The last 12 months have been a blockbuster year for crypto with BTC surpassing $1T in market cap for the first time, Ethereum launching EIP-1559 to prepare for the migration to proof-of-stake consensus and the establishment of the first U.S. future-based BTC ETF.

Despite the recent market volatility, we believe increasing institutional demand from large financial services firms (e.g., banks, asset managers, fintechs) and publicly traded companies (e.g., Meta, Google, Visa) is a testament to the long-term staying power of the digital asset class. At the same time, the growing appetite for crypto requires enterprise-grade infrastructure to enable secure, compliant and scalable participation in Web3/DeFi.

That’s why we at Sapphire continue to be excited about Blockdaemon. We joined the Blockdaemon journey at their Series B round last September–impressed by the highly performant infrastructure that Blockdaemon was building to enable market participants to transact, stake and earn via nodes.

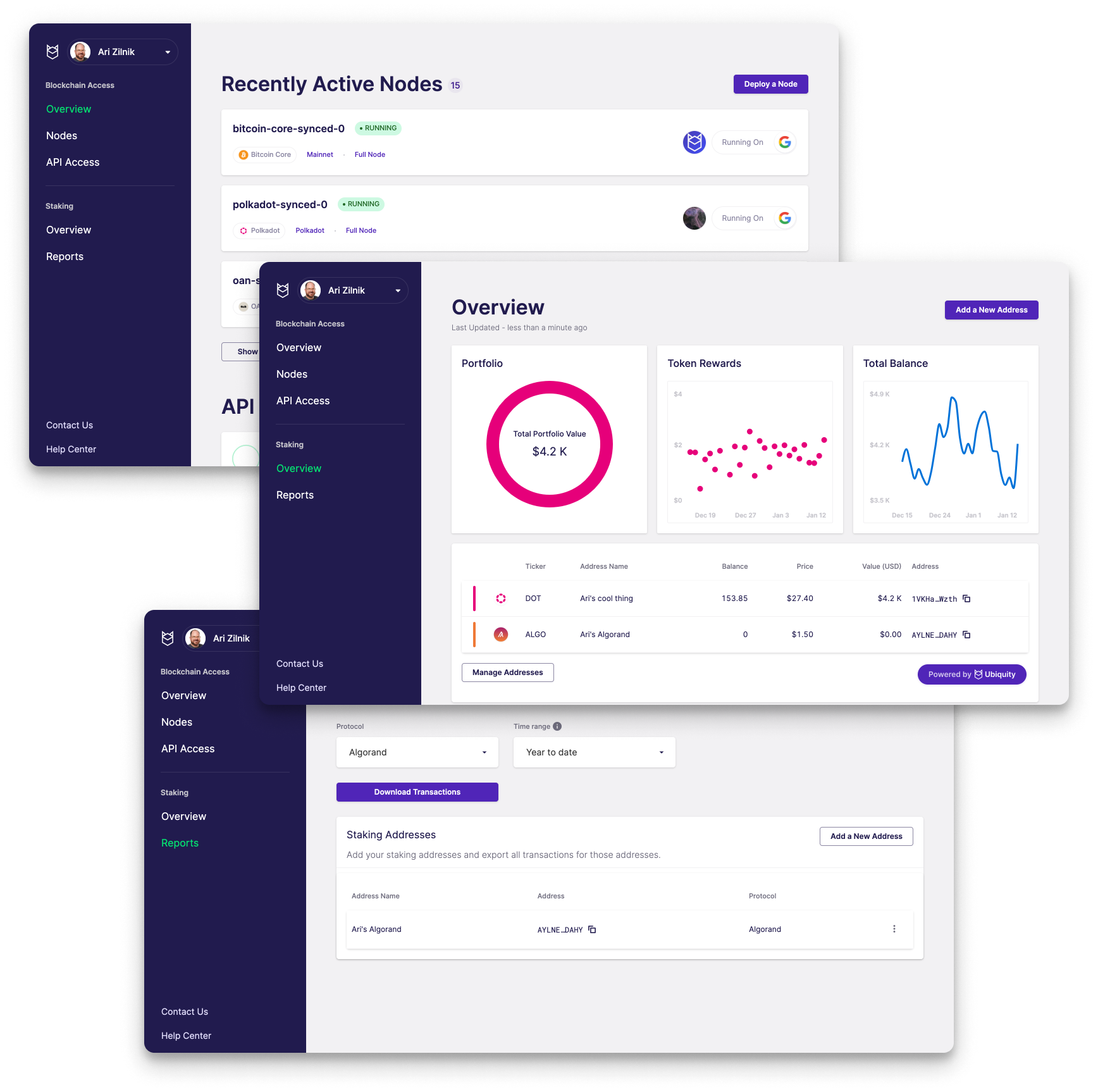

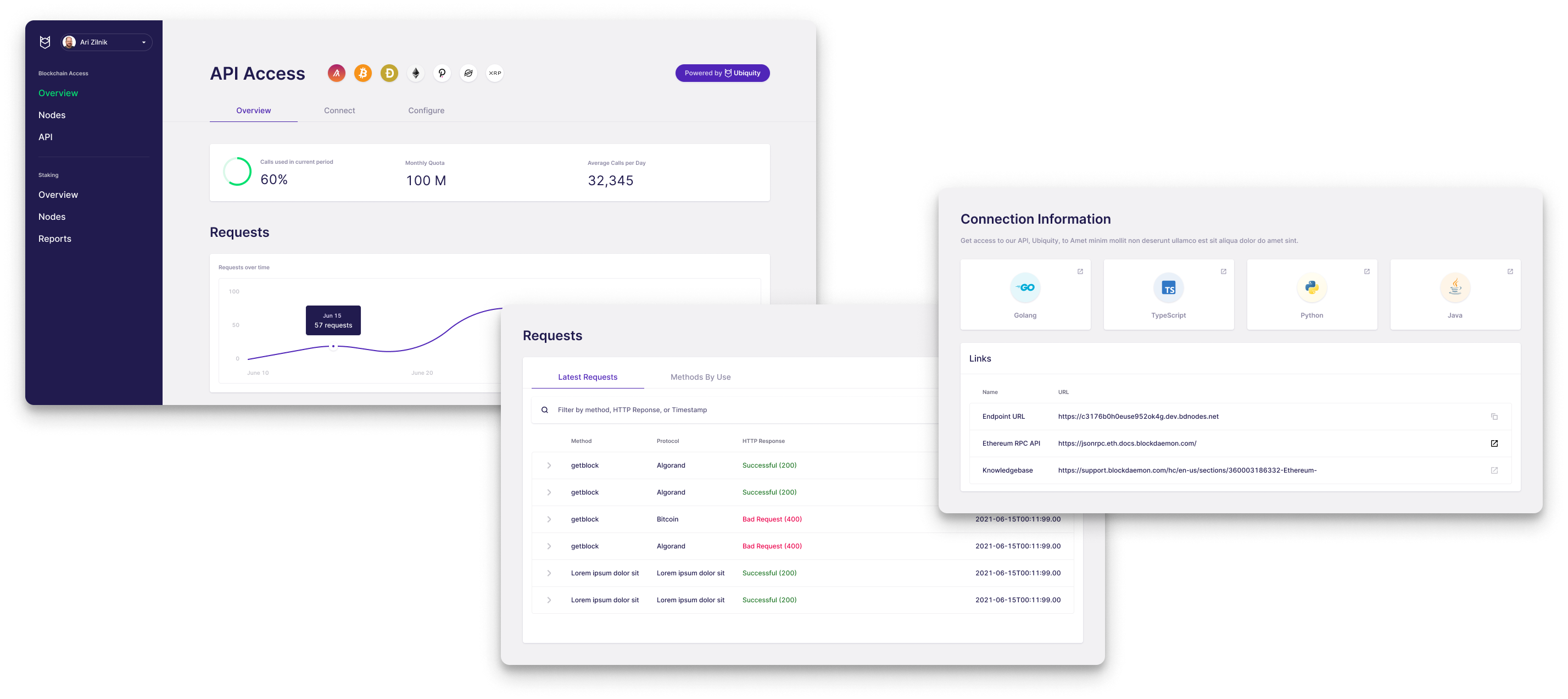

Since then, the company has continued to cement its position as the de facto institutional staking and node management platform, scaling to support 50+ blockchain networks across 70+ global points of presence, and adding an impressive roster of customers like Voyager, Uphold and Anchorage across the largest global exchanges, custodians, investors and financial institutions.

For all these reasons and more, we’re thrilled to once again back Founder & CEO Konstantin Richter, and the entire team at Blockdaemon, to co-lead their $207M Series C.

CEO & Founder, Blockdaemon

Konstantin continues to excel in his vision towards building a ‘one stop shop’ for crypto yield generation, enabling institutional clients to access wide range of blockchain services (e.g., transaction nodes, staking, liquidity options, custodial APIs and high availability clusters) through a single interface. He has also attracted 10x talent during an exceptionally challenging hiring environment, fostering a culture of innovation and excellence.

We look forward to seeing Konstantin propel Blockdaemon into its next phases of hyper-growth as the company launches institutional-grade liquid staking, engages in strategic acquisitions and establishes a DeFi fund to support broader ecosystem growth.

At Sapphire, we seek to partner with companies of consequence that are truly visionary, disrupting the status quo and building creative solutions to foundational problems. Blockdaemon is doing both–creating the fundamental infrastructure to enable widespread institutional access to DeFi within a secure and compliant framework. We are excited for what lies ahead for the Blockdaemon team and are thrilled to be partners along their growth journey.

Special thanks to Jason Brooke who has been deeply analyzing the crypto space and greatly contributed to the development of this blog.