Today at Sapphire Ventures, we are extremely excited to announce our lead investment in Reonomy, a New York based company that is revolutionizing the way data is used in the commercial real estate (CRE) market.

Over the last several years, we’ve been fortunate to partner with folks that are upending the database and data warehouse markets and we’ve invested in multiple generations of companies advancing the state-of-the-art in data transformation, data preparation, business intelligence and analytics. We’ve also had great fun and success working with entrepreneurs who have changed a software vertical or service landscape altogether (e.g. corporate HR, retail and CPG commerce, government operations) by offering innovative functionality that is married with good data — a trend that continues with our investment in Reonomy.

When we first met Rich Sarkis (CEO) and the rest of the Reonomy team, we were intrigued, in part, by the size of the end markets they were beginning to disrupt. More importantly however, we were truly fascinated by the complexity of the problem they had solved and the ease with which we were able to understand the applications they had built, even as CRE newbies. The fact that we genuinely enjoyed and appreciated our interactions with everyone on the team, and that the hockey-stick growth in the business was labeled “actual” — not “forecast” — only fueled our excitement. Ultimately, we decided to lean in on leading Reonomy’s Series C round despite the Company having raised funds earlier this year and having sufficient cash on hand to support its operations.

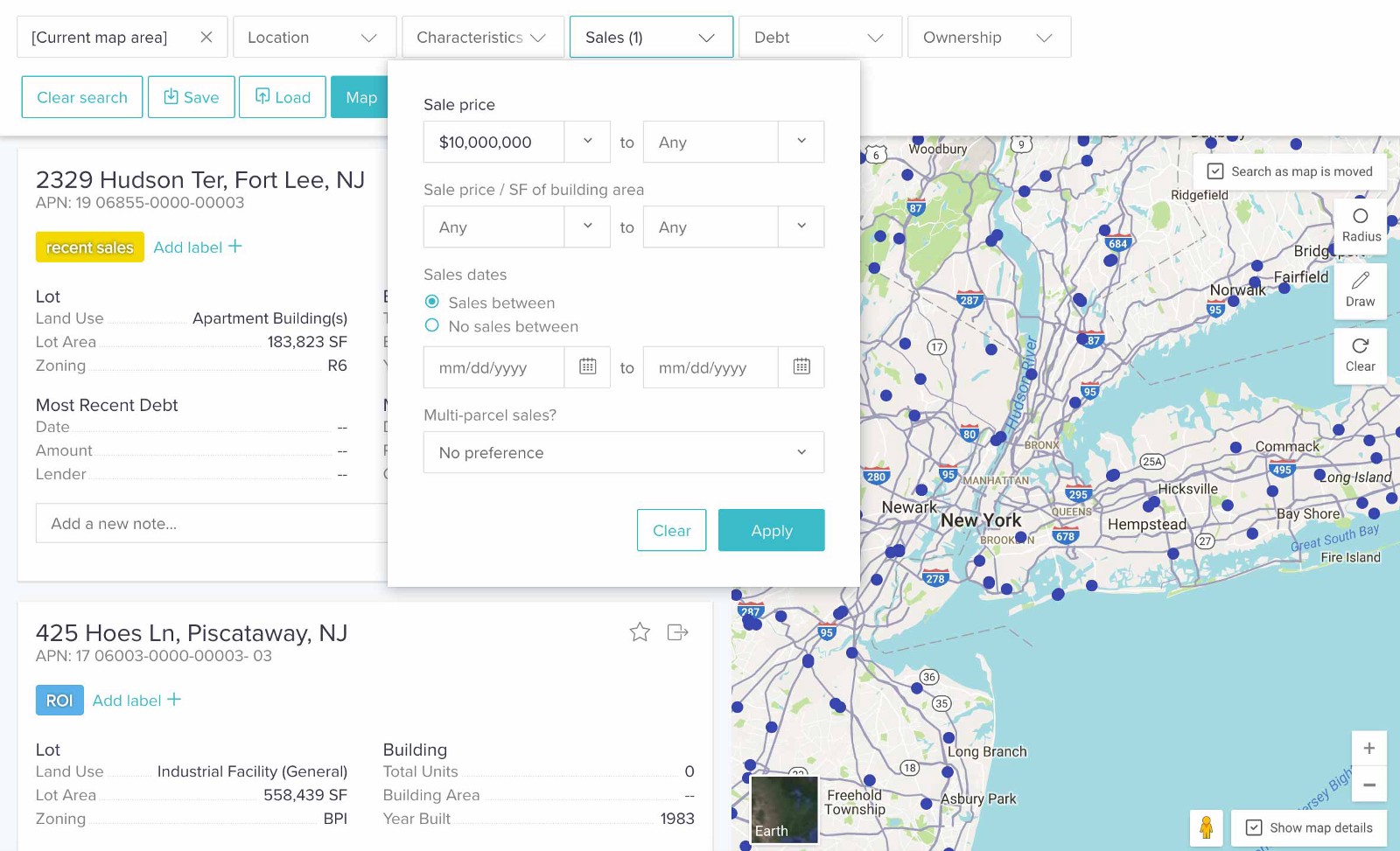

So, what makes Reonomy so exciting? In their own words, Reonomy is “lifting the veil on commercial real estate”, through data and applications that provide transparency across markets, which are extremely dispersed (spread across 3k+ counties and 20k+ municipalities in the U.S. alone), “dirty” and dynamic. Reonomy constantly aggregates and cleanses this data, selling data APIs as well as applications that are useful for participants in CRE markets such as brokers, investors, lenders, retailers, etc. Because of this, Reonomy is able to provide information around property details, property owner details (often deliberately obscured), transaction and valuation information, as well as workflow, visualization, and discovery capabilities. Today, Reonomy’s database spans 100M+ companies, 150M+ people and 99% of commercial properties in the U.S., which gives the Company an unprecedented understanding of the CRE lending and ownership landscape.

Reonomy started offering its solutions in New York City prior to launching a nationwide product and gaining significant momentum in the second half of last year. Given our experience helping young, hyper-growth companies scale to successfully support rapid and efficient growth over the long term, we are extremely excited to get involved at this point in the Company’s journey and are looking forward to helping Reonomy bring data disruption to CRE and its related markets!