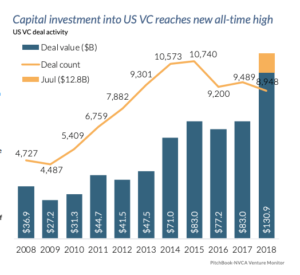

In 2018, U.S. venture funds invested over $130 billion in startups — crossing the $100 billion mark for the first time since the dot-com boom in 2000. In addition, U.S. venture funds themselves also raised record amounts not seen since 2000, raking in over $50 billion across 220+ vehicles. Across the board, deal sizes surged.

At the same time as multiple folks have noted, the number of absolute financings has not kept pace, rather more money continues to go into fewer but larger rounds starting as early as at the series seed.

At the same time as multiple folks have noted, the number of absolute financings has not kept pace, rather more money continues to go into fewer but larger rounds starting as early as at the series seed.

To succeed as an investor in an ecosystem such as this — flush with venture capital and venture capitalists, is it enough to differentiate yourself just by having capital? To attract entrepreneurs and limited partners (the people or firms that invest in a venture fund) to your fund we believe it is not. We would argue that you have to distinguish yourself with an authentic and valuable model.

What do you stand for? How can you deliver for your portfolio companies over and above the competition? There’s more than one way to skin a cat — but it’s essential that you figure out what makes your firm original and lead with it.

I recently dug into this topic on a panel on The Shifting Funding Landscape I hosted at Slush along with Rebecca Kaden from Union Square Ventures, Rebecca Lynn from Canvas Ventures, and Alice Bentinck from Entrepreneur First. Below are seven ways I’ve identified where VCs have differentiated themselves and found success.

1. Stick to a thesis

Thesis-based investing takes the long view on how a specific industry or trend will evolve over time. Investors come to a consensus on their vision for the future (generally a 5-10 year horizon) and run each potential investment through the model to ensure it aligns with and helps drive the change.

According to Fred Wilson, thesis-based investing is an excellent strategy for smaller venture funds that can maintain and execute a singular vision. His firm, Union Square Ventures, is a pioneer of this approach. Leveraging their thesis around the power of networks led them to invest in companies like Twitter, Tumblr, Twilio, and MongoDB (to name a few). And thesis based investing does not have to be rigid. Today Rebecca Kaden at Union Square Ventures articulated the third iteration of their thesis – now about backing trusted brands that broaden access to knowledge, capital, and well-being by leveraging networks, platforms, and protocols.

Other venture firms also use thesis-based investing and continue to iterate on the model. For example, Forerunner Ventures zeroes in on entrepreneurs defining a new generation of commerce by tracking major cultural shifts from a consumer perspective. From there, they select companies to invest in based on how they dovetail with these shifts. These include investments in companies like Glossier and Warby Parker and exits in companies like Dollar Shave Club and Jet.

2. Platform as VC

When Josh Kopelman and Howard Morgan launched First Round Capital in 2008, they championed the concept of transforming their portfolio of companies into a community of entrepreneurs who supported one other.

To this end, they built the First Round Network, a platform where entrepreneurs can ask for help and share successes on every aspect of startup life — from fine-tuning pitch decks to accessing the latest software to hiring. From the data they collect on interactions, First Round publishes an annual State of Startups report, unveiling trends in everything from productivity tools to the benefits and challenges of parenting while working in tech.

Access to the First Round Network isn’t limited to First Round’s founders and C-Suite executives. All startup employees at First Round Capital’s portfolio companies can request and share insights — engineers, marketing teams, and customer success — alongside leadership. Well-known companies that have relied on the platform to scale include Square, Flatiron Health, and Ring.

3. Form your own agency

Andreessen Horowitz (A16Z) launched in 2009 with a novel structure modeled after the Hollywood talent agency Creative Artists Agency in which they hired partners not to invest but to provide their functional expertise — be it marketing, business development, or recruiting to help their entrepreneurs. A16Z might not have been the first to offer “value-add” services, but they did it in a big, public way — and the industry took notice.

Y Combinator emerged in tandem as a prominent seed stage accelerator, admitting scores of companies into ‘batches’ a couple times per year. Each company gets a focused three-month experience to work on their ideas, getting advice, pitch training, funding and connections to participating companies leading up to ‘demo day’ and then access to the YC alumni network. With investments like Dropbox, Airbnb, Stripe, and DoorDash, the model inspired many others to consider new ways of helping entrepreneurs and companies at the earliest stages.

Enter Entrepreneur First (EF). EF decided to partner with talented founders even earlier — at the pre-company stage and help them with critical early decisions like selecting a co-founder and refining their business model. Comprehensive and personalized commitment is why ambitious individuals like Zehan Wang and Rob Bishop of the neural network technology Magic Pony which was acquired by Twitter were attracted to EF.

(Of course, I’d be remiss not to mention Sapphire’s own Portfolio Growth team who help our GPs and portfolio companies — direct and indirect — with a variety of business development, talent and marketing activities.)

4. Send out the scouts

Who makes the best venture capitalists? Ex-bankers? Ex-operators? Current operators? Ex-journalists? College students? Recent graduates? The jury is out according to CB Insights data, but as an industry, we continue to think about this and experiment with new approaches.

Cue the scouts. Sequoia started using scouts in 2009 and in 2017 raised $180 million for a seed stage fund based on the model. The program involves distributing money to a network of well-connected entrepreneurs, academics, and industry leaders who invest in promising startups and keep their ears open for new opportunities for Sequoia. (In 2015, The Wall Street Journal published a list of more than 100 Sequoia Scouts, including Airbnb CEO Brian Chesky and Stanford Cryptography Professor Dan Boneh.)

Other teams have made this model their own, and today successful scout programs come in various forms, ranging from working exclusively with one fund to funds raised just to fund other scouts. Data Collective has innovated on the scout program and taken a whole new angle on it. Data Collective gives 40+ technology executives, engineers, data researchers, and scientists equity stakes in the fund to help source and work with DCVC portfolio companies — a great added incentive to uncover the next unicorn.

5. Community as deal flow

For the most part, there is no proprietary deal flow anymore. But there is proprietary access. One way to generate it is by building your own community from which to invest. A prime example of this is Jason Lemkin – the founder of the SaaStr community, the SaaStr podcast, the enormous SaaStr Annual conference (along with its European counterpart, SaaStr Europa), and his eponymously named SaaStr Fund.

It took Jason a mere five years to grew his presence 20X on Quora to 45 million views, publish more than 200 podcasts, and hosted some 12,500+ SaaS execs, founders and VCs, and execs at this year’s 2019 SaaStr Annual. In 2016, he raised a $70 million venture fund focusing on inbound investments from the community he created.

6. Harness data to your advantage

Just as companies are using data smarter and better to understand their customers, outmaneuver their competitors, and map their ecosystem — so too are venture firms. VCs are leaning on data to be smarter about everything from sourcing investments to benchmarking to helping a portfolio company make its next hire.

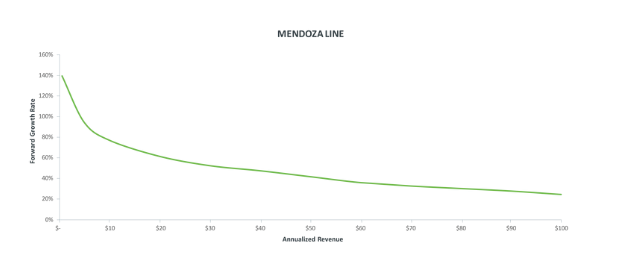

Scale Venture Partners, for example, launched the Scale Studio in 2018 to give entrepreneurs a window into industry metrics like the Mendoza Line.

The Mendoza Line is an acceptable growth rate for a SaaS company looking for venture funding. SVP also offers insight into the Magic Number, a calculation to predict which subscription models will become profitable.

Another data driven VC is SignalFire which has built their firm from the ground up with a heavily data-centric approach. Signalfire says it tracks more than half a trillion data points that it collects from millions of data sources, from patents, academic publications, open source contributions and financial filings. It does so as part of its deal sourcing work but also as part of the value add it delivers to its portfolio companies and last but very much not least in order to track millions of engineers around the globe.

Proprietary data can be an enormous asset. If you can collect and organize it in an effective way — it can be your best weapon.

7. Take a chance as a first-time fund

Old is new again. Instead of joining existing high-profile firms, more and more individuals are striking out on their own and starting new venture funds. 2018 saw some 70+ new funds raised representing almost $7BN. This new fund creation activity was also not an isolated event in 2018, but part of a larger pattern. According to Pitchbook, with the exception of slight dip in new fund creation in 2014, approximately 30%+ of funds raised every year since 2010 have been new first-time funds.

This is not an easy path. New funds can be laborious to raise. Many Limited Partners don’t invest in a first-time fund. And of those that do, many will only commit to experienced venture investors spinning out of existing funds. It is also a challenge to gain visibility among entrepreneurs. Rising above the noise and building your brand as an existing venture fund is tough enough; for those just starting out, it can be a much longer road to recognition and trust.

The upside, of course, is that first-time funds give investors an opportunity to start fresh. First time funds can offer greater independence, flexibility, speed, and creativity with investments since you’re not balancing your vision and priorities with your partners’.

Most first-time funds raise less than $100m — and while this may bring some disadvantages when it comes to competing with bigger funds, it can also give the new fund a chance to carve out a focused niche. We’ve seen new funds zero in by theme, by vertical, and by geography to take advantage of their particular expertise. In the past few years, we’ve seen new managers like Notation Capital, focused on technical founders in the general tri-state area; Backstage Capital, with a commitment to women, people of color, and LGBT founders; Basis Set Ventures, centered on AI; and Third Kind Ventures, which aims to invest in contrarian founders at the very early stages, targeting large outcomes in transformative spaces.

Whatever your tactic, make sure it’s authentic. You need to stand out even more if you’re starting your own brand.

Put Your Best Foot Forward

Founders and limited partners will quickly see through inauthentic copies. The startup ecosystem is well-networked, and the smart, ambitious people you’re trying to attract to your fund will know if you’re not being real. You don’t necessarily have to re-invent the wheel. There are many ways to support your portfolio companies and develop your approach to sourcing and making investments, but play to your strengths. Whether it’s an edge in data, access to industry leaders, a knack for fundraising, or your personal brand — lead with it. If you’re authentic, you’ll be a magnet for like-minded talent.