This article originally appeared in the Kauffman Fellows Journal.

We’re a little over half-way through 2020 and COVID-19, rollercoaster equity markets and record unemployment rates have dominated the 2020 fundraising narrative. The fundraising discussion seems to shift daily from gloom and doom to cautious optimism that the COVID fallout won’t be as bad as predicted. At the same time there are also still traditional venture-cycle liquidity considerations at play that may impact fundraising no matter what the final toll of COVID ends up being.

So where are we at so far? Just the first six months alone has seen a whooping ~$33BN raised by US venture funds through June 30.[1] This is a significant number and equivalent to what has been raised in a full 12 months in years past. It is hard to see the second half of the year raising as much as the first half, but if it does – that would put 2020 as the most money raised by US venture funds since 1999.

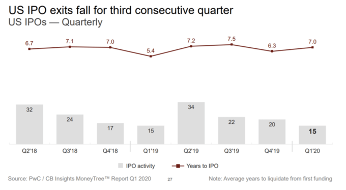

What could make for a tougher next six months? Liquidity is one concern. As most people in the industry know, liquidity is a critical component of keeping the venture ecosystem going. Outside of a brief spike in Q2 2019, mainly due to a swath of high-profile tech companies like Uber, Pinterest, Zoom, and Slack, IPO activity had been on a downward trajectory with Q1 2020 being the third consecutive quarter of decline. M&A is also a meaningful source of liquidity, but with the M&A outlook for 2020 skewing downward, there could be a continued lack of liquidity that may limit future investment in venture — particularly among emerging funds without established track records.

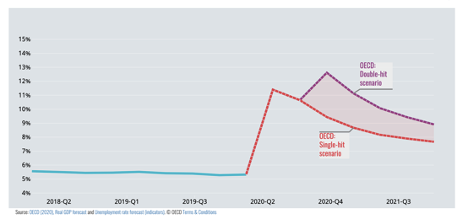

Weighing on many peoples’ minds is the question of whether we are already in a recession. If we’re not already, it seems pretty likely that one is coming.[2] How will the world react once we are all firmly on the other side of shelter in place and dealing with what looks like pretty extensive unemployment? The stock market is way up recently but there is no guarantee that it will stay there. Those of us that have been through economic cycles before also know amazing companies continue to emerge in downturns, and GPs need capital to fund those companies.

If you’re a GP looking to fundraise the second half of 2020, here’s what you need to know from the LP point of view.

1. The Experience Premium

A huge amount of money has been raised so far in 2020 and the overwhelming majority of it has gone into follow on funds, with only 3% of the money raised in the first half of 2020 going into first time funds.[3] Out of the almost 100 funds raised since January, some 21 were mega funds ($500+ million), and they account for 68% of all dollars raised.[4] In particular there are firms like Sequoia who are able to raise more than $7 billion despite the current conditions. Why? Market and human psychology show that LPs are more comfortable with battle-tested managers in times of uncertainty.

The gross majority of funds that have raised year-to-date have established brand names, market positions, LP bases, maturing track records, and in many cases realized returns, as well as critical experience in weathering downturns. Crisis or no crisis, these are all signals that LPs value. In an uncertain market like the one we face today; these attributes can be even more attractive.

2. To Raise or Not to Raise

With such a potentially bleak outlook on the market, why would a GP raise capital now? Despite COVID, shelter in place, and few IPOs, it’s not illogical for GPs with established LP bases to raise now.

First, GPs may want to raise capital to have dry powder to take advantage of investment opportunities in a recession.

Second, venture firms with established LP bases have almost undoubtedly told their LPs about their upcoming raises so they could budget accordingly. Circumstances can always change but presumably most LPs have planned ahead and have pre-determined capital waiting for their established GPs.

Finally, there is no guarantee that next year is going to be any better. If we go into a full-blown recession, if schools do not re-open, hospitals remain stressed and the stock market heads south there may be fewer LP dollars available to put into funds. This likely drives some urgency to raise now while there is money available.

A component of this is to get ahead of any additional “denominator effect,” in which a decline in the stock market, or pervasive recession affects the LPs’ ability to invest in venture as an asset class. LPs that invest in both public and private sectors often determine how much to allocate toward venture capital as a percentage of total assets. The amount that gets invested into venture capital naturally decreases if the value of their public assets decrease.

As a result, venture funds that try to raise later, during a more pronounced recession coupled with a downturn in the stock market, might face the hard truth that money has dried up– or at least that’s what the fear is. Right now, with the stock market way up, it doesn’t look like the denominator effect is going to be a factor, but if things change and the market goes sharply downward, the denominator effect could become a significant issue for some.

3. Beat the Odds

The good news for you is that LPs with a dedicated venture program understand that smart investing requires investing in up and down markets alike– and they allocate (as well as reserve) capital accordingly.

The same logic is true of venture funds and great performing funds can be started during downtimes as well as good. For example, Andreessen Horowitz’s first fund was raised in 2009, and Lowercase Capital’s famous first fund was in 2010— both years when venture fundraising was under extreme pressure. It will be exciting to see which of the new funds coming to market now in this uncertain market will become the future’s great funds.

Money from LPs dedicated to venture will still be there, and notably, strong emerging managers can be “haves” alongside established managers. This is true even in uncertain markets.

You know the “battle-tested” experience we spoke of in point #1? This is where emerging and established managers GPs can build that track record by actions such as:

- Building up an angel investing track record

- Picking the right companies that become future breakouts and securing meaningful ownership in these companies

- Holding multiple closes in your fundraise to show momentum

- Helping existing investments weather the COVID storm and raise subsequent rounds from strong firms

- Demonstrating early liquidity in your investments to either return capital or recycle

Final Thoughts – How to Attract LPs and Improve Your Odds of Raising:

Whether you have an established track record, or are more of an emerging manager, there are best practices all GPs should remember when fundraising:

Give advance notice: For any of you who plan on fundraising in the next 12 months and haven’t told your LPs yet, do so now. We need the heads-up to plan.

Prep for diligence: Expect LPs to want to understand what is driving the underlying performance of your individual portfolio companies.

We’ll ask you what your unrealized valuations are based on. Where does the growth and revenues of your portfolio companies come from? Is it based on other startups that might get caught sideways trying to fundraise, or from companies that will still be able to pay their bills if the market dips?

Some companies will be better at navigating COVID headwinds and tailwinds. Despite all the COVID/SIP challenges, many companies are thriving in this market (remote learning, telemedicine) while others (the travel industry, service sectors) are working hard to weather the storm. H2 metrics and market conditions in the remainder of the year will help us get a better understanding of what to expect in 2021.

We want to know how you’re thinking about the next few years. With the boom times calming down, knowing how your fund and your portfolio companies plan to navigate through this current change is critical.

Leverage your LPs: If you have existing LPs, ask them for introductions and to give you market feedback. Ask them about what they are hearing and what LPs are actively allocating to venture. Since folks are not traveling, and annual meetings and other events where LPs/GPs typically meet have all gone virtual, it can be incredibly hard to meet new LPs. In this environment, finding new ways to be introduced, leveraging your network, doing research, and speaking with fellow GPs who have successfully raised is even more important.

Be patient: It’s true there are funds that can raise despite all the global uncertainty, but this is not true for everyone. Can you slow your roll and fundraise in 2021? For funds that are establishing their track records, or that need more time for their companies to develop, consider using the rest of this year to develop your portfolio. Instead of fundraising, help your portfolio raise their next rounds, and either wait to fundraise yourself or do a minimal viable fund size close now and give yourself a year to raise the rest. It’s true no one knows what next year will look like and it could be an even tougher time to raise then now but having a portfolio that is growing and hopefully thriving during COVID will give you a solid base to show to LPs.