At the start of 2024, we felt it was clear that generative AI would remain a dominant force in both technology and venture capital. The model layer continued to attract the most capital, fueled by the computational demands of leading labs. Categories like code assistance, marketing and customer support were also primed for accelerated growth and CapEx increased as hyperscalers engaged in an arms race to expand global computing capacity.

What we thought would happen in the world of AI in many cases did, but there were also quite a few surprises. Few anticipated that we wouldn’t have seen a GPT-5 class model by now or that several once-red-hot startups, which had raised hundreds of millions in capital, would see their founding teams quit and decamp to Big Tech. We also didn’t see the rise of personal AI assistants, new AI form factors threatening the smartphone’s position as the central device in users’ lives, deep-fake scandals wreaking havoc in global elections, a re-shuffling of global search market share or anything even remotely resembling AGI—as many were predicting heading into the year. Nor did many foresee that reasoning models would create massive excitement and unlock a new scaling law.

While recognizing the direction of progress isn’t difficult, predicting the specific path–and the potential pitfalls–can be much more challenging. At Sapphire Ventures, our mission is to deeply study technology trends, form a perspective on how markets will evolve and back the entrepreneurs building towards that vision. With prediction season in full swing, we’re sharing some of our thoughts on the most significant themes shaping the near-term future of GenAI in the enterprise.

Here are our top 10 AI predictions for 2025:

Now let’s dive in and explore each.

Sign up for our newsletter

AI-native apps will see the strongest funding momentum

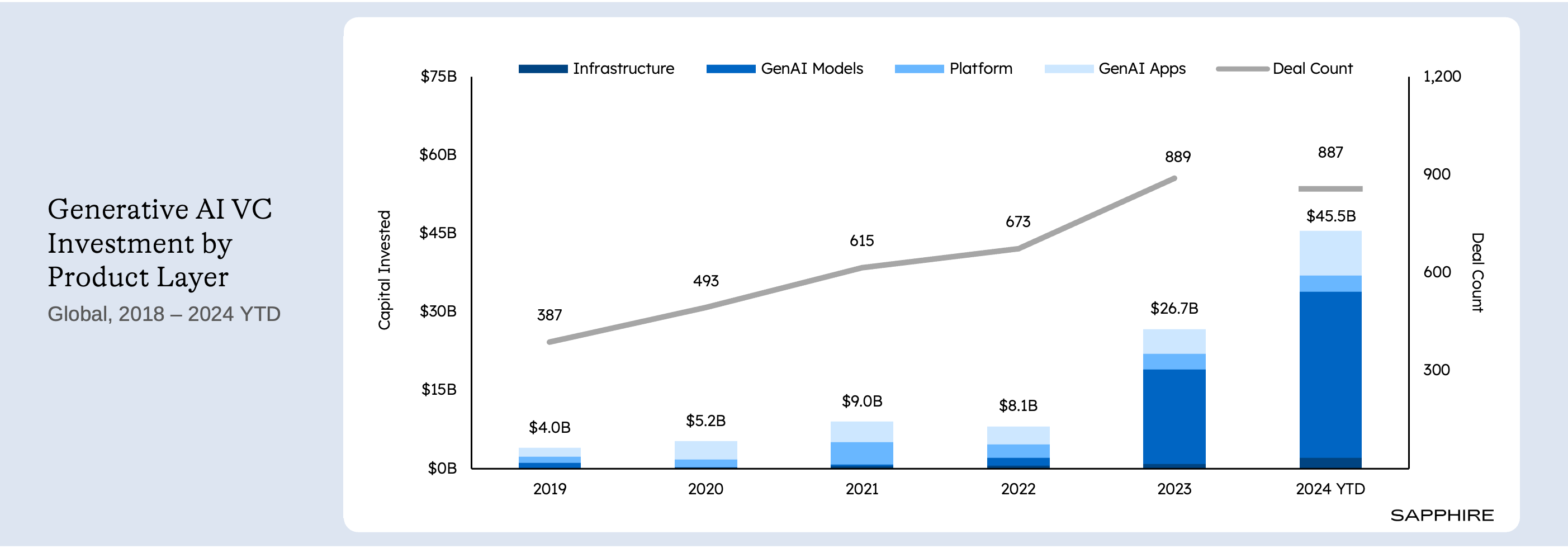

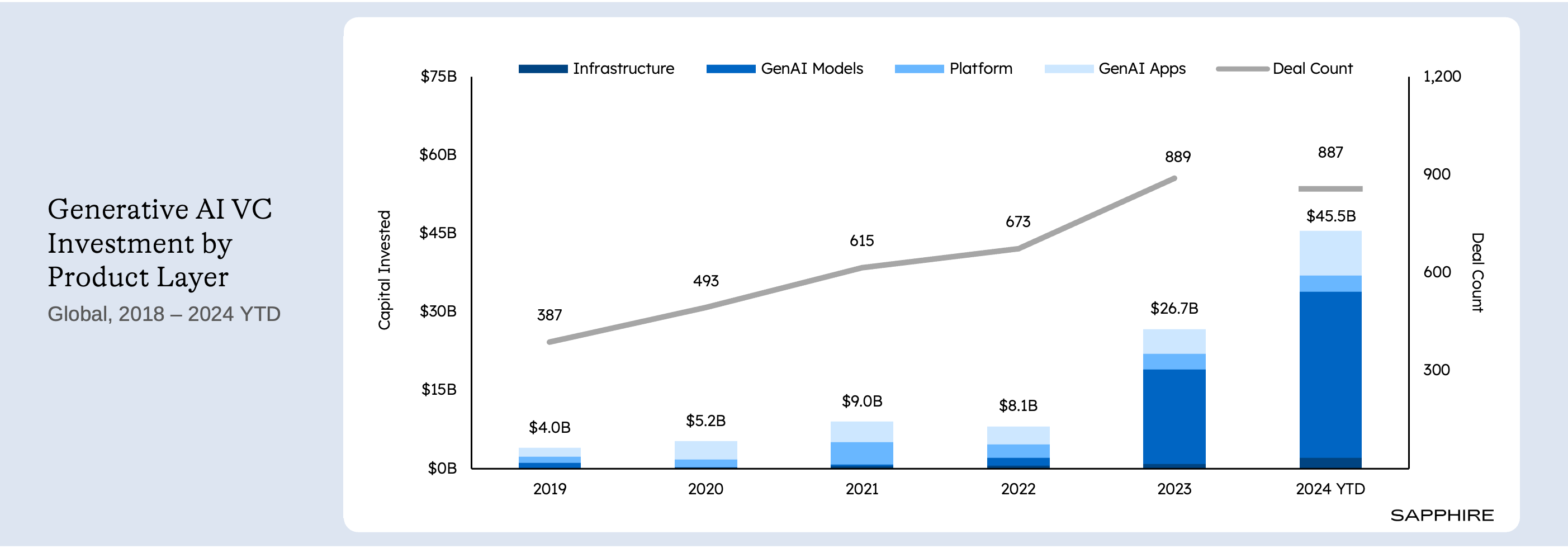

2024 was another record year for AI-native startup funding as $45B+ was deployed into these companies through the first week of December. Barring any additional multi-billion-dollar financings closed in the last few weeks of the year, we will likely settle around that figure representing a 70%+ increase from 2023.

Expand

Sources: Pitchbook data pulled as of December 4, 2024; Sapphire Internal Analysis (Dec. 2024)

Notes: Pitchbook data is updated on an on-going basis and is therefore subject to change; includes all enterprise software VC activity for deals w/disclosed transaction size; Generative AI categorization and sub-categories defined by Sapphire whereby other market participants may categorize underlying companies differently

These numbers are impressive and notable considering total VC funding is trending flat to slightly down for the year. Still, this undersells the momentum behind AI investment as a broader definition of “companies working with AI in some capacity” would push the totals higher.

We believe AI-native funding will continue to grow in 2025. Here’s why:

- Strong investor appetite for AI companies

- Ongoing participation of strategics and sovereigns in investment rounds

- Record level of dry powder on the sidelines

- Significant capital needs

- Fierce competition for talent

- The growing number of proof points across categories

To sum it up, to surpass this year’s mark, we will need to see a broadening of investment across all layers of the stack, as well as the foundation model players maintaining a cadence of large fundraises. Overall, we expect to see continued growth, albeit at a diminishing rate next year. The application layer is likely to experience the most expansion on a percentage basis, while the model layer again claims the most total capital.

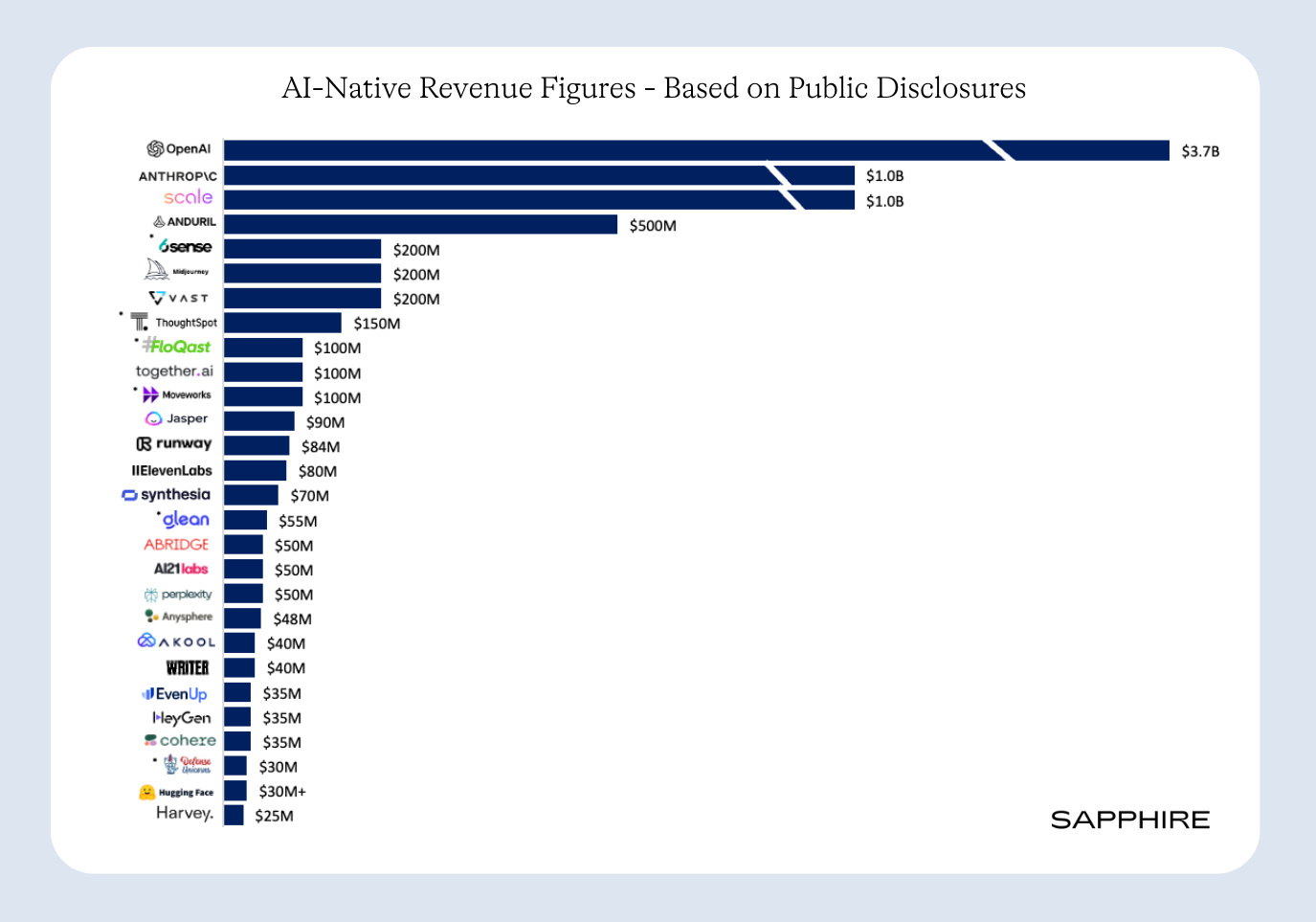

Many more AI-native companies will reach $50M in ARR

By our count, 30+ startups reached $25M in ARR versus 19 at the start of the year. A cursory glance at the chart below demonstrates the breadth of GenAI’s impact as we see companies building foundation models, code assistance, data management, marketing, sales, legal, knowledge management, search and customer support solutions.

While the above list is compelling, it’s worth noting that it only includes companies that have been reported on or have publicly disclosed numbers. We know there are many more that have already cleared this mark or will in very short order.

We think that a year from now, this current view will look quaint. Specifically, we believe there will be at least 50 AI-native startups generating $50M in ARR while still growing north of 50%, including several more that cross the $100M threshold.

AI exits will increase, but M&As will trump IPOs

The IPO market remained dry in 2024 with only a few software IPOs including ServiceTitan, OneStream, Waystar and Rubrik. The M&A environment on the other hand wasn’t quite as slow, but activity was still depressed relative to prior years and we didn’t see many blockbuster deals. While buyers mostly passed on big deals, we saw a lot of AI-specific tuck-in activity with the likes of Run.ai, OctoAI, Datavolo, Tenyx, Leonardo.ai and others being sold throughout the year. When it comes to AI M&A, one of the most interesting trends in 2024 was the “Extracti-hire” transactions between Microsoft and Inflection, Amazon and Adept and Google and Character.AI.

In 2025, we expect a more active exit environment, and we’ll see some of the very first AI IPOs. On that point, CoreWeave is on track to go public in the first half of the year with Scale AI soon to follow. Maybe Databricks will decide to go public as well. But there will only be a few with the bulk likely going public in 2026 and 2027.

Our position is grounded in four key observations.

- U.S. election overhang has been removed, resulting in what we expect to be a regulatory regime that will be, at least, incrementally more friendly towards deal-making.

- Big Tech companies and private equity firms are sitting on significant cash piles and have been biding time, sharpening their perspective on their “buy lists.”

- The recent surge in many enterprise software stock prices also strengthens their bidding position.

- Even in this still early stage of development, several categories will likely benefit from consolidation. We anticipate seeing activity in areas like code assistance, sales, and marketing, and data Management, in particular.

With all this in mind, we believe we’ll see more “Extracti-hire” deals and the first $5B+ traditional acquisition of an AI-native company.

Models will improve across multiple dimensions

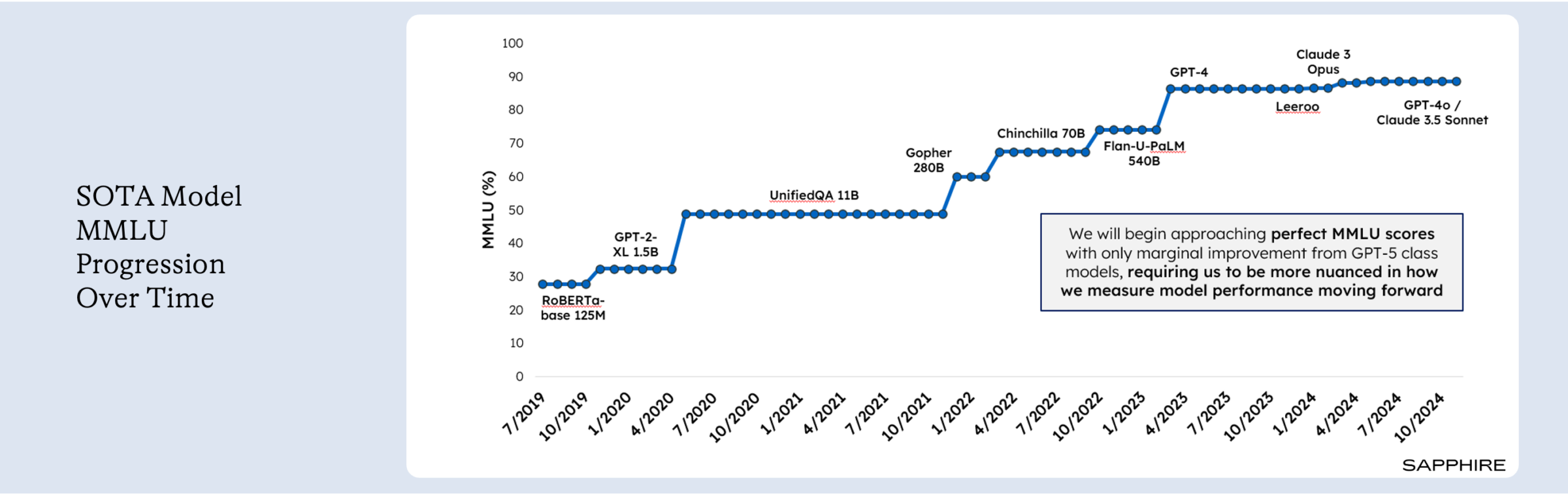

The debate around whether scaling laws are breaking down became a dominant discussion point in early November as multiple publications put out reports suggesting that OpenAI, Google and Anthropic were all seeing diminishing returns on their still-in-development next-generation foundation models. Any slowing in the rate of advancement is cause for concern as there are downstream effects with financial implications. Amid reactions, the fact that the models are still improving got overlooked.

While a more obvious prediction, we think it’s important to reiterate that foundation model capabilities are going to get better in several ways. Most notably, we are likely to see improved multimodal model performance and rapid advancement in reasoning models, which will complement the gains we see in core LLM capabilities when the GPT-5 class models get released in 2025. These advancements, along with hard AI engineering work, new and novel training techniques, new architectures (e.g., Mamba), better model orchestration capabilities, creative ways of combining Generative and Predictive AI, and still rapidly falling inference costs, will keep progress moving at a steady rate. For instance, the price of GPT-4 class models has fallen ~90% since initial release in March 2023, making trailing-edge intelligence significantly more accessible. We like to think of the coming period as a “Mixture-of-Everything” era.

The wall may come, but we don’t think we will hit it next year. In 2025, we expect GPT-5 class models to hit the market and anticipate several reasoning models to be released from major labs and hyperscalers. We also believe SLMs and Open-Weight models, led by Llama and its derivatives, will take several points of share from today’s leading LLMs.

Agents will begin to deliver on hype, though impact will be uneven

Agent announcements were a dime a dozen in the back half of 2024. Incumbents built entire conferences around them, startups rushed to demo them and VCs could not stop talking about the ways they would upend the economy. While the agent narrative was out in force, the impact to date has been negligible. We believe that will start to change in 2025.

We are still likely years away from agentic workflows, but think next year will bring material impact from agents in customer support, IT, sales, security and several vertical use cases. Success in offloading mundane, repetitive tasks in these areas will build confidence in organizations, and individual employees, to further invest in agents. Defining success metrics around productivity enhancements and closely tracking cost savings will be critical to building the business case for broader adoption.

While initial adoption will surge, we will also see a lot more “agent-washing,” where existing capabilities will be marketed as more advanced than they are. This will muddy the waters for buyers trying to delineate between automation, assistants and agent capabilities, as they look to transition AI spend from experimental to permanent budgets. There will also be high-profile agent failures, in both consumer (such as recent reports that Perplexity shopping agent struggles to fulfill basic requests) and enterprise, which may keep a lid on how fast the agent era evolves.

Despite some bumpiness in 2025, we are long-term bullish on agents and think the year ahead will be crucial in demonstrating initial product-market fit. It’ll be difficult to track the uptake and impact of agents over the near term, but we predict that at least one Mega-Cap tech company will claim $1B in cost savings from agent deployments during the year.

The Other AI Arms Race: The DoD will double down on AI

Since ChatGPT put GenAI on the map in a big way, there’s been an AI arms race taking place in the data center. In parallel, another AI arms race has been bubbling up within the government, and at the Department of Defense specifically.

While momentum is only just starting to build for defense tech, the next decade is poised to be a golden era of investment in the category–particularly in AI defense tech. As we noted in a piece from earlier this year on the topic, ongoing global conflict is driving the need for modern tech with the DoD itself admitting to its technological shortcomings and beefing up its budget in an effort to adopt the latest technologies possible. These trends, coupled with top defense talent flocking to the private sector, have created an environment ripe for defense tech to flourish.

Don’t just take our word for it, proof points from over the past year of defense tech companies’ successes are piling up in a way that can’t be ignored. In the public markets, Palantir’s stock increased 320%+ in 2024, climbing to a ~$160B market cap. In the private markets, Anduril raised a $1.5B Series F at a $148B valuation, up ~70% from its 2022 mark. Starlink on the battlefield in Ukraine. SpaceX’s critical role in Space defense projects. The continued advancements in drone technology. The list goes on.

We believe that defense tech, which has already claimed $3B+ in VC funding through the end of November, will more than double in 2025 and has a good chance to be the fastest-growing category of vertical tech for the year. Furthermore, we believe there will be a significant increase in the reported budget and number of unclassified AI projects from their current levels of $1.8B and 685, respectively.

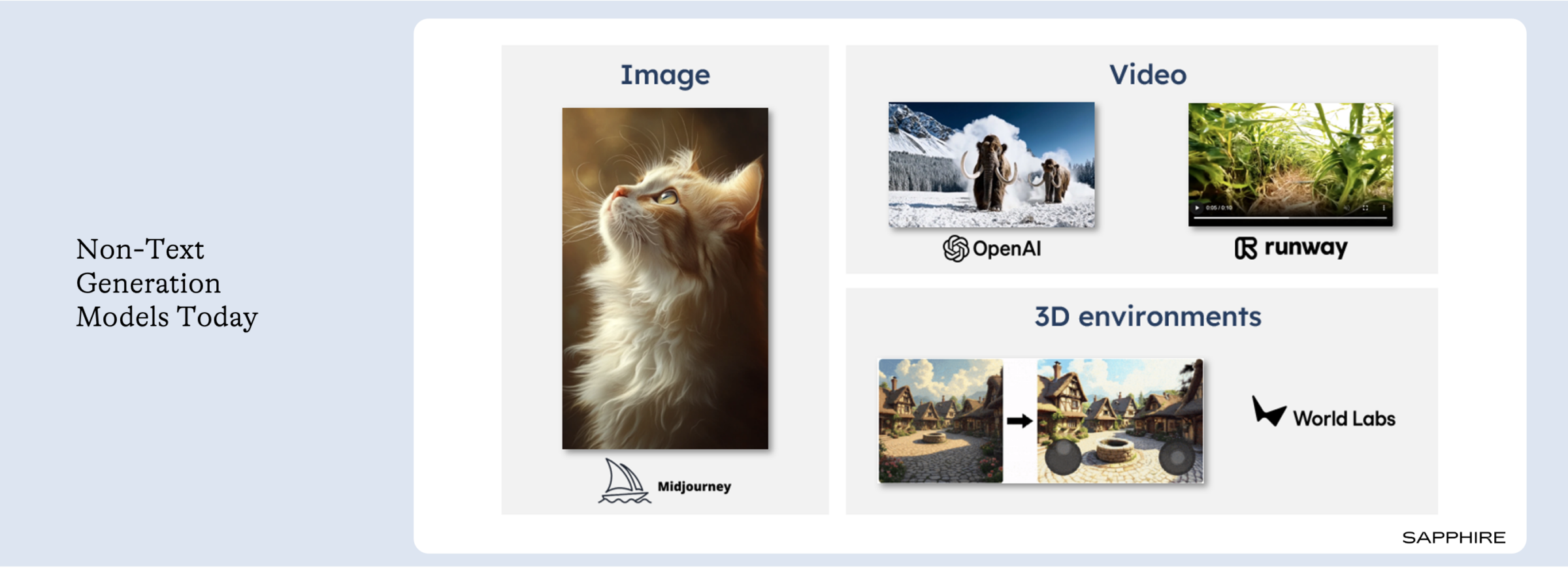

AI-generated content to surge with video becoming a rising star

It’s impossible to read an article, listen to a podcast or watch a video without encountering AI-generated material. One study suggests that AI-generated content increased by 8000% between the launch of ChatGPT and March 2024–only 16 months later. In many cases, AI-generated content is easy to detect, but in 2025 we expect this to change.

AI-generated material is increasing across modalities at a breakneck pace in ways that are changing how we produce and consume content–and for good reason. GenAI has proven itself to be fast, cost-effective and scalable. GenAI tools provide huge benefits in brainstorming, editing, dubbing, translating and designing use cases, driving adoption by marketers, sales reps, media companies and individual influencers.

As multi-modal models advance and GenAI apps become more powerful, content creators stand to become more productive than ever. However, there are several thorny issues to navigate as AI-generated content takes more share in the coming years, including establishing clearer regulations on copyright and artist compensation, building content authentication mechanisms to combat deep fakes and misinformation, preventing model collapse from AI-generated content being reused in training and perhaps more philosophically, guarding against a general degradation of the quality of knowledge we consume.

We think the pros of AI-generated content far outweigh the cons. Looking ahead, we will see a breakout consumer and enterprise video product that will be similar in scale to NotebookLM. We also think that 2025 will be the year we see fully AI-generated media hit top 20 charts in music, short-form video and daily podcasts.

As consumption grows, outcome-based AI pricing models will be slow to ramp

One of the most common questions amongst our portfolio company leaders today is how to price new AI capabilities. What’s clear is that we’re in an experimental phase with no clear answer. Multiple pricing models will co-exist as categories feel their way toward a new equilibrium (i.e., seat-based, consumption-based and outcome-based models).

With so much experimentation going on, it’s too early to tell what the dominant model will be, though we believe incremental pressure on seat-based models will persist, particularly as agent capabilities mature. Next year will provide valuable data into what works and what doesn’t. We’re particularly interested in watching churn levels for premium-priced seat-based SKUs as a signal of customer value and feature defensibility.

Our sense is that many categories will evolve to include a base-level platform commitment–possibly tied to user seats–along with premium AI consumption baked into that price. Any usage beyond this threshold would be charged on a metered basis. But it’s still too early to tell. Where we have more conviction is that outcome-based pricing will be slower to ramp and more limited in scope than many anticipate. We see the mode working across tightly scoped use cases where inputs and outputs are clearly measurable and agreed upon between customer and provider. However, that is not the case for most enterprise tasks and workflows. With all this in mind, we predict outcome-based models will be responsible for less than 1% of total enterprise software revenue in 2025.

AI: A major security threat and antidote

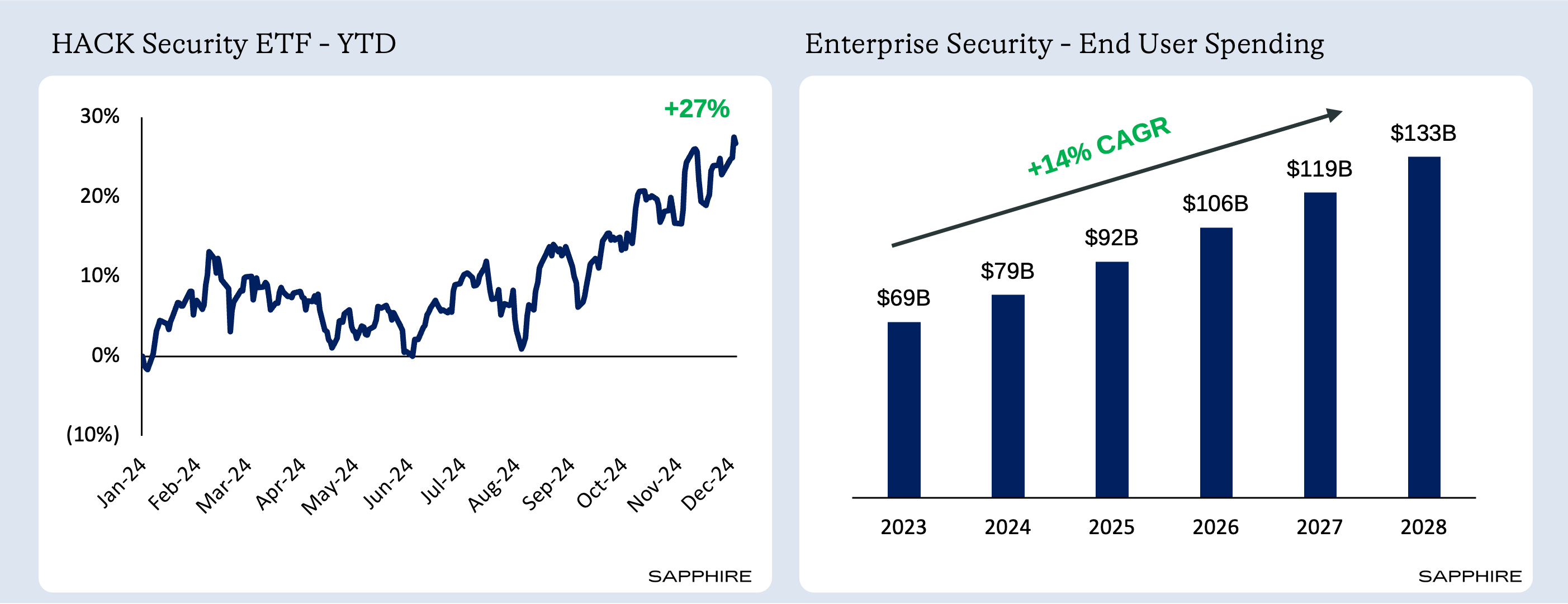

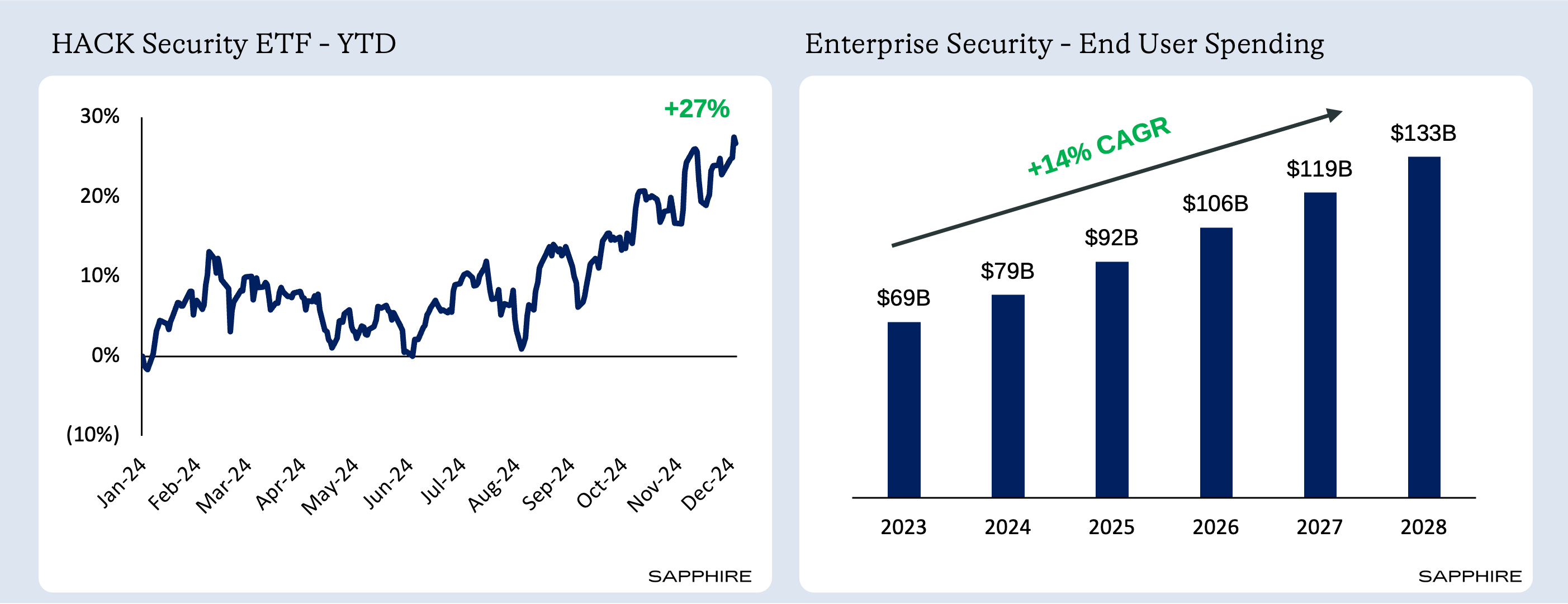

Given the increasing cost of security failures by large companies, it’s no surprise that security is the only other category to remotely keep pace with AI from a CIO prioritization and public market performance perspective through 2024. In recent quarterly CIO reports published by major investment banks, security was ranked a top 1 or 2 priority. Security is a constant struggle between the white and black hats, which keeps the category evergreen from an investment perspective and highly defensible from a corporate spend perspective.

AI has rapidly become both a leading attack vector and the first line of defense in security. For the bad actors, AI has improved the quality and quantity of attacks (e.g., advanced phishing and social engineering attacks including the use of deepfake audio and video), expanded the threat surface, and introduced new compromises such as prompt injection attacks, model and data poisoning, and data leakage. To put some context around the challenges, HiddenLayer found that 77% of surveyed companies have experienced a breach of their AI tools, and Hugging Face publicly disclosed a compromise of their Space platform not long ago.

Expand

Sources: (1) CapIQ as of 12/5/2024; (2) “Cybersecurity Primer,” TD Cowen (November 2024).

On the flip side, AI can help companies secure their data, improve observability, identify and mitigate threats, streamline security processes and strengthen predictive analytics. Vendors in the space have been quick to react to the opportunityChairman Mark Warner recently called the “worst telecom hack in our nation’s history – by far” and the ongoing campaign by foreign adversaries targeting U.S. critical infrastructure. It’s obvious to predict that security spending and cyberattacks will increase, but if we took it a step further, we think we’ll see an AI-enabled cyberattack that creates billions in economic damage for a specific company or government entity in 2025.

AI regulation will move slowly absent a major calamity

Questions about how to regulate AI have existed for a while but became mainstream with the release of the current generation of foundation models. Their rapid, transformative capabilities raised concerns with corporate executives, researchers, lawmakers and citizens about everything from data privacy to job loss to more fantastical rogue AI-takeover scenarios (e.g., remember the calls to destroy the data centers?).

To date, there has been much discussion on regulation, including performative hearings and calls to further study the issue, but little agreement on how to proceed. The European Union is the exception, having passed the EU AI Act in March and entering it into law in August of this year. The act was positioned as putting Europe at the forefront of safe and trustworthy AI development, but was quickly labeled as another example of innovation-restricting bureaucracy.

In the U.S., the most expansive piece of proposed legislation, California’s “Safe and Secure Innovation for Frontier Artificial Intelligence Models Act,” was vetoed by Governor Newsom. His decision, which was largely cheered by industry participants, was based on a view that the measures were too stringent and didn’t do enough to consider the specific context of AI

deployments. In China, the biggest move has been to publish a set of guidelines that they hope can be used to set standards for AI development in important industries.

We believe AI regulation will advance slowly in 2025, unless spurred by a major calamity. Even then, it may prove challenging. We don’t see any significant legislation on AI at the federal level taking place any time soon, though there will be more use of tariffs and trade restrictions to limit access to critical inputs. Expect more frameworks, high-level commitments, and commissioned studies, but nothing that puts material restrictions on the pact of AI development.

We’re Just Getting Started

There is no doubt much to be excited about in the year ahead. Many of these themes warrant entire posts of their own and we didn’t even hit on topics like AI winners and laggards in the public markets, AI’s impact on the , new AI-powered devices, and the next iterations of personal AI assistants. More to come on all those topics throughout the year!

On that note, we would love to hear your thoughts and what you think should have made our list. If these themes and predictions resonate, or even if you disagree and want to debate, please reach out to Jai, Kevin, or Alex.

We wish you all a great end to 2024 and a Happy New Year!