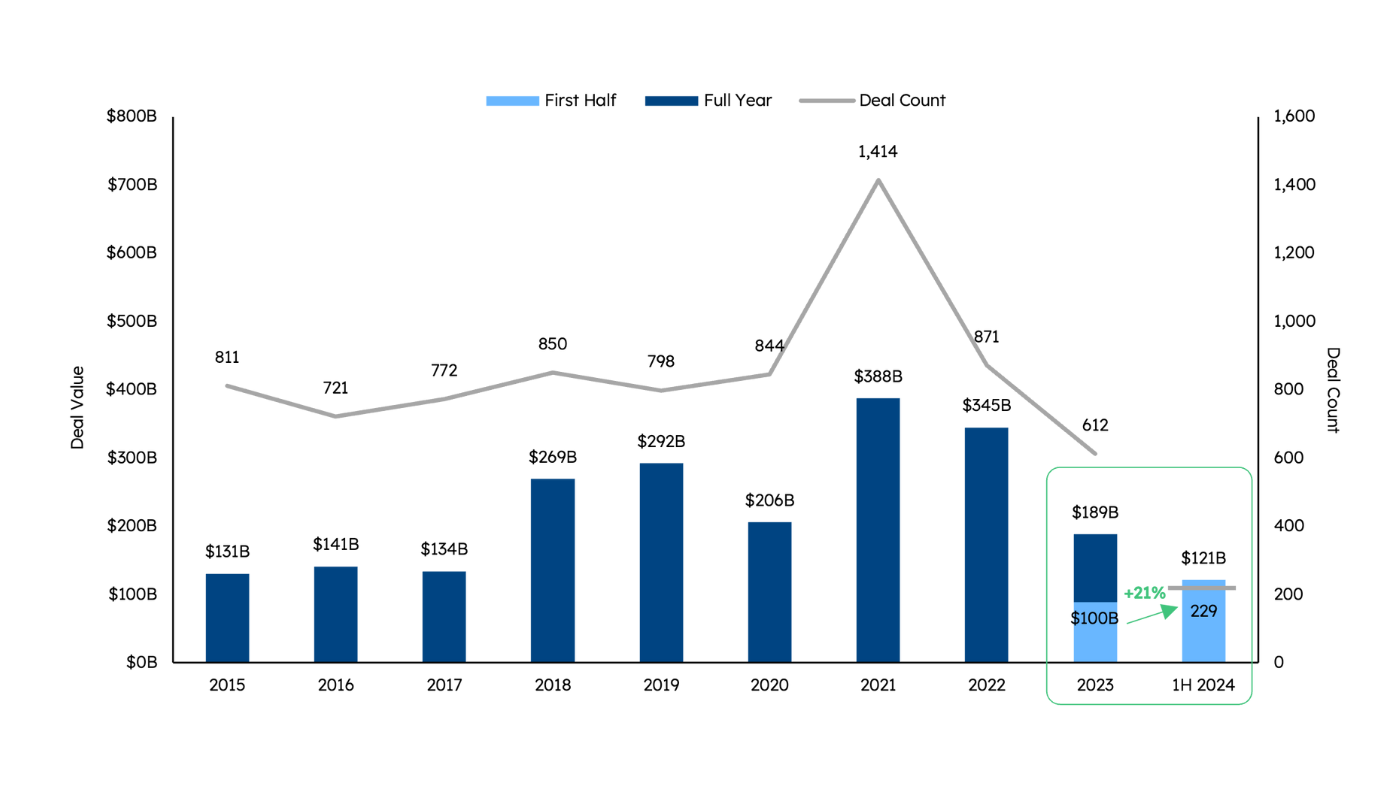

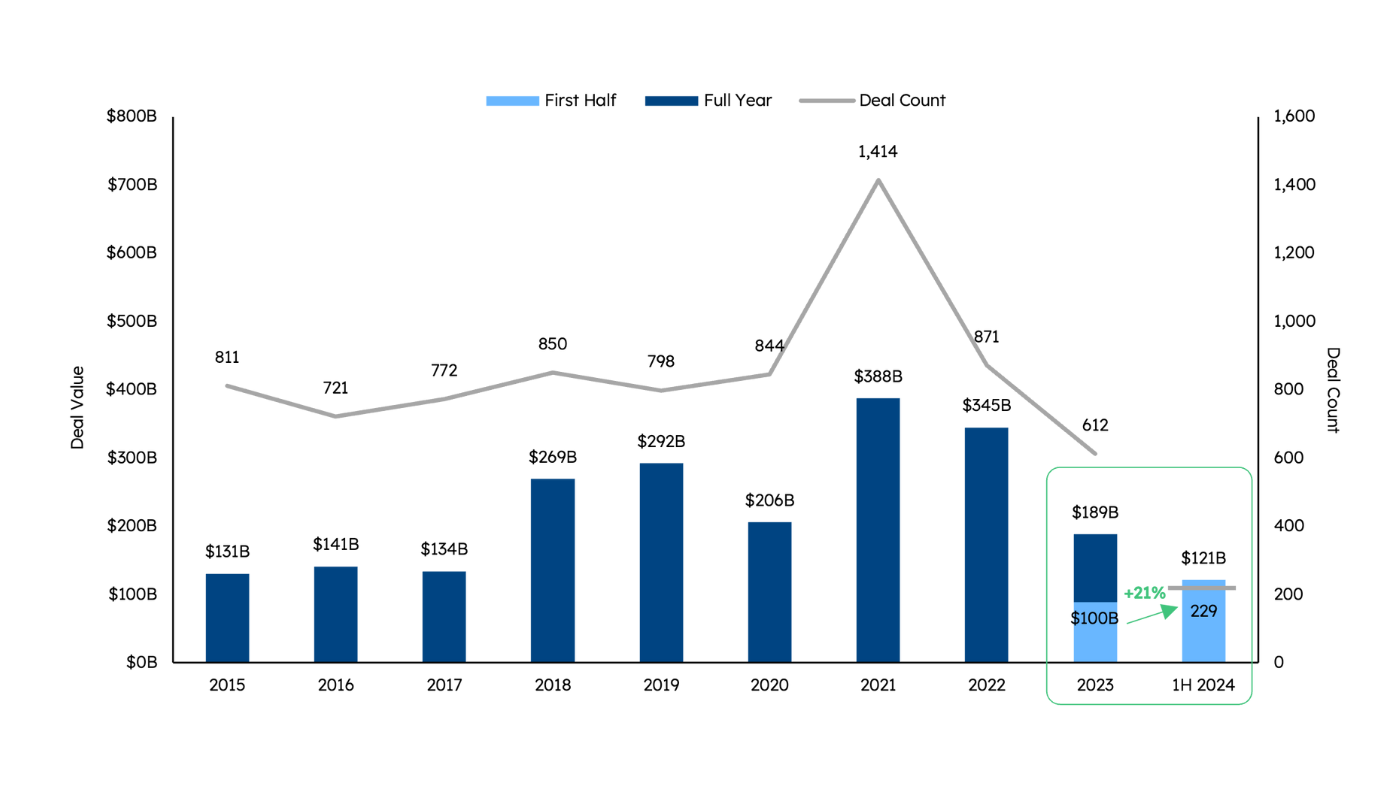

Mostly correct. The first half of 2024 saw $121 billion of announced enterprise software M&A transactions (+21% YoY in dollar terms), including the $35 billion bid by Synopsys for Ansys and IBM’s ~$6 billion deal for HashiCorp. It was not all big deals though. Consistent with our prediction, we saw 219 deals (96% of all deals) totaling $40 billion (33% of total capital) announced at prices under $3 billion. Notably, despite the overall pick-up in activity, the hyperscalers, either for lack of interest or lack of regulatory permission, continue to remain on the sidelines (though Google reportedly flirted with both HubSpot and Wiz). We expect deal activity to maintain strong momentum in the second half of the year.

Mostly correct. The first half of 2024 saw $121 billion of announced enterprise software M&A transactions (+21% YoY in dollar terms), including the $35 billion bid by Synopsys for Ansys and IBM’s ~$6 billion deal for HashiCorp. It was not all big deals though. Consistent with our prediction, we saw 219 deals (96% of all deals) totaling $40 billion (33% of total capital) announced at prices under $3 billion. Notably, despite the overall pick-up in activity, the hyperscalers, either for lack of interest or lack of regulatory permission, continue to remain on the sidelines (though Google reportedly flirted with both HubSpot and Wiz). We expect deal activity to maintain strong momentum in the second half of the year.

Expand

Sources: Pitchbook data pulled as of Jun. 30, 2024; Sapphire Internal Analysis (Jul. 2024) Notes: Pitchbook data is updated on an on-going basis and is therefore subject to change; includes all enterprise software M&A activity ex-China/HK for announced deals w/disclosed transaction size excluding add-ons

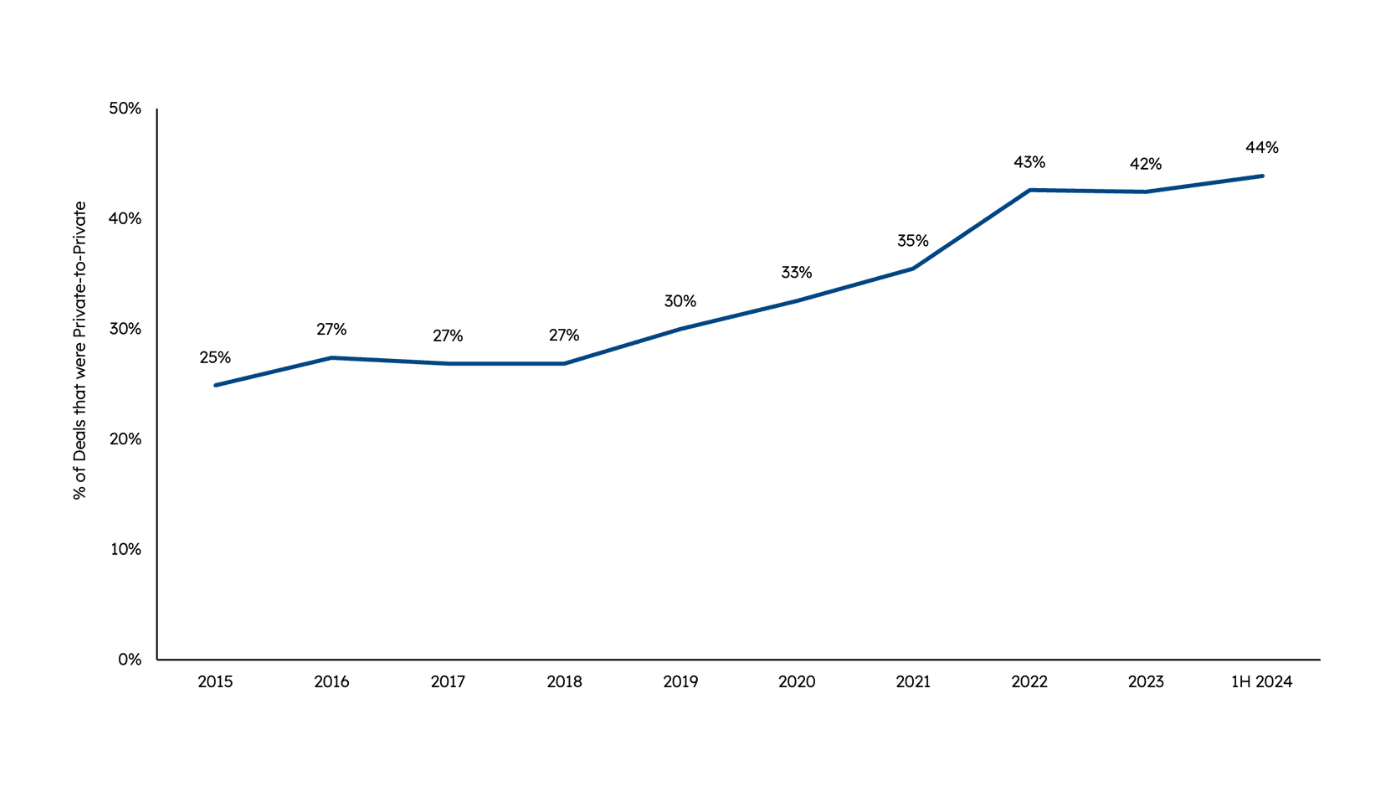

Prediction #9: …and Private-to-Private M&A Will Increase as Stronger Players Consolidate Positions

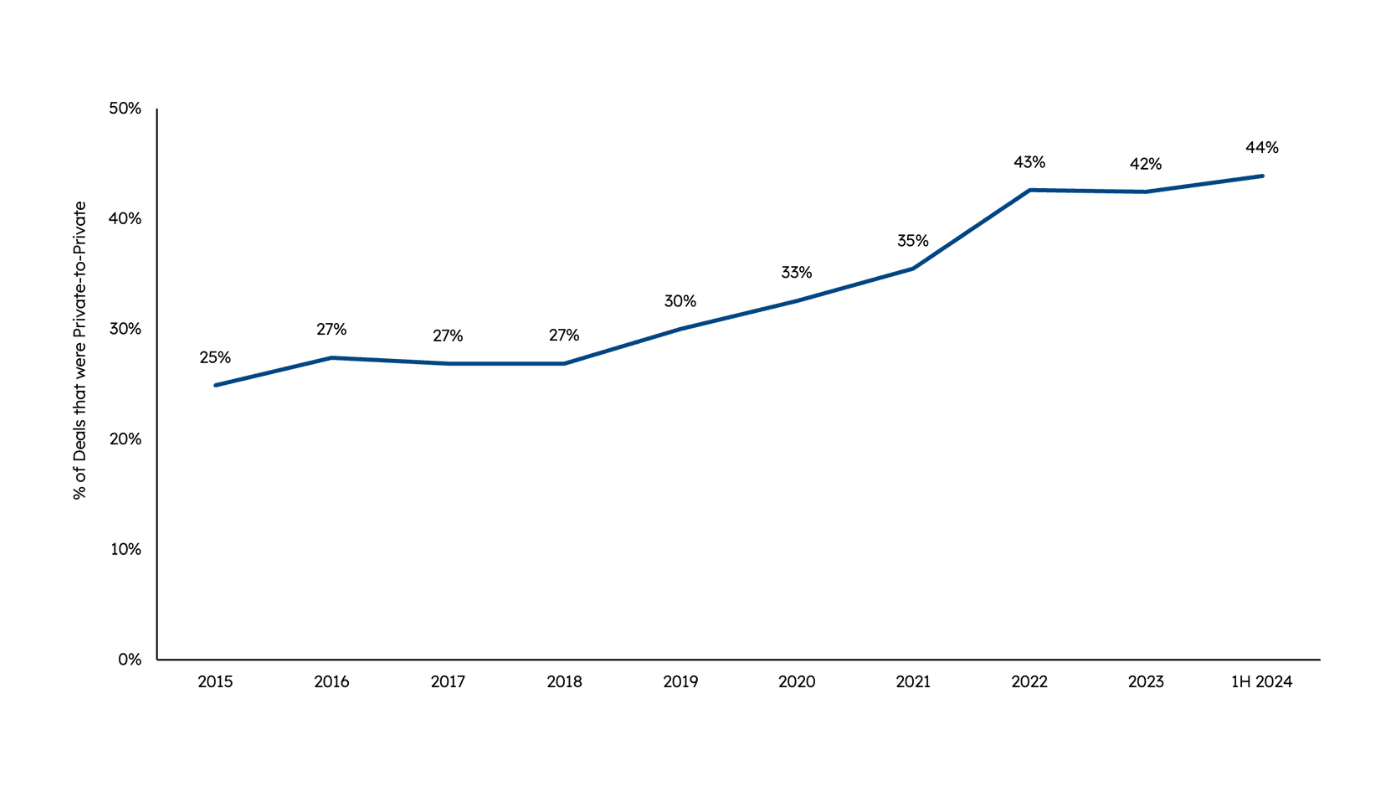

Right so far on this one as well. Through the first half of the year, 44% of announced enterprise software M&A deals were between private companies. This is up from 42% in 2023 and represents the high point of the past 10 years, based on our analysis. We have seen well-known, late-stage private companies be active buyers in recent months with OpenAI scooping up Multi and Rockset, Wiz acquiring Gem, Databricks adding Tabular and Prodvana, Deel buying Zavvy and AlphaSense picking up Tegus. We believe this type of deal activity will continue to become even more prevalent as potential acquirers look to strengthen their position and companies running out of capital are faced with an increasingly stringent valuation environment.

Right so far on this one as well. Through the first half of the year, 44% of announced enterprise software M&A deals were between private companies. This is up from 42% in 2023 and represents the high point of the past 10 years, based on our analysis. We have seen well-known, late-stage private companies be active buyers in recent months with OpenAI scooping up Multi and Rockset, Wiz acquiring Gem, Databricks adding Tabular and Prodvana, Deel buying Zavvy and AlphaSense picking up Tegus. We believe this type of deal activity will continue to become even more prevalent as potential acquirers look to strengthen their position and companies running out of capital are faced with an increasingly stringent valuation environment.

Expand

Sources: Pitchbook data pulled as of Jun. 30, 2024; Sapphire Internal Analysis (Jul. 2024) Notes: Pitchbook data is updated on an on-going basis and is therefore subject to change; includes all enterprise software M&A activity ex-China/HK for announced deals (both with and without disclosed transaction sizes) excluding add-ons; private-to-private deals only include strategic acquisitions and do no include PE acquisitions of private companies

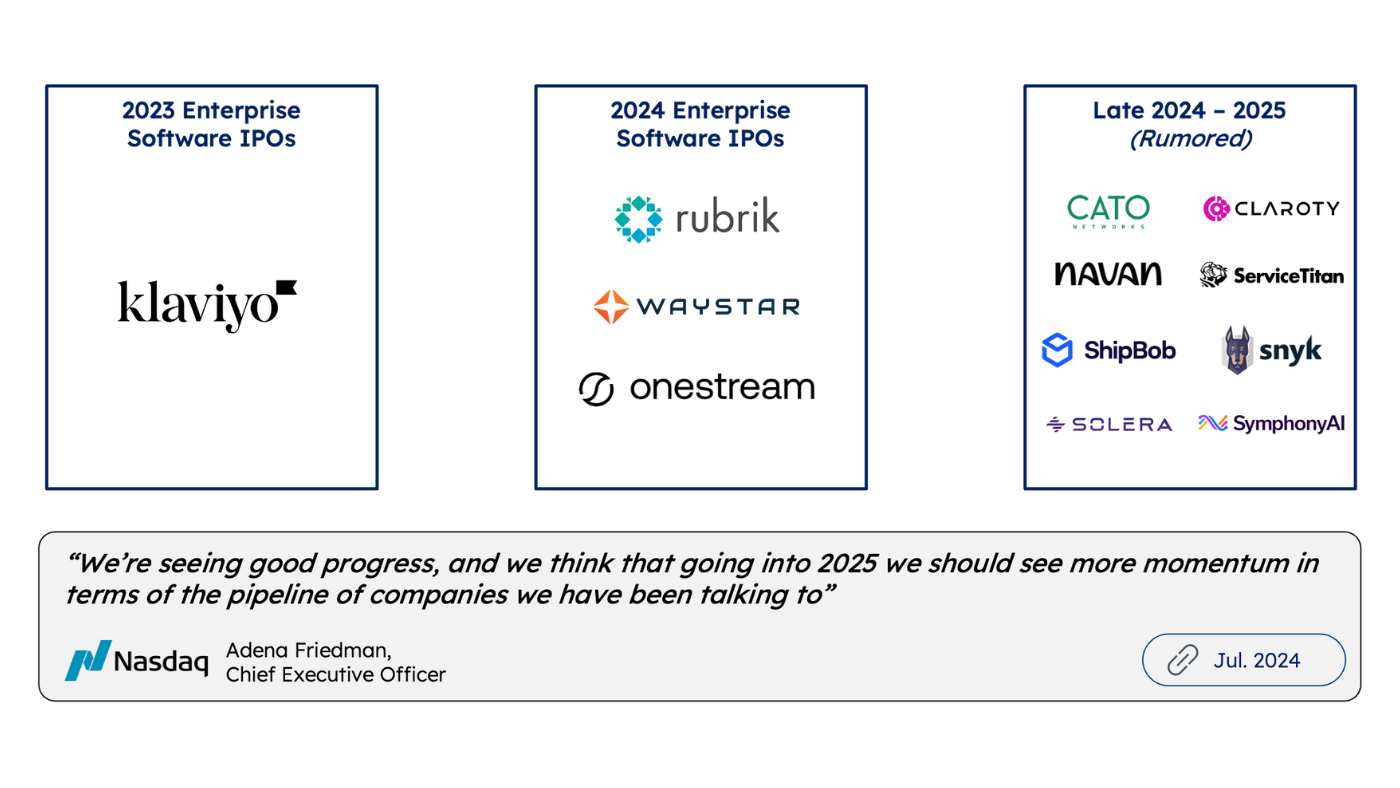

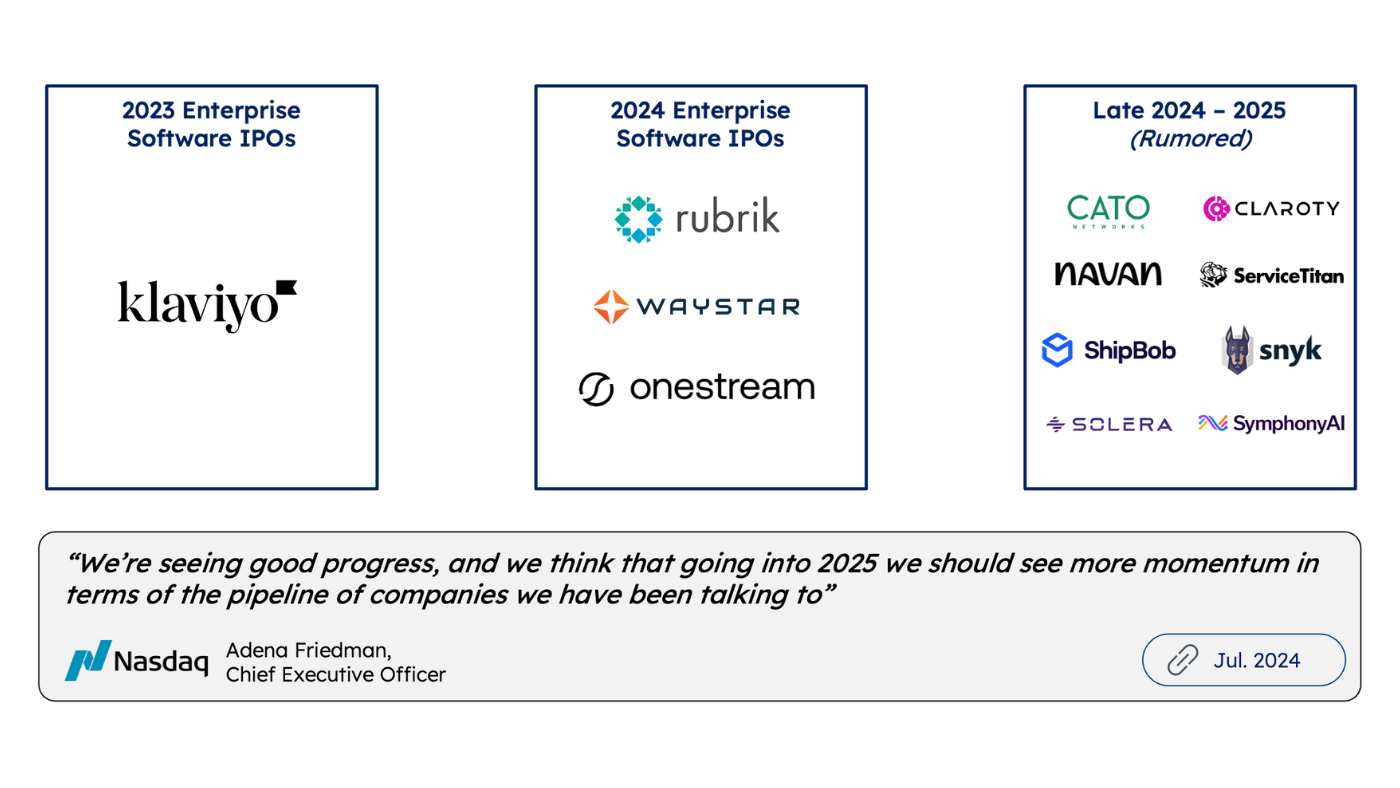

Prediction #10: Software IPOs Will be a Thing Again – but the Real Action Happens in 2025

Given the low bar (one deal in 2023), it was hard to go wrong on this one. With both Rubrik and Waystar going public in 1H 24, and OneStream kicking off 2H 24 with a July IPO, we have already cleared the 2023 total for new issues. Pricing and trading have not been great, but the public investors we speak to are hungry for alpha, and we believe a large backlog of software IPOs continues to build for 2025.

Given the low bar (one deal in 2023), it was hard to go wrong on this one. With both Rubrik and Waystar going public in 1H 24, and OneStream kicking off 2H 24 with a July IPO, we have already cleared the 2023 total for new issues. Pricing and trading have not been great, but the public investors we speak to are hungry for alpha, and we believe a large backlog of software IPOs continues to build for 2025.

Expand

Sources: S&P Capital IQ data pulled as of Jun. 30, 2024; Sapphire Internal Analysis (Jul. 2024); IPO rumors: Cato, Claroty, Navan, ServiceTitan, ShipBob, Snyk, Solera, SymphonyAI.

So overall, let’s call it 7.5 out of 10 points to date, with a line of sight to get to 8+ by year-end. Not too bad in an era where forecasts, be it for interest rate cuts or S&P targets, end up revised so frequently. However, as July has very clearly shown us, market behavior can change, both swiftly and forcefully, so we remain humble. For now, we encourage you to take a closer look at the accompanying report for a deeper dive into the state of the SaaS capital markets. We will be back in January with our full 2024 year-end review and a new set of perspectives on what we expect to see in 2025!

Let us know what you think about the report and our predictions. We’d especially love to hear from you about where you might disagree and what we may have missed. Reach out to Steve Abbott ([email protected]) or Kevin Burke ([email protected]) with any thoughts or questions.

Legal disclaimer

Various statements made throughout this article including “Predictions” reflect Sapphire’s beliefs and opinions only and must not be considered to be investment advice; Sapphire provides no assurance or no guarantee that any such prediction will ultimately occur.

Nothing presented within this article is intended to constitute investment advice, and under no circumstances should any information provided herein be used or considered as an offer to sell or a solicitation of an offer to buy an interest in any investment fund managed by Sapphire Ventures (“Sapphire”). Information provided reflects Sapphires’ views as of a time, whereby such views are subject to change at any point and Sapphire shall not be obligated to provide notice of any change. No assumptions should be made that investments described were or will be profitable. Due to various risks and uncertainties, actual events, results or the actual experience may differ materially from those reflected or contemplated in these statements. Nothing contained in this article may be relied upon as a guarantee or assurance as to the future success of any particular company. Past performance is not indicative of future results.