I badly needed a standing desk a year into working from home. But unknown to me, Amazon and other retailers had already run out of the models I was considering. Standing desks, like almost everything else, were completely out of stock with a long wait time before new inventory would be available. Thankfully, the product shortages have eased two years later and the timing couldn’t be better with the holiday season right around the corner.

According to KPMG, only 11% of retail executives anticipate significant shortages of holiday inventory – much improved from the 39% that were concerned about stock outs during the 2021 holiday season. In other words, holiday shopping is likely to go more smoothly this year than in the prior two years. And if anyone would like a standing desk, I happen to have an extra one after I received two instead of the one I ordered! The significant shortages many of us experienced during the pandemic, as well as the frequent occurrence of receiving the wrong order got us thinking about the state of supply chain and logistics technology today.

What led to the significant shortages we all experienced in 2020 and 2021? During the pandemic, there was an unexpected surge in demand for home goods and services, but the demand was hard for companies and service providers to meet because they were handicapped by social distancing and supply shortages. Add to the mix exogenous factors such as the Suez Canal blockage, as well as geopolitical challenges, and suddenly, products ranging from jigsaw puzzles to semiconductors, baby formula and many others were out of stock at one point or another.

The rapid shift in consumer buying behaviors since COVID hit often exposed the fragility of existing supply chain and logistics infrastructure. While we aren’t out of the woods yet, we believe there’s a silver lining here. The challenges of the last three years acted as a catalyst for investment in the people, processes and technology that will lead to a more resilient supply chain and logistics ecosystem.

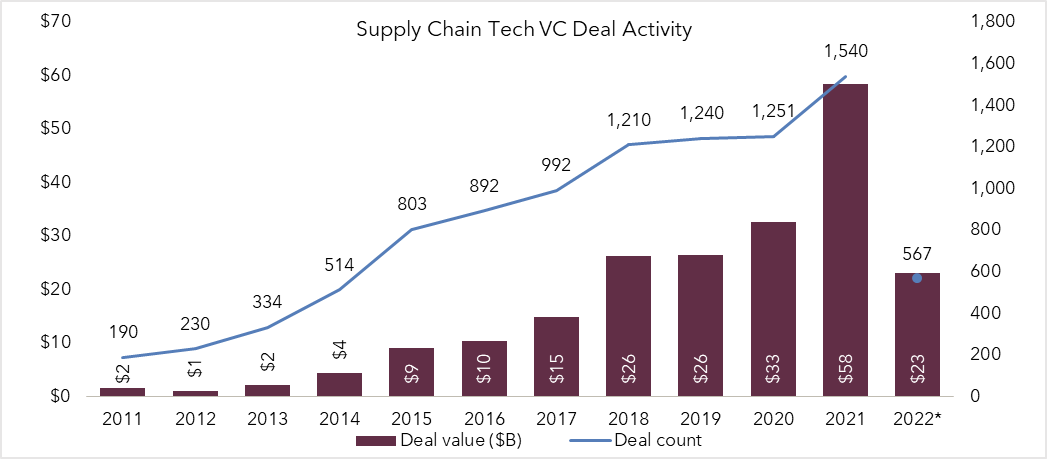

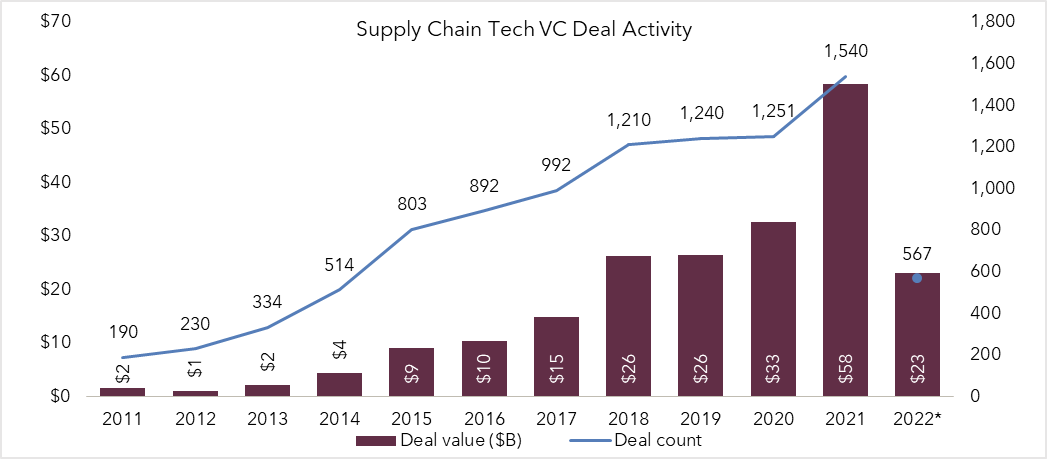

2021 was a record year for venture capital investment in supply chain & logistics technology at $58B in deal value. It’s no surprise that despite a funding downturn, $23B has already been invested in supply chain & logistics technology companies in the first half of 2022, putting this year on track to exceed every prior year other than 2021 (see the chart below).

Source: Pitchbook Q2 2022 Supply Chain Tech Report

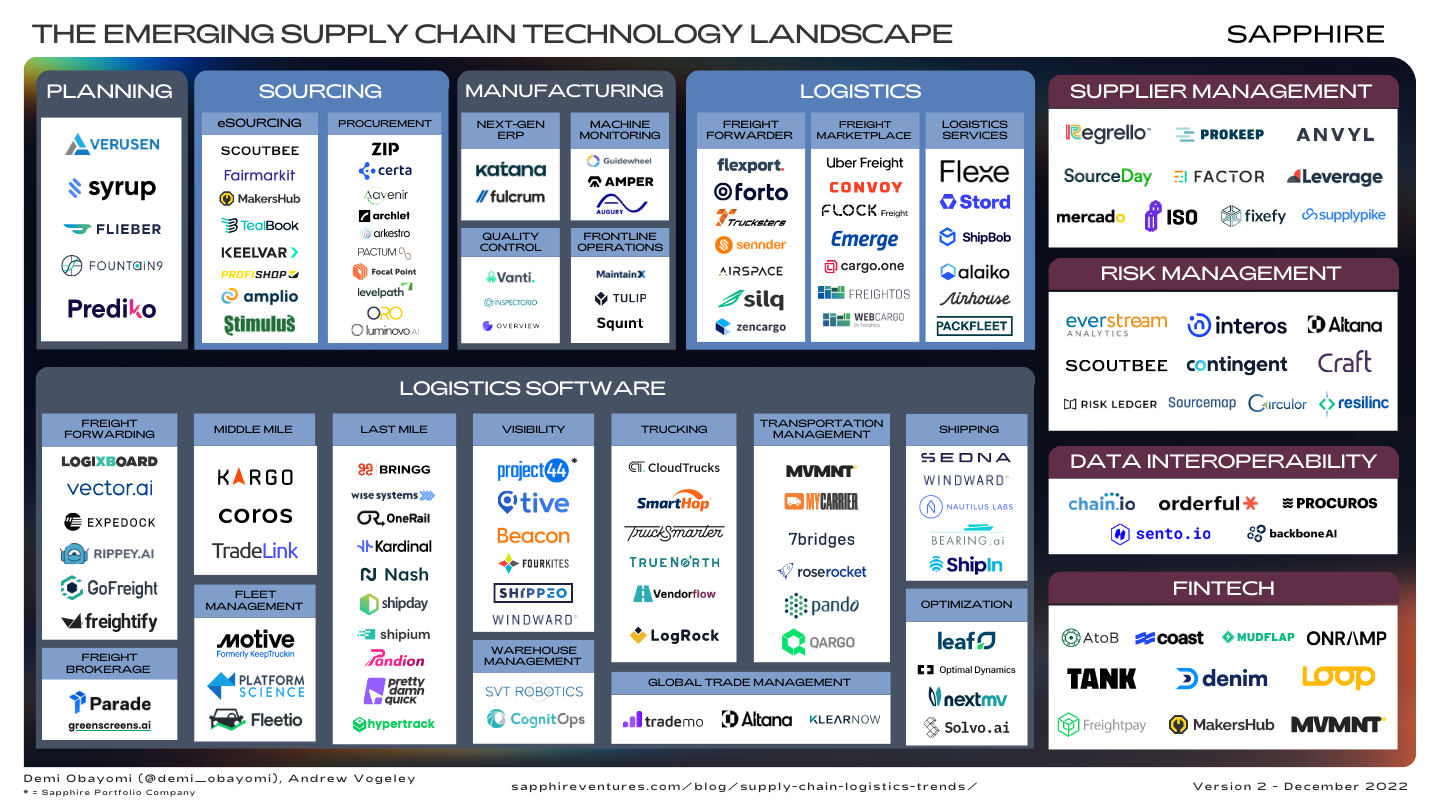

In this post, we’ll take a close look at emerging trends in supply chain & logistics technology, and reveal a market map of 100+ vendors leading the charge.

Emerging Supply Chain & Logistics Technology Trends

Given our focus on emerging technologies, many of these supply chain & logistics trends are still in the early innings of adoption, but we believe they have the potential to become key drivers of the supply chain and logistics industry in the near future.

Supply Chain Visibility Goes from Niche to Mainstream

Perhaps the biggest winners of the supply chain disruptions caused by the pandemic were supply chain visibility vendors such as project44 (a Sapphire portfolio company). Real-time tracking and visibility quickly shifted from a “nice-to-have” to table stakes, as shippers demanded the ability to track their multimillion dollar goods in the same way that we can track our personal packages. Companies like project44 and Tive provide API-first access to tracking data, giving logistics companies the ability to provide their customers with insight into where their cargo is and when it will be delivered. Shippers also purchase visibility solutions to optimize their operations, improve inventory management and avoid costly penalties at ports, for example.

Customer Experience Becomes Critical to Survival

For too long, only companies like Amazon and Flexport were able to access the capital and talent required to build end-to-end digital experiences that include customer-facing portals, document management and online tracking. But that is starting to change with a new crop of vendors developing products that enable any supply chain & logistics company to deliver a digital experience of its own to customers. One example is Logixboard, which has built software for traditional freight forwarders to provide a digital-first experience to shippers, enabling them to better compete with the tech-enabled forwarders that have emerged over the last decade.

Disruptive Business Models Maximize Market Potential

The cost of a new technology influences its adoption rate and the extent to which it can penetrate a market. For example, over a decade ago, outfitting a warehouse or factory with robots often meant a large upfront capex investment, which only the largest enterprises could afford. In the last few years, however, many startup robotics companies have flipped this model on its head by offering customers the option to pay for robots on a subscription basis, ultimately increasing their total addressable market.

Fast forward to today, the ability to monetize through financial services like payments or factoring has created an opportunity for vendors to take this idea to the extreme and offer their products at no upfront cost to the customer. MVMNT is a recent example of this, offering its TMS software to brokers for free to gain access to as many brokers and as much freight volume as possible that can then be monetized through embedded financial services.

Comprehensive Risk Management is a Prerequisite for Resilience

McKinsey estimates that on average, auto manufacturers have 18,000 suppliers across all tiers of their supply chain. Due to the interconnectedness of supply chains, the status of an upstream supplier impacts the ability of downstream suppliers to deliver on their obligations. This dynamic creates a market need for real-time insight into the entire value chain inclusive of Tier 1, 2 and 3 suppliers. Companies like Altana, Interos and Everstream have developed risk management solutions that combine online data and on-the-ground intelligence to help supply chain leaders anticipate and quickly react to potential risks (e.g., plant shutdowns, geopolitical concerns, etc.).

New Tailwinds for Supplier Sourcing Tech

Creating a distributed network of suppliers will be critical to defending against future supply chain disruptions. Case in point, the current geopolitical tensions highlight the importance of not being overly dependent on particular suppliers or regions. This has been a boon to supplier sourcing companies like Keelvar and Fairmarkit which have also received fresh backing from investors this year. Both startups provide solutions to run an end-to-end supplier sourcing process, which is essential for companies and governments seeking to reduce their reliance on certain suppliers and nation states.

Though Hidden From View, Supply Chain & Logistics Heavily Impact ESG

A thorough approach to ESG tracking factors in the practices of all vendors involved in manufacturing a product and transporting it. As corporations are mandated by regulators, shareholders, and the public to operate in a manner that meets or exceeds ESG standards, it has become necessary to track emissions, energy usage, labor practices and other components of ESG. This is where vendors like Sourcemap and Circulor have focused their efforts, enabling customers to report on the provenance of raw materials, ongoing labor conditions and other aspects of their supply chain & logistics operations.

Investing in Optimization to Eliminate Waste

It’s no secret that logistics is frequently fraught with waste. Convoy’s Future of Freight report suggests that 35% of all heavy-duty truck miles are still being driven empty resulting in billions of wasted miles annually. Fortunately, the complexity of logistics lends itself well to optimization. The benefits include less unused capacity, more efficient routing, higher driver satisfaction and reduced emissions. Leaf Logistics coordinates across shippers, carriers, brokers and partners, to tackle inefficiency and empty miles at a system-wide level. Optimal Dynamics is another notable company that helps individual shippers and carriers make load-by-load decisions that maximize the probability of being profitable and on time, even if the unexpected happens.

The Rise of Dedicated Automation Tools to Drive Productivity

For the most part, the supply chain & logistics industry still runs on paper-based and other analog processes. Identifying the most time-consuming processes that lend themselves to automation will be critical to improving industry-wide productivity. Several companies have emerged to address workflows as varied as document extraction (Expedock, Rippey.ai) and customs clearance (Vector, KlearNow). Solutions like Regrello take a different approach by allowing users to define a process, manage the execution and automate tasks.

Revolutionizing Procurement with Machine Learning

Simulations are often used in high-end manufacturing to predict how a product will react in a variety of working conditions. Vendors like Arkestro and Pactum are bringing this approach to procurement. Using a combination of machine learning and game theory, these companies simulate the procurement process in advance, offer the resulting purchasing terms to suppliers and automate negotiations on behalf of the procurement team.

Modern Collaboration Requires New Communication Tools

Supply chain & logistics is still plagued by a high volume of phone calls and emails that are increasingly difficult to keep up with. Meanwhile, dedicated communication & collaboration tools like Slack, Symphony, and Front have emerged over the last decade to serve the needs of coworkers, financial services, and customer communications respectively. This wave is finally coming to supply chain & logistics. Companies like Sedna, Prokeep and Vendorflow are taking a “reach them where they are” approach by providing software that augments traditional email and mobile messaging with features that allow for data capture, automation, collaboration and the ability to exchange data with systems of record.

The Need for Data Interoperability Can’t Be Ignored

It’s our belief that the supply chain & logistics industry will adopt more and more technology over time. But this creates a new problem – all these systems, whether they were adopted two decades ago or just last week, must be able to exchange data if the industry is to become more resilient. This is what gets us excited about companies like Chain.io, Orderful and Procuros as they provide off-the-shelf integrations to a variety of supply chain and logistics systems that shippers, supply chain & logistics companies and technology vendors can use to connect one system to another without having to reinvent the wheel.

The Emerging Supply Chain & Logistics Technology Landscape

In looking closely at the emerging supply chain & logistics landscape, we came across hundreds of companies. Below is a map of the landscape featuring a representative set of these emerging vendors. While we did our best to be thorough, it’s inevitable that we missed some companies. If we missed yours, please get in touch (details at the end of this post).

In categorizing these companies, we started with the four major steps in every end-to-end supply chain:

- Planning

- Sourcing

- Manufacturing

- Logistics

Underpinning these core categories is Logistics Software, which we use as an umbrella category for companies developing software for logistics providers such as freight forwarders, brokers, trucking companies, etc. We also felt it was important to round out the market map with supporting functions such as Supplier Management, Risk Management, Data Interoperability and FinTech.

Planning

Planning in supply chain & logistics can be broadly broken down into Demand Planning and Supply Planning.

- Demand Planning is the ongoing process of forecasting customer orders based on historical data, the existing order book and other inputs.

- Supply Planning refers to the process of determining and acquiring the raw materials, equipment and personnel needed to manufacture and deliver finished goods.

There are several established supply chain planning vendors across both Demand and Supply Planning such as Arkieva, Blue Yonder, E2Open and Kinaxis.

Startups like Verusen augment existing planning tools with modern data and machine learning capabilities while others like Syrup, Flieber, Fountain9 and Prediko are developing dedicated inventory planning tools for brands and retailers.

Sourcing

One of the outputs of supply chain planning is a list of items to be purchased along with details such as quantity, timing, price, etc. Some of the largest software vendors in this category include Coupa, Jaggaer and Oracle.

For various reasons, a company may need to source a new supplier, which is where eSourcing comes in. We previously described how geopolitical risk and the need for supply chain resiliency have created renewed interest in sourcing technologies. Scoutbee, Tealbook and Stimulus are other vendors to keep an eye on in this category. Amplio is unique for its focus on electronic components while Profishop has developed an Amazon-style marketplace offering millions of products.

Several new vendors have also emerged to bring a modern experience to the employees, procurement, legal, finance and other teams involved in B2B purchases. In addition to the automated procurement vendors mentioned earlier, companies like Zip, Certa, Aavenir and Archlet have experienced impressive traction and customer adoption while early-stage companies like FocalPoint, LevelPath, and Oro are notable for the extensive procurement experience of their founding teams. Luminovo is another company catering to the specific needs of the electronics industry.

Manufacturing

The next step in a typical supply chain journey is Manufacturing, where goods are produced using the materials purchased and the manufacturing plans created in the prior two steps. Key systems involved in this process include ERPs, Manufacturing Execution Systems, Product Lifecycle Management Systems and Quality Management Systems offered by companies such as Epicor, Infor and Oracle.

Emerging vendors like Katana and Fulcrum may not be full blown ERPs just yet, but they continue to add functionality that expands their use cases beyond core manufacturing execution. Xentral is another Next-Gen ERP with a primary focus on e-commerce businesses. Within the Manufacturing category, Machine Monitoring companies like Guidewheel, Amper and Augury track machine activity and serve as an early warning system to prevent downtime. Also within Manufacturing, Quality Control is a critical step and subcategory we’re watching with companies like Vanti, Inspectorio and Overview all receiving new funding this year for their ML-based approaches. Finally, MaintainX and Squint empower frontline workers in manufacturing with a digital approach to training, work instructions and project management while Tulip supports similar use cases and more through its flexible app builder.

Logistics

Once the product has been manufactured, the final step is distribution to the end customer. In this category, we highlight tech-enabled companies that have emerged over the course of the last decade to challenge the way traditional logistics services companies operate. Flexport was one of the first to do this and is now a well-known Freight Forwarder that has inspired others like Forto, Trucksters, Sennder and AirSpace. Silq addresses the “empty mile” problem in container shipping using information collected from the factory floor to plan and consolidate loads into fewer containers thereby reducing the number of empty containers crossing the Pacific.

Within Logistics, Freight Marketplaces have evolved from the traditional freight broker model to match shippers and carriers on their proprietary digital platforms. UberFreight, Convoy and Emerge primarily focus on road transportation while cargo.one is worth noting for its focus on air cargo. Companies like Flexe, Stord, ShipBob and Airhouse act as 4PLs managing critical portions of their customers’ end-to-end logistics needs while Alaiko and Packfleet offer similar services in Europe.

Logistics Software

Logistics Software is a category we’ve coined internally to differentiate between Logistics companies that are involved in the physical movement of goods from one point to another, and software companies that are used by shippers, brokers and carriers to move goods more efficiently.

Logistics Software spans a wide variety of subcategories such as Freight Forwarding and Freight Brokerage, which we use to refer to companies like GoFreight, Parade and Greenscreens that develop customer experience, document automation, pricing, capacity management and other solutions for freight forwarders and freight brokers respectively.

Middle Mile vendors such as Kargo, Coros and TradeLink, streamline scheduling, data collection, claims and other manual processes that occur during inbound and outbound warehouse logistics. Also within the Logistics Software category are Last Mile companies, which typically offer solutions such as access to third party delivery drivers, dispatch, route optimization, tracking, etc. as goods make the final leg of the journey to the end customer. For companies that prefer to build versus buy, vendors like HyperTrack offer APIs, SDKs and other tools that developers can use to rapidly launch last mile applications without having to reinvent the wheel.

Fleet Management vendors offer solutions such as vehicle and equipment tracking, driver safety, compliance, maintenance, as well as spend management. Visibility companies provide real-time insights into shipments across modes (air, ocean, road, rail, etc.) using data obtained through integrations with carriers, telematics devices and other sources. In the Warehouse Management subcategory, SVT Robotics enables warehouse automation by connecting robots to warehouse management systems, manufacturing execution systems and other supply chain software while CognitOps develops analytics software that enables distribution center leaders to increase worker productivity and overall building throughput.

In the Trucking subcategory, companies such as CloudTrucks, SmartHop, TruckSmarter and TrueNorth provide software and financial services to owner-operators while early-stage companies like LogRock focus on trucking compliance solutions. Transportation Management continues to be a hotbed for innovation, and every single vendor highlighted in the market map has received fresh funding in the last 12 months. Global Trade Management vendors aggregate data on worldwide trade from sources such as government bodies, public filings and global logistics companies for use cases such as the transportation management, trade compliance and trade finance associated with the import and export of goods.

Shipping companies like Nautilus, Bearing and ShipIn serve the maritime industry with solutions to reduce carbon emissions by optimizing vessel speed, improving safety, verifying maintenance procedures and maximizing profits. Last but not least, Optimization companies include nextmv, which enables developers to build optimal logic for processes like routing and scheduling, and Solvo, an early-stage company that has developed technology for optimizing pricing.

Supplier Management

Broadly speaking, Supplier Management encompasses all interactions with suppliers that occur after contract signing. This includes the onboarding, collaboration, innovation and performance management that creates the most profitable relationship for both sides. Majority of the vendors in this category focus on purchase order workflows (PO changes, status updates, etc.) and supplier performance management while ISO, SupplyPike and Fixefy provide tools for suppliers and their customers to perform order/inventory reconciliation and resolve disputes.

Risk Management

As mentioned earlier, we believe Risk Management will be a key focus area going forward due to the recent disruptions to supply chains worldwide. Companies such as Craft and Contingent aggregate online and offline data, news and reports to create profiles on suppliers and share alerts on material changes in weather, geopolitics, economic/financial markets, ESG considerations, security and cybersecurity and other factors that could impact suppliers.

Companies like Everstream Analytics and Interos provide advanced functionality, such as visibility across multiple tiers of suppliers and entity resolution to determine the specific supplier facilities/locations that are at risk. Risk Ledger focuses on cybersecurity risk exposure and provides a platform to collect real-time data on cybersecurity policies and controls directly from suppliers.

Data Interoperability

There are hundreds of emerging supply chain technology vendors, not to mention all of the established vendors that are already widely used. The success of the industry-wide push to digitize will depend on the extent to which these systems can be quickly and easily connected to one another. Chain.io, Orderful and Procuros provide off-the-shelf integrations to ERPs, as well as visibility, procurement, supplier management and other supply chain & logistics systems. Sento provides a similar solution, but is focused on the systems commonly used in the food and beverage industry.

FinTech

A host of startups have emerged to bring modern, customer-friendly financial services to supply chain & logistics thereby providing the industry an alternative to traditional financial services firms that tend to be expensive especially for smaller companies.

AtoB, Coast, and Mudflap offer fuel cards that come with discounts typically reserved for big fleets. Tank Payments and Denim (formerly Axle Payments) provide factoring services to carriers and brokers respectively. Trucking software companies like Smarthop and CloudTrucks also offer factoring and fuel cards as part of their broader suite of products.

Loop and FreightPay aim to eliminate billing and payments errors for shippers, carriers and 3PLs. Finally, Makers Hub has developed software for sourcing and procuring manufacturing services, but primarily monetizes on payments and working capital solutions, similar to MVMNT, which offers its transportation management software for free and monetizes by offering factoring and other financial services to carriers, brokers and shippers.

Building a Supply Chain & Logistics Company? Get in Touch.

Every single good and service we consume has passed through an entire supply chain and logistics journey of its own, making the digitization of this category one of the most important opportunities of our generation. We have been amazed by the amount of innovation taking place within the category, and are excited to back entrepreneurs on a mission to redefine how supply chain and logistics will work in the coming decades.

Please reach out to Demi Obayomi at [email protected] and Andrew Vogeley at [email protected] if you are building a company in supply chain & logistics tech. We can’t wait to hear from you!

Thanks to Anshu Prasad, Eric Rodriguez, Ram Radhakrishnan, Brian Laung Aoaeh, Janie Yu, Julian Counihan, Harvey Williams, Justin Young, Michael Shephard, Mike Droesch, Mike Zayonc, Rick Zullo, Santosh Sankar, Seth Corder, Spencer Foust, and Ty Findley for sharing their expertise and insights with us.